Novo Nordisk: Easy Double From Here?

The market massively undervalues Novo Nordisk's pipeline. Here is why.

You probably don’t know Charles Best and don’t know Frederick Banting but they together exerted a disproportionate influence over human development, comparable to those of Hippocrates, Avicenna, Louis Pasteur, Alexander Fleming.

What they did single handedly prolonged the average human lifespan by as much as 20 years—they isolated insulin in 1922.

For centuries, diabetes was essentially a death sentence. Once you were diagnosed, you would start counting down… Your blood would literally turn sweet as sugar built up, they would stick within your veins, clog them, causing heart attack, kidney failure, nerve damage…

Before 1922, there was no treatment. After Banting and Best's discovery, there was hope.

August Krogh, a Danish professor, was on a lecture tour in America when he heard about this breakthrough.

His wife, Marie, had diabetes, and he immediately recognized the importance of this discovery.

He returned to Denmark and secured the rights to produce insulin in Scandinavia.

In 1923, Nordisk Insulin Laboratorium was born.

Fast forward 100 years.

The company that started by producing life-saving insulin is now known with the name “Novo Nordisk” and it’s worth over $280 billion, making it one of the most valuable pharmaceutical companies in the world.

What’s interesting is that a few months ago, it was worth well over $650 billion.

If you invested $10,000 in Novo 5 years ago, you would have nearly $50,000 last July. If you kept it, you would only have $18,000 today— it lost 60% of its total market cap in 9 months…

So, what changed?

In summary, it happened the way it always happens:

Amazing company, delivers a great performance.

Great performance leads to unrealistically high expectations.

Great performance also attracts competition from other players.

Investors flee on the slightest bad news as expectations were too high.

Basically, the hurdle rate of the business was just too high. It had to be a plane to go over such high bars! It wasn’t its fault, it’s investors who set expectations.

Now that the investors have realized it isn’t a plane but a nice horse that could jump over reasonable bars, a question appears—has the bar come low enough for it to jump?

That's exactly what we're going to explore in this deep dive.

So, let’s cut the BS and get straight it!

What you're going to read:

1. Understanding The Business

2. Moat Analysis

3. Investment Thesis

4. Fundamental Analysis

5. Valuation

6. Conclusion

🔑🔑 Key Takeaways

🎯 Novo Nordisk has a dominant position in diabetes and weight-loss drugs.

🎯 Its pipeline is actually better than rivals including Eli Lilly, though it may be a bit behind in time to market.

🎯 Weight-loss market is expected grow fivefold by 2030, meaning there are ample opportunities ahead for further growth.

🎯 Its balance sheet is rock solid as its annual EBITDA can easily pay the all debt. Its industry leading margin profile and return on investment also indicate competitive advantage.

🎯 It’s very attractively valued at 14 times forward earnings given it grew earnings 20% annually in the last 5 years and Wall Street expects high double digit growth for this year and next.

🏭 Understanding the Business

Novo Nordisk operates in two main therapeutic areas: diabetes care and obesity.

For decades, the company's identity was tied to insulin and diabetes care. It pioneered numerous innovations in insulin delivery, from pens to pumps to long-acting formulations.

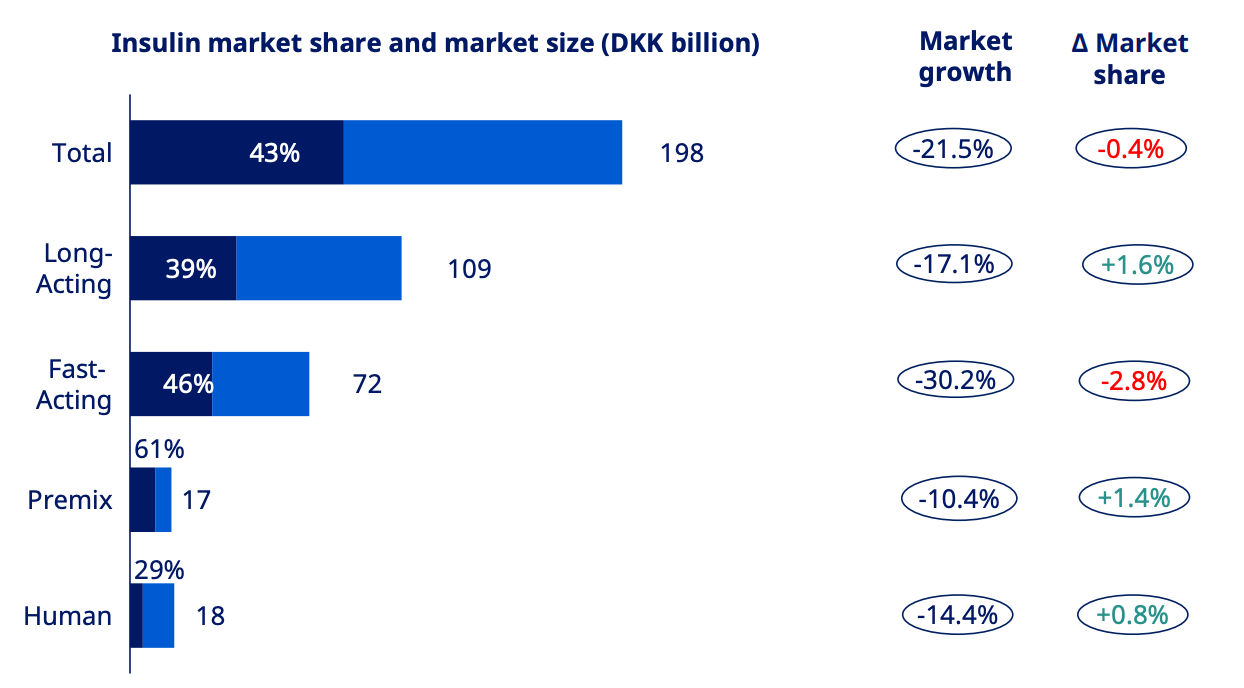

Today, it has approximately 43% of the global insulin market, making it the world leader.

But something transformative happened in 2017…

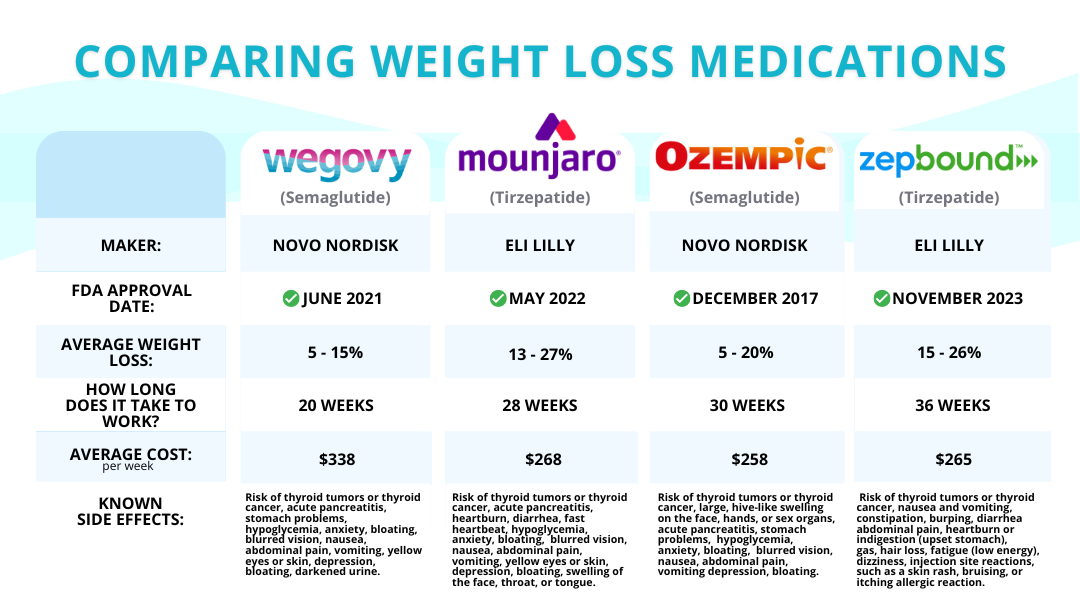

That year, Novo Nordisk launched Ozempic (semaglutide) for type 2 diabetes, a drug in the GLP-1 receptor agonist class. These drugs mimic a hormone that regulates appetite and insulin production, helping diabetics control blood sugar levels.

Doctors and patients quickly noticed an interesting side effect—significant weight loss.

This wasn't entirely unexpected, as earlier GLP-1 drugs had shown similar effects, but semaglutide was different. The weight loss was more substantial and consistent.

This led to a question that would create an obvious breakthrough—what if we make a more concentrated dose of it for weight loss?

It worked like a miracle…

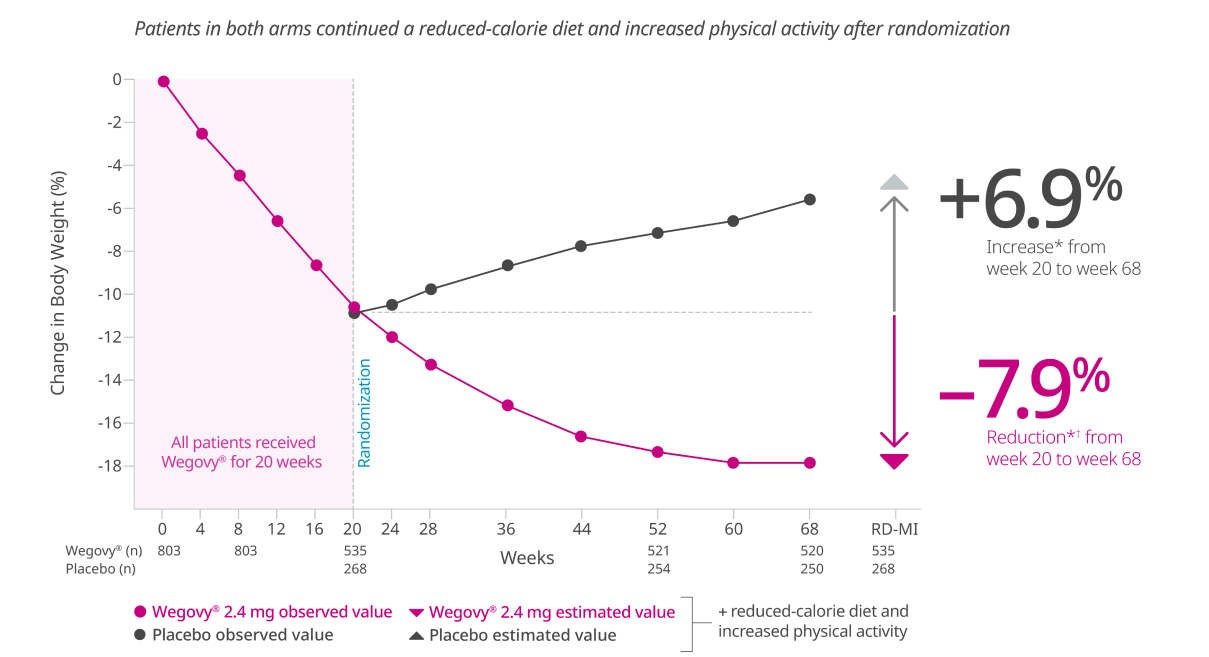

They named it Wegovy and got approval for a weight-loss label from the FDA. The results were staggering. Patients, on average, lost 8% of their body weight after 20-weeks and as much as 16% after 44 weeks.

It was 2021, the timing couldn't have been better.

The world was slowly coming out of Covid-19, lockdowns were being eased and people were slowly getting used to living outside again. Yet, people had spent the last two years mostly at home, eating junk food and watching Netflix to pass time.

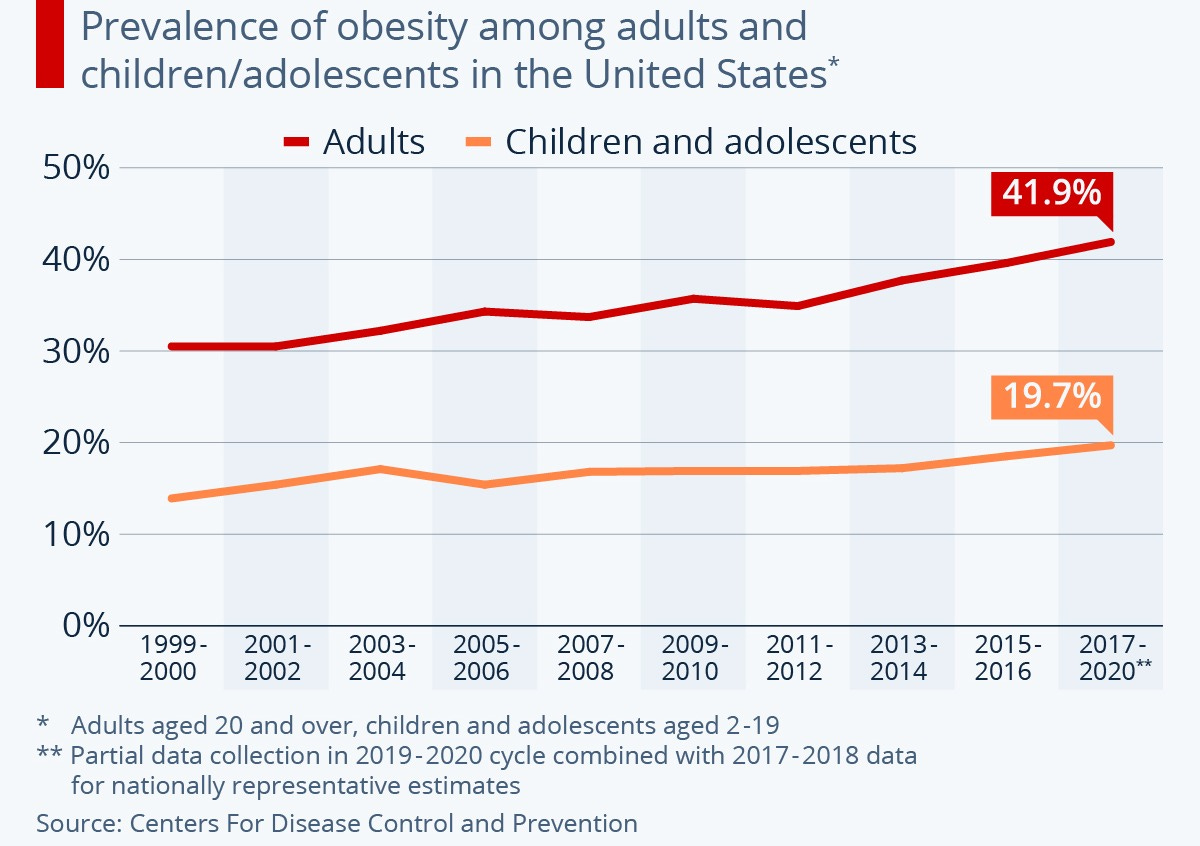

Result? Obesity rates have been climbing steadily worldwide, with over 40% of Americans classified as obese. The medical community had increasingly recognized obesity as a chronic disease requiring medical intervention, not just lifestyle changes.

Novo’s drug was like a long expected savior…

Sales exploded, and Wegovy became a sensation.

It entered the popular culture faster than any medicine in history!

Celebrities and influencers began discussing their "Wegovy journeys" publicly.

But this wasn't just a social media fad.

Medical research showed that these drugs could potentially reduce the risk of heart attacks, strokes, and cardiovascular death by up to 20%. They showed promise in treating conditions from sleep apnea to fatty liver disease. What’s even better? The safety profile was better than all other previous weight loss drugs.

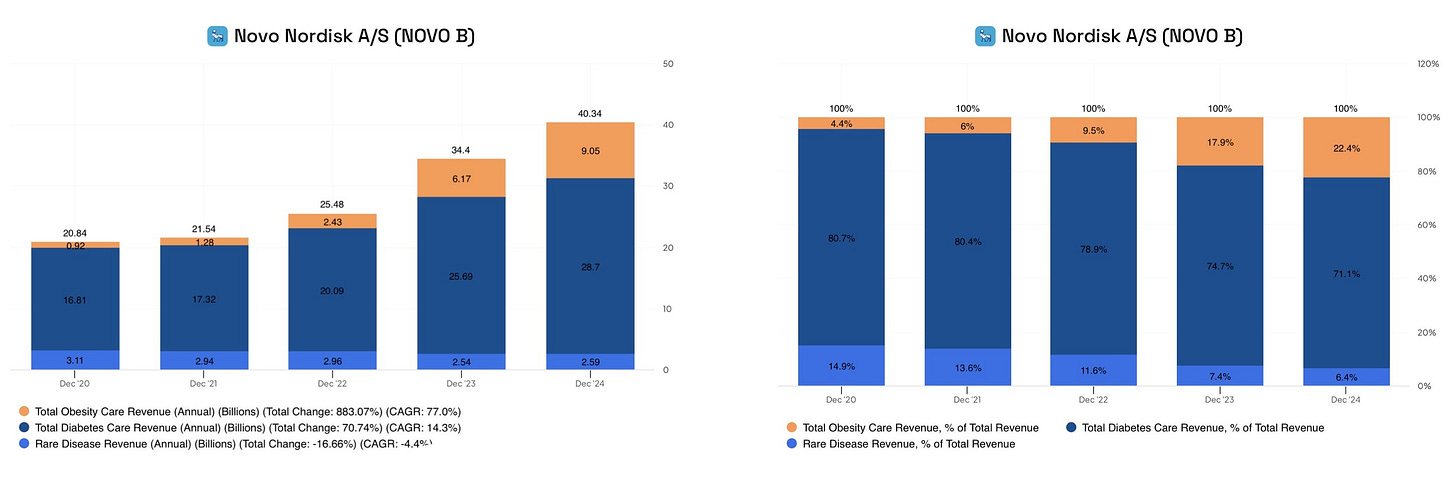

Weight loss category, which was nearly non-existent before 2020, became 22% of the total revenue in just 4 years…

This is basically what Novo Nordisk does today.

It’s the global market leader in all insulin categories and it’s leading the market in GLP-1 based weight loss drugs too.

People will always need insulin, people will always want to be skinnier and AI can neither replace your insulin nor make you fit. Looks like it has everything a good investment needs to have:

Simple to understand.

Not under threat of replacement by AI.

It’s been creating new categories to fuel growth.

So, why the hell it lost 60% of market value in the last 9 months then?

The thing with investing is that your returns lay in future. For your investment to appreciate, it should keep delivering nice performance in the future.

How can you know this?

It’s moat, or durable competitive advantage. This is why it’s the most important part of the investing process. It basically makes the future performance more predictable. You can say, ‘this is going to keep winning as long as this market exists’.

This is what went wrong with the market’s Novo Nordisk thesis.

Howard Marks says, “success comes with seeds of failure.”

This is exactly what happened to Novo. There was an unwanted result of the exploding demand—shortages had become commonplace.

The demand was so high that Novo couldn’t meet all of it. This gave competitors time and opportunity to catch up and encroach upon its market share.

It went from being priced as a “winner” to a “loser.”

I don’t think this is true, I think it’ll still be a “winner.”

Let me explain.

🏰 Moat Analysis

To better understand the competitive position of a company, you should understand where competitive advantage comes from in its market.

There could be many things:

In fashion, competitive advantage comes from brand name.

In consumer products, competitive advantage comes from uniqueness. The iPhone is unique among competitors, no soda tastes exactly the same as Coca-Cola etc..

In retail and manufacturing, it comes from economies of scale and scope. Costco and Walmart are examples.

In social networks like Instagram and Facebook, it comes from network effects.

Where does it come from in pharmaceuticals?

Brand is not important, the best drug is a working drug; uniqueness is impossible; economies of scale and scope exist if the patient pool is big enough; there are no network effects…

For pharmaceuticals, people tend to easily say “oh it’s patent protection, it automatically gives you monopoly rights.”

No it doesn’t. This is exactly the wrong way to look at it.

It allows you to sell what you have discovered under the brand name you pick, but it doesn’t prevent others from discovering the same thing by themselves and selling too.

It doesn’t grant a monopoly over the market.

Thus, the competition in the market will still occur. The most important thing is what you are bringing to table in that competition.

This is why the most important thing in pharmaceuticals is R&D pipeline.

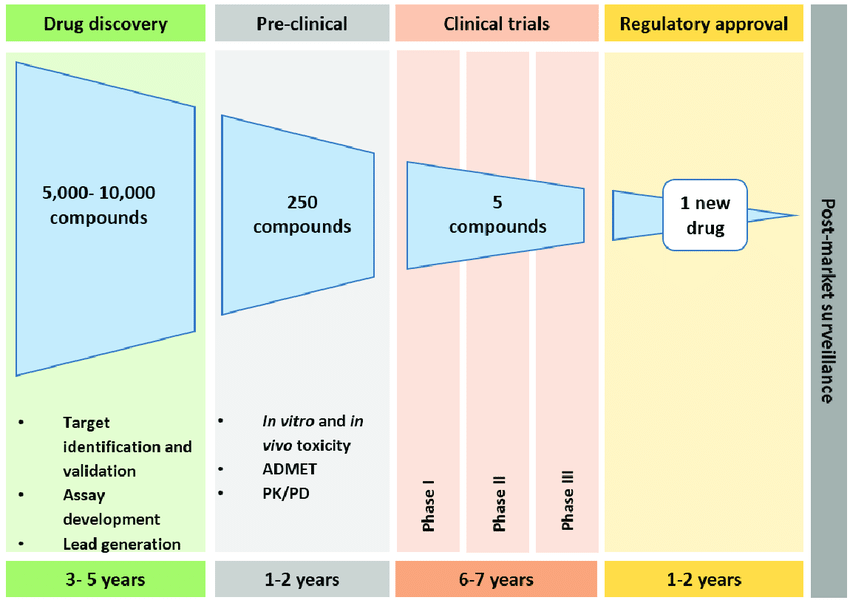

On average, it takes 13 years from drug discovery to market.

This means that if you have a Phase III drug on the pipeline and the competitor has something similar but just at Phase I, you can assume to have at least 3-4 years of advantage ahead of it.

If you are the only one with that drug, this means that the total addressable market will be owned solely by you for the next few years. This is real monopolization.

The competitive advantage lies in the pipeline, and Novo has it.

After Ozempic and Wegovy became a sensation, they quickly fell in shortage as the demand was way higher than Novo could meet.

This limited its ability to exploit demand and kept the uncontested share of the market relatively big, giving late comers an advantage.

Eli Lilly used it well.

It came up with two drugs that compete with Ozempic and Wegovy— Mounjaro and Zepbound.

Mounjaro was approved by FDA in 2022, exactly five years after Ozempic, illustrating the advantage that a timely pipeline provides. It was meant to rival Ozempic in the fight against Type 2 diabetes.

Zepbound was launched a year later, in 2023, it was Eli Lilly’s response to Wegovy. It was specifically meant for weight-loss.

The difference? Lilly’s drugs performed better in weight-loss compared to those of Novo’s. The shortages allowed them to take time without watching the contestable market shrink so they could improve the drug.

Suddenly it started to look like Eli Lilly may get the upper hand going forward—investors started to slowly dump Novo stock for Eli.

It only accelerated after the Phase III trial of its next-gen obesity drug Cagrisema, developed as a rival to Zepbound, provided only 23% weight loss after 60 weeks compared to 25% expected.

The stock got hammered…

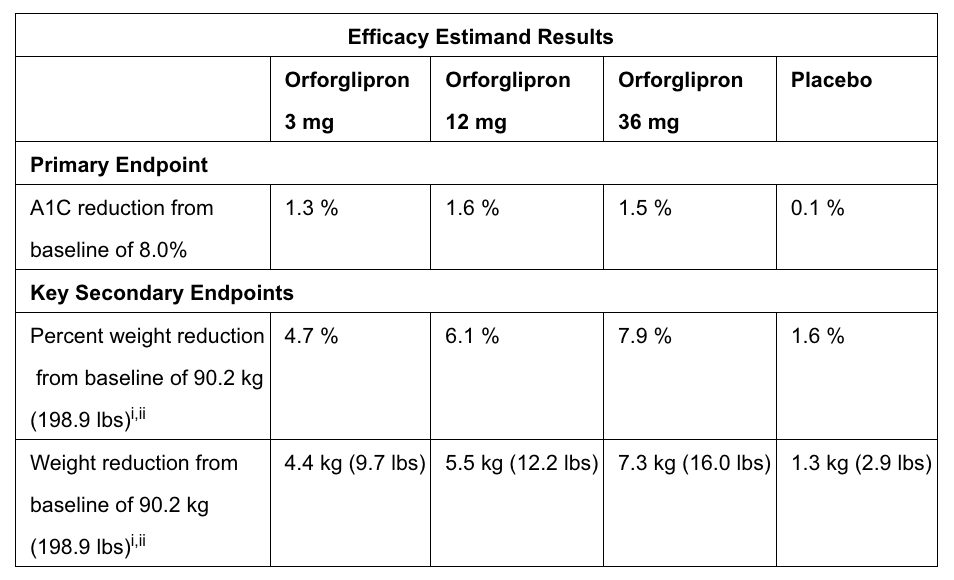

Another bid drop came yesterday as Eli Lilly announced that its Phase III oral weight-loss treatment, orforglipron, provided 7.9% weight loss in 40 weeks, passing Ozempic’s 6%.

The stock got hammered again…

Currently, people are so hyped about Eli Lilly’s product line and pipeline that they completely ignore Novo’s pipeline, as if it’s empty.

This is not true, and to be true, its pipeline in weight-loss is superior to that of Lilly’s.

Currently, it has four important drugs in the pipeline:

Cagrisema: Zepbound rival, at Phase III.

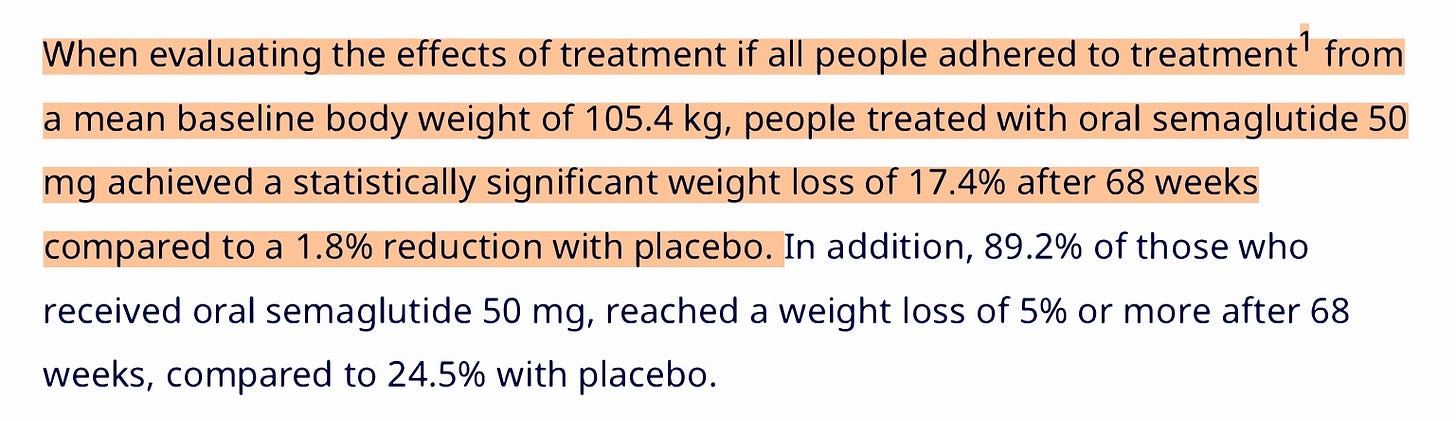

Oral Semaglutide: Orforglipron rival, at phase III.

Tri-agonist: Rival to Eli Lili’s experimental drug Retatrutide.

Oral Amycretin: Next-gen weight-loss pill, targeting GLP-1 and amylin receptors.

Let’s look how they compared to peers in Eli Lilly’s pipeline.

Cagrisema doesn’t live up to Novo’s high expectations, but it still outperforms Lilly’s Zepbound. While Zepbound led to 21% weight reduction at the highest dose in 72 weeks, Cagrisema led to 22.7% reduction at the highest dose in 68 weeks.

What disappoints the investors most about this isn’t Cagrisema’s performance compared to Zepbound, it’s performance against Lilly’s drug that will follow Zepbound, retatritude.

Retatrutide led to 24.2% weight reduction after just 48 weeks! This is indeed superior, but it’s not actually a rival to Cagrisema. It’s a completely different drug. Cagrisema is a dual agonist, meaning it mimics two hormones, GLP-1 and amylin. Retatrutide, on the other hand, is a triple agonist, meaning it mimics three hormones, GLP-1, GIP and GCG. They aren’t even in the same league.

What’s in the same league with retatritude is Novo’s tri-agonist, named UBT251. It mimics the same three hormones as retatritude but promises an even better performance. Retatritude led to 17% weight loss in 24 weeks while UBT251 led to 15% in just 12 weeks!

When it comes to oral weight-loss solutions, Lilly’s Orforglipron achieved 7.9% weight reduction after 40 weeks. Novo’s oral semaglutide? 17% after 86 weeks!

Last but not least is oral amycretin. This drug currently has no peer in Eli Lilly’s pipeline. It led to a 13% reduction in body weight after 13 weeks, nearly as good as experimental UBT251 and Lili’s retatritude!

Result? Novo is not behind Eli Lilly in the weight-loss pipeline.

Lili expects to launch its oral treatment in Q4 2025 while Novo will launch oral semaglutide in early 2026. Eli Lilly expects to make ritatritude available in late 2027 while Novo will likely launch amycretin in 2028.

What you are looking at is a few quarters of time to market advantage for Lili while Novo will follow with superior drugs. Does it justify Novo’s 60% undervaluation compared to Lilly? I would say a resounding no.

Before banking too much on Lilly’s time to market advantage, one should think about the factors that Novo suffered—shortages. If Lilly drugs are also affected by the shortages, it could completely wipe out Lilly’s a few quarters of time to market advantage as it wiped out Novo’s first mover advantage.

Overall, this isn’t a market that anybody could monopolize with a one-size fits all solution and Novo’s market position is rock solid with a very strong pipeline that gives it a solid competitive edge.

This is as good as you can get in pharmaceuticals.

📝 Investment Thesis

My investment thesis for Novo rests primarily on three pillars.

➡️ There is massive untapped market potential!

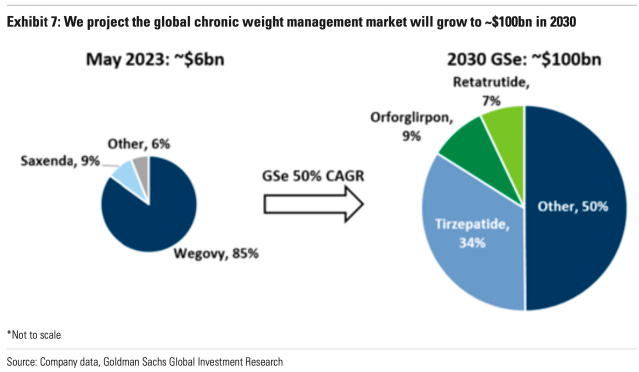

Goldman Sachs estimates that the global weight loss drug market will reach above $100 billion in 2030.

Note that this is a conservative forecast. Goldman previously forecasted that the market would reach $125 billion in 2030.

In 2024, combined sales of Wegovy and Zepbound reached nearly $14 billion. If you add other drugs primarily meant for diabetes but often prescribed off-label for weight loss, the current market size will be around $20 billion.

This means that the market will grow fivefold in the next five years and Novo is the best positioned company to meet that demand.

Even if it gets competition, in such a big and exceptionally fast growing market, supply will likely remain under demand for a long time.

➡️ Novo has the best pipeline in its active categories.

Novo Nordisk, hands down, has the best pipeline for diabetes and weight-loss drugs.

The current negative sentiment is largely due to the perception that it’s behind Lilly when it comes to taking their weight-loss pipeline to the market. This is correct, but its pipeline drugs are also stronger than those of Lilly.

Plus, GLP-1 is still in much demand and many pharmacies are reporting that the drug is still in shortage despite FDA’s removal of semaglutide from its shortage list. If the shortages remain chronic, this can offset any time to market advantage that Lilly may have over Novo.

In any case, the total addressable market is large enough for more than a few players and this is enough for Novo to keep performing well even if Lilly keeps its timing advantage.

➡️ Expanding Use Cases

GLP-1 medications are showing promise in treating conditions beyond diabetes and obesity:

NASH (non-alcoholic steatohepatitis)

Sleep apnea

Polycystic ovary syndrome

Cardiovascular disease prevention

Alzheimer's disease (early research)

Each new approved indication expands the total addressable market and Novo has unmatched expertise in peptides research, especially GLP-1.

This is exactly how it ended up creating a new category in the weight-loss market.

As peptides use cases are further researched and expanded, Novo can find itself in a very advantageous position to dominate a yet another category that it’s not currently foreseeing.

Overall, opportunities ahead of Novo are abundant and the bar it needs to jump over is very low given that it’s currently valued at 14 times forward earnings.

📊 Fundamental Analysis

➡️ Business Performance

I don’t know whether it also happens to you but when I look at the revenue and income trajectory of business, a couple of words appear on my mind instantly such as “very good”, “not too bad”, “promising”, “incredible”, “unsatisfactory”, “bad” etc…

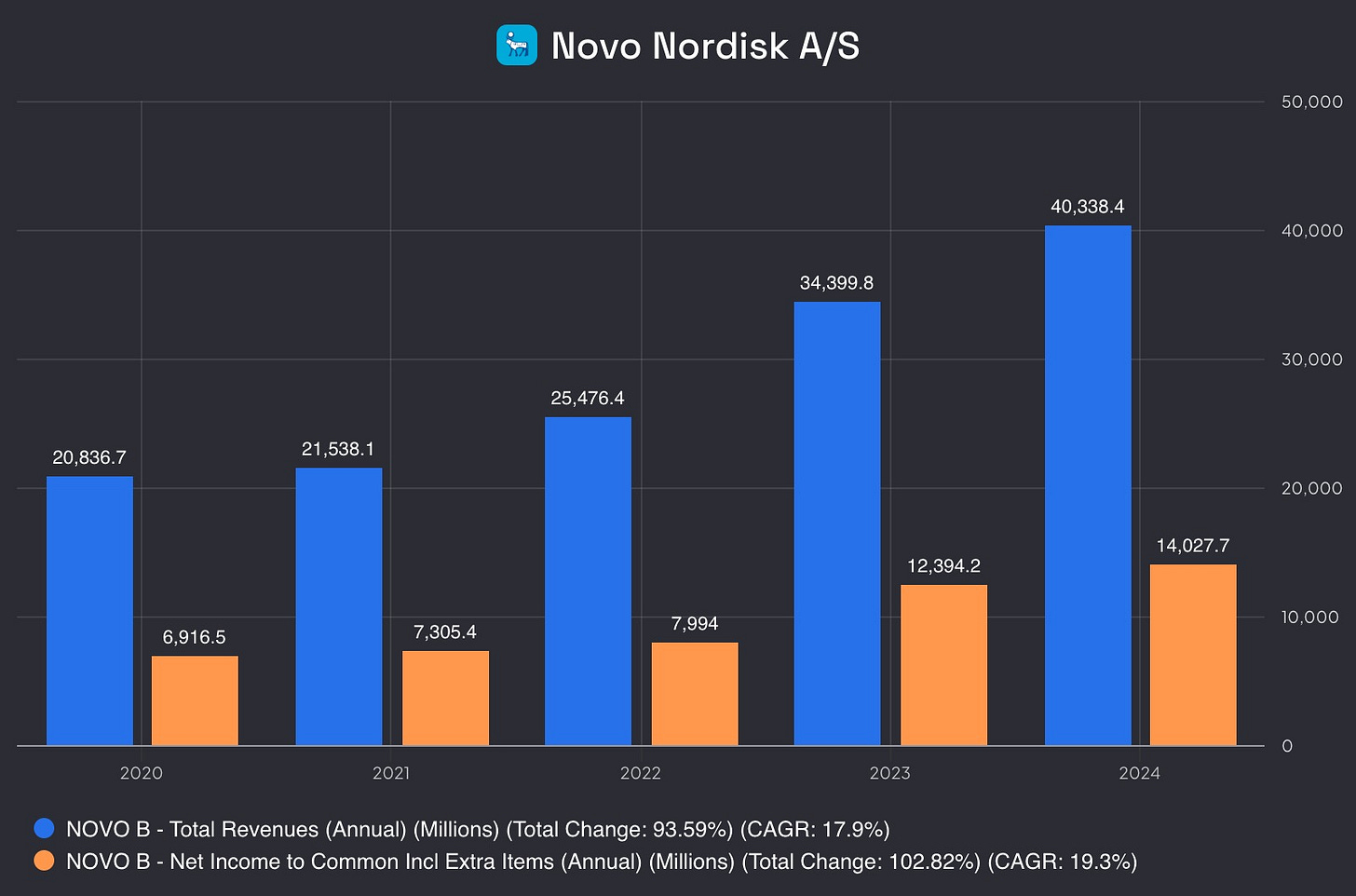

When I look at Novo’s performance what appears in my mind is—phenomenal.

Despite already being one of the largest pharmaceutical companies in the world, this company doubled its revenue and net income in the last 5 years!

Notwithstanding this stellar performance, even conservative analyst estimates still predict double digit revenue growth for the next two years.

What’s even better?

Net income grew faster than revenues indicating increasing operational efficiency and leverage.

It doesn’t get much further comment, it draws such a nice picture that its investors can comfortably fall asleep at night watching this picture. It’s comforting!

➡️ Financial Position

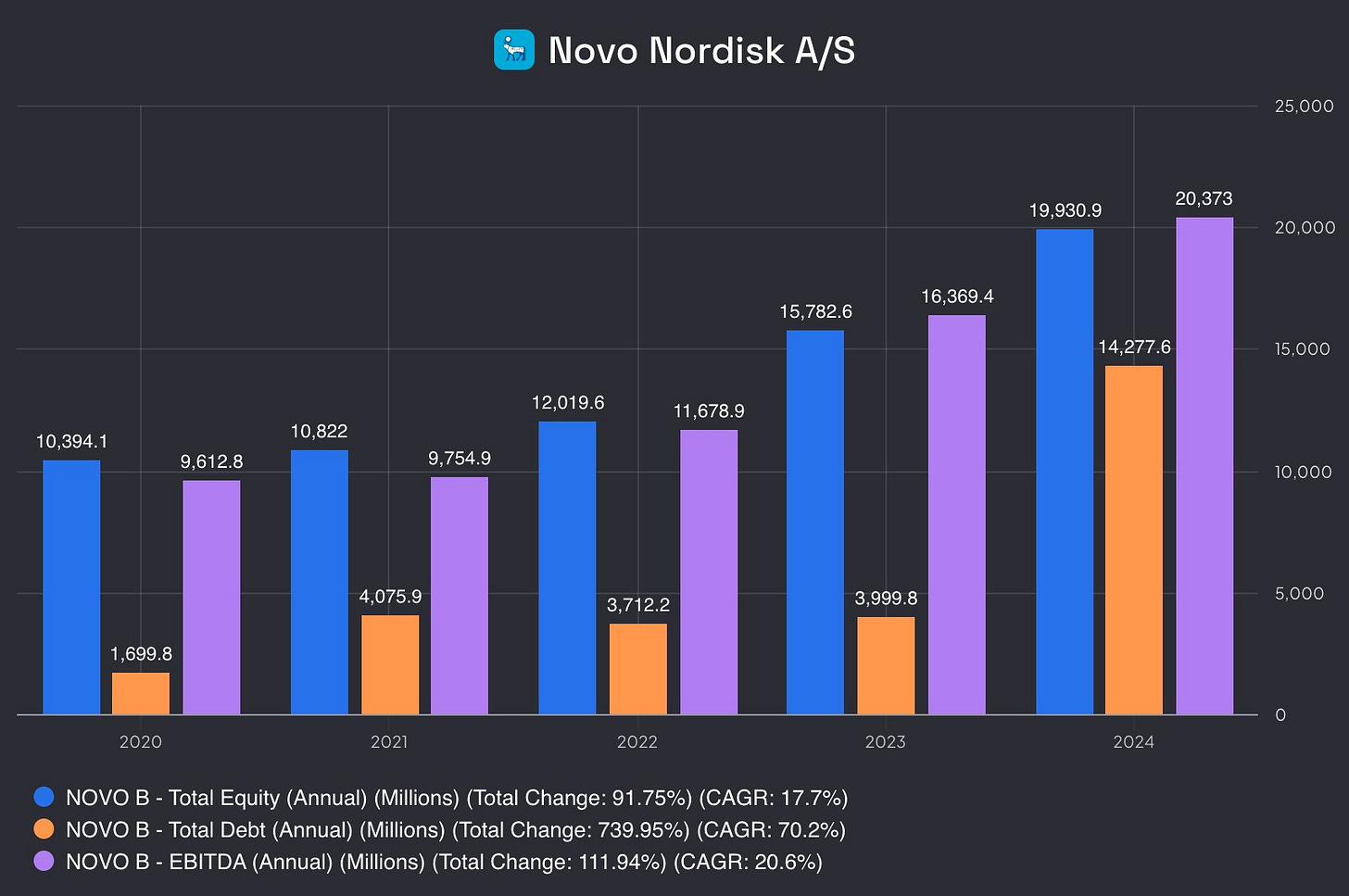

Again, when I look at Novo’s balance sheet, two words pop up in my mind—rock solid!

Just take a look at it, it’s like an investor’s dream.

It checks all the boxes:

Its equity pool is larger than the total debt.

EBITDA can pay all the debt within one year.

What’s even better is that this strong balance sheet is not just for now—it’s a trend.

In the last five years, Novo’s total debt has never been more than its equity pool or its annual EBITDA, not just for once. This indicates despite its stellar growth, it’s not taking that much risk or need much leverage to sustain that performance.

It does this because it’s an exceptional business and its balance sheet guarantees that it can survive even the worst of economic storms.

This is not a position that warrants further scrutiny, it’s straightforward—rock solid!

➡️ Profitability and Efficiency

Gross & Net Margin

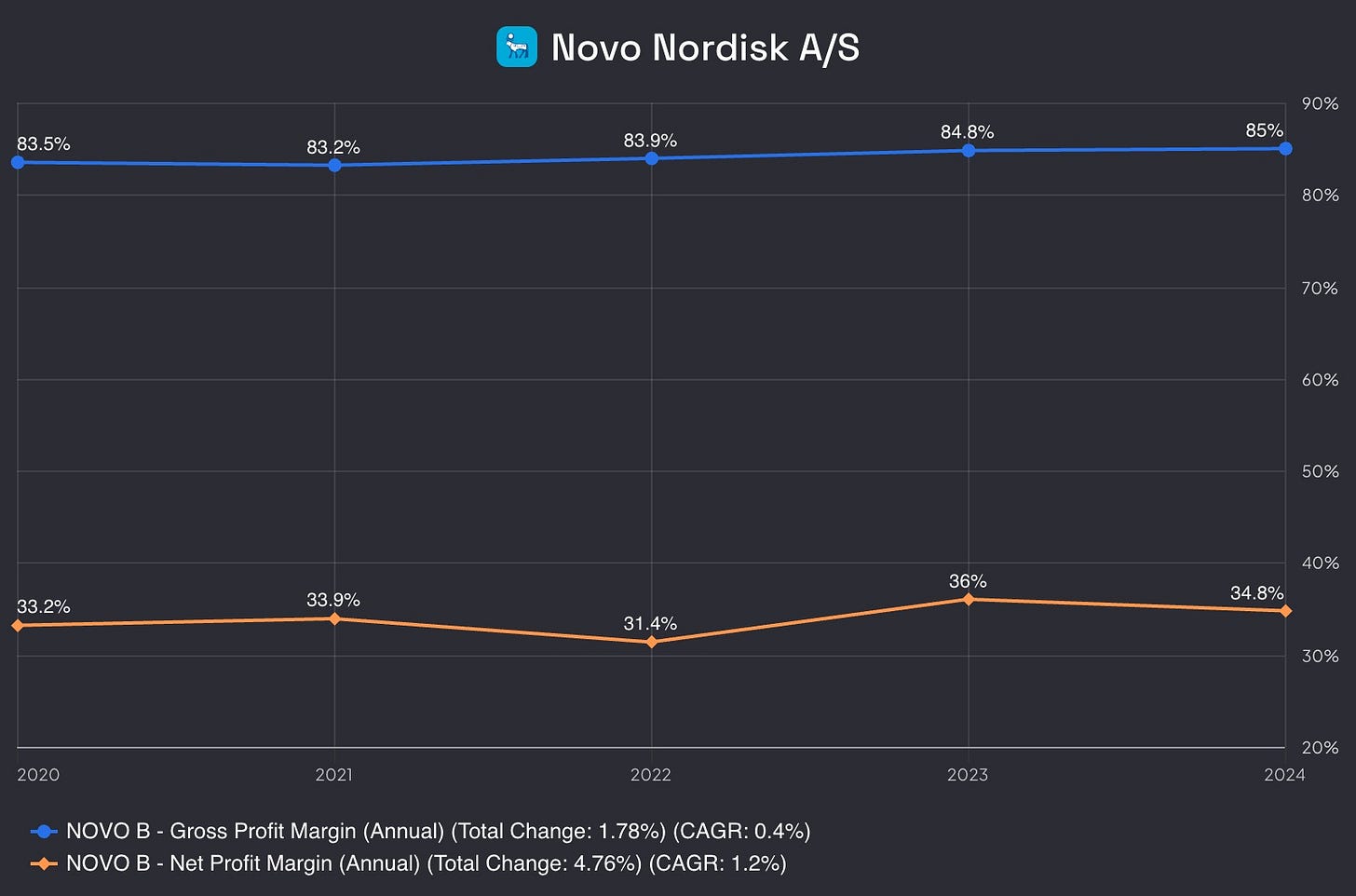

I have probably looked at margin profiles of thousands of international stocks so far.

Among all of them, this is the closest to what can be called stable— and don’t get me wrong, it’s an amazing thing if you already have high margins like Novo.

Its gross margin has remained largely stable in the last five years, expanding just a bit from 83.5% to 85%.

This is where you clearly see how wide Novo’s moat is. Despite an increasing number of companies in its markets, this hasn’t created any pricing pressure over the business, forcing it to reduce its gross margin. No, it remained stable. Its competitive position is rock solid.

Its ability to translate its top line to bottom line also remained intact. This tells us that Novo hasn’t created any deadweight loss despite nearly doubling in size in the last five years.

Overall, these are margins that make the most cutting edge tech companies envy. For comparison, even Apple has 46% gross margin and 23% net margin.

This business is able to charge a premium for its products and is able to translate it to net income. And it does both of these really well!

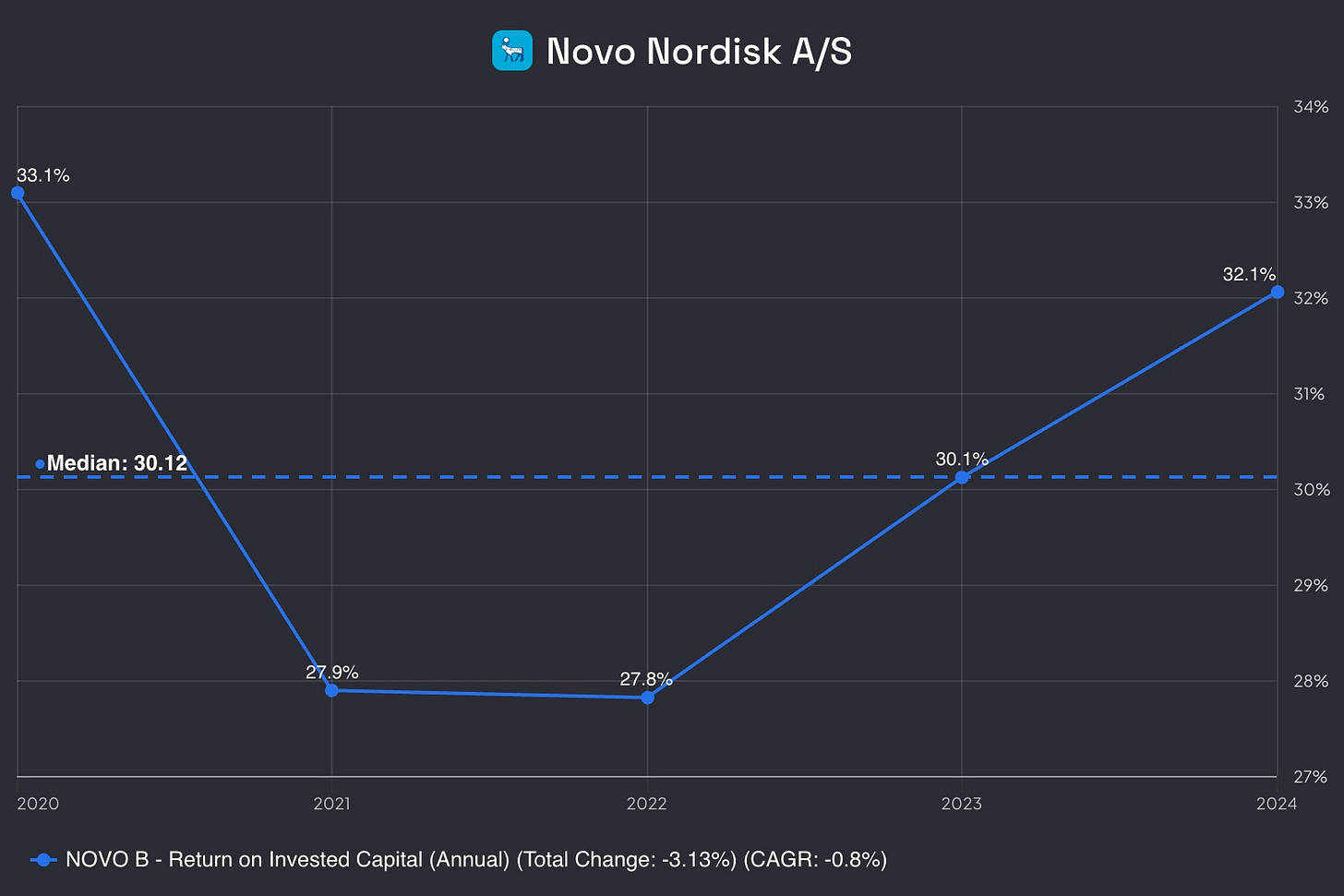

Return on Invested Capital

Charlie Munger once said:

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns.

—Charlie Munger

Business's return on its own investments largely determines your return on your investment.

Thus, if you ask me one thing to look at while making investment decisions, I would say it’s return on invested capital (ROIC).

Consistently high ROIC is a hallmark of a great business—and Novo is one of them!

In the last 5 years, the lowest ROIC of Novo was 27.8% while the median was 30%.

To understand how phenomenal this is, consider that average ROIC for all American businesses is 12%.

Novo is generating much return on its invested capital so investors are also well positioned to get a high return on their Novo investment provided that they buy at the right price.

This is the next question. Is the price right?

I believe it is.

📈 Valuation

I have always said this, I will say it again here— When the business is right, valuation is the easiest part of the investment process; when the business s wrong, it’s the hardest.

Right business has a future proof product, competitive advantage and superb capital allocation.

Novo has it all.

This makes valuation an easy process as it’s moat makes its past performance dependable.

Novo grew its net income nearly 20% in the last 5 years.

Even if we conservatively assume that it’ll grow net income just 15% in the next 5 years, we will get a $28 billion net income in FY 2030.

Its median P/E multiple in the last 5 years was 35!

Even if we attach a conservative final P/E of 20, we will get $560 billion business, it’s currently valued at $280 billion.

Given the low risk profile of the business and limited downside at the current valuation, this is very attractive to me.

🏁 Conclusion

Novo Nordisk represents one of those rare opportunities to invest in a company with both growth and quality characteristics.

It dominates a rapidly expanding market

Its profitability metrics are exceptional.

Its financial position is impeccable.

You can’t expect to buy such a quality business at 14 times forward earnings if the sentiment also remains good, but it’s not.

Yet, I believe this negative sentiment is largely created by investors who first blindly drove expectations to the sky and then jumped when they saw it was getting too high. They are like people who got scared by their own shadows.

If you ignore them, and look at what’s really happening in the business, you will find confidence. Its pipeline is rock solid and it’s now largely derisked as an investment due to the drop in stock price. At 14 times forward earnings, further downside is very limited for such a high quality. What could you expect? 10 times forward earnings?

I have resisted to get into this for a long time thinking that I already had a decent exposure to healthcare and price was only fair.

Now I am calling it a bargain, which makes it a buy. And I’ll be buying it as soon as market opens tomorrow.

This is a phenomenal investment thesis write-up. You just walked laps around the type of analysis people would find on SA

Definitely a buy. Pity that euro markets are closed today. Added GTC order to buy at EUR 48 or below.