Klarna: Time To Be A Contrarian

It's scary, and you may feel stupid until it works. But it'll work, and money will put a smile on your face.

When I first started investing, I was a deep value hunter.

Early Buffett & Graham style. I was looking at obscure corners of the market, buying positions with extreme illiquidity and no coverage. Bid-ask spread would be insane, so it would take weeks for me to build positions.

This method works when you do it right, but it is tiring. It’s a constant effort, and you feel more like an active freelancer feeding yourself rather than an investor.

Then, for a brief time, I was a rebound investor.

I was looking at things that got unjustifiably hammered by the market. I would buy a position and wait for a rebound.

This method also works if you do your homework well. It’s a bit less effortful than deep value, as portfolio turnover is slower, but you still need to be pretty active, as you need to close rebounded positions and roll the proceeds to new ones.

When I got tired of it, I started buying exceptional companies with long runways for growth.

These could be large-caps that are hammered down for some reason, or small-caps that are poised for sustained growth but remain undervalued as the market discounts their ability to scale.

As I switch from one investing style to another, the main things I look changed substantially.

In deep value, you are looking for downside protection and a catalyst; in rebound, you are evaluating the durability of the core business engine; in high-quality growth, you are mainly assessing the competitive advantages and growth runway.

Regardless of whatever style you adopt, one thing is indispensable across all strategies to succeed—you need to be a contrarian.

In deep value, you are saying that something is more valuable than the market thinks; in rebound, you are saying the market was wrong to punish the stock; in high-quality growth, you are saying the market is unduly discounting the future.

Contrarianism is essential to make money in markets.

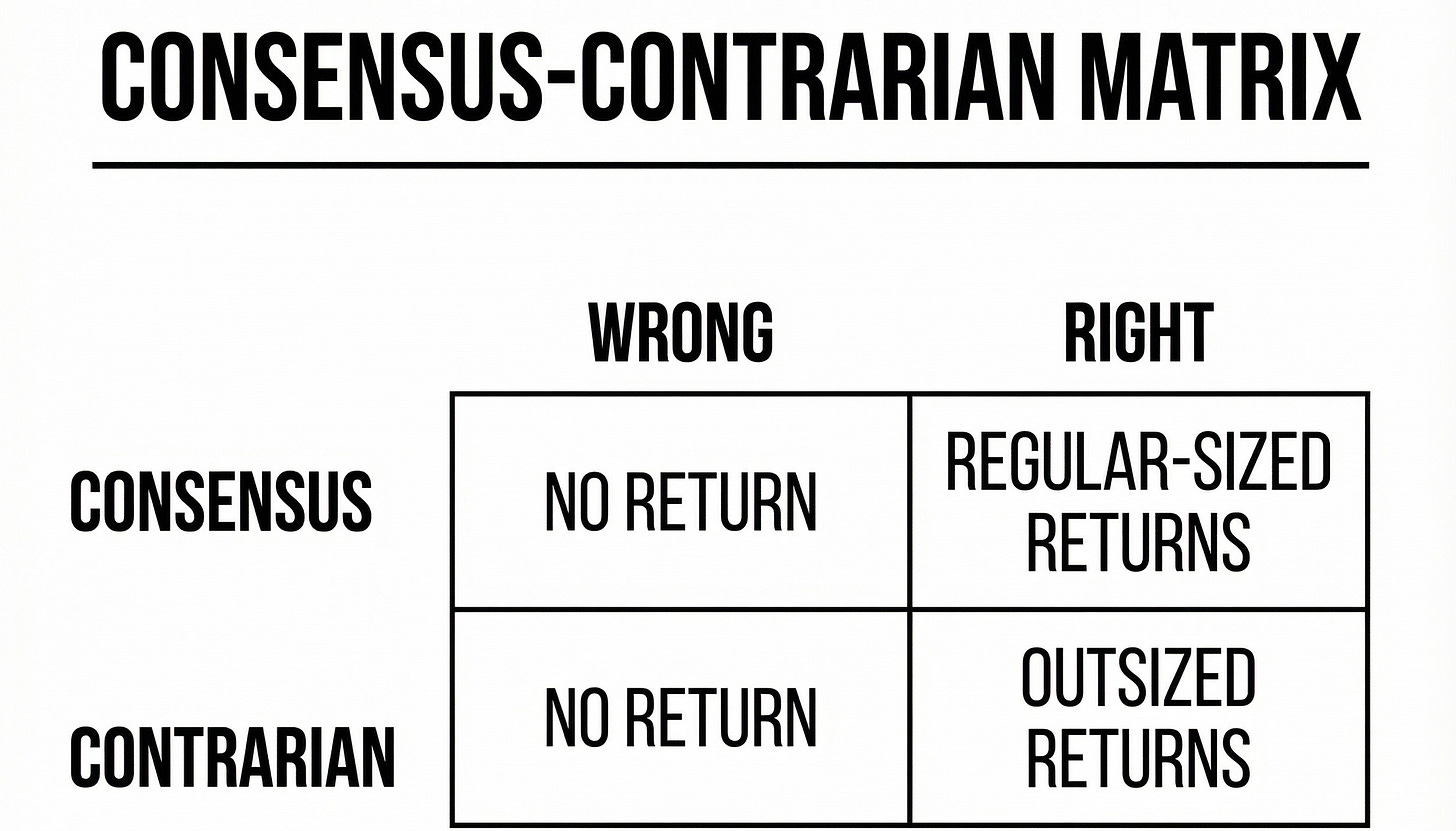

Howard Marks uses a contrarian-consensus matrix to illustrate this point:

The only way to generate outsized returns in the market is to be a contrarian and be right. In all other ways, you either lose or stay where the herd is, but do not win.

One thing that complements contrarianism and increases your chances of winning is long-termism.

It’s always harder to predict what’s going to happen tomorrow than where we’re headed in the long-term.

Don’t think just about markets. It’s the same in life. Let’s say you are a resident heart surgeon. It’s hard to know what case you’ll be seeing in the emergency room tomorrow, but over the long term, you can predict what cases you’ll see often.

Long-termism applies to every investment strategy that is not speculation.

Buffett and Graham used to give two years to their cigar-butts to move up. If you are waiting for a rebound, you'd better give it at least 3-4 quarters, as the market tends to insist on trends in the short-term.

This is a general rule. If you want outsized returns in life, you should get comfortable with approaching things when they look broken, take the long view.

I bought Sofi and Robinhood back in 2023. These were the charts:

Sofi was down by 75% from its highs, while Robinhood was down over 80%.

Nobody liked them. I remember the day I bought SoFi. People said it was a scam and headed for bankruptcy. Source? Stock price.

Same for RobinHood. They said no serious person would use it as a brokerage. Source? Stock price.

We all know how well these stocks performed since then.

When a stock price becomes the main reference point for bears, and you clearly see they don’t know what they talk about, there is an opportunity to be a contrarian and win big.

Now I am going contrarian once again, this time betting on Klarna.

The ignorance I saw last week after it announced its earnings was massive. I saw that many people don’t even understand this business, yet they have megaphones to talk.

This convinced me that I can make serious money in this stock.

This is why I’ll be discussing it in more detail today.

So, let’s cut the introduction and dive in.

Klarna: What is it, really?

I published a deep dive into this stock last week, which was before its earnings. This is why I won’t go deep into the history, transformation, and value proposition of the business here, but will just share a snapshot of the business, establishing what it is and what it is not.

If you want a deeper intro to the business, you can read the full deep dive below 👇

Most people just say “Klarna is a BNPL” business, and this is all they know. They don’t know what the BNPL model really is and how Klarna expands on it.

This is why they can’t see what Klarna really is.

To understand it, you need to understand the BNPL model. The whole promise of BNPL is not charging interest to consumers on installment payments.

How do the firms achieve this?

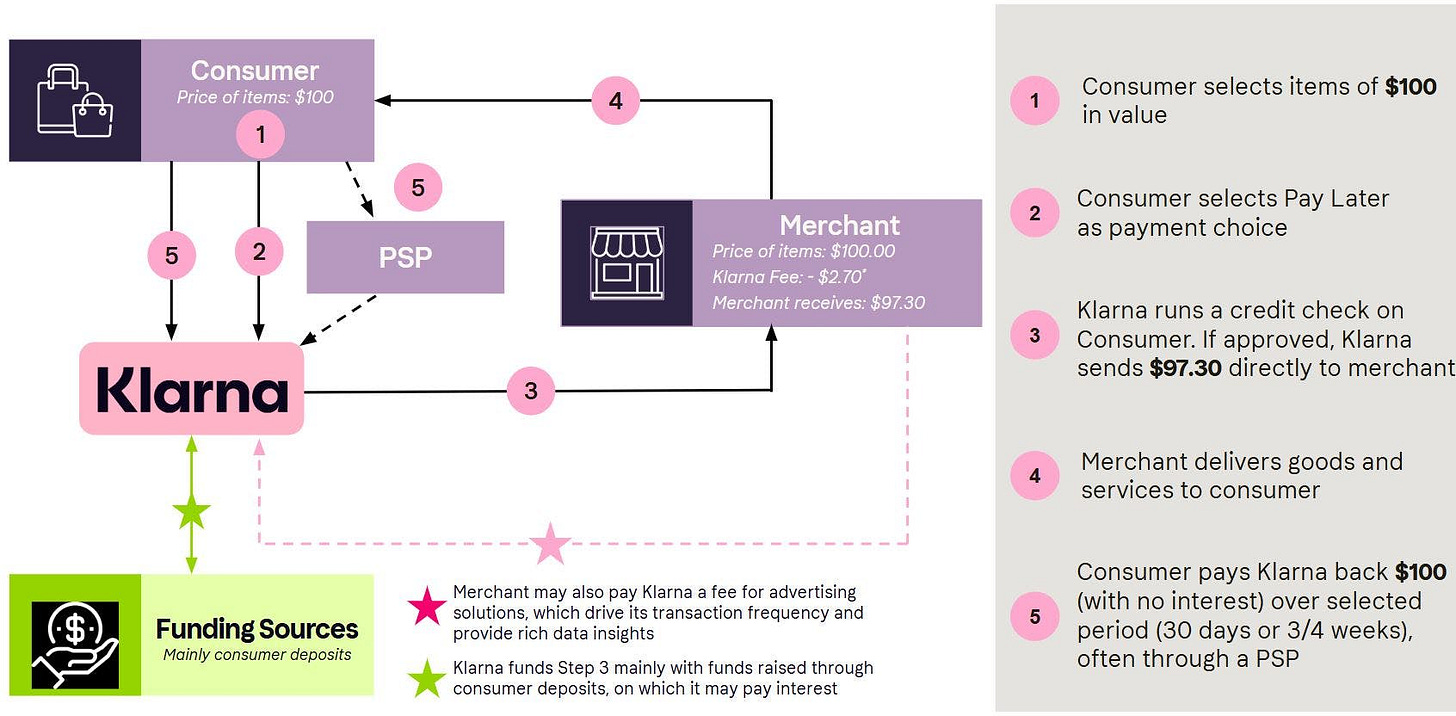

They partner up with merchants as the availability of BNPL increases the conversion rate of merchants. In exchange, merchants pay a portion of their revenue to BNPL providers. This is their main revenue channel, and they use it to cover credit losses and their operating expenses; what’s left is net income.

In this sense, BNPL is like a closed-loop network as money flows directly from the BNPL provider to a merchant:

As you see above, if the consumer connects his bank account to Klarna for repayments and purchases from a partner merchant, payment service providers (PSPs) stay completely out of the loop.

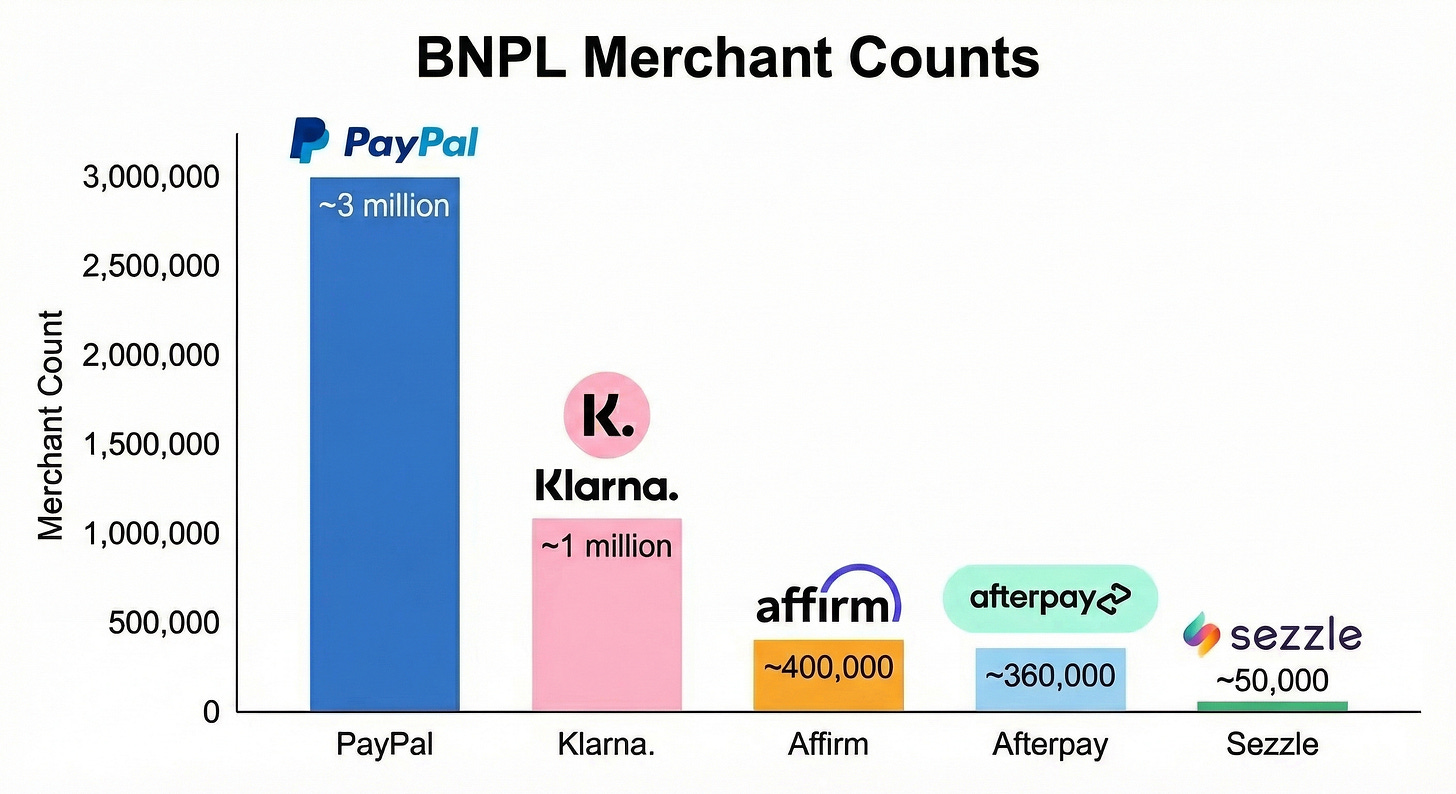

Thus, it’s possible to measure the strength of this business through the size of its network. This is because more merchants mean more customers are attracted to Klarna, which results in higher purchase volume and in-network revenue.

Klarna has the largest network among the competitors, except PayPal, which leverages its installed base:

As you see, Klarna’s network is twice the size of its closest competitor, Affirm.

What people don’t understand is that Klarna has built this network over the course of 20 years. It started with the BNPL model in 2005 to create a synthetic invoice shopping experience online. However, they didn’t have the installments at the time.

The current installment-based model emerged around 2016, and Klarna was well-positioned to capitalize on it due to its existing network. For the late comers, building this network was hard as it requires building both the customer and merchant sides at the same time.

Affirm has come a long way as it’s one of the earliest movers in the US and the best capitalized one, as it was founded by a member of the PayPal mafia, Max Levchin. However, for others, it’s extremely hard to build a viable network.

Sezzle is an example.

Its early ambition was monetizing the merchant side, but they quickly discovered that building that network is plain pain. Merchants already have viable alternatives like PayPal, Klarna, and Affirm, so they aren’t looking to integrate another one. And Sezzle can’t convince them because it lacks a giant established user base.

This is why its network stalled around just 50,000 merchants. It’s a hard task.

Instead, Sezzle pivoted and turned to monetizing the customers through subscriptions. It’s willing to reduce its lending standards, and the subscription fee is something like a retainer that subprime users pay to keep that channel for extra purchasing power open.

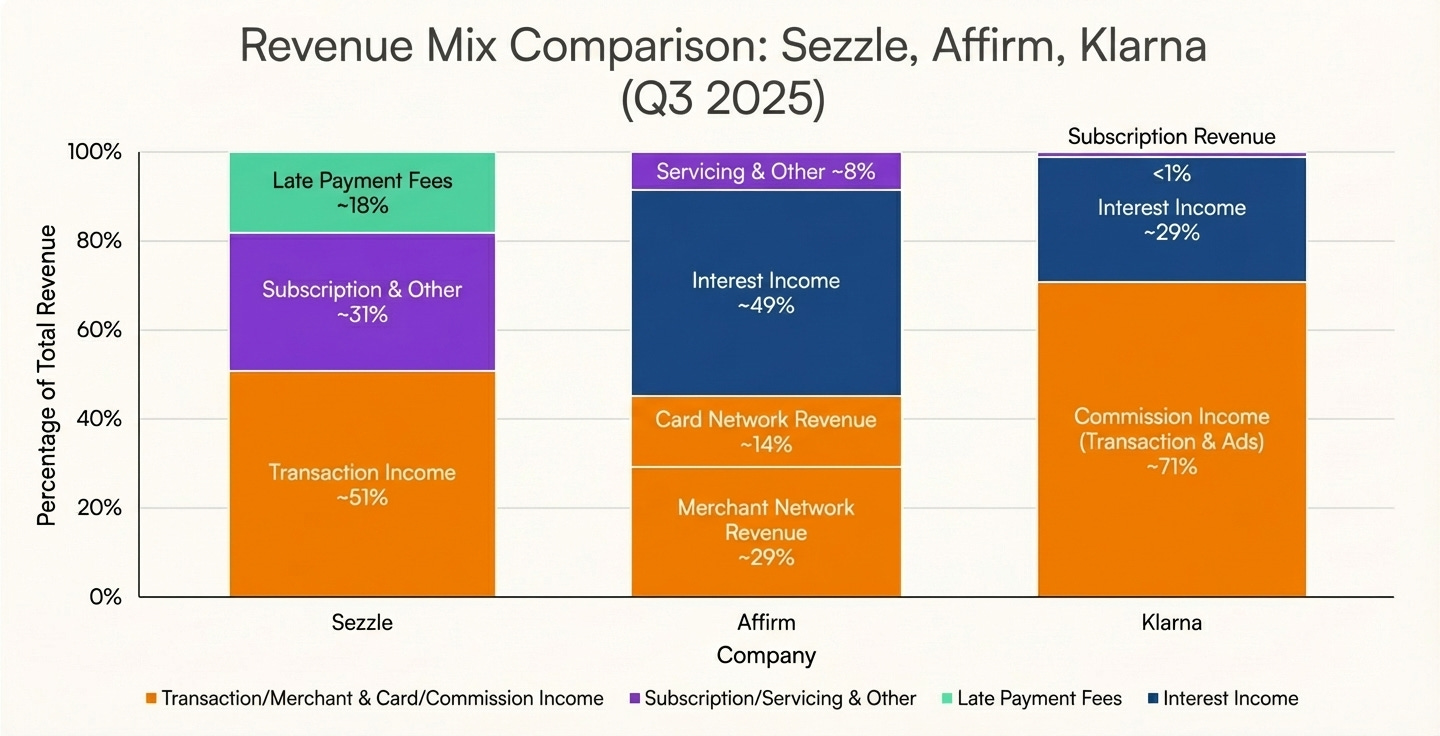

Indeed, when we compare revenue mixes of the competitors as of Q3 2025, we clearly see Klarna’s network power as the bulk of its revenue comes from merchant fees:

So, I would say Klarna is the only BNPL player that has reached the tipping point through its BNPL network, while other players turned to monetizing the consumer side way earlier as they noticed the hardship of scaling the network business.

As a true BNPL network, Klarna is in its own league.

Though I believe its network already sets Klarna apart from the competition, it’s not the only thing that differentiates it. If you go back to the above chart that shows how Klarna works, you’ll see that they say most of their funding comes from their deposit base.

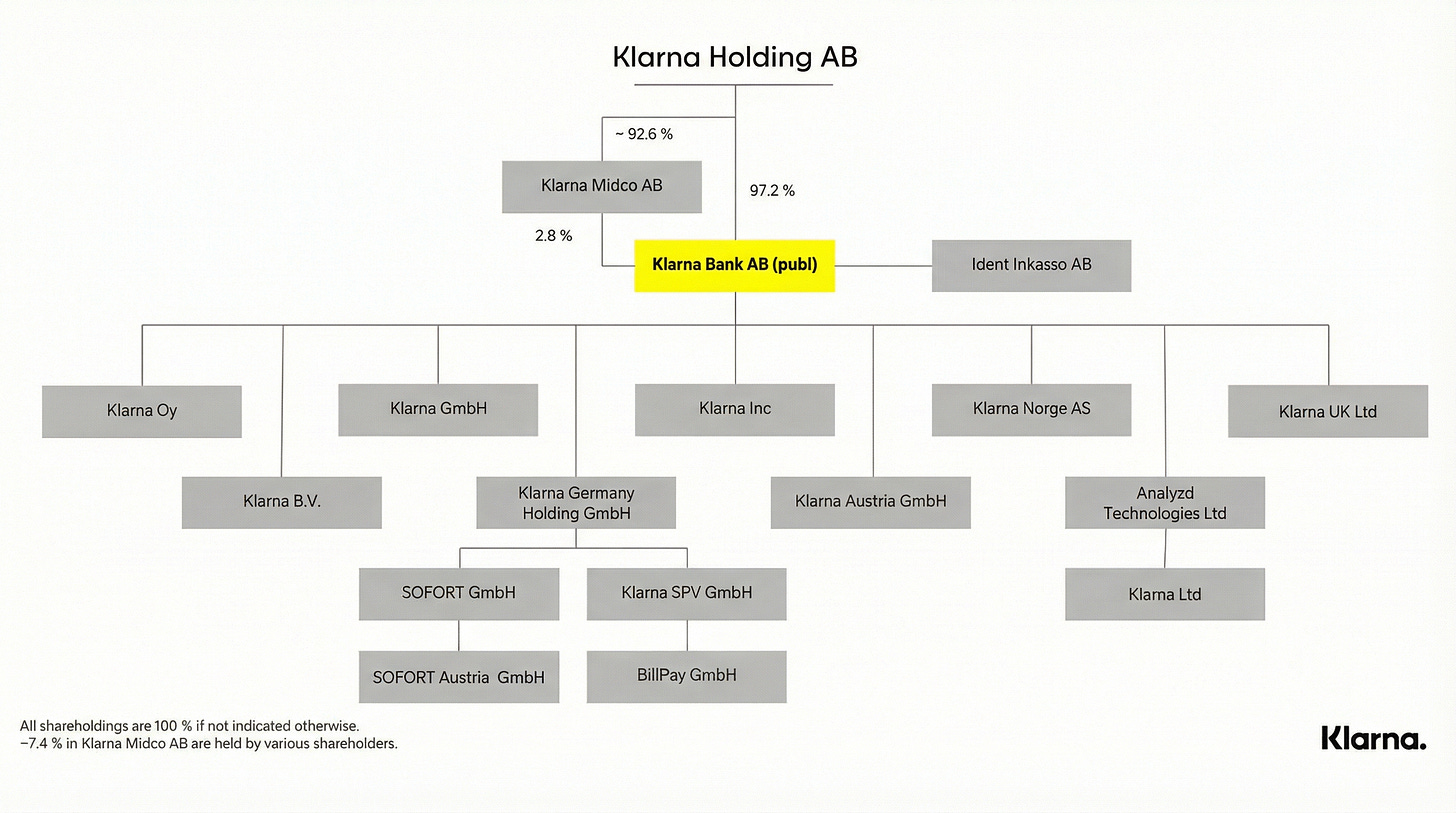

How? This is the point most people ignore or even don’t know about Klarna, it’s a licensed bank in the EU!

Owning a bank allows Klarna to have lower funding costs than its competitors, which is a significant edge when it comes to scaling interest-bearing products, like short-term loans. It also gives Klarna a huge runway for growth by expanding to adjacent markets in the financial services space.

Currently, it’s able to directly offer banking products to customers in Europe while it delivers these services through banking partners in the US. However, it’s not hard to see that they get a bank charter in the US as well, since the European charter shows that they prefer owning the stack.

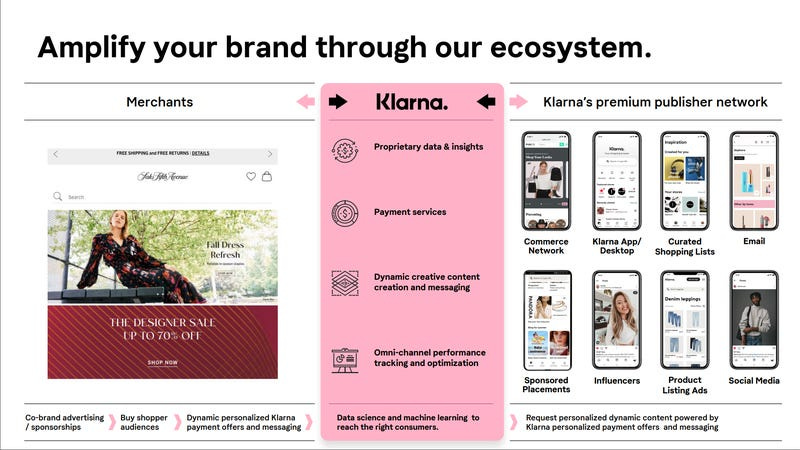

Finally, on top of their BNPL and banking stack, they built an advertising business where merchants are paying them to be featured on their network:

In short, we are looking at a unique company, not just a lender disguised under BNPL hood.

I would describe this business as a neobank that owns the premier BNPL network in the world and an integrated advertising platform.

Investment Thesis

My investment thesis could be summarized pretty easily under three pillars:

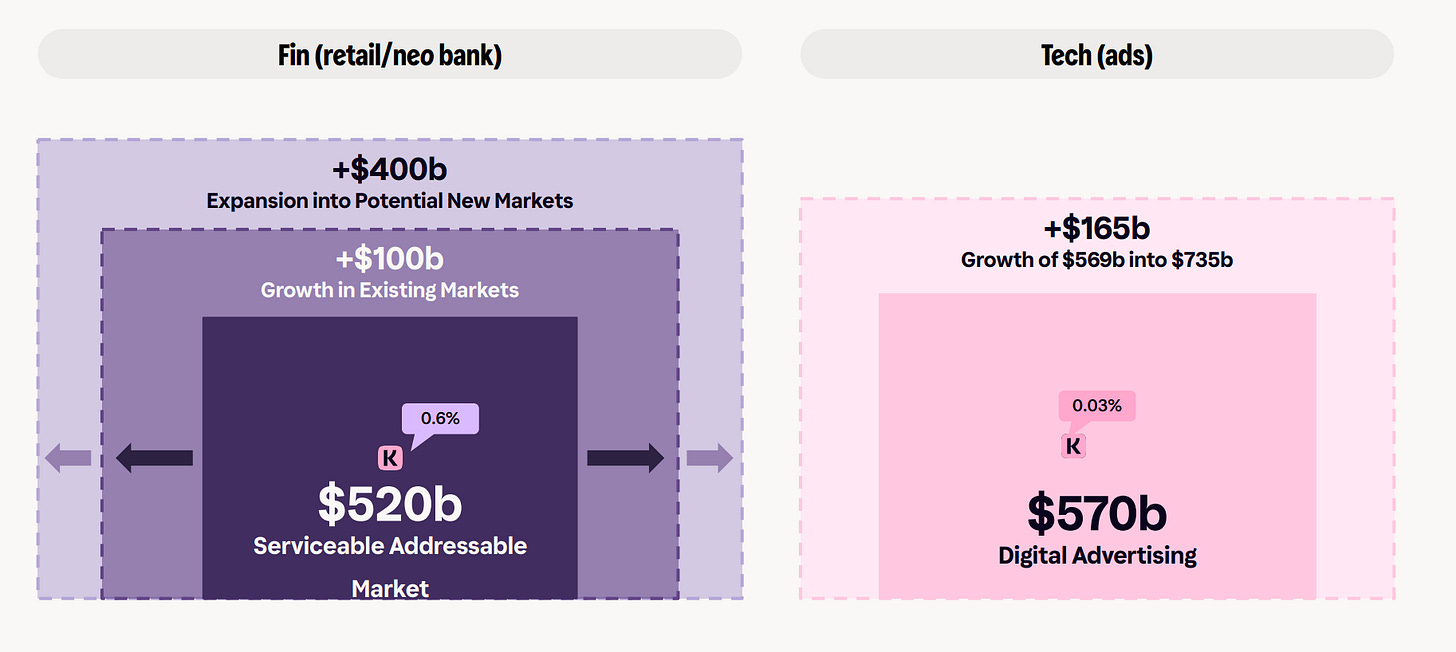

1️⃣ The addressable market is huge.

Klarna currently sees itself primarily as a BNPL provider operating in payments.

active in 26 markets across Europe, North America, and Australia, where total retail spending was around $19 trillion last year. Given that they currently have around 2.7% take rate, their serviceable market is around $520 billion.

We should note that this excludes all the opportunities beyond payments. Given that it’s a neo-bank, it can easily expand into adjacent markets in the financial services industry, in which case its addressable market easily reaches $1 trillion.

I don’t think its ad business will be something meaningful compared to fintech, but that’s still a big market that we shouldn’t ignore.

What this signals to me is that as long as execution doesn’t stall, I don’t see any reason for growth to plummet, as this is a huge market that is virtually never saturated.

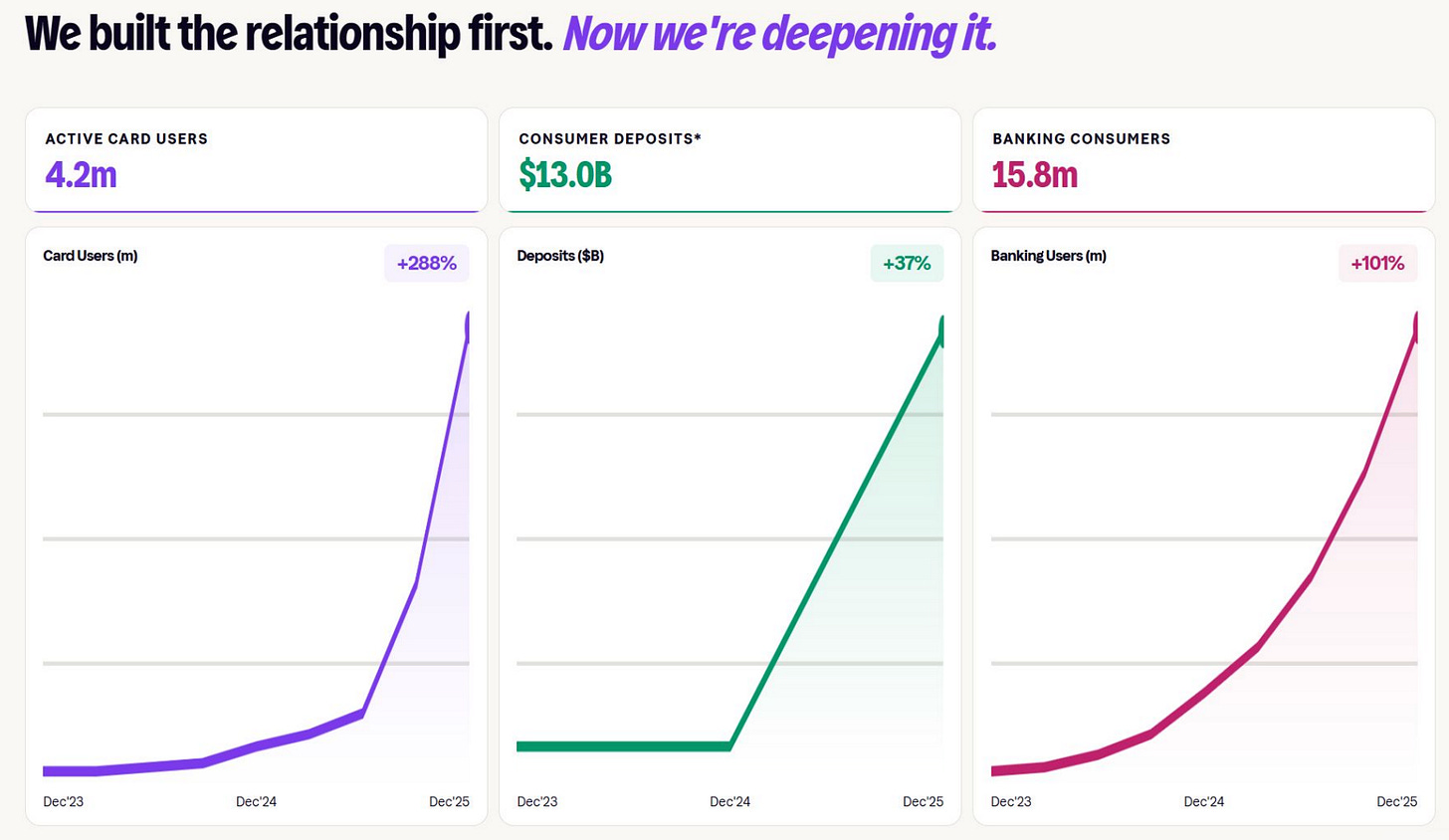

2️⃣ Klarna will double down on the neo-bank stack.

As I said above, one of the main factors that distinguishes Klarna is its banking license. AS a result, it has built a comprehensive neo-bank stack that is way ahead of the competitors.

As it’s already the leader in the BNPL market and growth there will eventually flatline, it has already started to push its users down the funnel and convert them into full banking customers.

As you see, customer deposits skyrocketed since 2023, and banking customers literally doubled since 2023. This trend will likely continue as the annual revenue per customer jumps from $28 for basic users to $120 for banking customers. There is a lot of juice to squeeze here, as only 13% of their users have banking accounts.

If they can convert 10% more of their basic users to bank customers, this single-handedly boosts ARPAC to $35–36 from $28, an uplift of about 25-27%.

3️⃣ They have significant operating leverage.

I have been saying for a long time that fintech and insurtech are two spaces where AI will be net positive to those who adopt them without posing any risk of disruption.

Indeed, these two spaces are characterized by actuarial assessment and repetitive customer-facing tasks like onboarding, claims processing, etc.

If a company can replace humans doing these tasks with AI agents and products, it can reach margins hard to imagine for legacy players in the industry.

We saw how this played out for Lemonade, and we are now seeing it for Klarna.

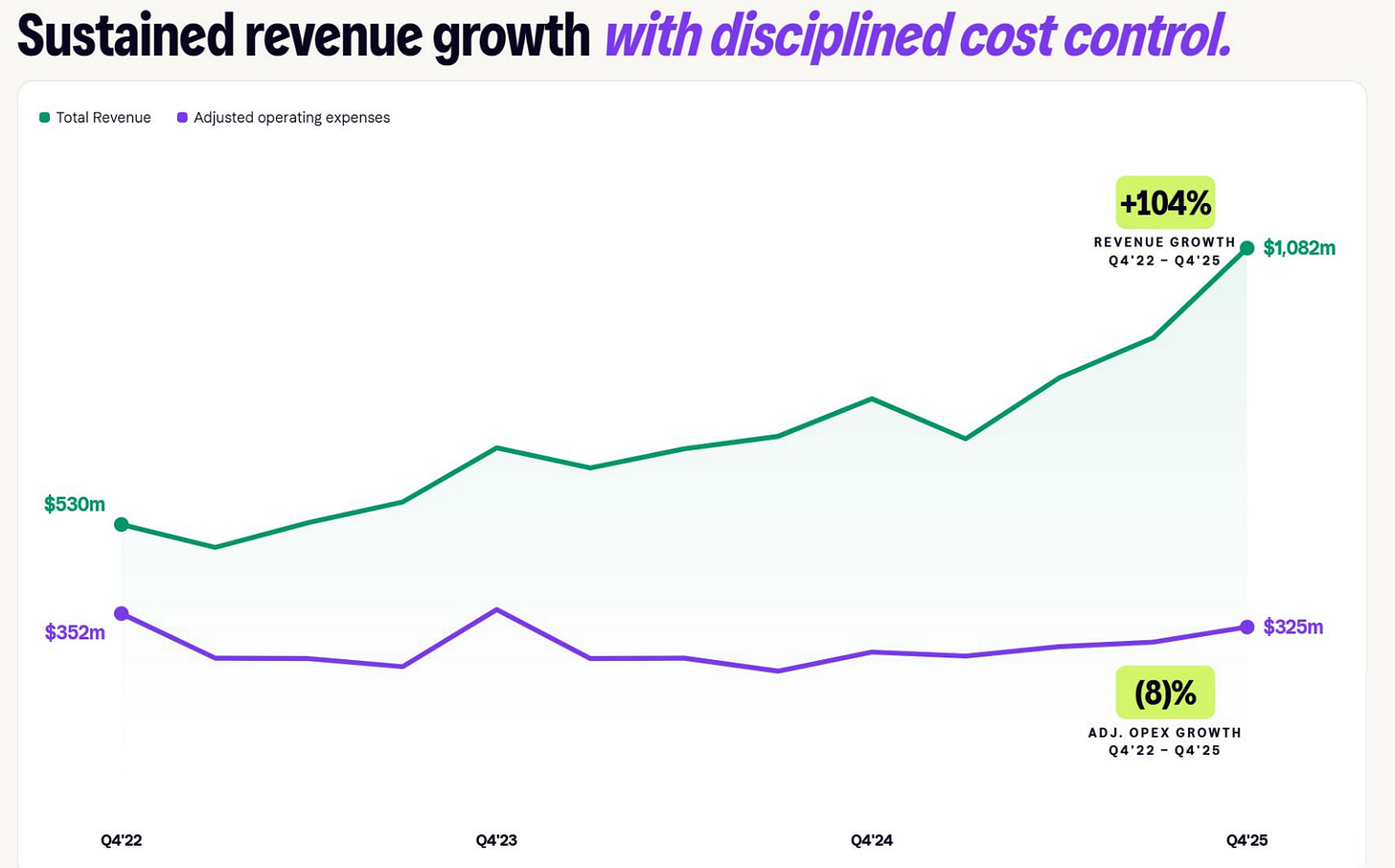

While their revenue doubled since 2022, their adjusted opex declined:

Their efficiency gains will only increase as AI systems develop and their adoption deepens. As a result, their significant growth will be accompanied by rapid margin expansion over time. This is basically the winning recipe in the market.

In short, Klarna is operating in a huge market with a lot of growth opportunities, and it’s well-positioned to exploit these opportunities thanks to its full neo-banking stack.

It has a dual growth driver as it’s actively converting basic users to higher-value banking customers, aside from organic user growth.

They are very good at adopting AI in their business, which results in an operating leverage unprecedented in financial services.

Add on top of all these that it’s still being led by its founder, and it’s not too hard to see that this business will keep growing fast, at least for the next 5-10 years.

What Went Wrong?

Let’s set this straight from the beginning—nothing is exactly wrong with the business, but the stock has been wrong all along.

First, it started wrong.

Klarna was priced to perfection at IPO. On the first day of trading, it opened at $45:

For reference, this price was just below my 5-year price target. This is why I didn’t buy at the IPO and waited. Unsurprisingly, the stock has been in a decline ever since.

As I said, the bulk of this decline was justified as the stock was well above its fair value. After 5 months of sliding, the stock reached $18 levels two weeks ago, which I believe is in the ballpark of fair value on a conservative scenario.

When I saw this, I decided to write a deep dive and published it last week. I said I could buy a position, and I would likely buy half of it before earnings and the other half after earnings.

However, as we moved into the week, I decided that any upward movement would likely be temporary in the current market environment, so I decided to wait.

Then the company announced earnings, and the stock dropped by almost 30%.

Now the question is simple—what was in the earnings that prompted this reaction?

I would say, and strongly say, “nothing.”

Let’s reason through it, shall we? What would be the core metrics to assess a business like this? I would say three things:

Growth

Charge-off rates

Transaction margins

I think it all got a passing grade in all these metrics.

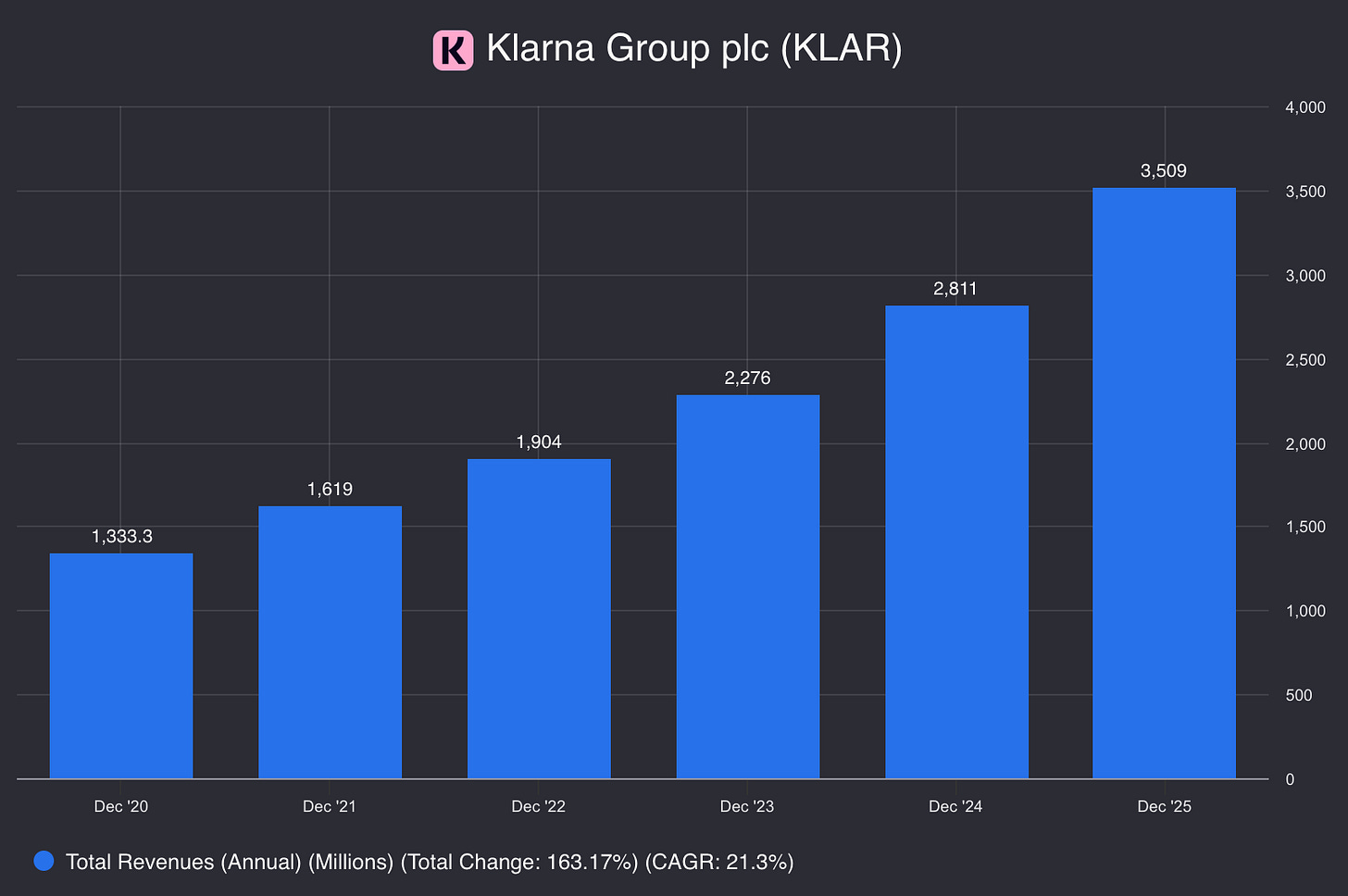

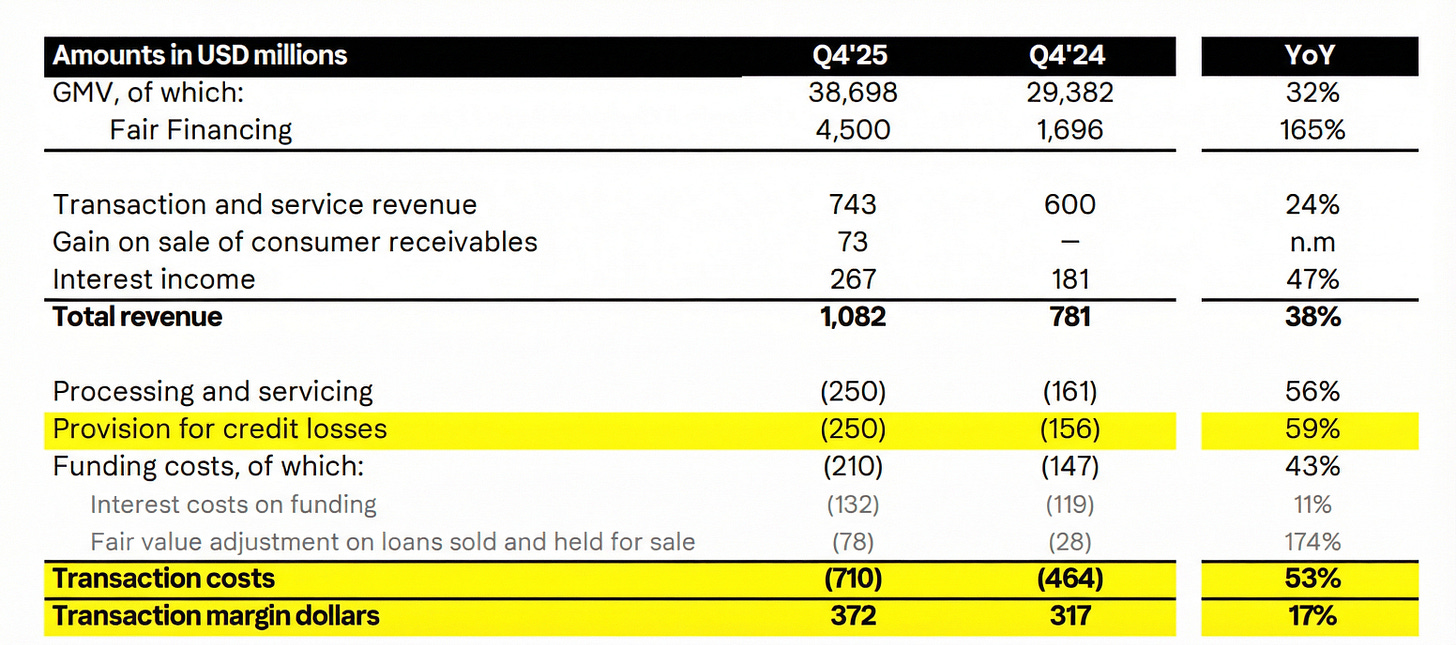

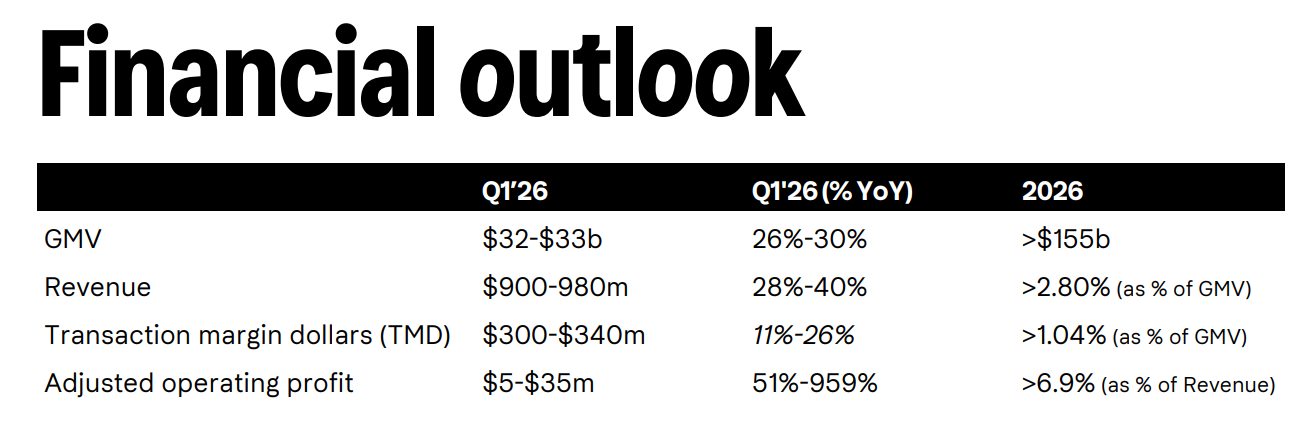

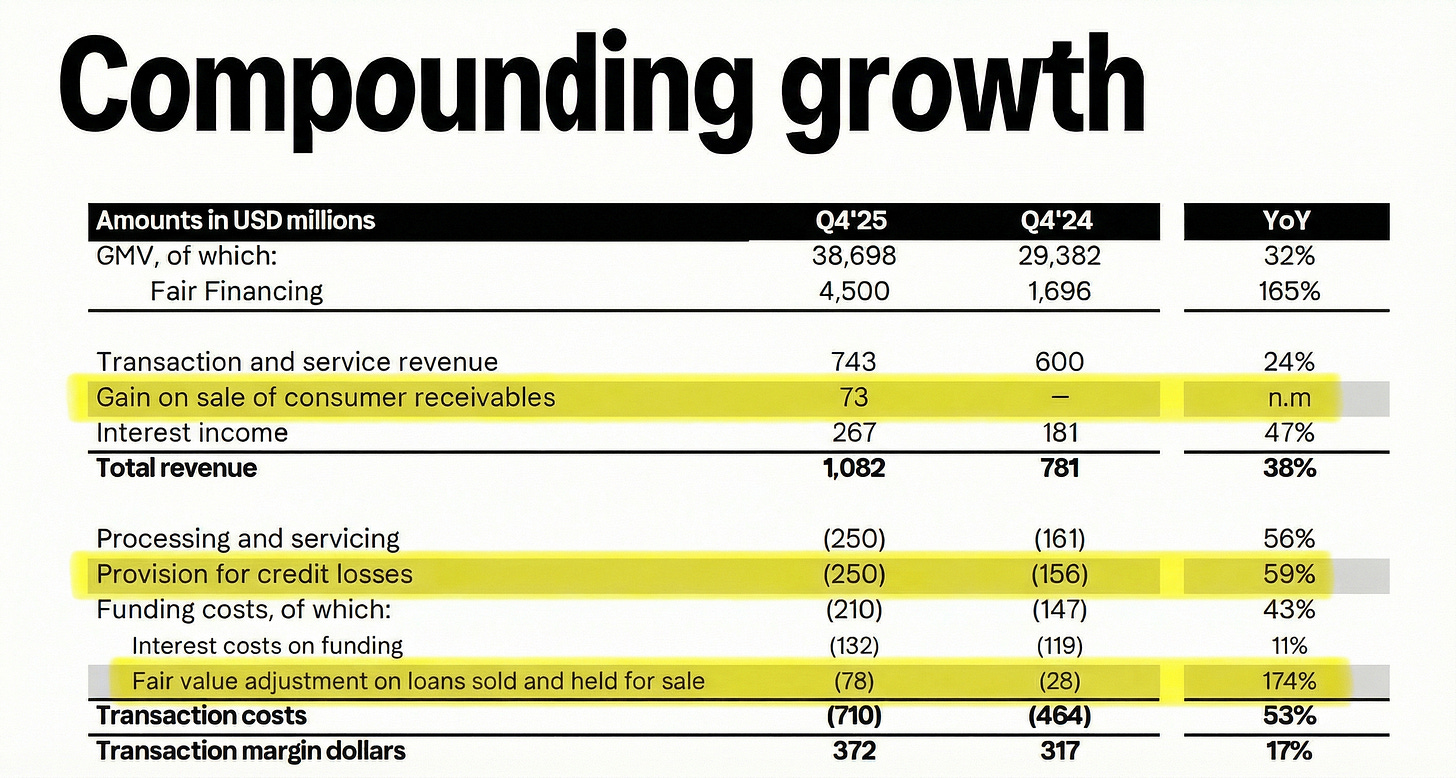

Growth was especially impressive to me because it accelerated from 28% in the previous quarter to almost 39% in the last quarter. The full-year growth accelerated from 23.5% in 2024 to 25% in 2025.

Two factors played a critical role in this growth: increasing banking customers and ramp up of the interest-bearing products. We can clearly see this as interest income made up nearly 22% of their revenue starting in 2025, and it reached nearly 25% at the year's end.

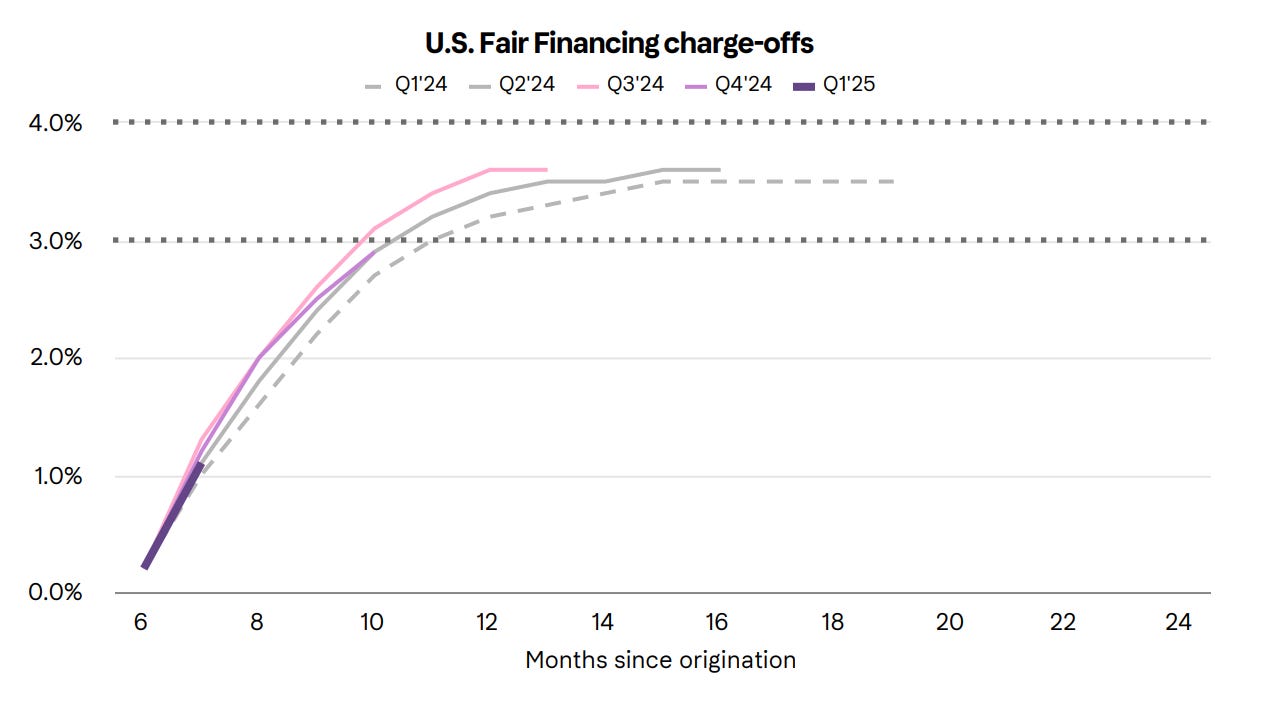

Its interest-bearing product, which it calls “fair financing”, is essentially a larger ticket personal loan product that naturally has a higher charge-off rate than the small-ticket, shorter duration pay-later products.

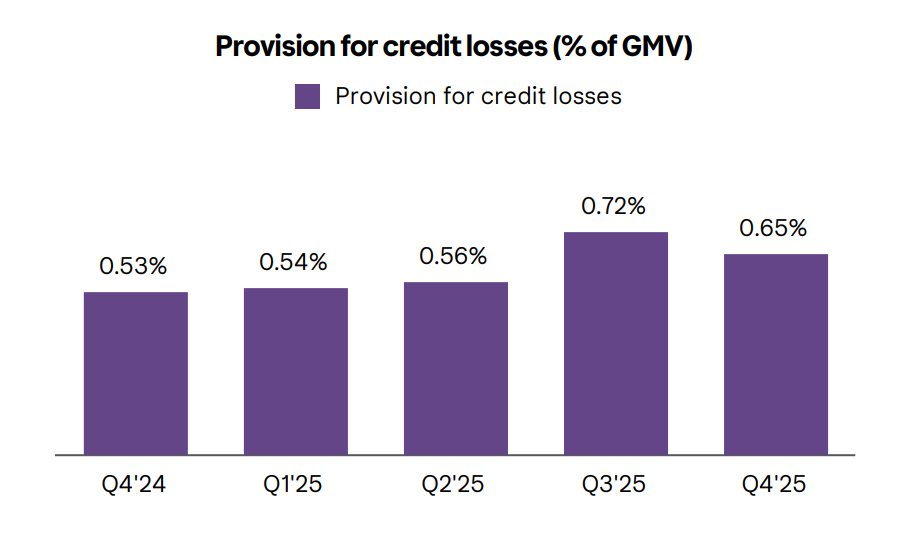

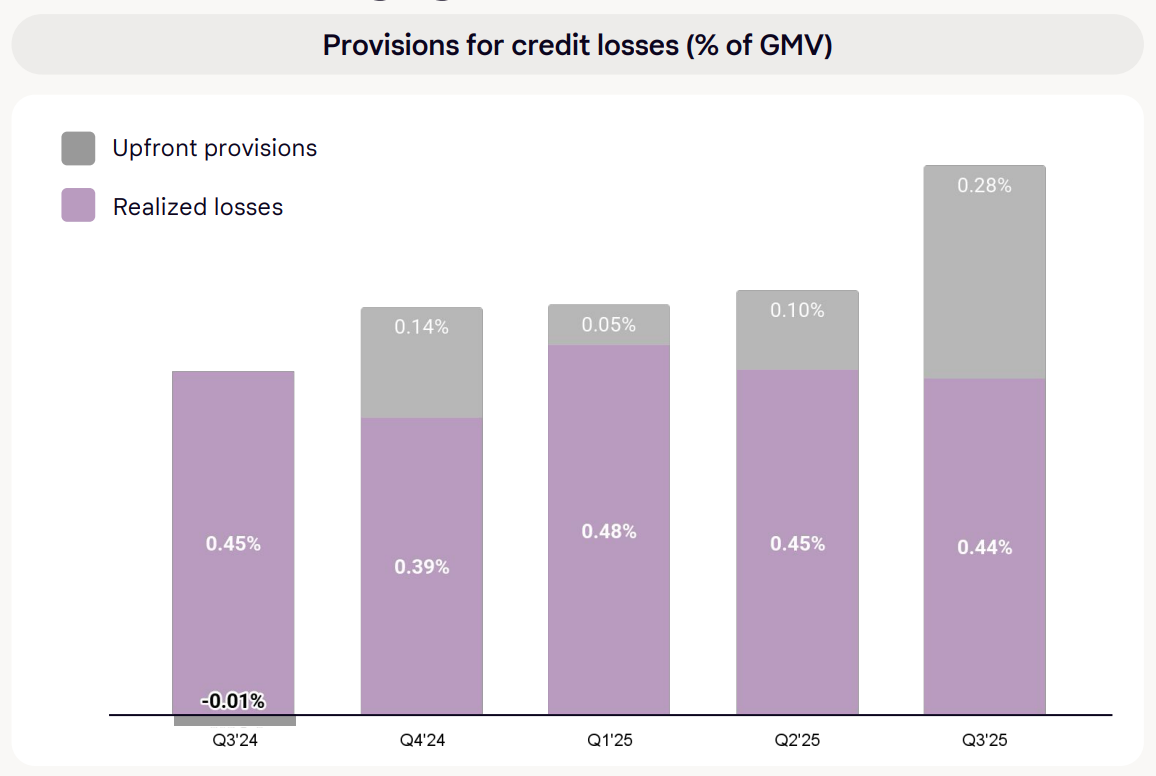

Despite this shift in revenue toward interest-bearing products with higher charge-off rates, Klarna’s provision for credit losses as a percentage of GMV remained stable:

This reflects Klarna’s strong credit performance across its products. While the charge-off rate is around 1% for its short-term pay-later product, it climbs to 3.5% for its fair financing product, which is just 0.5% above the national average of 3% and perfectly in line with that of Affirm’s.

So, as opposed to what many people think, Klarna’s credit performance is not deteriorating. It’s stable, and it’s pretty good.

Let’s turn to transaction margin dollars (TMD) now.

This is the core operating metric for Klarna as it shows how the underlying credit engine is performing. Think of it like gross profit.

This is actually where they fell short of their guidance. They delivered $372 million against their guidance of $390 million.

Though many people lamented that, it’s far from alarming, and directly relates to the change in their revenue mix.

As per the accounting standards, they need to record their provision for credit losses upfront, but they record related revenue as they collect payments. In short, there is a mismatch between when they record expenses and revenue.

As a result, ramping up interest-bearing loans artificially depresses the margins as they incur the loss provision now but record revenues gradually.

This drag can easily be responsible for the miss, as they only missed the transaction margin target as a % of revenue by 2%. As their interest-bearing product ramp stabilizes, it can easily expand transaction margin by 2%. So, the miss didn’t really bother me.

If this is the case and it was actually an “okay” print, what bothered the market so much?

Well, I would say the same thing as Pagaya—below expected growth guidance.

They guided for +22% GMV growth for this year against 25% consensus estimate. Their guidance for TMD also fell short at 1.04% of GMV against 1.2% expected.

This is what the market reacted to, not credit performance or paper losses connected to ramping up the interest-bearing product. In this sense, it’s pretty similar to what happened with Pagaya. It also delivered a blockbuster quarter, but the growth guidance didn’t satisfy the market.

It’s obvious that lending-centered fintechs are giving prudent guidance this year as a class. This is logical as there is a cloud of uncertainty as to where the broader economy is headed and what the new Fed Chair’s overall stance will be.

In short, despite all the fuss, I don’t see a material erosion of Klarna’s business or its performance. The current narrative is largely driven by the price action, which itself isn’t a consequence of bad performance but unsatisfactory guidance.

Some Common Misconceptions About Klarna

After the earnings and price reaction, the narrative about the stock went overly negative, prompting many people claim erosion in Klarna’s business.

Most of these people and accounts don’t have any idea about what they are talking about, and they post that way because hammering a fresh IPO that was once valued outrageously in private markets always generates engagement.

Though I don’t really give a damn about these posts, some people, everyday people who are trying to invest to the best of their ability to make a little extra, may be affected badly. Thus, I want to address a few of these misconceptions here.

1️⃣ Credit Performance Is Deteriorating

This is perhaps the most common misconception I have seen.

People are just looking at the YoY increase in provision of credit losses as a % of GMV and saying that credit quality is getting worse.

This view completely ignores the shift in the product mix. Their fair financing (interest-bearing product) GMV growth accelerated from 139% year-over-year in Q3’25 to 165% in Q4’25 ($4.5b), reaching 193% in December.

This means that their interest-bearing product volume in December was almost 3x that of the same period last year. As explained above, these are longer-term loans where the company collects revenue over time but records the provision for losses immediately. This artificially inflates loan losses as a % of GMV.

If you look at the actual realized losses, they are pretty stable. We don’t have the breakdown for this quarter, but realized losses as a % of GMV were actually down previous quarter, despite scaling the fair financing product for some time now:

So, given that their fair financing volume in December was 3x that of last year’s, we can easily say the jump was due to an accelerating shift in the product mix.

The fact that fair financing charge-offs remained stable across vintages is a further indication that increasing loss provisions are not due to deteriorating credit, but due to increasing volumes.

It’s obvious that Klarna’s credit quality is robust, and “their loans are going down the toilet” is just a narrative driven by engagement hunters who Tweet based on the stock price.

2️⃣ Markdowns are increasing.

I saw this argument a few times on Twitter, but clearly, people making it don’t understand anything about this business.

Klarna runs two off-loading programs for the loans it originates, one for the short-term BNPL loans, which is illustrated by the line item “Fair value adjustment on loans sold and held for sale”, and the other one is for fair financing, which shows up as “Gain on sale of consumer receivables”.

Last quarter, Klarna’s losses from fair value adjustments on loans held for sale increased from $28 million last year to $78 million this year.

However, this doesn’t signal a credit deterioration.

For short-term BNPL loans, Klarna strips off the high-margin merchant fee and sells the receivable at a discount to keep its balance sheet lean. This discount exists because buyers are taking on credit risk on loans that don't carry interest, so they naturally won't pay face value.

As long as the merchant fee Klarna retains on these offloaded loans exceeds the markdown it takes when selling them, the offloading is accretive.

The reason this line item nearly tripled while GMV grew only 32% is that Klarna deliberately expanded its offloading program, particularly in the U.S. This is a strategic capital decision. They're choosing to hold fewer of these receivables on the balance sheet, which is a desirable thing for a lender looking to grow volumes.

On the Fair Financing side, Klarna offloaded $1.6 billion in receivables for a $73 million gain. These loans get a premium from buyers because they carry interest income, so the sale price exceeds book value.

Taken together, the combined P&L impact of both offloading programs was roughly negative $5 million last quarter. Yet transaction margin dollars still grew by $55 million YoY, absorbing both a nearly tripled offloading cost and a 59% increase in credit loss provisions.

It’s clear that there is nothing wrong with the core business engine of this company.

3️⃣ Negative cash flow.

This came very surprising to me as it clearly indicates that people don’t really understand what this business is.

I saw that many people pointed to a strong negative turn in Klarna’s operating cash flow. They cursed the business based on this figure:

The first thing you have to remember is that Klarna is a bank, and it’s the most natural thing for a bank to have negative operating cash flow, especially if the loan book is growing faster than collections. This is what’s happening with Klarna.

The main driver was $3.6 billion in new loan originations.

$2.8b from the core lending book (net of repayments), driven by Fair Financing growing 165% YoY, and $800m from loans originated specifically for the new offloading programs.

On the funding side, deposits grew $2.1b, though about $850m was parked into government securities for regulatory liquidity requirements, leaving $1.3b available for lending. Loan originations significantly outpaced available deposit funding, which is what drove operating cash flow to -$1b.

Outside of operations, Klarna raised $988m through new borrowings and equity, bringing total cash flow to roughly flat before a $634m tailwind from favorable FX movements. Klarna ended the year with $3.8b in cash, up from $3.2b. As long as Klarna earns a spread on this borrowing, the model is healthy.

Klarna’s interest income was $937m in 2025, earned on a loan book that grew from $8.1b to $10.5b. Its interest expense paid was $425m over the same period. That’s a $512m positive spread, showing clearly that borrowing to fund loan growth was accretive.

In short, Klarna’s change in cash flow doesn’t indicate broken operations; it just shows us a bank that is pressing for growth. Those who look at the cash flow statement and freak out apparently have no idea about this business.

Valuation

I valued Klarna in my previous write-up using different scenarios. They went as follows:

Bear: 18% annual growth by 2030, 12% net-margin, 6% dilution, 15x exit multiple

Base: 20% annual growth by 2030, 14% net margin, 5% dilution, 20x exit multiple

Bull: 25% annual growth by 2030, 15% net margin, 4% dilution, 25x exit multiple

I think the current outlook fits between my bear and base cases. The Wall-Street was overoptimistic about the future, which shows us the importance of being conservative with assumptions.

As the bottom end of their guidance is 22% revenue growth this year, I think we can still assume something between 18%-20% annual growth for the next 5 years, which means the current fair value should be at least $18, promising almost 40% upside from here.

Even if we come up with an ultimate bear scenario, which is:

15% annual growth for the next 5 years

10% net margin

6% dilution

We get $7.04b in revenue, $704m in net income, and $1.40 EPS at 504m shares outstanding. At a 15x exit multiple, we are looking at a $21/share stock price.

Discounting it back to today at a 10% annual rate, we get ~$13/share, which is exactly where it trades now.

Note that this is already a very unlikely scenario I created just to highlight how cheap today’s valuation is. In this scenario, even if you just adjust the net margin to 15%, fair value goes up to $19.50.

In short, I think it’s very, very hard to lose money on this stock if you are willing to take the long view.

Closing

Klarna is one of the most misunderstood companies I have recently seen. I shockingly watched that many investors labelled this as BNPL in their mind and didn’t bother to dig a bit deeper to understand that this is actually a bank.

This ignorance creates many misconceptions and mismatches between reality and expectations, which dragged the stock down where it is today.

I sense SoFi like opportunity in this stock as its valuation has gotten ridiculous.

If this were just a BNPL, I still wouldn’t be willing to bet, but its neo-bank structure makes me confident that they have many spaces to expand to and generate growth.

Though I really like it here, I have to say you shouldn’t expect a short-term catalyst. This business will likely grow out of its misvaluation due to sustained growth and thus increasing fair value, as SoFi did from 2022 to now.

So, you have to be patient, but the return will be worth it.

Second, their initial investors are currently in the lock-up period that expires in March. Given that they have a very VC-heavy cap table, I think they can sell despite the obvious undervaluation to fund new investments. This may drag the stock further down.

I bought the first chunk of my position on Thursday evening at around $14. I’ll wait until the lock-up expiration to double down to see if I can get an even better price.

I am planning a 3-4% position size, but can easily go above that as I see execution.

This is my plan for now.