Buying This Fast Growing Company With 5x Potential

Fast growing business, margins will inflect next year, valuation has recently become a no-brainer.

“All happy families are alike; each unhappy family is unhappy in its own way.”

This is how Tolstoy’s great novel Anna Karenina opens. I think it’s one of the best openings in all literature. Interestingly, I always remember this opening sentence when I think about investing.

Why, you may ask.

Well, because if you asked me one single skill that’s most useful in investing, I would say “pattern recognition.”

What I have understood in my investing career is that each failing company fails in its unique way, but successful companies are more alike in how they succeed.

Think about Amazon and Walmart.

Amazon basically adopted Walmart’s model for e-commerce. Indeed, many early-stage Amazon executives were ex-Walmarters.

Yet, similarities go beyond the similar markets.

Steve Jobs and James Dyson admired each other because of their shared obsession with product design. Dyson makes home appliances while Apple makes consumer electronics, but their success is visibly similar. In many senses, Dyson is the Apple of home appliances.

I am not making this up; it’s a common feeling. Look at the title of the article below, The Business Times published this back in 2017:

Google guys were inspired by how Steve Jobs locked in customers by turning Apple into a closed ecosystem, and strategized to reinforce their search dominance with a browser, Chrome.

David Velez, the founder of NuBank, drew inspiration directly from Capital One. At General Atlantic, Velez worked alongside Capital One’s founder, Nigel Morris, who taught Velez how to leverage data to match financial products with consumers.

If you knew how Capital One succeeded, you would recognize the same model in NuBank, and perhaps you would invest very early.

In short, recognizing successful patterns is crucial in investing.

When I turn back as an investor and try to understand what worked for me, the same pattern keeps emerging. I have made most of my money in a particular type of business.

I can count 5 properties that keep emerging in my successful investments:

A product or service that works on frequent, repeat purchases.

The product or service has some degree of natural stickiness.

The business has some degree of competitive advantage.

Growth combined with improving margins.

Digital delivery that enables rapid scaling.

Lemonade, SoFi, RobinHood, Dave, Palantir, etc., all had at least four of these properties. This is not a coincidence. There are structural reasons that are embedded in industrial organization theory:

When a product or service requiring repeat purchases is joined by a structural stickiness, the foreseeability of revenues improves drastically.

Digital delivery removes the barriers before the firm size, enabling winners to grow very big, very fast.

Growth with margin improvement leads to rapid multiple expansion.

So, if you can buy a stock that fits these criteria, you can quickly make multiples on your investments.

For the last two months, I have been watching a company that has all these criteria.

The stock has recently declined to criminal valuations despite amazing growth prospects ahead. So, I decided to pull the trigger despite this broadly overvalued market.

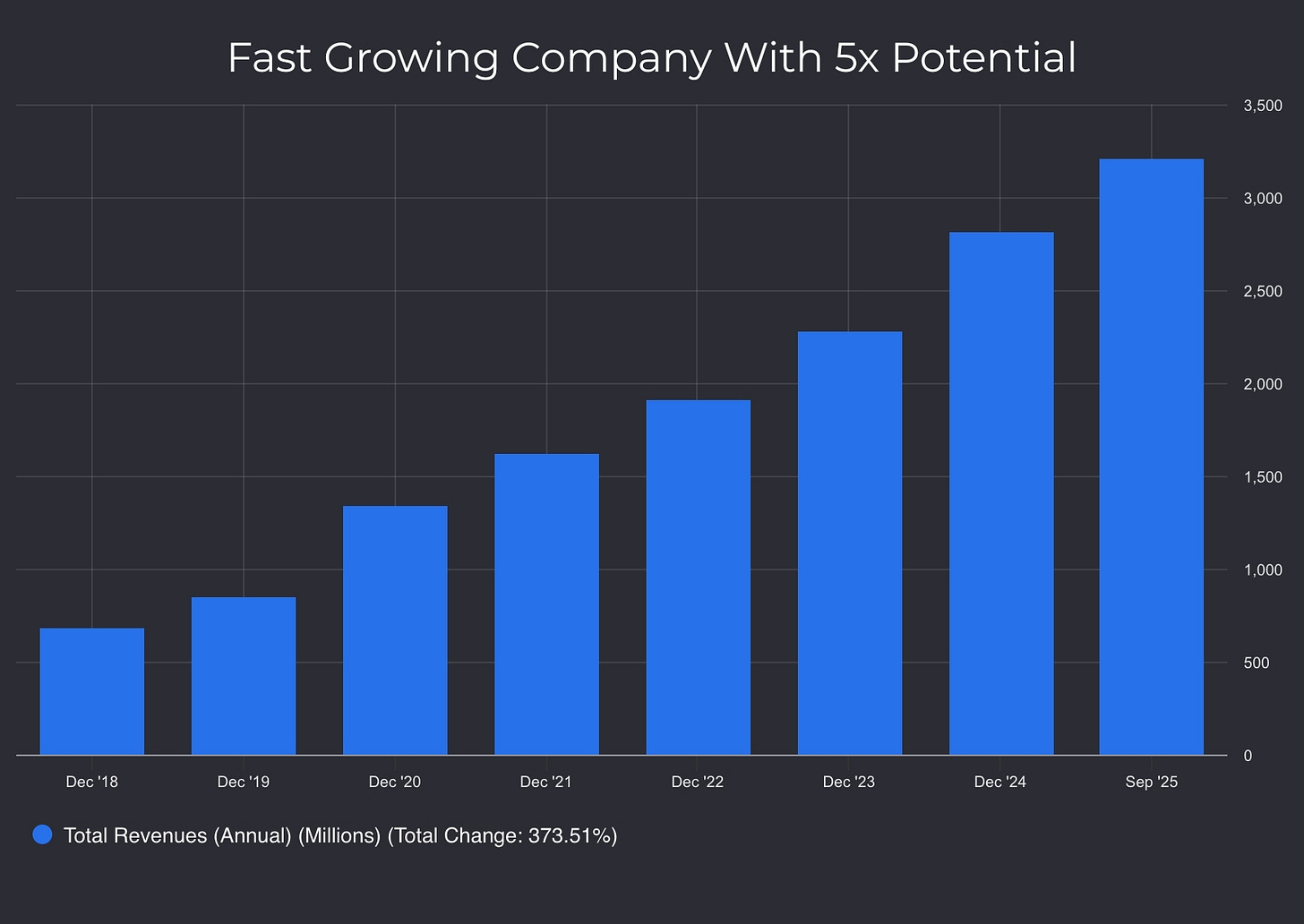

Take a look at this:

This company has been performing at the elite level for the last decade.

Revenues have grown ~25% annually since 2018.

It is expected to hit GAAP profitability this year.

Analysts project ~20% revenue growth for the next 5 years.

What is even better? It’s trading at just 15x 2027 earnings.

It’s a true gem in a broadly overvalued market. I was going to wait a bit more for better valuations market-wide, but it got so criminally cheap after last Thursday’s sell-off that I decided to open a position now.

It can easily make 3-5x in the next 5 years, even if it only hits conservative targets.

So, let’s cut the introduction and dive deep into it!

🏭 Understanding The Business

The most successful business ideas emerge from founders’ own problems or from the inefficiencies they observe in the industries they work in.

Shopify is a great example.

Tobias Lutke wasn’t trying to build an e-commerce software company. He wanted to create an online store to sell snowboards. The site would be called Snowdevil. Lutke tried to use existing e-commerce storefronts, and he found all of them terrible. This is how he noticed a need for a great e-commerce storefront provider.

The idea for this company came exactly this way, from a problem that the founder noticed through his own experiences.