Buying This Fast-Growing Company With 3X Potential!

It grew revenues 30% annually from 2020 to 2024, expanded margins and has a stellar return on investment. What's better? It's profitable and trading at just 15 times earnings.

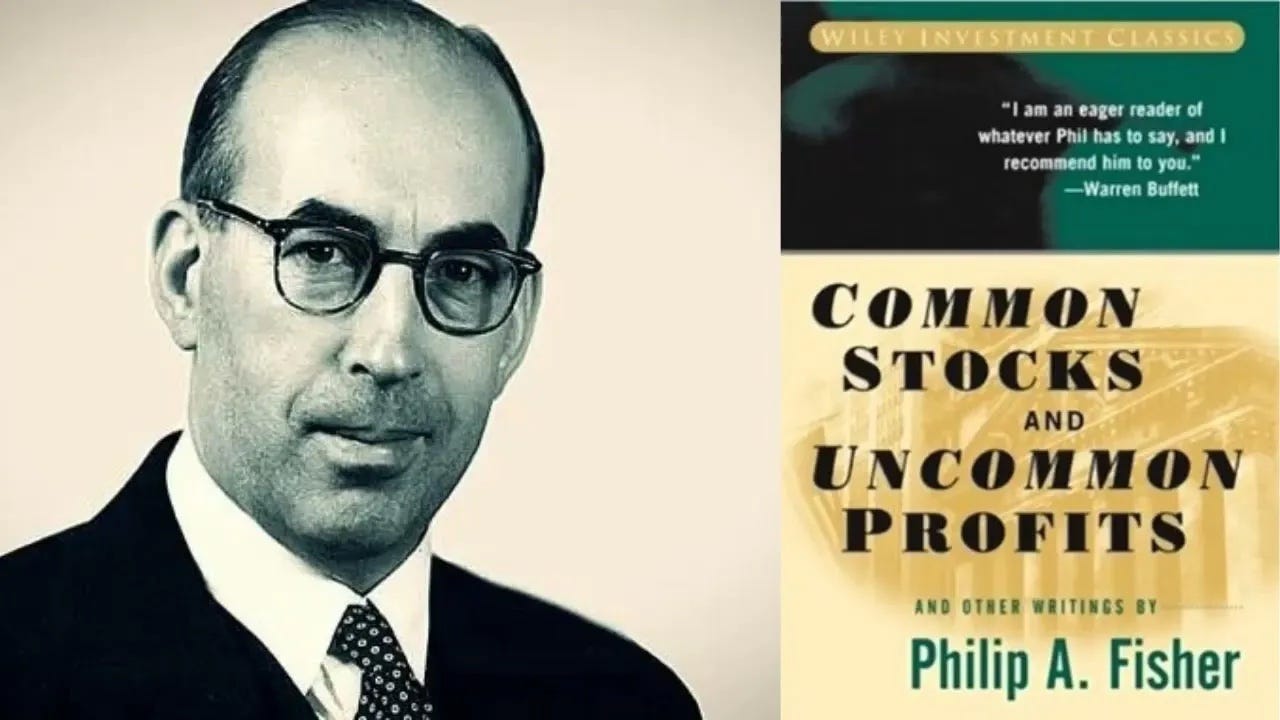

If I had to pick one book to read about investing, it would be Common Stocks and Uncommon Profits by Philip Fisher.

If Benjamin Graham’s The Intelligent Investor laid the groundwork for value investing, Fisher laid the groundwork for growth investing.

Be careful, I am not talking about momentum investing, i.e, buying stocks that are driven higher by expectations rather than the fundamentals. I am talking about “quality growth investing.”

This is actually what investors like Peter Lynch and Terry Smith practice. Warren Buffett also adopted this approach after he met Charlie Munger.

If you read Buffett’s writings and listen to his talks in Berkshire Annual Meetings carefully, you see that he constantly emphasizes “buying companies with durable competitive advantage that can grow earnings above the average rate for a long time.”

That’s classical Fisher.

If you look at the track records of investors following this philosophy—Charlie Munger, Warren Buffett, Peter Lynch, Terry Smith, Chuck Akre, Nick Sleep—you see that it works.

So the question is, how can you find those companies?

They come in all sorts and shapes, but all such companies I have known have one common property, and Fisher explains that too:

“The business should be doing something worthwhile with its products or services, something that makes people’s lives better.”

Philip Fisher—Common Stocks and Uncommon Profits

They do something that makes people’s lives better. They are painkillers.

Your life isn’t just better with them; it would also have been worse without them.

This is the exact framework we apply when picking our growth positions.

Take fintech, for instance.

We picked Dave in October last year when nobody was actually paying attention to the stock. I laid out the same vitamin/painkiller framework and explained that Dave was a painkiller because it saved people living paycheck to paycheck from overdraft fees by providing them cash advances and early paycheck access.

Here is the full deep dive from October 👇

The stock was around $40 at the time; it’s $208 now. 5x in just 8 months!

It’s not just Dave; many growth positions in our portfolio also became multibaggers in the last few months, driving a 31% return for our portfolio in the last twelve months against just 10% of the S&P 500.

It’s not genius, it’s not market timing, it’s not trading—it’s the framework that works.

Now, I have found another company that vastly improves people’s lives.

It has all the properties that long-term compounders have.

Its founder led.

Growing revenues by 30% annually since 2020.

Profitable since 2021 and doubled profits since 2022.

What’s even better? It’s trading at just 15 times earnings with a market cap of $100 million.

It doesn’t end here… The Founder owns over 7% of the company and hasn’t sold a single share since it became public.

It isn’t under the threat of disruption by AI, and it has a very long runway for growth.

Checks all the boxes.

So, let’s cut the intro and dive deep into this hidden gem I am buying!

🏭Understanding the Business

If you asked me to name an industry that won’t be disrupted by AI in the next 10 years, I would say healthcare.

Yet, this is not a healthcare business.

This is a business that the healthcare industry depends on.