Dave: Next Big Fintech?

There are three core properties that differentiate Dave from other fintechs: It's solving a narrowly defined problem, it's profitable and it's fairly priced despite running up 700% last year!

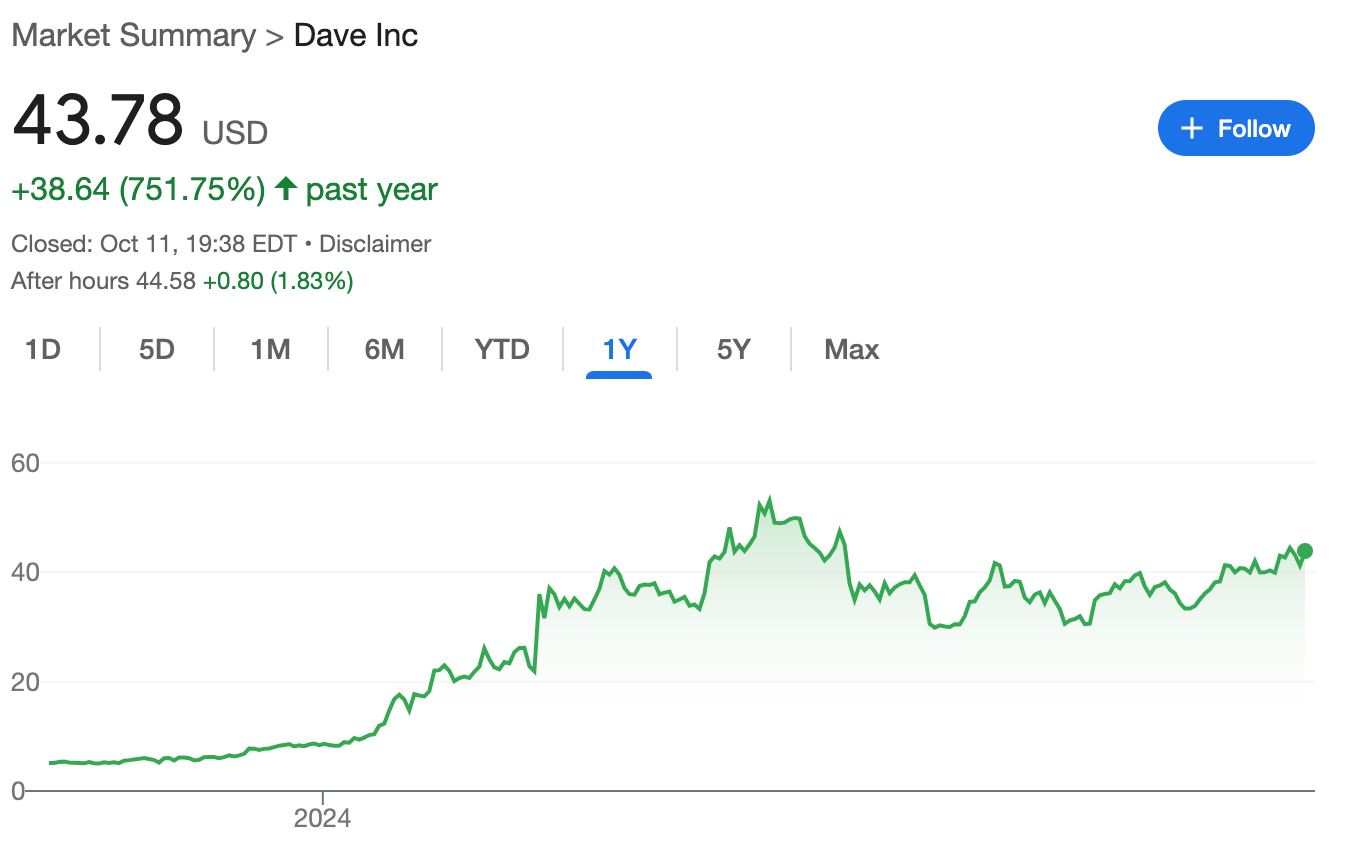

If I saw Dave’s chart when I first started investing, I would be intimidated:

Up 750% last year. I would have never invested in this company thinking that it has already had a great run.

Well, this is exactly the wrong way of looking at stocks. It was Peter Lynch who corrected my reasoning.

“How lower it can go” and “how higher it can go” are always stupid questions.

Lowest it can go is always zero and the highest is always indefinite…

Peter Lynch bought Toys R Us for $1 per share and sold it at $5 per share. How higher did it go? It went to $25 per share.

The stock doesn’t have emotions, it doesn’t know you own it, it doesn’t know it had a great run. It doesn’t feel like it has to go down a bit because it went up too much or vice versa.

What’s important is whether the increasing price also increases risk. In Dave’s case, the answer is a sound no.

Despite going up 700% in the last year, Dave still trades around at just 10 times EBITDA and it’s just starting out.

It has around 10 million members while the total addressable market in the US consists of 180 million people. Its customer acquisition cost is really low and the market cap is just under $600 million.

What’s better?

Its flagship product is sold many times over to the same customers, driving significant revenue growth. Looks like it literally created a “subscription product” in the financial market.

Dave is, by far, my best small-cap fintech idea and I think it’s very well positioned to become a $2.2 billion company in the next 5 years, roughly 4x of today’s valuation.

Why and how? This is what we will discuss today.

So, let me cut the BS and dive deep into Dave👇

What are you going to read:

1. Understanding The Business

2. Competitive Analysis

3. Investment Thesis

4. Fundamental Analysis

5. Valuation

6. Conclusion

🏭Understanding the Business

If you were an entrepreneur who just started a fundraising campaign for his business, the first question you would hear from the VCs would be “is this a vitamin or a painkiller?”

You may ask “what the hell does this mean?” But this is probably the most important question when it comes to investing in young companies, may they be startups or young public companies.

“Painkillers” are the products that solve people’s pressing issues while “vitamins” are the products that enhance the experience people already have.

Stripe, for instance, is a painkiller. Before Stripe it was very hard for small businesses to get paid online. Self-checkout kiosks in the grocery stores, on the other hand, are vitamins that enhance our shopping experience.

What’s the relevance? Well, this is the relevance:

It is way easier to sell painkillers. People know they need it and they race to come to you. With vitamins, however, you have to convince people first that they need it.

This explains why neobanks in the US and EU grew slower than their peers in less developed regions.

Sofi is probably the most widely known neobank in the US and I am a big shareholder in the company. I love the fundamentals and management. However, when you compare its performance with NuBank, which is a Latin American neobank, you see that NuBank is 6 times as big as Sofi despite both being founded in 2011.

This is because neobanks are purely vitamins for most of the American population.

As of 2021, only 10% of the US adults were unbanked.

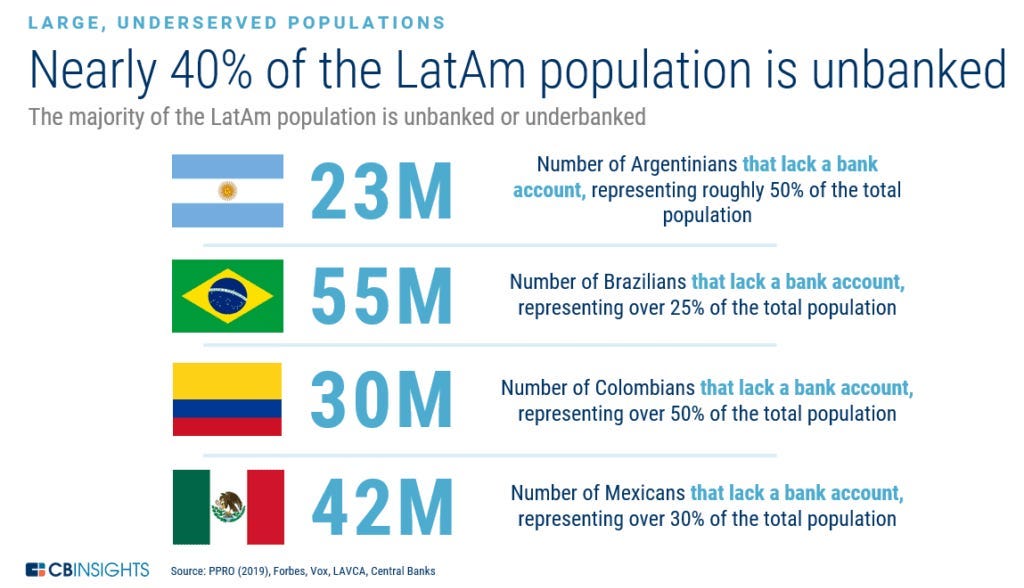

To the contrary, neobanks were painkillers for Latin Americans.

As of 2019, 40% of the LatAm population was unbanked.

It only makes sense that when NuBank gave these people the opportunity to open a bank account on their phone, they took it. They came for the painkiller.

Neobanks in the US offered smoother experience, higher interest rates on savings and more willingness to issue personal loans. These were all vitamins and they lacked a specific value proposition that could be seen as a solution to a specific problem, a painkiller.

Dave tapped exactly on this point.

Instead of positioning itself as another neobank or a fintech company, Dave focused on a specific problem: Overdraft fees.

Overdraft fees are the fees that your bank charges you when they let the transaction go through even if you don’t have enough money in your account.

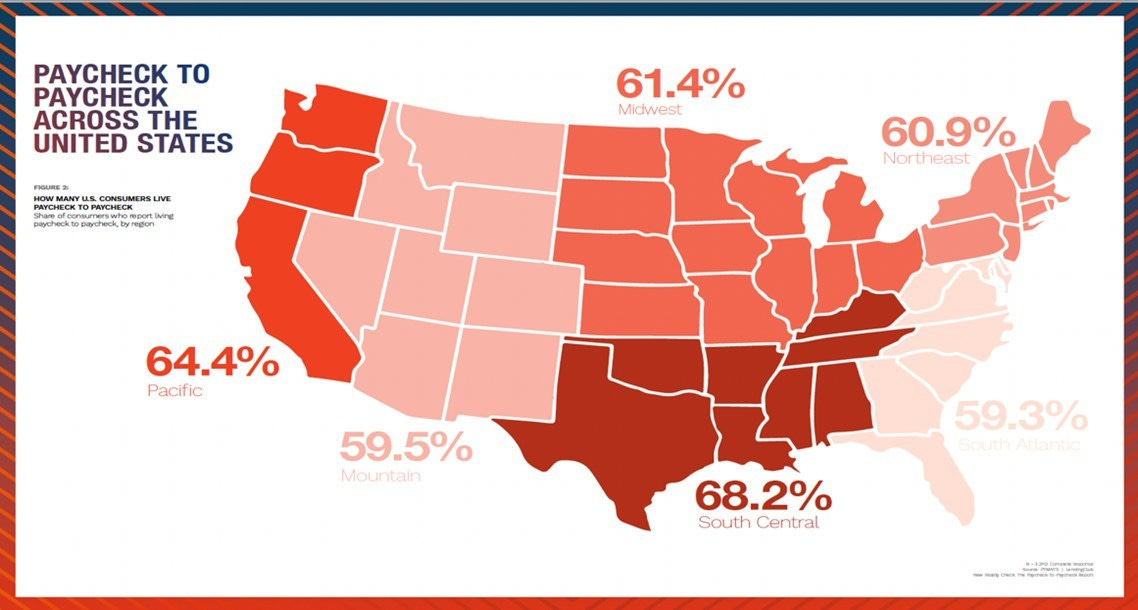

Who are the biggest victims of overdraft fees? Americans living paycheck to paycheck and 66% of the US adult population live paycheck to paycheck.

This is approximately 180 million people.

Not all those people are struggling, some of them make more than enough yet they have problems with budgeting. Rest simply struggle to meet the ends. Most of those people are loyal to their debt, and they pay it at the first chance. Yet, they often need some little extra money to cover their monthly expenses and this is where traditional banking products like overdraft fees and personal loans hurt them.

Dave has brought a solution to this.

Most of those people need extra money between $100-$500 to meet the ends. Seeing this, Dave offers its members up to $500 cash advance without credit check with no fees. They can use this to pay their bills or they can transfer it to their primary bank account and use it to avoid overdraft fees etc…

It doesn’t end here. It also offers a checking account through its banking partner, Evolve Bank & Trust. If you link your Dave account to your employer’s direct deposit system, Dave pays you up to 2 days early. Again, an offer tailored for those living paycheck to paycheck.

It also suggests easy side hustles such as instant-pay surveys where you can make +$1,000/month by working for just 20 hours a week.

As you see, all Dave's offers are tailored to address a specific problem of a specific audience. This is why it sells.

You haven’t even heard the genius part.

Dave makes generates significant revenue by charging $1/month membership fee to its members. It’s essentially a subscription service.

You are basically paying $12/year to make sure that you have access to $500 cash advance whenever you need it. This is an amazing deal given that the lowest overdraft fee among traditional banks is around $10.

This is a genius business model:

People are paying $1 membership fee in case they need the advance.

Dave pools all the money and pays cash advances to those who need it.

It works like an insurance pool so unpaid advance doesn’t hurt Dave’s equity.

Dave’s condition to become a member to benefit from cash advances almost works like a Trojan horse. It has a higher chance to convert those users to checking account customers while it would have struggled greatly if it directly offered opening a checking account.

It is very simple, yet innovative.

When I talk to people about Dave, they are really surprised that such a simple business model actually works, and works on scale. So, they ask whether Dave remains competitive for a long enough time with this simple model. Let’s try to answer this.

♟️Competitive Analysis

Fintech is a giant market that is filled with strong incumbents like Wise, Relay, Sofi, Chime, MoneyLion etc…

What’s worse is that you are also competing with established giants like Chase, Bank of America, Wells Fargo and Citi.

It’s really hard to get in this market by simply offering a competitive product. Dave couldn’t do this and it knew it. Instead it’s using what’s called “indirect entry strategy.”

In competition theory, there are two types of market entry: Direct and indirect.

Direct entry simply means matching the existing products in the market and trying to steal some market share from the incumbents through better marketing, promotions, cheaper prices etc…

This is generally a good strategy in markets where differentiation is not important and the most decisive factor is price. You can just appear in the market, offer a lower price and people will pick you.

It doesn’t work well in the digital markets that are dominated by strong and highly differentiated incumbents.

Indirect entry is the dominant strategy to enter markets with strong incumbents.

In this strategy, entrants come up with a product that doesn’t participate in competition but renders competition irrelevant by decoupling.

This is exactly what Dave does and I respect the management for being able to see this.

No fee cash advances is an underserved part of the market and by focusing solely here Dave gained 10 million users despite launching just in 2017, 6 years after Sofi.

The question is whether Dave can maintain this growth long enough as it’s expanding its product offerings so it can become the primary banking partner of its member base?

It is well positioned to do this.

Dave’s sharp focus on cash advance seems to have created a flywheel and triggered what’s called “increasing returns to scale.”

It is simple:

More users Dave brings in, the more money is pooled in.

As the pool expands Dave can grow the size of cash advances.

Growing cash advance size attracts more users at lower acquisition cost.

This flywheel is clearly working as Dave’s maximum cash advance in 2022 was $250 just like other businesses that provide cash advances such as Chime.

However, fast forward 2 years, Dave’s cash advance ceiling increased to $500 while Chime’s cash advance limit still stays at $250.

As a result Dave’s customer acquisition was accelerated and acquisition cost decreased from $24 in 2022 to $17 in 2023 and to $15 in the last quarter.

It is very hard for any potential new entrant to match Dave’s acquisition cost while offering as big advances as Dave.

If Dave keeps differentiating its service at this rate it can easily increase its monthly membership fee without losing business. In a scenario where Dave bumps cash advance limit to $750, paying $1.5 monthly membership fee instead of $1 wouldn’t be a big deal for users. However, it would bump Dave’s operating income by roughly $12 million, as this would be %100 gross profit, given that Dave is poised to generate $24 million subscription revenue this year.

Dave can easily reach a minimum viable size to compete with bigger incumbents by pushing this strategy as it already has 10 million members. For comparison, the largest neobank in the US, Chime, is predicted to have around 20 million customers.

Once Dave reaches a sufficient size, it can capitalize on its existing user base and introduce other neobank services, becoming an all around Chime competitor.

Overall, Dave employs a solid competitive strategy and its competitive position looks strong as evidenced by its decreasing customer acquisition cost.