What’s the most important decision if you want to win a game?

Is it the strategy? Or tactic? Could it be the teammates?

No.

If you want to win a game, the most important decision you should make is obviously what game to play.

Rule #1: You should pick a game that you can win, that you have an edge.

I have been a fan of poker for nearly a decade now. It’s the only casino game I play.

Why? Because it’s a game I can win. It’s the only casino game where the long-term dynamics of the game don’t make house the natural winner.

It’s a game of math and probability.

In investing, there are only two games..

To make money, either you take a short position or long.

It’s possible to make money through both, but in one of them odds are stacked in favor of you while they are against you in the other.

I think the best way to maximize your chances is to categorically refuse to play a game where the odds are stacked against you.

This is why I am never short.

Yet, many people still try shorting stocks to hit a jackpot and they end up losing their hard earned money instead.

So, why are the odds against you in the game of short?

Simple math and the dynamics of the stock market 👇

🧮 The Math Is Against You!

You can make money in the market both by being long, or short.

But this doesn’t mean that they were created equal and it’s equally simple to make money in both ways.

No.

To the contrary, making money by being long, i.e just buying a stock thinking that it’ll appreciate in value, is a way easier and more probable way of making money than shorting a stock.

Why? It’s simple.

If you are long, you just need to be right on the business. If you are right on the business, in the worst case, you are going to underperform the market but you’ll still make money over the long-term.

In shorting a stock, being right on your short isn’t enough.

You should also be right on timing.

You could be right that the business you are looking at is doomed to fail or worse, it’s a fraud. Yet, to make money over that assumption, other people should also quickly realize this fact and draw their money out of this business.

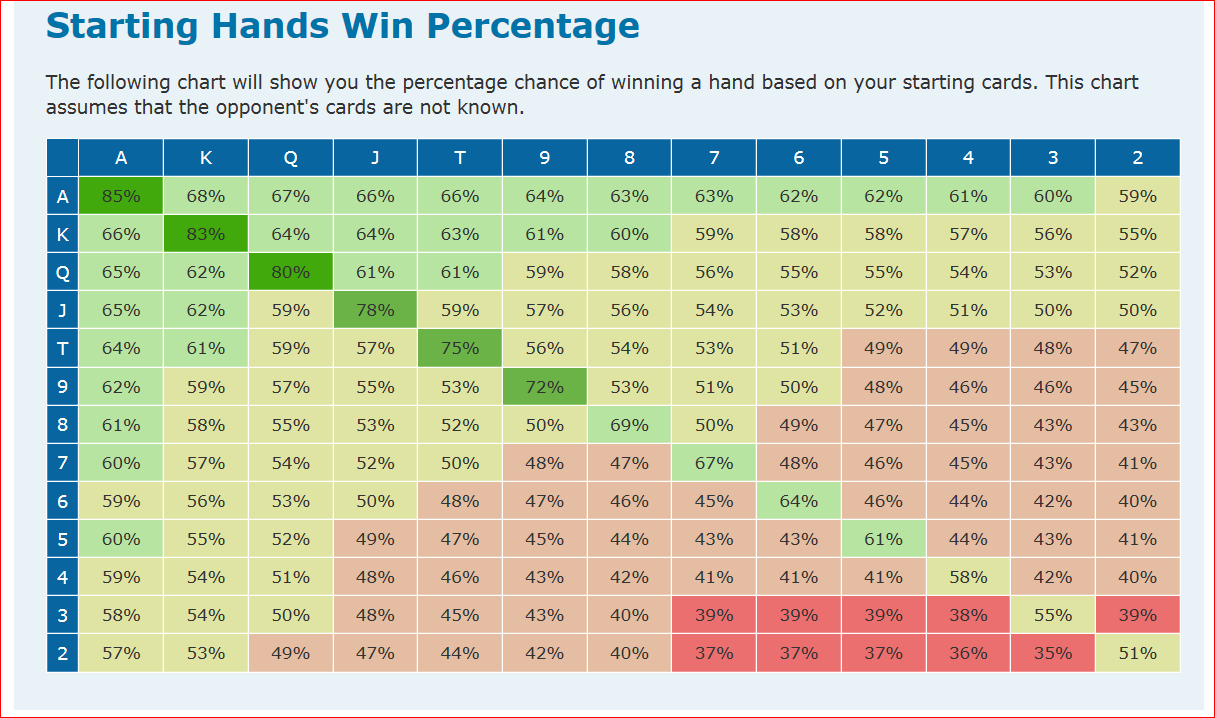

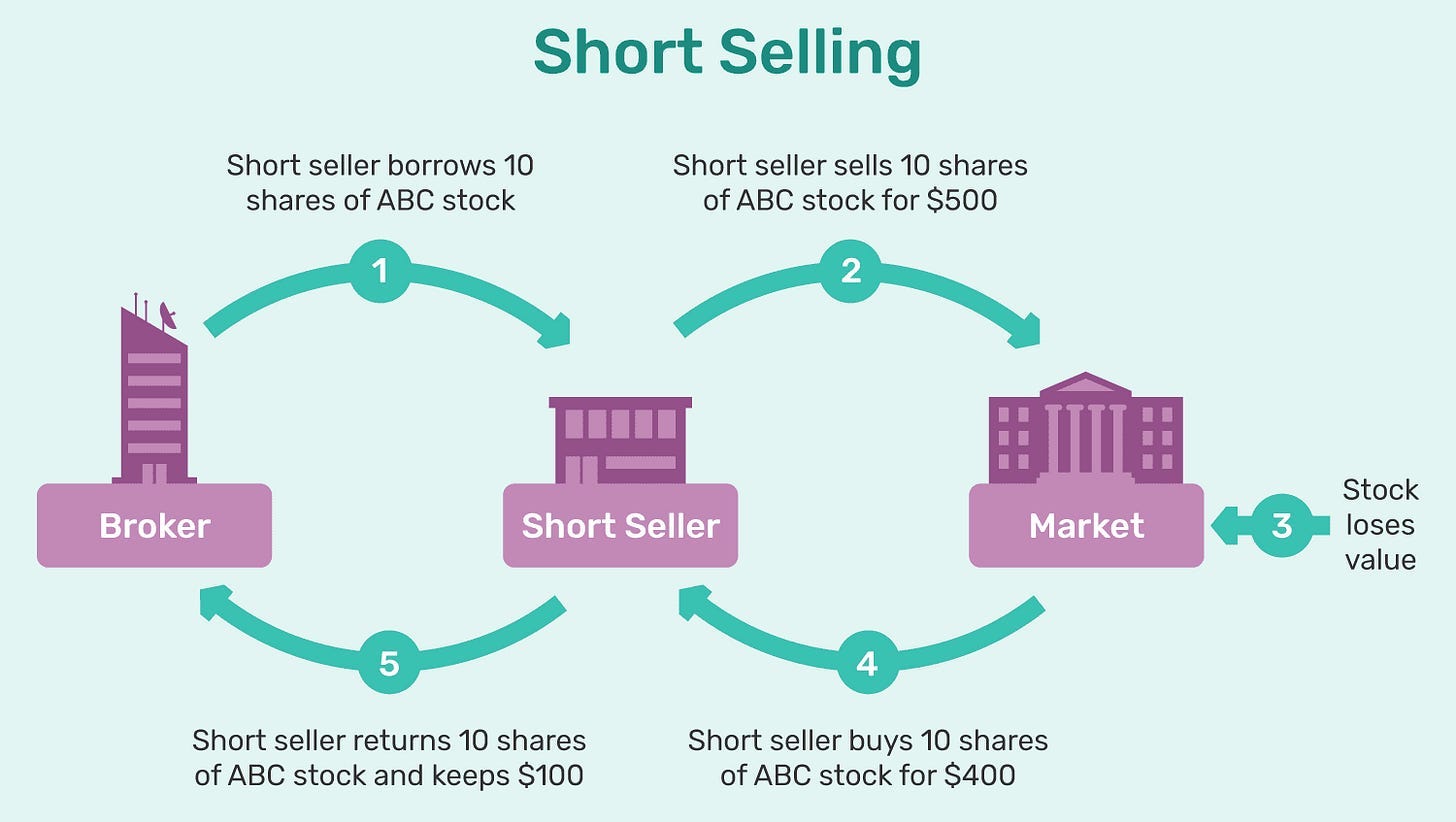

Why? Because when you short a stock, you aren’t selling something that you own. Instead, you are borrowing shares from others to sell them open in the market thinking that the stock price will plummet and you’ll close the short by buying the stocks in the market for a fraction of the price you sold them and pay your debt. The difference will be your profit.

This is how short works.

Do you see the danger here?

Borrowing comes with costs.

As long as you don’t close your short position you are paying interest on this debt everyday.

What does this mean? This means that you can still end up losing money if the stock price remains higher than you expected for a longer period of time.

Thus even though you are right about the ultimate direction, as long as it happens later than you expected, interest payments will eat you alive and force you to close your position at a loss.

This is why we say the market can remain expensive longer than you can remain solvent.

If you think this is something that could be overcome by diligent work and expert short-sellers don’t experience such losses, think again.

This is exactly what happened to Bill Ackman in his Herba-Life short.

He shorted Herbalife stock in late 2012, thinking that the company was toast. Shortly after, Carl Icahn entered the trade and took a long position.

The end result?

Bill was right. Herbalife wasn’t a quality company and the stock crashed 70% from the levels Ackman shorted in 2012.

But first… It tripled in the next 7 years, reaching all time highs in 2019.

Ackman had exited the trade in 2017 after the stock nearly doubled from where he shorted and took a massive $750 million loss while Icahn made over $1 billion in a single trade.

In the game of short, it’s not enough to be right over the ultimate direction; you should also be right about the time, which is exponentially harder.

Literally, there is no indicator or a principle you can use to know the right to open your short position. You just do it and hope that you lit a fire which will attract other people to take a closer look at the company and see the flaw. It may not happen soon.

Just assume that, as an investor, your hit rate is 80%, meaning you are right in four of five decisions regardless of whether it’s short or not. Still, to make money on your short position, you should be right on the timing which has a way lower chance.

This drastically decreases your chances of making money in short selling and you may end up losing all your money in the margin account.

You don’t have this problem in the long game. If you are right, what you’ll lose at most is the opportunity cost which you’ll likely cover in the long run if you keep the stock even after it reaches your initial fair valuation.

Math is your enemy in short selling whereas it’s your friend in the long game.

This is not the only reason though, there is also one other crucial factor that makes shorting infinitely riskier than long play: Human factor.

❌ Active Players Are Against Shorts

Stocks are not just a piece of paper.

It represents ownership in a business and there are people who own that business and run it.

What’s even better is that people who run the business are often the owners of the business. Even in publicly traded companies, management teams are largely compensated by stock options. This helps to align the interests of the management and shareholders.

Thus, those people who are actively running the businesses actually want their stock price to go up and actively work for that. They are the ones running the show.

Investors, on the other hand, are passive players.

Thus, when you short a stock, you are automatically misaligned with the active players. This is like battling uphill or swimming against the current. Even if you were right on your assumptions, in the first place, there are people who are actively trying to correct the mistakes while you are passively waiting for everything to go worse.

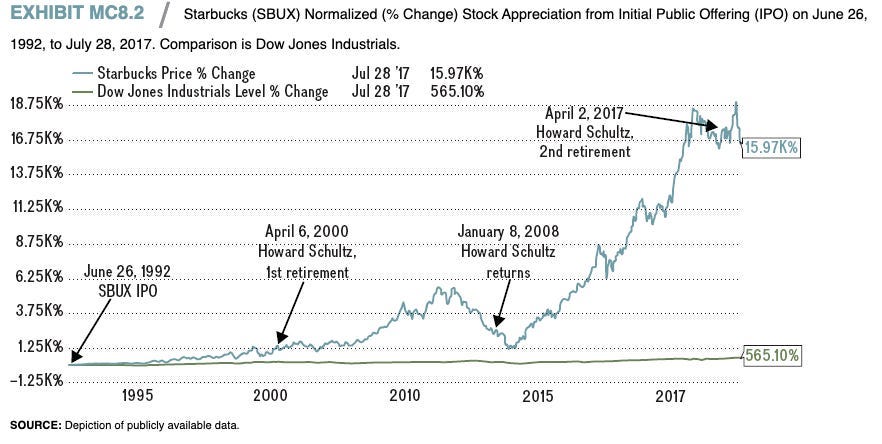

Indeed, business history is filled with legendary turnaround stories.

Tesla was once days away from bankruptcy, then it became the most shorted stock in the market, then it went up 30x in three years.

Apple was 6 months away from bankruptcy in 1997 when Steve Jobs returned the company, shorts were confident that turnaround wasn’t possible. 14 years later, Apple became the most valuable company in the world.

Starbucks was rapidly losing market share and same store sales were declining in the early 2000s. Howard Schultz returned as the CEO in 2008 and turned the company around.

This is the case in most businesses, except outright frauds. In such cases, short sellers have the highest chance of success. If they come public with their short and accuse the company of fraud, if true, many other people will likely see it and the business will go down before active players get a chance to correct the business.

However, even in potential fraud cases, it’s not guaranteed.

Recent SuperMicro Computer case illustrates the point.

Their auditor resigned last year, in a manner that was like accusing the company of cooking the books. The stock took a nosedive, people shorted the stock thinking that the business would totally collapse.

What do you think happened?

They did a very successful damage control and cleared the allegations. We will never know whether there were something wrong and they successfully buried it or not. But the fact is that they significantly lowered their revenue guidance since then.

The stock?

It dipped in mid-November. Imagine, news about the accounting fraud came out, the business lost 75% of its value in a month. It would look like a no brainer short. And many people shorted it.

What has happened since then? The stock tripled.

This is why it’s a loser game. Even if your assumptions about the business and your timing were right, you are betting against the active players who actually exert influence on the business. They can turn around the business, but you can’t dynamite it to collapse.

📈 There Is No Limit On Your Loss

This should be obvious to every short-seller but I am amazed to see that somehow most of them just ignore this point.

It’s so simple.

If you are long in any stock, the maximum amount you can lose is your cost basis. That’s it. There is nothing under 0.

It’s not the same for short sellers.

In theory, they vehemently disagree with this.

Try talking to any short seller and he’ll say that they also have the limit on what they can lose: Deposit in their margin account.

Yet, I assure you it never happens that way. Interestingly, short sellers tend to be way more confident than bulls so they tend to see price upswings “temporary”.

Thus, most of them deposit additional money in their margin account as the stock prices rise to meet the minimum margin requirements. Thus, once they lose faith in their trade, they have to cover their short at way higher prices, resulting in higher losses than they expected.

Some short sellers cover fast, some are very persistent.

It’s like digging yourself a hole in the ground. You may notice it before it’s too late, but if you get carried away, you may find out that it’s too deep to get yourself out.

Why would you take such a risk?

I wouldn’t.

🏁 Conclusion

The biggest reason winners win is that they have excelled in playing a game they can win.

Warren Buffett is the best investor of all time.

Have you seen him buying software stocks? No.

It’s not because it’s impossible to make money in software stocks, it's because he was born and raised in the analog era so he knows he doesn’t have an edge over the portfolio managers of the 21st century in picking software stocks. So he doesn’t. He plays a game he can win.

Shorting is a game that a few people could win.

If you are amazingly capable in reading the systematic chains of error in macro and have enough money and courage to bet on it, you may make money.

This is actually how Soros and Druckenmiller made billions shorting.

They successfully shorted British Pound and Thai Baht.

But unlike equity short sellers, in these cases, they weren’t betting against the system. They were betting on the system to work the way it was supposed to work.

In Pound short, for instance, the British Pound was pegged to the German Mark while the British Economy was stagnating and needed lower rates and the German Economy was growing fast and overheating so it needed higher rates. Result? It only makes sense that their currencies shouldn’t be pegged to each other. The system design required a meltdown at such situations and they bet that it would meltdown, which it did.

Just because the name of the position was short doesn’t mean they took a position against the system, they bet that system would work by giving its reflex.

It’s different for equity investors.

When you are short in the stock market, you are betting against the system that was designed to go up over time.

Isn’t it already hard to play the game by the rules? Only 8% of the portfolio managers consistently outperform the market.

The game is already hard enough.

Why would you make it harder? I wouldn’t and I wouldn’t suggest you try.

Play the game you can win. That’s the first rule of winning.

1) "If you are long, you just need to be right on the business."

Good businesses can trade at insane valuations, e.g. pandemic stocks in 2021, and have their valuations punished severely due to worsening macro conditions.

Sure, you can say that you wouldn't invest in such an overvalued business, but it's tempting when everyone around you is raking it in.

Severe drawdowns can also test the resolve of the most patient investors.

2) "In shorting a stock, being right on your short isn’t enough.

You should also be right on timing."

You're right about shorting individual stocks. It's too easy to be on the wrong side of a short squeeze, like Bill Ackman with Herbalife (as pointed out in the post) and hedge funds with GameStop in early 2021.

3) "As long as you don’t close your short position you are paying interest on this debt everyday."

The funny part about high interest rates is that short ETFs actually have very high dividend yields right now, i.e. you are literally being paid to short. For example, SH (inverse S&P) pays a 6.2% dividend yield.

Obviously, you still have to be right on the direction and timing, otherwise you could lose money.

4) "When you short a stock, you are automatically misaligned with the active players. This is like battling uphill or swimming against the current."

This is definitely true. Shorting over the long term definitely makes no sense, but that doesn't mean it shouldn't be a component of a thoughtful investment strategy for times when the macro outlook is weak. https://blog.inverteum.com/p/professional-investment-strategies-need-short-component

Good point about no limit to how much you can lose on a shorted stock. Shorting is harder than going long because the market goes up long-term, nobody really wants stocks to fall, and when they do fall, it happens way faster than when they grow. So you entry and exit must be precise. There's little room for mistakes.