🚨Trade Alert #9: Increasing Three Positions, Exiting One Position

Increasing three positions that offer limited downside and big upside going forward and exiting one that has become increasingly risky over the last few months despite phenomenal performance.

Last week was crazy in the markets…

Trade Desk beats earnings, gets hammered down by 35%.

Root loses 20% market cap instantly after a double beat.

Fortinet delivers a double beat, declines by 25%.

These are just some headline examples, stocks most people know. Beating earnings and getting nuked in the market is a common phenomenon recently.

So, what’s the problem?

I think it’s simple—sky-high expectations.

In most of these cases, the market wasn’t expecting just a beat; it was expecting a beat on top and bottom lines, and also a beat on forward guidance.

If you provided soft guidance or just reiterated the guidance and did not raise it more than the market expected, you got nuked.

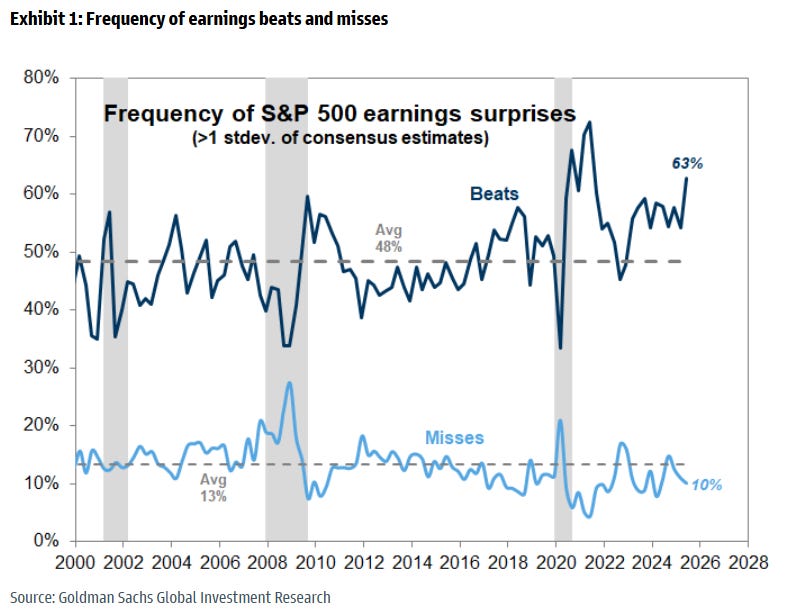

Why is this the case? Well, because this is one of the best earnings seasons in history:

More than 63% of S&P 500 companies are beating earnings, and only 10% are missing.

This is the best ratio since the beginning of the millennium!

What does this lead to? Even higher expectations.

In my experience, this has generally been the point that heralds the short-term peak.

The reason is simple—success carries seeds of failure.

As companies beat the estimates, expectations got higher and higher, ahead of the stock price. This is a recipe for disaster.

Why?

Because most of the jump in stock price comes from estimate revisions.

The market is just a pricing mechanism that tries to reflect the consensus on the stock price. It’s not a coincidence that companies make big moves after earnings, while they generally go sideways between earnings in the absence of macro factors or firm-specific news.

When a company delivers a big earnings beat, the message is simple—expectations were too pessimistic, and they have to be revised.

This is why the price jumps, not because of the beat itself.

The downside is that, when this happens, those who bet on better results already make most of the money to be made, and analysts following with an upgrade don’t make much of an impact.

Thus, analysts often try to stay ahead of the market.

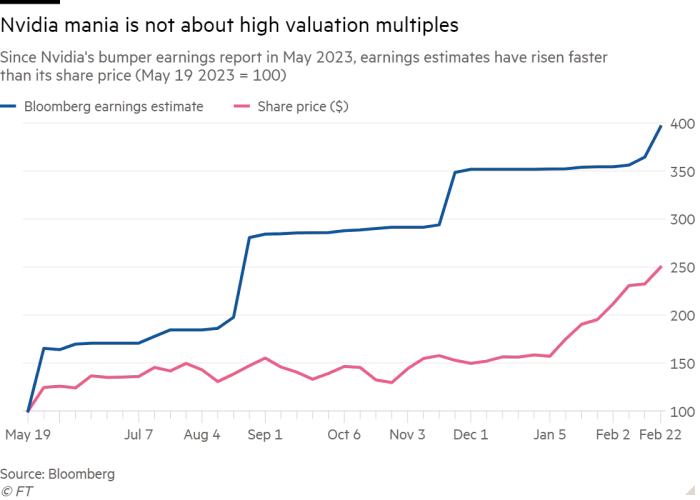

Nvidia’s estimate revisions and stock price clearly show this:

As you see, from May 2023 to February 2024, earnings estimates for Nvidia have risen faster than the price.

Do you see how this mechanism slowly paves the way to large declines?

Once analysts raise estimates too much to stay ahead of the market and the stock price adjusts, missing earnings even by a bit or providing a soft guidance signals the exact opposite move—downward revision of estimates.

When TTD stock goes down 30% because of soft guidance, the reason is that the market thinks it’ll trigger a series of downward revisions of estimates.

This is why analysts rush to revisit their ratings post earnings.

Given this mechanism, long-term investors’ job is basically predicting which companies will get upward revisions in estimates.

Michael Mauboussin calls this “Expectations Investing”, and he wrote a great book about it. If you haven’t read it, I strongly recommend:

Now, what does the frequency of stocks going down 20-30% upon satisfactory results tell you?

It tells me that expectations are already too high now.

When this happens, it’s hard to make money by being long the overall market. You’ll get more downward revisions than upward, which will significantly reduce your returns.

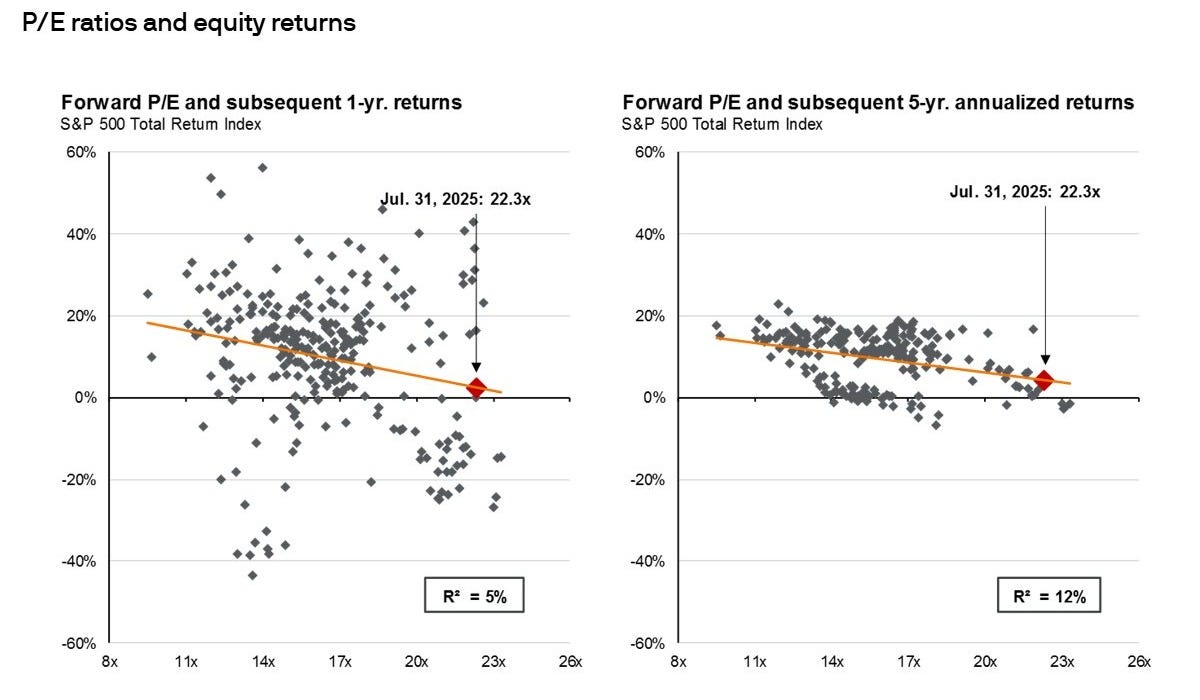

History proves this:

S&P 500 forward P/E is now around 22, and 5-year forward returns have been unequivocally low from this level.

Though this shows that the market isn’t generally attractive to deploy capital now, this environment often creates attractive opportunities for stock pickers.

Here is how it works:

Some stocks already price in multiple cycles of downward revisions.

This leads to an overly pessimistic narrative around the company.

A combination of these sends the stocks spiraling down.

When a stock goes through this, it’s generally left with a very limited space for further downside revision.

Suddenly, the bar ahead is so low that the company can easily jump over it and again trigger a series of upward revisions.

When this happens, those who got in earlier get rewarded handsomely.

So, at this stage, the goal of a long-term investor should be identifying positions where upward revisions are exponentially more likely than downward revisions going forward.

All the positions I am increasing today are of this kind.

Following the same line of reasoning, I will be exiting a growth position that I have carried to 4x returns in the last two years.

I think the likelihood of upward revisions has significantly reduced for this stock, while risks, both valuation and regulatory, have increased.

I’ll be willing to get back in again at lower prices, but for now, I think locking in the gains and looking for more asymmetric risk/reward plays is the sound thing to do.

So, here are the exact transactions I am making:

1️⃣ Buying More Novo Nordisk

This one is a perfect example of raising expectations until the failure is certain.

Take a look at the chart:

The stock was trading at the current levels back in 2021, before the GLP-1 trend took off.

After the drug became a blockbuster, the stock price went to $140 levels in less than 3 years.

The company got upward revisions of estimates one after another, and the stock was priced to perfection. At that point, the likelihood of further upside revisions had significantly declined, and the chances downward revision had increased significantly.

Anybody could see this on a quick napkin valuation.

At its peak in June 2024, the company had $635 billion market cap, and it had generated $40 billion in revenue in the trailing twelve months with a net margin of 35%.

Assuming 15 times exit multiple, stable profit margin, and 8% discount rate, it would have to grow its sales 35% annually in the next 5 years.

If it did, it would only justify its valuation, meaning investors buying into that scenario would only get market returns.

Those who expected outsized returns at that point were simply betting on better than 35% annual growth.

Let me ask you something—have you ever seen a pharmaceutical company with over $40 billion in sales growing over 35% annually for 5 years?

I haven’t.

That’s rare even for the highest quality tech companies.

What’s the last time Meta posted 35% annual growth for two consecutive years?

At the time, the stock was priced for perfection, and expectations were so high that failure was drastically more likely than success.

When something is priced to perfection, disappointment is often the result.

This is what happened to this stock.

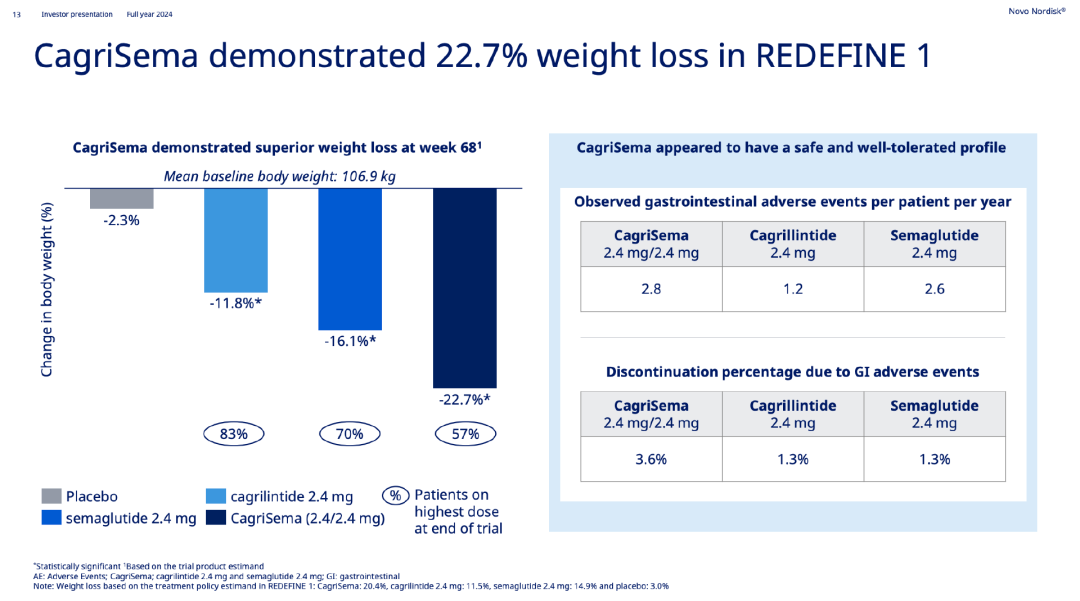

First, Cagrisema's, its next-generation obesity drug, trial results didn’t meet investor expectations.

The drug delivered a 22.7% loss in the Phase III trial, while investors expected at least 25%.

Shares took a hit.

Why did it matter?

It mattered because Eli Lilly’s upcoming drug, Retatritude, provided 24.2% weight loss in a 48-week trial.

The narrative was simple—Novo is falling behind Lilly in competition.

That narrative was strengthened when Lilly announced its oral GLP-1 provided an Ozempic-level weight loss in trials.

Shares took another hit.

Finally, the management reduced the guidance after a double beat in the last quarter, and the stock is back to 2021 levels when the weight-loss narrative had not taken off.

This is exactly why this stock is a great opportunity now.

Assuming that the market was fairly valuing it in 2021, as it was trading around its median P/E for the last 10 years, the expectations for incremental contribution from the weight-loss segment have declined to nearly 0.

The market thought the company deserved the current valuation back in 2021, just as a diabetes play, and now it’s priced no more than that despite unlocking a giant weight-loss market.

This means that upward revisions to estimates are drastically more likely now than downward revisions.

Valuation clearly shows this.

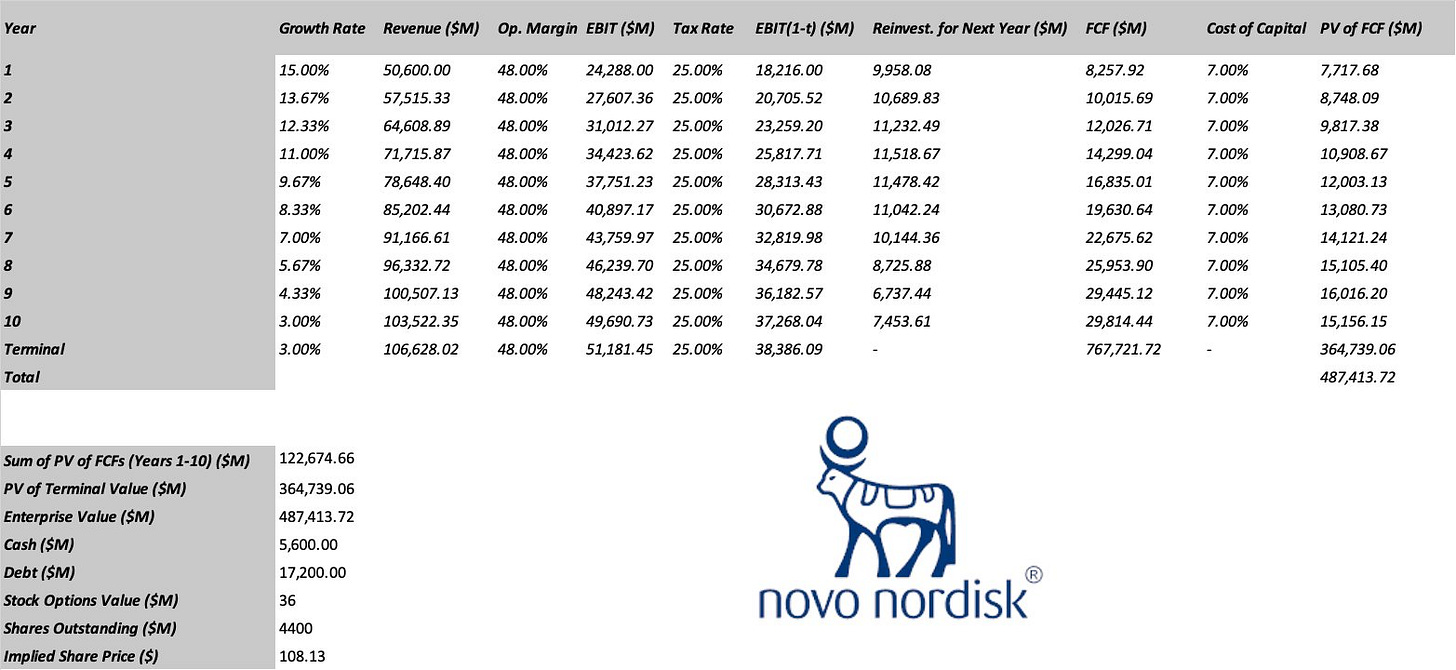

Assuming:

A very low, 9% annual revenue growth rate for the next 10 years

Decreasing ROIC from 25% to 15%

Stable operating margin at 48%

25% marginal tax rate

7% cost of capital

We get a fair value that is more than double today’s price:

The current valuation literally implies 4% annual sales growth for the next 10 years.

This is a very low bar to achieve for a company that dominated both the global diabetes market and the global weight-loss market.

So, the likelihood of upward revisions has drastically increased in my view, while there is a very, very limited space for more downward revisions.

Can the business perform well enough to trigger those revisions?

I bet it’ll.

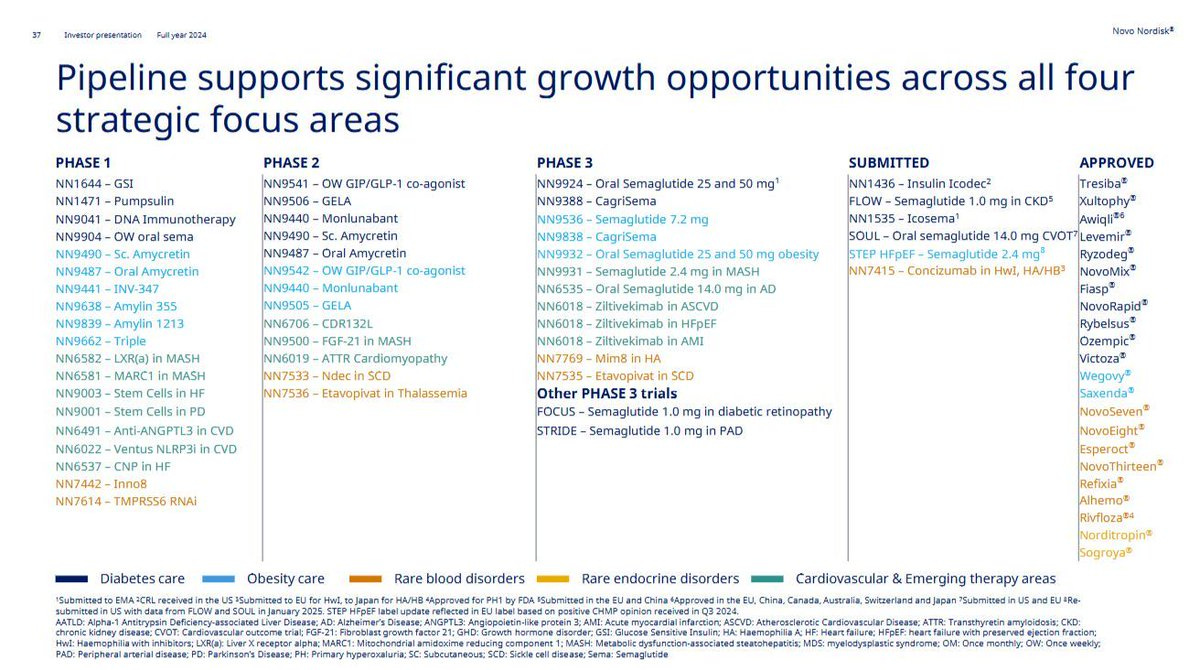

I think the market really erroneously interpreted its weight-loss pipeline.

Its pipeline is actually ahead of Lilly’s, and we have started to see this.

Let’s take a quick look at its pipeline:

It has 4 noteworthy drugs in its weight-loss pipeline:

Cagrisema (Phase III)

Oral Semaglutide (Phase III)

Amycretin (Phase I)

Tri-agonist or Triple (Phase I)

These drugs are all superior to their peers at Lilly.

Let’s start with Cagrisema.

The market reacted badly to Cagrisema's trial results because the perception was that it would beat Lilly’s pipeline drug, Retatritude. This is why the market expected at least 25% weight-loss, as Retatritude promises 24.7%.

I think this is a massive misunderstanding.

Retatritude and Cagrisema are categorically very different drugs.

Cagrisema, just like Lilly’s Zepbound, mimics two molecules, GLP-1 and Amylin, while Retatritude mimics three molecules, GLP-1, GIP, and GCG. Cagrisema, therefore, was meant to rival Zepbound, not Retatritude. Cagrisema does its duty as it offers comparable performance to Zepbound, which offers 22.5% weight-loss after 72 weeks.

In Novo, what rivals Retatritude is its tri-agonist drug, code-named “Triple.”

Novo licensed it from a Chinese biotech company. It was originally called UBT251.

It mimics the same three hormones as Retatritude but promises an even better performance. Retatritude led to 17% weight loss in 24 weeks, while UBT251 led to 15% in just 12 weeks!

The only advantage Lilly has here is a bit of time-to-market advantage as Retatritude is at Phase II while Novo’s Triple is at Phase I.

On the oral side, Novo was thought to be falling behind, but Lilly’s latest trial results last week showed that Novo’s drug was actually superior:

On top of all these, Novo has a drug that Lilly has no peer in its pipeline—Amycretin.

It led to a 13% reduction in body weight after 13 weeks. This is nearly the same as what UBT251 and Lili’s Retatritude offer. This is despite being an oral solution.

In sum, I believe the market massively discounts Novo’s capabilities and future growth opportunities at this point. The stock is valued as if the weight-loss segment doesn’t even exist.

As the current valuation implies just 4% average annual growth for the next decade, I think upward revisions are more likely than downward revisions at this point.

I’ll be doubling this position, taking it up to 2% or more of the portfolio.

This next trade I am doing may surprise many people who have been following the publication and portfolio for a while.

This stock has been a total performance driver in the last two years, appreciating 4x from my original purchase price.

Today I’ll be finally exiting this position.