Trade Alert #8: Opening A New Position, Exiting One and Increasing One Position

Buying a new asymmetric opportunity, increasing one of our foundational positions and exiting one position.

I have been saying for a long time that the market is overvalued. Yet, an overvalued market isn’t a reason to stop allocating capital.

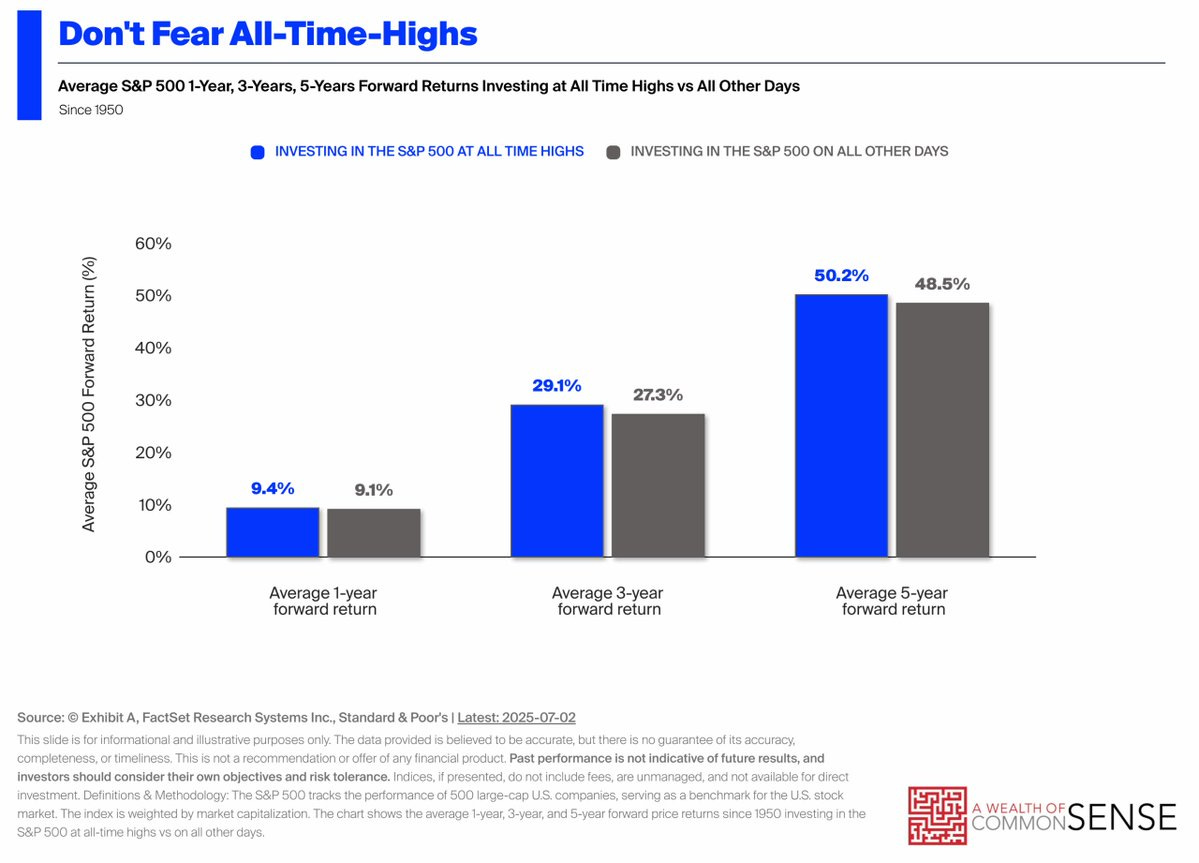

Historically, once at an all-time high, the market just keeps going.

The correction eventually comes, but you never know when. This is why all-time highs or expensive markets aren’t a reason to exit the market and sit on your cash until the correction comes.

As Howard Marks says, market calls only work in extremes, and though the market is expensive, we are currently far from an extreme overvaluation like the 2021 highs or the dotcom bubble valuations.

What investors should recognize is that we are in a stock picker’s market.

Buying the broader market won’t likely yield satisfactory returns in the near future, but you can still invest in overlooked stocks with big upside potential.

The problem is that these opportunities are rare now.

Our existing positions are the default address for our capital, yet most of them have become multi-baggers in the course of the last 6 months.

Since the valuations they have reached bar us from adding on to them, we look for overlooked stocks that have an asymmetric risk/reward profile.

These are rare. Luckily, we decided on one last week.

I was actually following that stock for over three years, but I never got an opportunity for an attractive entry. The stock price saw the current levels before, but fundamentals were lagging. In the last 2-3 years, fundamentals have improved significantly, making the current price an attractive proposition. The management is also guiding for accelerating growth in the next 5 years, making it an attractive offer now.

We will be adding this stock to the portfolio today.

Aside from this, I’ll be adding to an existing position in the portfolio. It’s one of the strongest stocks in our portfolio, yet the market currently doesn’t appreciate its long-term potential.

The management keeps the long-term guidance intact, and there are still many other levers it can pull to enhance shareholder returns, such as buybacks. The management is accelerating them, too.

We believe it now presents an attractive opportunity to build the position up for the long-term.

Last, we will be exiting a position that didn’t work for us as planned. Though I believe the long-term investment case is intact for this company, it doesn’t make business sense for us to keep it in the portfolio for a few reasons:

It’s not one of our fast growers, and its current allocation is too small to add value to the portfolio as a foundational position.

We aren’t looking to grow it further as we don’t want to allocate large amounts of capital at the current market conditions. We want asymmetric bets that can pay off handsomely even with a small position.

By exiting it, we can fund our new entry without using extra dry powder.

Thus, we believe it’s time to exit this position.

I have scheduled this update to go live an hour before the market opens, so everybody can have time at least to skim it and follow the trades if it makes sense for them.