🚨Trade Alert #6: Buying Three New Stocks

Buying a new undervalued growth stock and two other positions with high dividend yields and limited downside.

We don’t attempt market timing.

This has been the guiding principle of our investment strategy since the start of our portfolio. But.. We do adjust our positioning depending on where the market is.

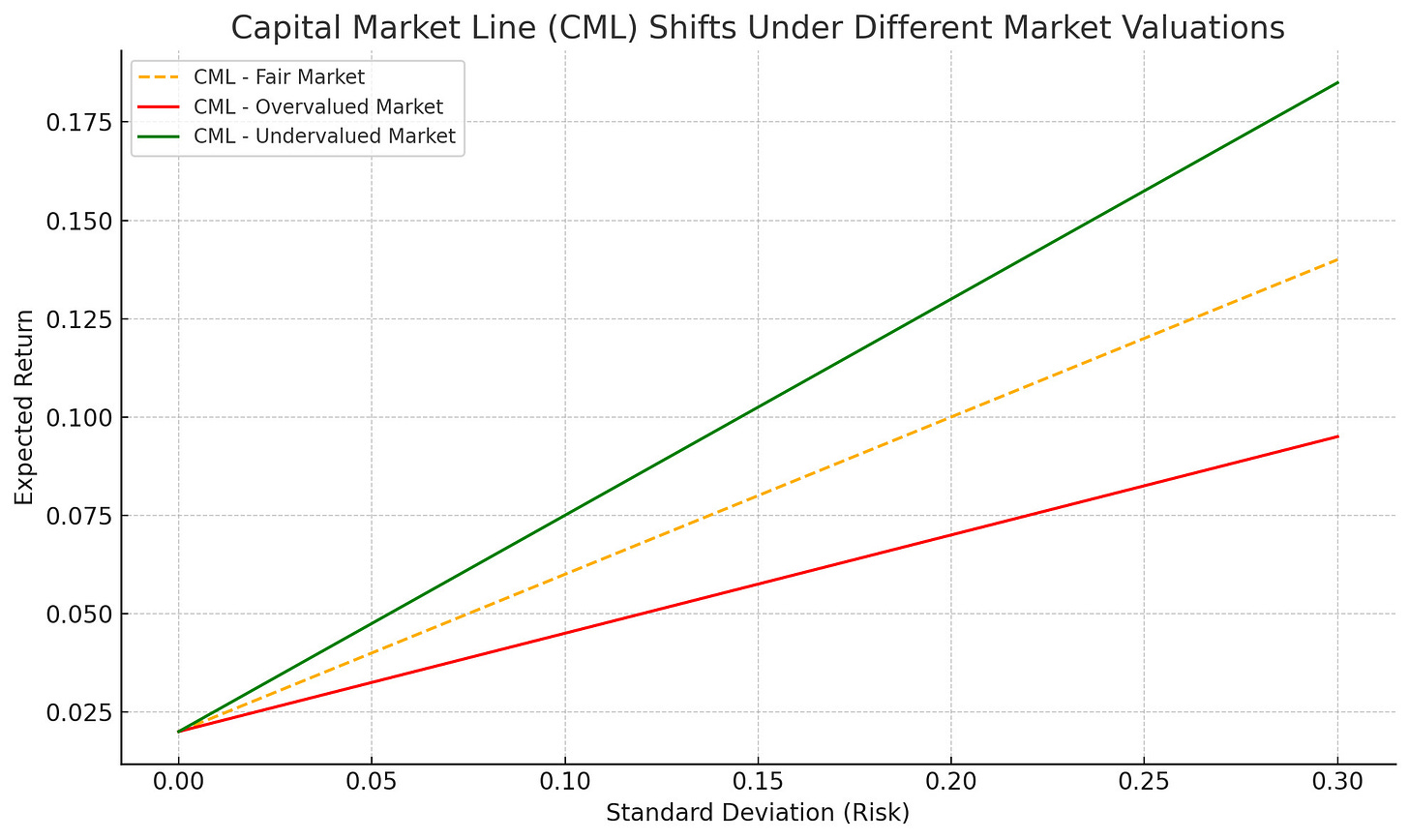

It all comes back to the simple concept of the capital market line:

When the valuations are high, the expected return decreases for every amount of risk assumed, whereas when the valuations are low, risk-adjusted return increases.

This phenomenon takes place at both the market level and the individual stock level all the time.

At the market level, it tells us how we should adjust our risk posture.

At the individual stock level, it tells us where the opportunities are.

When the market is overvalued, we assume that the capital market line shifts downward, and we adjust our positioning accordingly.

We increase our cash position, demand a larger margin of safety, and diversify away from markets where the risk is concentrated.

Today, I think we are at that point. I think the market is overvalued.

I don’t think it’s grossly overvalued or that it’s a bubble, but it’s overvalued.

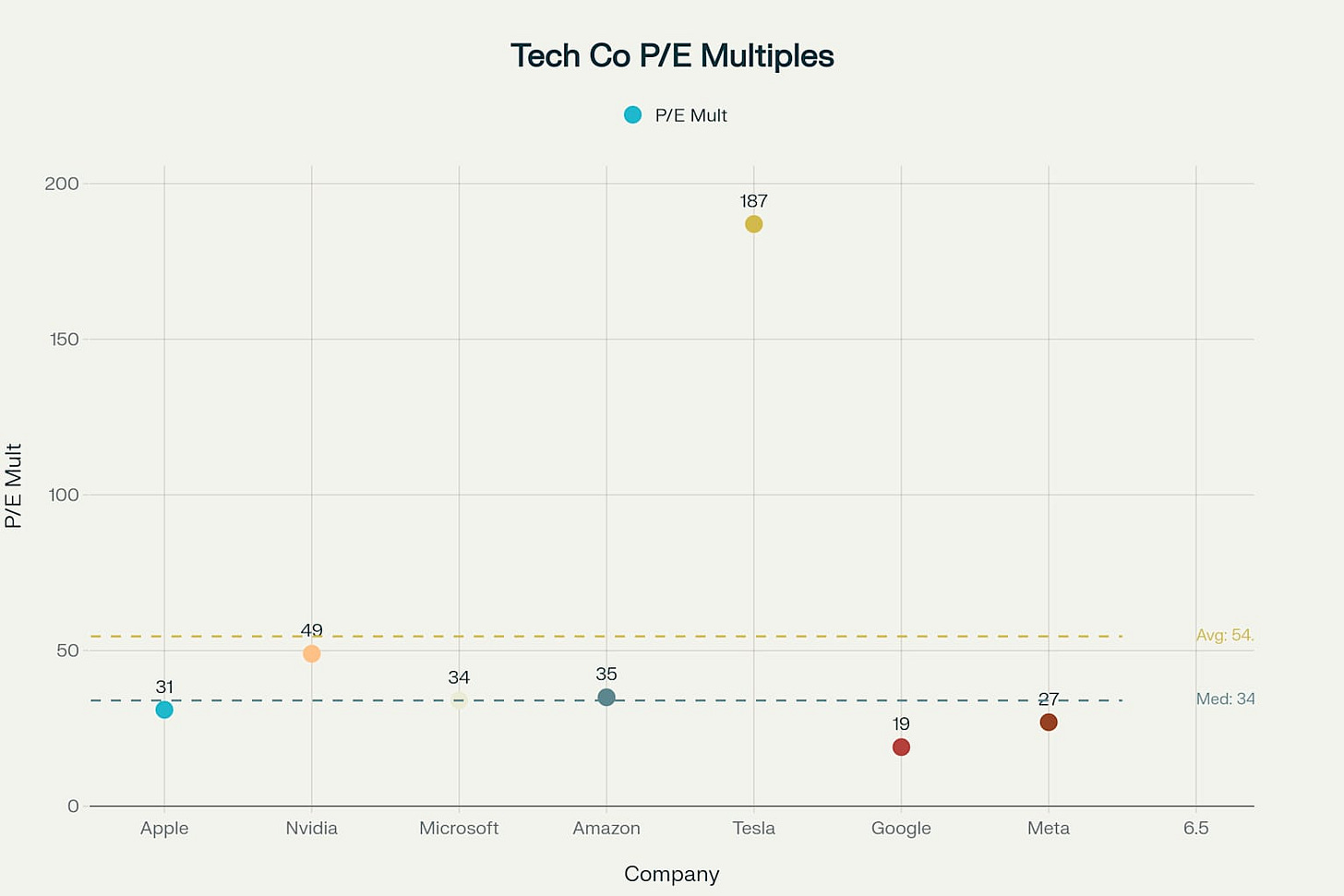

You don’t need an overly complicated analysis. Just take a look at Mag-7 valuations that make up more than 34% of S&P 500 index:

Median P/E of Mag-7 companies is 34, and the average is 54. Even if we exclude the top and bottom extremes, Google and Tesla, the average P/E is 35.

The market is overvalued; it’s a fact. Whether this valuation could be justified by accelerating growth is a different story.

Naturally, most of the positions in our portfolio are now either overvalued or don’t offer the margin of safety we demand.

Many of our growth positions have become multi-baggers over the last 3 months, preventing us from blindly adding to them.

In such cases, our modus operandi has been looking for new opportunities, possibly in different markets.

We have experienced that this approach dramatically improves the risk posture of the portfolio.

An increasing number of positions reduces unsystematic risk.

Geographic diversification reduces systematic risk exposure.

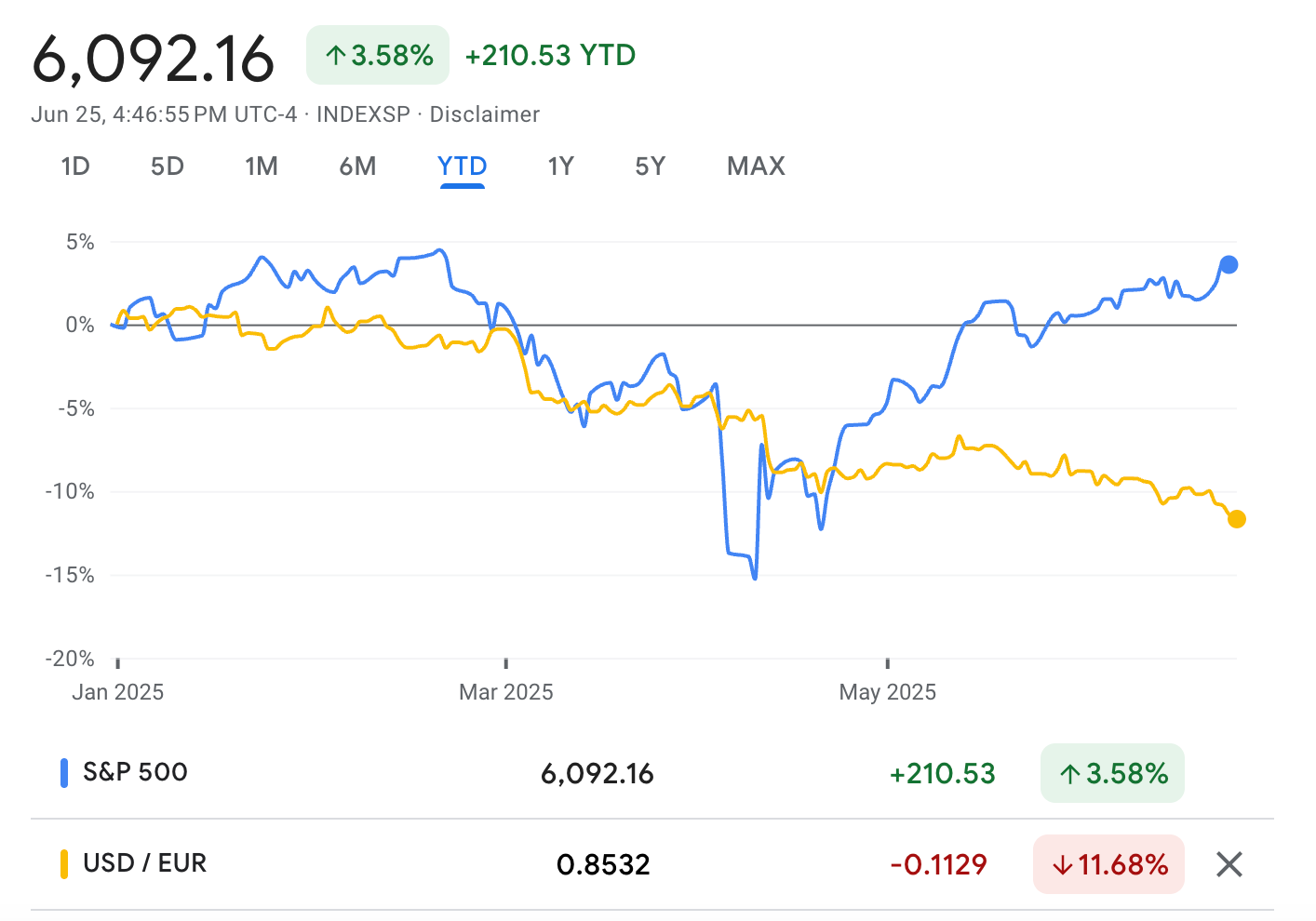

If you look at how USD has performed year-to-date against other big currencies and compare it with the market return, you see that it makes sense.

We already own global stocks, but given where the market is today and the likelihood that USD’s erosion may continue as the Trump administration sees a strong USD as the culprit for lost manufacturing jobs, I think it makes sense to overweight global stocks now.

Today, I am going to add three global stocks to advance this strategy:

One of them is a fast-growing, undervalued business that has just over $3 billion market cap.

The other two are more established businesses, both with very high dividend yields and strong capital appreciation performance. For reference, they both have over 4% dividend yield and have appreciated by over 200% in the last 5 years.

I think these trades will largely enhance the risk posture of the portfolio while still maximizing the upside.