🚨Trade Alert #4: Trimming One Position And Increasing Two Positions

Internal capital allocation from unfavorable risk/reward profile to more favorable risk/reward profiles.

We don’t try to time the market.

This is one of the fundamental aspects of our investment philosophy. We don’t even attempt it.

But… We do adjust our position according to where the capital market line is.

For any investment decision to make sense, the risk-return ratio should be favorable. This is why we expect a higher return from a security as the perceived risk increases. Otherwise, it doesn’t make sense.

This is exactly why treasury bills have a lower return than equities, and equities have a lower return than private equity and venture capital.

On the capital market line, they look like this:

What investors should understand is that risk is defined without respect to price, while return is always a derivative of the price.

If the market thinks a security has become more or less risky, it tries to reflect that on the price, but the price isn’t involved when the risk is defined or perceived. To the exact opposite, a higher price creates the illusion of less risk because it’s perceived as the market reflecting lower risk on the price.

Thus, what happens when prices increase is that the capital market line shifts downward.

Think about it.

There is a stock trading at $50 per share, and the potential return is a 100% gain. If the price increases to $80 per share without a fundamental derisking of the business, potential return decreases to 25% while the risk stays more or less the same.

When the price declines without a fundamental change, the exact opposite happens: The capital market line shifts upward, and the promise of return increases.

Now, it’s really hard to make these calls for each company. Nobody could understand if the price moved without a fundamental change for every company. An information gap exists.

But… We can look at the overall valuation of the market. It reflects where the capital market line stands today.

Why? The answer is easy—diversification.

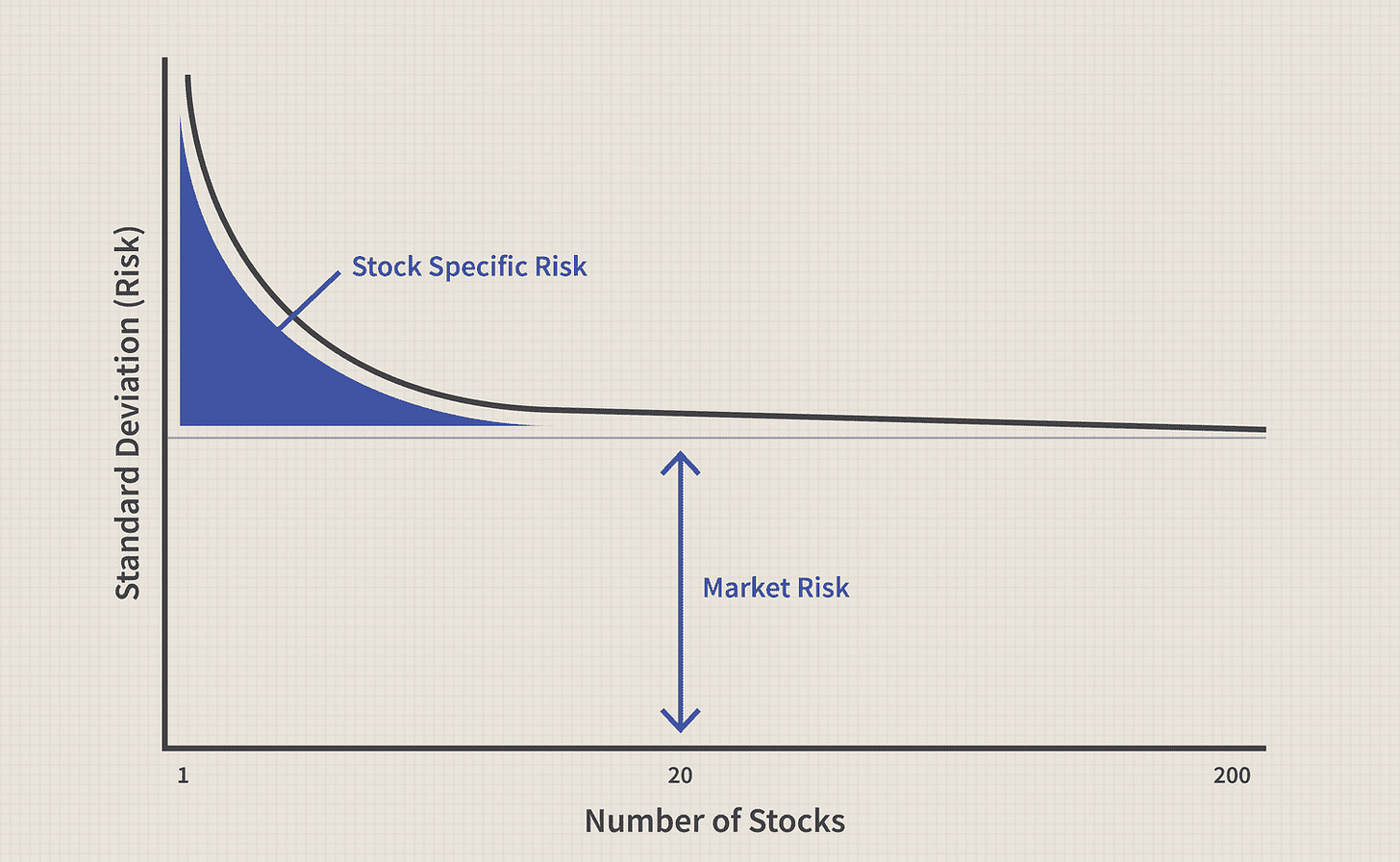

When you diversify beyond 20 stocks, unsystematic risk flatlines. You could think of the market index as a diversified portfolio of dozens of stocks.

Thus, we can assume that the overall unsystematic risk of the index remains more or less the same all the time.

Result? A change in price shifts the capital market line up or down.

When the capital market line shifts up, we become more aggressive; when it shifts down, we become more defensive.

I believe the capital market line shifted downward lately.

We are nearly back all at all-time highs, yet the threats and uncertainties that caused the correction we had still remain:

Tariff threats still exist.

Fed still hasn’t resumed cutting rates.

The administration is about to pass a massive spending package.

In such an environment, I would rather play more defensively than aggressively.

This is why I’ll be executing three trades at the market open today:

I will reduce one of the growth positions that appreciated significantly and now takes 15% of our portfolio.

I will increase other growth positions so that the risk/reward profile still remains favorable.

I’ll increase one position that recently experienced a pullback but is set to benefit from the weakening USD.

I have scheduled this to go out before the market opens today, so everybody can have time to read and digest.

Here are the exact transactions I’ll be making:

The first one is trimming one of our best-performing positions in the last two years.