🚨Trade Alert 12: Exiting Three Positions, Increasing Two Positions

Making 5 new trades to position the portfolio for sustained outperformance while growing the cash buffer against a potential market correction.

Let’s set this straight—the market is expensive now.

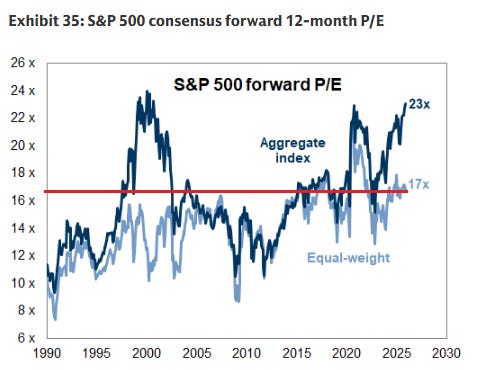

S&P 500 is trading at 23x times forward earnings, which is the level we have reached only two times in the last 30 years: the Dotcom Bubble and the Covid Bubble.

Still, as opposed to what most people think, I would say this is not a bubble, yet. I think we have to divide the companies into two groups and assess the valuations separately for them: Mega-caps powering the AI boom and others.

When it comes to mega-caps that are trading at a premium, I don’t see much of a problem.

These are literally the most dominant companies the world has ever ever seen, and they are trading at, on average, 30x forward earnings. While this is expensive, it’s nowhere near bubble levels, given that they are growing earnings 15-20% a year.

What we can objectively say is that they are optimistically valued, but definitely not in a bubble. The problem I see is that most of this optimism is tied to the AI boom.

The problem is that we have already started to see cracks in this optimism.

These companies trading at a premium, like Google, Oracle, Microsoft, Nvidia, are the infrastructure providers to the prominent AI-labs to which the whole AI application layer relies. Thus, hyperscalers’ return on investment is largely tied to the fortunes of these foundational model providers.

The problem now is the skepticism about their ability to grow to a scale that justifies the current spending spree of the infrastructure players.

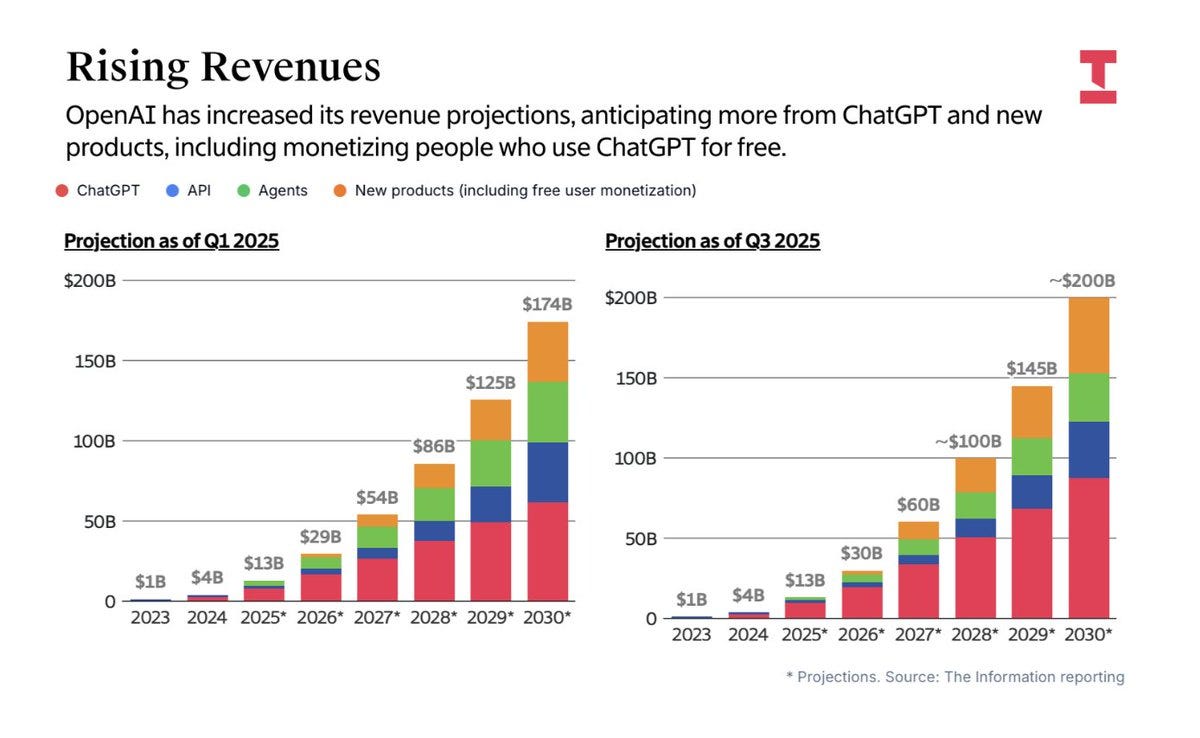

OpenAI is now projecting ~$200 billion in revenue in 2030, up from $13 billion this year:

The company also projects $40 billion in free cash flow in 2030. For reference, Microsoft generated $293 billion revenue and $78 billion in cash flow in the last twelve months. When you put the projection in context like that, it sounds surreal, and investors are having a hard time believing it.

This is why the market started to question whether there’ll be sufficient ROI on the current capex. Thus, investors are not willing to pay higher premiums for these companies anymore; a median of 30x earnings is already optimistic enough.

So, the market doesn’t get a serious thrust from those names anymore.

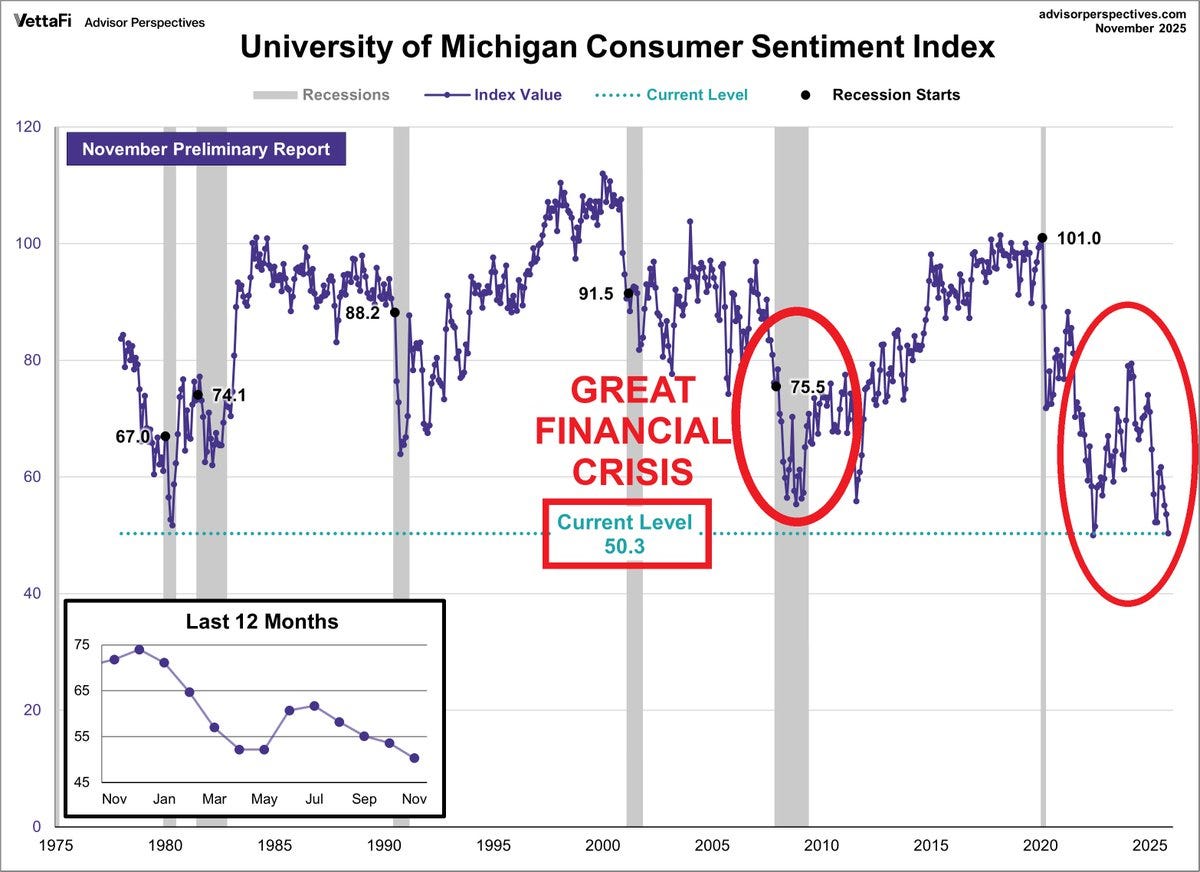

When it comes to others, however, the situation is even more shaky. Inflation has proved persistent, and unemployment is rising. This has led to a cost-of-living crisis for everyday Americans.

The consumer sentiment has hit its lowest point since the 1980s:

As a result, many industries like restaurants are already in a recession, and some others are close to a recession, as Secretary of the Treasury Scott Bessent said on CNN.

In this case, we won’t likely get a better performance from the rest of the market as the S&P 500 equal-weighted index is also trading at 17x forward earnings, which is also historically high. There is nothing here to drive valuations further up, as almost all sectors not driven by AI-optimism are struggling.

This means that it’s increasingly harder to find sectors that are poised to do well in the near term, and the companies in such rare sectors are already optimistically priced.

Meanwhile, our portfolio has now delivered superior returns since 2023:

2023: 36%

2024: 50%

2025 YTD: 47%

As a result, most of the positions in our portfolio have reached or exceeded their fair values, so we can’t rely on them to generate above-market returns going forward.

So, what are we doing given that opportunities are dry and cracks in the market sentiment are emerging?

We are positioning opportunistically.

We are closing underperforming positions and growing our cash position with a portion of the proceeds. The rest of the proceeds go to rare opportunities in the market.

Despite optimistic valuations in well-performing industries and above-average valuations even in the underperforming ones, there are still some companies that are obviously undervalued because of company-specific risks.

If you caught last week’s trade update, you know that we bought Pagaya before earnings, and we have already made handsome money on that position. Pagaya is the type of opportunity I am talking about. There was never a question about growth, but the company was undervalued because of the risks from bad loans.

After diving deep into its balance sheet and performance of the loans, we figured out that it would take a 70% further markdown on the loans carried on the balance sheet to wipe out the equity base. We saw that the markdowns were in a normalization trend, so a disaster scenario wasn’t likely. Thus, we took a position.

The company reported record growth and just 8% QoQ increase in write-offs, which proved our thesis, and the trade paid off well.

Thus, we’ll keep exiting the underperforming positions and put a portion of the proceeds in opportunities like that, while the rest will go to our cash position.

This will allow us to generate alpha while the market is going sideways, and also better position us to take advantage of any correction in the market due to our growing cash pile.

Today, I’ll make another set of transactions in line with this strategy:

Exit three positions.

Increase two positions.

You’ll also find the link to the portfolio spreadsheet at the end of the write-up.

Let’s get started.

Here are the exact trades I am making:

Let’s start with the exits, as always.