🚨Trade Alert 11: Opening Two New Positions And Exiting Three Positions

Adding two new asymmetric bets and exiting three underperforming positions.

Today, I am going to execute a bunch of transactions that will set our portfolio for sustained outperformance in 2026 and beyond.

If you have been following the publication for a while, you know that our portfolio has delivered very strong returns in the last 3 years:

2023: 36%

2024: 50%

2025 YTD: 47%

So, why the hell am I doing shuffling the portfolio given that it’s already performing strongly YTD?

There are two reasons:

Base effect

Mean reversion

I tried to explain base effect in the last two portfolio updates, but let me briefly touch on it here too, so you can better ground the philosophy behind the shuffle up.

As fundamental investors, we try to find companies that trade below their fair value.

When we think we find something like that, we bet on it, and if we are right, the market eventually recognizes it, and we make money.

This is the whole mechanism.

However, once the market recognizes undervaluation, it closes the valuation gap as fast as possible to prevent others from making easy money.

Assume that you bet on a stock that you thought was 30% undervalued. Once the market recognizes this, the rally in the stock starts, and it generally appreciates 30% within months, sometimes within days or even hours.

As a result, your portfolio performance within the last 12 months reflects that full 30% appreciation.

However, given that the market has now valued it fairly, the best you get next year from that position is the market return, let’s say 10%.

Most of our positions have appreciated substantially, becoming multibaggers in the last 24 months. So, unless something extraordinary happens, they won’t double or triple again next year.

Thus, we need to generate alpha from somewhere else for the near future, i.e next 12 months.

The second reason is the mean reversion.

Above, I said, theoretically, that the market closes the valuation gap when it recognizes it.

In practice, the market does more than that. When it recognizes a gap, it doesn’t just close it; it often drives the stock above its fair value.

This happens because once a stock starts moving upward, all the opportunistic investors flock into it, trying to take advantage of the momentum. They attract others who think the company can do even better and the stock can go even higher.

Result? The stock becomes overvalued.

When the stock becomes overvalued, you can’t expect market returns anymore; you should expect a decline as mean reversion pulls them back to fair value.

In a bull market, a lot of stocks are priced generously, so the market itself becomes overvalued.

This is the case we are having today.

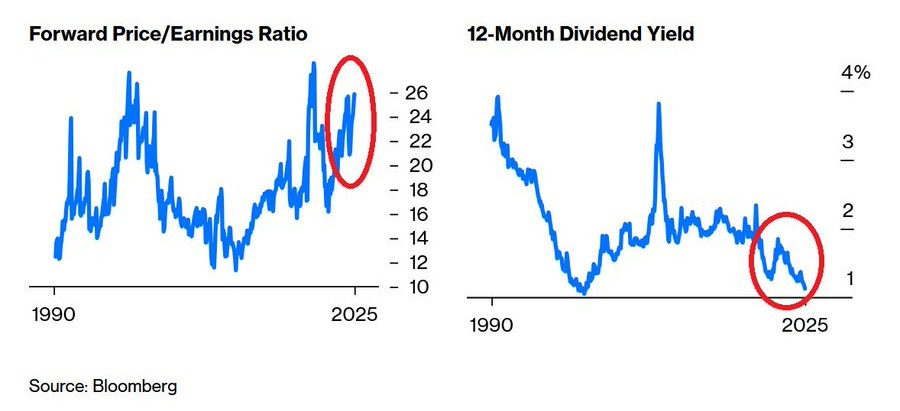

The market is trading at a historically high 23x forward earnings and around 1% dividend yield:

Thus, it’s more likely than not that we’ll get a mean reversion.

All these factors create headwinds for not just ours but literally all high-performing portfolios.

We have to prepare the portfolio for these headwinds and position it for sustained outperformance.

We’ll do this by:

Buying new stocks that can generate alpha.

Keep our cash position as large as possible.

Cutting positions that are unlikely to generate a return in the near future.

Today, I’ll make the first set of transactions to achieve this. I will:

Exit three positions.

Open two new positions.

Here are the exact transactions I am making:

Let’s start with the exits.