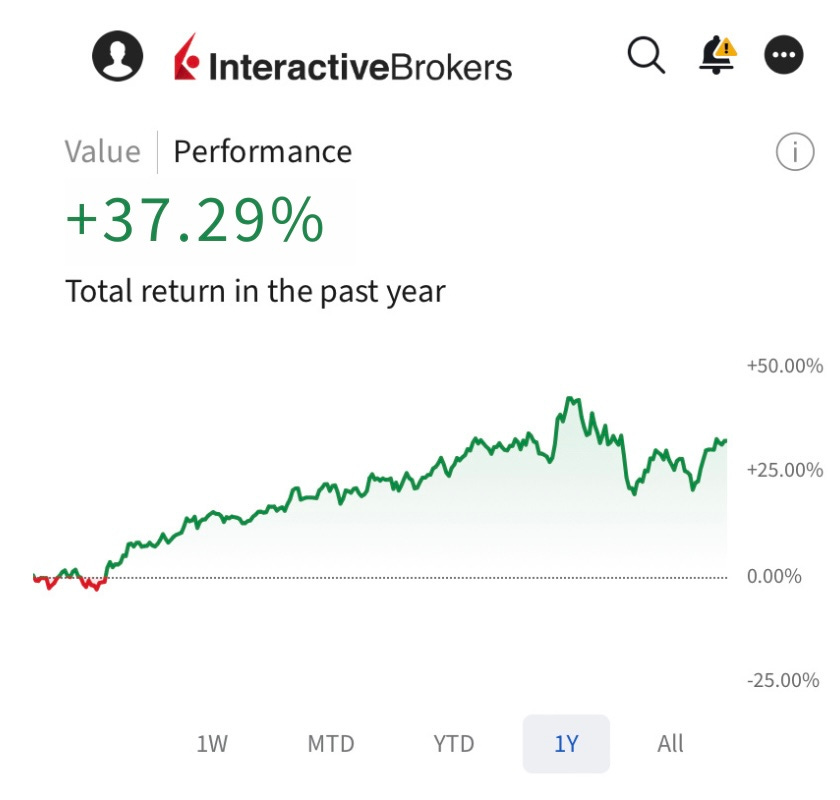

This Is Our Outperforming Portfolio!

Our portfolio outperforms the market by a margin. Stocks and ideas here will help you outperform too!

I’ll be straight with this:

Our portfolio is outperforming the market by a margin!

This is so important to me as there are hundreds of research newsletters that don’t have skin in the game.

As long as you don’t have a skin in the game, you are creating the so-called “expert problem.”

Experts get paid for the ideas, not the results.

Research services by experts pump out stock analysis and they say “why it should work” or “why it shouldn’t work”.

When the result is not good they talk about “why it should have worked.”

We don’t have this here.

I don’t have any other position or investment other than in the stocks I have written about in this publication. If they don’t work, I get killed too. I am 100% aligned.

What Do We Really Do?

When I started this publication, I was disturbed by the inequality of the playing field in the industry.

Investing, as an industry, was static and monolithic. I thought decoupling would eventually hit the industry.

There are signs of it: Some investors are charging based on performance now and some others like Terry Smith are charging flat fees instead of the classical hedge fund structure of 2 & 20.

I thought we would eventually go to a structure where retail investors could also participate for a minimal fee. I thought a publication would be a good place to do that.

Here, we talk about the fundamentals of investing so our members can understand our style and perspective and we pick stocks based on this knowledge so you can also see the results. We have skin in the game. We keep doing research and analysis about companies that look interesting to us so we can know what to do if opportunity arises in those stocks.

We think, we implement, we share the results.

Here, you know you are paying for results and deep thinking about investing. You are not paying for “hey look I analyzed this company do you want to see?”

We intend to keep it this way.

Portfolio Strategy

Our portfolio strategy is simple. We want to outperform the market in the long-term.

We don’t engage in short term hedges like shorts and leveraged plays.

Our strategy can be explained under three main pillars:

We use a barbell portfolio.

We keep most of the assets in high quality compounders surrounded by strong economic moats. We complement these companies with smaller companies that have high and fast growth potential.

We look for undervalued exceptional companies.

When it comes to our foundational positions, we are super price sensitive.

This is because of the magic of buying cheap.

If you can find an exceptional that is 33% undervalued, that position will be up 50% when it reaches the fair price and you will have a double when it appreciates 24% beyond that.

For us, this is the easiest and safest way of outperforming the market.

However, make no mistake, such opportunities come rarely. This is why when they come, we bet big. As Buffett says, “when you see those opportunities, betting small is as big of a mistake as not betting at all.”

This is why we bought a lot of Meta when the market hammered it down after earnings.

We buy fast growing companies under three conditions.

We complement our foundational positions with companies that have potential for high growth.

We have three conditions to buy such companies:

1) Fair price. We don’t like to overpay for growth. It always ends up in disaster.

2) The company should have a long runway and have some form of competitive advantage.

3) No risk of permanent loss of capital. The company should be profitable and it should have a strong balance sheet.

These conditions help us find companies with high growth and very little risk of permanent loss of capital. When the permanent loss of capital is limited, we can wait patiently for them to perform and when they do, we outperform by a margin.

Our portfolio is up 37.29% in the last twelve months, outperforming S&P 500 by roughly 10%.

Here are the headlines:

We run a barbell portfolio.

We have have 10 holdings in portfolio.

All but one are above our average price.

My Full Portfolio

As of 29/09/2024, my portfolio is composed of 10 stocks.

I have written about all 10 stocks in this publication. I am pretty glad with the current state of the portfolio as there is currently no company in the portfolio that I don’t want to hold for decades.