The Market Cycle Of Politics: Should You Play The Trump Trade?

Is it going to be the golden era of the United States or an era of stagnation? I refuse to bet on any of these options. I think everything will be just fine.

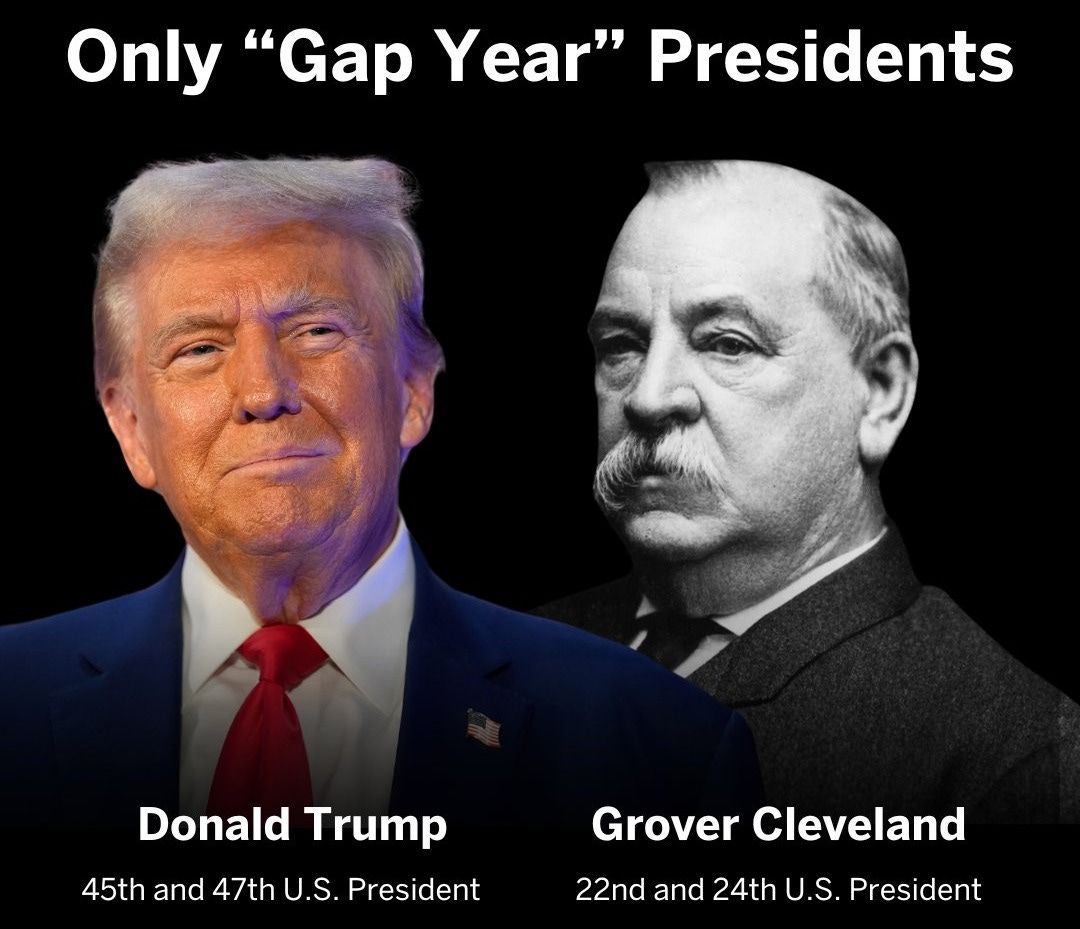

Donald Trump is set to begin his second term next Monday. To my knowledge, this type of comeback only happened twice in US history: One by Grover Cleveland in 1892 and the other by Trump in 2024.

His comeback divided the United States. Democrats now largely think that everything they gained over the last decade since Obama’s historical triumph is about t…