Tariff Proof Business Growing Revenues 50% And Trading At 55% Discount!

One of the best high growth opportunities I currently see in the market.

“Businesses disrupting traditional industries pay the highest return on investment.”

This is intuitive.

Disruption brings decline of incumbents. As they decline, the share of the market they previously captured becomes contestable again. Disrupter quickly captures all those shares in addition to organic growth of the market.

This is why they become so big so fast.

Amazon, PayPal, Spotify have all disrupted traditional industries where huge value was locked in and exploited by incumbents.

I found such a company last year.

I tracked it throughout 2024 and finally invested it back in January. I published the deep dive here.

What happened next?— It doubled in two months.

Valuation quickly went off the roof and we exited the position, locking in gains.

Luckily, when the industry getting disrupted isn’t defined by network effects and winner-takes-all characteristics, you can find other businesses that are successfully implementing a new business model and disrupting incumbents.

Amazon was followed by Shopify, Mercadolibre, AliBaba, Pinduoduo; PayPal paved the way for next-gen payment processors like Block and Adyen etc…

I now believe we have another business disrupting the same industry with even stronger fundamentals than the one that doubled our money:

It has four times more customers.

It has a more consistent track record of growth.

It is active in many more markets and expanding faster.

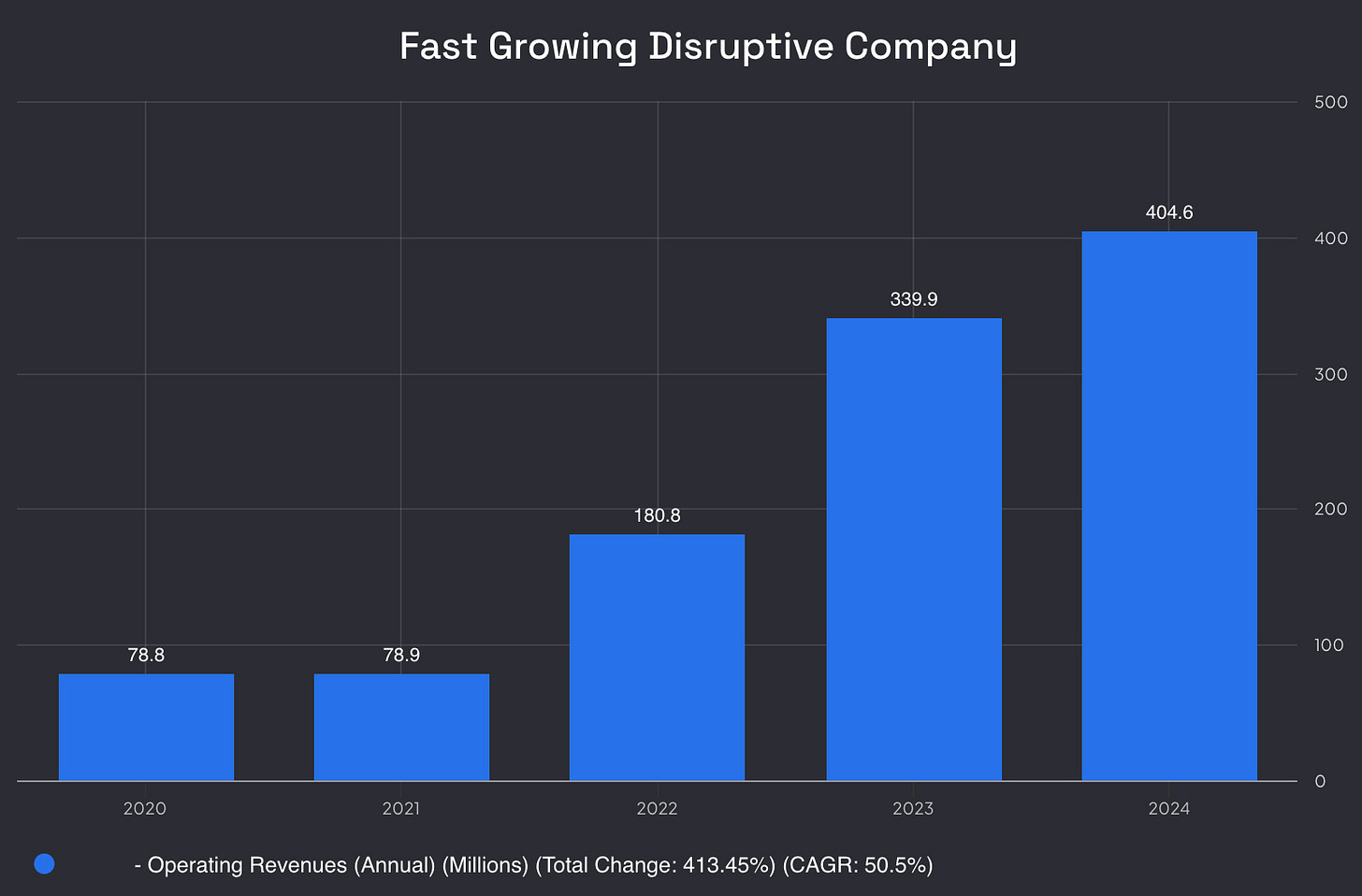

It grew revenues 50% annually in the last 5 years.

What’s better? — It’s currently trading at just 4 times sales while the management expects 30% annual revenue growth for the next five years.

Let’s cut the BS and dive deep into this gem!

Business Overview

After the internet, the main form of disruption has been cutting out the intermediaries and going direct to consumer.

This happened in shopping, streaming, gaming and many other fields..

Yet, there are still industries ripe for this kind of disruption.

Insurance is one of them.

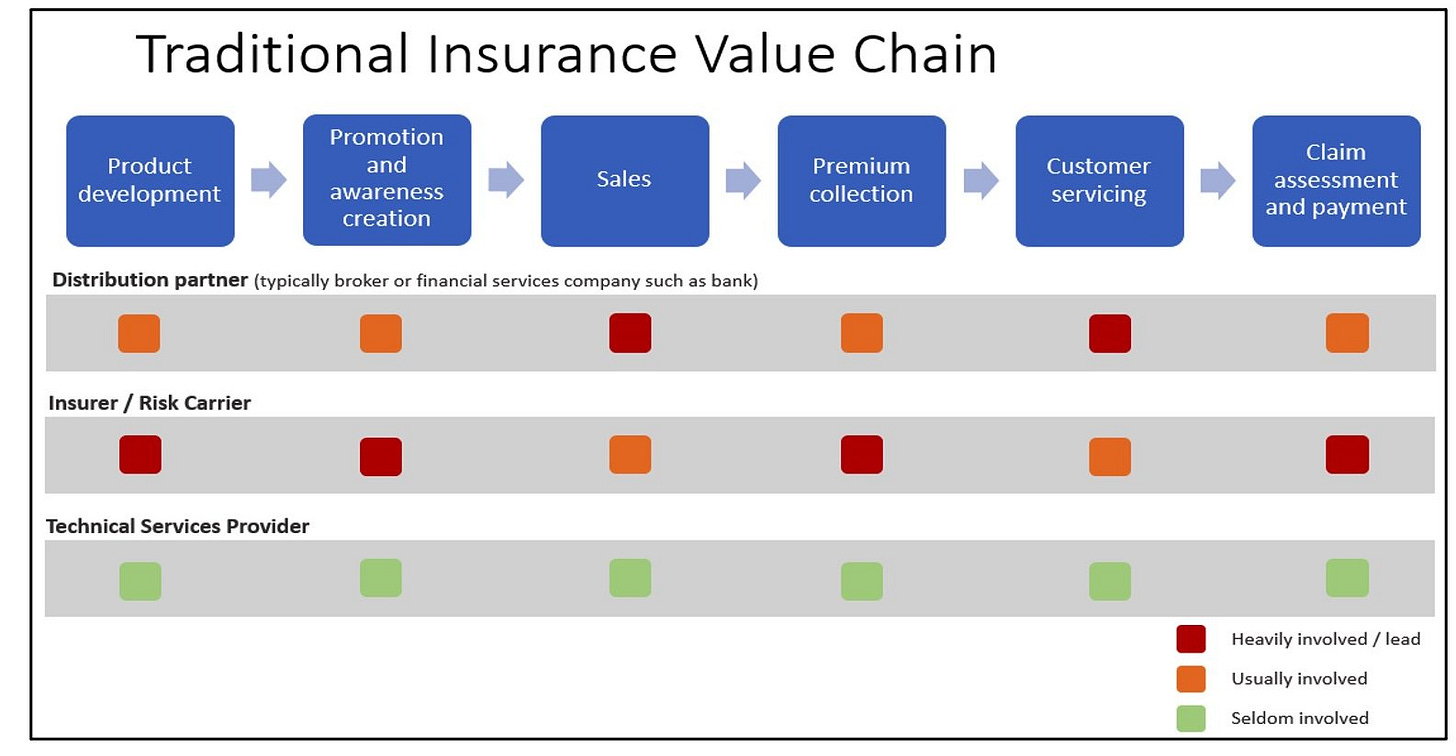

It’s traditionally run through intermediaries. This wasn’t a choice— this was a mandate of the conditions:

It was impossible for insurers to open branch offices in every city.

In absence of branch offices, they needed intermediaries to reach clients.

Insurers started to work with agents who would land clients for them in exchange of 15% commission for new clients and around 5% for renewals.

This way, agents and insurers have become co-dependent. Agents made living on commissions while insurers left customer acquisition costs largely on agents.

Over time, agents became so heavily involved in sales and customer service that it was too costly for insurers to replace them with their own services.

Until now…

Rise of the internet completely changed distribution, everybody was now able to access a service from anywhere and instantly. As a result, businesses relying on the distribution of goods, like e-commerce, got disrupted first, switching to direct-to-consumer model.

For service businesses like insurance, disruption of distribution wasn’t enough. We also needed a disruption of the service element because agents don’t just reach the prospects, they also help them with onboarding, claims processing, and servicing.

With the rise of AI agents, we now have the service element too and insurance has become completely ripe for disruption— and it’s getting disrupted.

We caught this with Root back in January. It's disrupting car insurance and it has done so good so far. It doubled in two months after we bought it.

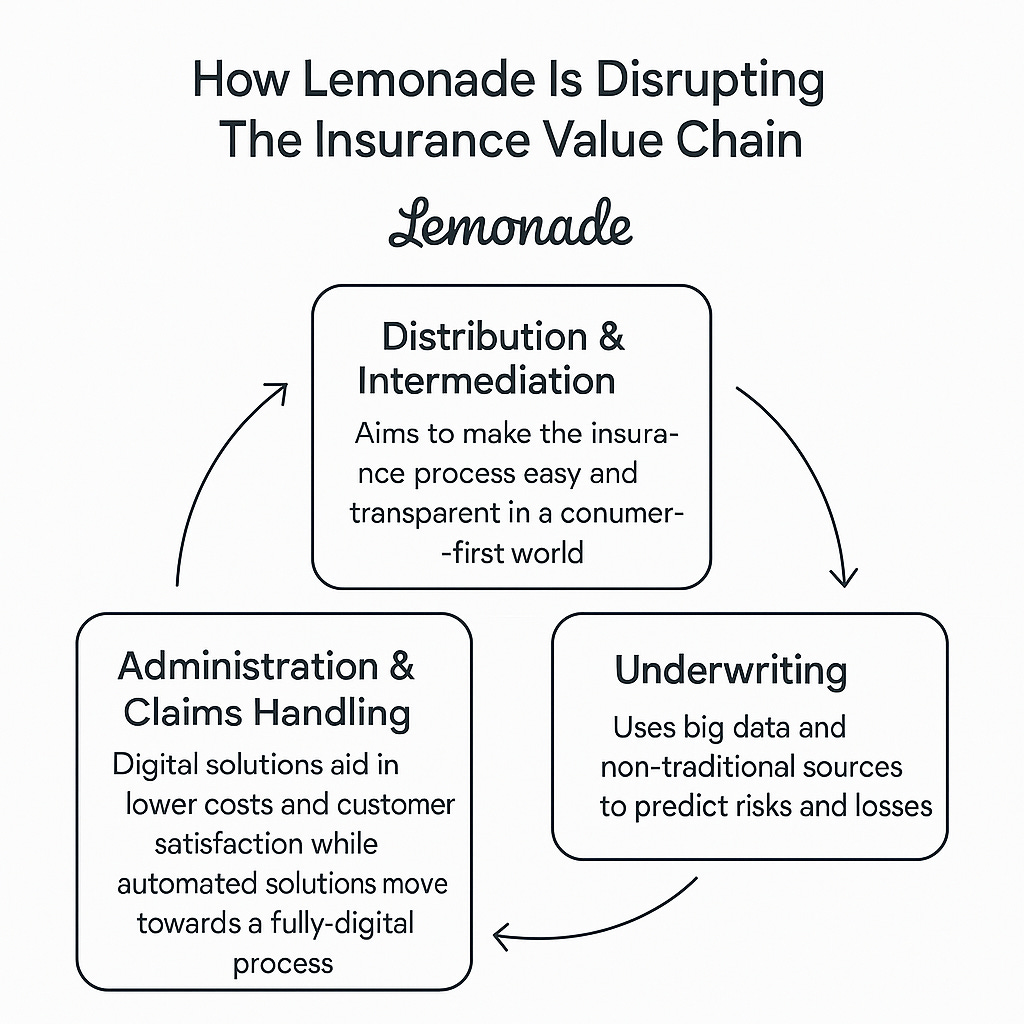

Lemonade is even better than Root, it’s disrupting the whole insurance industry.

It’s a direct-to-consumer insurance company active in renters, homeowners, pets and car insurance. They use AI to disrupt every step of the insurance value chain.

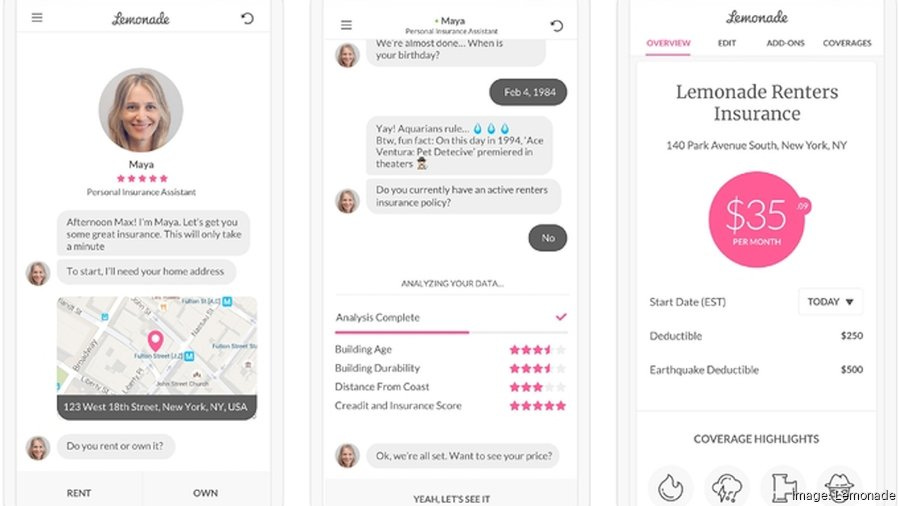

For distribution, they rely on the internet rather than agents. 98% of their customers land on their page after they see an ad on the internet. For operations, they rely on three AI agents:

Maya: It’s Lemonade’s onboarding agent. Once a prospect initiates a purchase, he is directed by Maya. He needs to answer just a few high value questions instead of filling out pages long forms. The whole process takes under 90 seconds!

Jim: It’s a claims processing agent. Through Jim, clients file claims in seconds and get paid in minutes. 55% of all claims are settled by Jim directly. This drastically reduces expenses related to claim handling by humans.

Cooper: It’s an operating agent, much like a middle-manager qualified to make some valuable business decisions. For instance, when Cooper detects a cyclone forming on the coastline through satellite images, it instantly stops ads in that region without human orders.

Here is a snippet of how it's AI Maya works to offer a price in a minute:

Many insurers tried before to replace workers with bots but they didn’t succeed because their value chain was established differently. Disrupting the industry meant disrupting themselves.

Lemonade, on the other hand, was built as an AI native platform. They are the first insurance company that truly managed to replace workers with AI agents.

This is not a platitude, we see this on data:

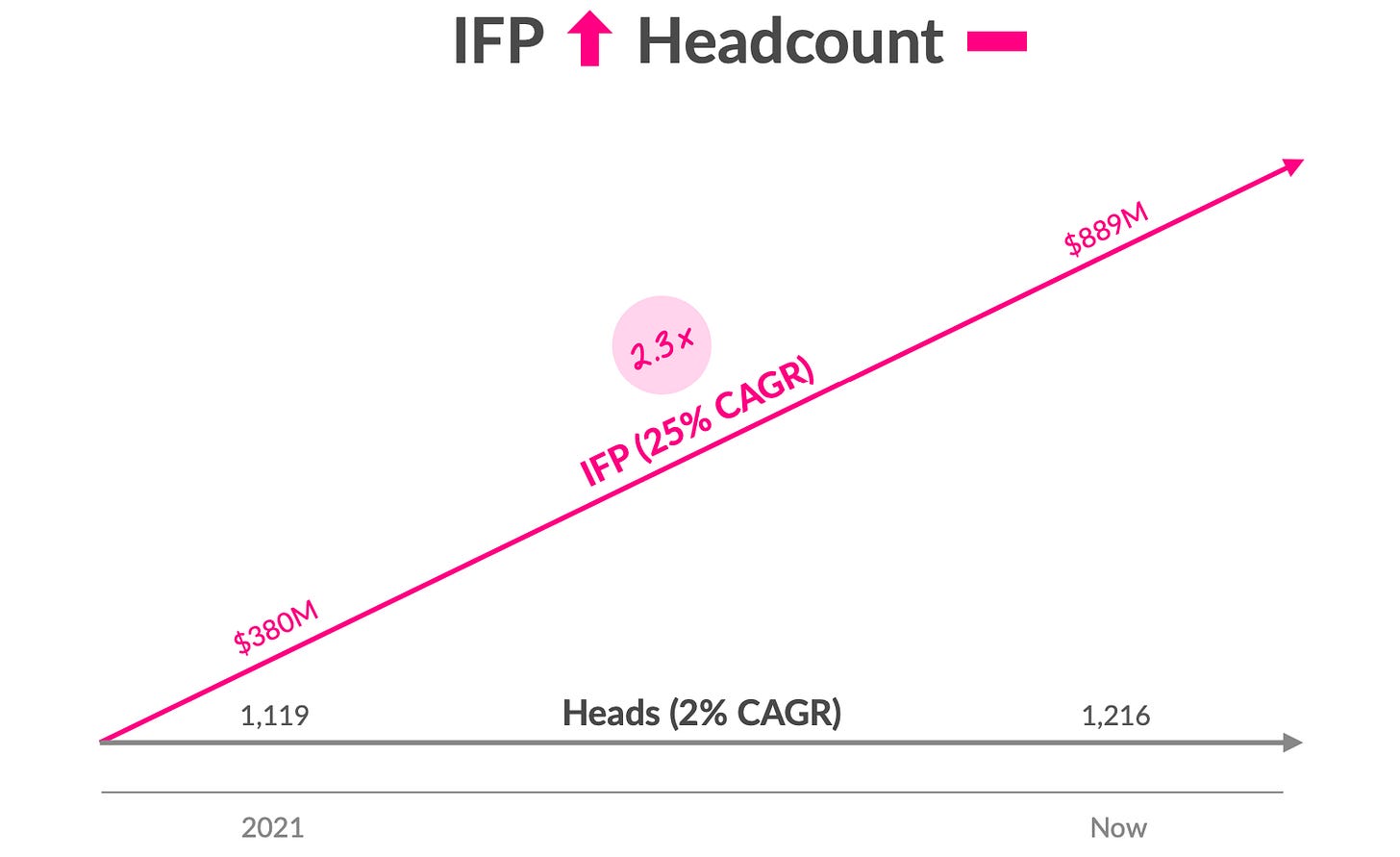

While policies in force more than doubled since 2021, head count only increased 8%.

It’s selling more policies, processing more claims, making more business decisions yet its headcount remains nearly flat…

Do you see where this goes?— It could scale infinitely while keeping headcount largely flat.

Its revenue could grow 10x yet the headcount will only increase 40%.

Result? It’ll be infinitely more efficient than incumbents, with much lower costs. It’ll be able to pass some of these savings to clients, attracting many more prospects, which will in turn further cut its costs per policy and allow it to reduce prices even more.

It’ll end up with cheaper policies than incumbents with also faster processing times and better customer service.

Does this remind you of something? — It reminds me of Jeff Bezos.

Customers will always want cheaper prices, faster shipping and wider selection.

- Jeff Bezos

In the same vein, insurance clients will always want lower prices, faster processing and better support.

Lemonade’s AI native architecture addresses these needs. This is why it has a solid competitive position in the market despite its small size.

Competitive Analysis

Let’s be honest with ourselves, insurance is a commodity market.

You only care about two things— price and coverage.

You can only lure clients by offering an equally comprehensive policy as your competitors at cheaper prices, all else is noise, there is no other edge.

In commodity markets, there is only one way to do that— you must have lower costs.

In these markets, competitive advantage stems from a system allowing you to have lower costs than your competitors just like Costco and Walmart.

Lemonade is doing exactly this.

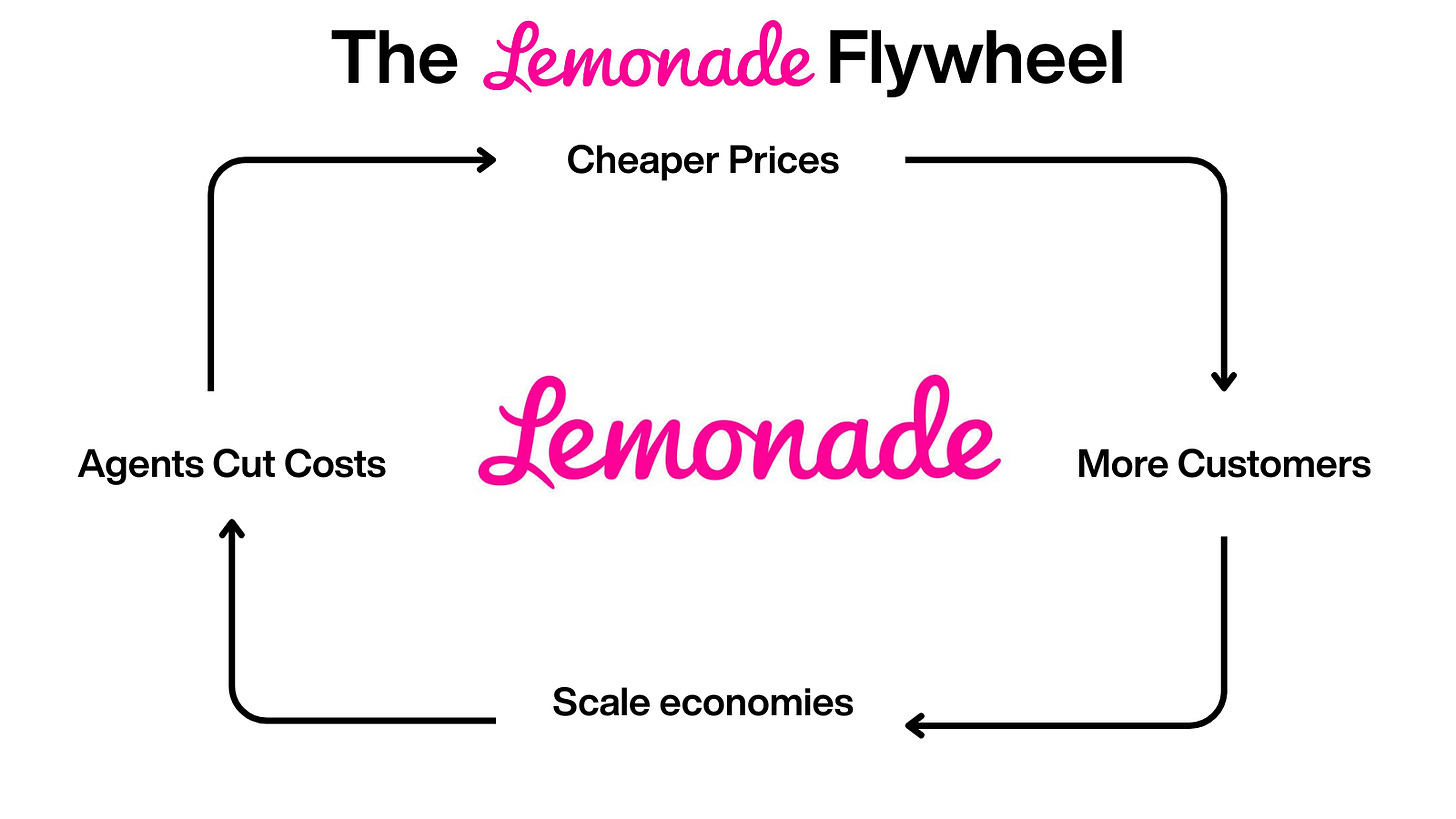

They have created a perpetual efficiency machine that constantly cuts costs as they scale and passes those cost savings to clients.

It does this by utilizing AI agents instead of humans at every step of its operations— Maya, Jim and Cooper.

Together, its agents drastically enhance customer experience, allowing clients to purchase a policy under 90 seconds, file a claim and get paid in minutes and seamlessly have their policy renewed without getting called by agents.

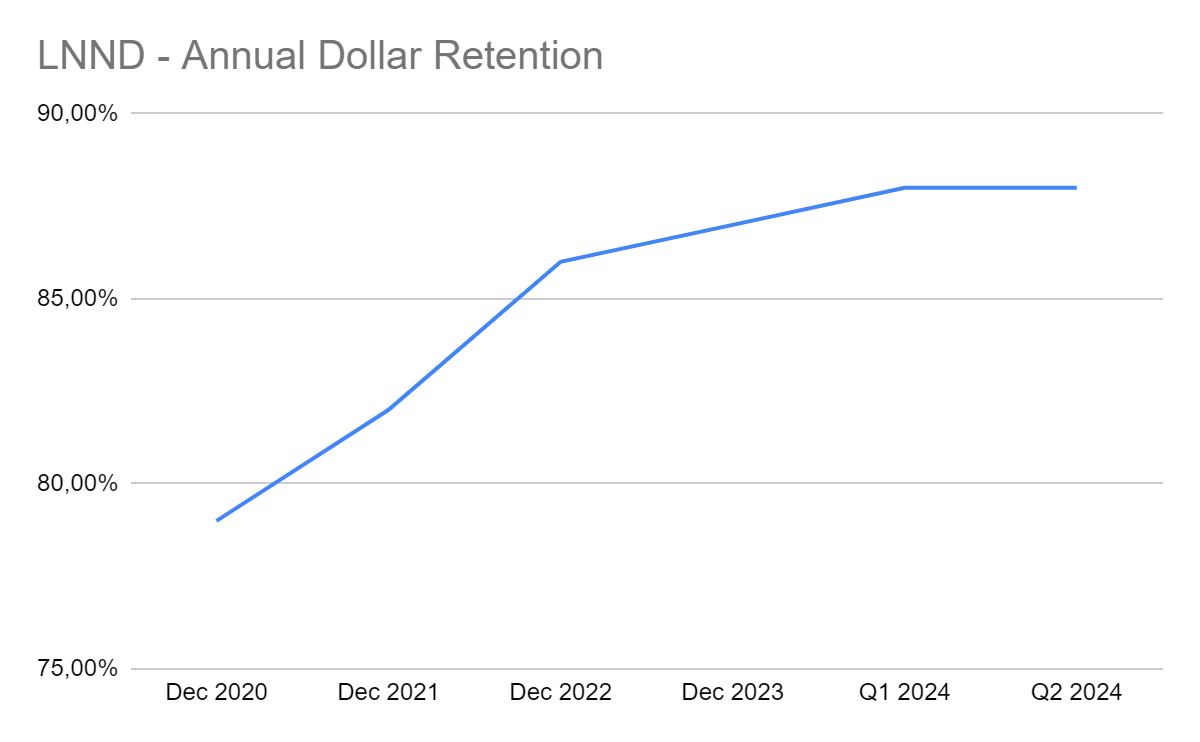

Result? They have an 87% retention rate while the industry average in the US is 82%.

Even a small increase in retention rate disproportionately enhances fundamentals because these policies come without new customer acquisition costs, the largest expense for insurers.

In traditional insurance overhead costs accumulate at three points:

Onboarding

Claims processing

Customer acquisition

To start with, 98% of Lemonade’s policies are sold through direct-to-customer channels and all onboarding is handled by its customer facing agent Maya while legacy insurers sell 92% of their policies through human agents. This drastically cuts commissions Lemonade has to pay.

The second bottleneck occurs in claims processing.

Traditionally, all insurance claims have been handled by humans. Lemonade changes this. All claims are filed through its claims processing agent Jim. Jim instantly handles 55% of all claims assigning only 45% to human processors.

If a claim is settled directly by AI, it’s a win-win situation:

Client gets happy because he is paid in minutes instead of days.

Lemonade cuts costs as claims handled by AI have 0 loss adjustment expense.

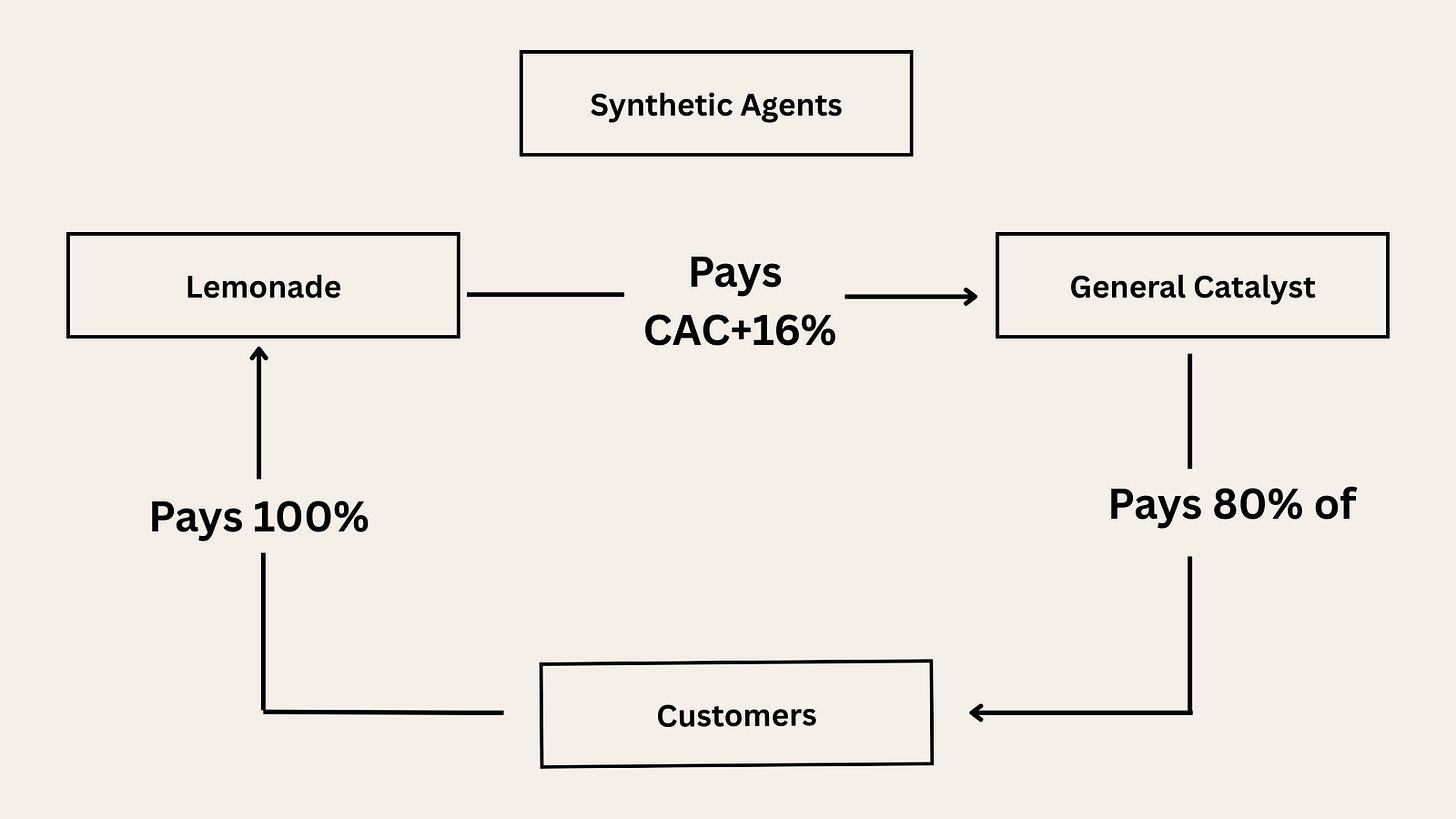

To address the third bottleneck, customer acquisition costs, they came up with a genius model called “Synthetic Agents”.

Traditionally, insurers leave their customer acquisition costs on agents. Agents find the client for the insurer and the insurer pays them lifelong commission going forward. They generally pay around 15% to their agents per new policies and 5% for renewals.

This model hurts insurers. They already operate with laser-thin margins around 2-3%, so eliminating even just 5% commission can drastically boost the margins. If an insurer makes net 3% profit, eliminating 5% renewal commission could boost this to 8%, more than doubling the net margin.

This is what Lemonade aims with its “Synthetic Agents Program.”

This is an agreement Lemonade and General Catalyst, VC backing Lemonade, entered to boost Lemonade’s growth.

According to the program, General Catalyst funds up to 80% of Lemonade’s customer acquisition cost. In exchange, Lemonade promises to pay the full amount plus Internal Rate of Return (IRR) up to 16%.

Once 16% is reached for any cohort, commission’s from that cohort will terminate and Lemonade will keep 100% of premiums.

If the customer terminates policy for any reason, sunk cost will be borne by the General Catalyst alone without any harm to Lemonade.

What do you think this leads to?— Lemonade’s customer acquisition cost collapses and the cash-burn stops.

Just like that you have an operation that uses AI agents for onboarding and claims processing and uses synthetic agents with limited commission.

Thus, we get a business scaling quickly without growing its workforce.

Its revenues grew 25% annually since 2021 while its headcount grew only 2% annually in the same period.

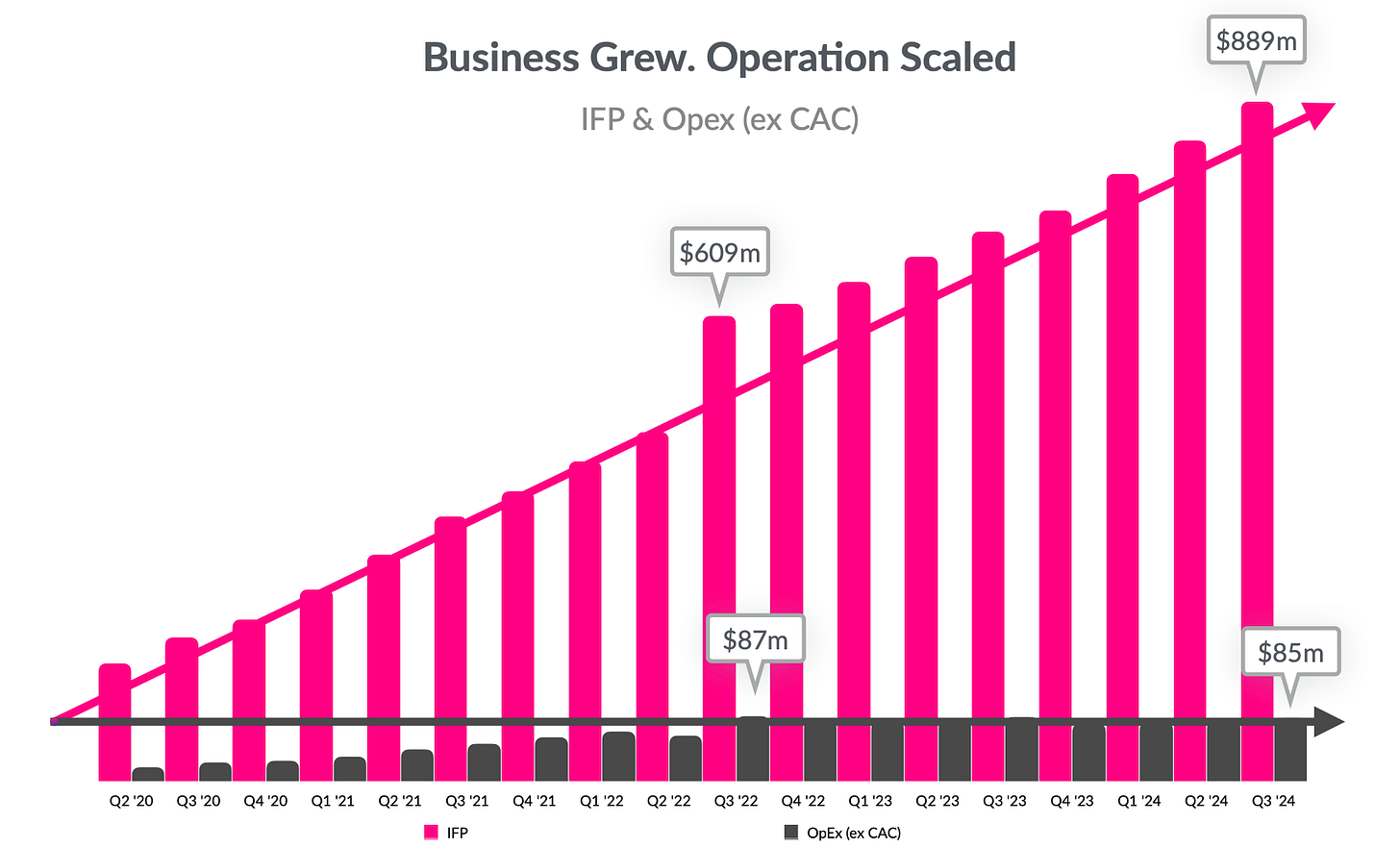

Result? Operating expenses declined while top line skyrocketed:

Tripling in force premiums, decreasing operating expenses….

This is a combination you can rarely see even in the cutting edge software companies let alone insurance.

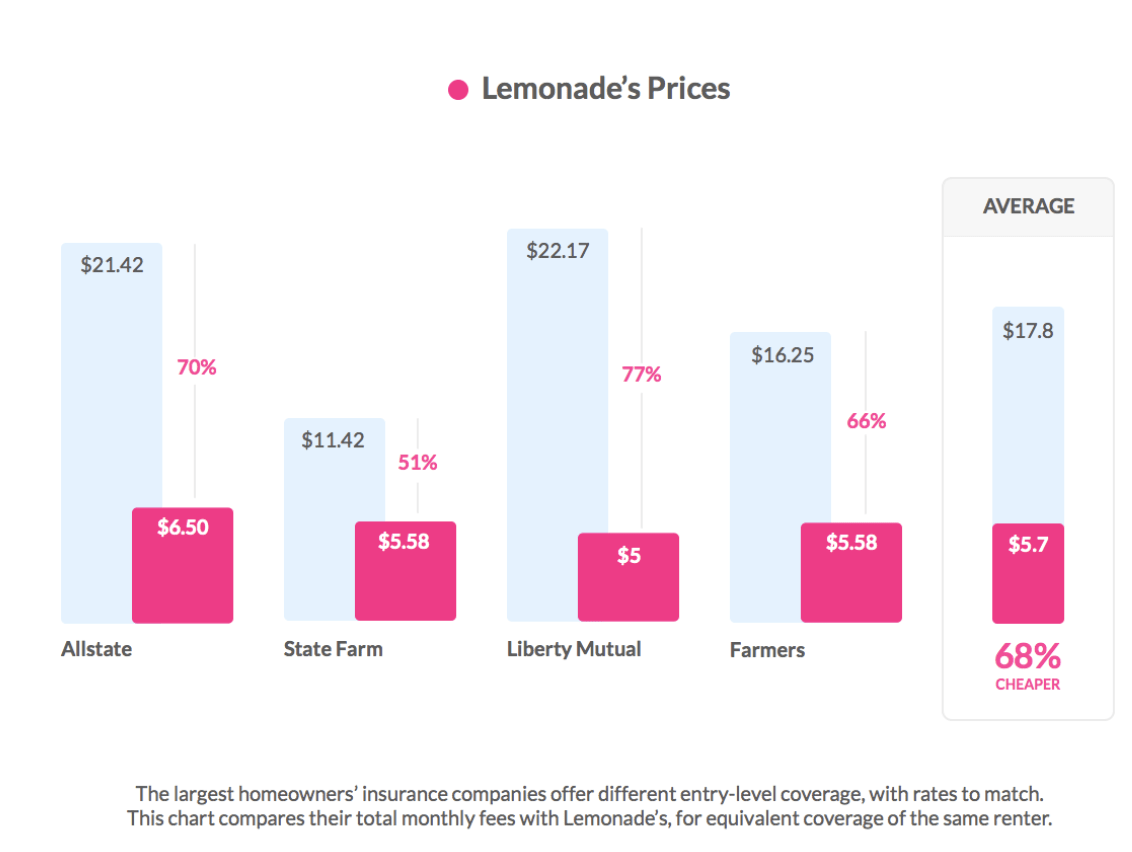

It achieves this growth by passing some of its cost savings to clients, offering cheaper policies than competitors:

On average, Lemonade is 68% cheaper than competitors.

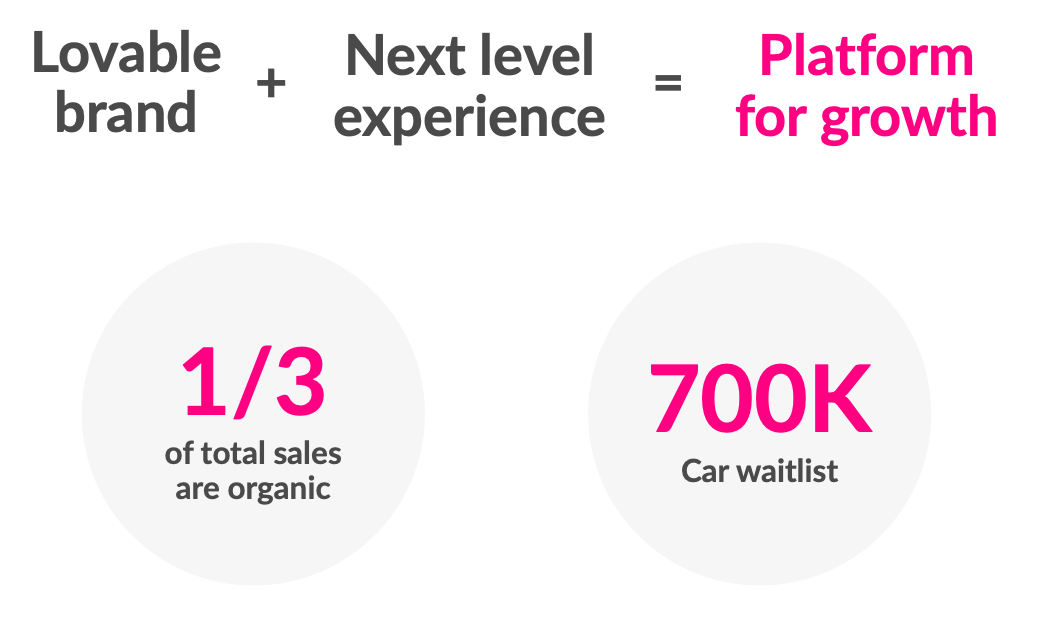

This attracts more customers, at lower customer acquisition costs, and it passes more of the savings to customers attracting even more customers. This is much like the famous Costco flywheel, only it’s Lemonade:

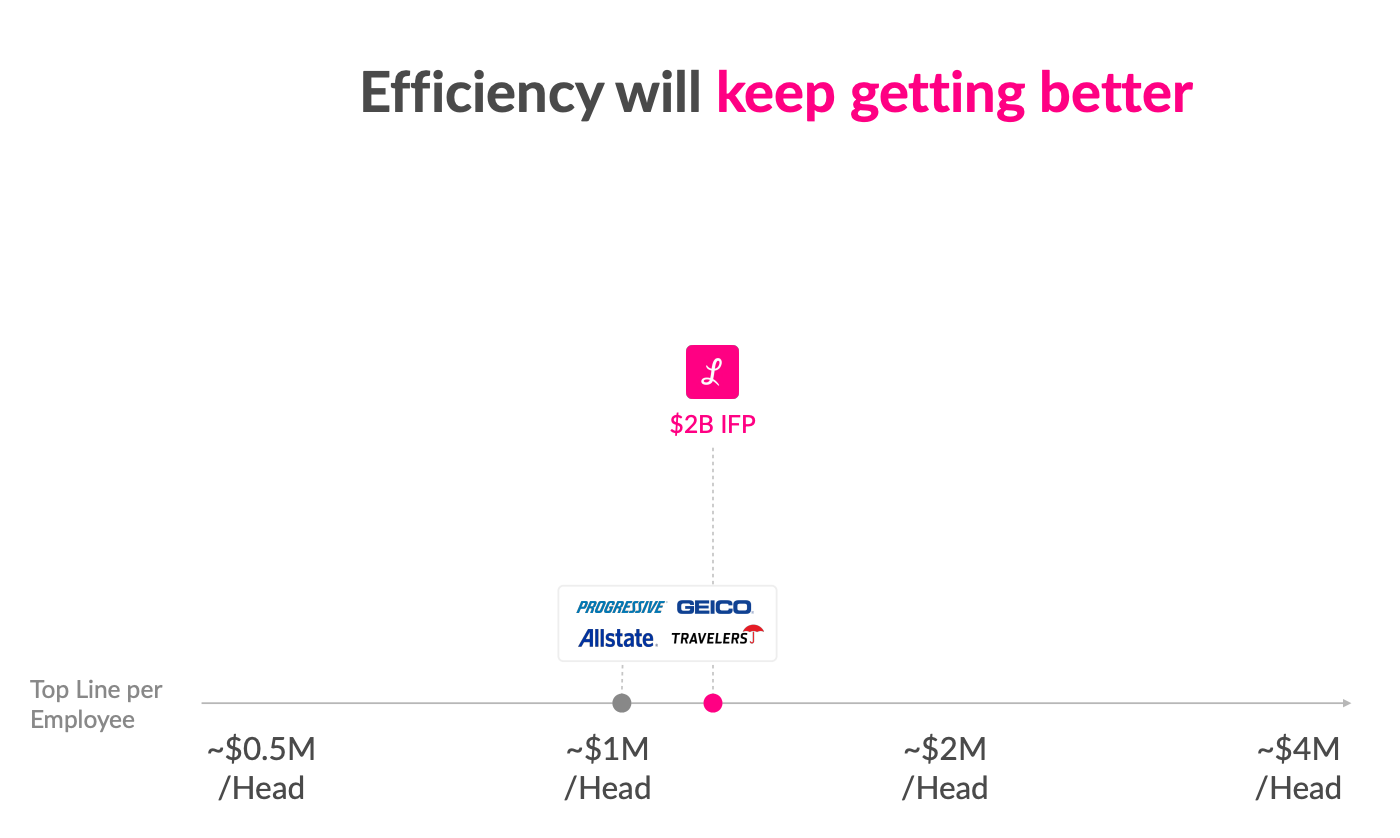

This flywheel is so strong that Lemonade will have higher revenue per employee than competitors at the fraction of scale.

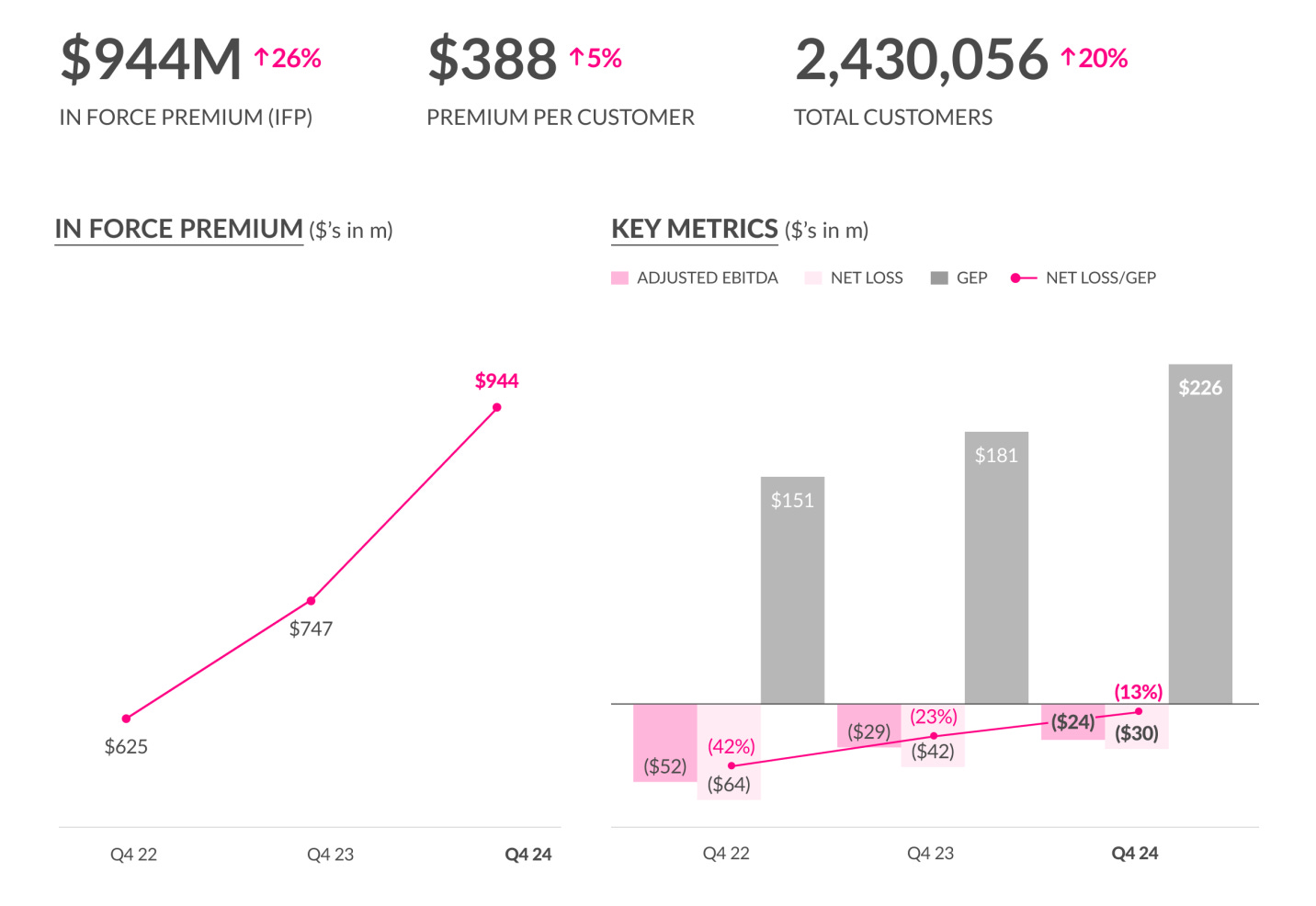

For comparison, GEICO had over $40 billion in force premiums in 2024 and it has around 40,000 employees, giving it $1 million in force premium per head.

Lemonade finished 2024 with $944 million in force premium and 1,235 employees, giving it $750,000 in force premium per head.

This is already amazing and management expects that at $2 billion in force premiums, it’ll be way more efficient than all legacy competitors:

Becoming more efficient than legacies at 1/20 of their scale… This is a result of superior unit economics enabled by the most advanced tech stack in the industry and innovative customer acquisition strategies.

They together create a flywheel that gets increasingly more efficient as the business scales, just like Costco.

They have the right structure and strategy, and numbers clearly show that their system is superior to that of competitors.

In a commoditized market, this is all you need to outperform.

Investment Thesis

My Lemonade investment thesis relies on three pillars.

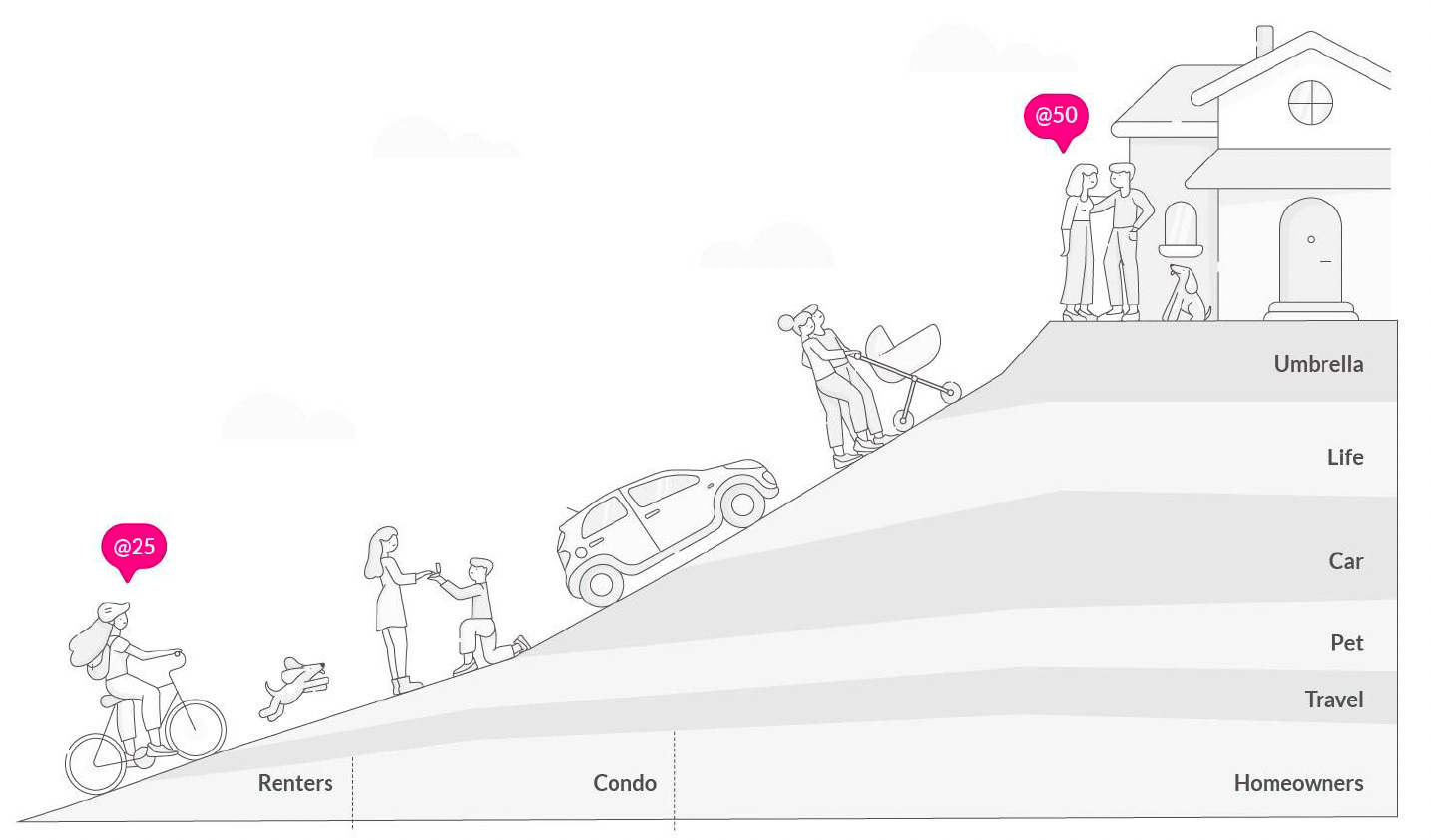

➡️ It Will Grow Organically As Its Customers Get Richer

Lemonade is a next-gen, AI native, application based and direct-to-consumer insurance provider. – Now read this description once again and tell me who do you think its users are?

The jargon you need to describe the business also reveals its customer base, GenZ and young millennials. This group has one distinct property– they are just starting moving up the economic ladder.

As they switch from a starter house to a bigger one, as they expand the family by having a child or pet or adding a car, they will need to spend more on insurance. This will translate to a massive channel if new leads of which the acquisition cost is virtually zero.

Can you see what this is going to do to its margin? – They’ll explode.

➡️ There Are Opportunities for Geographic Expansion

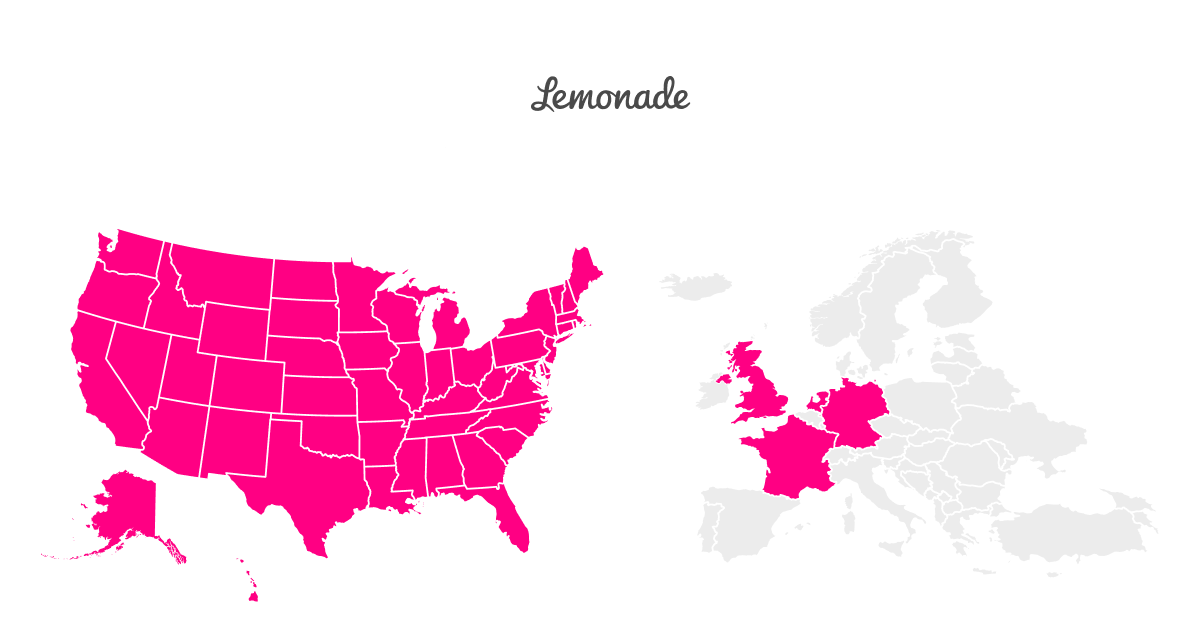

As of today, Lemonade is licensed to sell renters, homeowners, pet and car insurance across all 50 states. Yet, it’s only active in 39 of them. Though these states collectively represent 93% of the US population, the rest is still big enough to move the needle for Lemonade given its small size.

Thus, its expansion all across the US isn’t a matter of “if”— it’s a matter of “when.”

It also got a Pan-European license to operate throughout the European Union. It’s currently active in Germany, France and Netherland. It also launched in the UK back in 2022 under a temporary regime and got permanent license in 2023.

Because of its AI native nature, and inherent multi-lingual support, its expansion into other countries proved nearly effortless, significantly expanding its addressable market.

It still has 27 countries to expand in the EU plus Canada and Australia.

What does this mean?-- It can keep growing fast for a very long period of time.

This is what you would expect from a great investment.

➡️ Car Insurance Will Be A Big Winner

Lemonade started to offer car insurance in Illinois back in 2021 and has scaled to 9 states since then.

In 2022, they acquired a telematics based car insurer, Metromile, licensed to operate in 49 states. They have spent the last 2 years integrating Metromile technology to their own stack and migrating users to Lemonade platform. This process was largely concluded in 2024.

It’s now time to roll it out nationwide.

Of their 2.2 million customers, 1.2 million already have car insurance. This leaves you with 1.1 million people— and 700K of them are already on the waitlist!

Even if it can cross-sell to 50% of these people in the next 2-3 years, this is going to add around $300 million to earned premiums. Together with users switching from other providers, this segment can generate up to $500 million in earned premium in the next 4-5 years.

Combine it with the increasing average premium per client and declining loss ratio, you are looking at a fast growing business that will further accelerate in the next 2-3 years.

This is a very attractive position for me.

Fundamental Analysis

➡️ Business Performance

Insurance has a completely different set of key performance indicators than other businesses.

Revenue is not the main indicator of growth, it’s a proxy.

What you want to see are mainly two things:

You want the company to sell more policies.

You want it to lose less of the premiums it earns.

That’s it.

It basically works like revenue and gross margin— and Lemonade is nailing it here!

It reached nearly $1 billion in force premiums last year and grew its gross earned premium by 25% last quarter on year-over-year basis!

Yet, this is not the best point. While it grew fast, it also cut losses. Its annual gross loss ratio declined to 69% in 2024 from 98% from 2021.— Wow!

This means that it was losing 98% of the premiums it earned in 2021 and it declined to 69% last year.

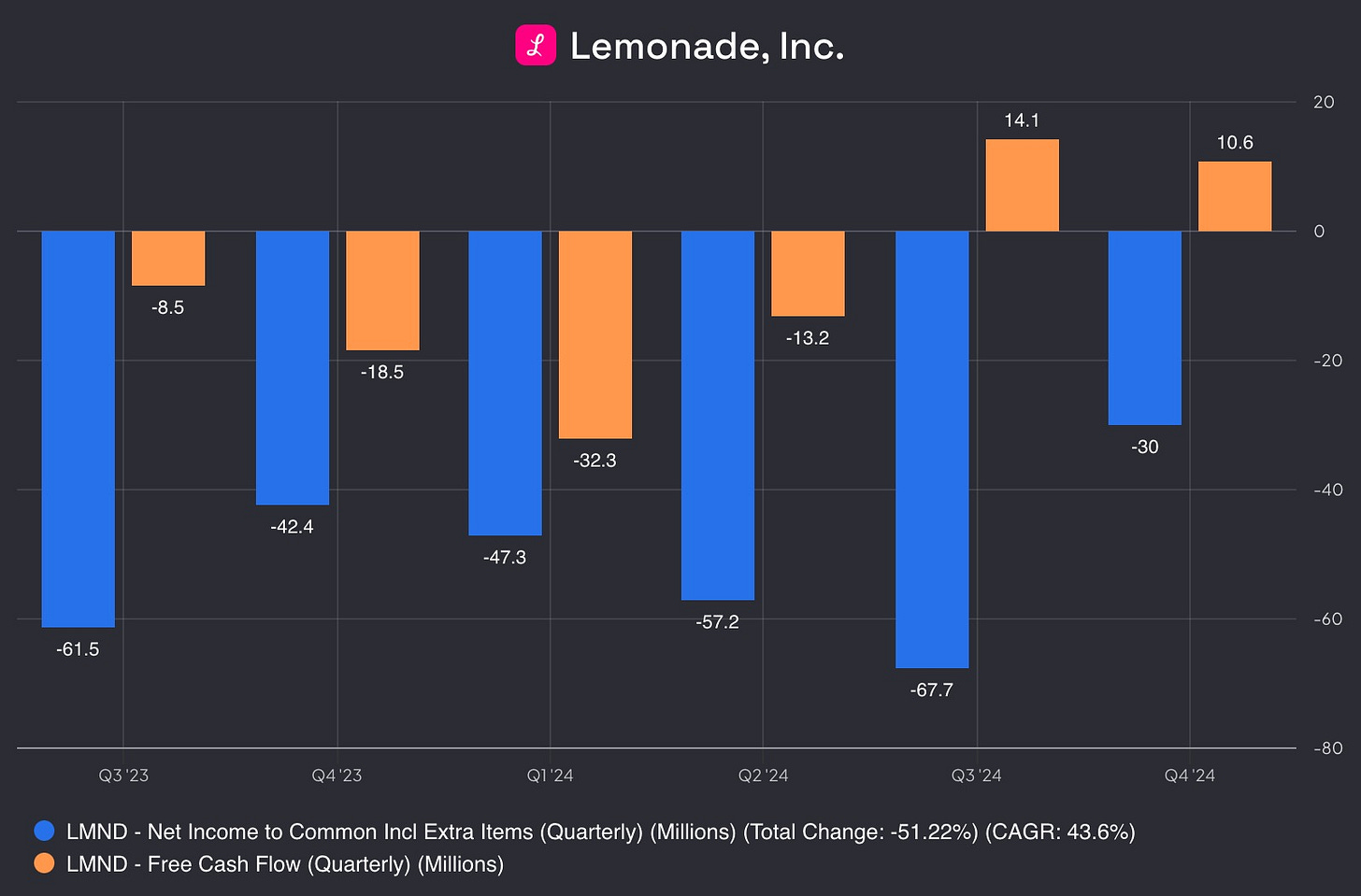

There is still a way to go but fast growth and declining costs, combined with stopped cash-burn due to introduction of synthetic agents, enabled it to hit a great milestone— it’s now cash flow positive.

This means that, despite the seeming unprofitability on paper, there is actually no cash leaving the company. This is, by any means, a huge milestone.

As I have said synthetic agents largely contributed to this as the business now can leave the customer acquisition cost on third parties without needing to pay them a lifelong commission.

This will have two effects on the business:

In the short term, profitability will delay as it’ll be paying additional promised return to General Catalyst.

In the long-term, growth will explode as once General Catalyst gets the promised return, no more commission will accrue to it and Lemonade will keep all premiums.

In the meanwhile, the business will remain cash-flow positive and it won’t need to raise additional capital, diluting the shareholders.— This is genius!

I can’t imagine how an insurance disrupter could have a better model and performance. It’s rock solid from all angles!

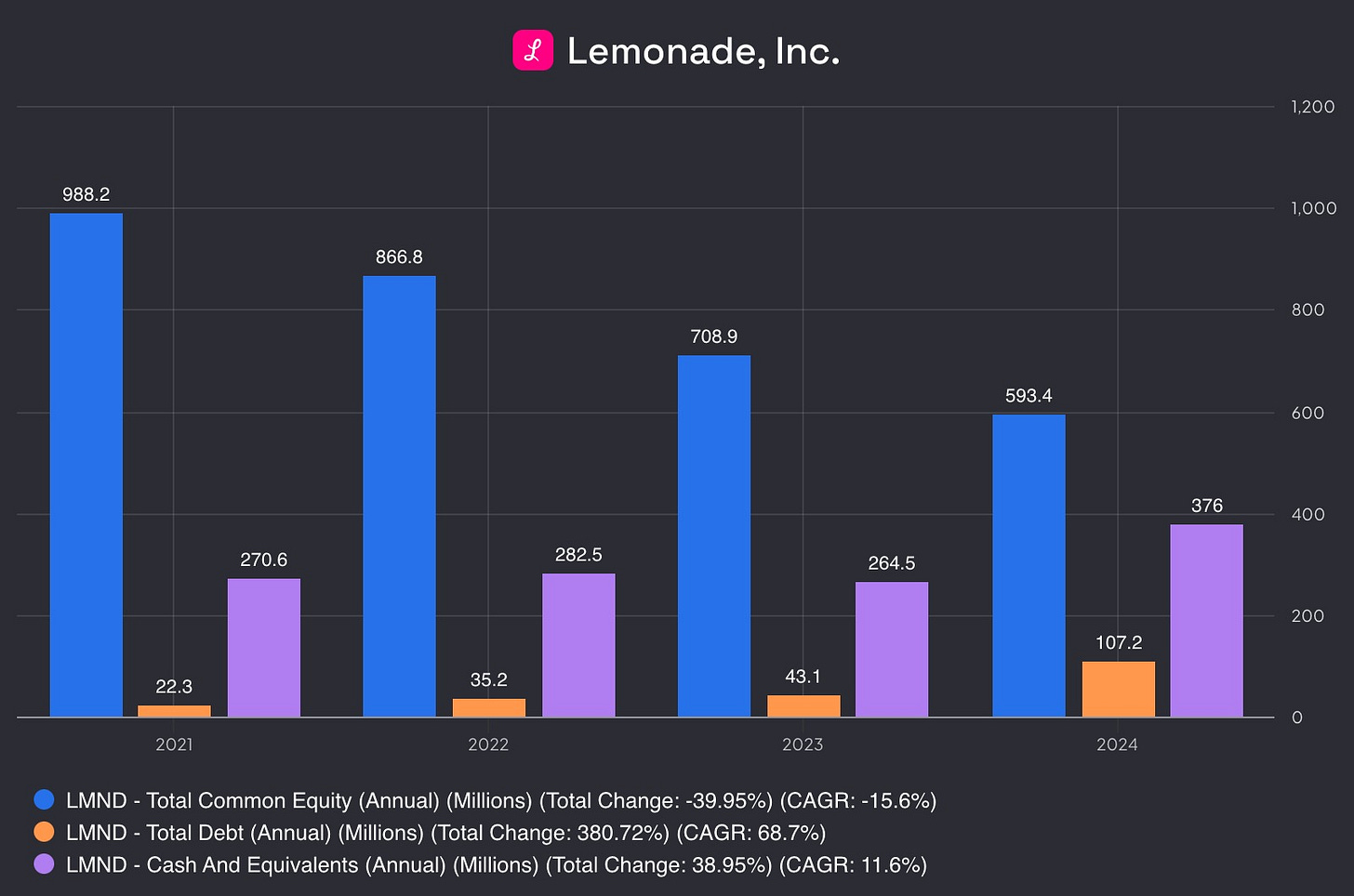

➡️ Financial Health

I have always thought the best indicator of financial health isn’t the balance sheet—it's the business's earning power.

Look at Coca-Cola and you’ll see that it has more debt than equity on the balance sheet. Does this mean its financial position is weak? Hell no.

Coca-Cola’s earnings are so consistent and predictable that it can afford to operate with high debt. It knows people will be drinking Coca-Cola in the worst of financial crises. They did in the Great Depression, they did in the Great Financial crisis etc…

Thus, for those businesses, high debt is even desirable as it’s cheaper than equity.

For fast growing businesses, it's the exact opposite. They are characterized by uncertainty. If the future uncertainty is high, you want them to have a strong balance sheet.

For me this means higher equity than debt and net cash position.

Lemonade has it all.

It’s equity pool is nearly 5 times larger than its debt and its cash position is three times as large as its debt, giving it a net cash position of $269 million.

What’s the best part?— It’s not burning cash anymore.

Thanks to its synthetic agents and collapsing loss ratio, it turned cash flow positive last year. There is no outflow of cash anymore.

All the cash position you see here will only grow from now on. It’ll use this for investments and growth will accelerate.

You are looking at a business that’s set to grow 30% next year without cash burn and with a net cash position as much as 10% of its total market cap.

If this isn’t a rock-solid financial position, I don’t know what it.

➡️ Efficiency & Profitability

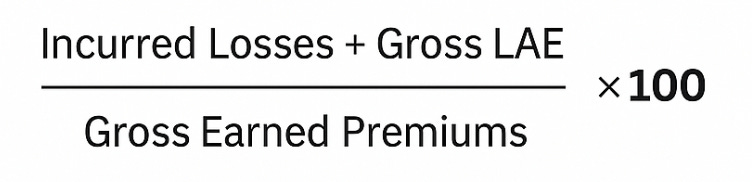

Gross Loss and Net Loss Ratio

Normally, what you would look at to assess profitability of a business are gross margins and profit margins. In insurance, these correspond to gross loss ratio and net loss ratio.

Gross loss ratio is basically how what percentage of the earned premiums the businesses pays out in claims. In doing so, expenses made for processing the claim, assessing the damage and all related expenses are included. They are called loss adjustment expenses.

In sum, gross loss ratio is calculated as follows:

Then you come to the net loss ratio. This is basically the final loss of the insurer after reinsurance payments. Reinsurer pays both for the percentage of the claim and percentage of the adjustment expenses.

Thus, gross loss ratio measures solely underwriting quality of the business and net loss ratio measures the total of underwriting quality and capital allocation.

It’s just like gross margin measuring the competitive strength of the business and net margin measuring overall operating efficiency.

Lemonade is performing phenomenally here.

It has decreased its gross loss ratio from 89% in Q4 2022 to 63% in Q4 2024! Net loss ratio also decreased from 97% to 62%.

This is an amazing performance.

When you consider that average net loss ratio for property and casualty insurance in the US is 76%, you understand how impressive Lemonade’s performance really is.

Their model isn’t just changing how we buy insurance but is also changing fundamental characteristics of the business.

This is what real disruptors do and Lemonade is doing just this.

Sales-to-Invested Capital

Traditionally, we use ROE, ROIC or ROCE to assess investment quality of the business. The downside is they come out negative if the business isn’t profitable yet.

What do we do then?

Aswath Damodaran suggests using sales-to-invested capital ratio. It’s basically revenues divided by the sum of debt and equity minus cash. This shows us how much the business generates per dollar invested.

In 2024, Lemonade had a total invested capital of $324 million and generated $526 million total revenue. This means that it generates $1.6 per every $1 invested.

For industry leaders like Progressive, this is around 2.3 times. So, why is Lemonade lagging here?

It’s because its customer base is still very small and the number of new customers is relatively high. Thus, it hasn’t made back its acquisition cost for most of its customers now. Thus, it keeps paying commissions even on renewals.

Legacy insurers like progressive make most of their money through renewals and it has already made back its acquisition cost on them.

Thus, as Lemonade’s cohorts get older, most of their acquisition costs will be totally paid off so its expenses on them will decline and earnings will grow. This is going to directly increase its investment efficiency.

Its current sales-to-capital ratio of 1.6 is already not too far away from those of the legacy players like Progressive and it’ll only get better as the business matures.

It gets a passing grade from here.

Valuation

This is the trickiest part.

When we have a mature business with predictable earnings and durable competitive advantage, it’s so easy— just make reasonable growth assumptions and attach a conservative multiple.

What happens when you have a fast growing and unprofitable business?

There is no shortcut, you have to run a DCF:

First create your story.

Then run the numbers.

My story for Lemonade is obvious— it’s disrupting the traditional way insurance has worked.

It’s going to grow fast in the next 5-8 years before slowing down as the total addressable market is huge. When it matures, it’ll have higher net margins and higher sales to capital ratio than industry average because of its AI first model.

Here’s how they translate to paper:

My model gives $57 per share fair value and $49 per share option value where 20% chance of failure is baked in, assuming that the business’s value will be cut by a third in case of failure.

This means that the business is 55% undervalued relative to its option value.

If you are looking for a relatively lower risk growth stock, I believe this is one of the most attractive options in the market.

Conclusion

Lemonade is disrupting the insurance industry.

Though its scale is still small, we see that it’s succeeding in this quest when we look at how business fundamentals have improved over time:

Loss ratios have collapsed.

Retention rate is above industry average.

Operating expenses remain flat despite tripling in force premiums.

Nearly all of its policies are sold by it directly to customers, 55% of all claims are settled by AI in minutes and its internal AI system acts like a middle manager.

As a result, we have a very lean direct-to-consumer insurance operation— and it’s trading at a significant discount.

On top of all these, insurance is a tariff proof business that people will prioritize under any macroeconomic conditions.

I have always had three conditions to buy fast growing businesses:

It should have a long runway.

It should be reinvesting profitably.

It must have a strong financial position.

Lemonade meets them all.

I don’t know whether Lemonade will fulfill this promise, but I know it has everything to do so.

And this is as good as you could get in the stock market!

Very interesting. Thanks!

How do we get an active link to the discord group?

Is there a WhatsApp group?