Sweet November: Our Portfolio Outperforms S&P 500 By 26%, Here Is What We Own!

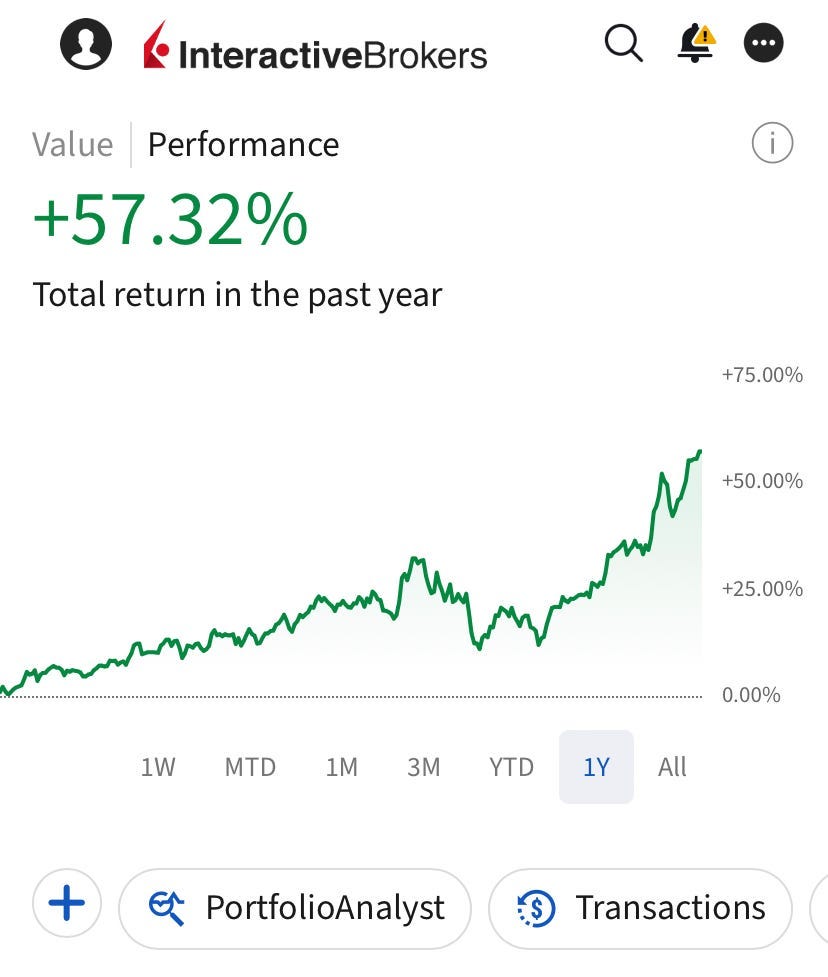

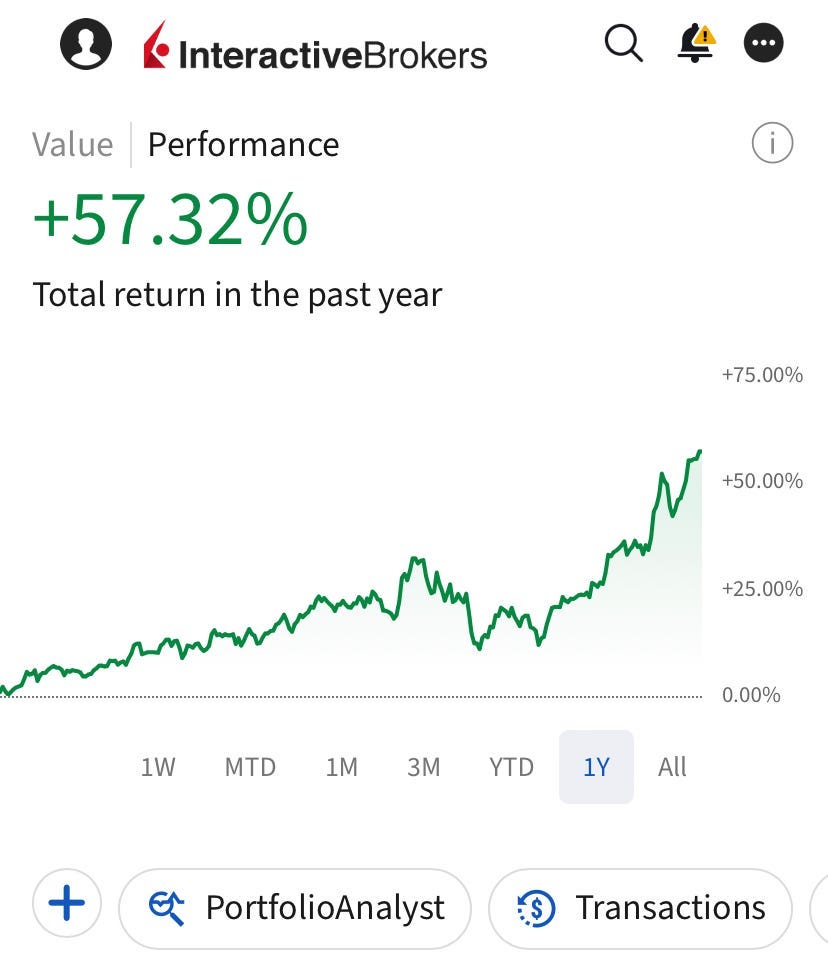

Our portfolio is now up 57% in the last twelve months against 31% of S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 26%!

Portfolio is now up 57% in the last twelve months against 31% of S&P 500!

I am proud that our portfolio is delivering on the low risk-high return strategy that I adopted. I will explain our strategy and share the portfolio updates in a minute but first I want to briefly discuss the signs of danger I have started to see in the market.

It seems to me that people have started to forget that you can lose money in stocks.

When being “less expensive” becomes a quality worth praising and money flows from large-caps to micro-caps, you can start thinking that the peak market is close.

I have been observing on Substack that most writers, even self-described value investors, started to buy micro-caps. There is nothing wrong with micro-caps if you are naturally a micro-cap investor. However, when there is a market-wide shift to micro-caps, it’s usually because there is no money left to be made in large-caps.

There are other ominous signs too:

Cathie Wood has again become a regular guest on CNBC.

Pre-revenue companies are getting insane valuations.

Warren Buffett holds a record amount of cash.

On top of that, consider that investors are buying micro-caps, they beat earnings, go up 50% overnight; Bitcoin is at record highs; gold is at record highs; real estate prices are at record highs… Result? Everybody is feeling like a genius.

When everybody feels like a genius, it’s time to turn more defensive, not offensive.

This is what we are doing nowadays.

Our Strategy Now: Seek Counter Attacks!

There is no doubt that the market is now “highly priced.”

As opposed to what most people think, buying already expensive companies is not the only mistake you can make in an expensive market. There is another one:

Exiting the market.

I suggest you do an easy real life experiment to see how unproductive this strategy is. Get one of your friends and give him a balloon. Tell him to blow up the balloon until it pops. Your task is simple: Try to guess when the balloon pops. How many times would you need to say “now” to get it correct?

Same thing happens in the market too. We can see it’s overvalued but exiting the market exposes us a whole new set of risks. Instead, we should adjust our position.

If you have been following this publication for a while, you know that we use a barbell portfolio. This provides us with a great flexibility to adjust our position.

We are now taking the counter attack position:

Overweighting the compounders with massive moats.

Seeking opportunistic entries in growth stocks with strong balance sheets.

This strategy is paying of dearly:

Our portfolio outperformed the market by 26%, delivering 57% annual return against 31% of S&P 500.

Following transactions took place in our portfolio in November:

We opened 3 new positions.

Increased 3 of the existing positions.

We also closed 1 position for reallocation purposes.

We now have 14 positions in total and I believe the current composition of the portfolio is so strong that it can weather all the storms in the market and it can also ride any bullish wave.

In the last update, I have explained how each position fits in our strategy. In this update, I’ll also discuss the outlook for each stock we own and explain what you can expect from them going forward.

Let’s dive in!