Soluna Investment Thesis: Turnaround Story in Data-Center Space With 6X Potential

Data center hosting provider for Bitcoin miners, now expanding to AI/HPC clients with 900 MW of renewable capacity in development

Sometimes, a particular group of businesses can be at the right place, at the right time, and disproportionately benefit from the external developments.

There are multiple examples of this, but the closest one I can think of is the fiber-optic cable manufacturers during the dotcom boom.

They were already around for a couple of decades, but most fiber optic cable manufacturers were struggling in the 1980s and 1990s due to limited demand, which was mostly from government projects.

In the early 1990s, most of them were on the edge of bankruptcy. The Internet started to go mainstream in 1995 with Netscape’s IPO and and suddenly every telecom company in America decided they needed to lay fiber-optic cables across the country to handle the coming data traffic. Sales of the average fiber-optic cable manufacturer increased by 12x between 1996 and 2000. Most companies scheduled for bankruptcy turned around and created fortunes for the shareholders.

Today, data center developers are in a similar position to fiber-optic cable manufacturers in the mid-1990s.

Data centers have been around for decades, with most capacity controlled by major cloud providers and large enterprises. This changed when Bitcoin mining became profitable at scale. A new wave of independent operators emerged, building specialized mining facilities—often powered by cheap renewable energy in remote locations—to capitalize on the crypto boom.

However, only a handful achieved the scale and cost structure needed to survive Bitcoin’s volatility. Most remained unprofitable, burning through cash to expand capacity while Bitcoin prices fluctuated. Their dependence on external financing raised during boom times became fatal when crypto crashed.

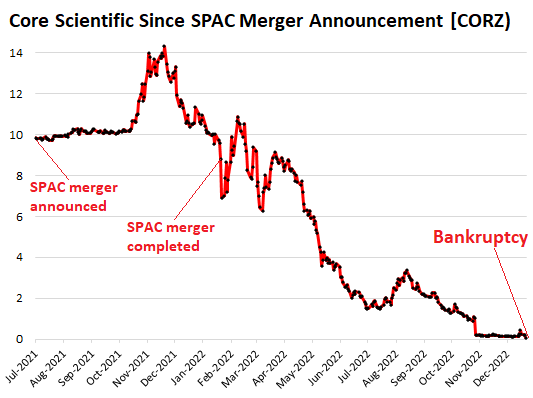

Core Scientific, Compute North, Argo Blockchain, and others filed for bankruptcy between 2022-2023.

Despite their unprofitability, they gained industry expertise and know-how in building and operating data centers.

Thus, once the AI revolution spiked demand for data-center capacity, they were well-positioned to quickly pivot and serve the demand. A substantial number of developers turned around their businesses and even returned from bankruptcy, like Core Scientific, by becoming data center development partners to AI/HPC clients.

Soluna is pursuing such a turnaround story by expanding to AI/HPC hosting.

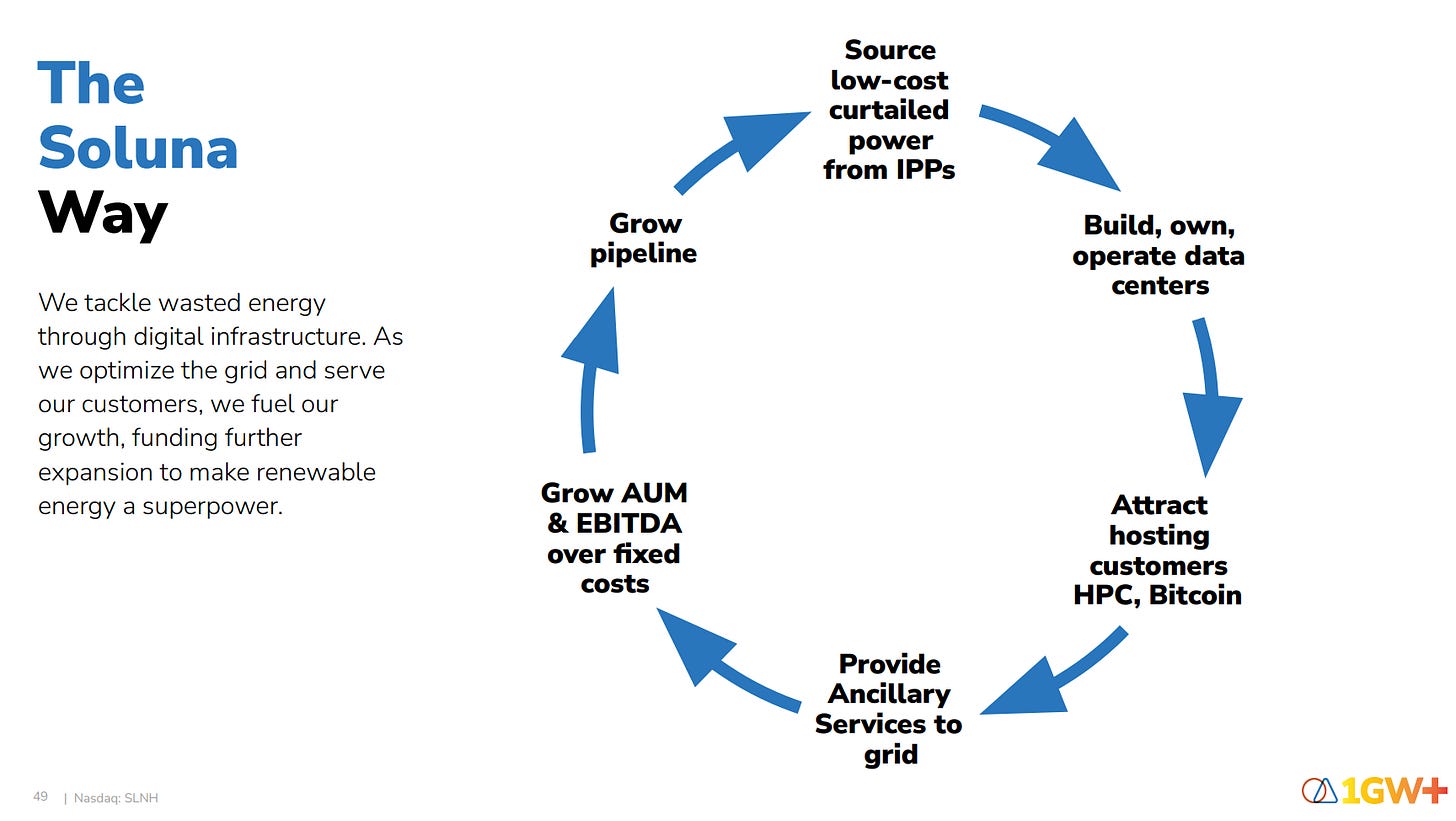

It’s developing data centers near renewable power plants to benefit from excess power generation that cannot be given to the grid or stored. Thus, plant operators are willing to sell this excess power at lower prices. Soluna takes advantage of these lower prices by locating data centers near renewable plants and receiving power directly from the plant.

So far, it has rented its data center capacity exclusively to crypto miners and mined crypto itself in a 25MW site. Though it has had some success in establishing this business and finding tenants, it hasn’t been able to generate positive operating income as Bitcoin’s block reward got halved in April 2024, and the network difficulty increased substantially as more miners joined and existing miners grew operations.

To be honest, I wouldn’t think the business can survive given no sight of turning a profit from the existing operations. However.. It’s now pivoting to AI/HPC infrastructure, trying to become a data center developer/operator for AI-Cloud tenants.

It has a 900 MW capacity under development, a bulk of which the management is planning to rent to AI-Cloud providers. Further, it has secured significant financing to keep the operations going and build new sites dedicated to AI/HPC tenants. It expects to finish the construction of a new 166 MW site next year, 83 MW of which will be reserved for AI/HPC tenants.

If the pivot holds, it can be one of those spectacular turnaround stories in the market. If they can find a tenant for their first dedicated 83 MW AI/HPC data center, they can literally generate 5x the current revenue just from that one site. Which makes it a high-risk/high-reward play.

The question is: Can it pull this off?

This is what we are going to discuss today.

🏭 Understanding the Business

The world occasionally undergoes big technical and technological transformations. This is natural as we find better ways to use resources and produce goods and services over time.

These transformations tend to lead to a jump in efficiency over the long term. However, inefficiencies tend to emerge in the transition periods as no two technical or technological standards can be directly plugged in place of the previous one and work perfectly. At those points, new businesses emerge to address those inefficiencies.

Today, we are going through two big technical & technological transformations:

Transition to green energy.

The AI revolution.

These transformations are also connected to each other.

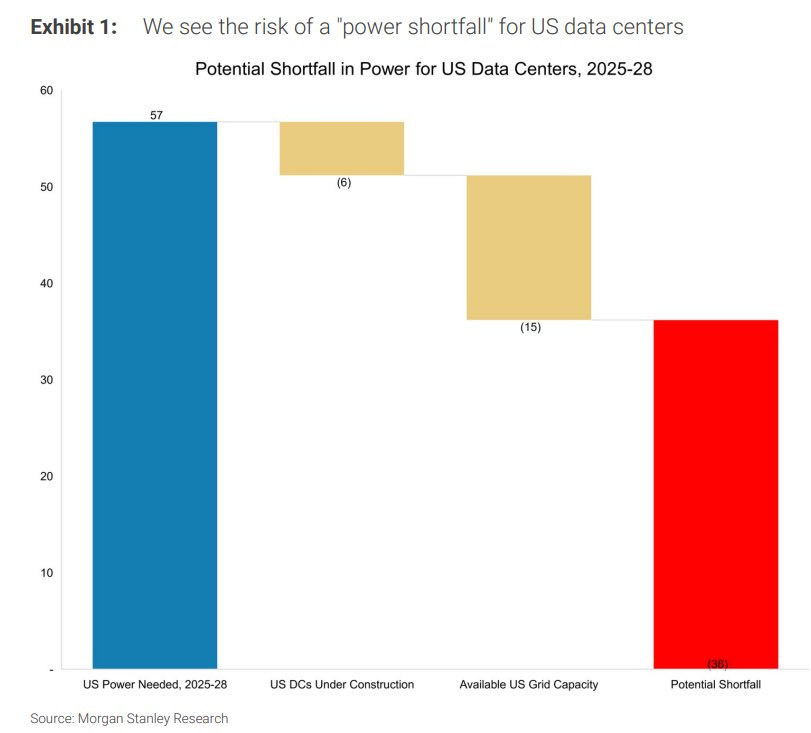

AI takes a massive amount of data-center buildout, which skyrockets the energy demand. As a result, prominent research from Morgan Stanley and Bloomberg expects a power shortfall for US data centers in the next 4-5 years.

Given the projected shortfall, one would expect that we should be using all the power capacity available. Counterintuitively, this is not the case. Though we are rapidly adding renewable capacity, we aren’t able to use all the potential in installed plants.

Why? Because, in renewables, you don’t decide when to generate power; nature decides. This week may be excessively windy, yet the next 2 weeks, the wind can be unusually calm. Thus, we should generate all the power we can while it’s available and store the excess for future use. This requires deploying massive amounts of storage.

We currently don’t have such deployed capacity.

This leads to inefficiency and instability in renewable energy generation, creating opportunities for the firms addressing this. I previously wrote about Fluence Energy because it’s one of those companies trying to address this inefficiency through utility-scale batteries. Yet, we can’t deploy storage fast enough to the degree that there won’t be any waste.

So, what happens when a plant produces excess energy but it can’t give it to the grid because the transmission lines are overloaded (congestion) and there is not enough storage for the excess power? It reduces energy generation; basically, the available energy from the sun/wind just goes unused. This is called “curtailment.” This is a source of significant inefficiency as the plant both undergenerates and underearns.

Soluna turns otherwise curtailed renewable energy into compute power.

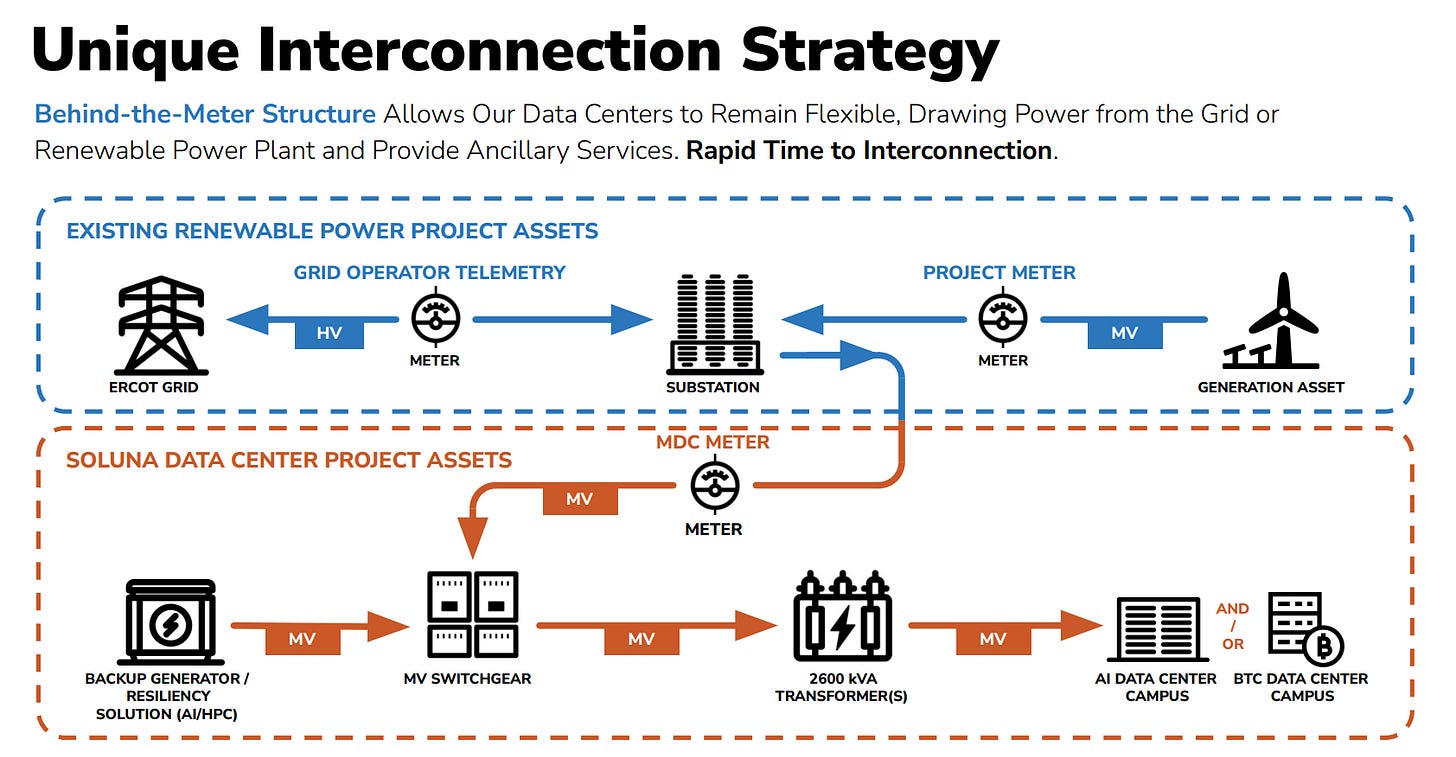

It builds “behind-the-meter” data centers near renewable power plants, which means that their data centers are connected to power plants by private wires, receiving power directly from the plants.

This enables it to benefit from renewable energy that would otherwise be curtailed.

When a power plant is not able to give power to the grid because of congestion caused by excess supply, if there is no available storage, it has to reduce its generation, i.e, curtailment. This is costly for plants for three main reasons:

They forego energy selling revenues.

They lose production-based incentives such as tax credits.

Frequent ramping and on/off cycling add maintenance and reliability costs.

In such moments, Soluna’s data centers draw electricity directly from the plant, reducing curtailment. This is a win-win business model as:

Plant generates some revenue instead of 0.

Soluna data centers use power at significantly lower prices.

Soluna runs hardest during cheap, curtailed-power windows and dials back when the grid tightens. Because the sites also keep a grid connection, they can blend sources to maintain high uptime while flexing compute to match power conditions.

Since Soluna’s sites are connected both to the co-located plant (behind the meter) and to the grid, they can shift load, drawing more when local renewable power is cheap/curtailed and less when the grid tightens. This flexibility lowers their average power cost.

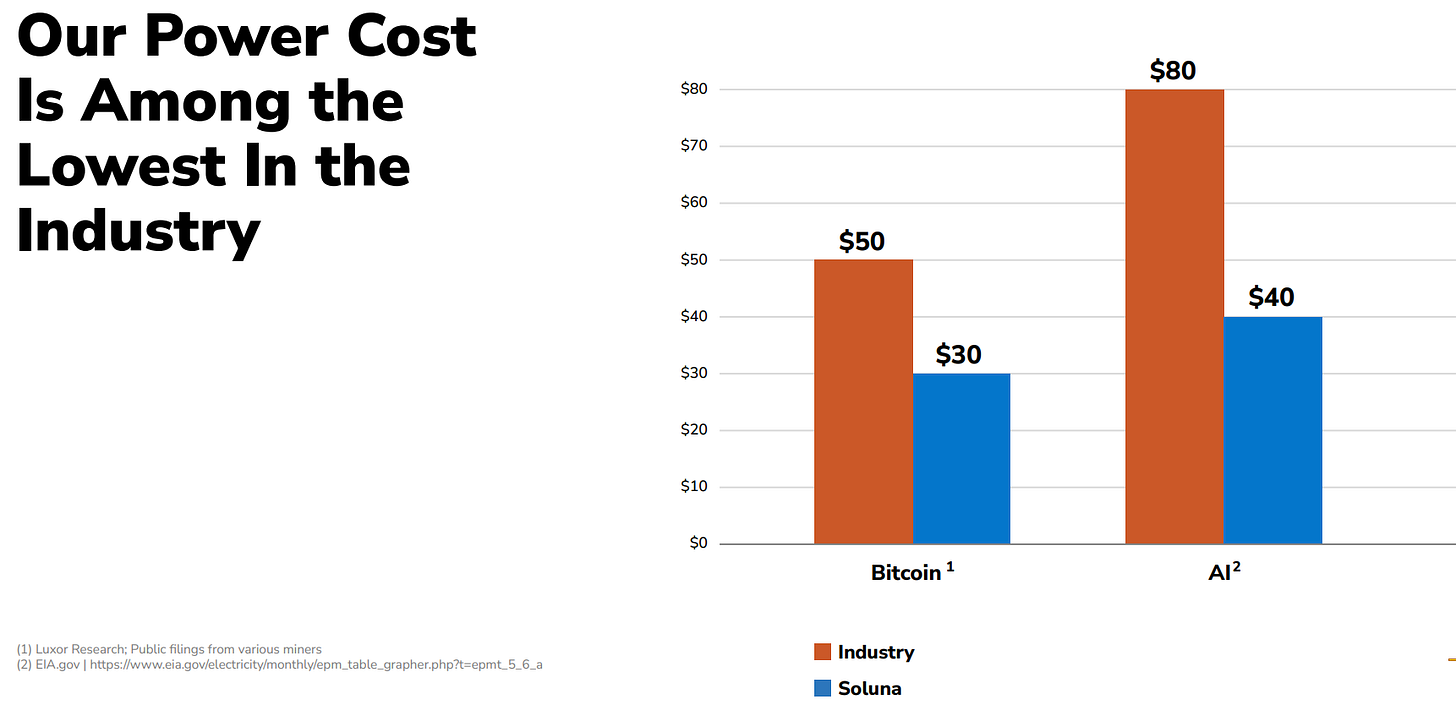

Result? Soluna’s power cost is 40%-50% lower than the industry standard:

Lower power cost positions Soluna as an ideal partner to host crypto miners, and theoretically, AI-Cloud providers.

Indeed, its business model today relies more on hosting rather than directly owning mining/GPU-as-a-service operations. What happens is that companies in crypto mining rent data centers developed and operated by Soluna. Soluna gets paid in two ways:

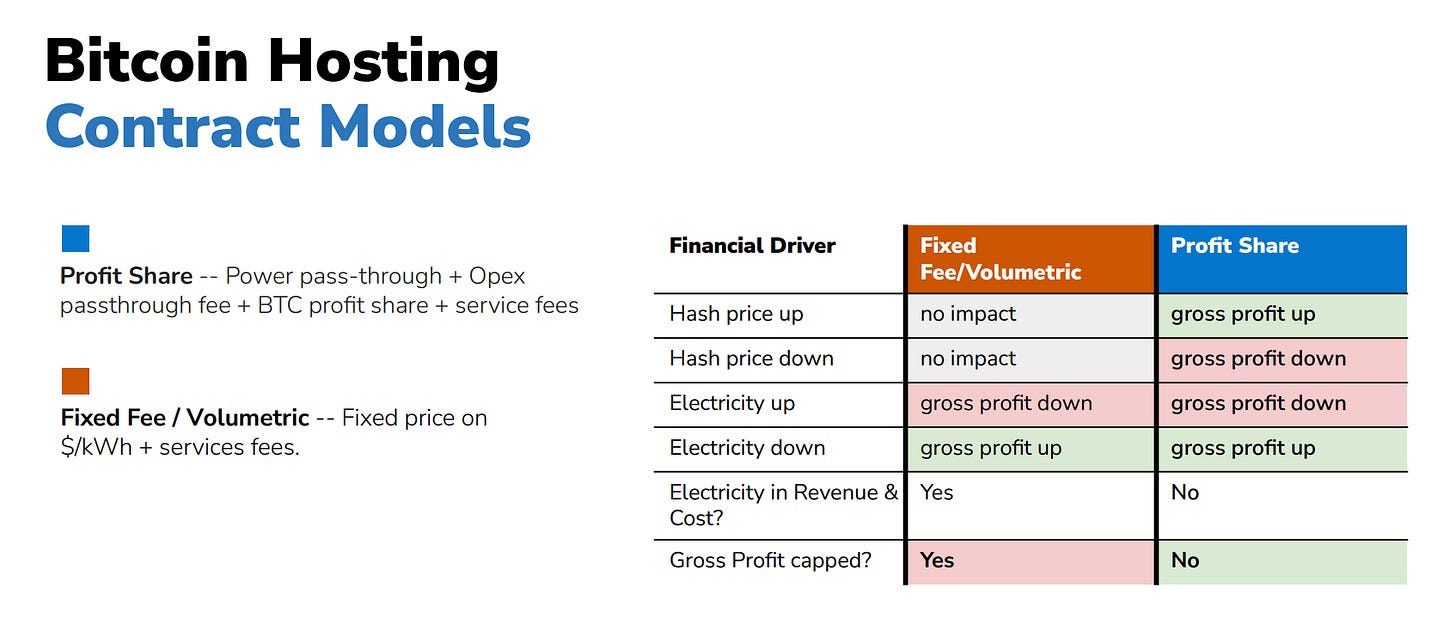

Fixed-fee structure: It can charge a fixed fee per kWh the customer’s machines consume + service fees. In this model, electricity shows up in both revenue and cost.

Profit-sharing structure: Power costs are passed through to the customer, Soluna charges opex/admin fees, and also takes a percentage of the customer’s mining profit.

Other than these two, it also generates some revenue from demand response. What does this mean? Big grid operators generally offer standby payments to their big customers in exchange for reducing consumption when the grid is stressed/oversubscribed. Some of Soluna’s sites are enrolled in those programs. When the grid sends the signal, the data center turns off some servers, reducing its consumption. In exchange, it gets reward payments in addition to standby payments.

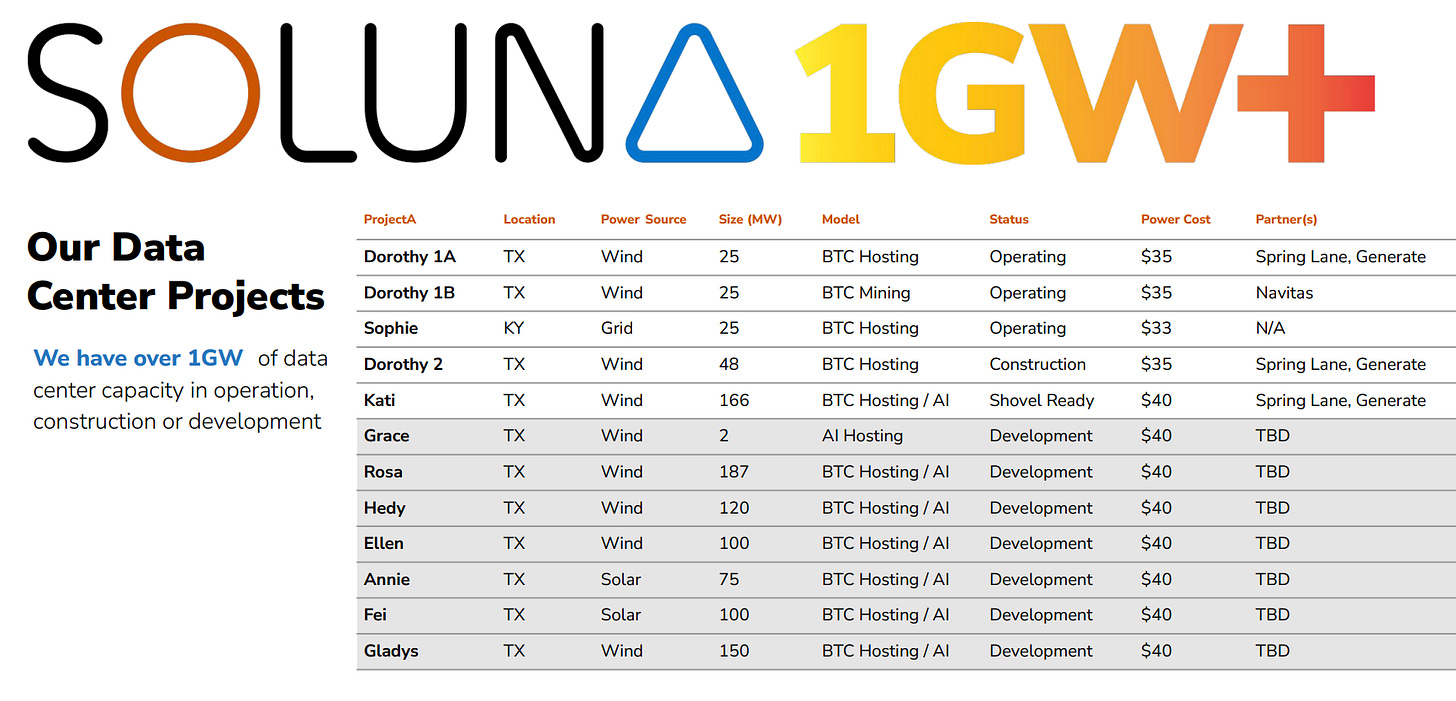

It currently has 107 MW active capacity across 2 sites named Sophie and Dorothy:

Project Sophie (KY) — 25 MW hosting.

Project Dorothy 1A (TX) — 25 MW, hosting.

Project Dorothy 1B (TX) — 25 MW, proprietary mining.

Project Dorothy 2 (TX) — 32 MW, hosting & another 16MW under development.

82MW of this capacity is reserved for hosting and generates revenue through a mix of fees and revenue-sharing agreements. Dorothy campus also participates in the ERCOT (Texas grid operator) demand-response program, adding grid payments on top of hosting/mining revenues.

The critical insight investors should get from Soluna’s business model is that it has developed itself into a data-center hosting partner with structural advantages in power costs, rather than a full-blown miner. This allowed it to keep operations relatively capital-light compared to a miner that owns fleets of ASICs. Indeed, it’s directly engaged in mining in only 25MW of the 107MW active capacity. Rest is for hosting.

When the GPU-as-a-Service business took off in early 2023, they quickly noticed that they were well-positioned to pivot to AI-compute due to their expertise in data center development and operation. They launched their GPU-as-a-Service business in mid-2024, but they exited this business earlier this year for three main reasons:

They had to buy or rent GPUs from third-party players like H&P Enterprises, which was unusually burdensome for them on the balance sheet compared to hosting.

The real value was created at the AI-Cloud level, so margins in renting pure capacity were poor.

Supply conditions improved significantly, driving down the prices.

Thus, they decided to pivot to where they have already excelled—hosting & colocation.

They are currently developing a new site, called Kati, which will have 166MW capacity, more than all its current operational capacity. Capacity will be divided roughly equally between Bitcoin mining and AI/HPC.

On top of Kati, it further has 734 MW pipeline capacity across 7 planned sites. All of these sites are projected to host both Bitcoin miners and AI-Cloud providers. The management expects that AI/HPC customers will make a growing share of revenue as they sign with AI anchor tenants.

If they can shift the bulk of the capacity to AI/HPC tenants, their revenue potential will substantially grow as:

AI/HPC tenants pay higher than Bitcoin miners due to stricter uptime requirements & denser buildouts.

Volatility is lower as they do longer-term contracts, and revenue isn’t affected by Bitcoin prices.

I think this is a very attractive business right now; however, significant operational and financial challenges exist.

Despite consistently growing the installed capacity, they have failed to generate positive operating income out of existing facilities, indicating significant inefficiency in their operations.

In theory, they can overcome such challenges by rapidly expanding the capacity and land AI/HPC clients, thus generating consistent revenue at an efficient scale.

This requires them to achieve three things:

Navigate finances to support new capacity addition.

Execute flawlessly and deliver new capacity at the promised time.

Attract top miners and AI/HPC tenants to turn capacity into revenue.

Can they achieve this? Can they attract those tenants?

Well, there is no guarantee, but I think they are favorably positioned in the market to achieve this as they have some competitive edges and a few catalysts ahead.

🏰 Competitive Analysis

Let me be straightforward here—companies with durable competitive advantages are rare.

Yet, in almost all the deep dives on Substack and posts on Twitter, people talk about moats and the competitive advantages of their picks.

For a competitive advantage to be a cornerstone of an investment thesis, it needs to be durable. This is what distinguishes moats from competitive edges. When the business has a moat, it means that it’s well-positioned to thrive in the long term regardless of macroeconomics and the competitive environment.

These occurrences are rare, and they almost always appear when favorable market dynamics meet with some deep structural advantages.

Take Coca-Cola, for instance.

The demand factor is so established that you wouldn’t expect people to cut Coca-Cola consumption in any economic environment. When this meets with a structural advantage like distribution and soft factors like brand power and cultural entrenchment, you get a true moat, and it’s one of the strongest in the market.

Another example is Costco.

The items people buy from Costco aren’t affected much by economic conditions; they are consumer staples. Thus, the demand factor is established. Once this meets with a structural cost advantage, it turns into a real moat and creates a business that can thrive in almost all environments.

Unless favorable market conditions meet with structural advantages, it’s really hard for businesses to have durable advantages.

What they often have is a competitive edge, an advantage over the rivals at the moment, but it’s not durable by itself or easily defendable, as entry barriers are generally low, and there is nothing that prevents competitors from copying successful models.

This doesn’t mean that businesses with competitive edges can’t thrive. They can thrive substantially if two conditions exist:

Consistently high demand

Rapid execution to capitalize early on the demand, locking in customers for the longer term.

This is exactly what I think about Soluna’s competitive position; this is why I used the term “competitive edge” instead of “competitive advantage” in the introduction.

Its business model indeed results in one of the lowest energy costs in the industry, attracting hosting customers. This pushes it to expand its data-center capacity and attract more clients.

This is indeed a competitive edge that makes it a hosting partner of choice for its customers. I think it’s hard to argue that customers would still want to host their operations in Soluna data-centers if it didn’t offer a substantial reduction in energy cost.

However, it’s nowhere near a moat for two reasons:

There is nothing that prevents others from following the same strategy.

Business model depends on sustained demand for data center capacity.

So, anybody looking at this business should be realistic about this. What it has is a competitive edge, not a moat, i.e, a durable competitive advantage.

Yet, this doesn’t mean that it’s favorably positioned to thrive in the short to medium term. The two conditions I mentioned above exist:

Demand for data center capacity will keep increasing in the next 5-10 years.

It’s rapidly expanding capacity to tap into this demand.

We can easily see this dynamic at play as it announced 71MW worth of hosting agreements for its coming sites since July:

Galaxy Digital will deploy 48 MW at the upcoming Project Kati 1.

Canaan will deploy 20MW at Project Dorothy 2.

KULR will deploy 3.3MW at Project Sophie.

In sum, it signed agreements for hosting an additional 71.3MW in the last 6 months, which is nearly as much as its current hosting capacity. Given that 68MW of this capacity will be supplied at the newly finished (Dorothy 2) or upcoming sites (Kati 1), we can assume that they are landing customers as fast as they expand capacity. I think this illustrates that the demand is high and they are acting quickly to tap into that.

In short, the business doesn’t have a durable competitive advantage that we can label as a “moat.” Yet, it has some structural edges stemming from the business model, most notably lower energy costs. When these edges meet with continuous high demand and rapid execution, the business can grow pretty quickly, regardless of the fact that the market is a competitive one. I think these factors exist for Soluna, allowing it to thrive irrespective of the competitors as long as it keeps executing.

📝 Investment Thesis

The investment thesis for Soluna is straightforward. It doesn’t actually have a path to generate significant value for shareholders other than rapid capacity addition and AI/HPC expansion.

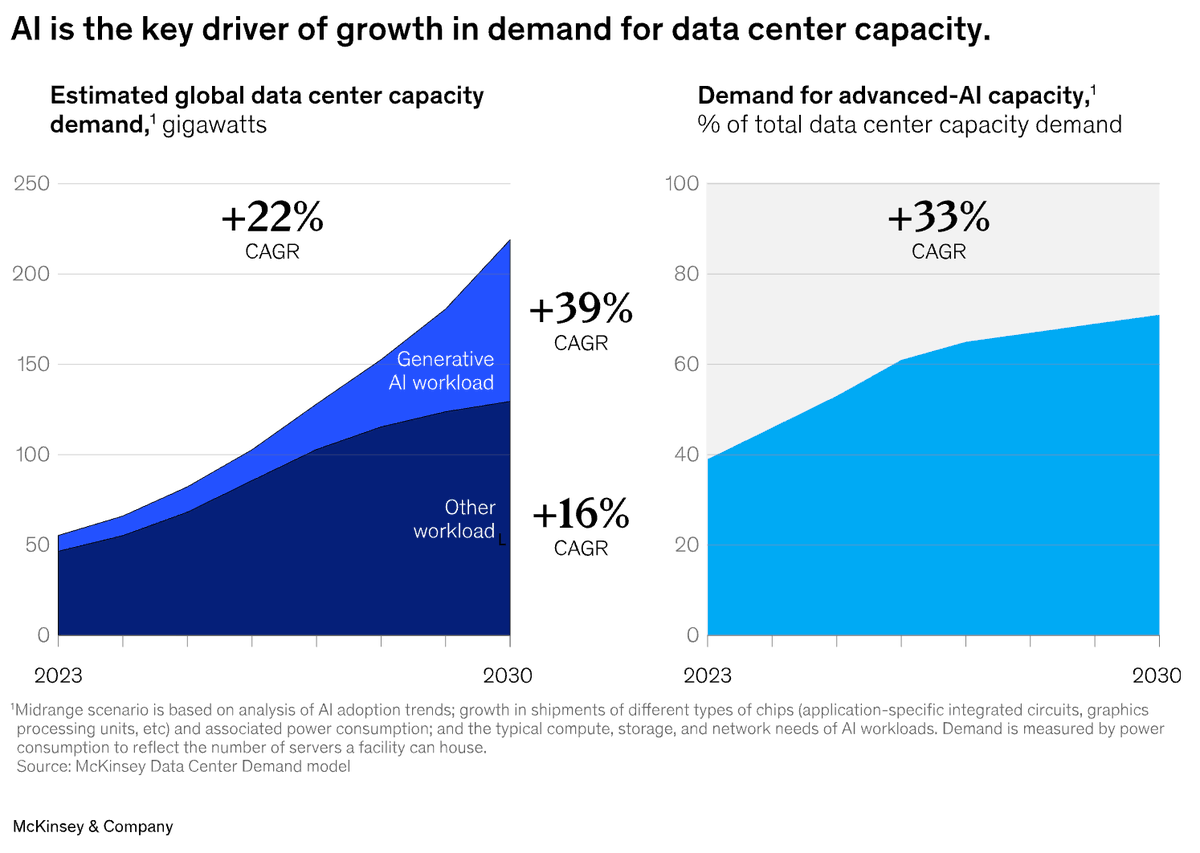

It’s not a secret that AI is driving significant data-center capacity demand, and it’s not going to stop anytime soon.

McKinsey predicts that data center capacity for AI workloads will grow 39% annually in the next 5 years. Total capacity is expected to grow 22% annually from 81 GW this year to 219 GW in 2030.

Data-center developers like Soluna are perfect partners for tenants looking to rapidly deploy their hardware at the cheapest cost structure possible. Soluna is planning to rapidly expand its data-center capacity in the next few years to tap into this market.

It currently has 900 GW capacity under development, including the Kati 1 project is shovel-ready and expected to start construction this year, with the first phase scheduled for operations in early 2026. Other than that, at the 48MW Dorothy 2 site, 16MW capacity is currently under construction, while 32MW capacity has already been installed and is operational.

Kati 1 marks a turning point for the company as it’ll be bigger than its current installed capacity + 16MW under construction in Dorothy 2. It’s also important because half of the planned 166MW capacity is reserved for AI/HPC tenants.

While all the previous projects were only meant for Bitcoin miners, all the projects after Kati 1 are expected to be shared between miners and AI-Cloud tenants. The management says that AI-Cloud tenants will have preferential access to the capacity in those sites. Meaning, capacity will go to those players as long as there is demand.

This will be a turning point for the business.

As far as disclosed in deals like Core Scientific/CoreWeave and TeraWulf/FluidStack, rents per KW for AI/HPC tenants are between $120-$150. This means at least $120,000 in revenue per MW capacity a month, and nearly $1.5 million a year. This means that, if it succeeds in finding a tenant, the company can generate around $125 million in annual revenue from the 83MW capacity reserved for AI/HPC in Kati 1.

This is a transformational figure for the business, given that it generated just $28 million in revenue in the last twelve months.

Though it’s uncertain whether it can find that first talent, I think this is more likely than not. It’s been able to find tenants for all the capacity it has built or announced for Bitcoin miners this year. Given that the capacity demand among AI-Cloud providers is not less than that of Bitcoin miners, I think it has a high likelihood of landing that first AI/HPC tenant.

Once that happens:

Revenue will skyrocket.

Access to capital will get easier.

More AI/HPC tenants or more demand from the same tenant will likely follow.

After that point, it’ll have an easier time financing and finding tenants for its pipeline projects.

All other possible catalysts ahead of the company, like increasing Bitcoin price, fade in importance compared to this gradual pivot toward AI/HPC. If it wants to survive and thrive, it has to lend those AI/HPC tenants.

I believe it’s highly possible that we’ll hear an announcement for the first AI/HPC tenant in late 2026, as the second 83MW phase in Kati 1 will be nearing completion.

This is the thesis here.

📊 Fundamental Analysis

➡️ Business Performance

Nobody, even those who are thinking about buying the optionality in Soluna, should sugarcoat its business performance. It’s been pretty unsatisfactory.

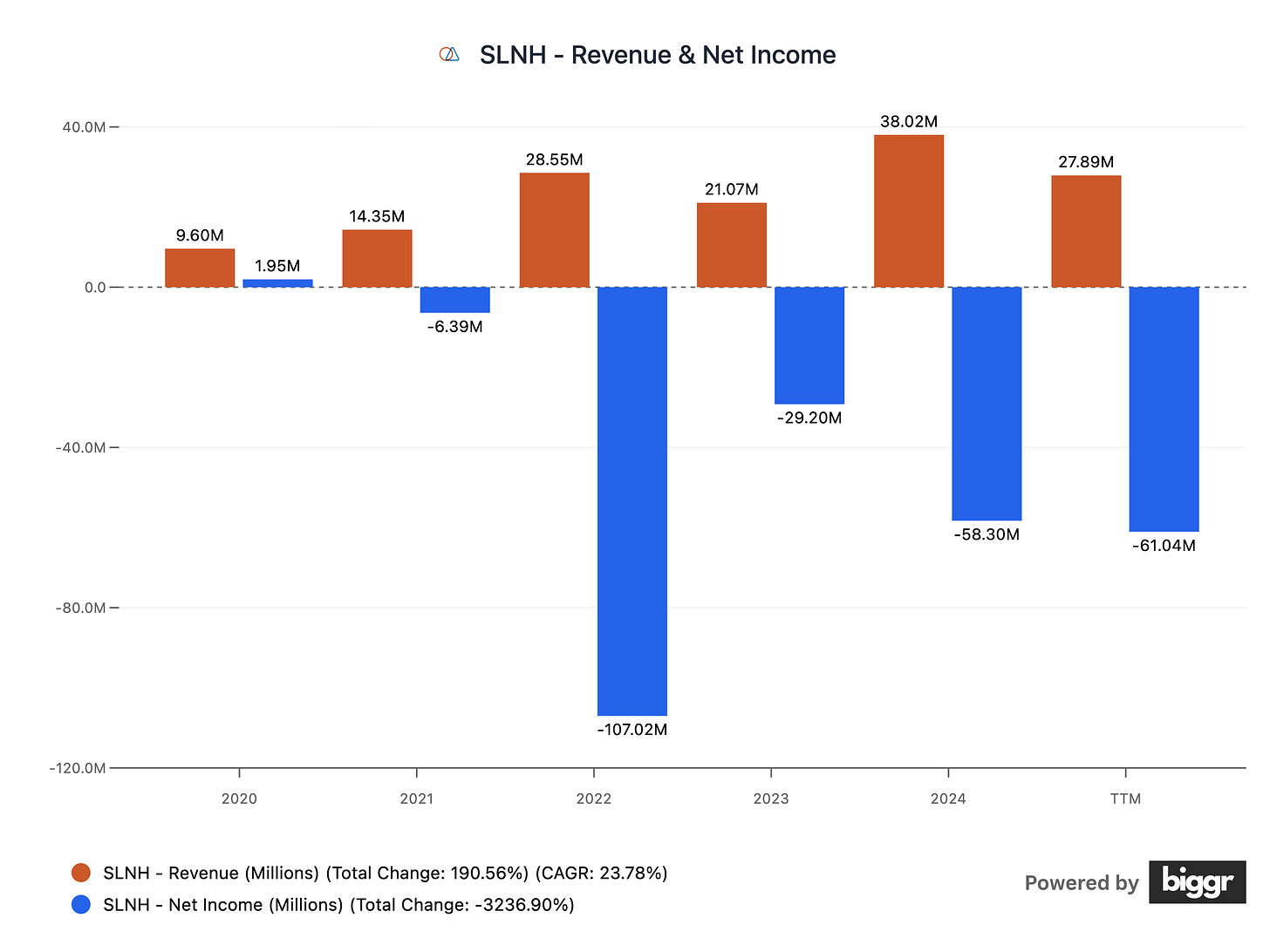

Though the business grew significantly in the last five years, tripling revenue from $9 million in 2020 to $27 million in the last twelve months, it has failed to turn operations into profit.

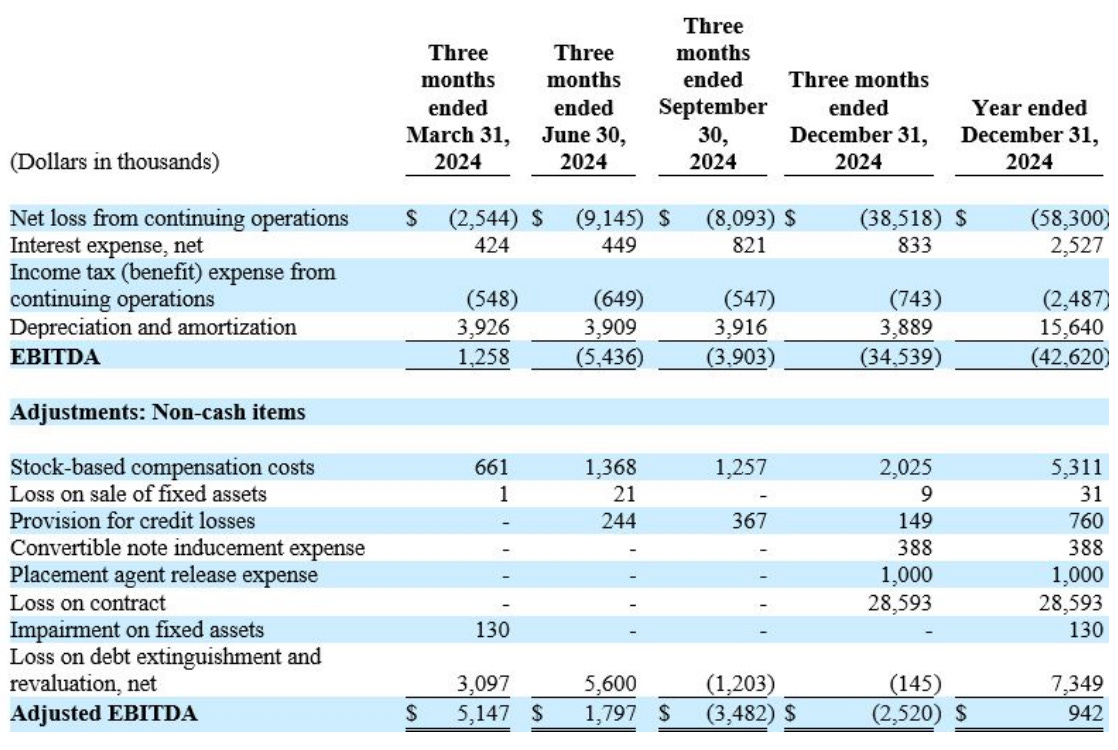

The good news is that most of these losses aren’t cash expenses. Meaning, the business bleeds cash, but it bleeds way slower than it looks. When we adjust it for non-cash and one-time expenses, the operating loss narrows.

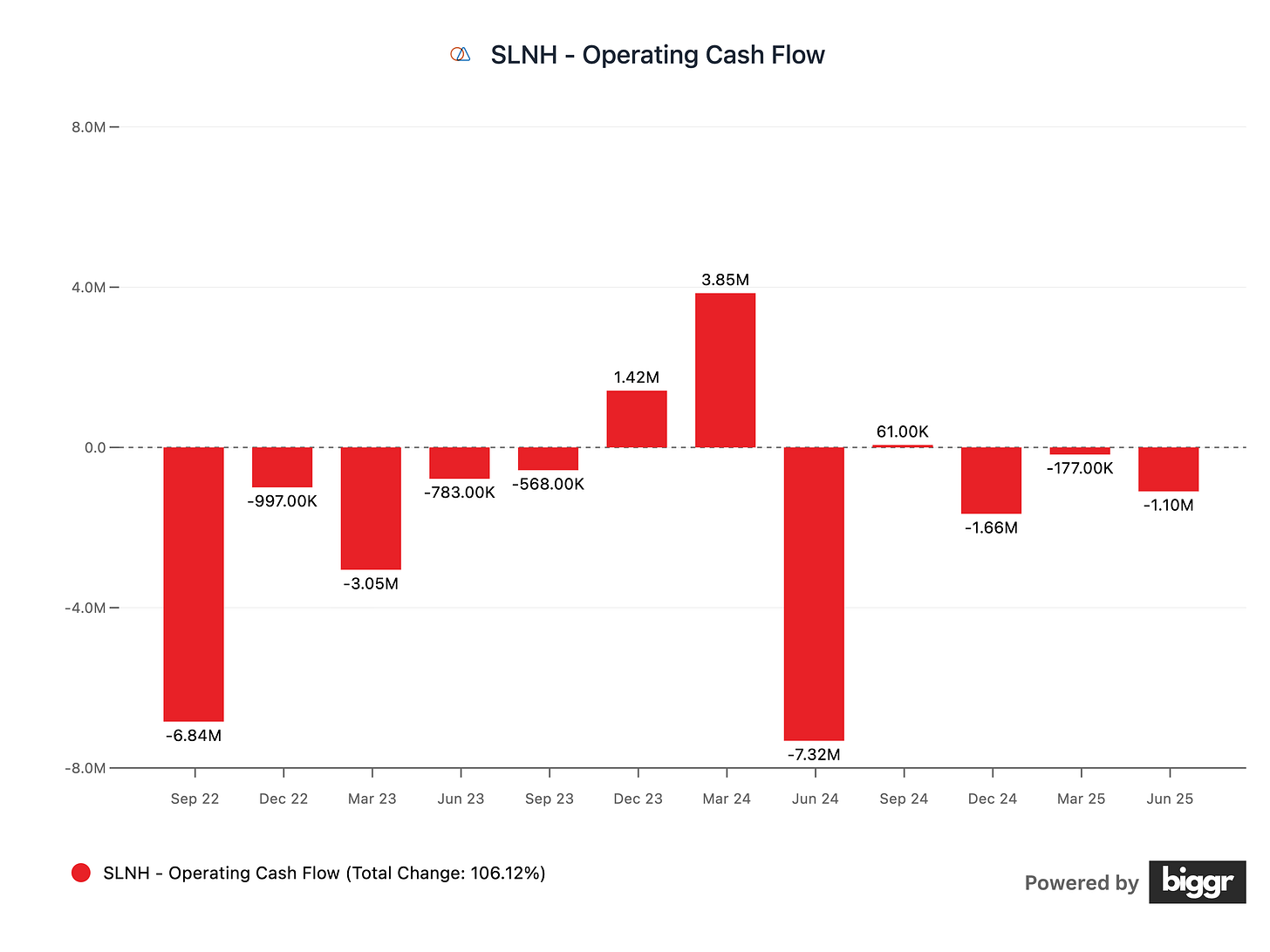

Indeed, in the first half of this year, operating activities only used $1.3 million of cash, despite massive losses on the income statement.

In short, it’s a complicated picture. How can we understand the real burn rate of the company?

In such cases, I add investing cash flow and financing outflows to operating cash flow, but exclude financing inflows. The resulting figure is the gap the company needs to somehow bridge to survive as a going concern.

To do this, we should start with Operating Cash Flow+Investing Cash Flow, as it shows how much the company is really losing/earning from operations and expenditures made to keep operations afloat.

In the first half, operating cash flow was -$1.3 million, and investing cash flow was -$8.3 million. Summing those up gives us -$9.6 million before financing activities.

On top of that, we should add financing outflows to see the net cash bleed of the company.

In the first half, it had two articles of financing outflows— $3.3 million of debt repayments and $3.6 million distribution to project partners, meaning $6.9 million total financing outflows.

Summing up -$6.9 million and -$9.6 million, we get -$16.5 million of net burn for the first half of 2025. This is the gap Soluna needs to bridge by raising debt, selling stock, etc.. For reference, this was around -$13.4 million for the first half of last year, and around -$31 million for the full year.

Last year, this gap was bridged by $14.7 million from capital partners at the project level, plus $14.4 million in new debt issuance and $2.3 million in proceeds from exercise of warrants to buy equity by external investors.

In sum, this is not a business printing cash. It bleeds cash, and it needs to bridge this cash gap somehow until a big project, possibly Kati 1, generates significant cash flows. Therefore, this makes it clear why I refer to it as a potential “turnaround.”

➡️ Financial Position

It’s obvious that the financial position of a $250 million company burning around $30 million cash annually should be, in the softest terms, precarious.

This is indeed the case for Soluna.

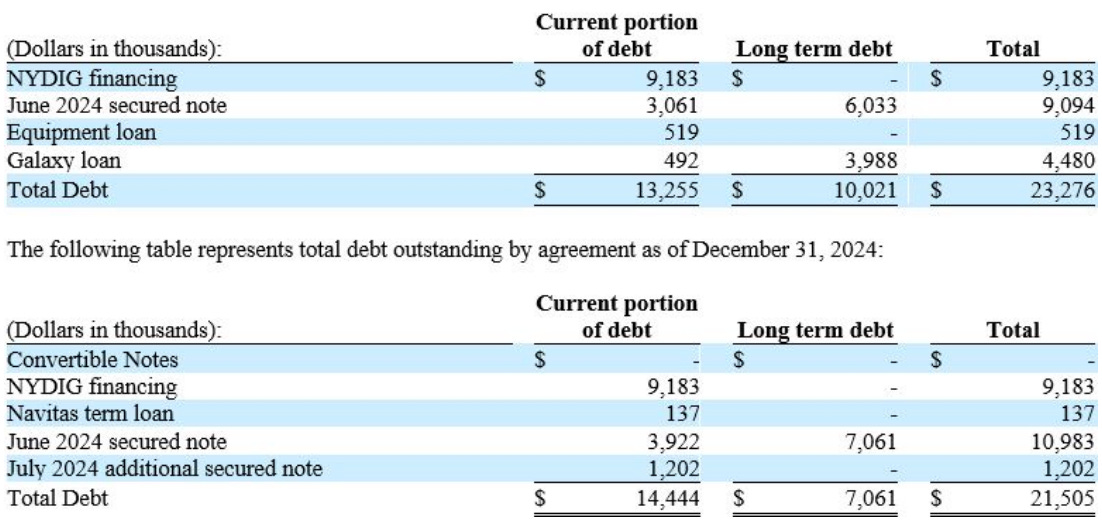

As of last quarter, the company had a total of $23.2 million in debt, which increased by nearly $1.7 million from 2024:

Against this debt, it currently has $29.3 million in total equity.

However, there is a caveat here. Most of this equity doesn’t belong to Soluna. As of last quarter, project partners had $48.8 million in non-controlling interest, and Soluna’s own equity was -$19.5 million. Meaning, that $29.3 million equity is non-controlling interest minus Soluna’s equity, so it’s not something spendable.

Given that the company still generates negative EBITDA and operating cash flow, it needs to cover its debt payments either by additional financing or selling equity. This is why its 10-Q filing last quarter included a warning from the auditor as to the business’s ability to continue as a going concern in a year’s time.

This is why it was priced for bankruptcy until recently:

However, things started to turn in September:

On September 11, they announced the start of the construction of Project Kati 1.

On September 16, they announced up to $100 scalable credit facility from Generate Capital with $12.6 initial draw. The capital will be exclusively used to refinance Project Dorothy 1/A-2 and Project Kati 1. This significantly increased the likelihood that they will deliver on Project Kati and find a tenant.

On Sept 23, they filed a prospectus supplement to sell up to $87.65 million under the At the Market Offering Agreement dated Apr 29, 2025, with H.C. Wainwright & Co. At the time of the announcement, they had already sold $12.3M worth of shares. At the current burn rate of ~$30 million, the remaining ATM capacity could fund roughly two years, but it’s contingent on market conditions and project spending.

On September 29, it announced the settlement of the court judgment that declared Soluna liable for $9.2 million NYDIG loan drawn by its subsidiary, Soluna MC Borrowing 2021-1 LLC. They agreed on a payment plan with NYDIG.

On September 30, they announced a 20MW hosting agreement with Canaan, starting from Q1 2026.

On October 9, they announced 3.3MW hosting agreement with KULR, starting from Q4 2025.

Thus, we can say that in September and early October, the business got into some arrangements/agreements that:

Secured around 2 years of runway.

Locked-in tenants for roughly 25MW capacity.

Secured financing for big projects that will transform the business.

Result? It’s still dependent on financing, but now it has a shot to finish a transformative project, Kati 1, and become a sustainable business generating nearly 6-7x more revenue than it’s generating today in 2 years.

In short, shareholders don’t need to worry about the going concern status of the business for a while. If the projects hold, the business can grow pretty fast and become a financially independent entity. If this scenario plays out, it’ll likely have generated immense value for shareholders, taking the risk now by betting on the turnaround.

📈 Valuation & Strategy

Given that Soluna is currently not in a position to generate predictable earnings, we can’t rely on traditional methods like discounted cash flow analysis to value it.

It is a high-risk/high-reward play that can make nearly 6x in the next few years if the story holds.

So, what should we do?

We should create a base scenario based on its current and planned capacity and calculate how much it can make if the plans hold. Then, we have to turn this into an option value. We’ll do this by assigning a chance of success and failure, and try to predict how much the company will be worth in both cases. Finally, we’ll calculate the value of this scenario as an option price.

Let’s start with the capacity prediction.