SoFi & UnitedHealth Earnings Review: Hold Despite Proper Performance

SoFi is firing on all cylinders and UnitedHeath is showing signs of recovery. Despite satisfactory performance from both, I think they are "hold" at the current levels.

What determines your returns as an investor isn’t whether you buy an exceptional company or not; what determines your returns is always the price you pay.

Price is the central concept of investing.

If you pay low enough, you can make money on companies that are going bankrupt; if you pay an egregiously high price, you can lose money even on the best company in the world.

It’s fortunate for me that SoFi and UnitedHealth announced earnings on the same day, so I can once again emphasize “price” as the governing concept of investing.

If you have been following this publication for a while, you know that both SoFi and UnitedHealth are substantial positions for me.

Here is the interesting part—I have changed my attitude on those stocks three times in the last two years, although their long-term fundamentals haven’t changed.

From mid-2023 until summer this spring, I said “Buy SoFi & hold UnitedHealth.”

After Q2 earnings, I said, “Hold SoFi & buy UnitedHealth.

Now I’ll finish this review by saying, “Hold both.”

And I’ll say this even though I find both reports proper. For SoFi, it’s beyond proper; it’s stellar.

Why? Because of the price.

If you have noticed, investors sometimes use the word “bet” to refer to their positions. So, the question is—what do we bet on when we buy a stock at a particular price?

What determines the price is the market’s consensus view as to the future of the company. It’s a future scenario for the business that is based on assumptions about:

Growth

Margins

Durabilitity

Return on investment

It translates into a scenario like: “The company will grow its revenues 10% a year in the next 5 years with a 20% return on investment, it will have a net margin of 15% and it’ll be able to generate more or less the same net income for the next 15 years.”

If this exact scenario implied by the market plays out, the stock generates what we call “market return” every year for the projected period. This is the risk-free rate (10-year Treasury yield) + equity risk premium. Meaning, you get the risk-free rate plus some premium for holding an equity, not a government bond.

If the company does better than that, you get a higher return; if worse, you get a lower return.

Now, there is one factor that has an undue influence in those scenarios—growth.

Why? Because the rest of the things can be standardized.

Given that no company is alone in its industry, and provided that the industry has also been around for some time, we have fairly accurate ideas about how long companies stay in their maturity before they start declining, what the average return on investment is, what the average margins are, etc..

It’s not easy to do this for growth.

A company may have distinct characteristics, business model, management, etc, that can lead to above or below average growth. Thus, assumptions about future growth disproportionately affect the prices today.

Therefore, it’s intuitive that to generate above-average investment returns, you have to find some companies that can grow faster than what the current market price implies, bet on them, and come out right. There are two paths you can take to do this:

The market already prices generous growth, and you can be even more generous.

The market is too conservative, and you can be a bit more optimistic.

In the former case, you’ll be betting on 40% annual growth while the market already priced 35%. In the latter, you’ll be betting on a 10% growth while the market prices 6%.

I think it’s way smarter to find the latter situations rather than the former; however, regardless of which one you pick, if you come out right, the market will adjust its expectations higher.

Think about a group of people watching an athlete. If they initially thought he could jump 3 meters away, but the athlete jumped 5 meters away, they’ll adjust their expectations and start thinking that the athlete can jump 6 meters away.

Maybe the athlete will jump it too. Then, they’ll expect 7 meters. Maybe the athlete can jump it too. But with every adjustment, the chance of failure will increase.

Howard Marks puts it best—“Success carries seeds of failure within.”

Smart investors see it when the bar has become too high and the odds of clearing it have declined substantially. The business can still clear it, but betting on the odds that aren’t in your favor isn’t how you make money in the market. You can come out right for once or twice, but do it 10 times and I guarantee you’ll lose money.

This is the case with SoFi.

It’s now like an athlete so good that he is jumping over 11-foot bars. Thus, the bets are no longer whether it can jump over a 5-foot bar; it’s whether it can jump over a 13-foot bar. Maybe it can, but it’s not a smart thing to bet your money on it. This is why it’s a hold despite being my biggest position.

For UnitedHealth, it’s more nuanced.

The bar was definitely too low three months ago when I urged everybody to buy it at around $260 per share in my earnings review. The stock is up 41% since then. It has beaten the guidance and raised the full-year outlook yesterday.

The bar? It is neither too high nor too low now. I think it’s currently at a fair height that UnitedHealth can jump over. This is why it’s also a hold.

With that being said upfront, let’s dive deeper into the earnings of both companies to see a more detailed picture of both.

1️⃣ SoFi: Business As Usual

Results:

EPS: $0.11 vs Est. $0.09 ✅

REVENUE: $962 million vs Est. $891 million ✅

This is my go-to title whenever I write an earnings review about SoFi.

The reason is simple.

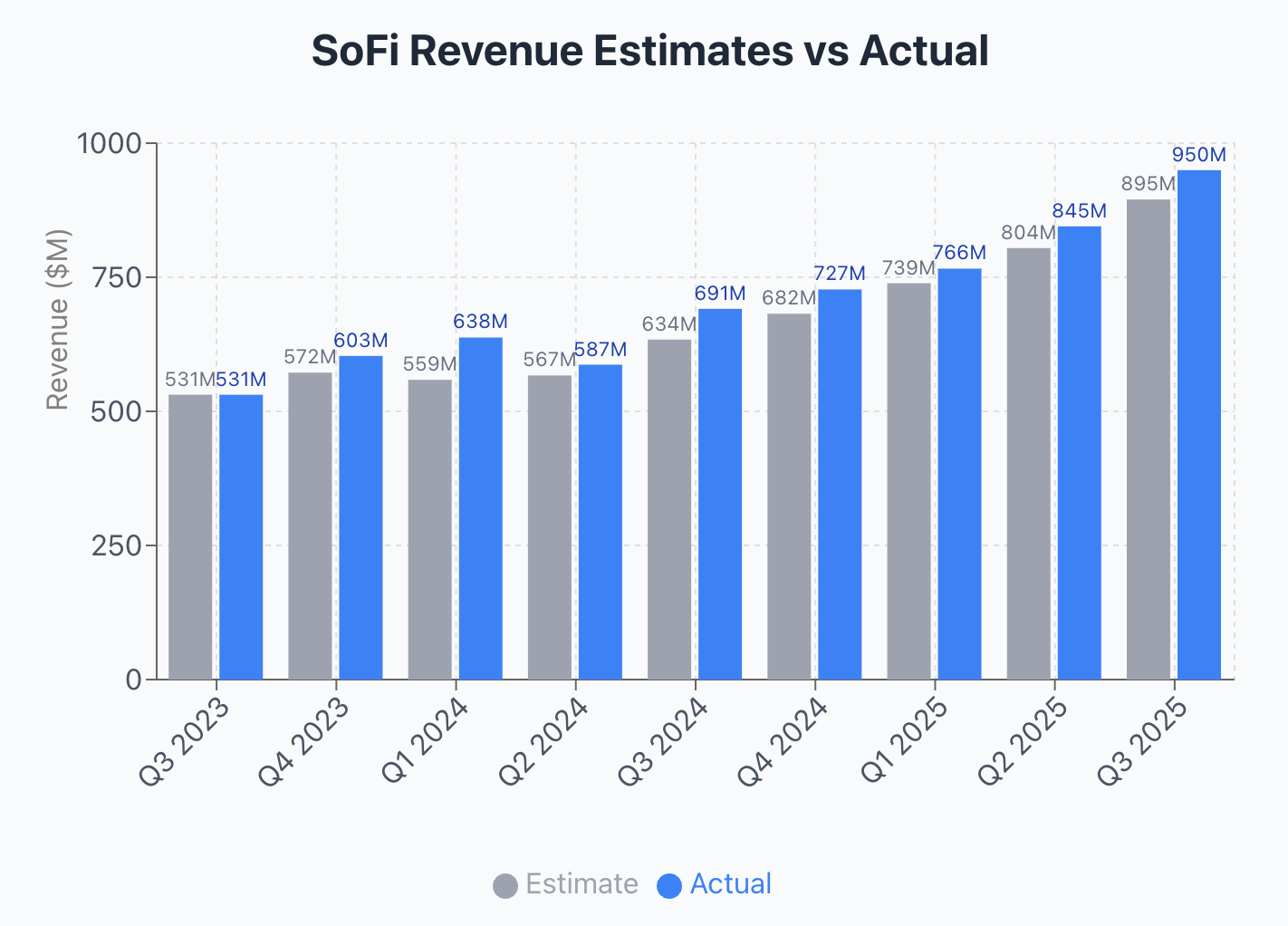

I opened my SoFi position back in July 2023. It’s been 9 quarters since then, and SoFi hasn’t missed either revenue or EPS estimates in any of those quarters. Most of the time, it delivered a triple-beat, going above EBITDA expectations, too, and it raised the guidance more than half of the time.

Here, take a look below at the estimates versus adjusted net revenues:

It deserves the title.

It posted another blockbuster quarter, firing on all cylinders. What’s more important for me is that my investment thesis for SoFi is playing out better and faster than I could imagine.

After this report, you are going to see many people talking about its growth and execution, but this doesn’t mean a dime alone. The business didn’t post any bad quarters in the last 2.5 years, yet it got hammered down many times post-earnings.

In all those times, our conviction got tested and stood up because the business was executing along the investment thesis I had in my mind. To better put the numbers in context, we have to remember the investment thesis.

I had three things in mind:

I thought it was well-positioned to become a one-stop shop for all financial services, taking market share from traditional financial institutions. We could track this by looking at the top-line and the member growth.

While people said it was just a bank, I thought it was a fintech company that owned a bank. We can easily track this by looking at the revenue share of financial products + tech platform.

The market valued it like a lender, while I thought it would become increasingly capital-light as non-lending businesses scale. We can track this by looking at the fee-based revenue share.

Here is the headline—all these assumptions are playing out now.

Let’s start with the top-line and member growth.

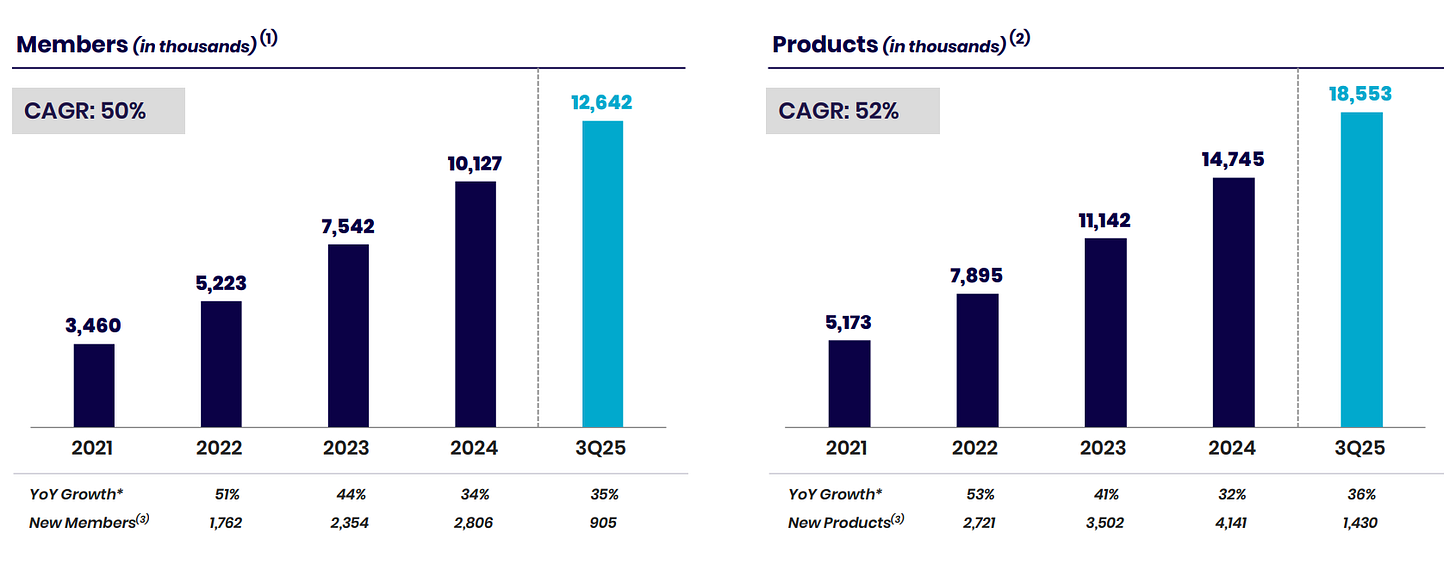

It posted a record revenue with accelerating growth from 34% same quarter last year to 38% YoY this quarter. This is all nice, of course, but what’s more important for me for a young growth company like SoFi is whether the top-line growth is supported by growth in customers.

This is especially important in sticky businesses like banking and insurance, as customers don’t easily churn, allowing businesses to generate consistent growth by selling more services to existing users. In those businesses, top-line growth should be supported by member growth, so we can confidently say that the business is still in its fast growth phase.

I am glad to say that this is the case for SoFi.

Top-line is accelerating, and it has added a record 905,000 members in one quarter:

What’s even more remarkable than this is that products have been growing at a faster rate than new members since 2021, indicating that the business is effectively pursuing up-sells and cross-sells. The management disclosed in the earnings release that approximately 40% of new products were opened by existing SoFi members last quarter.

In short, the business is growing its member base at a way higher rate than the traditional banks, confirming that it’s taking market share from the legacy players. Plus, existing customers are opening second and third products, indicating that it’s executing successfully on the one-stop-shop strategy.

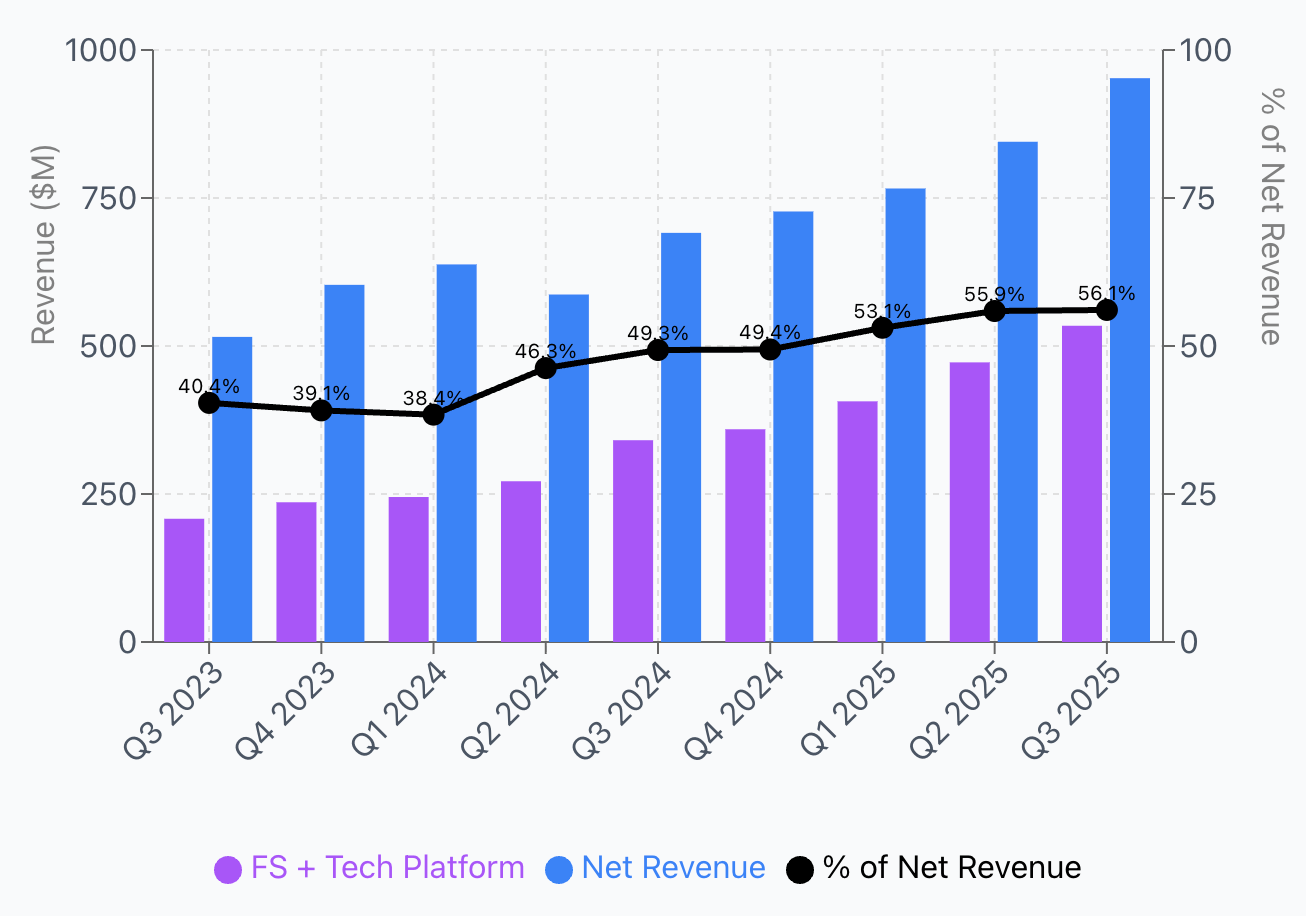

Second, it’s proving that it’s not just another bank but a true fintech company.

Financial services grew 76% YoY last quarter, up from $238.3 million from the same quarter last year to $419.6 million this quarter. Technology platform revenue grew 12% from $102.5 million to $114.5 million.

These are amazing growth numbers individually; however, together, what they indicate is far more consequential than the pure growth. Their combined share as a percentage of net revenue just hit a record high of 56.1%. This is up from 38% levels in Q1 2024, when everybody was still seeing SoFi just as a bank.

The fact that the revenue share of financial services+technology platform continued to grow even after the Fed’s rate cuts last September clearly shows that we aren’t looking at just a bank but a true fintech company. The thesis is playing out also for this point.

Third, it’s becoming an increasingly capital-light business.

It has grown its fee-based revenue share from 26% in 2021 to 43% last quarter.

This further provides confirmation as to it is a real fintech business, not just a bank. We’ll further see the effect of this development in its margins. SoFi’s profit margin is currently around 14%. This is unimaginably high for legacy banks, given that most of them are completely dependent on their net interest margin, which is, on average, between 3-4%.

Despite this high profit margin, I still see room for improvement here, as NuBank has an above 30% profit margin. I don’t think SoFi can get there due to higher competition in the US market, but I believe it can easily sit above 20% as fee-based revenue grows against lending.

In sum, SoFi is already a true fintech business. The thesis is playing out:

Members are growing fast.

It’s aggressively cross-selling.

Revenue share of fintech and fee-based services is improving.

On top of all these, its legacy lending business is poised for acceleration as the Fed signals that rate cuts are coming due to the weakness it sees in the job market.

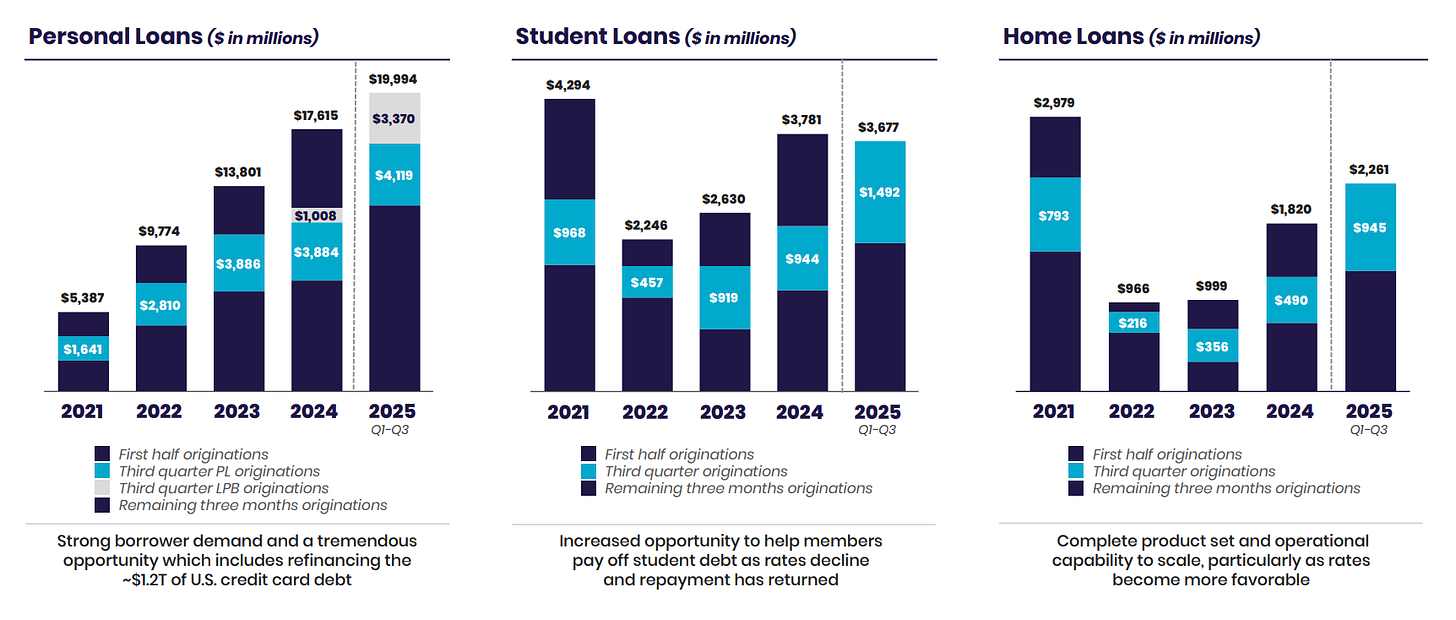

Its lending segment already reached a record of $9.9 billion in origination volume last quarter:

It’s incredible that over 30% of this volume came from the loan-platform business (LPB) that didn’t even exist until this quarter last year. SoFi doesn’t take balance sheet risk in that business but generates fee income by originating loans on behalf of the lending partners. Basically, we are looking at a lending business that doesn’t take balance sheet risk in 30% of its originations but generates revenue with a 100% gross margin.

That would be a dream of every investor.

Wait.. It gets even better.

SoFi’s net-charge off rate for personal loans declined both YoY and QoQ basis despite accelerating its lending business since Q3 last year:

This indicates two things:

Its borrowers are mostly prime.

Its underwriting is conservative.

This means that it has immense legroom to accelerate lending. This is further supported by its funding structure. This is where owning a bank shines and makes SoFi the best-positioned company to dominate digital banking in the US.

It’s currently funding 92% of all its loans through deposits:

This is way cheaper capital than interbank loans and warehouse credit facilities.

So, let’s step back and look at the bigger picture for lending:

It’s already originating record volume of loans.

Net charge of rates has been steadily declining.

You can fund 92% of all loans through a deposit base.

And the Fed is about to cut interest rates.

This means that it has significant room to accelerate lending as it can easily live with a 3-3.3% net-charge off rate in a lower rate environment and can use a warehouse loan facility or interbank loans to support the growth of its loan book.

In short, everything is as good as it can be for SoFi:

New members and cross-sells are driving top-line growth.

It’s becoming more and more capital-light light everyday.

Charge-off rates are declining.

The deposit base is growing.

Fed is cutting rates.

On top of all these, it’ll be launching crypto this quarter.

So, if this is the case, why am I rating it as a “hold”?

It’s the price.

Though the future is very bright for SoFi, I believe all of it has been priced into the stock.

Even if we annualize this quarter’s revenue, we get $3,800 net revenue.

The company is on its way to deliver 30% growth this year. So, assuming 25% annual growth for the next 5 years, we’ll get $11.6 billion in revenue in FY 2030.

Generously assuming it’ll expand its net margin to 20% and trade at 25x earnings, we’ll get a $58 billion business. Discounting it to the current day at a 10% annual rate gives us a $36 billion business.

It’s currently valued at $37.5 billion.

Those who are buying it here can expect market returns in the best case. However, if something goes even slightly wrong, you’ll likely get below-market returns.

This is why I am rating it a hold.

The business is overvalued, but if you are holding it already, the overvaluation is not excessive enough to warrant selling it here. I have already made several times my money in this stock, so I can live with market or a bit below market returns going forward, just to own the “what if” scenario.

However, if you are out, it’s probably better for you to stay out at this point and either look for other opportunities or wait for a better price to jump in.

This is how I would play SoFi going forward.

2️⃣ UnitedHealth: Bleeding Stopped, Recovery Next

Results:

EPS: $2.92 , proj. $2.81 ✅

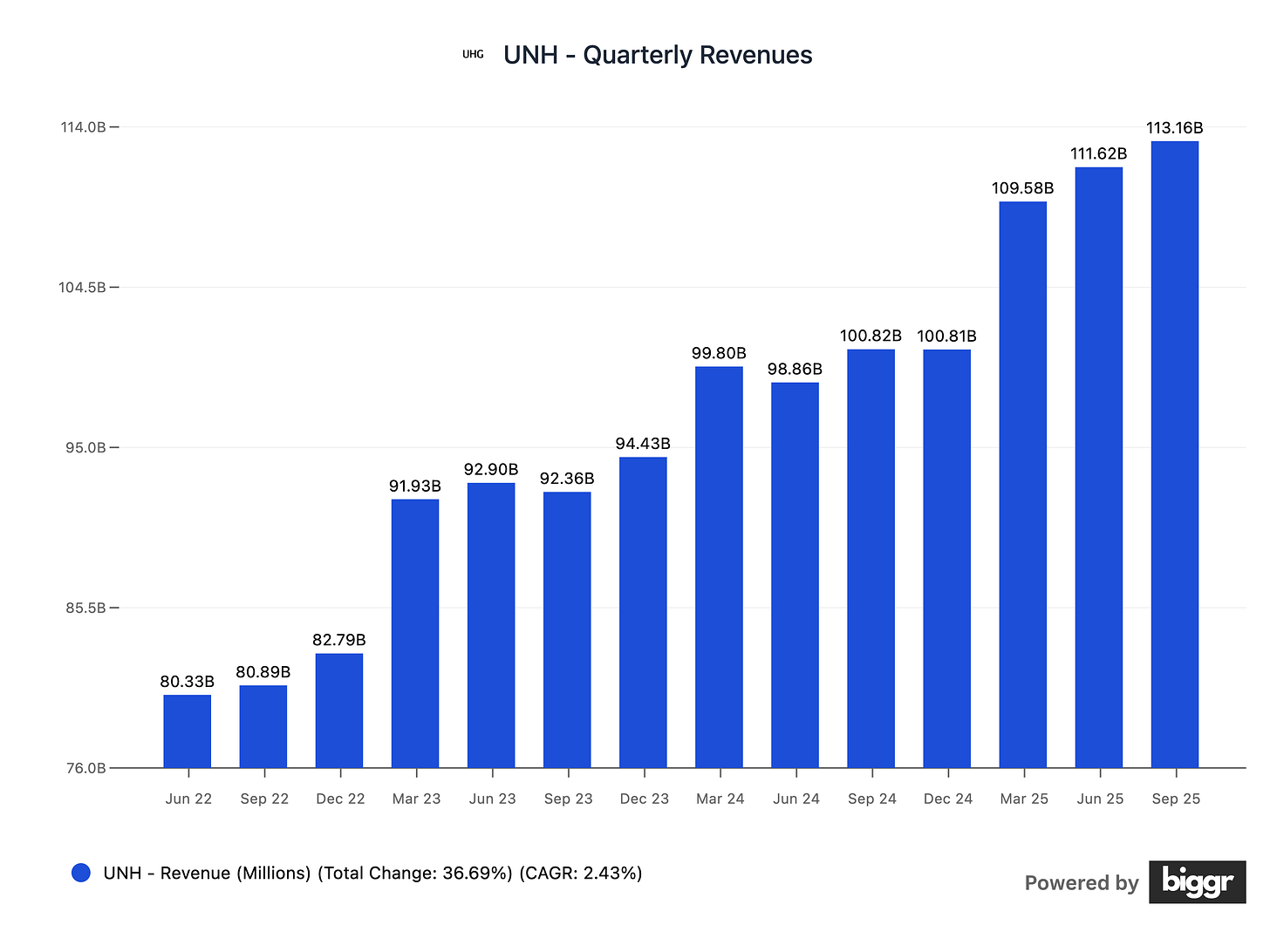

REVENUE: $113.16 billion vs Est. $113.05 billion ✅

I think it’s fairly clear to most people that the key to success in investing is buying exceptional companies and holding them for as long as possible.

The problem is that those businesses are rare and thus pretty well-known. As a result, they hardly trade at attractive valuations.

There are three circumstances you can buy those companies at attractive valuations and still expect above-average returns:

Industry recession.

Broader market crash.

Temporary firm-level problems.

In all these cases, the market gets overly pessimistic about the future, and you may buy those companies at attractive prices.

Yet, we haven’t gone into a serious recession in any industry since 2020 and haven’t gotten a broader market crash since 2022.

Therefore, when we look at the opportunities in those exceptional companies, they are mostly due to specific firm-level problems.

This is easy to see. What’s hard is to understand whether those problems are temporary or not.

Unfortunately, there is no clear recipe to find this out. It mostly depends on how well you know the company and the industry. If you know that there have been similar problems in the past with the company and it came out unscathed, you’ll be more likely to say it’s temporary. If you know that the companies with the same particular problem have almost always declined in that industry, you may think it’s permanent.

As a rule of thumb, I generally look at two things to understand which case is likely:

Is it something that the company was successfully doing so far, but not anymore?

Is it the main factor affecting the performance?

If the answer to both of these questions is “yes”, I tend to think it’s more likely to be a temporary problem rather than permanent.

I think this has been the case for UnitedHealth.

When we look at its top-line growth, we see no problem.

It’s been steadily growing its revenues at around a 10% annual rate.

Yet, we don’t see the same pattern for its net income:

Net income growth was pretty consistent until Q3 2023, then it got extremely erratic.

The drastic decline in H1 2024 was due to its $3.3 billion payment to healthcare providers to address the cyberattack on its Change Healthcare subsidiary. Yet, even after that, earnings remained erratic and in a pretty much downtrend.

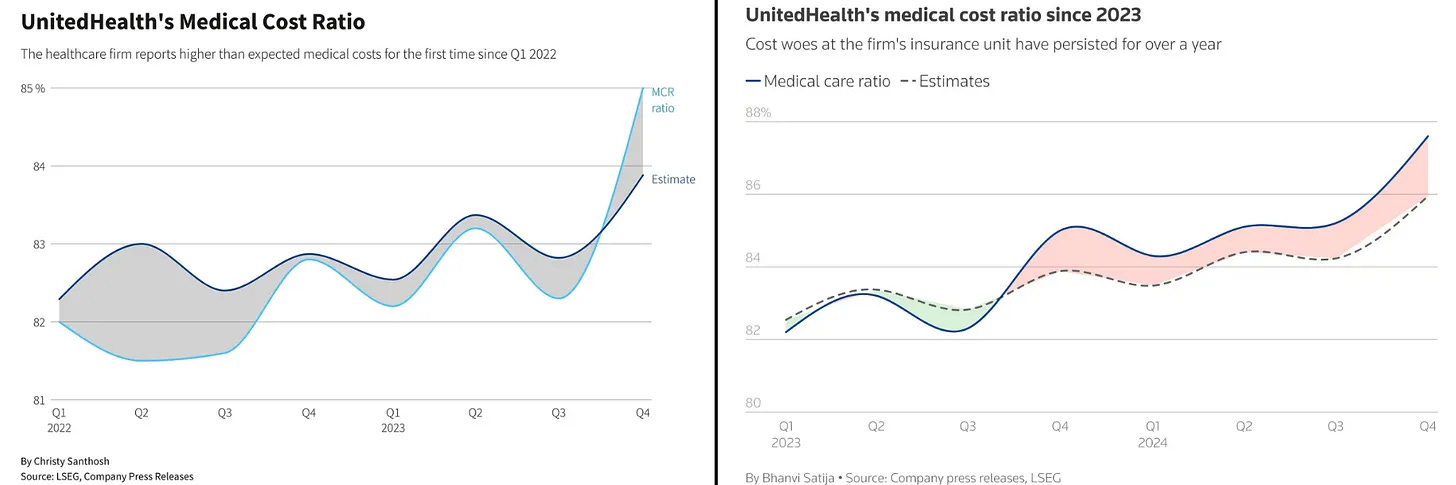

So, the question is—what changed after Q3 2023?

Luckily, we can easily see it.

Q3 2023 was the last quarter that the medical costs remained lower than expected:

Since Q3 2023, medical costs have consistently exceeded its expectations, eating away at its bottom line.

There are two reasons for this:

Above expected medical inflation.

Increasing activity rates.

These two are actually interconnected.

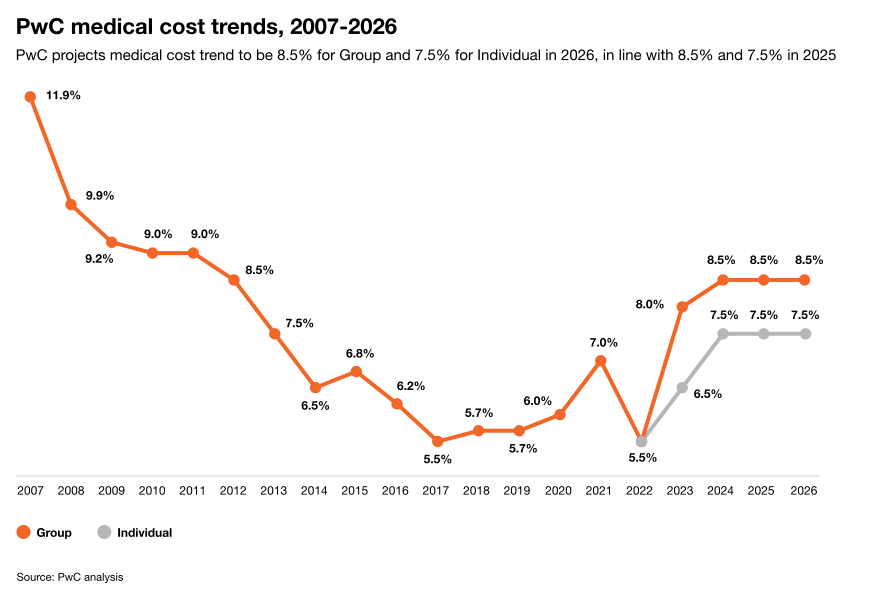

To start with, medical inflation in the US is expected to be around 8-9% for the full year 2025, which is way higher than the average inflation rate of 3%.

Though this has been the case for the US since 2000, medical inflation was actually coming down decisively beginning from 2007 until 2023. In 2023, medical inflation sharply increased, breaking the long-term downtrend.

As a result, less efficient providers had to terminate hundreds of thousands of plans as they weren’t able to offer attractive rates to their least profitable customers. As the most efficient provider in the industry, UnitedHealth decided to absorb those people, accelerating the top-line growth. It added over 2.7 million memers only in 2024.

However, those people started to show elevated activity right after they landed, as they were afraid that UNH could also decide not to offer them coverage at the rates they could pay for the following years. Once this is combined with the climbing medical inflation, UnitedHealth’s medical care ratio (MCR) skyrocketed:

This is why I believe that the problems UNH is facing are temporary.

It had been able to consistently estimate medical costs and price accordingly before Q4 2023. Its inability to do this since then is obviously what’s dragging down the performance.

It just needs to do two things:

Revise medical cost expectations.

Price accordingly.

They have already announced that they increased their prices for 2026, and I believe that price increase should have accounted for a generous estimate of the medical inflation and activity rates.

The good news is that their MCR looks to have peaked just below 90%. For the remainder of this year, they don’t have much to do to improve performance other than rigorous cost-cutting. They have signaled that by raising the full-year adjusted EPS guidance to $16.25 from $16. Though this is minimal, it means that they’ll keep things tight and squeeze whatever they can out of a bad year.

For the next year, I believe the uptrend in the MCR will turn downward, though it may take more than a year for it to settle under 85%, which is generally considered sustainable for health insurers.

So, in the medium term, I believe it’ll revert to its long-term average profit margin, which is around 5.5%.

Based on 10% annual growth and 5.5% profit margin assumptions, it’ll generate $38.5 billion in net income in FY 2030. Assuming a 15x earnings multiple, we’ll get nearly a $578 billion company.

Discount it back to the current day at a 10% annual rate, and we get a $358 billion company. The business is currently valued at $333 billion, indicating around 8% undervaluation.

If you believe that it can again trade at its old premiums due to being the dominant company in an industry and attach a 20x exit multiple, we’ll get $770 billion company in FY 2030, which implies $478 billion market cap for the current day.

In this case, the current market cap implies 40% undervaluation.

The truth is probably between those two points. It’ll likely get a bit lower exit multiple than 20, and the growth or margins may fall a bit short of our expectations. So, it’s probably around 20-25% undervalued on realistic assumptions.

Normally, I would say that this is a nice enough discount for an exceptional company. However, I think the current market conditions warrant being a bit more defensive than usual:

The market is at an all-time high.

A handful of companies are dominating the index.

The Fed is preparing to cut rates despite 3% inflation.

These factors make me think that an upward move in inflation will be inevitable, and the disrupted price stability will make it harder for sectors like insurance, restaurants etc, to forecast and pass their costs to customers.

In this case, I think it’s not enough for a business to be slightly undervalued. It should be egregiously undervalued to warrant deploying fresh capital.

This was the case for UnitedHealth after Q2. The stock is up nearly 50% since then, and it’s not the case anymore.

This is why I think it’s a hold.

If you already own it, lean back and watch it perform from here, knowing that your downside is limited. If you aren’t in, I think you shouldn’t risk your capital for 20-30% at this point. You have two options:

Deploy small amounts of capital to asymmetric bets with 10-to-1 potential.

Wait for a correction to get a position in high-quality names at more attractive prices.

Other than those, I don’t think it makes sense to deploy large amounts of capital at this point.

🏁 Final Words

Amazon is one of the best companies that history has ever seen.

Yet, those who bought it at its 1999 peak had to wait 10 years until 2009 to break even following the burst of the dotcom bubble.

They didn’t buy the wrong company; they just excessively overpaid.

This is the importance of price.

If the price is right, you can make money on a collapsing company; if the price is wrong, even the best company can’t save you.

Today, I think equities across the market are optimistically priced. As a result, the bar for high-performing companies is getting higher and higher.

This is why I think SoFi is a hold despite being one of the best performing companies in the market and with the biggest position.

The rising bar across the market also has implications for undervalued companies. Rising standards increase the market valuation and thus systematic risk. As a result, a margin of safety expected from an undervalued equity also increases.

This is why I think UnitedHealth is also a hold despite still being undervalued.

In short, I think you should stay out if you are out and enjoy the ride if you are already in.

Hope this helps.

That’s all friends!

Thanks for reading Capitalist-Letters!

Please share your thoughts in the comments below.

👋🏽👋🏽See you in the next issue!

I bought UNH at 267$, and your posts were an important part of the decision, thanks for you contribution