Rocking February: Our Portfolio Outperforms S&P 500 By 34%, Here Is What We Own!

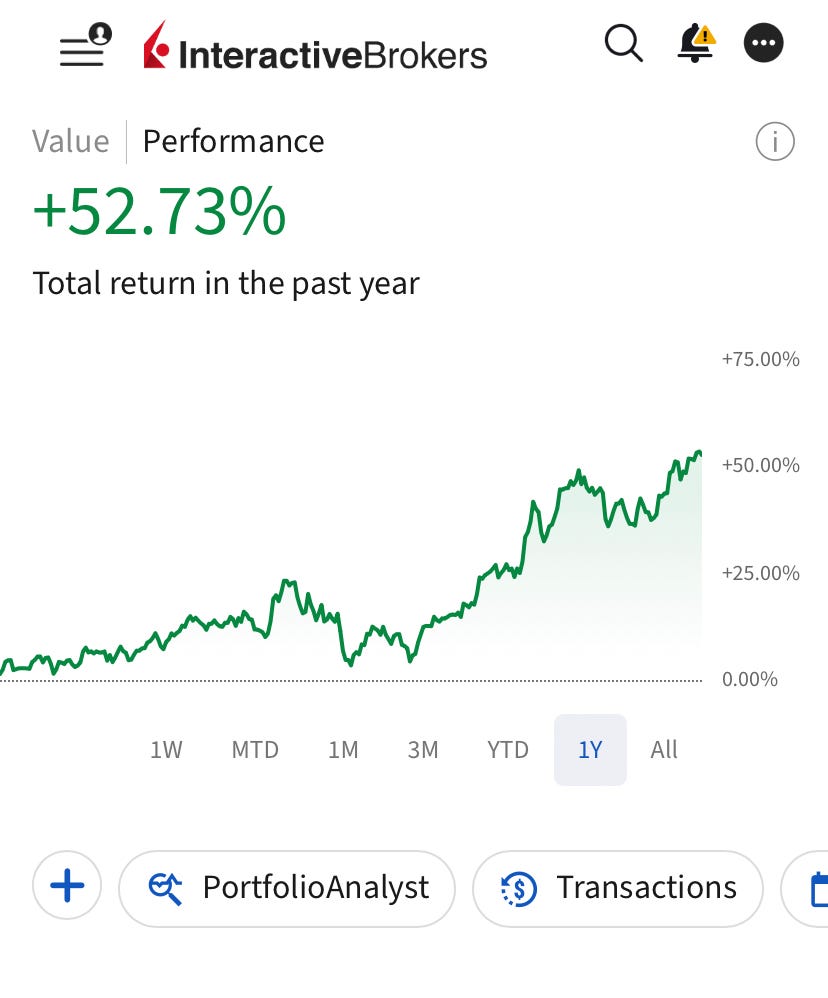

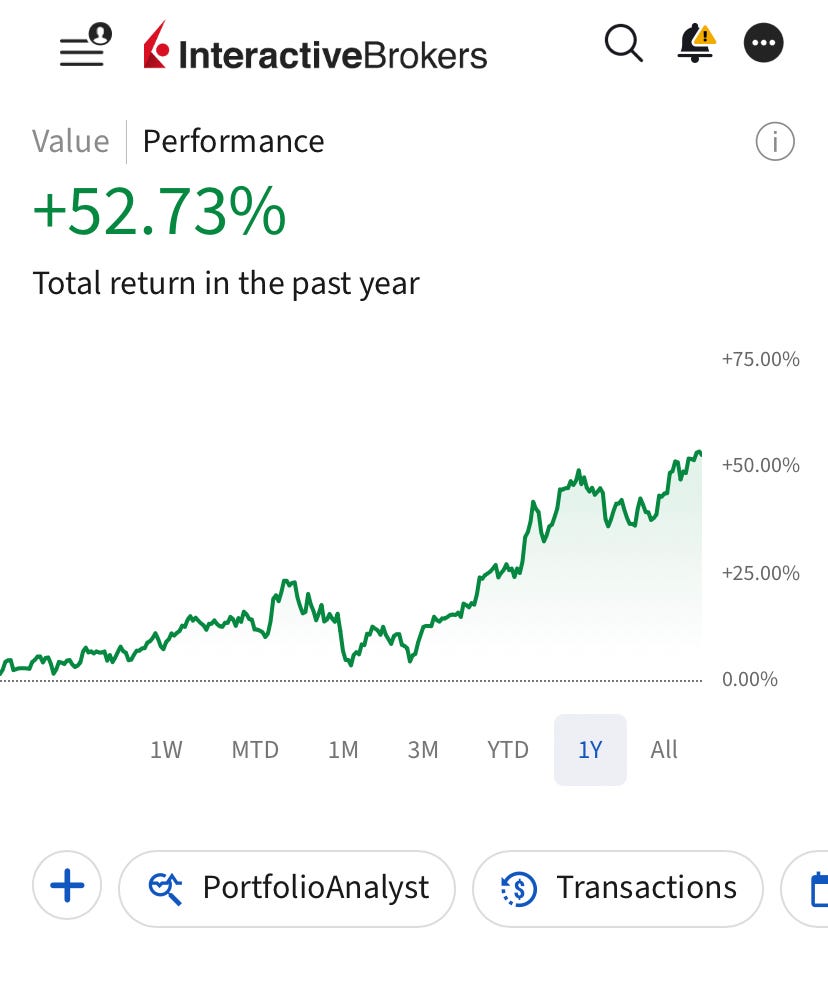

Our portfolio is now up 52% in the last twelve months against 18% of S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 34%!

Portfolio is now up 52% in the last twelve months against 18% of S&P 500!

Let me be straight: This is a great performance and I am proud of it.

I announced in the January update, this portfolio outperformed all but 1 one of the hedge funds whose results were available at the time.

After the January update, I got a question from one of our members: “How likely do you think this outlier performance will continue in 2025?”

I wanted to say “very likely.” Because I am a very competitive person, I am already always self-motivated to outperform the market all the time. I do it through disciplined practice of fundamental investing.

Yet, I didn’t say that. Instead, I explained why our method of investing works, what our principles were and why it’ll likely keep working over the long-term as long as we keep practicing it in a disciplined way.

It occurred to me at that moment: I provided that detailed and grounded explanation instead of ambitiously saying “very likely” because I feel responsibility to our people.

This responsibility comes from our original mission: Creating a vehicle for retail investors that they can easily and cheaply join, follow and participate in wealth creation through reading the publication, understanding the principles and following the choices we make at their will.

This is a way deeper mission that contributes to achieving superior results over the long-term.

Think about it: Why do we respect Warren Buffett so much?

He is the best investor of all times but the respect he receives from diverse groups can’t stem from just that.

People from all backgrounds and interests respect Buffett because he created wealth for thousands of ordinary people over the course of 50+ years.

Uncle Joe, who owns a small grocery shop in Omaha, created a generational wealth by buying Berkshire stock and sitting on it for decades, so did auntie May, janitor Jack, librarian Robin, driver Ben, waiter Carl and thousands of others…

Buffett may not have acquired Berkshire with that intent, but over time, he assumed the vision, saw what was happening and behaved others as his silent partners and executed for decades, cognizant of this mission.

I believe that responsibility he felt against his silent partners, substantially contributed to his results too.

In the last two months, I have received great messages from people who said they really made money, started to win, avoided bad decisions… In sum, they saw the needle move for them.

The sheer joy that I saw in these messages also changed me a bit I guess. I am more driven now by this broader mission of creating wealth for our people than by my innate competitiveness.

Thus, I am more committed and obsessed than ever to make choices that will generate wealth for our community and avoid those that may damage the hard-earned money of our members.

These will remain as our guiding principles going forward.

I am going to give you the portfolio update in a minute but let me talk first about a dangerous attitude I often see on Twitter (X) and other publications on Substack.

People are so confident in themselves and they take it so personally that they turn investing into a vanity metric competition. They tie their ego to how their stock picks perform.

Thus, once their picks skyrocket, they turn to other people who were negative about those stocks and assume an “in your face” attitude. Some others, in turn, label stock moves as “stupid” but they actually say it to the people who buy or sell those stocks at valuations they don’t like because stocks aren’t moving at will.

These are not serious actions and it’s definitely not the way you make money in investing.

We simply try to capitalize on some forward looking assumptions guided by some fundamental principles. Even the best investors are frequently wrong, and even the worst ones are sometimes right.

This is not a vanity metric competition.

Underlying mission should be creating wealth for you and for as many people as possible in a solemn manner, without succumbing to hubris.

Those who have access to our portfolio know that we had several of our picks become multibaggers in the last few months yet we have never assumed such a “told you” attitude and even rejected adding more at higher valuations despite the hype around them.

We will keep it this way. It has worked very well for us so far 👇

Our portfolio is now up %52 against 18% of S&P 500!

Following transactions took place in our portfolio in February:

We didn’t sell anything.

We opened 5 new position.

Increased 5 of the existing positions.

I had provided 2025 outlooks for all the positions in my portfolio in the last updates. In this update, I’ll also provide 2025 outlooks for our new positions and I’ll give my general commentary on what to expect from the portfolio going forward.

So, let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% special discount to celebrate new members!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today we own 23 positions.