Return Of The Moat: Six Heavy-Moat Stocks To Buy Now

We are heading toward a challenging market environment, it's time for the return of the moat.

There is a popular saying—good times create weak men; weak men create bad times. Bad times create strong men, strong men create good times.

Investing is very similar to this.

In good times, people get used to the market going up. Because the overall economic environment is friendly, money is abundant, and failures can easily be tolerated due to the abundance of money. Thus, making money is easier.

Companies can afford to spend recklessly, and when you do that, you can grow, this way or another. People get used to it, especially investors.

Investors are particularly vulnerable because everybody tends to think that their success comes from their investment skills. People buy a stock, it goes up, and they think they nailed it. This gives them an inner permission to act the same next time.

Ron Chernow, writer of biographies of John D. Rockefeller and J.P. Morgan, puts it s squarely:

This is exactly how weakness is brewed in markets.

Companies are like boats. When the sea rises, almost all the boats rise with it, except the ones that are obviously broken. But this doesn’t mean all those boats were built to endure storms. Floating in high water on a sunny day is nothing like navigating an Atlantic storm.

In good times, it gets harder to tell a good boat from a bad one; they all look like they swim well. Thus, money increasingly flows into companies that wouldn’t look as good if it weren’t for the good times.

The old art of buying companies with wide moats and not overpaying is forgotten.

But when the bad times come, when the sunny weather turns to a storm, only those who were built to endure stay afloat.

I am now looking up from that sunny beach, and I think a storm is coming, inching closer day by day. I think we are closer to the peak of this market cycle than we have ever been since 2022.

Why do I think it? It’s simple.

First, the credit spread is at historically tight levels since early 2025:

This means that we have been pretty generous with lending money, asking a very small premium from riskier borrowers. Except for a brief spike that followed the tariff announcements last April, credit spread has been below 3% since January last year.

This necessarily implies that many unworthy actors have been funded, and continue to be funded. If the monetary conditions get tighter for any reason, or consumers show weakness for some reason, it’s possible they may fail pretty quickly.

Second, there is not much room left to run for equities.

S&P 500 started 2025 at around 22x earnings, and it was trading around the same multiple earlier this week:

This means that almost all the appreciation in 2025 came from earnings growth. This is indeed the case, as the S&P 500 went up 16% last year, and JP Morgan expects that S&P 500 earnings growth will finalize around 14% for 2025.

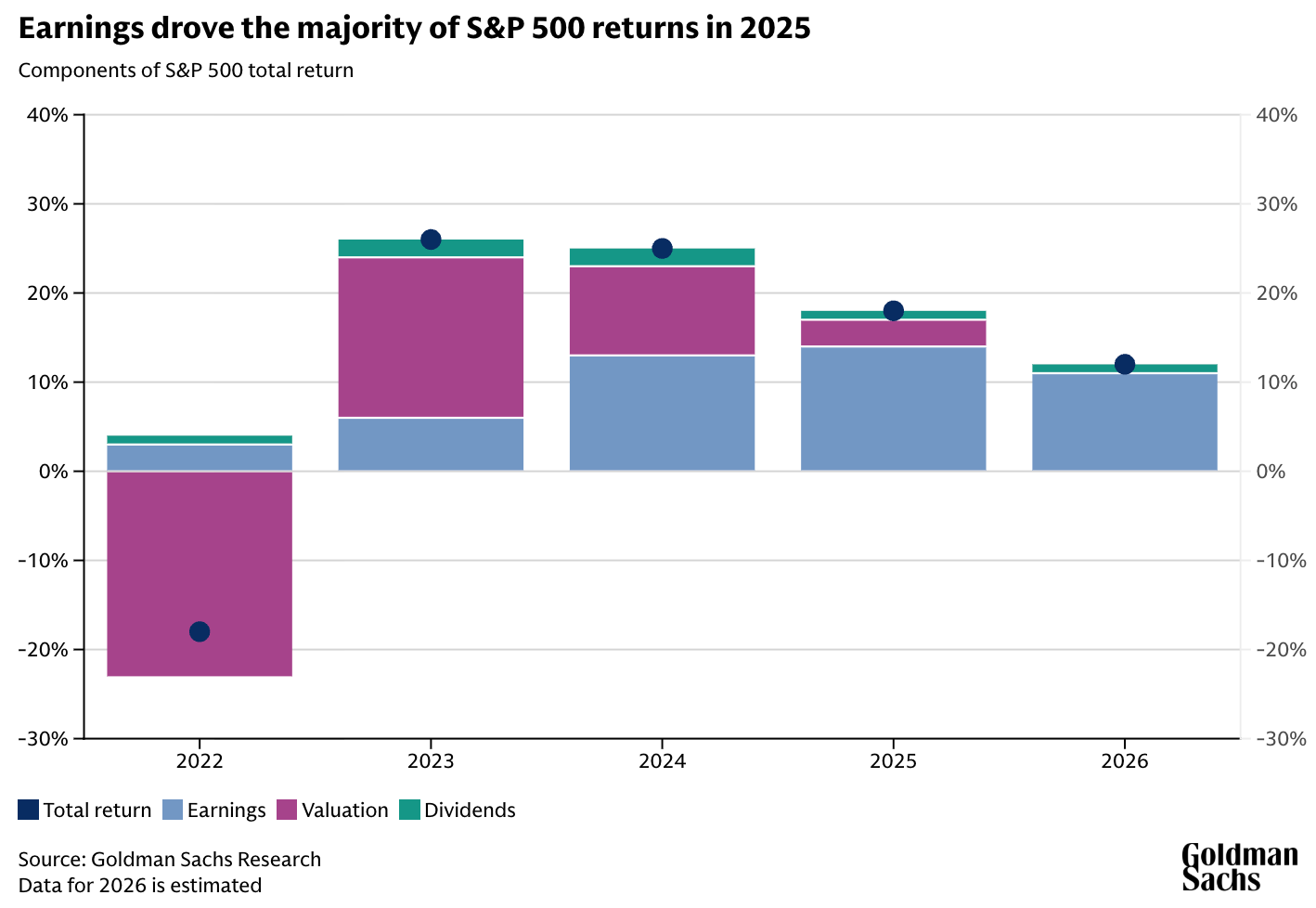

Goldman Sachs expects that this year will be the same. They think the S&P 500 will appreciate by 12% this year and all the returns will come from earnings growth and dividends:

Yet, for Goldman’s scenario to play out, multiples should stay steady. If the multiples contract, we are looking at an underperforming year.

This means we are no longer looking at a setup where the average company is poised to do well. Thus, investors shouldn’t expect to feel as skillful this year as they have for the past couple of years. Hard times are ahead.

I think the last few days proved this.

Despite the market being down only by 1.2% last week, many high-flying growth stocks have bled by several dozen percentage points, and pulled down the portfolios holding them by double-digits.

RobinHood is an example. And note that it’s an exceptional company, which was just overvalued. Imagine how momentum stocks without any fundamentals are doing..

So, if this is the case, what should we do?

I think it’s time for everybody to remember the essence of investing. You buy companies that are built to endure, and pay no more than fair value.

Don’t they go down in a market downturn? They likely do. But far less than others, and you’ll know that they’ll come out unscathed. Your risk of permanent loss will be as low as it can be. This is the important thing heading into tough times.

This is the best thing you can do, the safest shelter you can have.

It’s time for the return of the moat.

Given that we are going through unprecedented times of technological change and disruption, I think the moats we seek should be old school, like unbeatable unit economies due to scale, local monopolies in capital-intensive markets, strong brands with historical pricing power, etc. On top of these, they should be valued attractively.

Do they exist, given that we are near an all-time high in almost all markets?

Interestingly, they do. Due to two reasons:

People have focused too much on momentum lately, ignoring heavy moats.

Some of them are having temporary problems.

As a result, we can buy these stocks at a discount relative to broader markets and minimize the risk of permanent loss of capital.

Below are 6 of those opportunities I can currently see.

Let’s cut the introduction here and look closer at these names.

6️⃣ Amazon

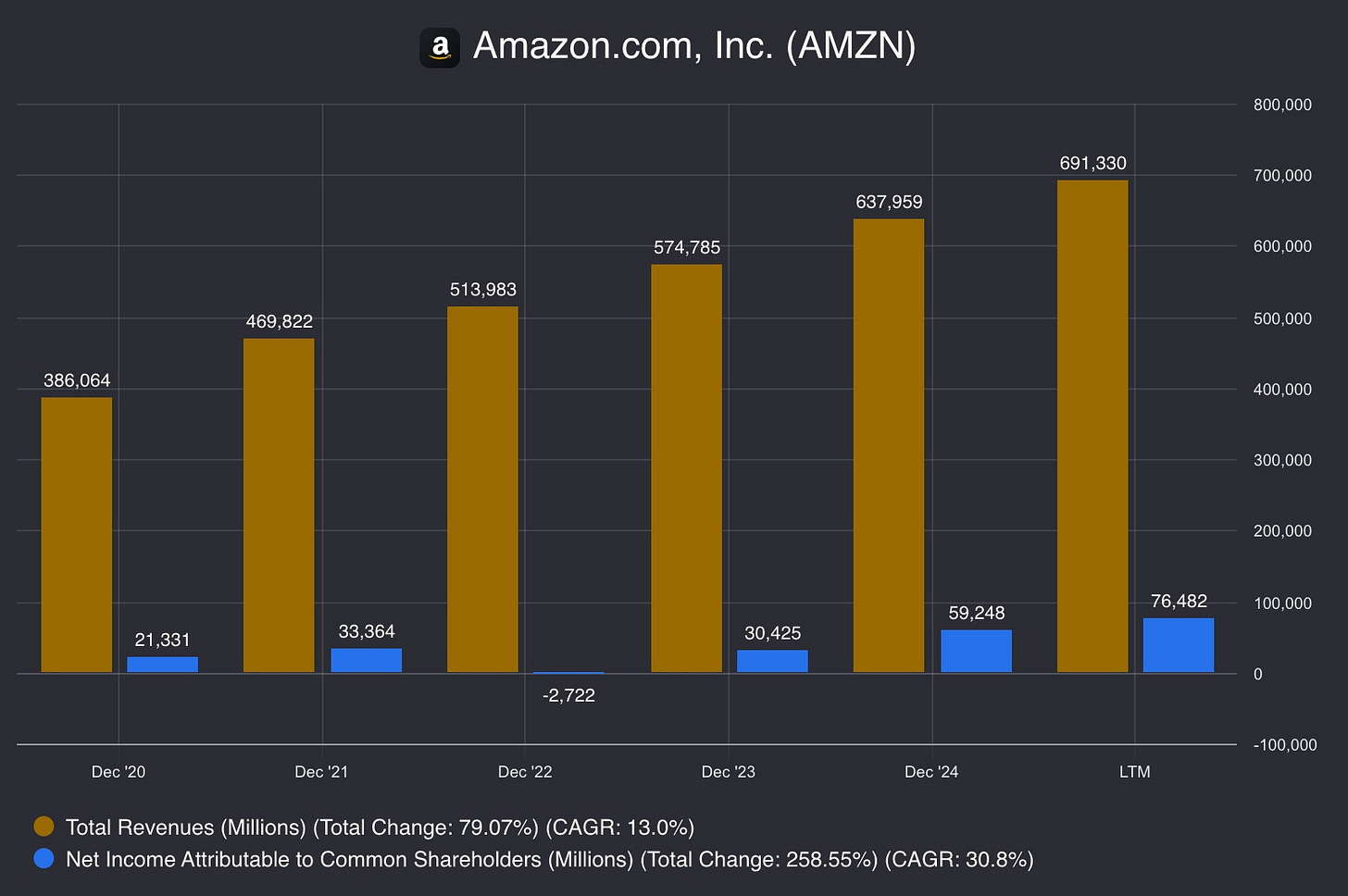

5-Year Revenue CAGR: 13%

Return on Capital: 15%

Forward P/E: 31

Amazon is the epitome of a moat. Its moat is multilayered, making it almost impossible to penetrate.

To start with, it’s protected by unbeatable unit economies at the business level.

Its legacy e-commerce business has the largest scale among all retailers in the world, except for Walmart. This is supported by the largest third-party logistics network in the US by revenue, as it generated $156 billion in gross-logistics revenue in 2024.

Integration of scale and a vast logistics network makes it impossible for competitors to beat its unit economics in the e-commerce side, which naturally creates huge lock-in for third-party sellers on its platforms. They can’t go anywhere, no better place.

Its cash-cow cloud business is protected by massive capex requirements that only a few companies in the world can match. For reference, its capex for 2026 is estimated to reach $150 billion, driven mostly by AWS expansion. On top of this, cloud business is sticky, and customers rarely switch, as migrating infrastructure is costly and risky.

These business-level advantages feed each other at the company level, creating a unique ecosystem. For instance, thanks to its dominance in e-commerce, it has the third-largest digital advertising business in the world.

It’s one of the strongest companies in the world, and closest to “impossible to disrupt.”

Despite all this, the stock has gone nowhere past year.

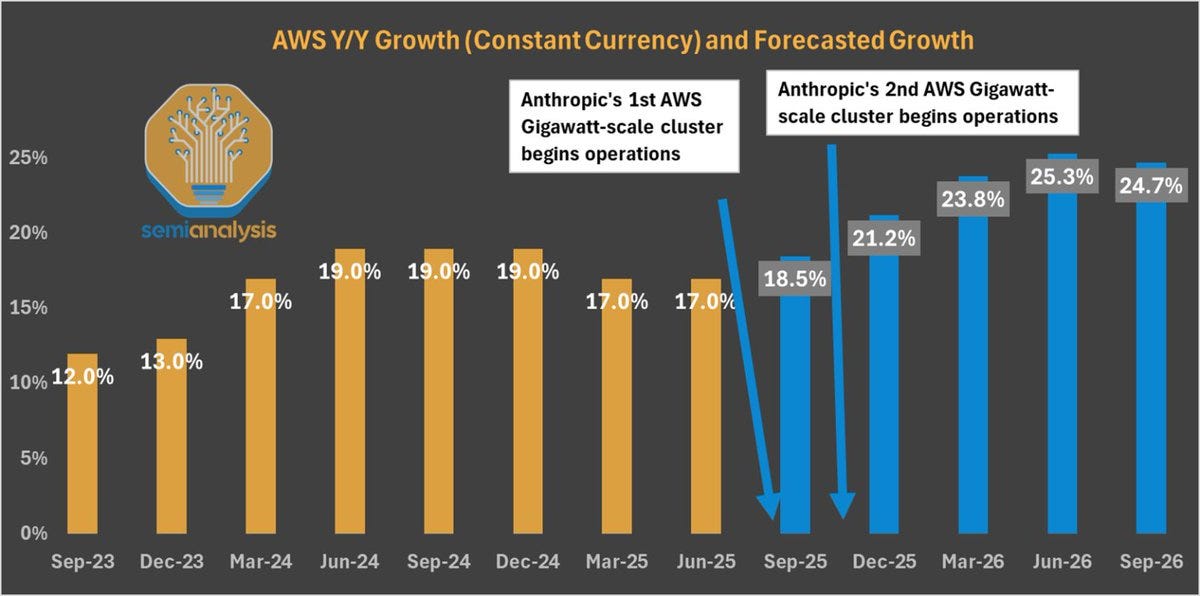

The biggest reason was AWS's growth lagging behind the competitors like Google and Microsoft. This is changing now as Anthropic’s gigawatt-scale AWS clusters came online last quarter.

This will boost AWS growth to over 25% this year, according to SemiAnalysis:

We have already started to see upward momentum as AWS growth reaccelerated to 20% last quarter. Given that they’ll spend even more this year and Anthropic is growing way faster than OpenAI currently, I think they can maintain ~20% annual growth on the AWS side for the next 5 years.

As AWS's run rate is expected to reach $140 billion this quarter, it can generate $340 billion in revenue in 2030. Assuming 30% net margin and 25x exit multiple at the business level, AWS will alone be worth $2.6 trillion in 2030. Discounting it back to today at 8% annual rate, we get a nearly $1.8 trillion business today.

Given that the whole company is valued at $2.5 trillion today, we are getting the rest of the company for $700 billion. As the rest of the company is set to generate around $580 billion in revenue this year, I think we are getting it for a discount at 1.3x sales.

Non-Cloud side includes higher margin businesses like third-party seller services and advertising, but it’s priced as if it were purely a retailer. This is where I think the alpha lies in Amazon. Pure retailers close to their scale, like Walmart and Costco, are trading at a significant premium to non-cloud Amazon despite slower growth.

In short, I think Amazon is trading at a slight discount. It’s fairly valued at most, but not overvalued in any case, and it’s not exposed to any risk of disruption. So, I am happy to own Amazon as we are going into a harder business environment.

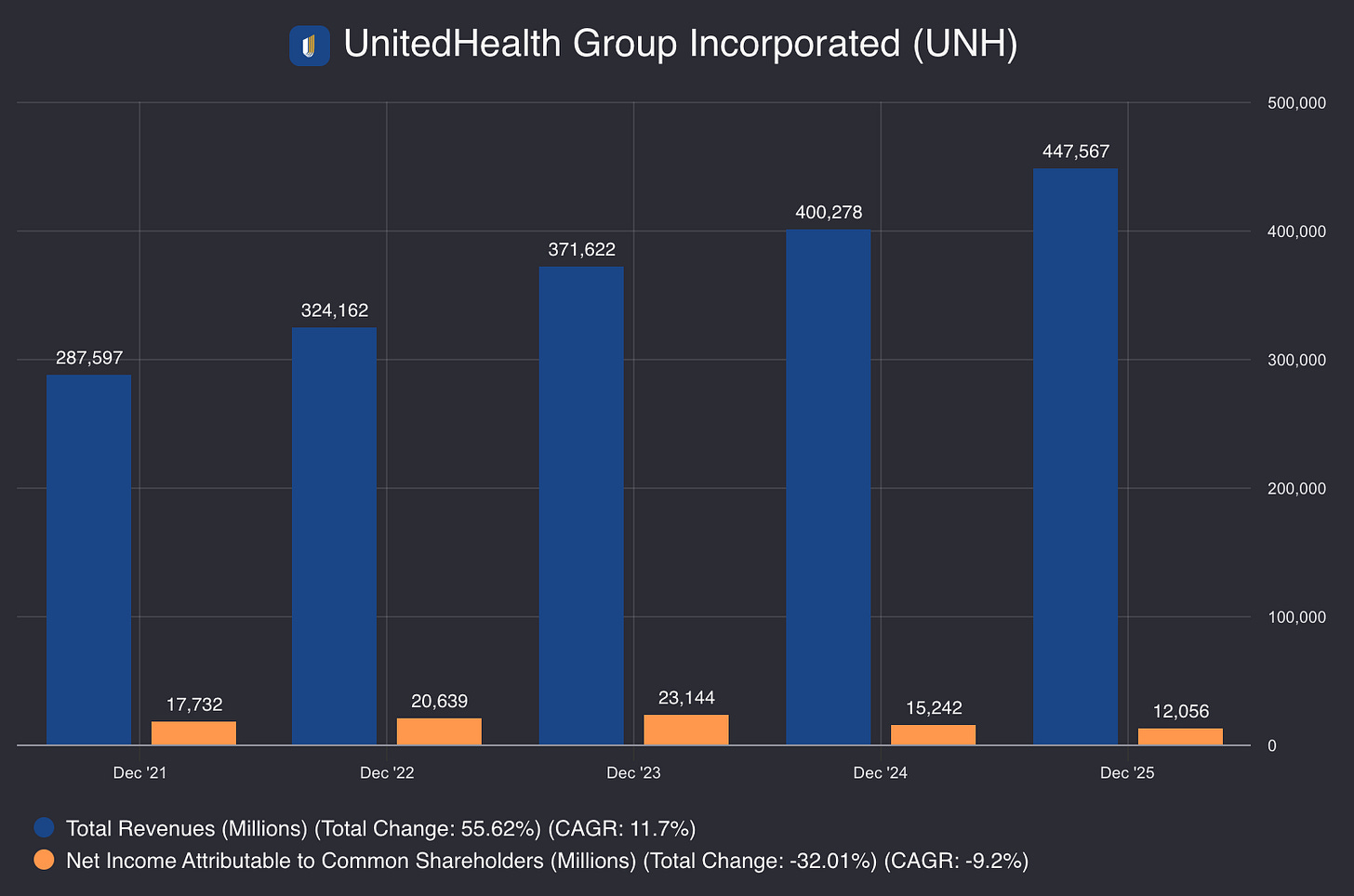

5️⃣ UnitedHealth

5-Year Revenue CAGR: 12%

Return on Capital: 13%

Forward P/E: 16

This is a controversial one, given how poorly the stock has performed last year. However, this doesn’t mean the business is deteriorating. This is why I like it. Despite the shortcomings, it’s still one of the most durable businesses in the market.

It’s both the largest health insurer in the US, UnitedHealthcare, and the largest healthcare service provider, which is Optum. This vertically integrated structure gives UnitedHealth a bargaining power on its network, allowing it to minimize costs and scale on the insurance side by passing some of these cost savings to clients.

As a result, the business turns into a slow but steady growth machine.

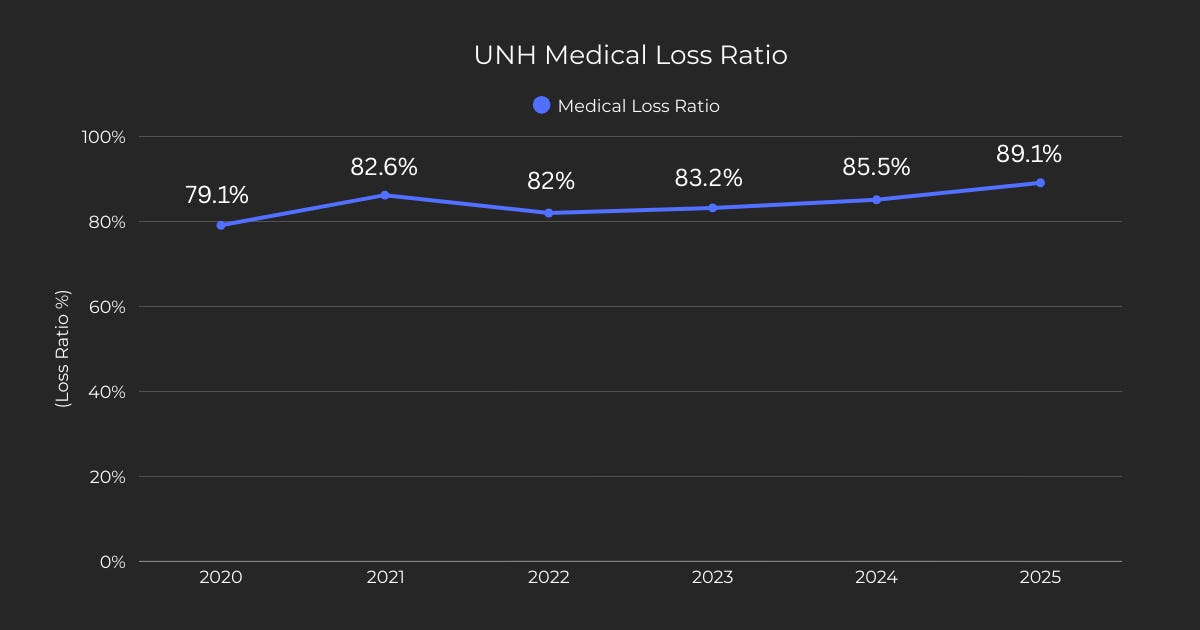

The problem with UnitedHealth is that the aggressive growth in recent years created a bloat in the company. They accepted high-morbidity clients they should have rejected. When this was joined with a higher-than-expected activity rate across other client segments and medical inflation, their medical loss ratio (MLR) skyrocketed:

As a result, profits collapsed despite satisfactory top-line growth. They are now reversing this.

Its legendary CEO, Stephen Hemsley, took over again, and the business has committed to bringing back disciplined growth. This is why they are reducing short-term growth efforts, exiting unprofitable markets, and implementing strict cost discipline.

This is why they are guiding for a slightly lower revenue this year but nearly 10% earnings growth.

As they are guiding for $17.75 adjusted EPS per share, the stock is now trading at 16x forward earnings. Assuming they’ll continue growing low-double digits beyond 2026, 16x earnings is an attractive price given its unshakeable market position.

If you own the position with an average between $300-$400, I don’t think it’s worth it to double down now. But if you are out, you should know that it’s very hard for you to suffer a permanent capital loss from this stock at this level.

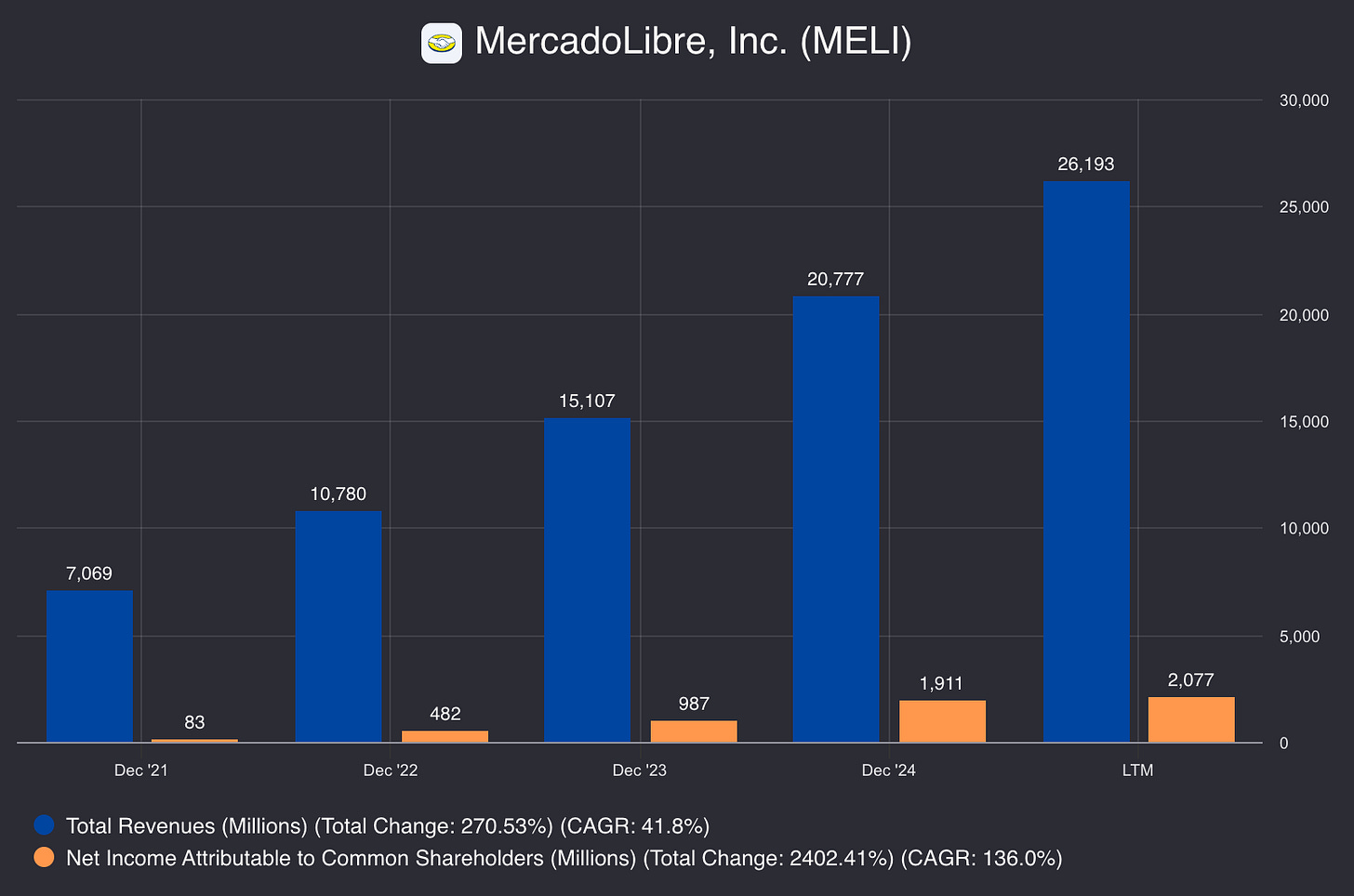

4️⃣ MercadoLibre

5-Year Revenue CAGR: 41%

Return on Capital: 20%

Forward P/E: 34

MercadoLibre is basically pulling off Amazon in Latin America.

Since the day I started following Meli, what impressed me most is how well they have analyzed and are implementing the Amazon playbook.

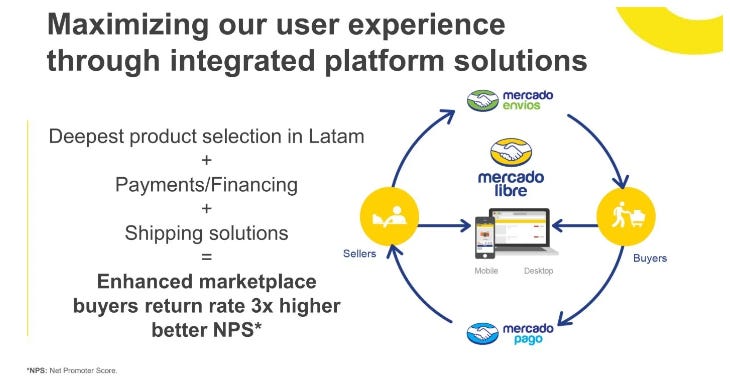

If you have been following this publication for a while, you know that I don’t like investing in pure e-commerce businesses. The reason is simple. There is no moat in simple e-commerce retail.

What develops a moat is integrating a dominant e-commerce platform with a higher margin complementary business.

Amazon did this with third-party seller services and advertising. MercadoLibre is doing it with logistics and fintech, MercadoPago. It’s providing comprehensive financial services to both buyers and sellers on the platform.

On the seller side, this acts as a locking factor as their platform income makes it easier to access financial services through MercadoPago. On the buyer side, the marketplace gets stickier as MercadoPago offers flexible payment arrangements like installment payments and deferred payments, all integrated into the marketplace.

This creates a flywheel where growth at each side feeds the other one.

We can easily see this on the results as it has achieved a record streak of 27 consecutive quarters of year-over-year (YoY) revenue growth exceeding 30%.

Fintech grew by 68% last quarter, now making up 43% of sales. E-commerce growth was also strong at 38%.

It’s posting one blockbuster quarter after another, and I don’t think it’ll slow down soon.

E-commerce platform penetration is still low in Latin America, as only 15% of retail sales are from digital channels. Market research firms expect that the e-commerce market in LatAm will grow 10% annually until 2030. The same applies to financial services as well. In the next 10 years, fintech services in LatAm are expected to grow 15% annually.

Meanwhile, Mercadolibre is trading at just 10x projected 2030 earnings as analysts think top-line growth will magically collapse to 5% in 2030 after 17% growth in 2029.

This obviously understates the business’s potential, durability, and the growth trajectory of the region. I believe it’ll have at least a decade of low-double-digit or high single-digit growth beyond 2030, making the stock a steal at 10x 2030 earnings.

I’ll add to my position below $2,000 a share.

3️⃣ TAVHL.IS

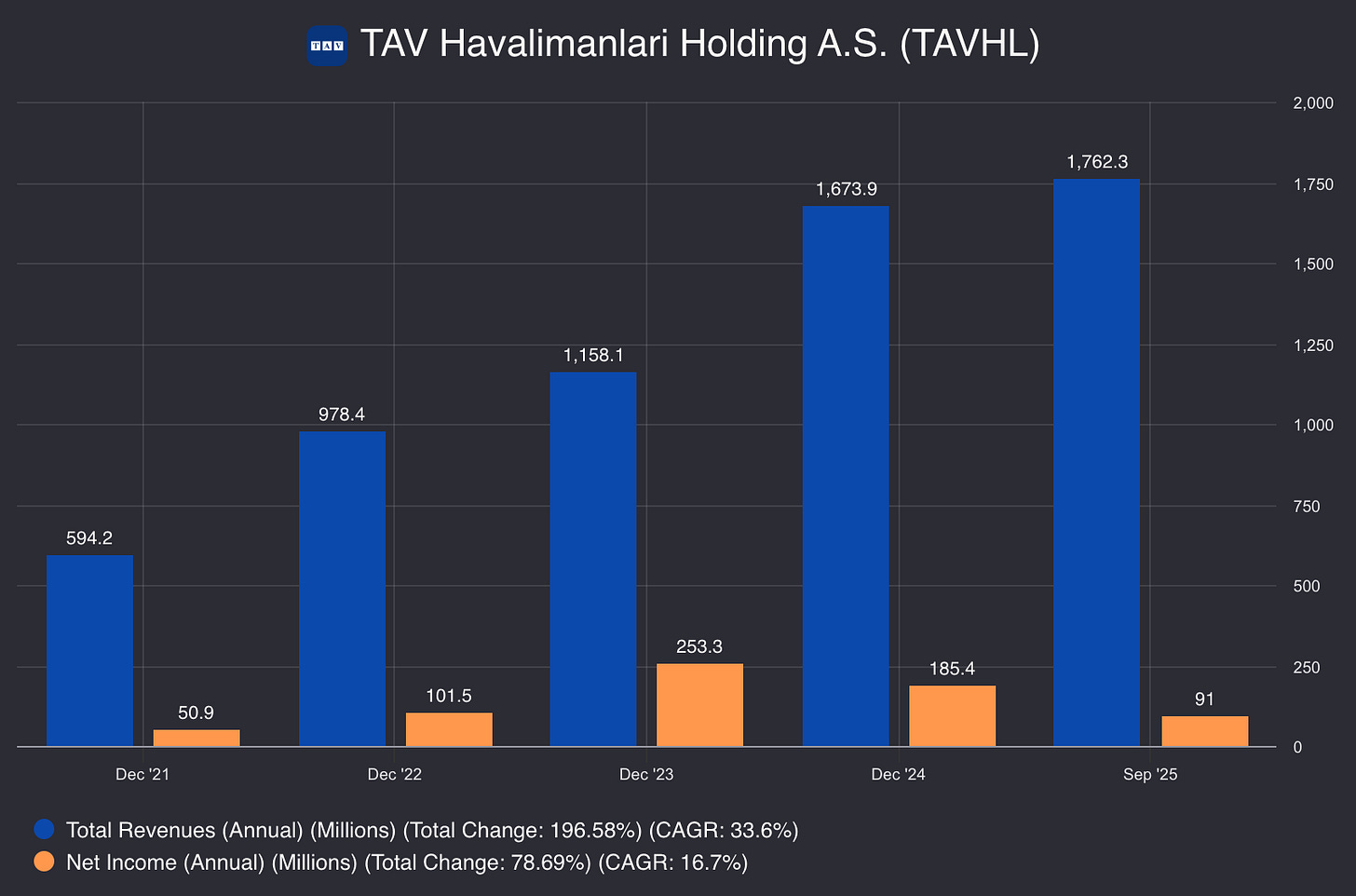

5-Year Revenue CAGR: 33%

Return on Capital: 9%

EV/EBITDA: 8.5

This is a physical infrastructure play.

TAV operates 15 airports across 8 countries — Turkey (Ankara, Izmir, Antalya, Bodrum, Gazipasa), Kazakhstan (Almaty), Saudi Arabia (Madinah), Tunisia, North Macedonia, Georgia, Croatia, and Latvia. France’s Groupe ADP is the majority owner of the company with 46% stake.

In short, it’s a structural monopoly as most cities in the world tend to have just one airport, and the biggest ones have two.

What makes it an interesting play here is that it has many secular tailwinds ahead:

It’s just coming out of an investment supercycle.

Middle East and Middle Asia are poised for fast economic growth.

Country risk is declining as inflation stabilizes and the Central Bank cuts rates.

After the latest capex cycle, the business transformed into a strong monopoly with an EBITDA-weighted average concession duration of 32 years. This was only 8 years in 2020. They acquired Almaty outright in 2021. They spent approximately €2.5 billion to achieve all these.

The stock remained under pressure because of elevated capex, but it’s changing now as they are getting into the deleveraging phase.

The management is guiding for EBITDA of €520–590 million for the full year 2025, with a target of bringing net Debt/EBITDA down to 2.5–3.0x. It’s currently trading at 8.5x EV/EBITDA, which is a significant discount to European peers that are trading around 10-12x Ev/EBITDA.

Another advantage of owning this company is that the concession is denominated in euros, so currency risk is out of consideration. If anything, it benefits from inflation as its earnings are in euros while most of the operating expenses are in Turkish Lira as Turkey is its biggest market.

I owned the stock for a few months last year, then I exited to capitalize on other opportunities in the US market. I am considering initiating a position again as I want to diversify away from the US and overweight structural moats.

2️⃣ Tasmea

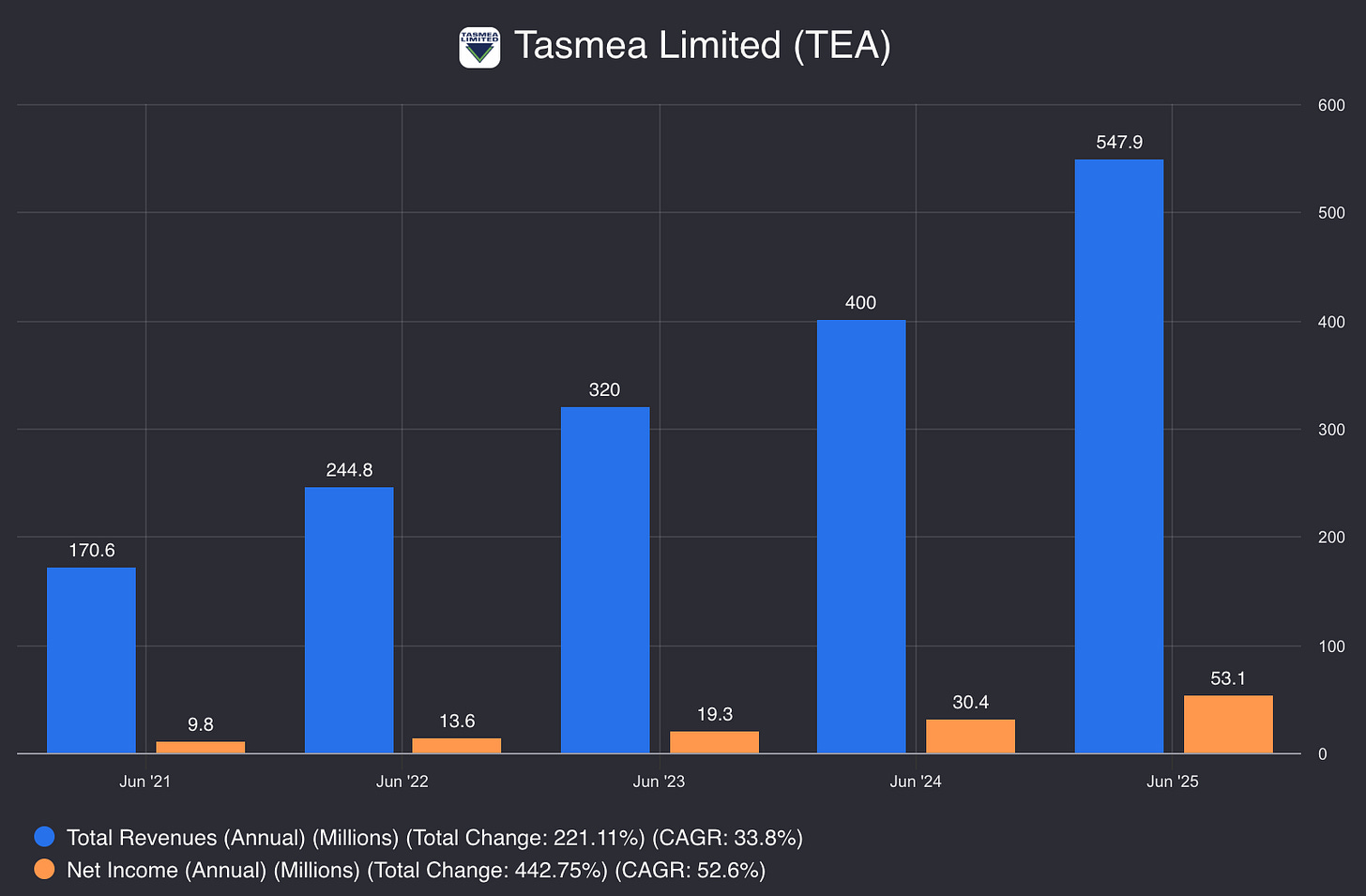

5-Year Revenue CAGR: 34%

Return on Capital: 17%

Forward P/E: 15

This is one of my favorite businesses lately.

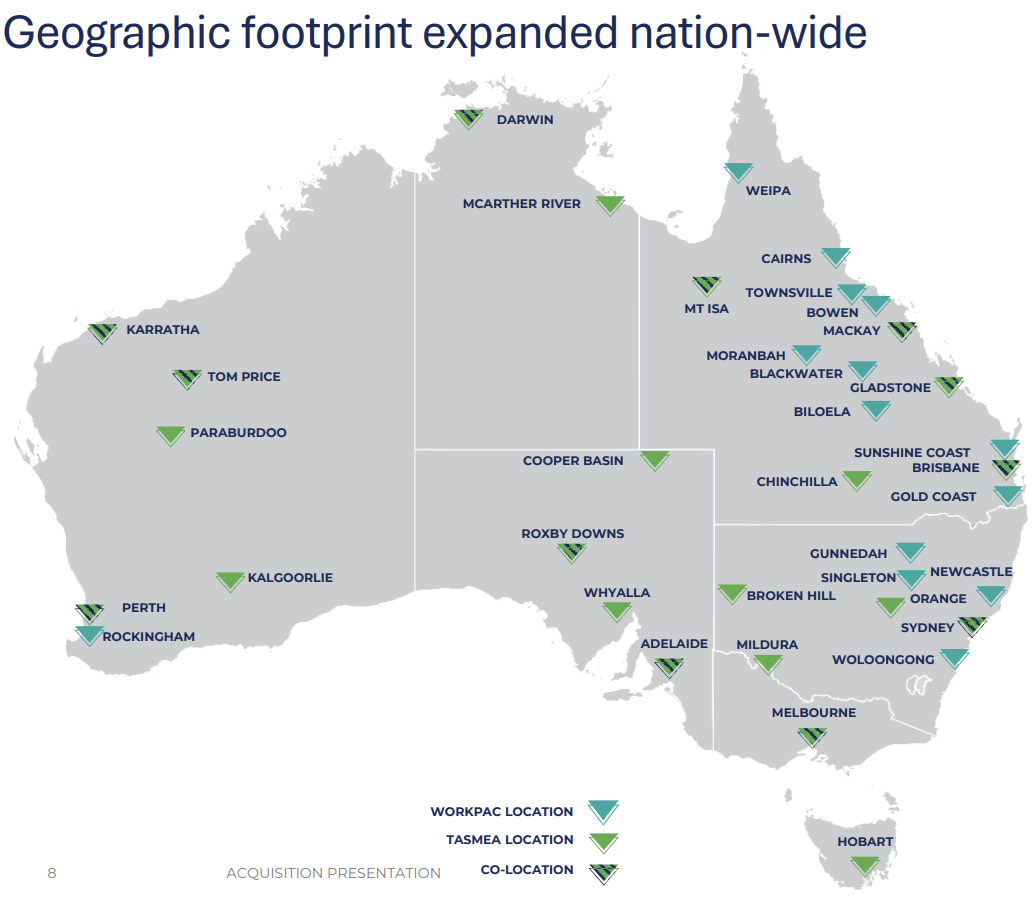

The business is very simple—It’s a conglomerate of maintenance and repair businesses serving critical asset owners like miners, water utilities, and oil and gas companies in Australia.

Around 70% of its revenue comes from miners. This puts secular tailwinds behind the business since mining will have to grow considerably as metal and mineral demand is skyrocketing due to the energy transition, data center buildout, and industrialization of the emerging economies.

It has two structural elements to its moat:

Its diversified holdings allow it to provide comprehensive services.

It historically focused on the remote areas of the Australian market.

It’s already hard to find capable service businesses in those remote lands, and it’s harder to find one that provides as comprehensive a service as Tasmea.

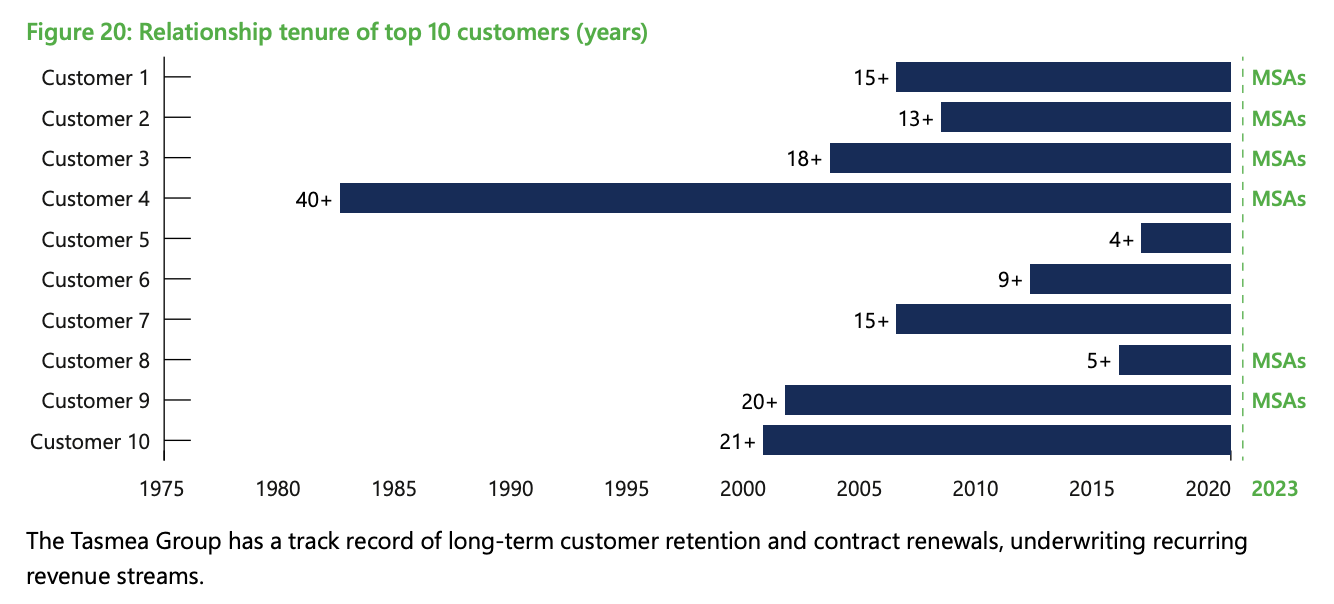

As a result, most of its customers stick with it for a very long-time, allowing it to grow by both adding new business and raising prices year-over-year for the existing customers. For reference, its 10 biggest customers had an average tenure of 16 years as of 2023; now it should be longer as they haven’t lost any major clients.

Insiders are extremely aligned, as two founders are still at the helm, and they own 62% of the company. The management is guiding for EBIT of A$160 million by 2028, and A$110 million for this year, and a net profit of A$70 million.

Given that it’s currently valued at A$1.07 billion, we are looking at 15x this year’s earnings, which I think is an attractive valuation for a company guiding for strong double-digit growth for the next 3-5 years.

1️⃣ 3i

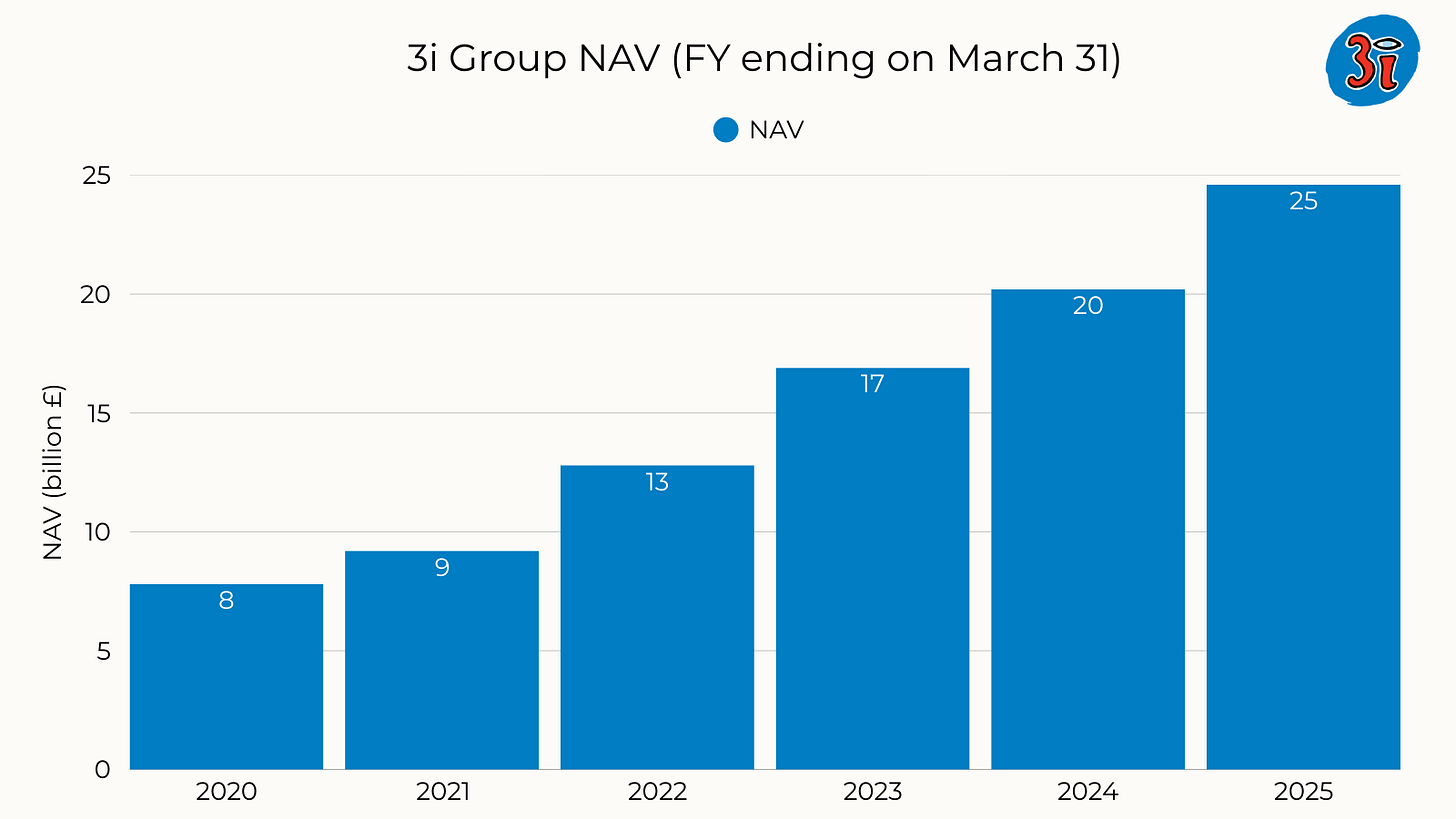

5-year Net Asset Value CAGR: 30%

Price/NAV: 1.1x

This is another business I really like nowadays.

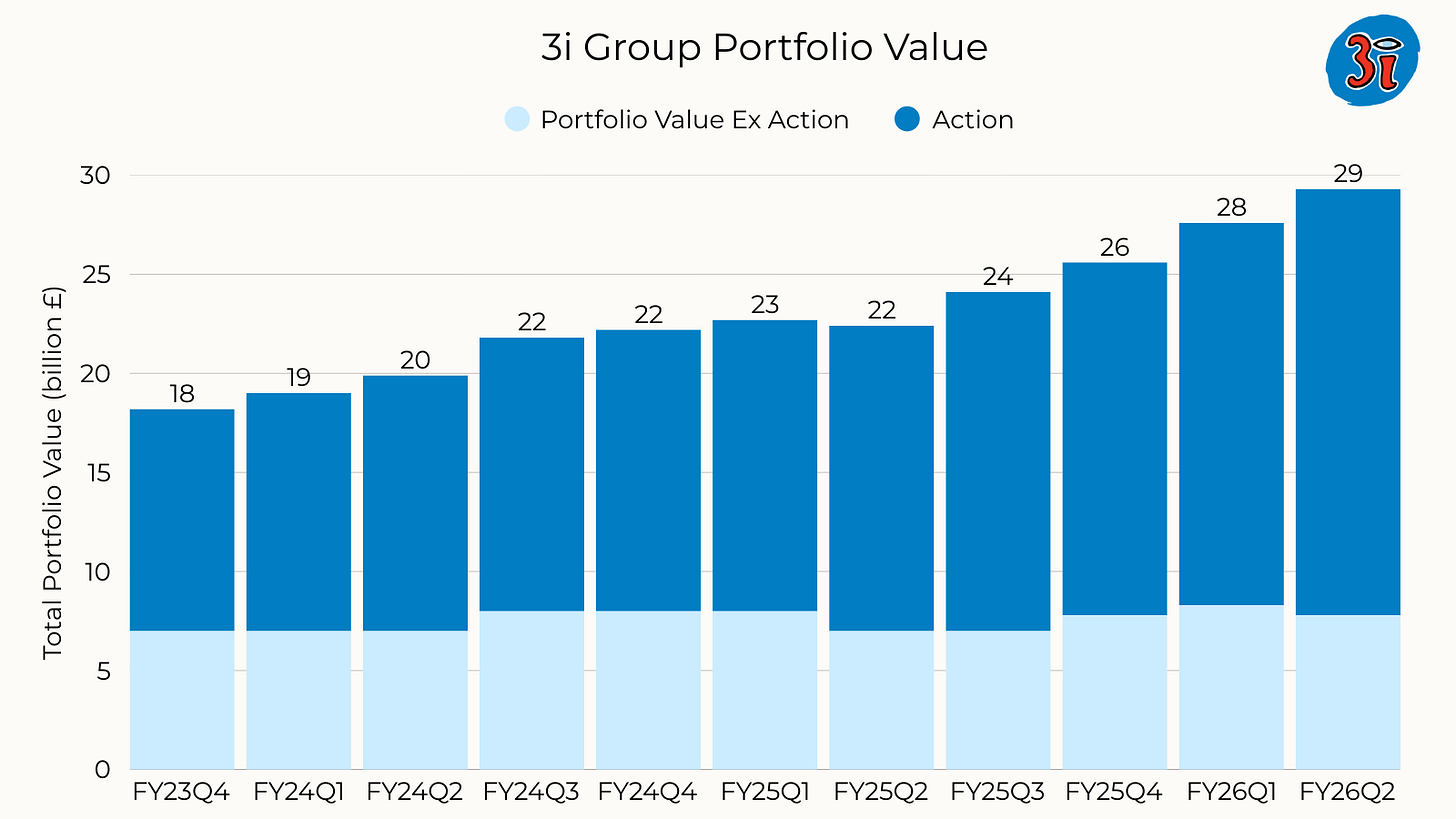

3i is a British private equity firm, and also the majority owner of the fastest-growing non-food retailer in Europe, Action.

As opposed to other private equity firms, most of 3i’s capital is its own permanent capital, thus it’s been pursuing a strategy of buying exceptional companies and holding them very long-term, similar to what Warren Buffett did with Berkshire.

For 3i, that exceptional business is Action.

They acquired a majority stake in Action in 2011. They have increased their stake over time as they recognized Action’s exceptional business economics. Thus, the rest of the operations stayed largely stagnant over time, while Action and its share in the portfolio continuously grew, turning 3i into a public wrapper around Action:

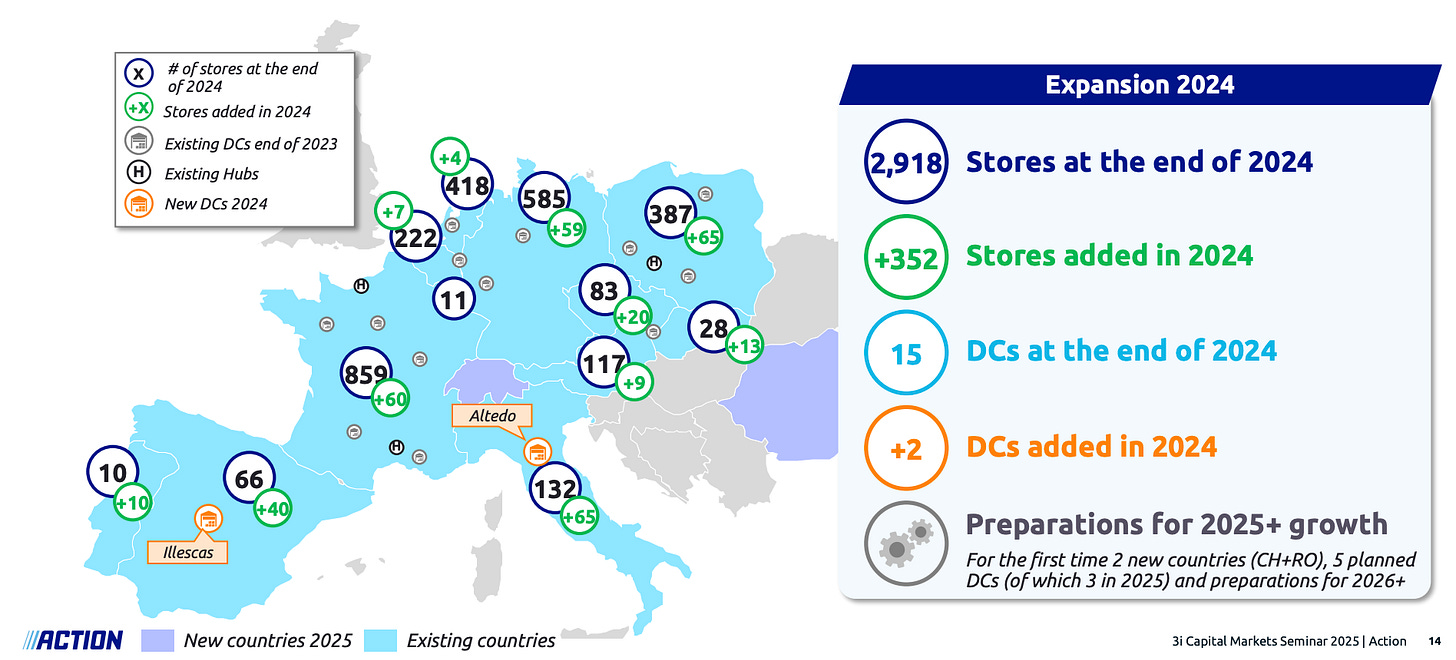

Action currently has around 3,000 stores across Europe, and the management says the whitespace potential is around 4,850. This means that it still has a long runway for growth ahead.

Its business economics are very strong, well-positioning the company to exploit that long runway. Its tight store network in Europe is supported by 18 distribution centers. This significantly reduces transportation and warehousing costs, creating local economies of scale, which makes it very hard for competitors to match its prices even if they have the minimum efficient volume.

When I first published my deep dive on this company, I said this regarding the valuation:

Given that the company grew EBITDA 31% annually since 2020, I think it can easily grow EBITDA 15% annually in the next 5 years. As the annual EBITDA (operating and non operating) was €2.5 billion according to the October update, assuming 15% annual growth, we’ll get we’ll get €5 billion EBITDA in 2030. Attaching 16x multiple, we’ll get a €80 billion company.

Action’s debt will decline as the company matures, so we can assume the Debt/EBITDA multiple will be 2x, giving Action a net debt of €10 billion and equity value of €70 billion in 2030.

Assuming stable 62% ownership, 3i’s stake will be worth €43 billion or £37 billion.

Discounting it back to today at 10%, we get £23 billion worth of stake in Action.

As of September 2025, 3i valued its stake in Action at £21.4 billion. Even if we assume that the remaining portfolio is valued fairly at £7.9 billion, we get a £30.9 billion NAV.

Dividing NAV by 993 million shares outstanding, we get 3,111 pence NAV per share, which is just 5% below the current stock price.

I think we’ll see something close to this value as NAV when 3i files its next update.

Last week, 3i filed its latest update, and they said the NAV was 3,017 pence per share:

Given the development of the business, I think they’ll hit around 3,300 pence per share of NAV by the end of the first half of this year, which means the current stock price of 3,335 pence is at a fair value ballpark.

Given that we are looking at a defensive company with a structural moat stemming from local economies of scale and giant volume, I think being able to buy at a fair value is a great deal.

It’s not going to 10x your money in 2 years, but you’ll be able to sleep tight and still get steady compounding. I think it’s a nice deal given how rare such opportunities are in this market.

🏁 Final Words

It’s not going to be an easy market this year.

Last year was hard as well, but most retail investors didn’t feel it, as they tend to chase growth and momentum, which did pretty well. However, if you ask professional money managers, they’ll tell you that it was hard. They felt it.

When I look at the alternatives, I can’t easily see what can go up this year. Equities, metals, and commodities all look richly valued.

Then I turn and look at the environment we are going into: Customers will increasingly feel the effects of tariffs; credit is already tight, and it’s not going to get easier than this; AI is boosting investment, but investors are getting impatient to see returns.

All this makes me think that there is more downside in the markets than upside. And this won’t be due to just volatility; multiples may compress due to a sheerly challenging environment. As a result, risk assets may get hammered down, and even permanent loss is possible in stocks that depend on the availability of easy credit.

On the other hand, you still have to stay as allocated as you can since inflation and currency debasement are also real threats.

Where can we go? I think it’s time to seek shelter in castles surrounded by wide moats. Buy them at attractive prices, ride the volatility, and a potential downturn without worrying much about a permanent loss of capital. You’ll stay allocated and still be well-positioned to compound your money steadily, though slower.

I know it’s not what many people are dreaming of, but it’s the realistic scenario given how far the markets have run ahead of the fundamentals in the last two years.

Solid take on the market environment right now. The credit spread tightness combined with high valuations really does set up a situation where quality matters way more than growth velocity. I ran into this last quarter when some of my higher beta positions got wrecked despite the market only dropping slightly. The boat analogy captures it well tho, it's easy to confuse a rising tide with good swimming.

What are your thoughts on Netflix and if it has a MOAT and if it is fairly valued? I’m very very curious about your opinion on that?