Our Portfolio Crushed S&P 500 In October, Here Is How!

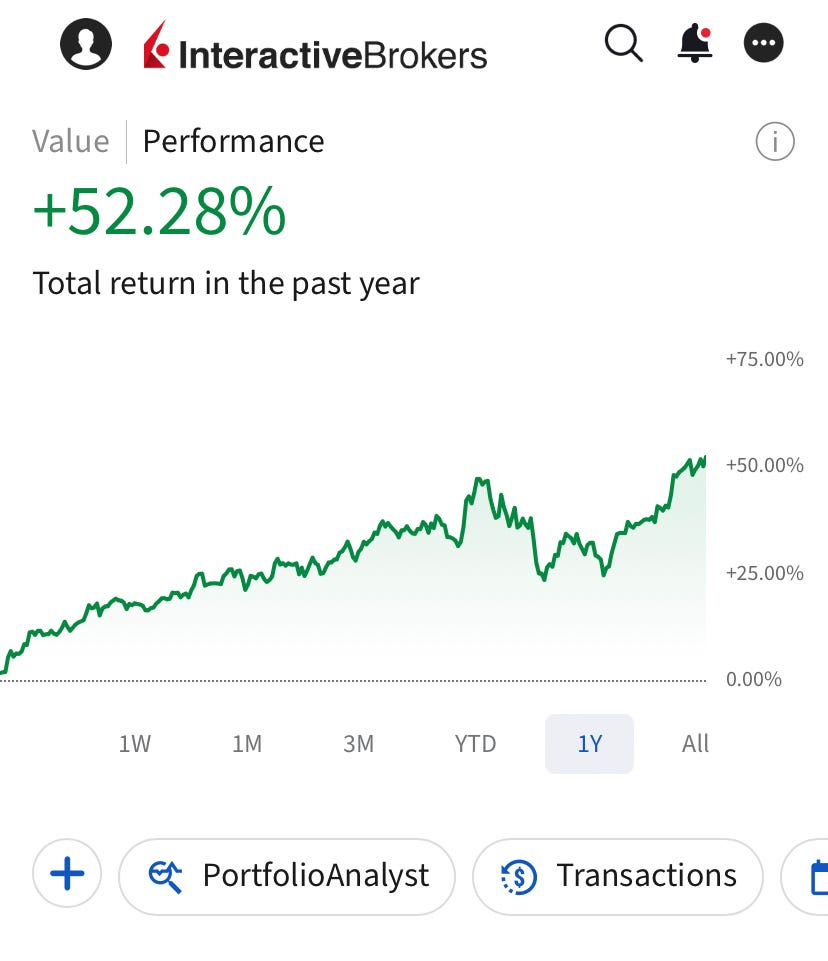

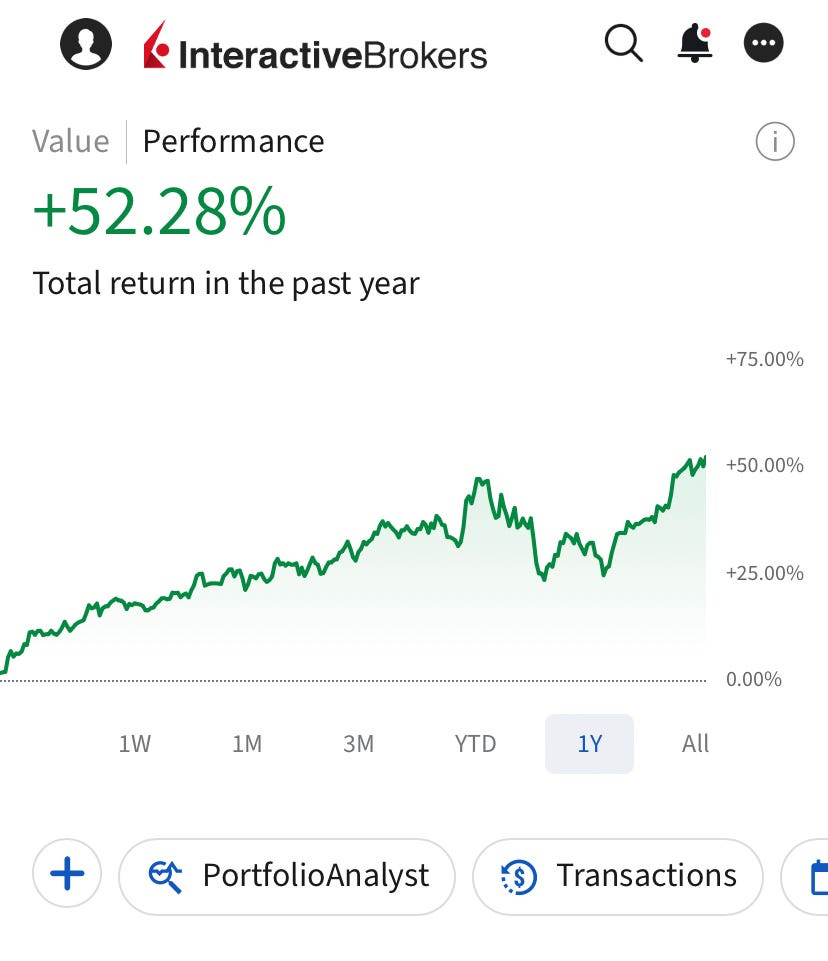

Our portfolio returned 52% last year against 35% of S&P 500. Here is what we own and our portfolio strategy.

Our portfolio is now outperforming the market by 17%!

Portfolio is now up 52% in the last twelve months against 35% of S&P 500!

I will explain our portfolio strategy, stocks we own and updates in a minute but let me tell you something very critical first: I noticed a very dangerous trend on Substack.

It probably exists well beyond this platform but reading other finance/investing newsletters on Substack helped me see it.

It’s thinking that a good portfolio is a compilation of your best ideas.

This probably explains, to some extent, why some investors with relatively good stock picking skills still underperform the market.

A portfolio is not just a compilation of best ideas, it must have a goal and strategy to achieve it. The stocks you pick should fit in that strategy.

If you determine that you have a low risk tolerance and picking your third best idea would disproportionately increase your risk exposure, then you might as well skip it and buy what better fits in your desired risk posture.

Otherwise you may easily end up with a portfolio that skyrockets some days and crashes on others so you won’t be able to see where it’s going.

This is not good investing.

Now, let’s see what we have in our portfolio!

OurPortfolio Strategy: Low-Risk, Above Market Returns

My portfolio strategy is constructed to maximize returns at every level of risk.

I use a barbell portfolio composed of foundational stocks and high-quality fast growers.

It is simple:

Buy exceptional quality companies when they are cheap due to a market correction, an industry recession or some temporary firm level problems.

Buy fast growing companies with strong balance sheets and limit the risk of permanent loss of capital.

When bought at right prices, these exceptional companies slightly outperform the market in the long-term, compounding at an average of 12-13%. Supported by the fast growing companies that outperform the market in good times by wider margins, the portfolio outperforms the market by far.

In bad times, these exceptional businesses play a stabilizing role in the portfolio and limit the downside risk. Fast-growers stay strong because of their solid balance sheets. They are poised to quickly recover when the market stabilizes due to their financial strength.

Result?

Our portfolio outperformed the market by 17%, delivering 52% annual return against 35% of S&P 500.

Following transactions took place in our portfolio in October:

Added two new positions. We now have 12 positions in total.

Added on 5 of our existing positions.

Trimmed 1 position.

In this update, I won’t just give you an overview but I will also explain how the positions we own fit in our portfolio strategy so you will see what I meant above.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

🎃Here is a 20% late Halloween discount, valid only until Monday 🎃

This Is Our Outperforming Portfolio!

We now have twelve stocks in our portfolio.