Oscar Health: A 100-bagger In The Making?

One of the most asymmetric opportunities in the market.

“How to find 100-baggers?”

This has been the central question for a group of investors who understood the power of this concept.

It is not for vain.

In the 1960s, the world was going through a generational technological transformation, much like the one we have today.

Today it’s the internet and AI, in the 1960s it was commercial computers, copy machines, photograph machines…

Today it’s Nvidia, Amazon, Google, AMD; in the 60s, it was IBM, Xerox, Polaroid..

Just like we have the Magnificent 7 today, in the 1970s, Wall Street came up with something similar— the Nifty 50.

There was a little disagreement on whether Walmart was a part of this gang or not. Though this may look like an immaterial question, it changes everything.

Walmart started trading on the NYSE in 1972, and it’s a staggering 2,000 bagger since then!

Now let me tell you something staggering— If you accepted that Walmart was 2% of Nifty 50 and all other 49 stocks went to 0, your investment in Nifty 50 would still compound at 13% annually since then, versus 10.7% of S&P 500.

This is how powerful having something like that in your portfolio!

As investors noticed the power of this concept, they started to opine on it, trying to come up with a methodological way to find 100-baggers.

Yet, all these books are more on quantitative criteria like return on investment, historical growth, etc…

Yet, most 100-baggers share one quality— they are disrupters!

Think about Amazon, Google, Meta, Apple…

You may say these are all tech companies. No, 100-baggers may be in boring industries, but they are still disruptive. Take Old Dominion Freight Line, which disrupted a very old and traditional industry by offering less-than-truckload freight.

This may look simple now, but it was revolutionary at the time.

Oscar Health is one of such businesses with 100x potential!

They are disrupting health insurance with a direct-to-consumer model.

They were backed by some of the most influential venture capital firms as Google Capital, Khosla Ventures, General Catalyst, Founder’s Fund, and Tiger Global, validating their disruptive potential.

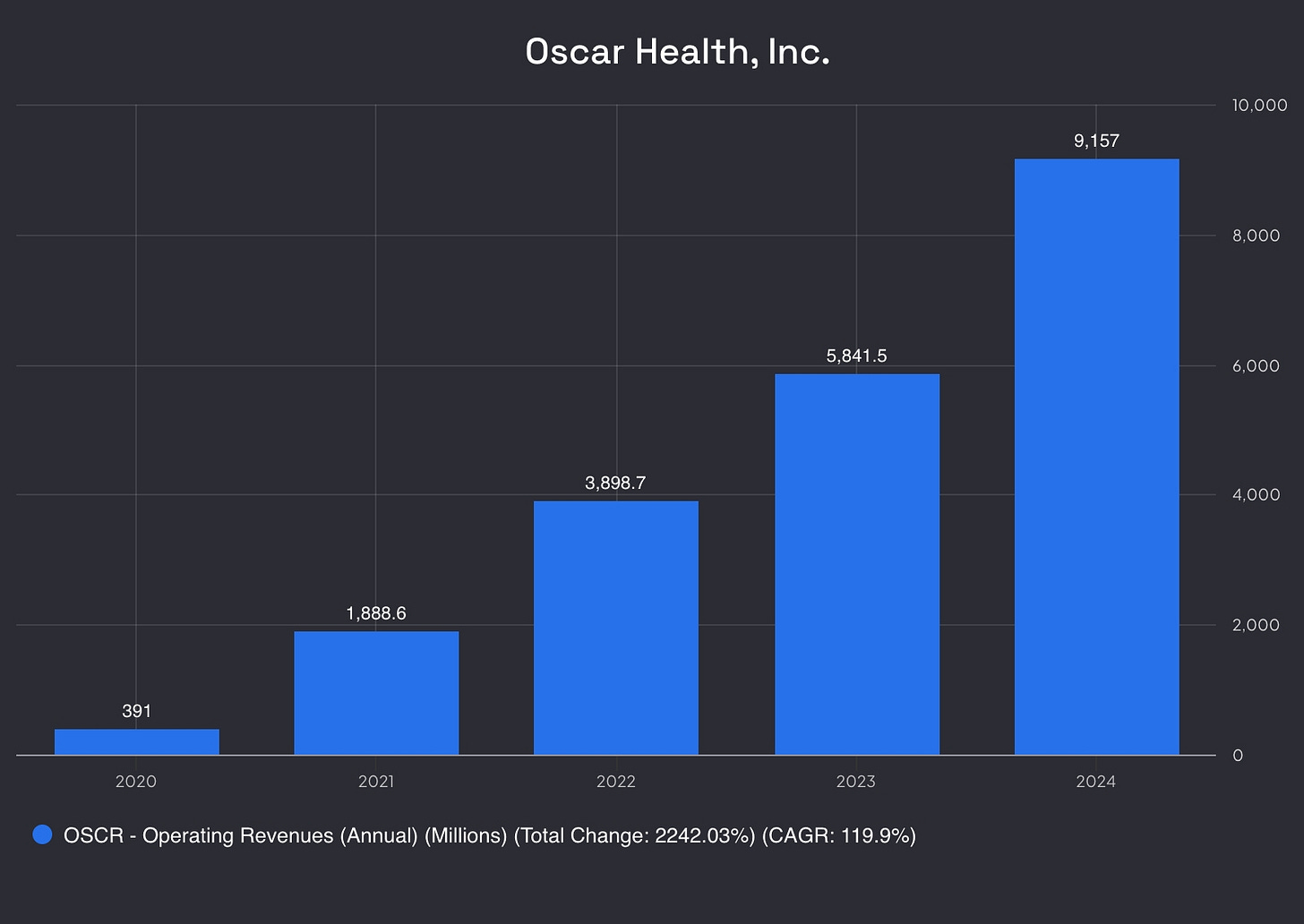

And they are delivering:

They have increased members from 100,000 in 2017 to 1.7 million in 2024.

Revenue skyrocketed from $200 million to $9.2 billion.

Medical loss ratio declined to 81% from 95%.

The question is simple— Can they keep delivering?

This is what we are going to discuss here.

So, let me cut the BS and dive deep into one of the most asymmetrical opportunities I currently see in the market!

What you're going to read:

1. Understanding The Business

2. Moat Analysis

3. Investment Thesis

4. Risks

5. Fundamental Analysis

6. Valuation

7. Conclusion

🔑🔑 Key Takeaways

🎯 Oscar Health is disrupting the health insurance industry with its tech-first, consumer-centric approach.

🎯 It’s growing fast. Members increased from 100,000 in 2017 to 1.7 million in 2024, while revenues surged from $200 million to $9.2 billion in the same period.

🎯 Their medical loss ratio of 81.7% outperforms industry giants like UnitedHealth (85.5%), Cigna (87.9%), and Elevance (86.4%), demonstrating superior cost management.

🎯 It faces political risk related to the ACA marketplace and lacks vertical integration, but its strong financial position with $774 million in surplus capital provides flexibility for future growth.

🎯 At its current $3 billion valuation, it’s an asymmetric opportunity with potential for 5x returns in 5 years under conservative estimates, making it attractive for a small position in a diversified portfolio.

🏭 Understanding the Business

Venture Capital is an amazing place to start learning about 100-baggers because the whole business model is based on this concept— you make 100 investments, 99 go to 0, and 1 returns your whole portfolio a few times.

There is a specific type of company that venture capital sees as a potential 100-bagger:

Founder solves a problem he had in the first place.

It solves it way better than the available alternatives on the market.

This signals two important virtues.

If the founder has the problem himself, probably millions of people also have it.

People are already paying for inferior alternatives to solve it, so they could pay more for a better solution.

This is exactly what Mario Schlosser did with Oscar!

It was 2012. His wife was pregnant with their first child.

Like any responsible father-to-be, he wanted to ensure his growing family had excellent health coverage.

What seemed like a straightforward task turned into a frustrating ordeal.

The insurance plans were unnecessarily complex. Customer service was abysmal. The pricing was completely opaque.

Most concerning was that he couldn't get straight answers about which doctors were in-network. Every call yielded different information.

Schlosser, who had degrees from Stanford and Harvard, yet couldn’t wrap his head around the US healthcare system.

"The whole system felt designed to confuse and extract money from people, not help them."

In this inefficiency, he saw an opportunity.

He reached out to his friend Josh Kushner, who was already running Thrive Capital. Kushner had been thinking about healthcare inefficiencies, too.

Together with Kevin Nazemi, they decided to build a health insurance company from scratch—one focused on technology, transparency, and the customer experience.

They named it Oscar after Kushner's great-grandfather.

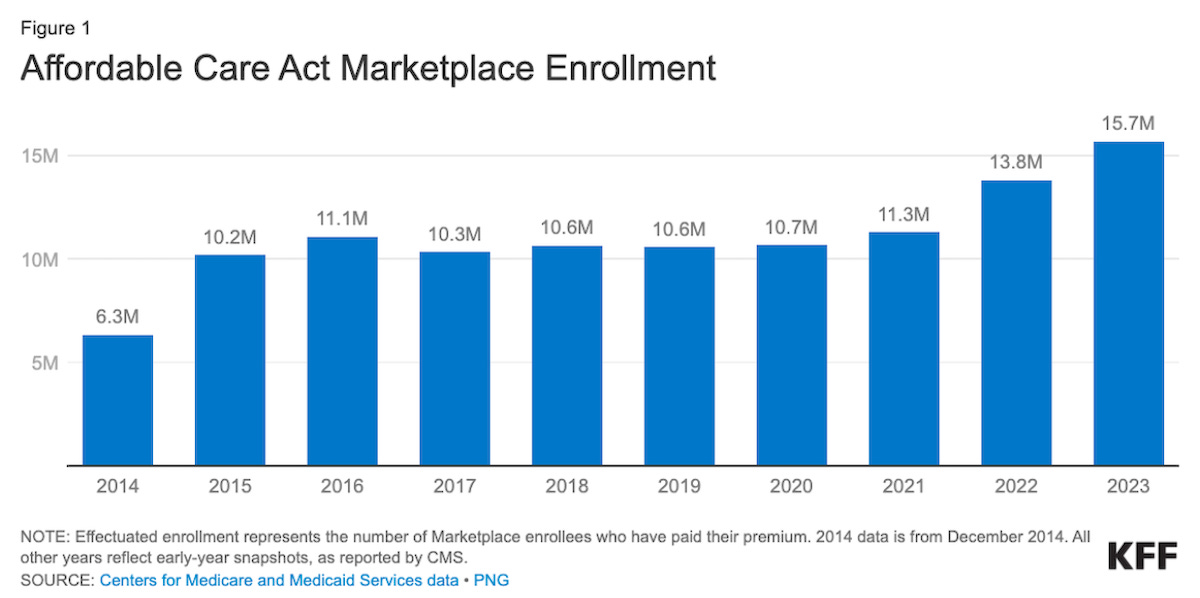

The timing couldn't have been better. The Affordable Care Act (ACA) had just been enacted. It was about to create a whole new marketplace for health insurance.

Before the ACA, low-income childless adults effectively had no option for affordable health insurance, as they were mostly excluded from Medicaid coverage.

For those who were eligible (low-income children, pregnant women, and individuals with disabilities), Medicaid plans weren’t generally sufficient, as they were standardized, government-sponsored plans provided by private healthcare companies. Optionality was very limited, and out-of-state non-emergency care was nearly non-existent.

ACA created a whole new market.

It determined some essential benefits that most plans must cover.

It created a new marketplace to buy health insurance with government subsidies.

This way, low-income individuals could buy health insurance directly from providers, and a percentage of their payment would be covered by government subsidies.

Eligible individuals just needed to purchase their plan on marketplaces created separately in each state.

The demand skyrocketed!

The Oscar team knew this was their chance to get traction in a very competitive industry. If they tapped into marketplaces, they would be like the first sellers on the Amazon marketplace.

They adopted a fully digital business model focused on providing fast, cheap, and consumer-friendly service that would step ahead of others in the marketplaces.

This was the right model; within just one year, they enrolled over 40,000 members and reached $180 million in revenue!

So, how is Oscar different from other health insurers?

Traditional insurers operate on what I call the "black box" model.

You pay your premium, and in return, you get an insurance card and a confusing booklet explaining your benefits. When you need care, you're mostly on your own to navigate the system. If you have questions, you call a 1-800 number and speak with a representative who often has limited access to your specific information.

The entire experience is reactive, transactional, and frustrating.

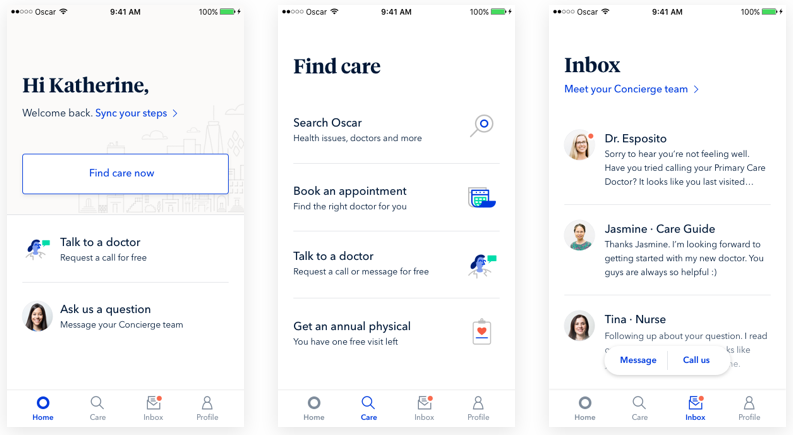

Oscar is completely reinventing this approach through the "healthcare as a service" model.

They created a cloud-native platform that users can:

Buy insurance in 5 minutes.

Send a direct message to a personalized concierge to find the right doctor and learn about costs.

Schedule virtual visits mostly for $0 additional contribution.

Get personalized care recommendations based on your past.

File and track claims, see bill explanations, and pay bills.

In sum, Oscar’s platform was designed as something that would provide end-to-end healthcare service.

This is a genius model.

Why?

Because traditionally, health insurers only have a few options to enhance profitability—they either raise prices or cut costs.

For decades, they thought they didn’t have real control over costs as the medical activity rate was out of their control. Thus, when activity rates increased, they tightened standards for claim approval, which gained the industry its infamous reputation.

The interests of the insurer and the insured were misaligned.

Oscar recognized that the real way health insurers can boost profits is by keeping their clients healthy and thus reducing activity rates. Their revolutionary assumption was that the technology now allows for creating such a relationship between the insured and insurer.

They call this “Total Cost of Care.”

Instead of avoiding activity at all costs like traditional insurance, Oscar prompts clients to take small actions to avoid further big activities.

An example? If you have a chronic disease, it prompts you to schedule an appointment regularly with a provider to keep it under control to avoid deterioration that could result in a major surgery.

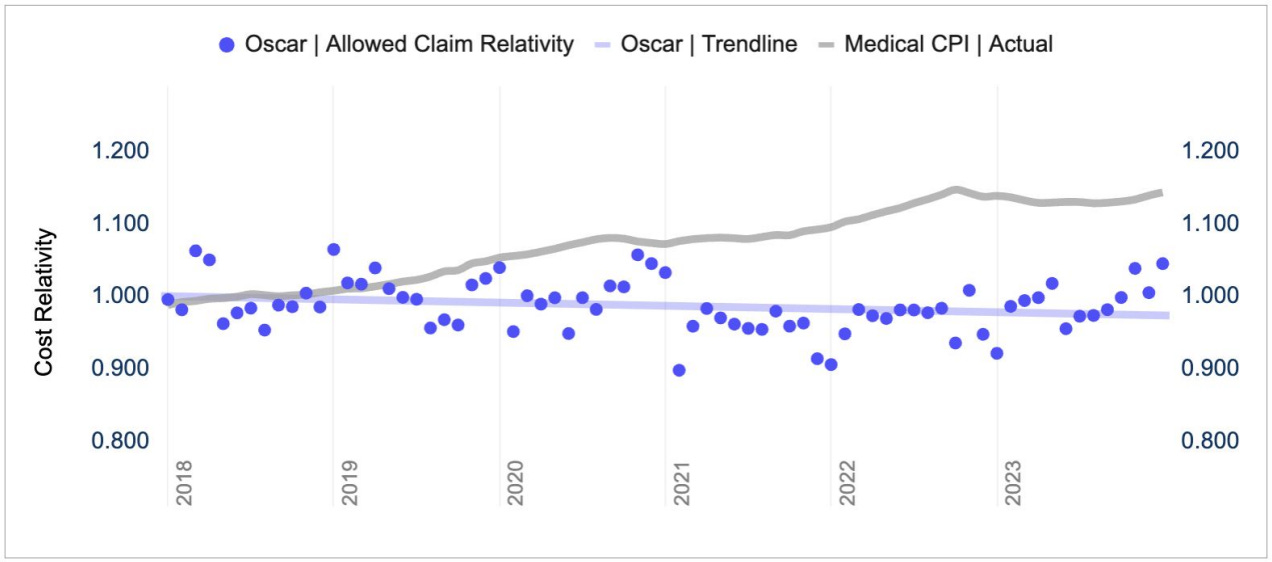

Result? Their claims cost is growing much slower than the medical inflation rate.

This is why it’s a 100x opportunity.

It solves a problem millions of Americans have, and it solves it better than others.

The question isn’t whether it’s working or not; it’s whether they have the durability to provide investors with outsized returns.

For reference, an average 100-bagger takes 20 years to get there.

Does Oscar have the competitive strength to endure in one of the most competitive industries dominated by behemoths?

🏰 Competitive Analysis

Insurance is a competitive industry, and it’ll always be.

In a no-winner-takes-all market, there could be only two sources for competitive advantage:

Differentiation.

Lower costs.

In healthcare, possibilities for differentiation are limited. Most services are essentially the same and standardized, mostly because of the well-known costs and heavy regulation. There is no brand power.

In such an environment, all advantage comes at to cost.

Yet, cost isn’t just a number, as most people think, it’s two-dimensional.

Lower cost for the same service.

Higher service quality for approximately the same cost.

The whole Oscar system was engineered to pull these two levers to the maximum extent possible.

Oscar rebuilt every core insurance workflow — policy admin, claims, network contracting, care navigation, and member CRM — on a single cloud-native platform.

It uses this platform to execute its “Total Cost of Care” approach.

This approach is based on prompting small patient activities to avoid further big claims that put the real pressure on the system. In short, it wants to keep you healthy.

Once onboarded, every member is assigned a mini-team of Care Guides plus a nurse, accessible by chat or phone. This team tracks your chronic diseases, check-up schedules, and directly answers your questions through the messenger module built in-app.

Result?

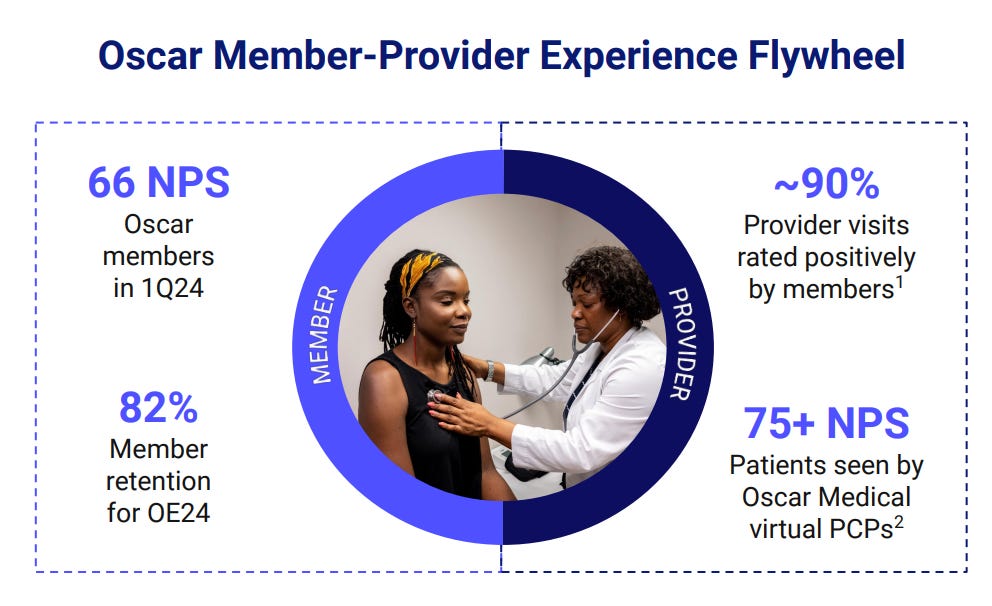

Oscar has the industry-leading Net Promoter Score (NPS) of 66, while industry giants such as UnitedHealth and Kaiser Permanente have an average score of 48 and 42.

This approach doesn’t just boost customer satisfaction, it also allows Oscar to significantly reduce its medical costs.

In Q4 2024, Oscar reported a medical loss ratio of just 81.7%!

For comparison, industry giants have much higher loss ratios:

Cigna: 87.9%

Elevance: 86.4%

UnitedHealth: 85.5%

It doesn’t just stop here…

Its digital platform allows it to process claims, handle billing, and provide customer service in a streamlined way with the help of AI. This reduces operational costs. SG&A expenses took 24.3% of the revenue in 2023, and this declined to 19.1% in 2024, while the industry average is 20%. Management targets below 16% by 2026.

These cost savings will allow it to offer lower prices than its competitors as the company matures.

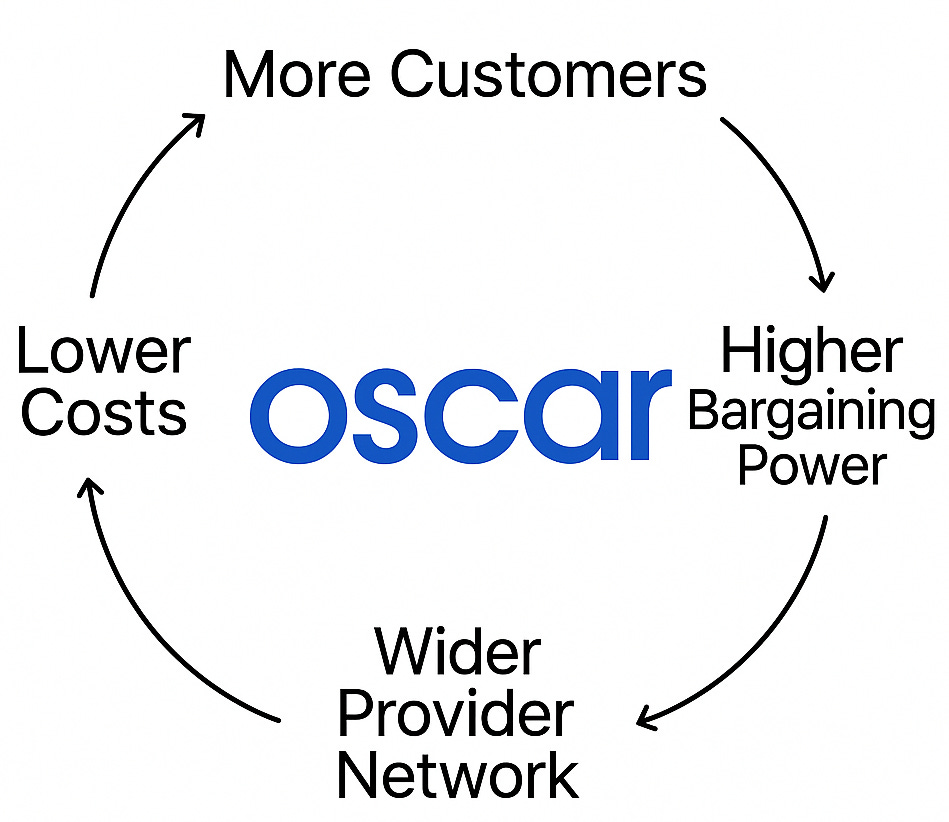

As its customer base expands, its bargaining power will grow, resulting in a wider provider network and lower prices. It can again pass some of these cost savings to customers, effectively creating a Costco-like flywheel.

Now… Is this enough competitive strength to mature into a healthcare behemoth?

Let’s be realistic, it’s not. But this is exactly why it could be a 100-bagger in making rather than an actual 100-bagger.

Oscar’s biggest weakness is the lack of vertical integration.

The largest health insurers like UnitedHealth, Cigna, and Elevance are vertically integrated. They own either medical centers to provide services or pharmacy benefit managers (PBM). Some of them, like UnitedHealth and Cigna, own both.

When you scale to dozens of millions of members in a highly regulated industry with laser-sharp margins, a few bucks that you save by managing your own pharmacy benefits or providing some of the hospital services make all the difference.

Oscar currently only owns a primary care service.

If it wants to scale into a $100 billion company, it has to invest in vertical integration.

But this is exactly why they shifted Mario Schlosser to the CTO role and brought an industry veteran, former Aetna CEO Mark Bertolini, as the current CEO.

He has one critical mission:

Oscar wants him to use his old connections to bring in a few large employers as customers. This is how they will break out of a small B2C provider and into a big league.

This is not an option, it’s a necessity. Otherwise, it will forever stay as a small B2C provider in primarily feeding on the ACA marketplaces.

If they can execute on that, they could reach a scale where they can afford further vertical integration by acquisition of medical centers and building a PBM.

Can it do that? Why not! But there is no guarantee.

The current competitive position is enough to guarantee fast growth for the next 5-6 years by expanding in the ACA market, but for further scale, it needs vertical integration.

📝 Investment Thesis

My investment thesis for Oscar is primarily based on two pillars.

➡️ The addressable market is huge.

As of 2024, there were 21 million people enrolled in ACA marketplace plans.

Oscar currently has only 1.7 million members.

Yet, this is only a small portion of the total prize.

The real prize in the ACA market is Small and Medium-Sized Businesses (SMB).

Healthcare benefits are becoming increasingly expensive for these employers. As a result, coverages shrink and employers are effectively paying for plans that have very little utility for employees.

Instead, employers can design ACA-compliant plans with providers, leave the selection of the plan to employees, and reimburse them for their contributions. This way, an employee can pick the most comprehensive plan with little out-of-pocket contribution, as the rest will be reimbursed by the employer and subsidized by the government.

This is a great win-win scenario, and this is exactly why it’s a huge market.

The SMB market adds approximately 75 million eligible individuals to Oscar’s total addressable market. The total number of employees offered reimbursed plans increased by 170% from 2022 to 2023.

Even if it can’t tap into the big employer market soon, the current total addressable market has nearly 100 million individuals. This is a $300 billion market opportunity.

This may not be enough to make it into a 100-bagger, but it’s sure enough to make it into at least a 10-bagger.

➡️ Profitability will improve as costs decline.

It already has one of the leading medical loss ratios in the industry, with 81.7%.

The management is targeting 80% in 2027, though given that they are very close and their claims cost is increasing at a slower rate than healthcare inflation, they can reach this target by the end of this year or 2026.

Further, SG&A expense ratio will rapidly decline as fixed investments disperse over a wider customer base. We can already see this happening:

Their fixed expenses were 40% of all SG&A in 2023. This declined to 30% in 2024.

As the total share of medical losses and SG&A in revenue declines, profitability will rise, which will also result in a multiple expansion.

This is a recipe for outsized returns.

🚨Risks

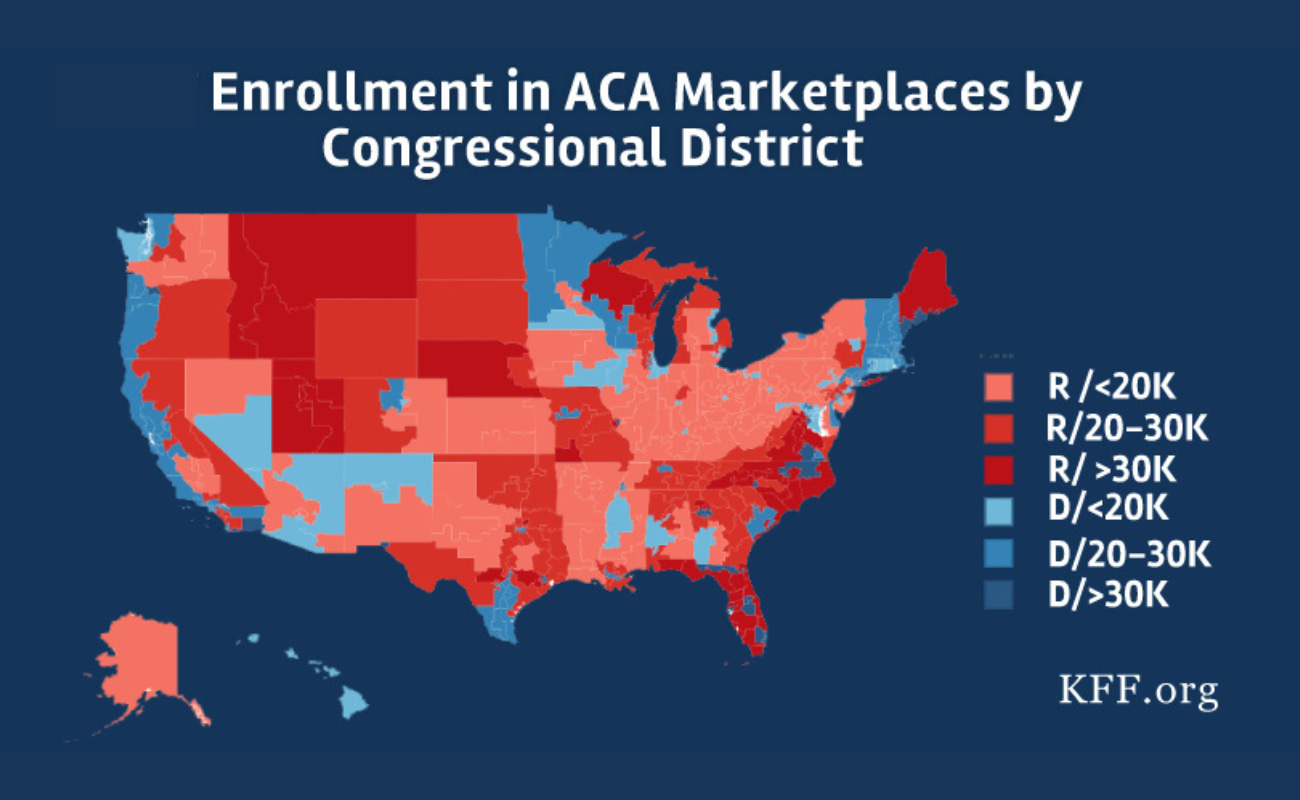

Oscar operates in a market that was created by a political will rather than market forces—there was nothing like an ACA marketplace before Obamacare.

This means that it’s also vulnerable to political actions in the other direction. This is increasingly a possibility as Republicans now hold the presidency, the House, and the Senate.

Yet, Trump repeatedly said that he is not looking to repeal the ACA; he wants to revise. A direct attack on the ACA could politically hurt Republicans, as most enrollees are in Republican districts.

Thus, I don’t believe Republicans will directly target and try to repeal the ACA.

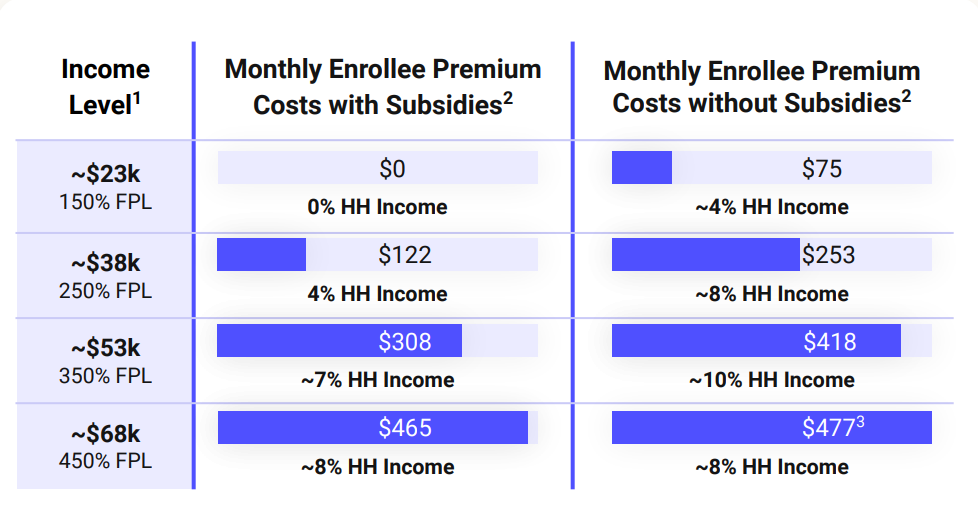

What’s more likely is that they will let go of enhanced subsidies.

Enhanced subsidies were brought under the American Rescue Plan Act of 2021, which was passed to help offset economic problems created by COVID-19.

The act increased the percentage of subsidies, so individuals had to pay less out of pocket. This caused a significant increase in ACA enrollments, and providers like Oscar benefited from it.

Enhanced subsidies expire at the end of this year, and there is a substantial chance that Republicans won’t extend them.

If this happens out of out-of-pocket payments for marketplace plans will significantly increase:

This will reduce enrollment and naturally decrease growth rates for providers like Oscar.

The management expects that, if enhanced subsidies expire, the total addressable market will shrink by 7 million individuals.

Management expects $2.2 EPS in 2027 without enhanced subsidies, with possible upside if enhanced subsidies are extended.

Thus, though enhanced subsidies are a factor, the business doesn’t depend on that as many people understand. It was founded and growing way before enhanced subsidies.

However, it depends on the survival of the ACA.

Though there is no guarantee the ACA will survive indefinitely, given the composition of beneficiaries, I don’t believe it’ll be repealed soon.

📊Fundamental Analysis

➡️ Business Performance

It just deserves one word: Stellar.

This company grew revenues at a staggering 80% annual rate since it became public in 2021!

This growth stems primarily from increasing membership, which grew from around 250,000 in 2019 to 1.3 million by Q1 2024.

This was because many providers like UnitedHealth retreated from the ACA market between 2016-2020 because of heavy losses and regulatory scrutiny, as the first Trump administration had promised to repeal the ACA. Yet, Oscar persisted, stayed in the market, built its offerings and footprint, and reaped the reward in the Biden era.

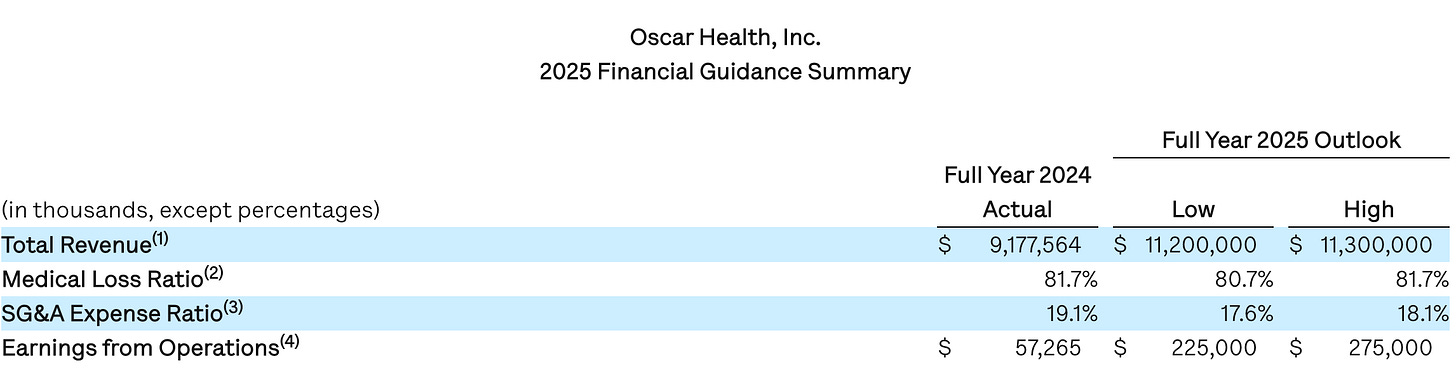

Further, it finally became profitable last year, posting $0.10 EPS for the full year.

What’s even better is that it’s guiding for around 22% revenue growth, medical loss ratio improvement of 100 basis points, and at least $225 million earnings from operations calculated as total revenues less total operating expenses.

In sum, the past performance was as good as it could get, and the guidance remains solid despite the challenges associated with the new administration’s views on the ACA.

What else can an investor expect from a healthcare startup? It’s as good as it gets.

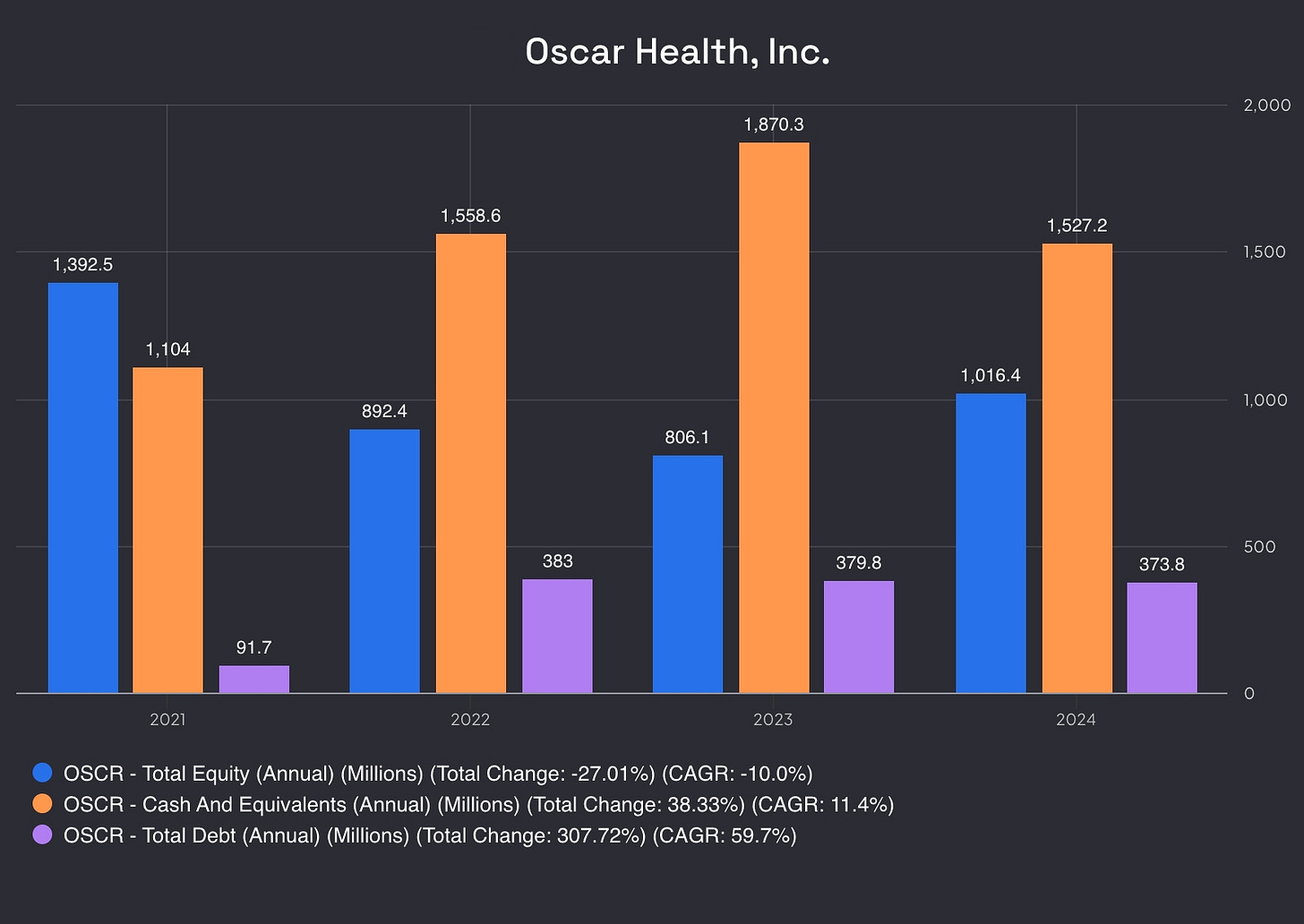

➡️ Financial Position

As a health insurer, Oscar doesn’t have much leeway in managing its finances, but still, its financial position is way ahead of industry standards.

It has around $1 billion in total equity against just $374 million in total debt. Further, if we take management’s 2025 guidance as a reference, this year’s EBITDA will probably be enough to pay the whole debt in under a year.

However, if you dig deeper, you see it’s even stronger than it looks on the surface…

Look at its cash position, you see how big it is?

Its combined statutory capital + surplus climbed to $1.24 billion in 2024 (up 55 % YoY) and now sits around $774 m above the minimum regulatory threshold.

This means that Oscar can ask state insurance commissioners to free up some of this money as an extraordinary dividend to the parent, and then it can use it to propel growth.

If the growth stabilizes this year and after we have some clear sight about enhanced subsidies, Oscar will likely draw some of this money and invest in growth.

This means that it’s actually in a way better situation than it looks. Its finances are not just rock solid, but also big enough to provide it with strategic flexibility.

➡️ Profitability & Efficiency

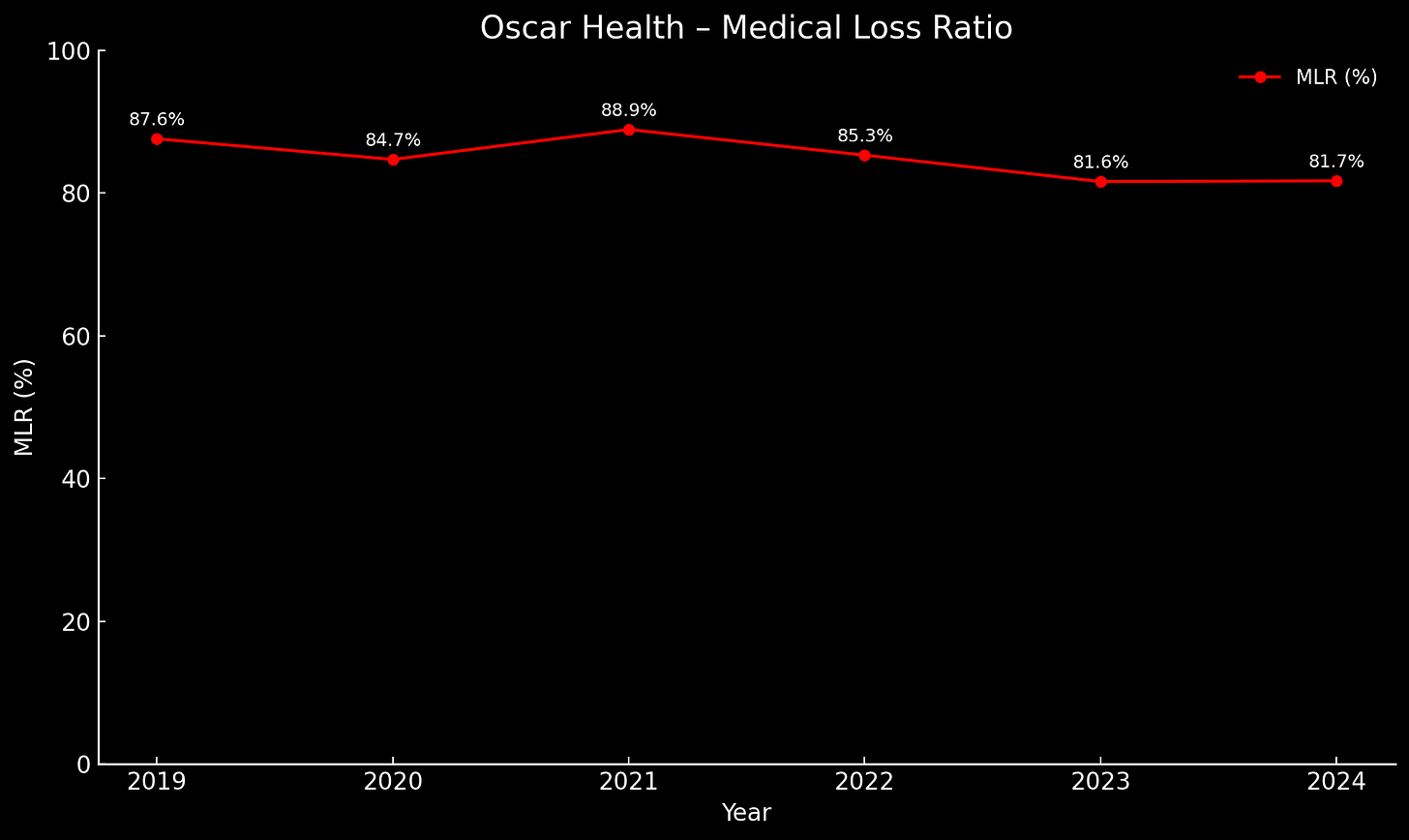

Medical Loss Ratio (MLR)

Oscar’s constantly improved in the last 5 years.

It gradually declined from 87.6% in 2019 to 81.7% in 2024.

This tells us that the company is getting leaner and more efficient in providing service to its clients. This is a direct consequence of its Total Cost of Care approach and proves that it’s working.

This is already below industry giants like UnitedHealth, Elevance, and Cigna.

The management guidance is expected to be around 80% by 2027. This might look like a little change at first sight, but health insurance is an industry of razor-thin margins. Cigna, Elevance, and Humana are all operating with around 2-3% net margins.

In such an industry, around 1% improvement in MLR will make a huge difference in profitability, and Oscar is getting there.

Combined Ratio

Combined ratio is calculated as the sum of medical losses and administrative expenses divided by total premiums revenue.

While MLR shows the service efficiency of the business, the combined ratio shows its overall underwriting profitability.

Oscar’s combined ratio has steadily improved since it became public in 2021:

The jump in 2024 is due to Oscar’s change in reporting administrative expenses. Previously, it was calculating the combined ratio based on administrative expenses related to InsuranceCo. In 2024, it changed this to report a single SG&A expense. If it wasn’t for that, the number would be well below the current 100.8%.

In short, it’s going in the right direction and will keep improving as the business matures.

📈 Valuation

This is the most interesting part.

Oscar’s valuation is unexpectedly cheap relative to its past performance and the management’s guidance.

Management expects 20% revenue CAGR in the next 3 years.

Even if we remain conservative and predict that growth will slow down a bit 2 years after that, we can still assume around 17% annual revenue growth for the next 5 years.

This will give us $21 billion in revenue for the FY 2030.

Oscar may have a way better profit margin than leading industry peers like UnitedHealth due to its already lower MLR ratio and declining SG&A ratio.

Yet, even if we assume that its net margin will be only as much as that of UnitedHealth’s, which is around 5%, we can assume $1 billion net income for FY 2030.

Give it a conservative 15 P/E, and we have a $15 billion company, roughly 5x of today’s valuation.

Discounting it back to today at 10% will give us a valuation of $9 billion, yet it’s only trading at $3 billion.

The reason for this discount is its dependence on the ACA and the Republicans’ long-standing aspiration to repeal it.

If the ACA is repealed, Oscar will have a hard time even surviving. However, if not, it’s a big bargain.

The question is whether a 66% discount is enough to assume such risk.

It depends on how big a position you could take. It’s too much of a risk to make it 10% of the portfolio, but I believe it’s a nice risk/reward proposition at 1-2% of the portfolio.

I am in.

🏁 Conclusion

In his book, 100 Baggers, Christopher Mayer notes that an average 100-bagger takes 20 to 25 years to get there, driven by constant revenue growth and some multiple expansion.

Healthcare is a giant trillion-dollar industry ripe for disruption, and Oscar is taking on this task. This means that, if it can endure, there is a very, very long runway for growth.

For comparison, UnitedHealth was founded in 1977, yet it still delivered around 10% annual revenue growth in the last decade.

So, what would it take for Oscar to become a 100-bagger?

Let’s do a quick napkin math:

If it grows revenues by around 16% annually for the next 10 years, we will have a $40.5 billion revenue in 2035. In the next 15 years after that, just 13% annual revenue growth will get us to $253 billion in revenue.

At that point, with a 6% net margin and some multiple expansion to 20 because of size will get to a $303 billion valuation, just over 100x.

Can it do that?

Well, the top 3 big health insurers, excluding UnitedHealth, are all valued at around $100 billion today. If we assume that they will grow just 1% faster than expected long-term medical CPI, which is 3.5%, they will all reach a $300 billion valuation in 25 years.

This makes the bet clear— Can Oscar become one of the top 5 healthcare providers in the US 25 years from now?

Well, there is a 1% chance it can do that.

However, as Jeff Bezos said, if there is a 1% chance for 100x returns, you should take that bet every day.

Even if it doesn’t get there, this company has an amazingly attractive return potential for the next 5-10 years.

I would buy on the short-term promise, and decide whether to sell and keep holding on the way. Meanwhile, I would keep it very small in the portfolio, knowing that there are serious risks.

If the risks materialize, you don’t lose much; if they don’t, the business is valued at a very deep discount that even a 1% position will move the needle substantially.

Interesting and promising pitch. I’m curious to hear what others think about Oscar Health. I’m considering investing in it.

This article is excellent—it clearly lays out Oscar Health’s disruptive potential in the health insurance industry.

I would like to add another perspective: To fundamentally solve the problem of low profitability in health insurance, it’s not enough to engage patients more deeply—insurers must influence the value structure of the therapies themselves and promote outcome-based pricing.

Oscar’s strength lies in its platform, data, and user interface. But to grow into a true healthcare giant, the next step should be to vertically integrate therapies that offer high-value care at low cost.

Take cancer treatment as an example. The current mainstream approaches rely heavily on high-cost, often low-yield therapies (chemotherapy, targeted drugs, immunotherapy). No matter how much insurers try to control costs, it’s hard to change this structural burden.

But if Oscar were to partner with a truly cost-effective, disruptive therapy, it could reshape the entire value proposition. For instance, I have developed an Intra-Tumoral Chlorine Dioxide (ClO₂) Injection Therapy—a novel treatment that involves direct injection into solid tumors, causing rapid necrosis. It has no systemic toxicity, extremely low production costs, requires only outpatient procedures, and delivers significant clinical outcomes.

This therapy introduces the possibility of outcome-based pricing in cancer care. We are currently launching clinical studies in Mexico, Germany, and Italy, with plans for a 1,000-patient clinical trial in the U.S. Preliminary results show stable efficacy, good safety, and ultra-low cost.

If Oscar were to support, integrate, or even invest in such a therapy, it could lead the way in building a value-based oncology care ecosystem. This would not only reduce Total Cost of Care but unlock an entirely new avenue for profit growth.

In short, Oscar’s next leap forward might not come from acquiring hospitals—but from partnering with therapies that redefine the cost-effectiveness frontier. If they are first to integrate such innovations, a 10x return might come sooner than expected.