Nebius: Under The Radar AI Infrastructure Stock Poised For 600% Revenue Growth!

Market still ignores it but institutions doubled their position last quarter.

“It should be a fast growing business in a fast growing market and it should have a competitive advantage.”

This is what it takes to become a multi-bagger stock in a short period of time.

It was early February when I came across such a stock.

One of our members posted to our Discord group a stock that I had never heard of until then. This is an advantage of being in a high-quality community.

I started reading it and everything looks amazing — triple digit growth, strong financial position, backed by reputable investors…

Then I saw the guidance, it was mind-blowing!

The question became clear: Can it execute to that scale?

I looked at the CEO and my amazement doubled!

He is one of the best entrepreneurs of his generation. He successfully caught all the coming waves in the last 40 years — personal computers, internet, mobile applications and now AI.

I am now reading everything I could take my hands on about the CEO and I am convinced they can execute.

This is real.

Yet, only one analyst follows the stock with a buy rating and the rest of the Wall Street seems to ignore it. They can ignore it only so far.. Institutional ownership already doubled in the last three months.

This stock will become a multi-bagger in days once other institutions start accumulating.

Here are some metrics for you:

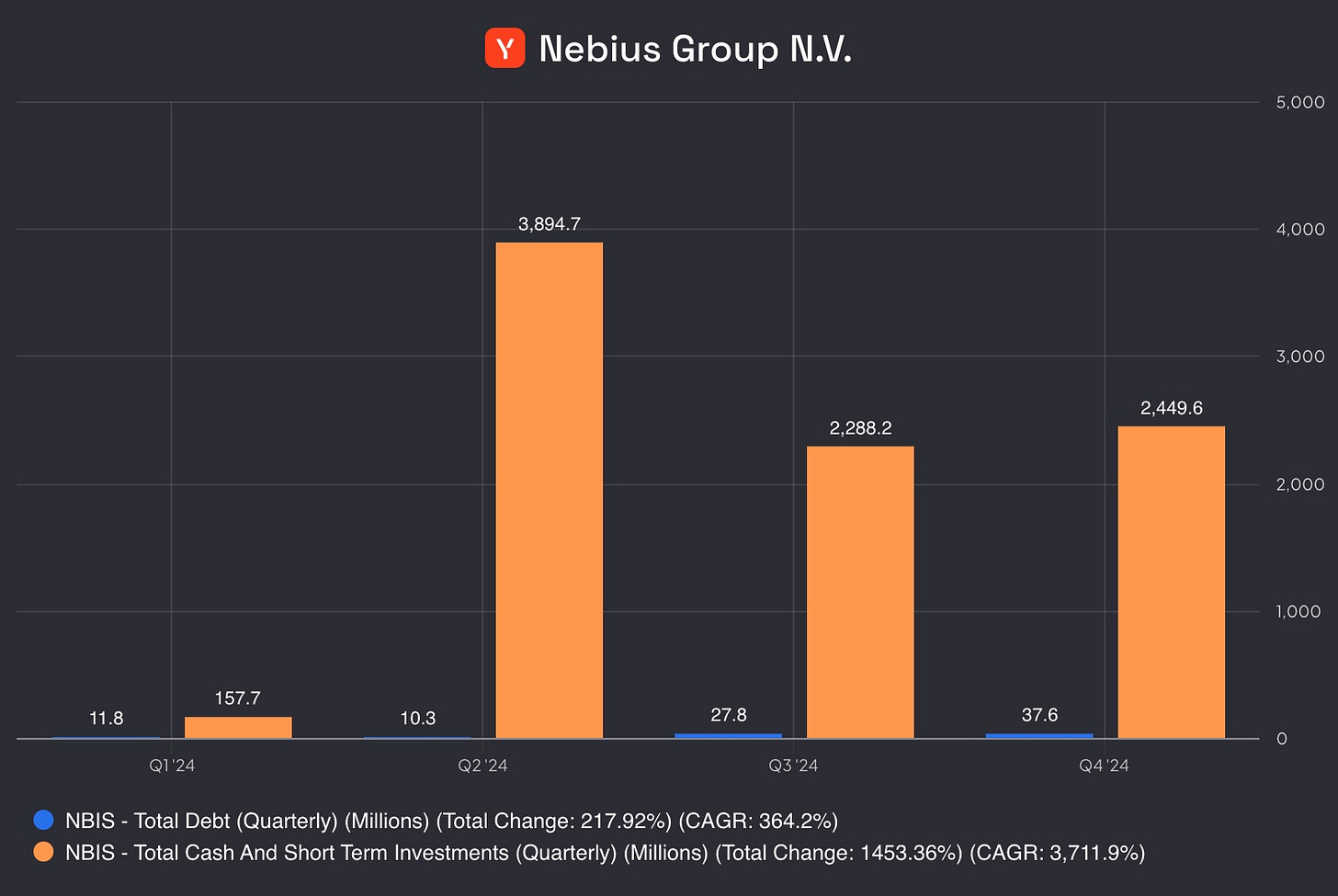

No debt with near $2.5 billion cash on hand.

Investing $1 billion in growth this year.

It is set to quadruple capacity by 2026.

And lately management has publicly confirmed that the annual recurring revenue is on course to increase sixfold this year…

So, let me cut the BS and dive deep into this gem!

Background

There are few entrepreneurs who caught multiple of the upcoming tech waves in the last fifty years — Steve Jobs, Jeff Bezos, Jensen Huang…

He is one of them.

Personal computers, internet, mobile applications…

When we see a man who captured just one of these waves, we say — “wholly fuck, what a great visionary.”

Arkady Volozh caught all of them.

He studied applied mathematics at the Gubkin Russian State University of Oil and Gas in Moscow, graduating in 1986. Post-graduation, he landed at a state-run pipeline research institute. It was a dull gig for him, he hated crunching data for oil and gas flows.

But it was a great period for any Russian to join the workforce. The Soviet Union was crumbling and gradually opening up to the world.

It was a chaotic period.

Arkady saw opportunity in that chaos. He noticed that the Soviet Union was short of a critical technology that was pervading the West — personal computers.

He started importing computers from Austria in 1988 and later founded CompTek in 1989 that would become one of Russia’s biggest distributors of network and telecom gear.

By the early 1990s, he was one of the youngest self-made millionaires in Russia.

Most people would have stopped there. He didn’t.

His eyes were on a rising critical technology — search engines.

He teamed up in early 1990s with Ilya Segalovich, a geophysicist friend from school who could code like hell. They built tools to dig through unstructured data—patents, Russian classics, even the Bible.

By 1993, they’d cracked Russian morphology making their search engine smarter than the clunky Western ones stumbling over Cyrillic.

In 1997 SofTool Exhibition, they unveiled their search engine —Yandex.ru

To appreciate his vision, consider this: The guy had already created one of the largest tech companies in Russia, then he created a search engine and Google wouldn’t still launch until a year later and it wouldn’t create its Russian site until 2003.

He wasn’t a bit early in the game, he was early by years.

By 2000, Volozh ditched CompTek’s CEO chair to focus on Yandex full-time. The timing was perfect. Russia’s internet was exploding. Yandex grabbed over 50% of the search market by the mid-2000s, outpacing Google with local smarts — maps, traffic, ads, all tuned to Russian life.

He headquartered the company in the Netherlands in 2004 to emphasize a global mission and to take advantage of Netherland’s favorable tax laws and agreements with more than 90 countries.

Yandex made its IPO in 2011 and raised $1.3 billion. This was unprecedented for any European company. His personal stake reached $1.5 billion.

Honestly, most people would have stopped there. This was his second hit after CompTek. He wasn’t just wealthy, he had also proved himself that his success wasn’t luck.

Yet, he was still looking at the next curve.

We understand this from Yandex’s registration statement filed with SEC pre-IPO👇

As early as 2011, they were thinking about building data centers — and so they did.

They opened their first data center in Finland in 2014.

The company’s valuation surged to $31 billion in 2021. At the time, it had over 55% share in the Russian search market and had grown into a tech ecosystem with applications like maps, ride-hailing (Yandex Taxi), food delivery, cloud computing.

Then came 2022. Russia invaded Ukraine.

More than 90% of Yandex’s revenue came from Russia, subjecting it to scrutiny.

Trading of YNDX shares on NASDAQ was halted on February 28, 2022.

Arkady was personally sanctioned by the EU.

Russia also imposed a rule requiring companies from “unfriendly” nations (like the Netherlands, part of the EU sanctioning Russia) to sell assets to Russian entities at a 50% discount in case of a divestiture. This slashed Yandex’s valuation for any exit.

The Kremlin also pushed to keep strategic tech like Yandex’s search and services under Russian control, adding pressure to split the company.

In February 2024, Yandex N.V. agreed to sell its Russian businesses—about 95% of its revenue—for $5.4 billion to a Russian consortium called Consortium. They paid $2.5 billion in cash and the rest in Yandex shares.

Yet, Arkady kept the international assets — most notably the data center in Finland and Yandex Cloud.

Post divestment, the Dutch parent company —Yandex NV— changed its name to Nebius and got the ticker NBIS in Nasdaq.

This is how Nebius came into existence.

Business Overview

Throughout 2024, they recreated the old Yandex cloud platform into a brand-new AI centric cloud platform while increasing their data center capacity.

They closed a $700 million investment round in December 2024 — investors include Nvidia, Accel and Orbis Investments..

Nvidia partnership is especially important. It helps them to secure cutting edge GPU supply as Nvidia comes up with new chips. It’ll be one of the first companies implementing Nvidia GB200 chips.

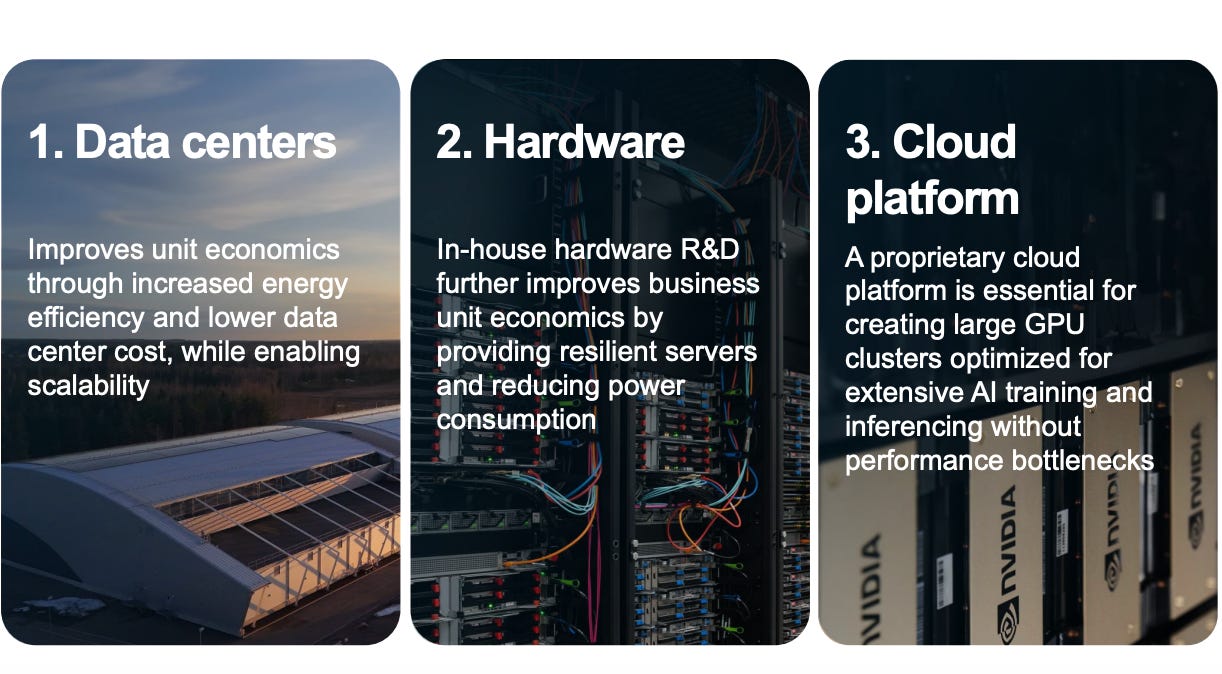

Its data centers equipped with the most cutting edge GPUs and AI centric cloud platform built on it allows it to position itself as a full-stack AI infrastructure business.

Most people get perplexed and intimidated when they see this — “What the hell is an AI infrastructure business?”

It’s a combination of enabling technologies for running AI applications and creating models.

Think of it like a business that has an energy central, creates its own power stations and lines and operates an electricity grid.

The only difference is that instead of electricity, data centers create something special called tokens — the smallest unit of data that AI models process.

Just as energy centrals produce electricity, data centers create tokens using compute power i.e GPUs.

Electricity generated is transferred to grids through transmission lines. Nebius has in-house server designs for ultra fast data transfer.

Then the grid ties everything — transmission lines, substations, and distribution systems — together with the infrastructure to move and manage electricity. Nebius has its cloud business, where end users come and buy compute as a service.

How does it make money?— Just like electricity centrals.

Electricity centrals either sell a portion of their capacity to other buyers, or they can distribute it themselves.

Imagine an energy central in Los Angeles that is also a distributor of the electricity in Los Angeles. If it has excess capacity, it can also sell it to the San Diego grid.

Nebius does exactly that. Other cloud providers, let’s say Microsoft, can come in and lease a portion of its capacity. Also, a company can also use its compute power though its cloud platform on pay-as-you-go model.

This is as simple as it gets.

It’s basically like Amazon Web Services, Microsoft Azure or Google Cloud, but it’s much more specialized. This is its advantage. Specialized where?— Specialized in AI.

Competitive Analysis

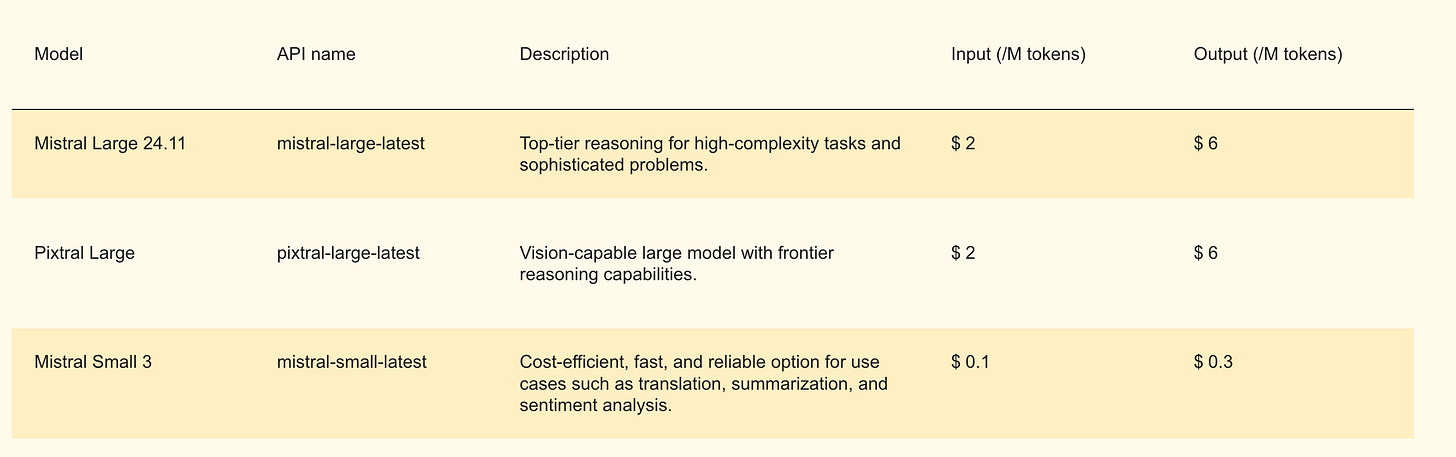

It was just around when I first heard about this company. Early February. A French company called Mistral AI dropped the first EU made LLM model competitive with those of ChatGPT and Claude.

It was called Le Chat.

I tried it. It wasn’t just good, it was really good.

My first impression was that it was cheap and fast. I checked the model pricing. It was indeed cheap.

Then I looked at ChatGPT pricing for comparison. Currently, ChatGPT o1 has a price tag of $15 per a million input tokens and $60 for output.

At that point I got really curious about their tech stack and guess what I found? —Yes, they are a Nebius customer.

I checked the Nebius documents and I indeed saw they featured Mistral as their customer. They even got a 5 star review from them!

Probably nothing could have been more bullish for me than seeing real competitive businesses being built on their infrastructure.

In infrastructure, you are as strong as your customers.

If people think it’s impossible to compete with others using your infrastructure, they aren’t going to come to you. Le Chat proved to me that people could go to Nebius.

They enabled Mistral to train a competitive model really fast and offer it really cheap.

How?—Because it tailored its offerings specifically for AI.

Large cloud providers —Amazon, Microsoft, Google— are like giant industrial kitchens built for all purposes, pastry, steakhouse, burger joint, taco corner etc..

You can bring in any tool you want but the setup takes time. You have to outsource your own ingredients and figure out how to use a giant industrial stove for your own purposes.

When you want to cook an AI model, your recipe book is the library called TensorFlow and your manual for the stove is CUDA.

TensorFlow is a software library that provides tools to design, train, and run machine learning models, especially neural networks for AI. You write high-level commands by it.

TensorFlow, is a high level framework developed by Google. It isn’t something that GPU can understand. For that, you need an instruction set that translates your high level commands to instructions the GPU can understand.

In Nvidia GPUs, that instruction set is CUDA.

TensorFlow and CUDA, when combined, work fast— and I mean really fast.

In all purpose cloud platforms like Azure, they don’t come pre-installed because it’s like a big kitchen and it doesn’t know what you’ll cook. You have to bring in TensorFlow and CUDA by yourself. That can be time consuming as you’ll have to deal with different versions and find the right setup.

In Nebius’ cloud you don’t need to deal with this. It comes with TensorFlow and CUDA pre-configured.

Meaning? You can start cooking AI applications right away!

It’s just like getting in a big industrial kitchen and finding the cookbook you needed on the counter with the stove pre-configured for your needs. You just start cooking.

Normally, you would expect such a specialized environment to be more expensive than general purpose ones. Not with Nebius.

It’s way more efficient and cost effective then peers for two reasons— custom hardware and natural cooling.

Its flagship data center in Mäntsälä, Finland, uses free cooling. It benefits from Finland’s chilly air to keep servers at 40°C. No water, no refrigerants, no power-hungry chillers.

On top of that, they design their own servers to use in their data centers. They aren’t depending on SMCI, Dell or HP.

Their custom design allows them to fit 20% more capacity than peers in the same data center limits and reduces energy consumption by further 20%.

Custom hardware and natural cooling, when combined, drive significant cost savings which Nebius passes to its customers, making it a viable alternative to hyperscalers.

Does this mean Nebius will dominate the market? Of course no.

This is not a winner-takes-all market and there is no one size fits all. Nebius has some differentiating properties that are enough to make it the supplier of choice for those looking for custom AI stacks and efficiency.

This is as good as you’ll get from a nascent competitor in a fast developing and capital extensive market as AI infrastructure.

Investment Thesis

➡️This is a huge market.

My favorite small business has always been coffee shops. I want to open a coffee shop one day and I’ll. Market for caffe grew exponentially in the last 20 years as the consumption went off the roof.

It’s clearly not a winner takes all market. It’s impossible to imagine 90% of all people buy their coffee from one business. This is why you have seen coffee shops pop up every corner in your neighborhood.

In such a market, there is only one rule— Don’t suck!

If you don’t suck, you’ll grow; if you suck you won’t do so-so, you’ll go bankrupt.

Nebius addresses a very big market with a lot of growth coming.

Gartner estimates that GPU as a service and AI centric cloud services will reach $260 billion by 2030. This is huge.

All Nebius needs to do is to not suck!

Even if it hits the management’s revenue estimate of $1 billion this year by the year's end and grows 50% annually for the next 4 years, it’ll generate $5 billion revenue in 2030.

This will still be 2% of the total addressable market.

How achievable is this? It’s pretty achievable if you don’t suck and it hasn’t so far.

➡️ It’s ramping up capacity.

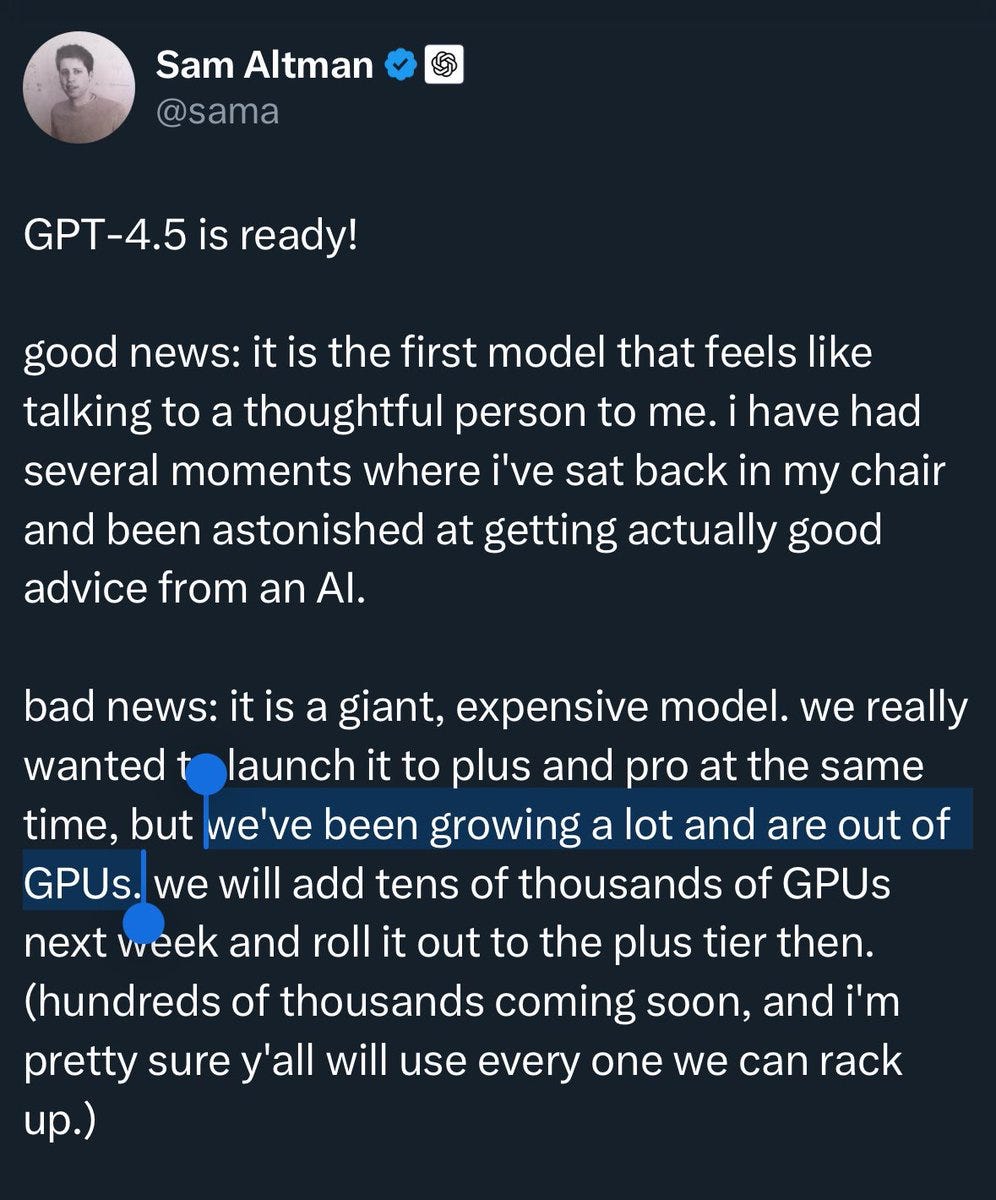

Large cloud providers are supply constrained. There is demand but they don’t have enough capacity.

Andy Jassy said this on CNBC and Sam Altman screamed on X— “Not enough GPUs!”

Demand is insane and it’ll only grow. I don’t remember any point in human history where we needed less compute power in the next 10 years.

Under these circumstances, Nebius will sell as much as it builds and it’s building fast.

It’s planning to triple data center capacity by the end of this year and double it again in the next 2-3 years. Same goes for the GPU capacity. They are tripling it this year and planning to quadruple over the next few years.

This will be huge if they can execute.

Looking at the management’s track record, I bet they can execute.

➡️ Institutional Investors Are Taking Notice

What moves the stocks is institutional money. Retailer money can only take it so far.

Palantir is an amazing example for this.

Retail was really early in that stock and it didn’t move for years— until 2023.

In 2023, institutions started to pour money in it, taking stock from historic lows to historic highs. It made 20x in just two years.

The dream set up for retail investors is finding a gem before institutions take notice. That’s about to be the case in Nebius.

We are still early but institutions started to take notice.

Institutional ownership has more than doubled last quarter.

As the company delivers on guidance, institutions will keep flocking to the stock. This will in turn increase the confidence of retail and they’ll buy more.

Perfect setup for explosive growth.

Fundamental Analysis

Performance

It’s a new business. It just completed divestment of Yandex's Russian assets last year and concentrated on AI infrastructure.

Yet, execution since then is more than promising.

The AI infrastructure groups revenue increased sixfold from $6.7 million in Q4 2023 to $37.9 million in Q4 2024 while the whole year revenue increased five times from $20.9 million to $117.5 million— This is insane.

In Q4, the management announced that ARR was $90 million and added— “with contracts already signed in Q1, March 2024 ARR will be at least $220 million.”

I want to emphasize, they said “at least.”

If we assume they can close a few more deals in the course of next few weeks, they will have already tripled their 2024 ARR.

The management confirmed they are on pace to reach +$750 million ARR this year.

Even if we ignore the guidance and concentrate on how they scaled from 2023 to 2024 and how they tripled ARR in just a quarter, we still have a short yet stellar track record of execution.

It’s impressive, nothing less.

Financials

It offers a dream scenario every investor wants to see in a growth company— no debt, strong cash position.

It currently has only $37 million debt on balance sheet against $2.5 billion cash, combination of what it got from Yandex divestment and investments raised in Q4.

They are planning to spend something between $600 million-$1.5 billion in capex this year. What’s even better is that the management expects to become EBITDA positive this year.

Given that they burnt $150 million this year, even if their becoming free-cash-flow positive delays, they have ample cash pile to rely on. Plus, given the track record of the management and investors already on board, I think they have wide access to capital markets at will.

Overall, even if they miss their operating targets, money won’t be a problem for the next 4-5 years.

Valuation

This business doesn’t have years of track record, its return on investment isn’t clear and it’s not a leader in a tipped market. It’s tough to value it.

How can you do it?— You must think of it like an option.

Create a future scenario for the business.

Decide what’ll be the value of the scenario if it fails.

Determine the current value of the scenario including success and failure.

To do that, we must start with a reasonable set of assumptions, here are mines:

The business will achieve the low end of guidance this year.

It’ll grow revenues 40% annually in the next 5 years.

Net margin will be lower than peers due to expansion efforts.

Exit multiple will be a conservative number, like 20.

Let’s run the numbers:

It achieves $750 million revenue this year and grows 40% annually next 5 years. This gives us $4 billion revenue in 2030.

Amazon has a 37% operating margin in its cloud business. Given that Nebius will try to scale quickly, let’s assume that it’ll have only 30% operating margin and around 20% net margin. This gives us $800 million net profit in 2030.

Attach a conservative multiple of 20, we have a $16 billion business.

Well, that looks like a no brainer right? Because we haven’t accounted for the chance of failure.

What’ll be the chance of failure? Given that management has been executing quite impressively in different companies for decades, I think they’ll more likely succeed than fail but I also don’t want to underestimate the chance of failure.

Let’s say they have a 60% chance of success and 40% chance of failure.

Multiplying $16 billion by 0.6, we have $9.6 billion value.

The rest? It comes from the failure scenario.

What’ll be the value of the business if it fails to realize our success scenario in the next 5 years? Will it go to 0? I don’t think so.

It has very valuable assets in place— data centers, equipment, engineering talent, cloud platform etc..

Plus, it will grow revenues to a certain extent, it’s already doing. So, I think it’s fair to say that in a failure scenario, which is delivering less growth than anticipated with infrastructure remaining intact, I think the value will be half of that would have been in success— $8 billion.

We said 40% chance of failure. Multiply it with $8 billion, we get $4.8 billion value.

In total, our scenario, together with its success and failure chances, will be worth $14.4 billion in 2030. What’s worth today?

Let’s again remain conservative and discount it back to now by using long-term average return of the market 10% and we get $8.94 billion.

The company is currently valued at $6.6 billion, 27% discount to our scenario.

Conclusion

I think this is one of the best set-ups in the market for the next 5-10 years.

You have:

A seasoned entrepreneur at helm who has founded one of the largest tech companies in Europe.

State of art infrastructure with customers already building competitive products on it.

Total addressable market that looks like it can scale to infinity.

Strong financial position with a lot of cash at hand and ability to raise further.

Revenue growing triple digits and management expecting to become EBITDA positive this year.

Institutional investors have just started to take notice of the business.

On top of all that, the market is excessively discounting business’ future potential, even in the very conservative scenario we just valued.

Nothing is guaranteed. If it works, you can make 10x of your money in the medium to long term. Will it work to that scale? Nobody can know.

But I know one thing. It’s very hard to permanently lose your money on this company at this price point. And in turn, you get a chance to shoot for 10x returns.

I am a buyer.

I’m long NBIS but my biggest concern is they are hoovering up demand whilst the big players are supply constrained and haven’t fully optimised their AI hardware stack. Short-term we see spectacular revenue growth but when supply catches up in next 12-18 months, I worry they will eat into NBIS by offering much cheaper ‘electricity’. Mid-term, NBIS could also struggle to stay competitive on frontier GPUs without dilution, given the very short depreciation cycles and high replacement costs. There’s no winner takes all in this huge market but long-term the minnows will be squeezed by economises of scale unless there are significant switching costs/first mover advantages.

Awesome analysis. I love nbis. Will be a bumpy ride but no real reasons to doubt their growth. Yeah they've missed their arr guidance past few earnings but lots of moving parts so it's understandable. Also I've read they will have no shortage of h200s due to the investment nvda made in nbis. If nvda sees something in nbis I'll defer to their judgement.