MercadoLibre: Knock Knock, You Are Not Alone Jeff!

The most attractive opportunity in the market with giant, giant MOAT and attractive valuation!

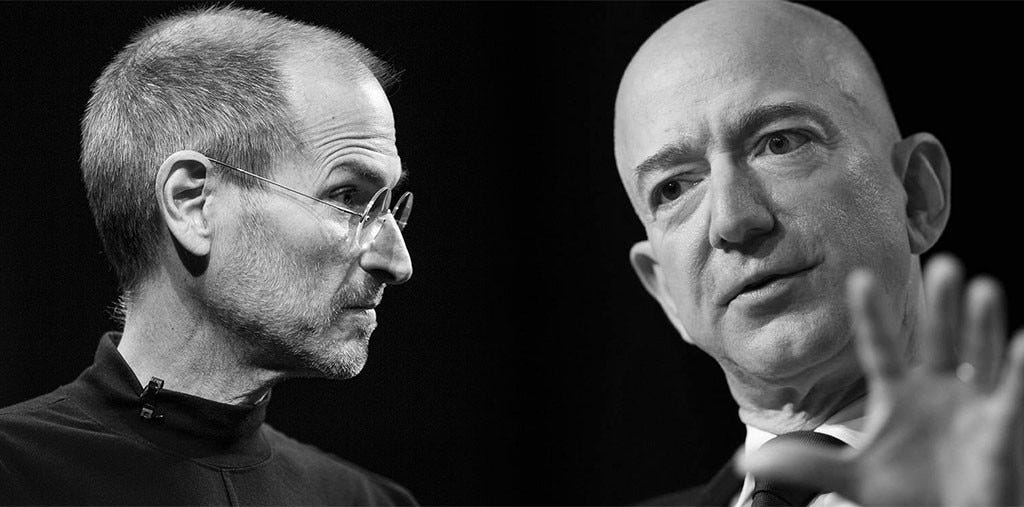

Among all the great entrepreneurs of the last century, I admire two above all: Steve Jobs and Jeff Bezos.

Jobs was the most remarkable entrepreneur of the last century:

He didn’t finish college.

He wasn’t a nerdy engineer.

He didn’t raise millions in VC.

Yet, he created the most valuable company in the world.

How? Two things: He had a great taste and he under…