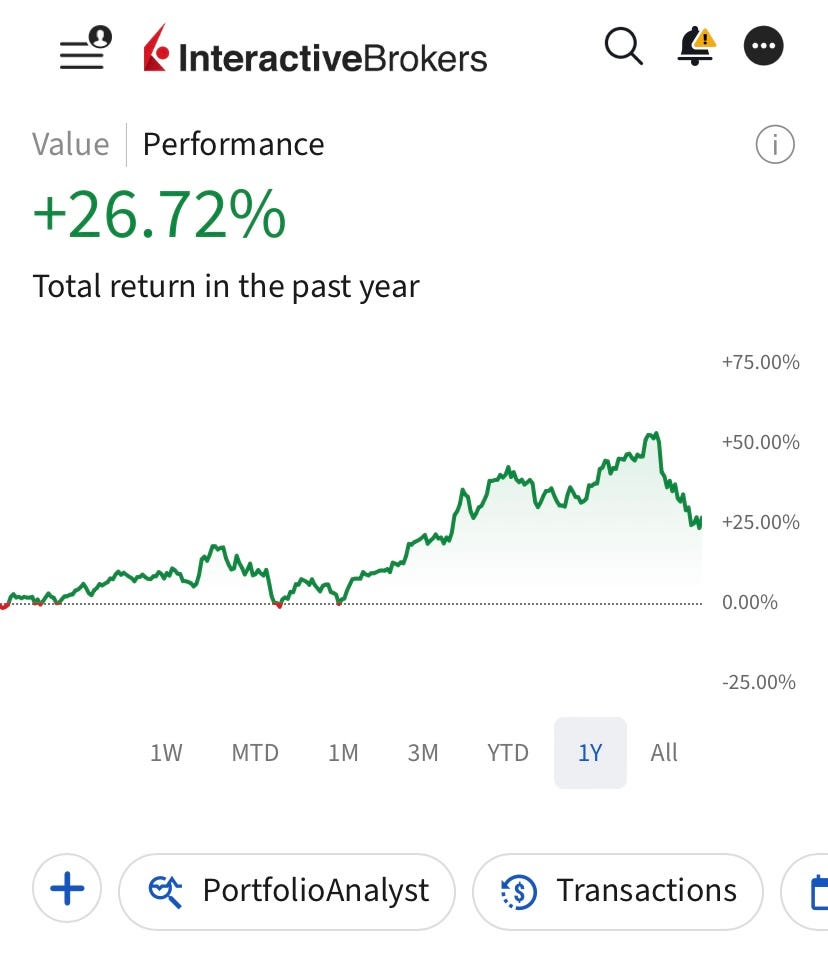

March Update: Our Portfolio Outperforms S&P 500 By 20%, Here's What We Own!

Our portfolio is now up 26% in the last twelve months against 6% of S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 20%!

Portfolio is now up 26% in the last twelve months against 6% of S&P 500!

I am going to be straightforward. It’s been a tough start to the year:

Seasonal weakness.

Trump’s tariff threats.

Weaker than expected earnings season.

Combination of these factors contributed to a correction in the market. Yet, our portfolio remained strong while most growth oriented portfolios got rug pulled. They swung quickly from outperforming by a wide margin to underperforming.

In this environment, our portfolio largely kept its outperformance margin and I am proud of it.

Those who are following the portfolio updates and these letters know that in the December update I wrote that the real outperformance doesn’t appear on the way up, it appears on the way down.

This is what Howard Marks establishes in his fascinating book “Mastering the Market Cycle.” He says a skilled aggressive investor delivers outperformance on the way down. This chart from the book illustrates the point:

Aggressive investors, as a group, tend to outperform the market on the way up. This is a natural consequence of higher risk-higher reward characteristics in growth stocks.

The crucial point is that they go up as a group, but every company in the group is worthy.

Most speculative stocks go vertical because the perception of low market risk creates the illusion that chances of success for their crazy projects are actually high.

When the market starts to decline, the tide turns.

This time, perception of higher market risk scares investors and they think such moonshots won’t work anytime soon so they flee from these stocks.

Result?— Portfolios concentrated around hot growth stocks and speculative names get rug pulled and they start to underperform the market.

Aggressive portfolio can stay ahead of the market on the way down if:

The business is profitable or has a clear path to profitability.

Fundamentals significantly improved while it rode the way up.

It’s financials are strong enough to weather a financial downturn.

This is what we have been trying to do here, and we are getting rewards of it.

We essentially try to buy two types of businesses— the ones that are already among the strongest businesses in the market and the ones with clear growth prospects.

The first type are known by everybody. We don’t bet on divergent thesis about those businesses. Instead, we try to take advantage of temporary mispricing of the market in times of fear and downturn.

The second type is where we have a thesis that the market hasn’t priced in. In such cases, financial strength and not overpaying is essential.

This approach has served us well so far and we will adhere to it going forward.

I will give you the portfolio update in a minute but first there is one more thing I want to talk about.

It’s hubris…

If there is one thing I constantly remind myself to be free of, it’s hubris. I am not saying it’s necessarily bad. In some crafts, hubris is an essential part. Art is an example.

But investing is not one of them. In investing, hubris is destructive.

I often see writers on Twitter and Substack who stick too strongly with their thesis. They blame others who don’t agree with them with not understanding anything even though fundamentals move at opposite direction to them.

This tends to be destructive.

Even Warren Buffett says he thinks he is right 6 out of 10 times. Who are we to assert that we should be right while the best investor of all times thinks most of his decisions were so-so?

In investing, there is no such skill as not making a mistake. It’s impossible. If you aren’t making any mistakes, it doesn’t mean you are good, it means you aren’t taking any risks to generate superior performance.

This effect of hubris is even more elevated in short plays. This is because:

Short requires a higher conviction to begin with.

It may take a longer time for the thesis to play out.

But you have a North-Star to follow: Fundamentals.

If the fundamentals are improving i.e revenue is growing, margins are expanding, return on capital is increasing, it’s generally a sign that you were wrong. But they persist because they feel like going back will damage their reputation as an investor.

It’s not true. In investing, changing direction as quickly as possible when you are wrong is considered a skill, not a weakness. The same applies to long plays too.

We have been trying to avoid this since the beginning, and we always will.

Our performance so far indicates that these strategies and humility served us well:

Our portfolio is now up %26 against 6% of S&P 500!

Following transactions took place in our portfolio in December:

We opened 1 new position.

We exited 6 positions.

Increased 6 of the existing positions.

We now have 18 positions in total. We had started positioning the portfolio more defensively back last quarter and last year. In this line we cut the number of positions from 23 to 19 by exiting some positions. We are now even more concentrated on our core holdings with 65% of the portfolio invested in 5 stocks.

In the last update, I discussed the outlook for our new positions. In this update, I will do the same for our only new position and I’ll also talk about why we exited 6 positions.

Also, in this update, I included a Google Sheets link so the members can track the portfolio real time, see changes, and follow it if they wish!

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% special discount to celebrate new members!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today we own 18 positions.