Grab: Exceptional Business At Fair Price

Grab is creating the next big ecosystem of interconnected businesses. The potential is undeniable, the price is fair.

Howard Marks once said—“if you want to succeed in investing, you have to take uncomfortably idiosyncratic positions.”

This is obviously true.

Given the ways markets are structured, being right doesn’t mean anything. If everybody else is also right with you, what you get is the market return. Mediocre.

To be really successful in the market, to make the big bucks, you have to be idiosyncratic, you have to say X when everybody else says Y, and come out right.

Though this is now widely accepted among informed investors, I think we often overlook that it also applies to success in general.

In life, the secret of being massively successful isn’t different. You have to make an idiosyncratic decision that makes no sense for 99% of the people and win. You have to be an “outlier.”

Exactly for this reason, outliers build outlier companies.

Nobody wants to be an outlier to open a laundry shop. Normal people can build outlier businesses, but outliers can’t build normal businesses. It doesn’t make sense.

So, when you see an outlier creating a business, you can be sure that there are two possible outcomes: It fails miserably, or it becomes something big.

Think about Steve Jobs, Bill Gates, Jeff Bezos, Mark Zuckerberg, etc..

Steve Jobs’ family spent their life savings to send him off to college. Can you imagine how hard a decision it was to drop out? Jeff Bezos was a VP at DE Shaw. Can you imagine how hard it was to chase a dream? You don’t risk these for mediocrity.

That’s why outlier founders can only build outlier businesses and why you should pay attention when an outlier somewhere in the world builds a business.

Anthony Tan is one of those outliers.

He comes from a wealthy Malaysian family, but this didn’t make things easier. He had a dream about creating a mobility company focusing on rideshare, but he didn’t get any support from his father.

When he refused to join the family business to pursue his dreams, his father disowned him and cut off all his support. He suddenly had nothing. If you are even a bit familiar with Asian culture, you know how big a problem this was.

He persevered, he found angel investments, convinced developers to work only for equity, and did sales on the streets to get customers.

This is how Grab was born.

It’s already an outlier business, dominating ride-hailing and deliveries in Southeast Asia, and even Uber couldn’t compete with it. Yet, I think it’s still early on its runway, there is at least a decade of high growth ahead, and I believe this business can do much better than people are predicting now.

Today, we are going to dive deep into it, and I’ll try to explain what makes it an outlier and why it’s becoming attractive.

So, let’s cut the introduction and dive deep into this exceptional business.

What are you going to read:

1. 🏭 Understanding The Business

2. 🏰 Competitive Analysis

3. 📝 Investment Thesis

4. 📊 Fundamental Analysis

5. 📈 Valuation

6. 🏁 Conclusion

🏭 Understanding The Business

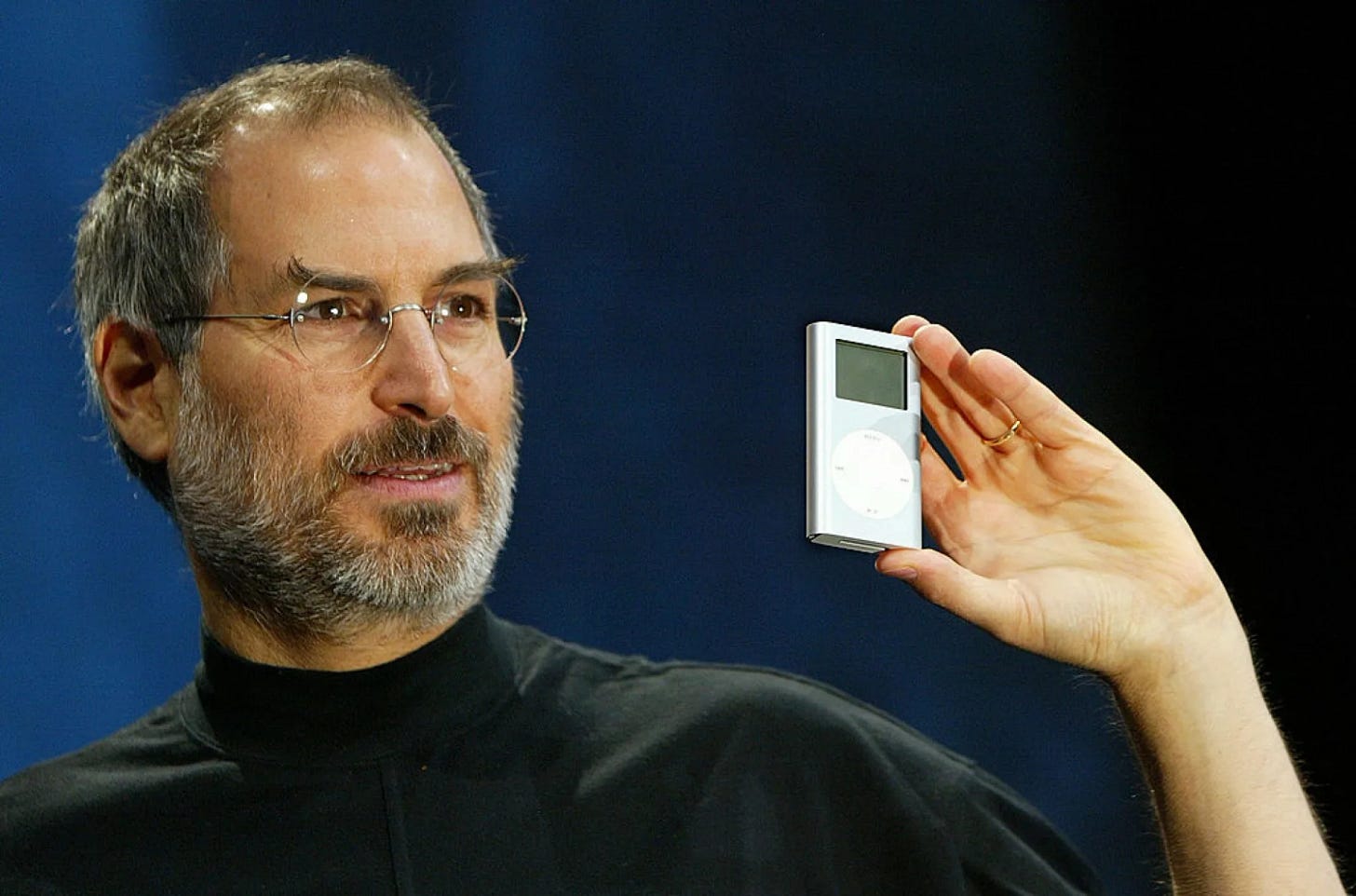

Among all the great entrepreneurs of the last century, I put Steve Jobs in a different place. There are many reasons, but the most notable one is that he effortlessly understood that the 21st century, the age of the internet, would be owned by ecosystems.

While everybody was opening up their products and systems, he closed them and linked all the products together in an artisanal way.

It started with the iPod.

He wanted to make it compatible only with Macs. Other executives said it would kill the iPod sales, but he thought the exact opposite. He thought it would increase Mac sales.

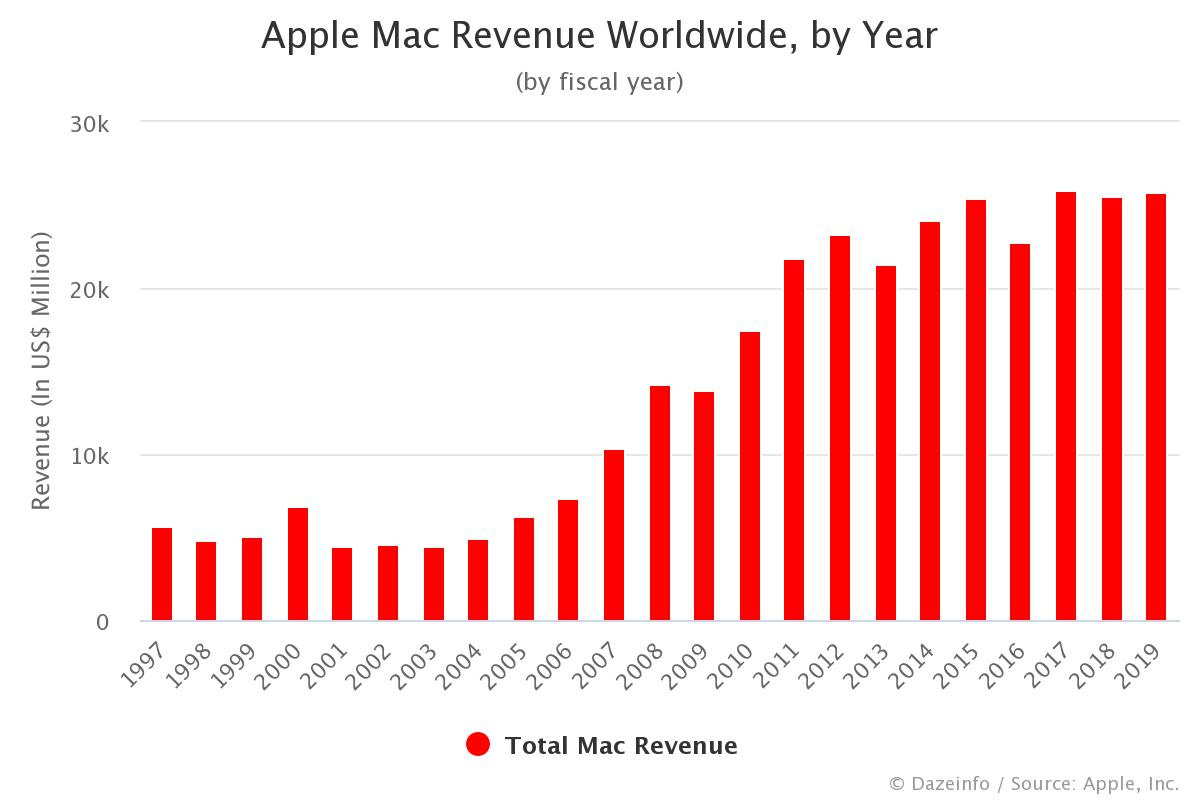

This is exactly what happened. iPod was launched in late 2001, and as you see previously declining Mac sales started to increase from then on:

His critical insight was that when you have a piece of software connecting complementary products and services together (this was iTunes for Mac and iPod), you could leverage your market power in one product market to another.

This is what the Google guys learnt from him.

He was a mentor to Sergey and Larry for a period, and they learnt from this critical insight from him, which was pivotal in turning Google to develop complementary products to its search, like Chrome.

Look at other tech giants like Microsoft and Amazon, and you see a similar pattern.

Would it still be so hard to switch from Microsoft’s operating system if we weren’t used to doing our work on Word or Excel? A merchant exiting Amazon loses several perks at the same time, like millions of prospective customers, ads, logistics, etc.

This is the power of ecosystems, and it’s no coincidence that all the tech giants of today are ecosystem businesses. They created several complementary products around a dominant product and leveraged their market power across products.

The thing with ecosystems is that they are rare. It’s pretty hard to dominate a giant market, and it’s exponentially harder to spot other opportunities around that market and successfully leverage your market power across the product lines.

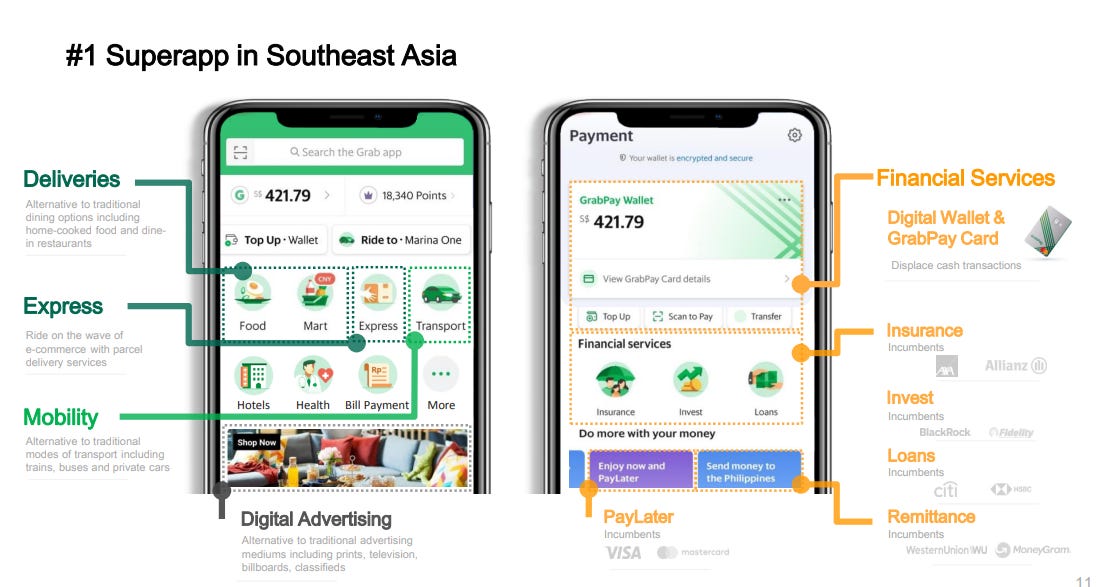

This is what makes Grab special: It’s not just one business, it’s an ecosystem of complementary products and services.

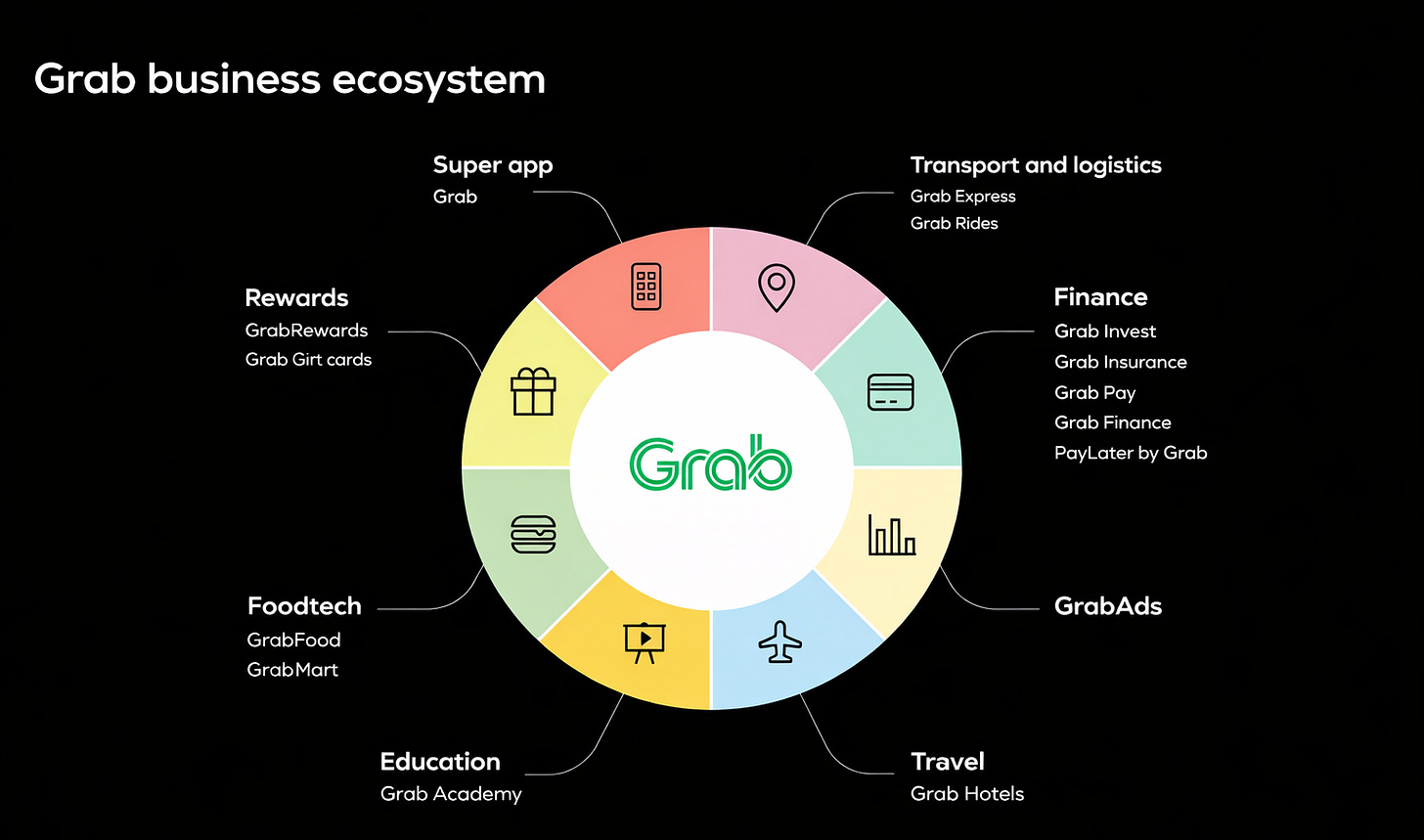

It offers several products under one superapp and three main segments:

Mobility: Ride-hailing (cars, taxis, motorcycles) and vehicle rentals for drivers.

Deliveries: On-demand food, grocery, and parcel delivery.

Financial Services: Digital payments, lending, insurance, and digital banking.

It also has an advertising business that is embedded in mobility and deliveries, whereby customers can bid for ad space across Grab’s digital app and physical assets like cars.

It doesn’t take a genius to see that these services are highly complementary.

A customer of ridesharing will likely be a customer of grocery delivery. And if he is going to be a customer of both services, why not use Grab’s financial services to benefit from tailored Buy Now Pay Later (BNPL) offers?

This complementarity creates significant synergies for the business, which is illustrated by the fact that 66% of all users were customers of at least two verticals in 2025.

This synergy allows it to grow all the complementaries together, like a rising tide lifting all boats:

Having an ecosystem of complementary businesses like Grab has two important consequences.

First, growth gets way easier as you now have three points for customer acquisition. And once a customer gets in using one service, you can promote him the other services, driving lifetime customer value up and thus generating incremental growth.

Second, retention also becomes effortless. When you have an ecosystem of complementary businesses, customers start to position you on a different league than the individual providers. For them to switch, a competitor needs to offer the full-stack solution, it should also ben ecosystem, not just an alternative to one product.

In short, what we have with Grab is not just one business but an ecosystem of complementary businesses: deliveries, mobility, and financial services.

Ecosystems are my favorite businesses to invest in because it’s very hard to challenge them when they become dominant in at least one product or service. Growth becomes way easier as they can leverage their dominance to complementary products and neighboring markets.

The question is, why is this case? Why is it so hard to challenge ecosystem businesses?

Let’s explain.

🏰 Competitive Analysis

I think one of the defining moments for our understanding of competition dynamics in the digital world came from James Moore.

In 1993, Moore published an article on the new dynamics of competition in Harvard Business Review—Predators and Prey: New Ecology of Competition.

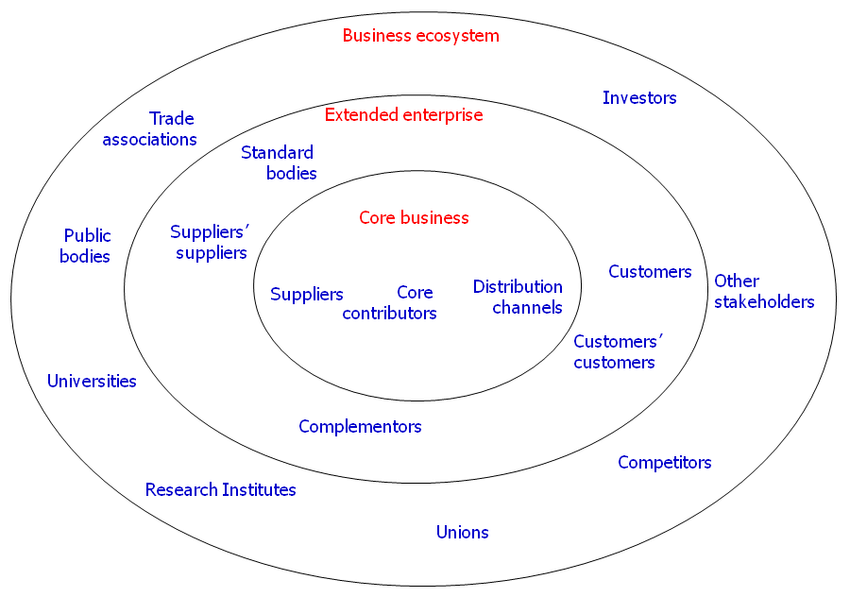

In the article, he defined business ecosystems as “an economic community supported by a foundation of interacting organizations and individuals.”

His ecosystem definition was genius as it didn’t include just interconnected businesses, but also other actors such as suppliers and even competitors. His business ecosystem looks as follows:

The genius of this model is recognizing that even competitors could contribute to the competitive strength of an ecosystem. Think about third-party makers of Notes apps on the App Store. They compete with Apple’s internal Notes app, but still strengthen Apple's ecosystem as they create a wide selection for users that isn’t available, let’s say, in the Huawei ecosystem.

The key insight of the article was this: When there are business ecosystems, the competition shifts from business level to ecosystem level.

It’s a simple but powerful observation. Let’s give a simple example.

When a user thinks about changing their operating system from Microsoft to something else, it’s no longer just about the operating system; there are other considerations. For instance, if you want to switch from Windows to Linux, you lose Microsoft Office products as they aren’t natively available in Linux.

As a result, for an alternative to supersede an incumbent, it should also be a similarly comprehensive ecosystem, matching the incumbent at least in material capabilities. Otherwise, customers won’t likely switch.

This is why it’s very, very hard for dominant ecosystem businesses to lose to competition. First, an alternative should offer a comparable package; then there is the question of why a customer should pick the alternative package instead of the dominant one. It’s very hard.

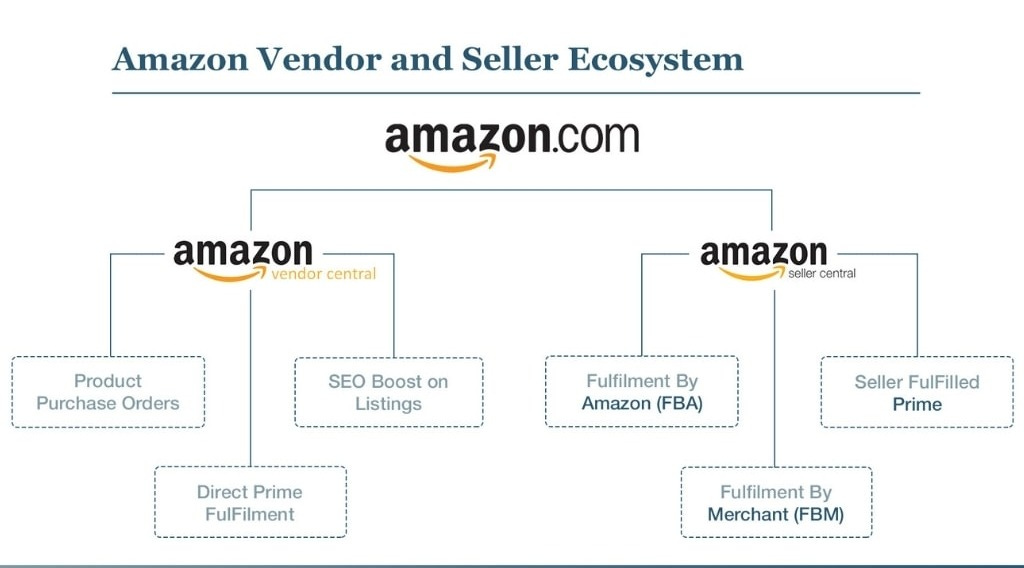

Think about Amazon’s seller ecosystem:

The primary upside of selling on Amazon is access to over 300 million monthly customers. This is already very hard to replicate. However, even if a competitor miraculously replicates it, sellers still won’t likely switch, as they also need other services like Fulfillment by Amazon, the ability to advertise, etc.

Thus, it’s almost impossible to outcompete a dominant ecosystem business.

This is exactly why Grab’s competitive position is rock solid, and it has a wide moat around it.

Its ecosystem of interconnected businesses across deliveries, mobility, and financial services creates significant customer lock-in that can only be offset by a comparable ecosystem.

It’s obvious when you think about it.

Let’s assume you are a driver. Grab allows you to provide rides to customers or do deliveries. Whatever you like that day. If you are also a customer of Grab’s financial products, it innately knows your earning potential and offers you credit that you can effortlessly pay back.

Why would you switch to a competitor app that only does deliveries? Why would you use another fintech that will take documents and long processes to get a loan from?

You wouldn’t.

Same for customers. Why would you download another standalone delivery app when you could get it all done through Grab, accumulate reward points, and use them to get a discount on your future rides or orders? You simply wouldn’t.

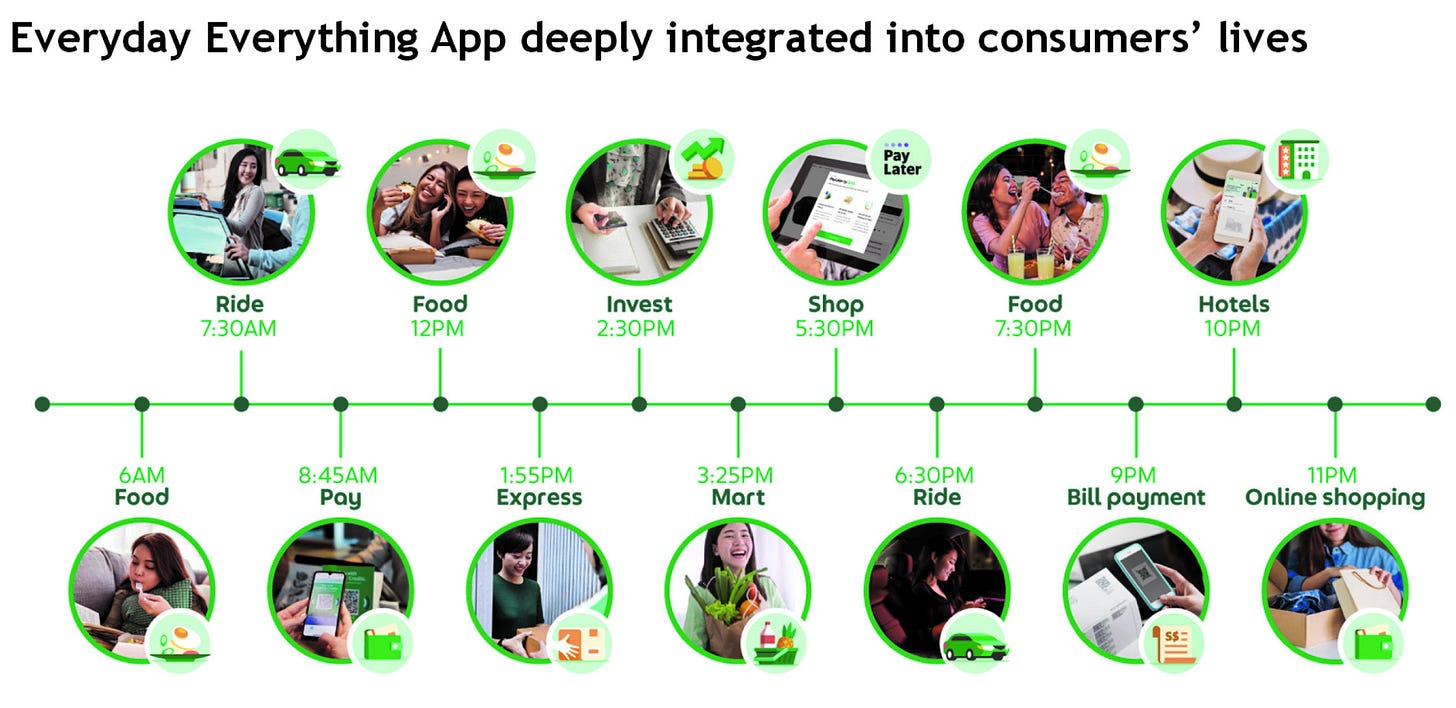

This lock-in effect is further reinforced by the fact that a Grab customer has over 14 points a day where they can interact with Grab’s ecosystem:

Multi-homing for individual services would be a significant inconvenience for the customer, while they could handle all the work above through one app and Grab’s ecosystem.

In short, Grab’s ecosystem shifts the competitive landscape from business-to-business to ecosystem-to-ecosystem, defying challenges from standalone competitors.

This is obvious to many people once they get the idea of ecosystem competition. What they still often miss when it comes to Grab is that the businesses it owns also make it harder for the competitor ecosystem to emerge.

What do I mean by that?

Both deliveries and ride-hailing are double-sided networks, meaning you need to attract both drivers and customers for business to be viable.

If Grab were a standalone business for ride-hailing, a competitor would have an easier time attracting drivers, and customers would follow. However, Grab’s ecosystem doesn’t just lock in customers, but also locks in drivers, as explained above. Thus, the breathing room for emerging ecosystems is so narrow that they have very little chance of maturing into full-blown ecosystem alternatives.

The fact that even Uber couldn’t hold its ground against Grab in Southeast Asia and exited the market by selling its operations to Grab illustrates this phenomenon.

In short, Grab has a powerful ecosystem that creates synergies across its businesses and locks in both customers and providers. Any challenger needs to match Grab’s ecosystem to become a mature competitor. This is very hard to achieve as Grab’s ecosystem doesn’t leave much breathing room for them.

So, this business has one of the widest moats that exists today, and competition is not an issue for it.

📝 Investment Thesis

My Grab investment thesis relies on three core pillars:

1️⃣ New verticals & organic growth in existing verticals.

When you have an ecosystem created around a dominant product, it makes it easier to expand into new verticals, as you can leverage market power across verticals.

This is how giant businesses like Apple, Google, Amazon, and Microsoft were built.

Apple leveraged its power in IOS across complementary markets, Google leveraged its dominant position in search, Amazon leveraged its dominance in e-commerce, etc.

Even Amazon Web Services, which looks unrelated today, started as a set of APIs that allowed developers to benefit from data gathered by Amazon’s marketplace. Microsoft could create its cloud business by leveraging its power in enterprise software, etc.

Grab has been deliberately following this strategy to expand its ecosystem. It already has many interconnected businesses across deliveries, mobility, and financial services:

This cross-leveraging opens up many future opportunities. I think one of the most significant of them and a natural course for Grab is e-commerce.

It’s already making strides in the market by expanding from where it already has a strong position—quick commerce.

Grab is leveraging its driver network to deliver small items bought from Grab Mart within 30 minutes. As a result, GrabMart is growing 1.5x faster than its food delivery service. It also has a service called Grab Online Shop that enables merchants to build their online stores that are integrated with Grab payments and its logistics services.

I believe the natural course of these developments leads to launching a full-blown marketplace to compete against Shopee and Lazada. It is uniquely positioned to take a significant market share in this market due to its last-mile delivery network and integrated financial services.

Even if these predictions don’t hold and it doesn’t launch a full-blown e-commerce marketplace, it still has many verticals that it hasn’t fully tapped into, like travel.

Plus, its existing markets are already poised for sustained growth for the next decade, as Statista predicts that mobility and delivery markets in Southeast Asia will grow ~10% annually by 2030.

In short, its ecosystem gives it a great position to enter new verticals and organically grow in existing verticals.

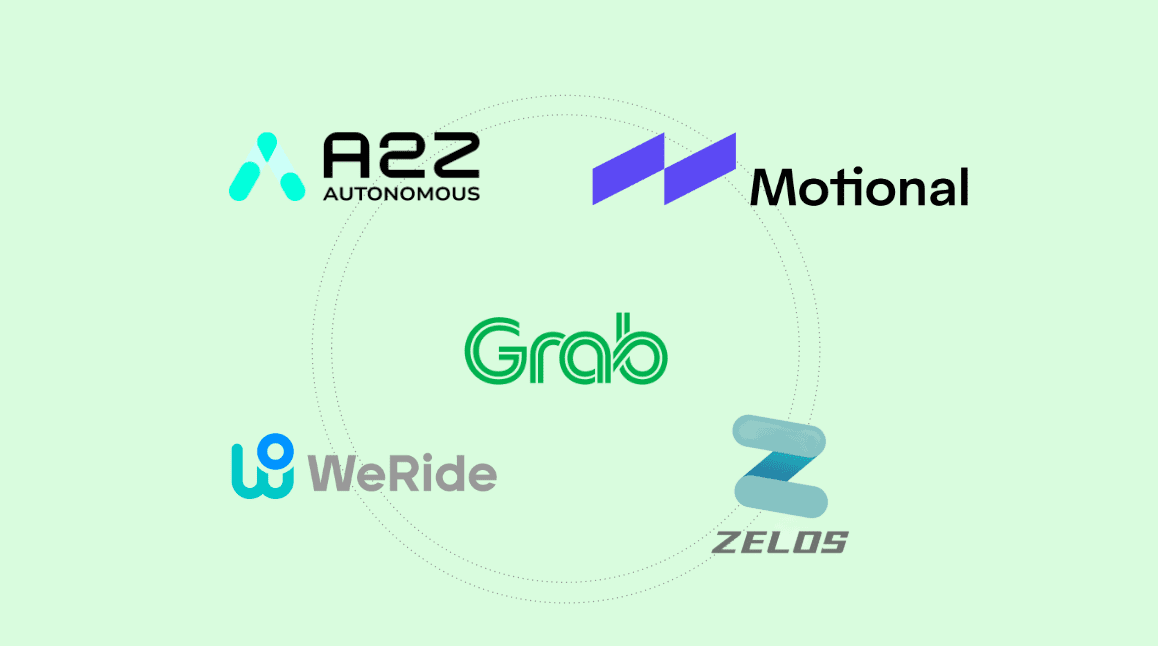

2️⃣ It’ll massively benefit from autonomous driving.

For the last few years, investors in mobility and delivery companies like Uber and Grab were afraid that autonomous driving would upset their businesses.

People who saw the issue from a distribution and commoditization perspective never agreed with the above thesis, including me. That negative sentiment started to change recently as robo-taxi businesses are launching one after another, like Google’s Waymo, Tesla Robotaxi, Amazon’s Zoox, and Nebius’ AvRide.

With the multiple robotaxi businesses already around, people started to understand that robotaxi technology will be commoditized way before any company can establish dominance in the market through a propriatery tech. This has become almost certain after Nvidia launched its AI platform for autonomous driving—Alpamayo.

Thus, I think it’s now well accepted that robotaxis will be a commodity. And in commodity markets, those who own the distribution win, not the manufacturers.

In developed economies, Uber largely owns this distribution; in Southeast Asia, Grab owns it. It already has partnerships with several autonomous vehicle providers:

There are two models aggregators like Uber and Grab can work with robo-taxi providers:

Opening up their platform to fleet owners in exchange of revenue share.

Buying the fleets and deploying vehicles themselves.

Uber recently disclosed that both models work extremely well for its platform. In the case of revenue share, it takes around 20% of revenue from Waymo, which is lower than its normal take rate of ~29%.

However, Uber saw that such partnerships were still more profitable than human drivers, as an average robotaxi completes at least 30 trips a day, which is way higher than the average for human drivers, which is around 20. Plus, it’s likely to increase that take rate as the technology matures and gets completely commoditized.

In the fleet ownership model, Uber predicts that an average robo-taxi fleet can now be bought for $100-$120K a piece. They calculate that a robotaxi can easily amortize itself in a year, assuming 30 trips a day.

In short, both models are extremely profitable for platform owners like Grab and Uber.

Grab has already launched its robotaxi services with WeRide in Singapore. I think it’ll take at least 5-6 years for these efforts to reach a substantial scale, but when they do, they’ll significantly boost the topline and expand margins for Grab.

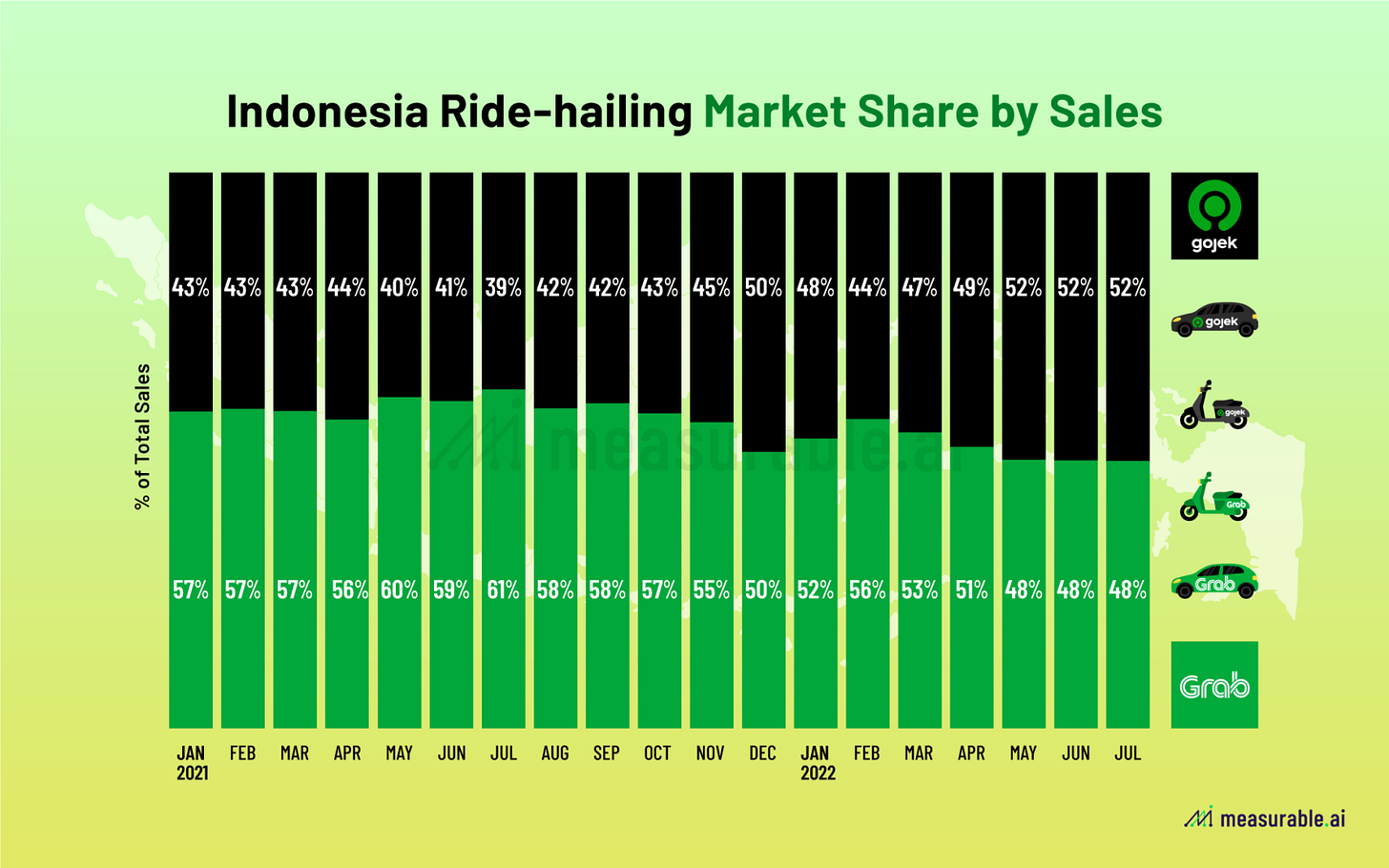

3️⃣ Grab will acquire GoTo and consolidate the market.

Grab and Goto (Gojek owner) are dominating the mobility market in Indonesia, the biggest consumer market in Southeast Asia.

I couldn’t find recent market data, but as of mid-2022, this was how they shared the market:

I don’t think it has changed much by now. Maybe a few percent shifted from Grab to Go-To or vice versa, but it’s not important. The important thing is that they hold a duopoly in this market.

The merger talks between these companies started back in 2020, when both of them were unprofitable. That made sense as the combined entity would control 90% of the market and would have way lower marketing and operational costs, but the deal didn’t happen.

Last year, the rumors were renewed, but Go-To’s CEO was opposing the deal. He was then ousted by the big investors like Softbank and was replaced by the COO. This was perceived by clearing the way for a potential merger.

Further, the Indonesian Wealth Fund, Danantara, wants to own a stake in a regional champion like Grab. They think they can leverage Go-To to achieve this. They want to acquire a stake in Go-To, and then Go-To would first acquire Grab’s Indonesian operations, and then Grab’s parent company in Singapore would acquire a majority stake of the combined entity.

This structure would clear the regulatory hurdles for the merger and give the Indonesian Wealth Fund a stake in the combined entity.

I think this deal is inevitable. Otherwise, Go-To will remain stuck in Indonesia. If the deal goes through, it’ll strengthen Grab’s grip over the largest market in Southeast Asia, giving it a monopoly over 280 million customers, which means endless possibilities to cross-sell its other verticals.

Wrapping up, I believe:

Grab can enter new verticals like an e-commerce marketplace.

It can derive significant growth and efficiency by deploying robotaxis.

It can reinforce its market position by M&A, most notably by acquiring Go-To.

All these mean that it won’t run out of opportunities to deploy incremental capital at high rates of return, generating strong growth.

📊 Fundamental Analysis

➡️ Business Performance

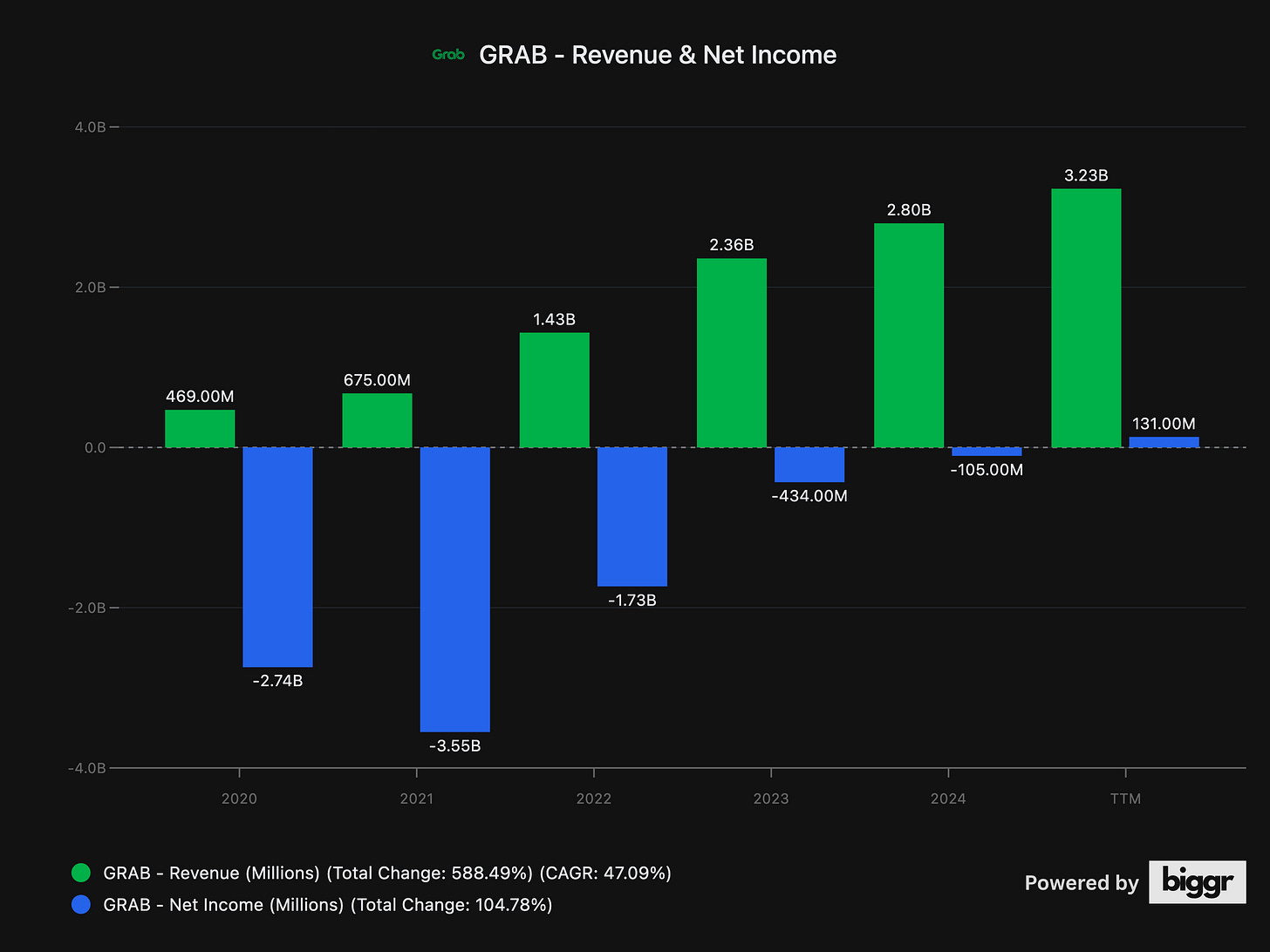

Grab performed phenomenally in the last five years. Look at this:

It has grown revenues 47% annually in the last five years, and it has just hit the inflection point, becoming profitable.

This is an amazing performance by any measure, and it clearly communicates Grab’s dominance in the region and affirms that its ecosystem strategy is working perfectly.

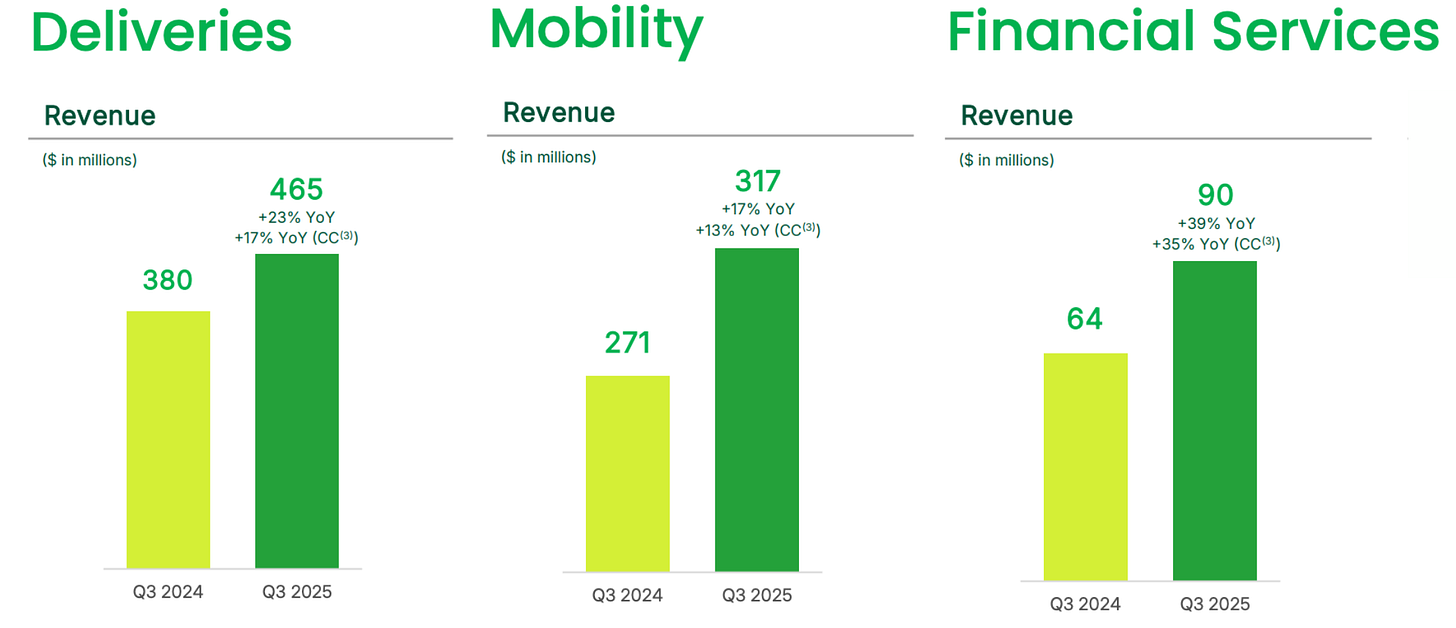

This neckbreaking performance leaves nothing much to discuss; we can only admire the way it executed so far. Given that its delivery and mobility segments are still growing strongly around 20% a year, and the financial services segment is still relatively small, growing 39% a year, I don’t think its growth will slow down soon.

Add opportunities in new verticals like e-commerce, robotaxi boost, and potential Go-To merger to the existing runway, and it’s easy to see that Grab has at least a decade of strong double-digit growth ahead.

An exceptional business at an exceptional position.

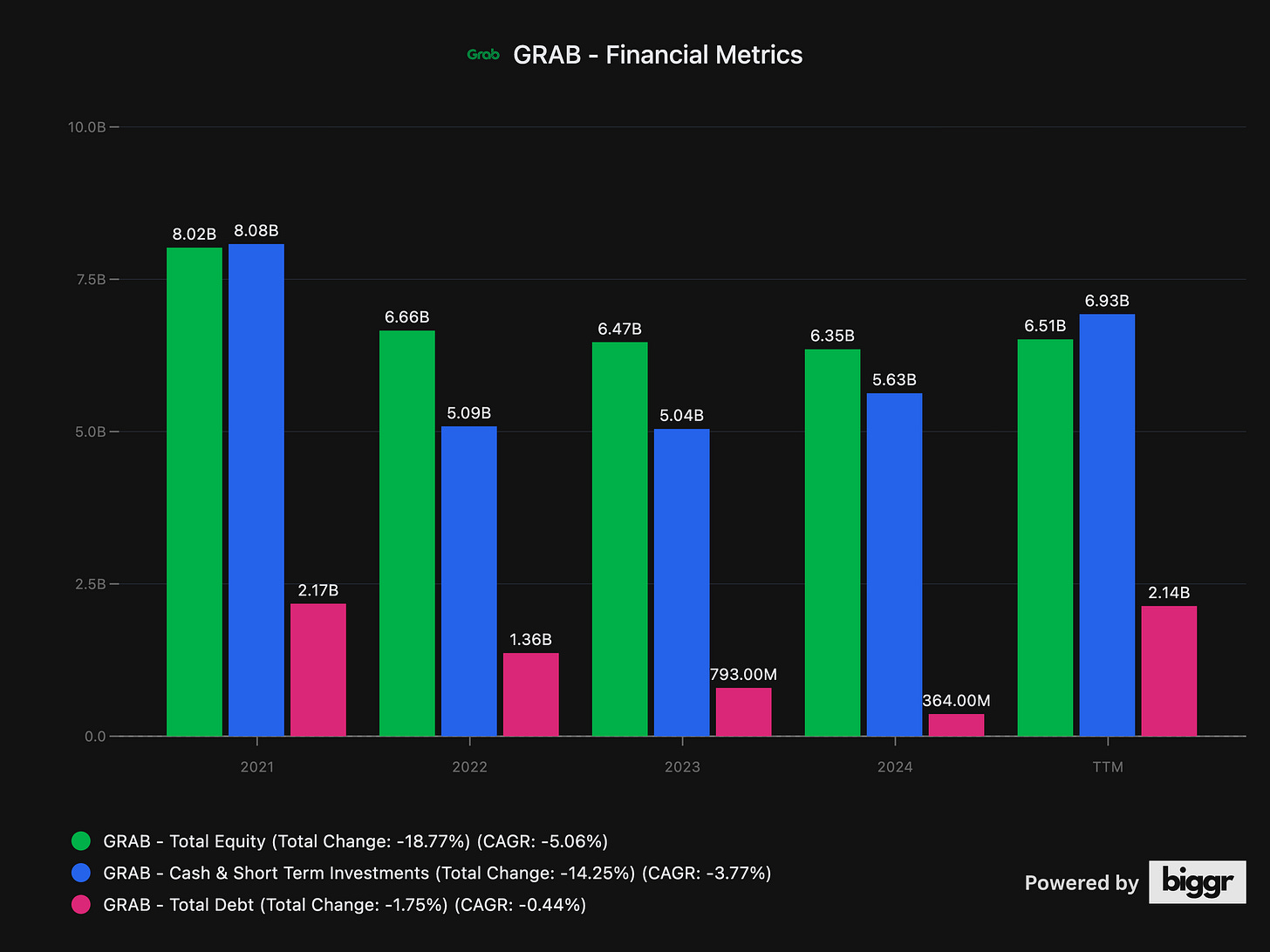

➡️ Financial Position

Grab has managed its balance sheet pretty conservatively despite being a fast-growth company.

It currently has $6.5 billion in equity against $2.14 billion in total debt, giving it a Debt/Equity ratio of just 0.32, which means very conservative financial management.

It also has $3.3 billion in cash and $3.6 billion in short-term investments, so it actually has a net cash position.

We have to note that Grab’s debt was ignorable in 2024, but it did a $1.5 billion convertible note offering to grow its cash reserves for a potential acquisition, possibly Go-To. If this weren’t the case, its debt would be ignorable.

In short, we are looking at a fast-growing business that has conservatively managed its balance sheet, with a net cash position. This balance doesn’t just guarantee that it’ll survive any financial downturn, but also well positions it to exploit future growth opportunities and acquisitions.

It’s rock solid.

➡️ Profitability & Capital Allocation

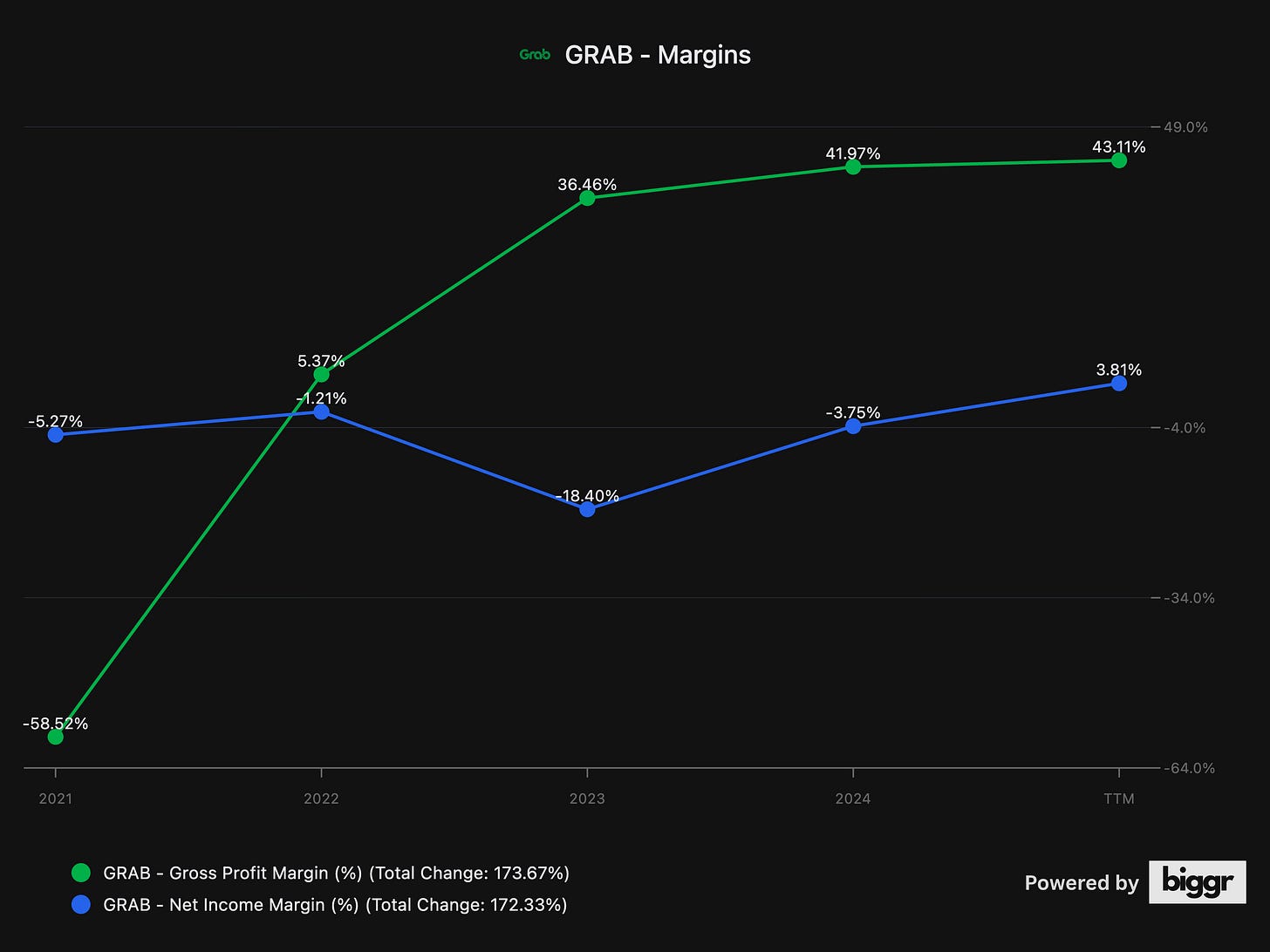

Gross & Net Margin

Grab’s margins are telling the whole story about this business—a dominant company having its inflection moment.

Its gross margin has expanded consistently in the last five years, meaning it doesn’t feel any competition. Net margin has also recently turned positive, signaling the start of its profitable growth era.

What impresses me about its margin profile is that its gross margin is nearly 10% higher than that of Uber. This is a result of its regional dominance.

Uber is a global business that is trying to expand in many markets at the same time. Some markets are more competitive than others, leading to a lower overall gross margin for Uber.

Grab, on the other hand, is dominating a smaller and well-concentrated market, where competition is less of an issue. Plus, its financial services segment naturally has a higher gross margin, pushing up the overall margins.

As a result of this regional dominance and higher margin businesses in the revenue mix, we can expect Grab to have a higher net margin than Uber when it matures.

Sales-to-Capital Ratio

Given that we are looking at a freshly profitable business, traditional capital allocation metrics like ROIC and ROE don’t mean anything.

For those cases, Aswath Damodaran recommends looking at the sales-to-capital ratio, which is basically total Sales/(debt+total equity−cash).

As of Q3 2025, the company had $6.51 billion in equity, $2.14 in debt, and $6.93 billion in cash and short-term investments, giving it a total invested capital of $1.7 billion.

Given that its TTM revenue is $3.2 billion, we are looking at a sales-to-capital ratio of 1.88, which means the business is generating $1.88 in revenue for every $1 invested.

This is pretty satisfactory given that the average of all US companies is just 0.84x and 1.55x excluding financials. Grab is generating way above-average returns on its invested capital.

In short, we are looking at a dominant business that is growing pretty fast, has a rock-solid balance sheet, and generates high returns on capital. That leaves one last question—what about the valuation?

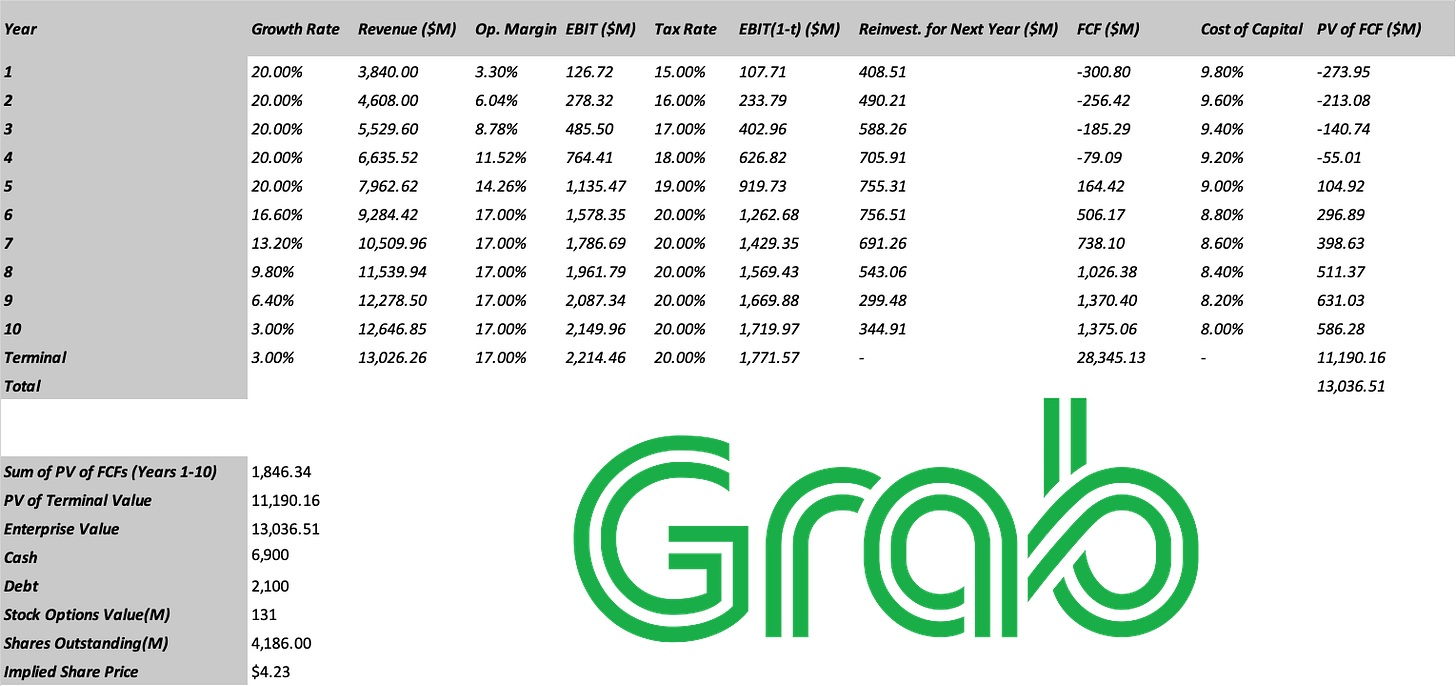

📈 Valuation

I repeatedly say these two things about valuation:

It’s not something objective.

A company with a moat makes valuation easy.

I am reminding you of this again.

Valuation has two parts—crafting the story and running the numbers.

Once you craft the story, running the numbers is a mechanical job; everybody running the same numbers will get the same result. So, the critical part of the valuation is crafting the story.

When you have a dominant business with a moat, crafting a story gets easier because the chances that an unexpected competitor or a technology will emerge and break your story decline drastically.

Luckily, Grab has a giant moat around its business.

So, our job is simple—create a plausible scenario and run the numbers.

For Grab, my scenario would be as follows:

I believe it’ll grow revenue 20% for the next 5 years, which will then converge to 3% in the year 10.

Its operating margin will be around 17% as Uber’s operating margin is expected to settle around 14% in the next three years. I think Grab can achieve 17% due to local dominance and financial services in the mix.

It’ll have a terminal ROIC of 15% thanks to its competitive advantages.

The current tax rate looks high because profitable subsidiaries pay the normal rate, but unprofitable subsidiaries in other countries don't reduce taxes owed in another country. It’s not that it’s taxed at 50%.

If we look at Q3 2025 only mobility and deliveries generated positive EBITDA, of which total was $259 million. Given that Grab paid $21 million in actual tax in Q3, its real effective rate was around 8%. I’ll be conservative and assume that this rate will be 15% in the short term as net loss carryovers deplete. Then, it will converge to 20% in the terminal period as statutory rates differ between 17%-25% in Southeast Asian markets.

Its current cost of capital is around 10% according to GuruFocus. The average for mature American companies is 7%. With a bit of an emerging market premium, its cost of capital will be around 8% in the terminal period.

The business had a total of 41 million outstanding stock options. The company didn’t ascertain its fair value, but it stated that the fair value of restricted stock units was $3.21 per share, so I’ll use that as a proxy, as it’s the best available information.

Here is what we get running these numbers:

Grab closed the week at $4.38, meaning it’s in the fair value range.

Normally, I would love to buy an exceptional business at fair value; however, given that the market is trading at record high valuations, I tend to keep my cash level relatively higher, preparing for an inevitable correction.

There is a good chance that we can secure a significant discount on fair value in the event of a slight market pullback, and it’s highly likely, as Trump is again using tariffs to pressure Europeans in the matter of Greenland. I’ll closely observe it and pull the trigger if we get that.

🏁 Conclusion

Grab is a unique business.

It has created an ecosystem of interconnected products and services that create synergetic growth and lock in both customers and service providers.

It has delivered a neck-breaking growth in the last five years and has recently become profitable. It still has ample growth opportunities ahead and a strong balance sheet to support further expansion.

It’s truly a unique business, at a unique position, and market prices it more or less fairly, according to my calculations.

If the current valuation was 15% lower, I would open a position tomorrow. But given that the market is now at 23x earnings and historically it has never stayed at this level for more than a year, paying the fair value feels expensive.

It’s nothing about the business. It’s just about the opportunity cost.

If there is a high likelihood of a correction on the horizon, and there is, I would want a larger discount, so bigger potential return from any position today, as deploying capital now means I will be able to deploy less in the future correction, possibly missing many no-brainer opportunities.

This is why I am waiting now, although it’s an amazing business with one of the widest moats in any market.

If it drops below $4, and preferebly $3.90, it becomes a no-brainer, and then I open a position.

Hope this helps.

Insightful deep dive and well written.

Grab just hit a major milestone: 15 straight quarters of Adj. EBITDA growth, first consistent net profit, and now running at 48M monthly transacting users.

Fintech revenue +39% YoY, loan run-rate at $3.5B annualized, guidance up to $3.4B revenue for 2025, and $7.4B cash fortress.

The superapp flywheel is real — high-frequency daily needs (ride/food/grocery) + embedded fintech = massive digital moat in SEA.

Execution is elite. $GRAB proving the model actually works 🚀📈

Grab is a strong product, but a weak equity right now. The core issue isn’t growth optics — it’s that Grab hasn’t proven it can convert its super-app footprint into a dominant, high-margin financial ecosystem. Unlike Alipay or WeChat Pay, GrabPay is an add-on, not infrastructure. Payments lack ubiquity, network effects are fragmented by country, and margins remain pressured by incentives, regulation, and competition. Until Grab shows sustained free cash flow expansion driven by payments or fintech — not rides or food — the stock is more likely to trade sideways than re-rate upward.

Grab

→ Started as a ride-hailing & delivery app that added payments

Alipay / WeChat Pay

→ Started as payments and became the backbone of daily life

That single difference explains almost everything

Grab competes with Uber + DoorDash.

Alipay and WeChat Pay replaced cash itself.