Finishing September: Our Portfolio Outperforms S&P 500 By 52%, Here's What We Own!

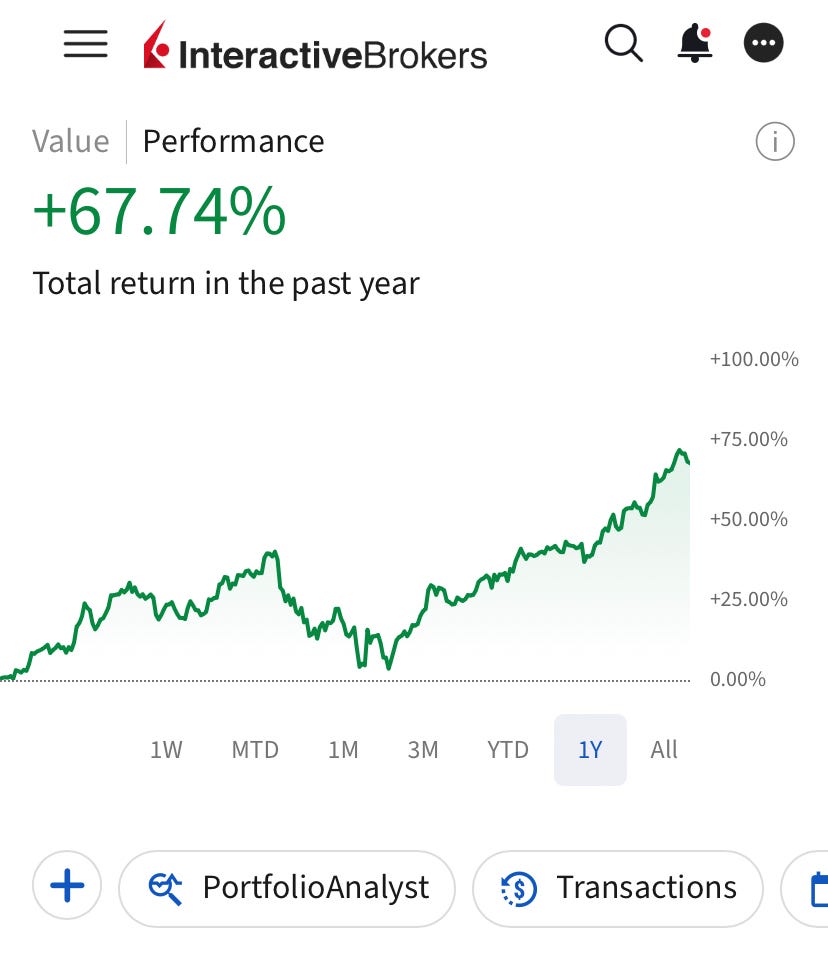

Our portfolio is now up 67% in the last twelve months against 15% of the S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 52%!

Portfolio is now up 67% in the last twelve months against 15% of the S&P 500!

I had opened the August portfolio update by saying that it had been an incredible month for us. Just when I thought it couldn’t get any better, it got better.

September was our best month within the last twelve months:

Our growth positions became multi-baggers.

Most of the foundational positions appreciated in price.

Beaten-down positions recovered substantially from their lows.

Result? Our margin of outperformance grew by 6%, reaching 52%!

Let me be direct—this is something extraordinary.

This portfolio had already delivered a 50% return last year. At that point, most people, including me, would be satisfied with even the slightest outperformance this year, given the base effects that would surely kick in.

Yet, this portfolio is now outperforming the S&P 500 by more than its total return last year.

What’s even better than this is how this portfolio behaves and how well it’s positioned to sustain this margin of outperformance in the future.

What does this mean?

If you have been following this publication for a while, you know that we run a barbell portfolio. We combine fundamentally strong growth positions with market-leading businesses that are valued attractively, so-called foundational positions.

Up until this quarter, most of our outperformance was driven by our growth positions. We have been extremely skillful in picking these positions in the last three years. Most of the growth positions that we added last year or early this year have become multi-baggers.

In this period, most of our foundational positions market-performed or performed slightly better than the market. So, their incremental contribution to our performance remained limited. A few of them, on the other hand, remained inexplicably undervalued.

I previously said that these foundational positions would surely recover, and when that happens, our margin of outperformance would grow substantially.

This is happening now.

Last month, most superinvestors filed their 13-F reports, and a considerable number of them bought the positions that we hold and deem extremely undervalued. That steered the market’s attention to those stocks and led to aggressive repricing.

As a result, one of our largest positions, one we also deemed most undervalued, appreciated 41% from its August lows. It appreciated 15% only in September, against just 2% of the S&P 500.

Thus, we are now generating significant alpha not just from our growth positions but from our foundational positions too.

This has substantial implications for us:

Growth of the foundational positions reduces the volatility of the portfolio.

The downside shrinks in case of a market correction.

Thus, if the market gets into a correction, we won’t get rug pulled like the portfolios deriving their outperformance from speculative, momentum names.

This is where real outperformance appears, not on the way up, but on the way down.

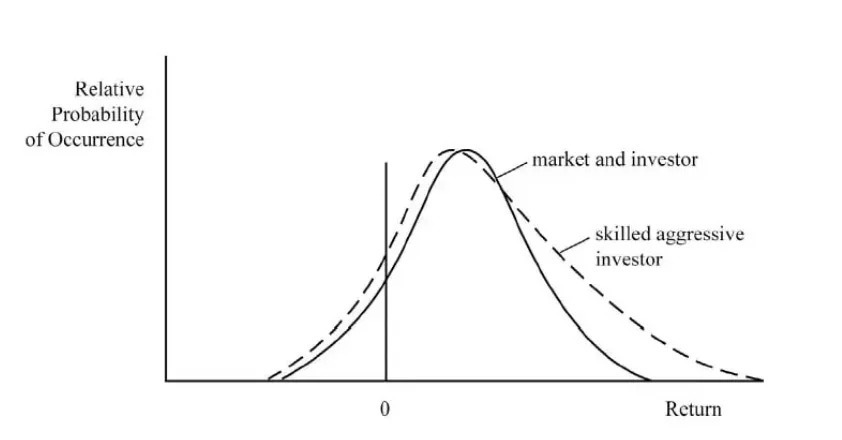

Howard Marks explains this perfectly in his book Mastering the Market Cycle:

When the correction comes, three things will happen:

Growth stocks that aren’t making any money will be thrown into a bottomless pit.

Multiples will shrink for the growth stocks that make real money.

Money will flow to defensive positions.

All of our growth positions have strong fundamentals, and they make real money. We don’t hold any speculative positions that aren’t making money. So, we’ll see their multiples shrink, but they won’t fall into a bottomless pit.

In the meantime, our defensive foundational stocks will either appreciate or stay, more or less, at the same levels, acting like an anchor for the portfolio.

As a result, we’ll keep staying ahead of the market while those who derive their outperformance will get rug-pulled and see all their gains erased in a matter of months.

So, our portfolio is very well positioned to keep outperforming regardless of what comes next, as it has done so far:

Our portfolio is now up 67% against 15% of the S&P 500!

In the previous updates, I had discussed the outlook for all new positions, provided a broader commentary for the portfolio, and rationales for some notable transactions.

In this update, at the request of the community, I’ll review the portfolio positions where I believe significant upside potential remains.

So, it’ll be a detailed one. Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 20,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 26 holdings in our portfolio.