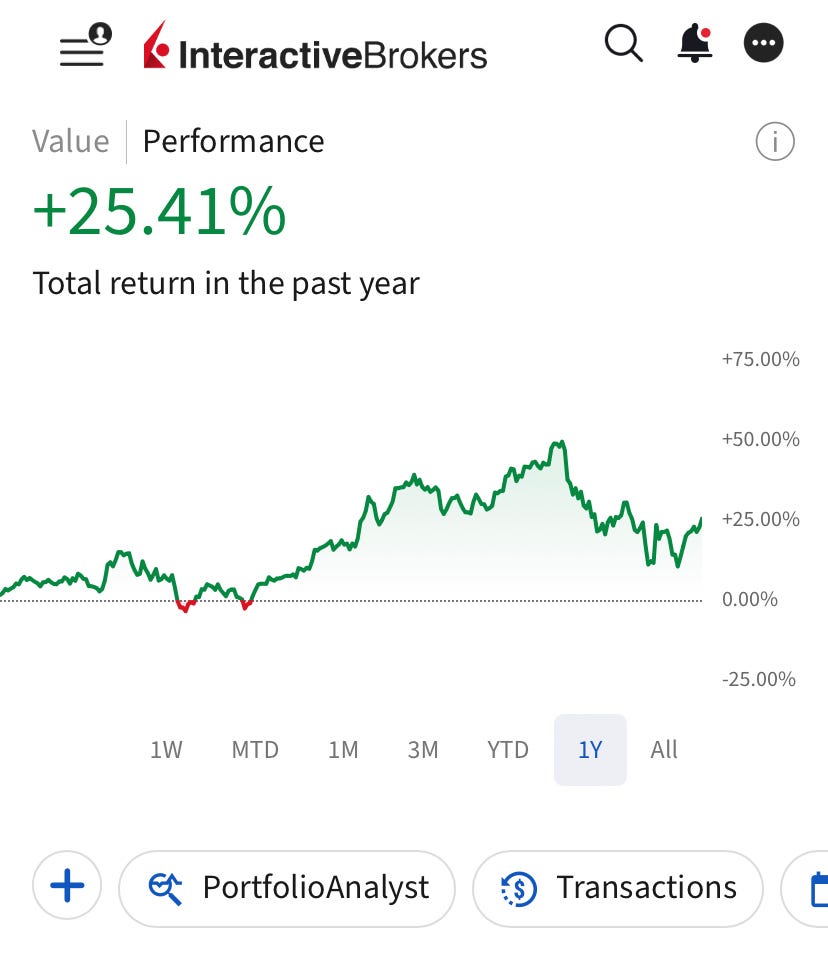

Finishing Q1: Our Portfolio Outperforms S&P 500 By 13%, Here's What We Own!

Our portfolio is now up 25% in the last twelve months against 12% of the S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 13%!

Portfolio is now up 25% in the last twelve months against 12% of the S&P 500!

Let me be straightforward—I am very proud of this performance.

This portfolio finished the year up 51% and outperformed all but 1 of Wall Street's hedge funds!

Yet, in the first update of the year, instead of hyping for more, I emphasized that real outperformance is delivered on the way down, not on the way up, and I always reminded that the real valuable thing was not the outperformance itself—it was the way we did it!

We delivered that outperformance by taking very little relative risk.

This is why I said the real success of this portfolio would appear when the market starts going down. I am proud to say that it happened exactly this way!

As the market started to nose dive, investors who derived their outperformance from holding speculative stocks got rug pulled.

We kept staying ahead of the market by a margin!

So, if we didn’t take more risks, where does our alpha come from? Three factors:

1. Barbell portfolio.

We own two types of stocks:

Foundational stocks with heavy moats. We try to buy them at attractive prices, and we buy them intending to hold them forever.

We combine our foundational positions with fast-growing businesses that have competitive advantages and solid balance sheets.

In good times, our growth positions drive a margin of outperformance, and in bad times, our foundational stocks work like an anchor, preventing the full erosion of the margin of outperformance.

Barbell architecture also allows us to enhance the above effects by quickly switching our positioning from very aggressive to very defensive.

We saw this dynamic play out many times this year, contributing to our continued outperformance.

2. Position Sizing

George Soros put this best—It's not whether you're right or wrong, but how much money you make when you're right.

I believe we have a nice batting average. However, if equally distributed, it would have resulted in a very small margin of outperformance.

What really contributed to our performance was position sizing.

We concentrated on the right positions. The bigger growth positions in our portfolio justified our conviction, while all losing positions were very small ones.

We never suffered an irrecoverable decline in either our high-conviction growth stocks or foundational stocks. We never had to exit at a loss because the business permanently deteriorated.

We made mistakes, but we were right on our high-conviction positions. We showed patience to them, added to them when they got sold off on good earnings, and they paid off.

When the market was at all-time highs, some of those positions had done 3x-4x in the preceding twelve months. When the market nose-dived, they didn’t go back to baseline, they are still up 100-200%!

3. Long-Term View

It’s impossible to predict what’s going to happen tomorrow, next month, with the next earnings, etc..

I always go through the following dilemmas:

If the position is a small one, I feel like I have to own more just before earnings.

If it’s a big one, I feel like I have to reduce exposure.

No one is immune to such urges; we feel them, but the important thing is we don’t give in.

I see many investors on Substack and Twitter waiting, ready to shoot after earnings, like a gunfighter. If the earnings are nice and the reaction is up 10%, they deem themselves successful if they buy when it was just up 1%. The same applies to negative reactions too. If it’s negative 10% and they sell immediately at negative 1%, they present it as a success.

Anybody who has read even the most fundamental works about investing knows that this is not smart investing. It’s more like a quick draw than investing. You may make money doing it, but it won’t be replicable forever.

We don’t operate that way here.

We take the long view. This is an important part of our position sizing:

We always start with a small position. Grow it if the market keeps undervaluing it despite improving fundamentals.

We don’t touch it if the fundamentals don’t improve, and seek an appropriate exit after following it for enough time.

We own a promising stock, which skyrockets 20% after earnings, but we do nothing. Instead:

We calculate the new fair value based on improved fundamentals and wait for the market to give us that price.

A few weeks, or maybe months later, it gets hammered down for macro reasons, overblown news, or for nothing. That’s when we double down.

This is basically how we find the alpha—barbell approach, position sizing, long-term view.

We didn’t day trade, we didn’t short, we didn’t use complex hedges. We derived all the alpha from stock picking and position sizing.

And it has worked phenomenally!

Our portfolio is now up 25% against 12% of the S&P 500!

The following transactions took place in our portfolio in April:

We didn’t sell anything.

We opened 3 new positions.

Increased 3 of the existing positions.

In the previous updates, I had provided my 2025 outlook for each company in the portfolio.

In this update, I’ll also provide an outlook for new positions and explain how I am planning to further position the portfolio for the macro uncertainty ahead.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 15,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 21 positions in the portfolio.