Finishing October: Our Portfolio Outperforms S&P 500 By 40%, Here is What We Own!

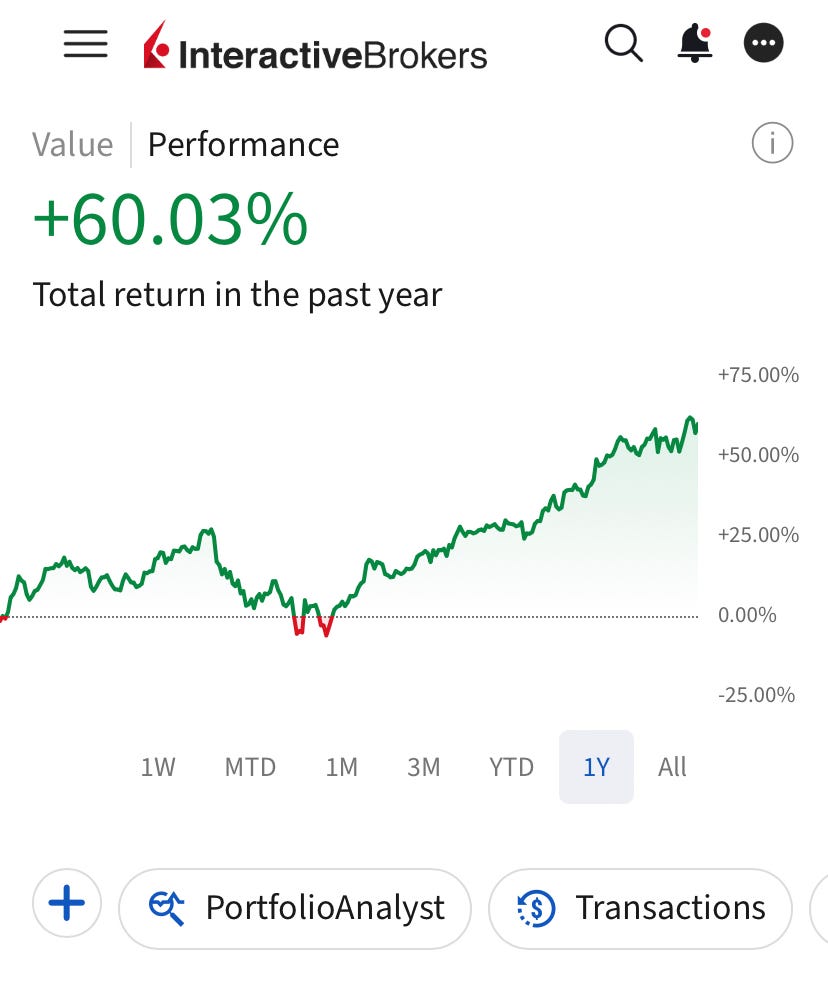

Our portfolio is now up 60% in the last twelve months against 20% of S&P 500. Here is our updated portfolio.

💥Our portfolio is outperforming the market by 40%!

Portfolio is now up 60% in the last twelve months against 20% of the S&P 500!

Let me be straightforward—October was an amazing month for us:

None of our positions suffered a significant drawdown.

A few of our positions reached their all-time highs.

One more position has doubled from our average.

I always try to keep it humble, but let me say that this is something to be proud of.

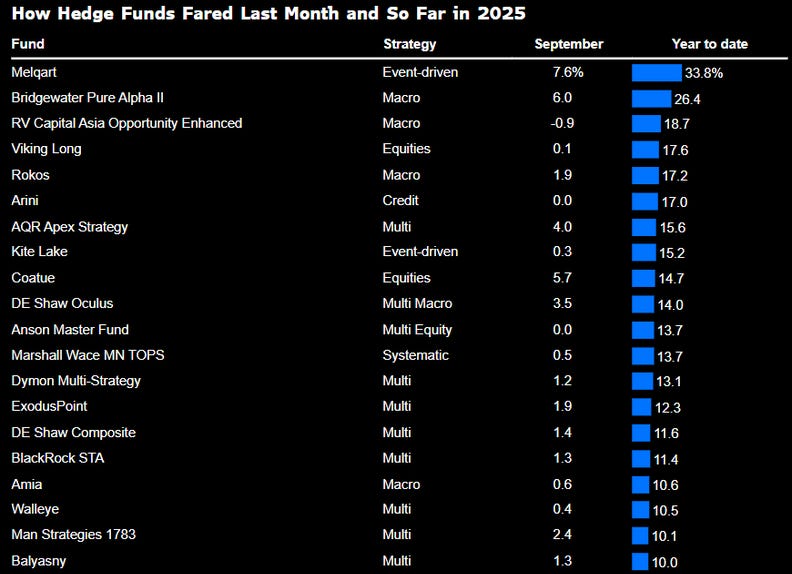

Around this time last year, we had gotten the YTD performance data for the best hedge funds on Wall Street, and our portfolio was outperforming all the disclosed performances.

Now, we also have the YTD performance data for the best hedge funds this year, and our portfolio is again outperforming all of them:

This is indeed something to be proud of.

What’s even better is that we have been able to remain consistent in our performance while the best-performing hedge funds in this list and their performances have changed wildly since last year.

This tells us something—it’s very hard to deliver high performance consistently.

So, why is it so hard, and how did we achieve it?

Well, there are two reasons why it’s so hard:

The market gets more efficient as we go longer into a bull market.

The chance of “false positive” increases for stock pickers.

I listed these two as separate reasons, but they are actually interconnected.

So, what do I mean by these?

For us to make money as investors, we need to find equities mispriced by the market. I call this gap between the market price and fair value “valuation gap.”

You bet that a valuation gap exists, and if the market recognizes this, it closes this gap, and you make money. Though this mechanism is in favor of investors, there are two problems:

The market tends to close that gap quickly once it recognizes it.

Many smart people do this in bull markets, so many gaps get closed.

The first one is intuitive. Once the market recognizes a valuation gap, it’s closed as soon as possible because the market doesn’t want anybody to make free money. This creates the “base effect” problem.

Assume that an issue is 30% undervalued. Once the market recognizes this, it tends to bump it up by 30% as quickly as possible. As a result, you quickly generate a 30% return. However, the issue is now fairly valued, and all you can expect from it going forward is the market return. If it’s a one-stock portfolio, you’ll see a 30% return within the year; however, next year you’ll see just 10% given that the market has valued it fairly.

Thus, if you want to keep outperforming, you have to find new issues with the valuation gap.

The challenge is that, in bull markets, too many of these gaps are closed pretty fast as many smart people are searching for them. Thus, the market gets more efficient.

The more efficient the market, the harder it is to find valuation gaps. This means that if you make the same number of bets as before, your likelihood of hitting false positives will increase. When you hit a false positive, it’s worse than doing nothing, as it drags the performance down, whereas doing nothing is neutral.

Despite the more challenging environment, we have been pretty skillful in finding new issues with the valuation gap and overcoming the base effect.

Here is the proof:

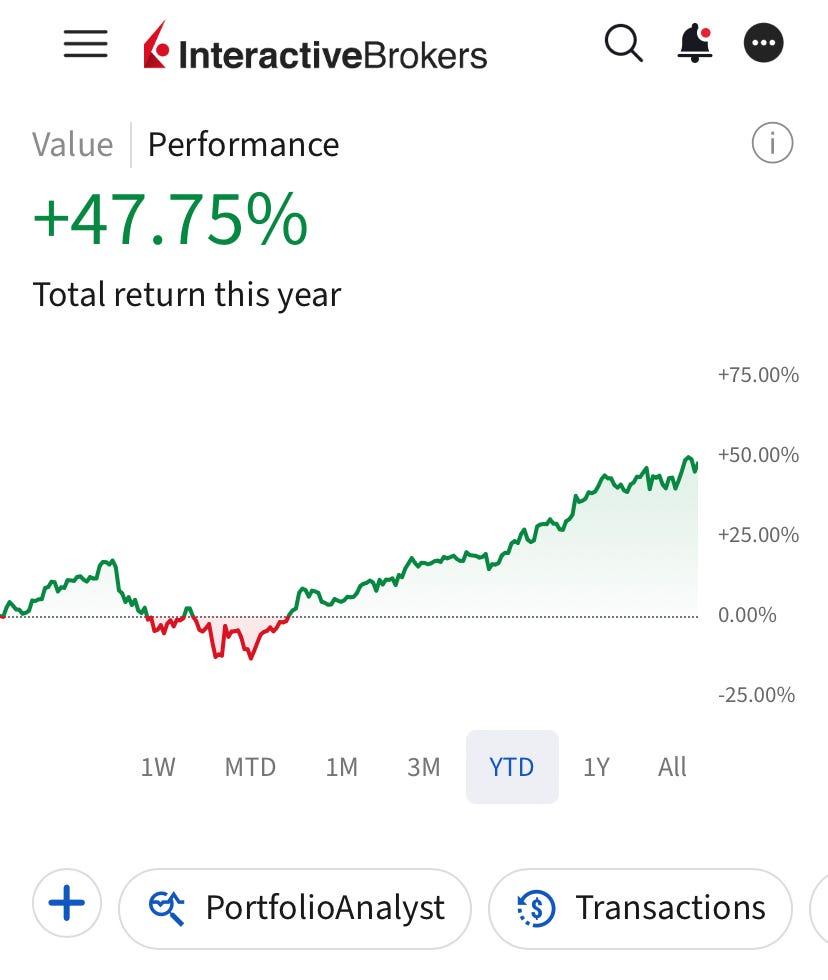

Portfolio is up 60% over the last twelve months, but we generated 47% of it in 2025.

Therefore, I believe the real question is— how did we avoid hitting the false positives, given that it has become harder to find such valuation gaps?

I think the answer is specialization, or you may call it domain expertise or focus.

I have a few industries in my mind that I believe are poised to disproportionately benefit from the technological transformations we are currently experiencing. Thus, we have been able to understand the industry dynamics better there and spot the companies best positioned to win in those industries.

Fintech and insurtech are examples.

For instance, we doubled our money on RobinHood last year, tripled it again on SoFi this year, and Dave, a stock I picked last October, is up 5x.

Similar pattern in the insurtech. Just within this year, we doubled our money on Root and doubled it again on Lemonade.

Because of establishing expertise in those several industries, we have been able to see the valuation gaps that others overlooked and have succeeded in avoiding hitting as many false negatives as generalist value hunters.

Excluding the stocks we bought before 2025, we have been able to find 4 multibaggers just this year. Meaning, four stocks we bought in 2025 have delivered 2x or more up until now. Given that there are still two months to go, this number can increase.

This was what I call the “active element” of our strategy, i.e, where we look, what we buy, etc. There is also a “passive element” that is at least as important as the active one.

It’s the discipline.

Despite our success in picking growth positions, we have resisted getting swayed into picking more and more speculative positions in search of higher upside.

All our growth positions generate real revenue, and they have strong balance sheets, which guarantee that they’ll stay afloat even in the strongest market downturns, substantially limiting the downside.

This kind of downside limitation is vastly more important for consistent returns than upside maximization. In good times, buying speculative stocks and riding the momentum may maximize upside, but that exposes you to substantial risks:

You never know when the momentum turns.

When the momentum turns, the downside is unlimited.

Indeed, when the momentum turns, what changes isn’t just the stock price for those speculative bets. Business conditions also change. Access to capital gets harder, and they can easily go bankrupt in the absence of cash flows to sustain themselves.

Thus, if you are trapped inside when the momentum turns, you are exposed to unlimited downside, and you’ll have to incur serious loss to avoid potential collapse.

Even if you manage to time the market and get out before the downturn, you’ll be exposed to the same risks when buying something again. You’ll never know whether the crash is done, and conditions will only get better. Thus, you’ll again find yourself in a position where you have to buy at the right time.

You can do this once or twice, but we know for sure that nobody can time the market consistently over long periods. Market timing inevitably goes wrong at some point, which kills the consistency.

We have decisively avoided such consistency-killing behavior and stuck with the strategy in a disciplined manner.

And it has worked incredibly for us so far.

Our portfolio is now up 60% against 20% of the S&P 500!

In the previous updates, I had discussed the outlook for new positions, provided a broader commentary for the portfolio, and rationales for some notable transactions.

In this update, I’ll share:

General commentary for the portfolio.

Future plans & what I’ll be buying and selling.

Positions that I think are still trading at attractive levels.

It’s going to be a detailed one. Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 21,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 26 holdings in our portfolio.