Finishing November: Our Portfolio Outperforms S&P 500 by 30%, Here Is What We Own!

Our portfolio is now up 46% year-to-date against 16% of S&P 500. Here is our updated portfolio.

💥Our portfolio is outperforming the market by 30%!

Portfolio is now up 46% year-to-date 16% of the S&P 500!

It’s been another great month for our portfolio, and I have many things to say, as it’s been an eventful month, but first, let me start with the most important thing—giving thanks.

We had Thanksgiving last week, and this is the first time I have addressed you since then. So, let me take this moment to say that I am thankful for you, for everybody reading this publication, for the great community we have on here and Discord, and for every exchange we have had so far.

When I first started writing, my goal was to create a no-nonsense publication that would generate alpha for investors and make this publication one of the biggest.

We have added thousands of readers on the way, but more importantly, we have created a close-knit community that is always in contact. I now know maybe over a hundred of our readers by name, and I am happy to call them friends.

I am thankful for this, truly.

Let’s now shift gears to portfolio!

I am very proud that this portfolio is heading toward its third year in a row, generating a +35% annual return. This is truly something.

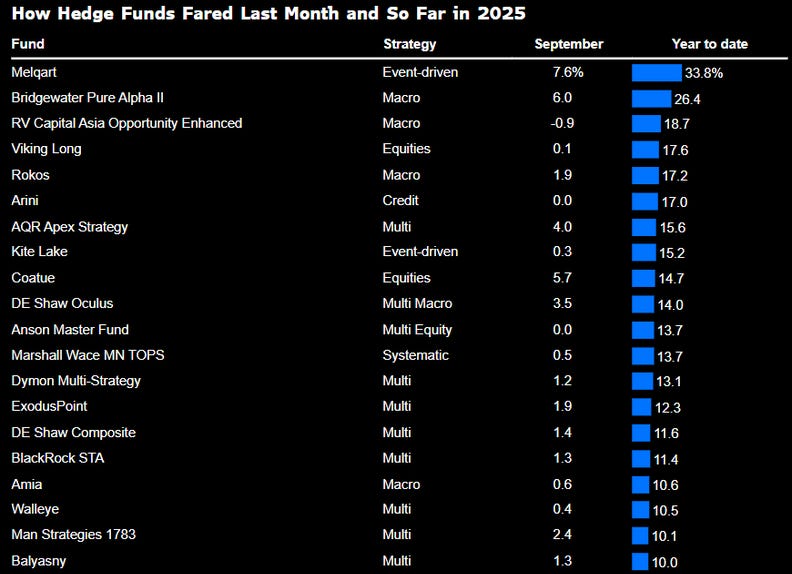

We didn’t just outperform the market; we outperformed all the major hedge funds that disclosed their performances back in 2023 and 2024. We are on track to beat them third year in a row, as I disclosed in the previous update:

What I think is more impressive than our performance is that we generated it through skilled stock picking and position sizing. Let's explain what I mean here a bit more.

When you start from a lower base, i.e, you hold high-quality & undervalued companies, it’s easier for you to expect high returns. That’s just basics.

The challenge we faced was that our portfolio had already delivered very high performance in the past two years, and thus, the upside had shrunk for most of our positions. We had to find new sources of alpha; we had to make new picks.

I am proud that we have achieved this:

We have found 4 multibaggers just this year.

When warranted, we expanded our scope and bought metals.

We kept our winners that had further potential, and they performed.

As a result, we managed to generate significant alpha from the ground all over again.

What’s most important to me here is that we haven’t compromised on downside protection while doing all these and generating this performance. I think the past three weeks showed what I was warning against for a few months now.

I have explained several times that generating high returns in a bull market isn’t hard. You can just buy the most well-known stocks in hyper-growth themes, even though they don’t have earnings.

Actually, no earnings is even better because no earnings means that the price can be determined solely by speculation and forward projections. There is a limit on how stretched profitable companies can trade, as earnings are like the pull of reality.

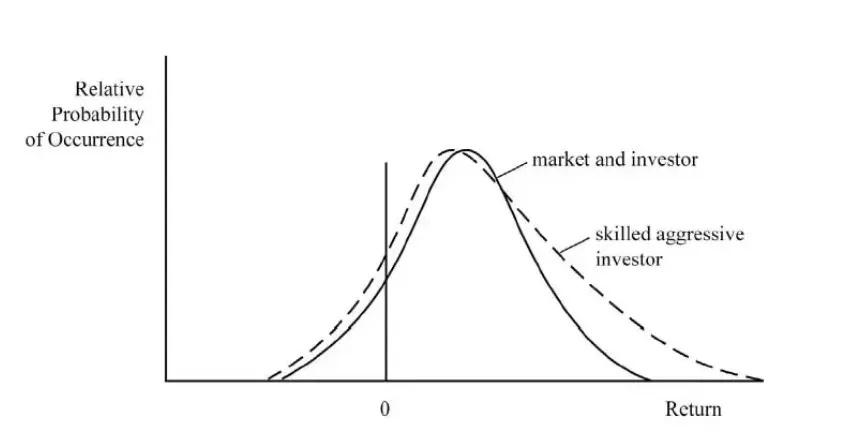

Howard Marks explains this very well in his book, Mastering the Market Cycle:

What this chart means is that aggressive investors who are positioned in higher beta stocks will likely have a higher performance if the market goes up. This is why many people buying no-revenue stocks will think they are good investors, as the stocks they hold can have unlimited beta in the absence of earnings anchoring the price to reality.

That’s easy to achieve.

What’s hard is staying ahead when the markets turn south.

High beta and no price anchor cuts both ways. When the market turns south, those who invest in speculative, no-revenue stocks get rug pulled. They go down so much so fast that they can’t even react most of the time.

We have seen this as the market pulled back in the previous two weeks. Despite the pullback being around just 5%, many people posted screenshots of 20-30% losses as their no-revenue holdings slid without a ground below them.

We have never engaged in such speculations to generate performance and always emphasized downside protection while investing for growth.

We do this by:

Picking growth positions that generate real revenue, preferably earnings.

Insisting on strong balance sheets that can weather any financial storm.

Buying when the stock is undervalued on conservative assumptions.

As a result, our portfolio remained strong in the recent pullback while many aggressive portfolios moved like altcoins.

Going forward, I am confident that our portfolio is poised for continued outperformance.

We have significantly repositioned in the last 5 weeks as we are nearing a new year.

Some of our portfolio positions had become overvalued, and they wouldn’t be just a drag on the performance next year, but they would also expose us to higher downside risk due to their elevation. We cut them together with our unsatisfactory positions and put the proceeds in new positions or increased existing undervalued positions.

As a result, our portfolio now has new sources of alpha to beat the base effects from this year and keep generating high performance next year. This also automatically reduced our downside risk as the stocks we bought or increased are way undervalued compared to what we exited.

In short, we have repositioned the portfolio to beat base effects and have a better risk/reward profile, as we have always done after high-performance years, to maximize the chance of outperformance for the following years.

So, our portfolio is very well positioned to keep outperforming as it has done so far:

Our portfolio is now up 46% against 16% of the S&P 500!

The following transactions took place in our portfolio in November:

Exited 8 positions.

Opened 2 new positions.

Increased 2 positions.

In the previous updates, I had provided my outlook for each company in the portfolio.

In this update, I’ll also provide an outlook for our new positions and share my overall portfolio commentary and strategy going forward.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 22,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 20 holdings in our portfolio.