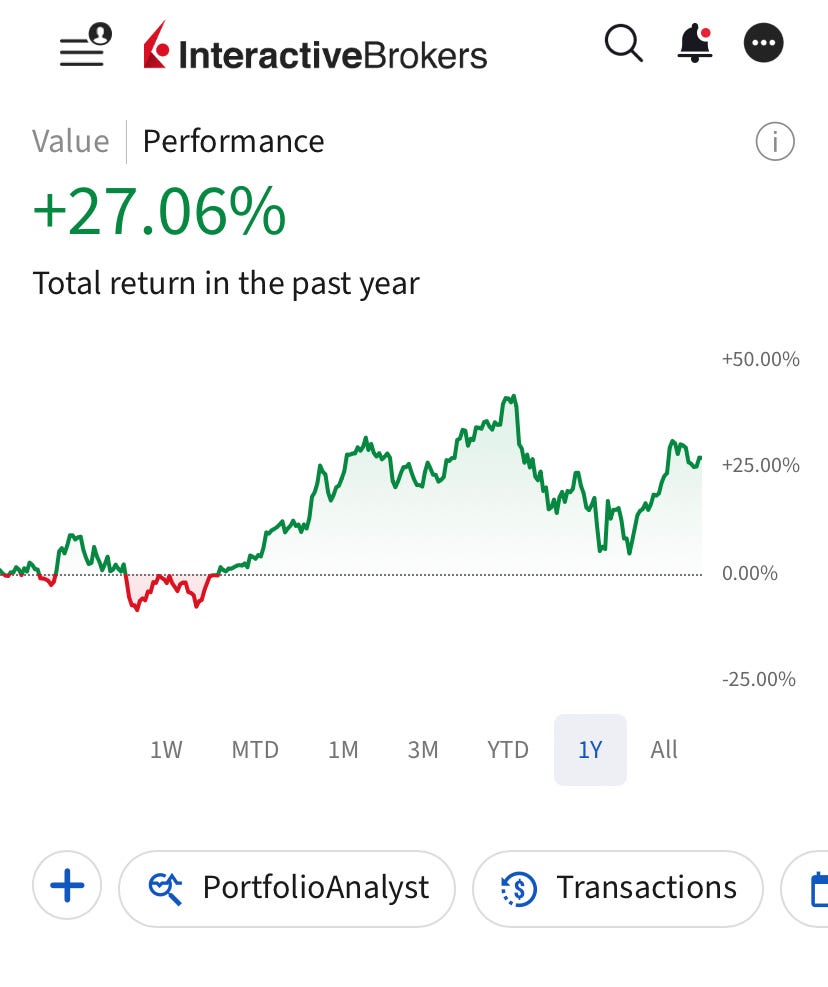

Finishing May: Our Portfolio Outperforms S&P 500 By 15%, Here's What We Own!

Our portfolio is now up 27% in the last twelve months against 12% of the S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 15%!

Portfolio is now up 27% in the last twelve months against 12% of the S&P 500!

I’ll be very direct and to the point—May was an exceptional month for our portfolio.

This is despite one of our larger positions lagging significantly.

So, how did we drive this outperformance?

Our growth positions came up with exceptional earnings! This wasn’t just important in terms of performance, it was also important in terms of validating our conviction.

Those who follow the publication regularly already know how I pick those positions. These stocks were generally overlooked by the market despite their stellar fundamentals for a few simple reasons:

They are under a certain size, so most institutional funds can’t buy them.

They were unprofitable at the time of purchase, repelling retail investors.

Their business models could be complex on the surface.

These factors create giant opportunities for those who can:

Pick the durable business models that will reach the inflection point soon.

Value the businesses in terms of future cash flow, not net earnings.

In the last twelve months, several of these stocks in our portfolio have hit that point and become profitable.

Every time that happened, our portfolio got a big bump as they became eligible to be owned by most institutional funds, and retail investors flocked to them following the profitability.

Yet, most of these businesses weren’t tested against headwinds, this is why May was important.

Result? They performed phenomenally in the face of macro headwinds arising from the trade wars.

This means that we are picking the right business models for the growth side of our portfolio.

I am going to give you the full portfolio update in a minute, but first, let me briefly talk about how we pick our growth positions, as many people have asked about this last month.

I have touched on this a few times before—we pick fast-growing businesses with strong balance sheets and competitive edge.

A strong balance sheet is straightforward. We want them to have a bigger equity pool than total debt. If they are profitable, we want at most 4-5 years of EBITDA to fully pay the whole debt. If not profitable, the cash burn rate should be very slow, giving it more than 5 years of runway without profitability.

The competitive edge part is often less clear. What do I mean by this?

It’s the business model.

Let me give you the manifesto first and explain it later:

We don’t buy wrappers; we either buy infrastructure plays or capital-intensive networks.

Now you are asking, what the hell does this mean?

Let me explain: Wrappers are the businesses that make it easier to access a core service or a product.

They act as a facilitator, they don’t actually create the core service or the product. This is why it’s easy to replicate them.

Think about your neighbourhood mini-market. It doesn’t actually produce the products it sells; it just brings them closer to you and charges a premium in exchange.

It’s easy to replicate them. You just determine the products people buy most often, buy them in bulk from a wholesaler, and sell them in your mini-market.

However, the wholesaler, on the other hand, is harder to replicate.

It has a way larger scale that enables it to partner with the largest manufacturers directly and get favorable prices from them. If you want to create a wholesaler, you need significant capital and a relationship with manufacturers.

We don’t buy wrappers regardless of how fast they grow. Most software businesses are like that.

What we buy are the infrastructure plays that create the core service or a product themselves. Following the previous example, a business distributing 10 best-selling soda brands to mini-markets is a way better play than the mini-market itself.

Or, we buy capital-intensive networks. Think about insurance. You need to overcome two issues:

Find enough capital.

Have a large enough pool of clients.

There are both capital and cold start problems.

Even if you find the capital, you need land clients. To do that, you’ll have to offer cheaper premiums and load up on marketing. All these are resource-consuming.

Even if you have the capital, there is a big chance that you’ll dry up your resources trying to reach the minimum efficient scale.

These are types of growth stocks we own, not wrappers.

And it’s working!

Our portfolio is now up 27% against 12% of the S&P 500!

The following transactions took place in our portfolio in May:

We exited 3 positions.

We opened 1 new position.

Increased 2 of the existing positions and trimmed 1 position.

In the previous updates, I had provided my 2025 outlook for each company in the portfolio.

In this update, I’ll also provide an outlook for our new position, discuss the rationale behind the trades of the month, and explain what I am looking to do next.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 16,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 19 positions in the portfolio.