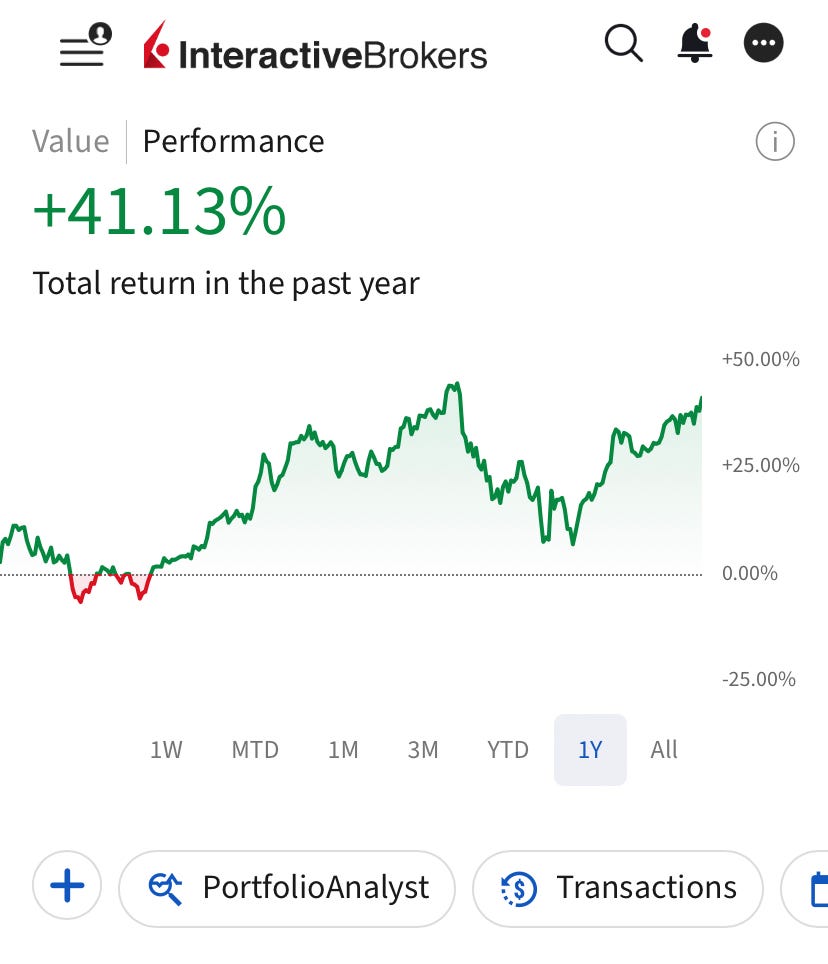

Finishing June: Our Portfolio Outperforms S&P 500 By 29%, Here's What We Own!

Our portfolio is now up 41% in the last twelve months against 12% of the S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 29%!

Portfolio is now up 41% in the last twelve months against 12% of the S&P 500!

Let me be straight—this was a hard year, and I am proud of how we performed so far.

There were several challenges:

At the beginning of the year, it was hard to find opportunities in an overvalued market.

When the correction came, it was hard to navigate the tariff-related uncertainty.

After the recovery, it was again hard to find opportunities in an overvalued market.

Yet, our portfolio delivered.

What I am more proud of is that the portfolio reacted exactly in the way it was structured to do.

If you have been following this publication for a while, you know our portfolio strategy:

We use a barbell portfolio.

We combine fast-growing businesses that are profitable and have strong balance sheets with foundational positions that hold monopolistic positions in their markets.

We don’t overpay.

In good times, our growth positions drive the portfolio to new highs, supported by our foundational positions.

In bad times, we expect our growth positions to decline less than their peers because they are supported by actual cash flows, not just sentiment. Also, our foundational positions act as an anchor due to their foreseeable earnings, limiting the downside.

We saw this play out in the last few months:

When the market was at this level, back in February, our portfolio’s YTD performance was in line with the market.

Then we got the correction in April, and the market has just recovered to the all-time highs. But now our portfolio is up 16% year-to-date while the market is just up 5%!

This is the important thing. We kept creating alpha when the market failed to do so.

Where did the alpha come from? It’s actually simple:

Our growth positions remained relatively strong during the pullback.

In recovery, the market noticed their potential and took them even higher than the pre-correction prices.

This is the strategy that I have been explaining since the beginning of this portfolio. It’s not just maximizing the performance, it’s maximizing risk-adjusted reward.

I have been saying this since the first day—despite our growth orientation, our portfolio is way less risky than the growth portfolios in the traditional sense.

How do we achieve this? We seek three criteria in our growth positions:

They should be profitable or at least free cash flow positive.

They should have strong balance sheets.

Valuation should be attractive.

This puts a floor under stock.

Unprofitable growth positions are basically valued purely on the vote by the market. There is no ground for they must stop at. They can basically decline without limit as long as the sentiment deteriorates.

For cash flow-generating businesses, this is different.

Even if the sentiment goes down the toilet, cash flows put a floor below them.

Imagine a business generating $10 million free cash flow a year now, with the potential to grow it 15% annually in the next 10 years and trading at just $150 million valuation.

If I were a private market investor, I would have bought that business.

The reason is simple.

In the 7th year, it will have generated a total of $100 million in free cash flow, meaning all the cash it’ll print after the year 7 will get directly into your pocket.

If free-cash-flow businesses become too cheap, they become a clear acquisition target for private investors.

This only makes sense as they perceive risk differently from public market investors.

For common stock investors, volatility is an issue. Even though it doesn’t directly measure risk, it affects your portfolio return at any given moment. For private market investors, it doesn’t matter. They don’t mark the prices to market every day. What’s important is the regularity of cash flows.

This is why there is a floor under cash flow positive stocks. Even if the sentiment goes down the toilet, they can’t go down as much because they will become an acquisition target.

Can’t unprofitable businesses get acquired? They might be. But they are mostly targets for strategic acquisitions, rather than financial ones.

The reason is simple. They lack what the private market investors demand—foreseeable cash flows.

By selectively buying growth positions with actual cash flows, we kept the downside limited while maximizing the upside.

This has worked spectacularly so far:

Our portfolio is now up 41% against 12% of the S&P 500!

The following transactions took place in our portfolio in June:

Trimmed 1 position.

Increased 4 positions.

Bought 4 new stocks.

In the previous updates, I provided my 2025 outlook for each company in the portfolio.

In this update, I’ll also provide an outlook for our new positions and explain the rationale behind the trades, and share our strategy going forward.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 17,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 24 holdings in our portfolio.