Finishing July: Our Portfolio Outperforms S&P 500 By 24%, Here's What We Own!

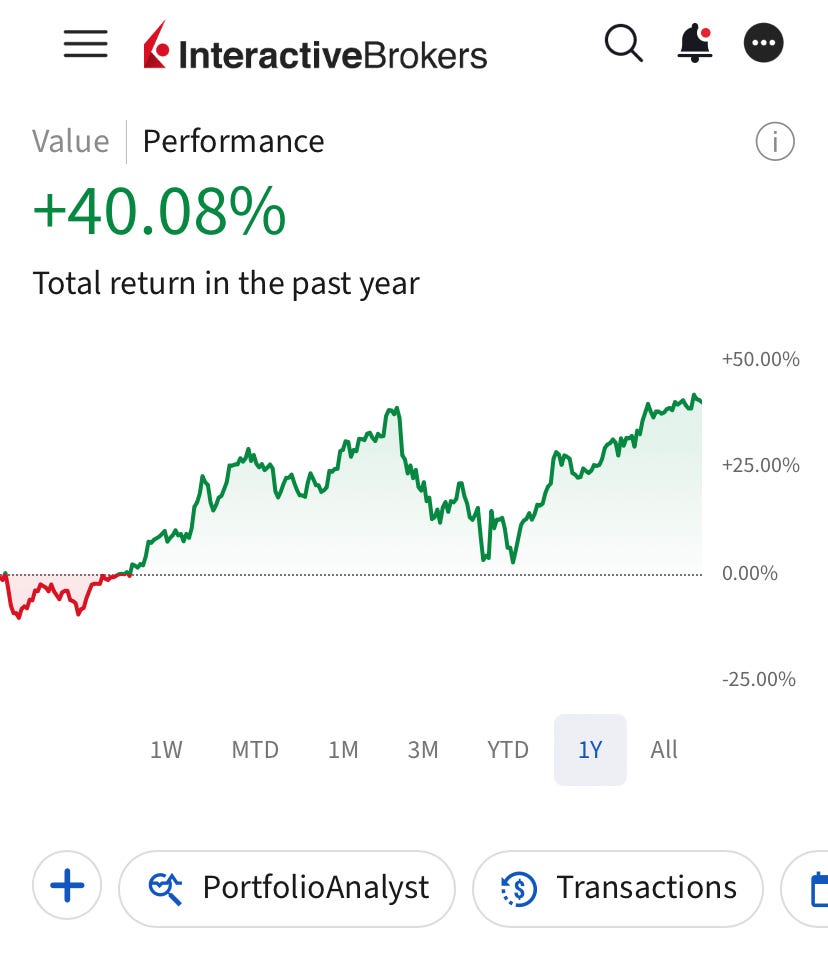

Our portfolio is now up 40% in the last twelve months against 16% of the S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 24%!

Portfolio is now up 40% in the last twelve months against 16% of the S&P 500!

I’ll be straightforward—it’s been an exceptional quarter for our portfolio.

I am very proud of the performance this portfolio delivered this year despite all the challenges. What made this performance even more impressive is the fact that it finished last year with a 50% return!

As Howard Marks says, “Success carries within itself the seeds of failure.”

This isn’t just because success tends to make people overconfident and lead them to take excessive risks, but it also alters the threshold—the bar to become successful increases until it ultimately becomes impossible to jump over.

Think about high jumpers in the Olympics.

Even when the winner becomes clear, they usually keep trying until they fail. Even when an athlete breaks a world record, he keeps pushing it until failure is certain.

This is the same with investors, and it’s a terrible pattern that often leads us to our worst failures.

For novice investors, matching the market performance is often considered a success. Outperforming the market even by a few percent is considered a definitive success. Yet, in all these steps, the expectations change, and the threshold for success gets higher.

If you are outperforming the market by 5%, clients who would be satisfied with a 15% annual return will find you. Once you post +30% for a couple of years, you're now attracting clients who seek +30% annual return.

Just like that, a 30% annualized return becomes the bar for success for you.

This is the seed of failure.

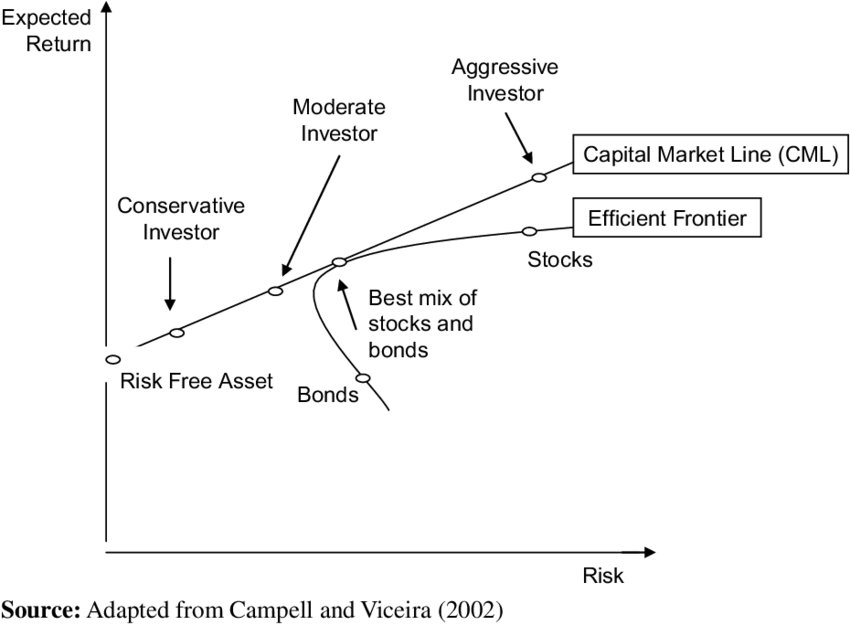

It’s a simple capital market line:

Investors become more and more aggressive to increase the expected return, which comes with increasing risk. As an aggressive investor increases the magnitude and frequency of high risk, the failure becomes certain.

However, unlike high jumpers, when investors fail, we don’t fall on a soft cushion; we literally take a swan dive to a solid ground.

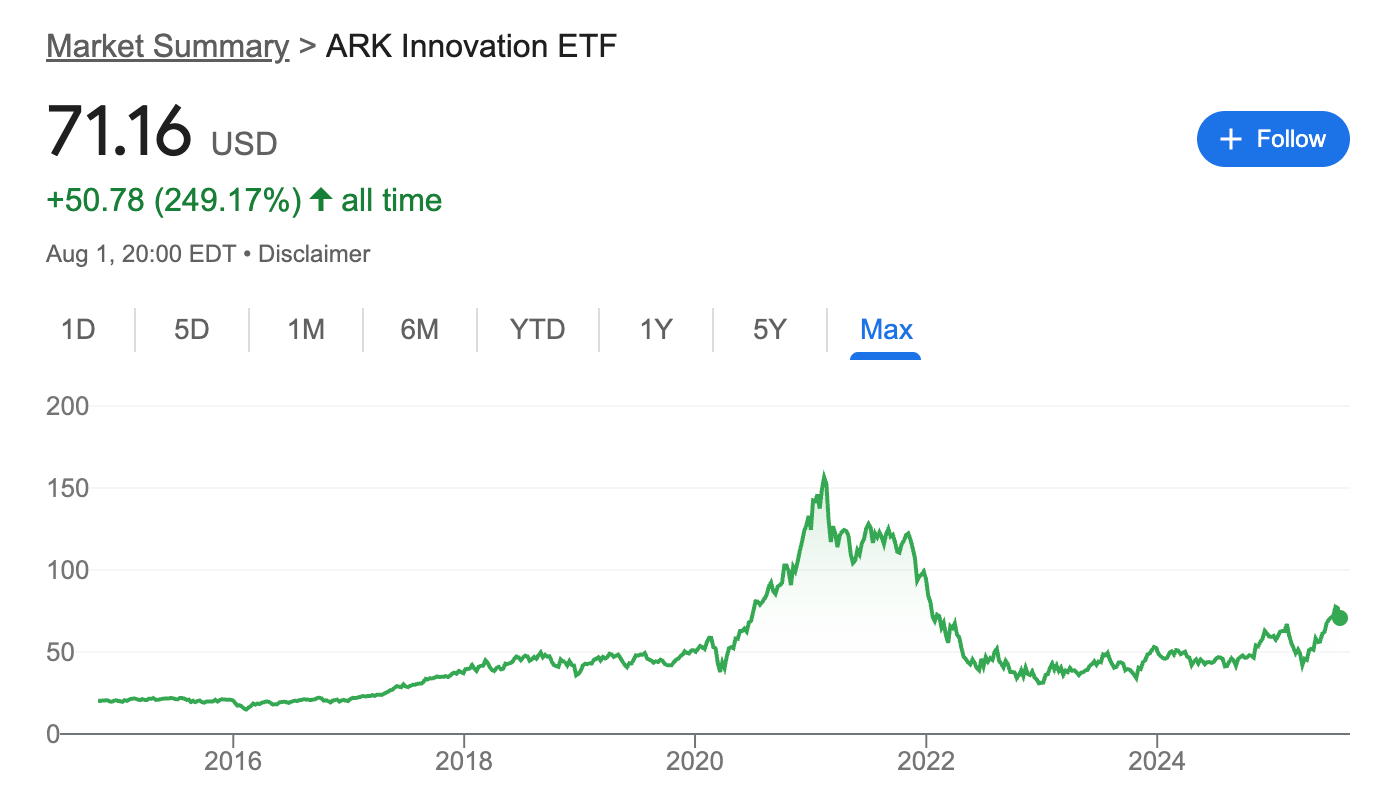

Cathie Wood’s ARKK is perhaps one of the clearest illustrations of this phenomenon in recent years:

She delivered a solid 19% annualized return since she launched the fund in 2014 to February 2020. Yet, if you focus on her performance from 2016 to February 2020, she delivered an exceptional 38% annualized return.

Meaning, by 2020, clients who sought outsized returns had already started to flock to her fund. This accelerated as her fund skyrocketed in in 2021 bubble, riding the Fed stimulus.

In late 2021, the bar for success for herself and her clients wasn’t at 15% annualized return; it was over 40% annualized return.

This pushed her to make bets on pure vision and future promise rather than the fundamentals. At the beginning of 2022, most of the stocks in her portfolio were unprofitable.

Result? Her fund crashed to the surface when the liquidity was drawn away and hasn’t recovered since then.

I always keep this in mind, and the biggest promise of our portfolio is to deliver outsized returns without assuming an excessive risk like Cathie.

Those who follow our portfolio know that. This is what I am even more proud of than the performance of the portfolio.

So, how do we achieve this? How do we maximize returns without assuming an excessive risk?

I have long thought about it, and I think I now have an answer—we simply give away the liquidity.

Liquidity is crucial for effective pricing in capital markets.

Arguably, the US markets are the most efficient public markets in the world because the liquidity is so abundant. This allows constant repricing of equities, reflecting the current sentiment and foreseeable outlook to their full extent.

Conversely, European markets and developing markets have less liquidity, so misspricing is more frequent in those markets.

This is exactly why alternative investments exist. If you give away liquidity, you can enter a market that is characterized by inefficiency, unlike public markets, where efficiency is higher. The owner may be willing to sell a perfectly fine apartment just because she wants to move to another city, and she may be willing to accept a bit lower offer just to get it done quickly. In the absence of millions of other bidders, you may close the deal well below fair value.

So, this should mean that everything will be easier if we invest in developing markets because we can find many more mispriced stocks, right?

Well, both yes and no.

Yes, investors will likely find many more mispriced equities in developing markets, but this doesn’t mean that they’ll make a profit on them. Liquidity is crucial to repricing and mean regression in capital markets. Meaning, in the lack of liquidity, the market may not reprice your picks, and you may not profit from your picks even if they were right.

By locking the capital in beaten-down, high-quality stocks, we open ourselves up to a whole new set of opportunities while benefiting from public market liquidity when the repricing is needed:

What drives our performance today is the stocks that we bought back in 2023. They were beaten down and highly de-risked back then.

In 2023, what drove the performance was the same high-quality, beaten-down stocks we bought in 2021.

In 2027, drivers of the performance will be the beaten-down, high quality stocks we are now buying.

And it goes like this.

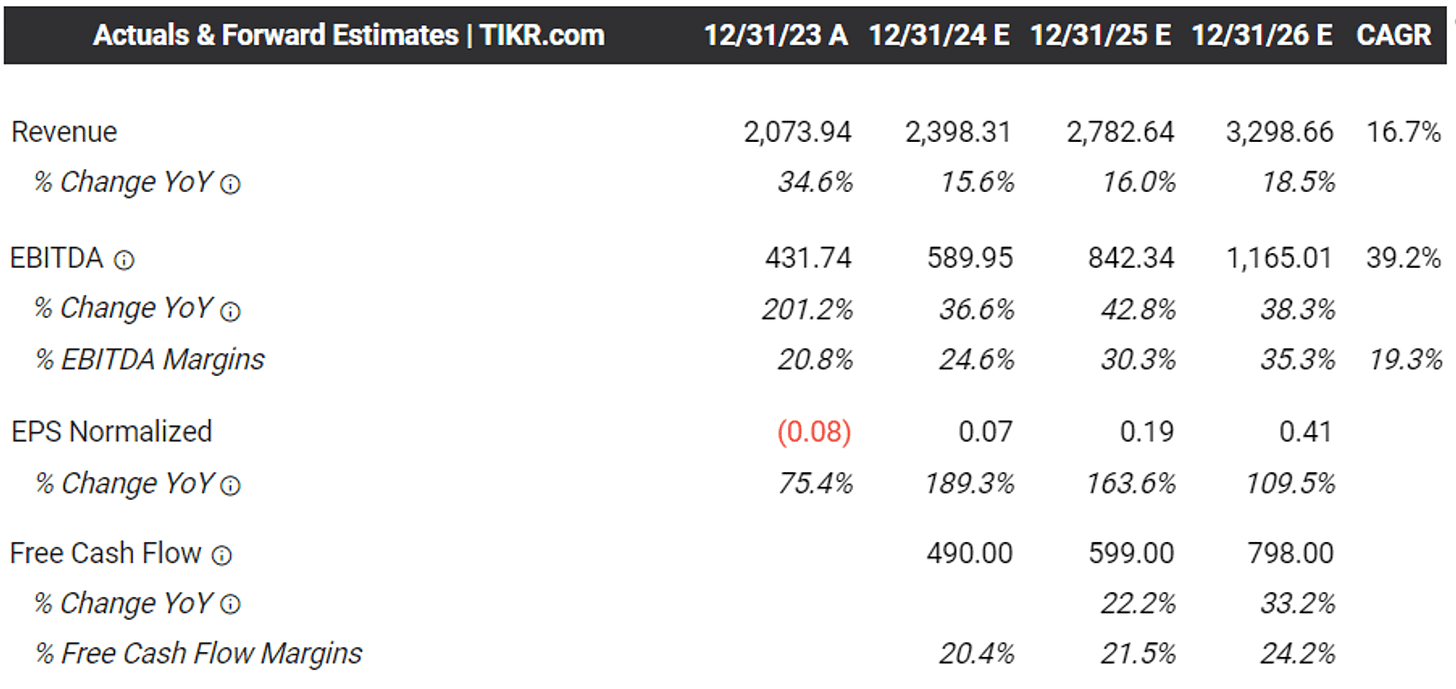

Here is an example: In 2023, Sofi’s management announced long-term guidance to hit between $0.55-$0.80 EPS in 2026 with 20% annual sales growth beyond it until 2030.

At the time, the analysts’ consensus EPS estimate was $0.41 for 2026:

In summer 2023, I analyzed the stock, and I was totally impressed. The management had never missed guidance; it was executing with perfection. The stock was around $5.

This meant that, assuming a 20x exit multiple, we were looking at a target price between $8-$16 for 2026, promising between 17%-34% annualized return.

The market was pricing in the increasing risk of total collapse. We looked at its loan portfolio and decided that it wasn’t possible.

We locked in the capital with a view to holding it until 2026, seeing it effectively as an illiquid investment.

It did nothing for a year, then it tripled in 9 months as the market had to reprice it.

We wouldn’t make that investment if we thought we could need that money in the next 5-6 months. Illiquid mindset allowed us to bet on an asymmetric play, and the public market liquidity ensured effective repricing and return on investment when the time came.

This way, we didn’t assume an additional risk in search of outsized performance, as the stock we bought was already highly de-risked.

This is not just an anecdote; this is how we operate.

Nearly all the performance drivers of our portfolio in any given year were bought in similar way.

This is our default mode of operation, and it has worked spectacularly for us so far!

Our portfolio is now up 40% against 16% of the S&P 500!

The following transactions took place in our portfolio in June:

Opened 2 new positions.

Increased 4 positions.

Exited 1 position.

In the previous updates, I provided my 2025 outlook for each company in the portfolio.

In this update, I’ll also provide an outlook and DCF valuations for our new positions and explain the rationale behind the trades, and share our strategy going forward.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 18,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 25 holdings in our portfolio.

13 of these positions can be considered foundational.