Finishing January: Our Portfolio Outperforms S&P 500 by 25%, Here Is What We Own!

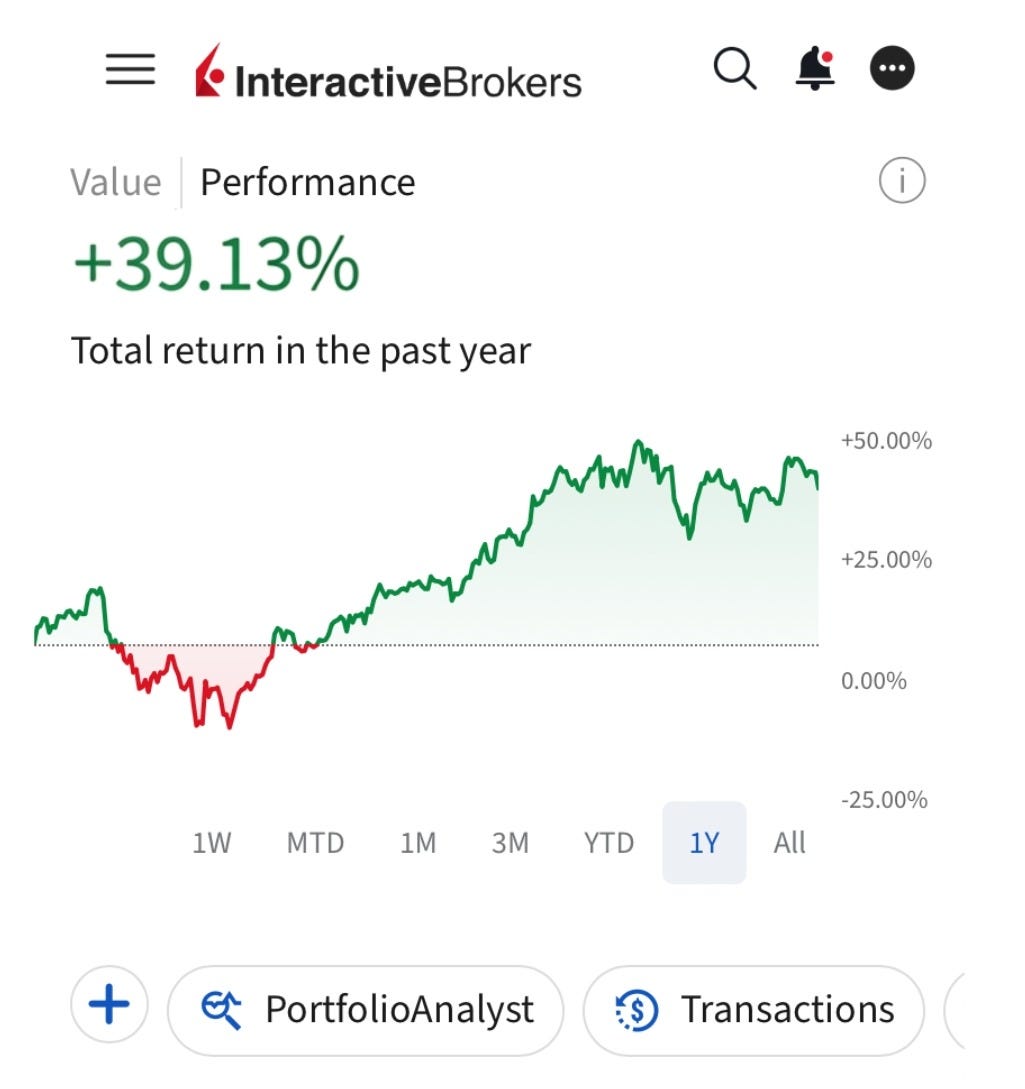

Our portfolio is now up 39% in the last twelve months against 14% of S&P 500. Here is our updated portfolio.

💥Our portfolio is outperforming the market by 25%!

Portfolio is now up 39% in the last twelve months against 14% of the S&P 500!

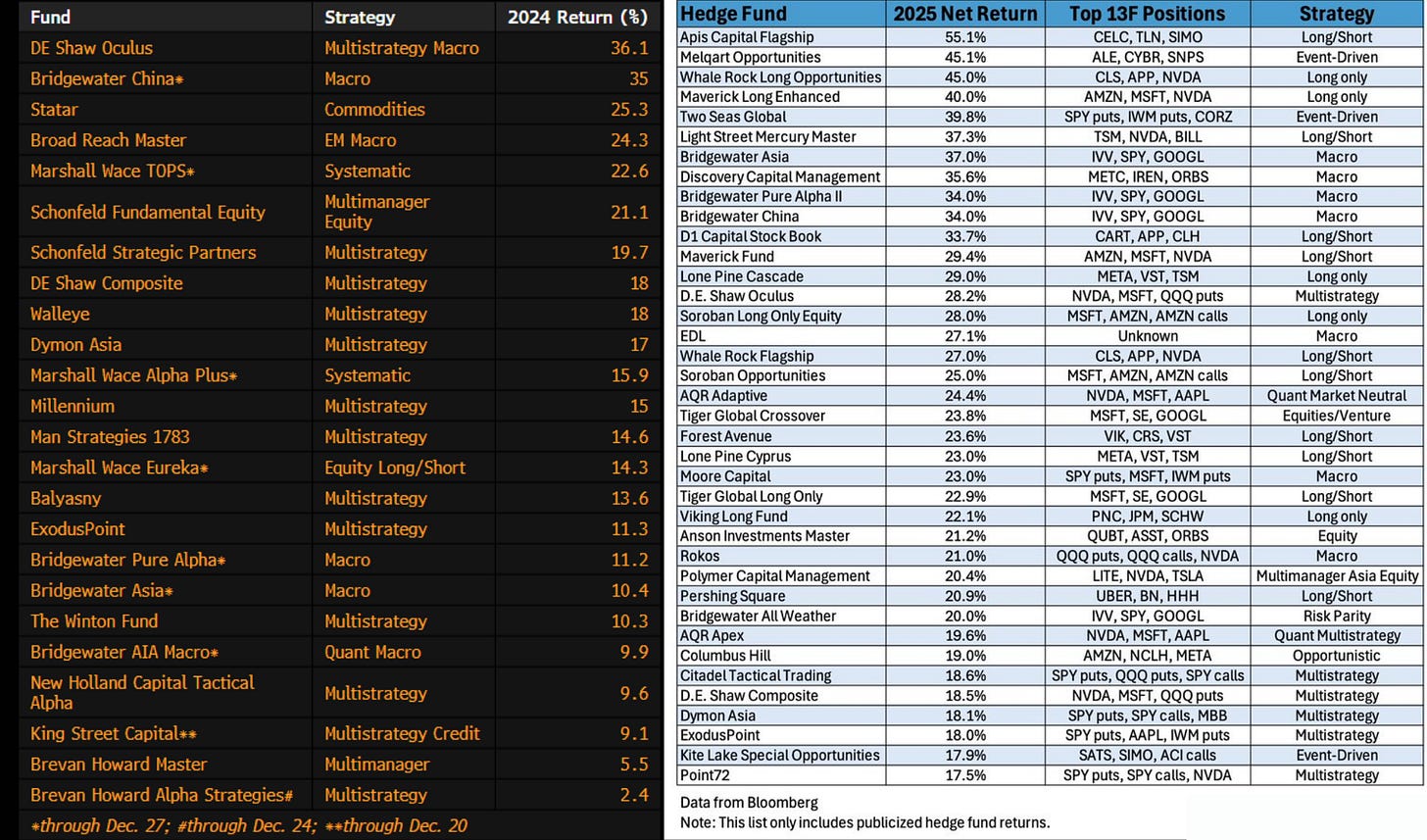

It’s been another great year for our portfolio. When I published the portfolio update in December, our portfolio was up around 44% in the trailing twelve months, and this was already better than all of the top hedge funds that publicly disclosed their performance.

Yet, it was not a complete picture because we didn’t have the annual numbers; we only got the numbers for the 9 months ending on September 30. Now we have them:

As you see, our portfolio would trail only Apis Flagship, Melqart Opportunities, and Whale Rock Opportunities funds in 2025.

What’s better is that it would top the list if we compare 2-year performances starting from 2024. If you started from January 2022 and looked at the total return for the 4-year period ending on December 31, 2025, our portfolio would top the list by a margin.

I am not telling all these to brag and praise the sophistication of our strategy. I am trying to do the exact opposite, because if you know me and know the portfolio, you understand that I keep things very simple.

I try to buy exceptional businesses at fair valuations and hold them until I think fundamentals deteriorate. That’s it. What I think creates all the difference with those funds and other portfolios in terms of consistency is a few small but very important points. Let me dwell on those points for a bit, to elaborate on our strategy.

First things first, I am managing my personal portfolio, so I am not under any stress from clients. Nobody asks me why I am not buying the current sexy thing, which is essentially the crux of our performance. We can afford to stay independent-minded.

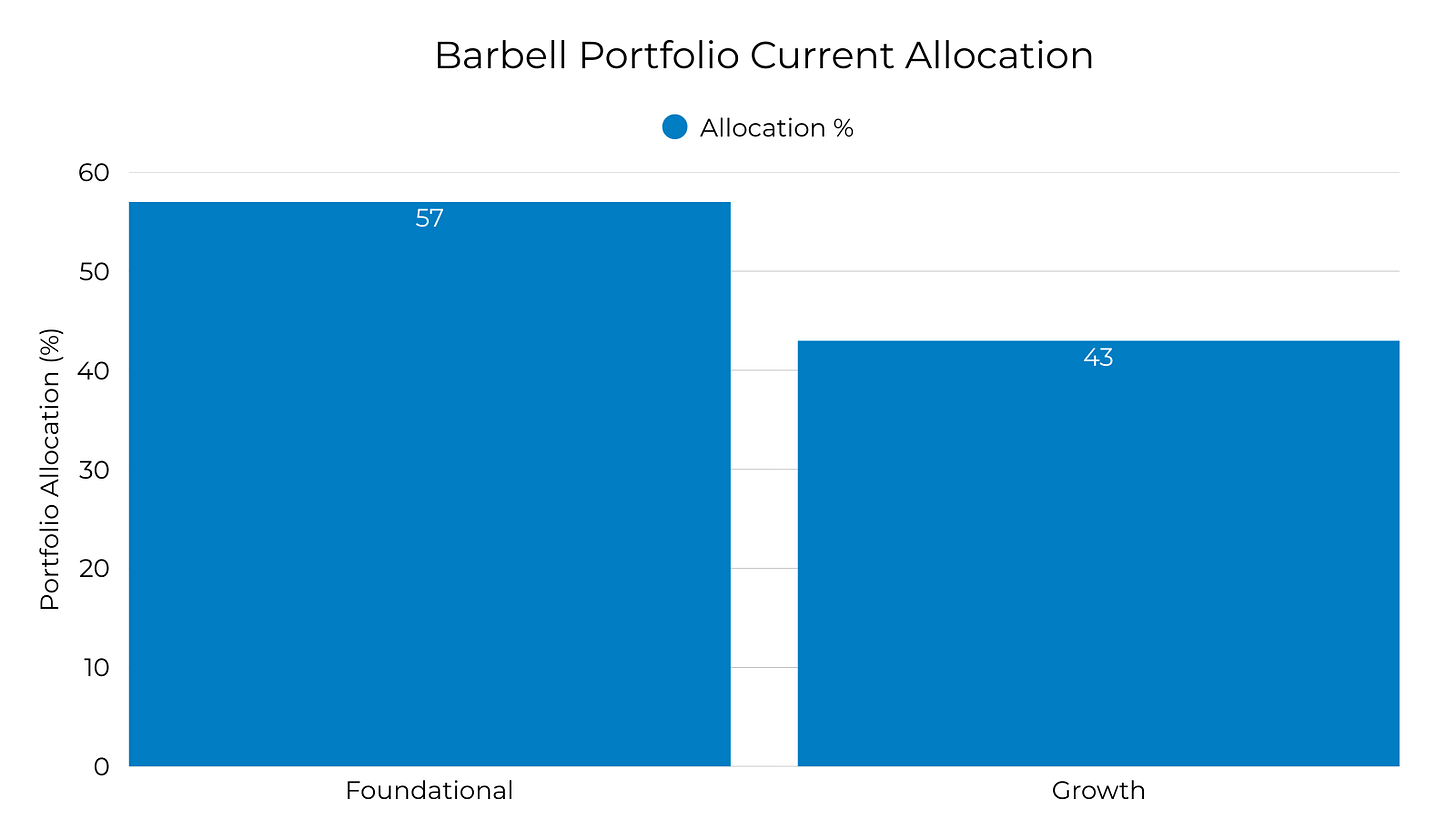

Second, I understand and care about the base effects. Most quality-oriented portfolios operate with a strict buy-and-hold strategy. I don’t, at least not for the totality of the portfolio. As you know, we run a barbell portfolio:

At one end, we have market-leading businesses bought at attractive prices, which I call foundational positions.

At the other end, we have fast-growing businesses with strong balance sheets and some kind of competitive edge, but not necessarily a moat.

Ideally, I never want to sell foundational positions. With them, our goal is to increase our ownership over time whenever they become attractive, using proceeds from growth positions or fresh cash. We expect just a bit above average but consistent returns from this portion of the portfolio.

When it comes to growth positions, we can exit or trim them. Once they reach fair value, further upside can only come from multiple expansion, which extends our downside in those positions. So, if we keep holding them, there are only two options:

Very limited upside in the following periods due to base effects.

Extended downside as they are more reactive to downturns.

In these cases, we exit or trim the growth positions and look for other growth opportunities that have larger upside than downside. This rotation requires skilled stock picking, but when done right, enables a portfolio to beat base effects and sets it up for sustained outperformance.

In the last few years, we have been extremely skillful in stock picking.

I say “we” because some of our best positions were pitched to me for the first time by the members of our community. Though I was the one who made decisions, finding the right business was still the majority of the work, because when something is really great, it’s not that hard to see it.

This strategy has worked very well for us, and in the last four years, we beat the market by increasing margins. This is why I said many times last quarter that we were repositioning the portfolio for continued outperformance by adding new positions.

That already started to work for us.

This month, we exited one of the positions we opened just in the last quarter for over 30% gain, and one position for around 10% gain. We added two new positions instead. One of the new positions is already up by 10%, while the other one is up by 5%.

This helped us offset a substantial base effect coming from strong performance in January 2025, and kept the performance close to ~40% levels, despite the marketwide choppiness.

I honestly believe we could have done much better, as I skipped buying some of the stocks I published research about to preserve my cash position. Fluence Energy is one of them, and the stock has doubled since I published my research back in October.

Though I wish I bought it, I don’t care much about it. Looking at our portfolio, I see several growth positions that should drive alpha this year. Plus, none of our positions, except one, is substantially overvalued, so we don’t have much downside as well.

All these make me very confident that we’ll deliver another great performance this year, and our strategy will keep delivering as it’s delivered so far:

Our portfolio is now up 39% in the last twelve months against 14% of the S&P 500!

The following transactions took place in our portfolio in November:

Exited 4 positions.

Increased 1 position.

Opened 2 new positions.

In the previous updates, I provided my outlook for each company in the portfolio.

In this update, I’ll also provide an outlook for our new positions and share my overall portfolio commentary and strategy for 2026.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month.

Here is a 25% discount to celebrate 23,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 18 holdings in our portfolio.