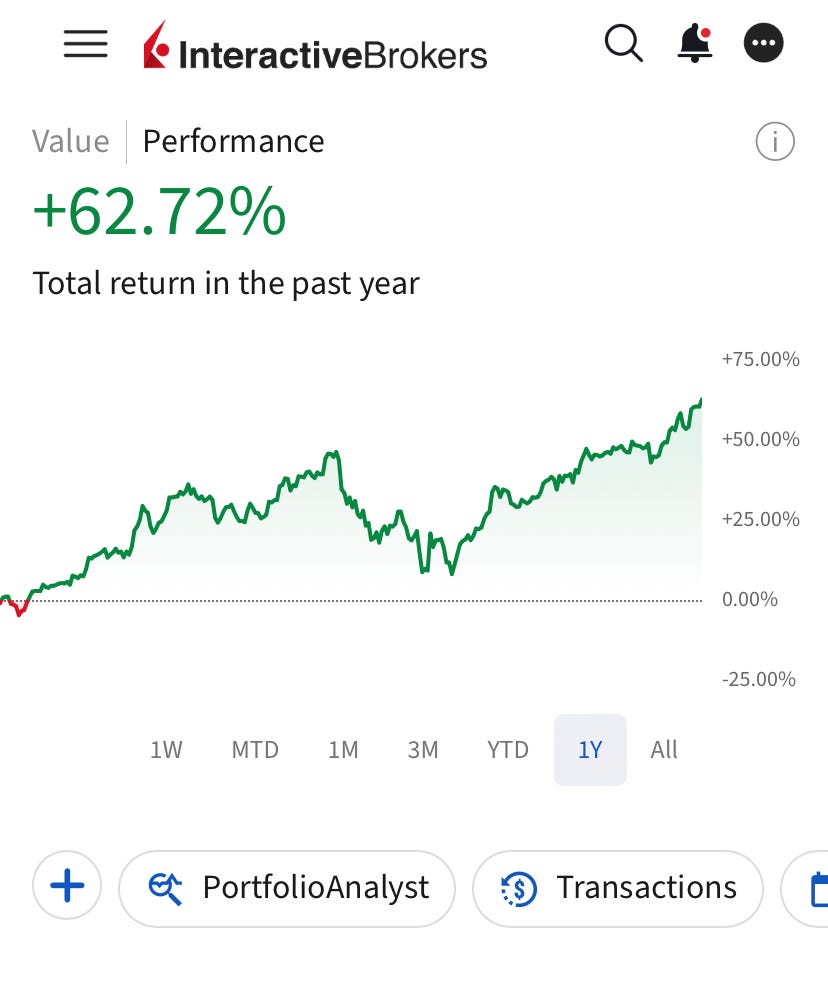

Finishing August: Our Portfolio Outperforms S&P 500 By 46%, Here's What We Own!

Our portfolio is now up 62% in the last twelve months against 16% of the S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 46%!

Portfolio is now up 62% in the last twelve months against 16% of the S&P 500!

Let me be direct—it’s been an incredible quarter for our portfolio.

We are literally entering the last quarter of the year, and our portfolio has widened its outperformance from 24% last month to 46% this month.

None of our positions lost substantial value last month, and several of them appreciated +20%, driving significant outperformance.

This is even more impressive given the fact that our portfolio had already finished 2023 with 36% and 2024 with a 50% return.

After the end of last year, I remember one of our members asking—what’s the likelihood you’ll sustain this performance next year?

I was very cautious answering this question.

The reason is simple. Outperformance is derived from alpha, something you are right about, and the market is wrong.

As a long-term investor, you pick a business that you think the market is underestimating. If it lives up to your expectations, the market takes notice of it and eventually closes the valuation gap.

That closing of the valuation gap is actually your immediate outperformance.

After the initial outperformance that comes from closing the valuation gap, you’ll start to reap just market performance from that stock going forward due to the base effect.

Imagine you own just one stock in the portfolio that is trading at $7, a 30% discount to its intrinsic value of $10. If the market closes that gap this year, you’ll generate a 42% return on that position and outperform the market. Next year, however, you’ll only generate market returns from that position, provided that the market still doesn’t underestimate the potential.

Due to that base effect, you’ll market perform next year despite your stellar 42% ($10/$7) return this year.

This is why I was cautious responding to this question.

Even if you own the best stocks, what you’ll get will be market returns after the valuation gap closes due to the base effect.

One way to beat this is that the stocks you own have incredible competitive advantages, so they overdeliver year after year, and the market constantly bumps the stock up, trying to bridge the valuation gap.

However, in those cases, the market doesn’t like playing catch-up because it’ll be free money for investors. It likes to stay ahead of the performance and preemptively price the stock at a premium, so you’ll again be left with the market returns.

Take a look at companies like Visa, MasterCard, Moody’s, etc.. They are trading at a significant premium because the market takes a preemptive approach and prices them at a premium.

So, if you deliver a high return like 50%, this is likely because your best picks have been recognized by the market, and the valuation gaps have been closed. Thus, they won’t likely generate the same performance next year.

This was why I was cautious.

So, how did we deliver this performance this year again?

We allocate capital based on valuation.

Once a position reaches its full valuation, we no longer allocate capital to it because we don’t want to accept market returns. We also don’t exit that position unless the fundamentals are not as bright or it’s EXCESSIVELY overvalued.

Instead, we do two things:

We allocate capital to new undervalued opportunities.

We opportunistically add to our performing positions if they retrace.

This way, we keep the downside for the newly allocated capital limited and maximize the upside.

Most investors do the exact opposite.

They add more aggressively to their winning positions because it gives them comfort; it’s psychologically easier. However, that exposes them to a strong base effect, or worse, a higher downside risk.

We also like adding our winning positions, that’s the right thing to do. As long as there is a valuation gap, you have to prioritize them because they have already proved themselves. Allocation to new positions comes with new risks. However, we do it opportunistically. If the stock retraces and the valuation gap is there again, we invest; otherwise, we seek new opportunities.

And we have been pretty successful in finding and adding these new opportunities.

We currently have three positions in our portfolio that we didn’t own in 2024. Two of them doubled, and one of them tripled from our averages.

This way, we have managed to generate substantial outperformance despite the base effect from our winning positions last year.

This has been our modus operandi for the last three years, and it has worked extremely well for us:

Our portfolio is now up 62% against 16% of the S&P 500!

The following transactions took place in our portfolio in June:

Opened 1 new position.

Increased 5 positions.

Exited 1 position.

In the previous updates, I provided my 2025 outlook for each company in the portfolio.

In this update, I’ll also provide an outlook and residual income model (RIM) valuation for our new position and share our strategy going forward.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 19,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 25 holdings in our portfolio.

13 of these positions can be considered foundational.