Finishing 2025: Our Portfolio Outperforms S&P 500 by 28%, Here Is What We Own!

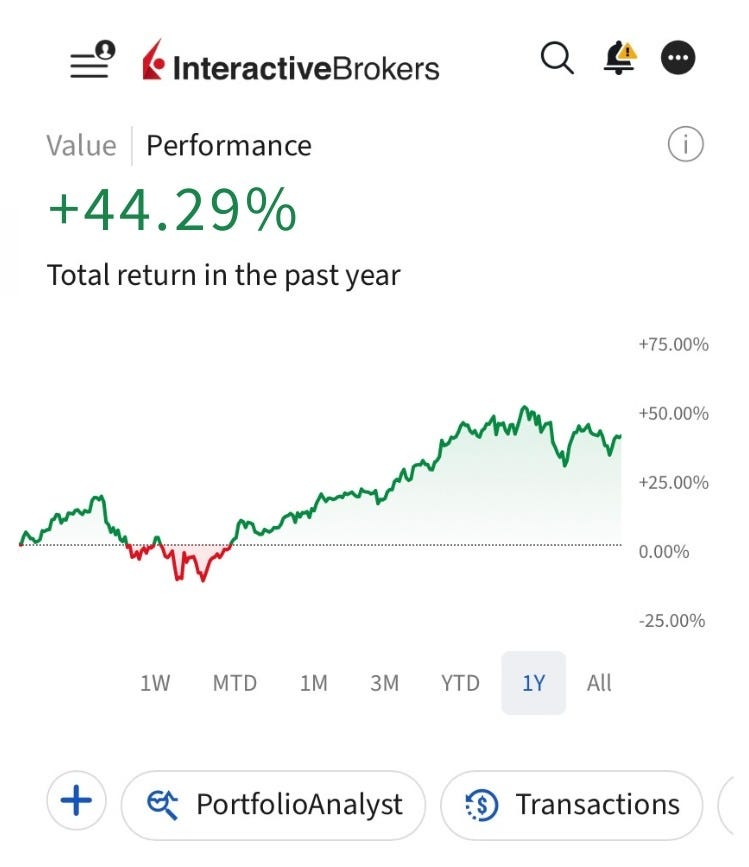

Our portfolio is now up 44% within the last twelve months against 16% of S&P 500. Here is our updated portfolio.

💥Our portfolio is outperforming the market by 28%!

Portfolio is now up 44% within the last twelve months against 16% of the S&P 500!

Let me be straight with this—it’s been another great year for our portfolio.

I started this portfolio in 2022, and we have now posted our fourth straight year of outperformance. What’s even more impressive than that is that our margin of outperformance grew every year.

Here is how our margin of outperformance has evolved since the beginning:

2022: 7%

2023: 10%

2024: 25%

2025: 28%

Though this is pretty impressive, I am not saying it here to brag. When combined with another observation about the market returns, it allows us to draw a substantial insight for our portfolio and the essence of outperformance.

Let me talk a bit about it before getting to the portfolio itself.

In the first portfolio update of 2025, I had said that our portfolio wasn’t just outperforming the market; it was also outperforming the best hedge funds on Wall Street.

In 2024, our portfolio had outperformed all but one of the top hedge funds that disclosed their performances. Fast forward to September 2025, and I told you that our portfolio was outperforming all of the top hedge funds year-to-date.

Here is the interesting thing: Only 9 funds appeared in both lists:

Given that the market was flat in Q4 this year, let’s assume that top performances in the 2025 list won’t change significantly, so we can consider them as more or less the final numbers.

In that case, the most successful fund in those lists for this two-year period was DE Shaw Oculus, which returned 36.1% in 2025 and 14% in 2024, a solid 24.6% CAGR. Our portfolio achieved a 47% CAGR during the same period, crushing DE Shaw Oculus.

This is very interesting in my view.

I looked at the 2023 list too, and saw that only 7 of the funds made it to the list in all three years. What’s even crazier is that NONE of the funds made it to the top 10 for all three years, while only DE Shaw Oculus managed to make it to the top 10 for any consecutive period.

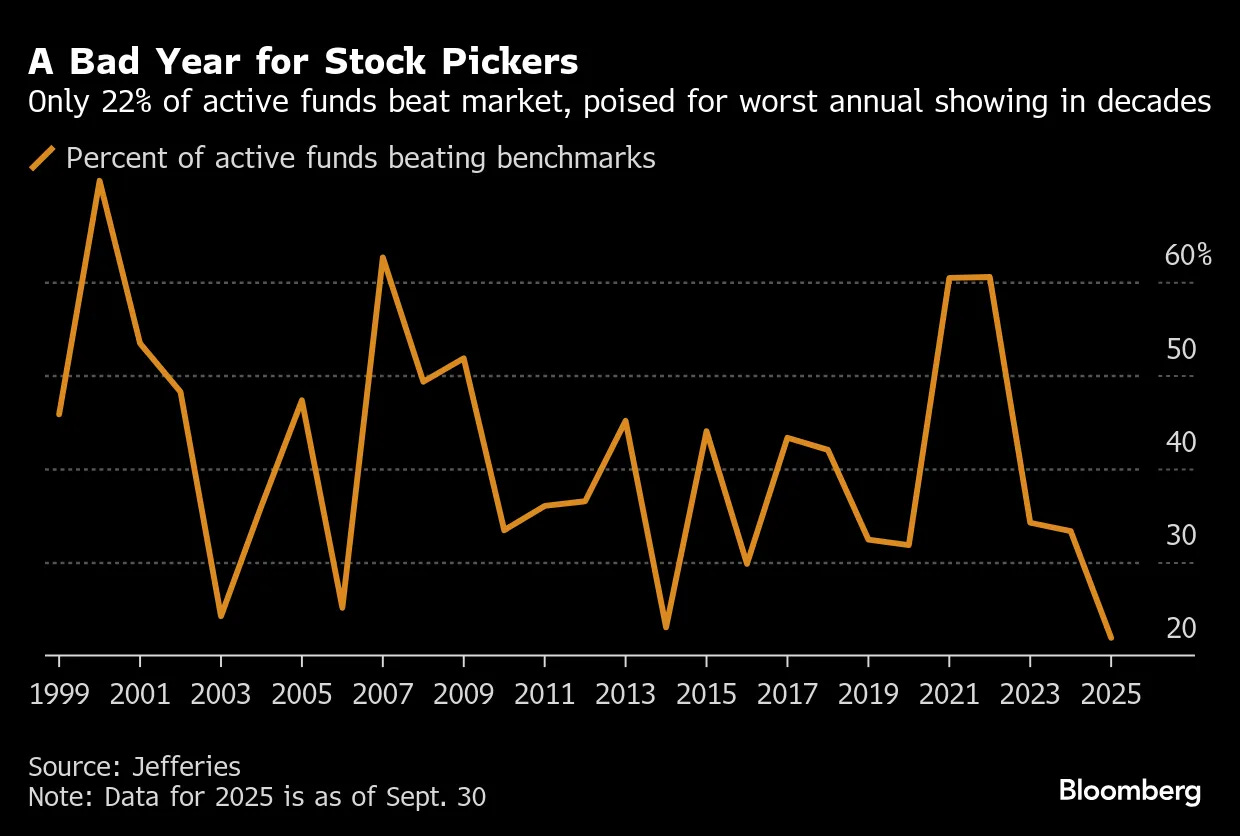

Other data confirms this phenomenon. Though the market rally continued, the share of active funds outperforming the market dropped from 25% last year to 22% this year.

If we simply put our portfolio against those in the list, it easily becomes the top performer for the four-year period since 2022, with an expanding margin of outperformance each year.

So, how do we do it? How come our margin of outperformance expanded each year while the best of Wall Street fluctuated greatly year over year in one of the best-ever bull markets in history?

Well, the first thing is that we never forget one key rule—stay humble.

You should always stay humble and remember that nobody can outsmart the market consistently. This leads you to just buying exceptional, high-quality companies, rather than tricking yourself into believing that you can pull off what nobody else can. Wall Street, on the other hand, always has a problem with staying humble.

The second reason is that Wall Street is in a different game.

They are in the game of growing their assets under management (AUM) so that they can make more in management fees. Nobody wants to shoot for unstable performance-based rewards; everybody wants the stable management fee. This is why recency is very important for them.

We can buy overlooked, high-quality companies and wait for a year for them to deliver performance; Wall Street can’t do that. The second they cease selling the next-big-thing, their AUM starts to shrink.

A combination of these two factors gives us a great edge.

We stay humble, don’t think of ourselves as too smart, which leads us to pursue only exceptional companies, for both foundational positions and growth.

The problem is that high-quality established companies tend to be undervalued only in three cases:

Company-specific concerns

Market-wide correction

Industry recession

If you managed to buy them cheaply, they should have been in a downtrend for some time; otherwise, they wouldn’t have become cheap. The thing with trends is that they tend to continue. This means that when you buy, you’ll likely need to wait for it to break the downtrend and play out if you aren’t just too lucky.

I call this “incubation period.”

It exists in overlooked but high-quality growth stocks, too. It takes time for the market to accept their quality and potential. I bought SoFi back in 2023. It did nothing for a year, then it made 3x. Incubation period.

When they get out of the incubation and move up, you just need to hold unless they become egregiously overvalued to the level that the next 10 years are optimistically priced in. By holding them, you stabilize the performance, and as more of them come out of incubation year-over-year, the higher your margin of outperformance gets.

This is why our portfolio performs.

We can hold through the incubation period to buy exceptional companies cheaply; Wall Street doesn’t want to hold through the incubation period to own great companies. They think they are smart enough to find something else.

It doesn’t end after the incubation period. The road upward isn’t a straight line. It goes up by 50% and then down by 20%. We don’t care, but Wall Street exits as they can’t afford to look like they are holding a falling knife. It would shrink their AUM.

This is why fund returns on Wall Street are so volatile. The funds themselves are so volatile; what would you expect?

For consistent outperformance, you need to sign up for the incubation period by buying an exceptional company at an attractive price, and then you should just hold it after it gets out of incubation.

I can’t overemphasize the importance of this.

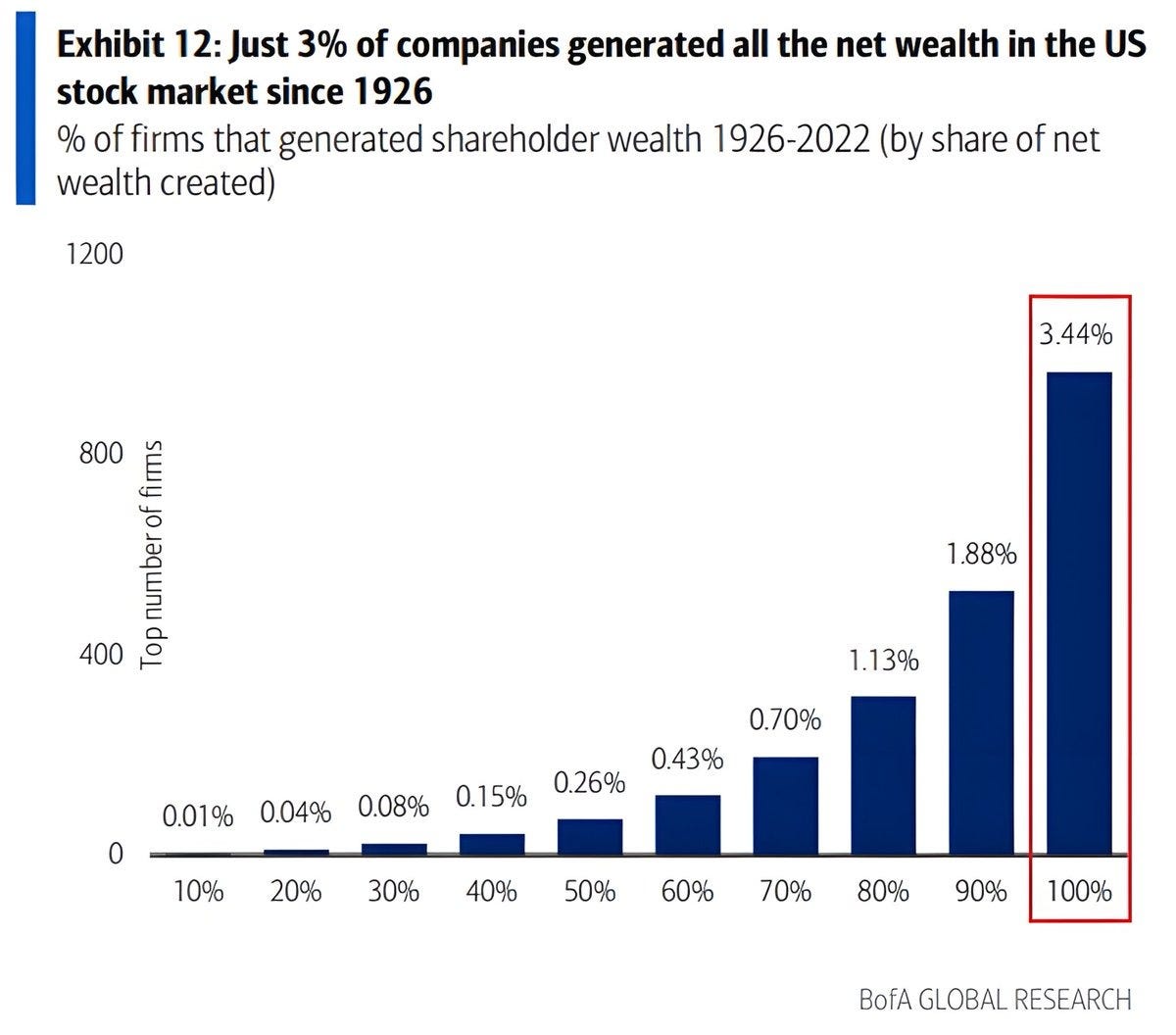

3% of all companies have generated all the wealth in the US stock market since 1926:

These are our so-called “exceptional companies.” The chart above means that if you can somehow get your hands on exceptional companies at attractive prices, you should just hold them. Jumping to others just dilutes your performance.

This is what we do, but Wall Street doesn’t. We wait for the incubation period, and if it ever comes out of the egg, we just hold.

While we hold them, we put new ideas in incubation. While we wait for the incubated ideas, the proven winners carry the portfolio. If something exceptional comes out of incubation, it furthers the performance, expanding the margin of outperformance. If what comes out of incubation isn’t exceptional, they still don’t harm us much, as we never overpay and keep each incubated idea small initially.

This is the strategy.

Hold the winners.

Put new ideas in incubation.

Wait for them to play out.

It has worked incredibly for us so far:

Our portfolio is up 44% YTD against 16% of the S&P 500!

We now own 20 stocks, and 7 of them are high-potential stocks currently in incubation, and all of them were bought at very attractive prices. We also keep holding our winners, and our downside isn’t too stretched in any of the positions.

In short, we are very well positioned for a strong 2026.

Below, you’ll find:

Our full portfolio, and a link to the full spreadsheet.

My fair value estimates together with buy/hold recommendations.

General discussion of the portfolio strategy and outlook going into 2026.

Let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month.

Here is a 25% discount to celebrate 2026!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we have 20 holdings in our portfolio.

8 of these positions can be considered foundational.