eToro: Promising New IPO?

I loved eToro's business model and the philosophy behind it.. But does it automatically make it investment worthy? I am not so sure...

Let me tell you something—so much money has been made in the last century by investing in middlemen.

Think about it.

Amazon is a middleman, Visa, MasterCard, and American Express are kind a middlemen, so are Uber, Airbnb, Booking etc…

This is not a coincidence; there is a reason for that.

Where the supply is centralized but the demand is decentralized, or vice versa, there are middlemen.

It only makes sense.

Middlemen are necessary for the diffusion of goods and services provided by fewer suppliers.

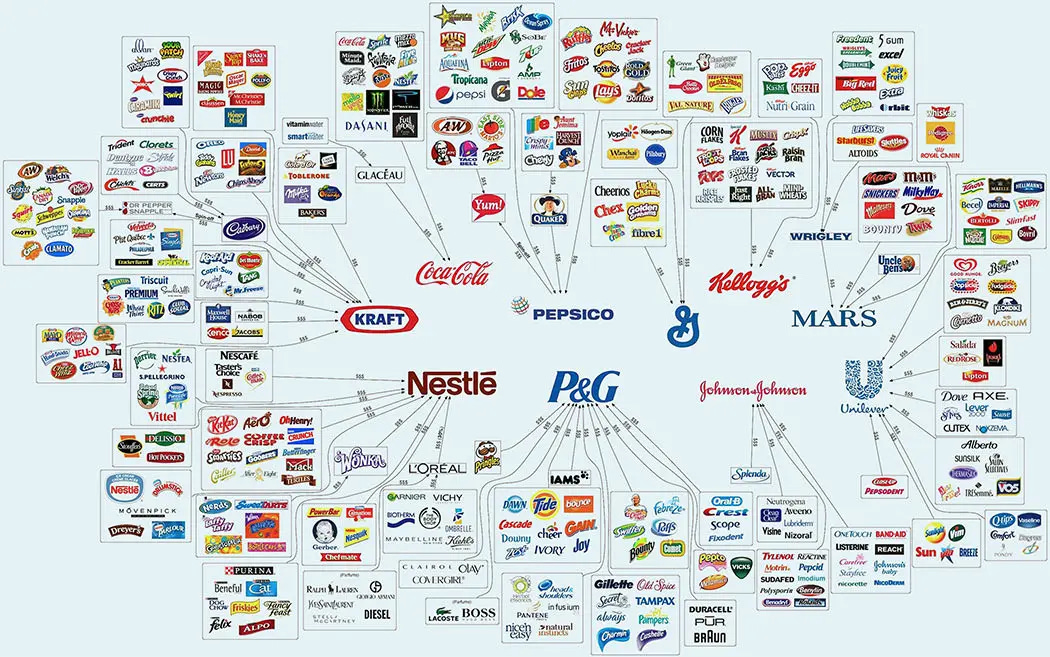

Take a look at this, most of the well-known consumer brands are owned by a handful of companies:

In a sense, your neighborhood mini-market is also a middleman. All the beverages and snacks it sells are produced by a handful of companies, which then sell to wholesalers in bulk, and your mini-market buys from wholesalers in bulks. It then sells to you in pieces.

Without the mini-markets and wholesalers, everybody would have to buy directly from the producers by piece. This would have been impossible to manage at scale.

This is not something new; it’s always been this way. All retailers are middlemen, insurance brokers are middlemen, car dealers are middlemen etc.

This was already a nice business model, and it has become something immensely profitable with the internet.

Think about it… Your neighborhood supermarket is nowhere near Amazon in terms of scale, your local car dealership is minuscule in size compared to Carvana, etc…

Why? It’s simple. The internet started what I call “great consolidation.”

Before the internet, it would take years for a successful retailer to go state-wide and decades to go nationwide. Thus, even if you knew there was a cheaper retailer called Costco in a different state, it wouldn’t make any difference in your shopping behavior, as it would be inaccessible to you.

You don’t have this with Amazon. It’s available everywhere.

Result? When Amazon had cheaper prices, everybody started to buy from Amazon, and this consolidated the market around Amazon. It currently has above 50% market share in the US retail e-commerce.

This is what the internet enabled—worldwide availability.

Result? Markets rapidly consolidated around better businesses, and these businesses have reached sizes never seen in human history. A $100 billion market cap for a middleman wouldn’t puzzle anybody today; we are used to it.

Yet, not all markets are prone to consolidation.

We can clearly see that e-commerce is prone to consolidation. It is dominated by a few businesses in each country—in the US, it’s Amazon; in China, Alibaba; in Latin America, Mercadolibre etc…

Mobility, hospitality, and digital advertising are also prone to consolidation.

There are a lot of reasons why an industry could be prone to consolidation, such as strong network effects, multi-sided platforms, zero-priced products etc…

Some industries don’t have them.

Finance, for instance, hasn’t seen an unusual consolidation after the internet revolution. If anything, it has become even more fragmented as many neobanks and fintechs emerged that took market share from the incumbents.

Though these businesses haven’t become as big as their peers in consolidated industries, they still created a lot of shareholder value as they grew from $0 to a few billion dollars in revenue very fast. This is indeed achievable when a market is a huge one. A neobank can grow from 0 to $5 billion in revenue in a few years, yet still own under 1% of the consumer banking market.

Why did I tell you all these? Because they clearly lay out an investment framework that you can use over and over again.

Middlemen could create vast value in the digital age. You can play it two ways:

In industries prone to consolidation, strategy should be based on picking the winners. You may risk being a bit late to gain a better sight to who’ll win the market.

In industries not prone to consolidation, most of the upside comes in the early growth stage, so the alpha is in being early. You don’t need to pick what would become a monopoly, you can pick what would become an average business in its industry and still make a shit ton of money if you were early.

Now there is a possible opportunity of this kind—eToro!

It ticks all the boxes:

It has just become public.

It’s an online middleman, a broker.

Finance isn’t a consolidation-prone industry.

In theory, all the conditions are ripe to make a lot of money on this one.

So, there are just two questions:

Can it become, at least, an average business in the industry?

Is the valuation right?

This is what we are going to discuss today.

So, let me cut the intro and dive deep into this promising business:

What are you going to read:

1. Understanding The Business

2. Competitive Analysis

3. Investment Thesis

4. Fundamental Analysis

5. Valuation

6. Conclusion

🏭Understanding the Business

Let’s get the simple version first—eToro is an online investment broker.

That’s it. It’s very simple, and everybody understands what an investment broker does. You can trade global stocks, ETFs, and crypto through the eToro platform.

In essence, it’s not more than a broker, yet, understanding its actual business is much more than that, just like Costco’s business is way different than your local mini market, though they both are retailers in essence.

eToro is not just an ordinary investment broker—it’s also a specialized community, and this is its edge.

Let me explain.

eToro could have easily been another ordinary online broker. There are dozens of them on the internet, and 99% of them aren’t able to grow to a sufficient size to become public.

How did eToro achieve this?

In the same way, Pinduoduo took over e-commerce in China—integrating a social network.

The reason Pinduoduo quickly grew among the industry giants like Alibaba and JD was that it turned online shopping from an isolated experience to a social activity. Think of it like going to shopping by yourself versus doing it with friends.

It integrated social features like following profiles, messaging etc.. and attached a reward to the use of these features, such as providing discounts in group purchases.

What happened was nothing less than exceptional—people first created groups with the people they knew, and over time, they created groups with the people they had never met before to get a discount on an item. What brought them together was their common liking of a particular product.

What do you think happened?

User growth skyrocketed.

Gross merchandise volume skyrocketed.

It became sticky because people also liked the experience.

Do you see what it did? It moved online shopping closer to physical shopping with friends, and this gave the business an edge over others.

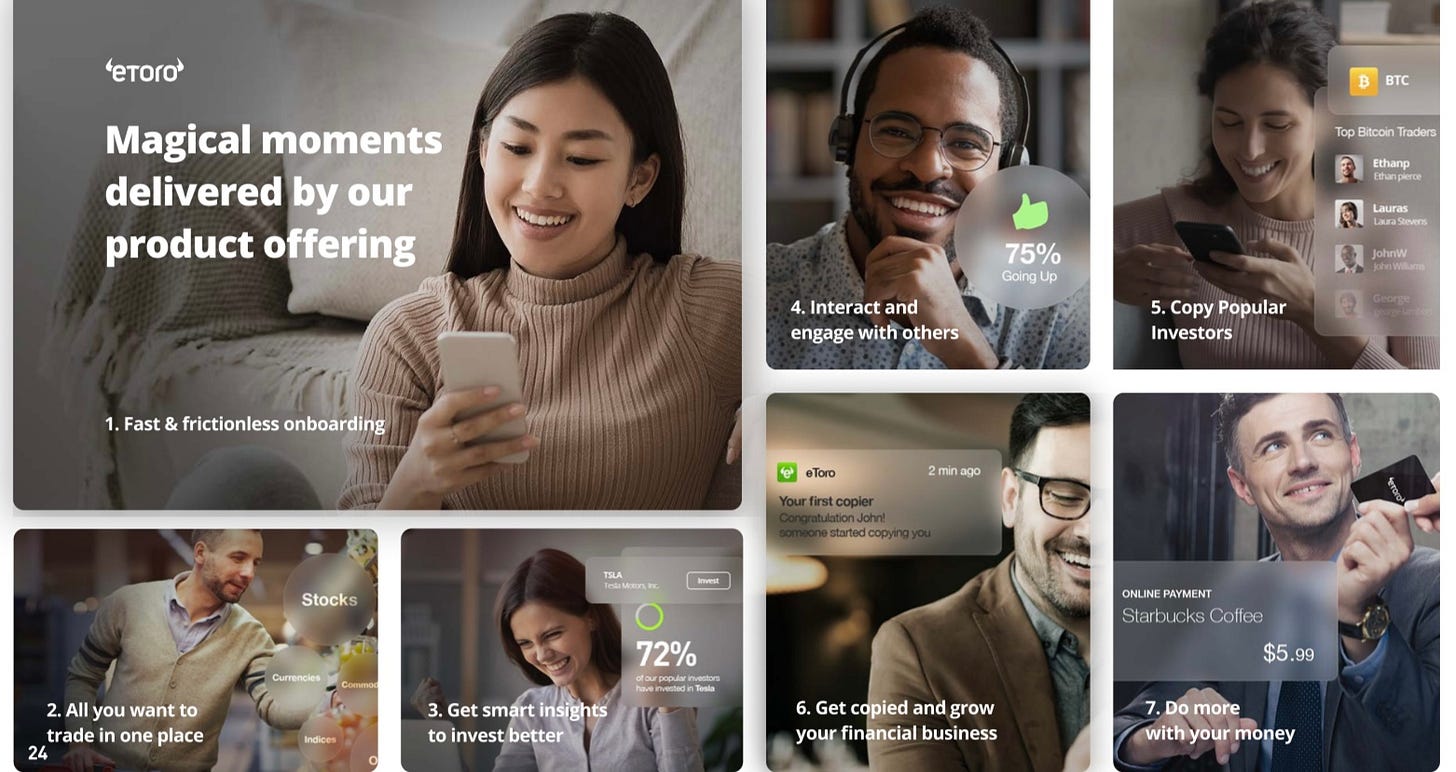

eToro is following the same playbook.

In its platform, besides trading, users can:

See other users’ portfolios.

Exchange ideas for strategy.

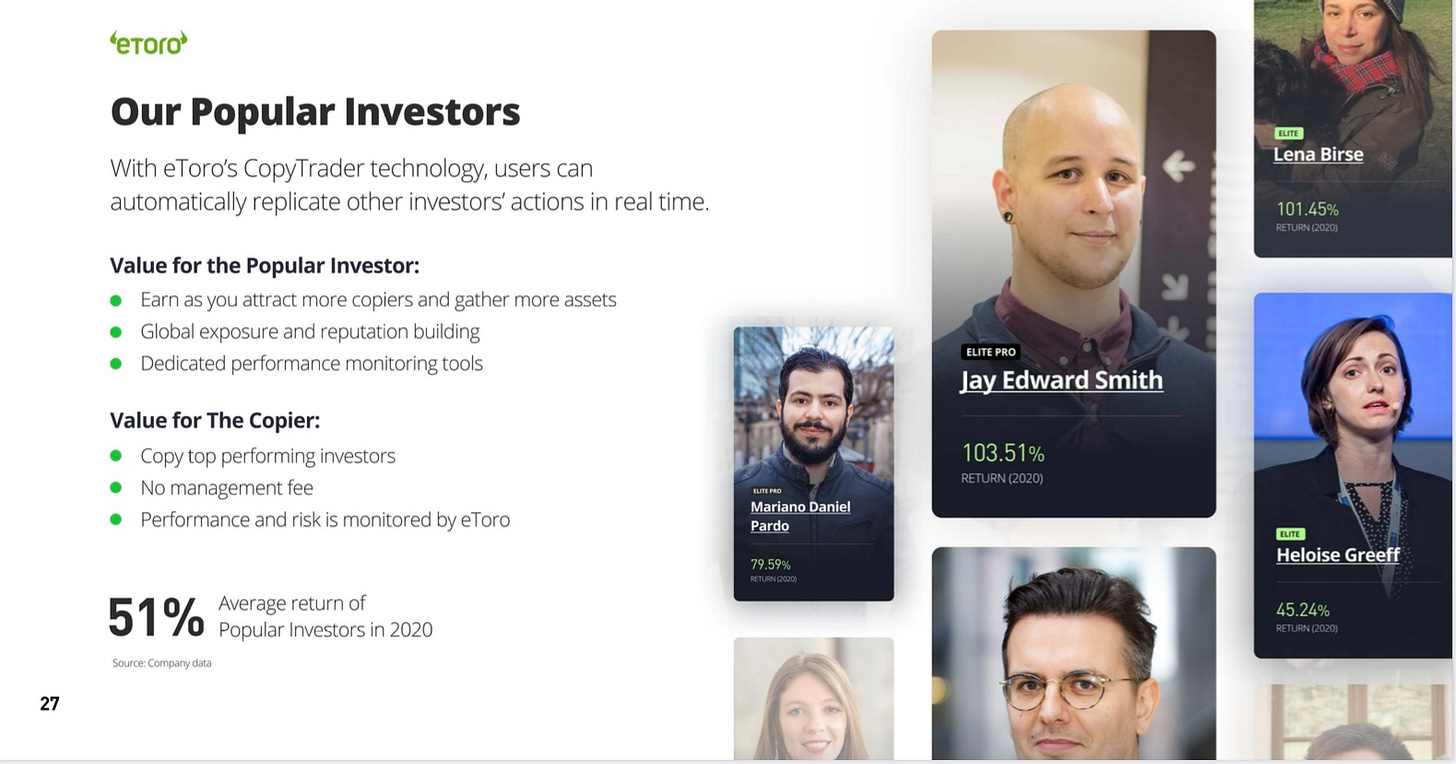

Copy and follow others’ portfolios with the “Copy Trader” feature.

Do you see what it does?

It turns a dull investment platform into a community where people can engage with each other, create connections, and leverage the community alpha. It further complements this community by integrating educational tools.

This creates a competitive edge similar to what social shopping created for Pinduoduo. What was once an easily replaceable product becomes unique and sticky.

Such a durable competitive advantage is what’s needed for any business to make the next leap forward, and eToro has a shot at doing this.

Because integration of social features turns it from a basic platform into a double-sided network.

And guess what? Double-sided networks tend to create a giant moat around the business.

🏰Competitive Analysis

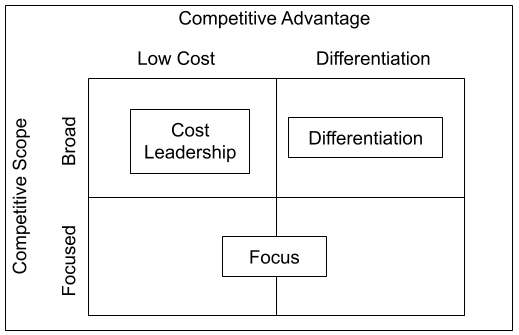

I have said this many times, I’ll say it here once again—all the competitive advantage, in essence, stems either from price leadership or differentiation.

Michael Porter, the father of competitive analysis, puts this emphatically in his masterpiece “Competitive Strategy.”

If you are a reader of books and papers written about Warren Buffett’s investment strategy, you’ll see that he thinks exactly the same. In Buffettology, Warren’s ex-daughter-in-law, Mary Buffett explains this well in her book “Buffettology.”

“Warren believes that durable competitive advantage stems either from durable price leadership (Costcos, Amazons, Walmarts of the world) or a unique product (Apples, Coca-Colas, Ferraris of the world).”

-Mary Buffett in Buffettology

Price leadership is straightforward; a unique product refers to a high level of differentiation. That’s all there is to its essence.

So, when we say “network effects are a competitive advantage,” some people tend to mistakenly think that it’s the source of advantage.

No, it’s the facilitator. What it drives, at the end of the day, is differentiation.

Strong network effects facilitate user acquisition and the community grows to a size and scope that is nearly impossible to replicate exactly the same way elsewhere. This uniqueness is the competitive advantage.

It erects significant exit barriers because you are unlikely to leave the product you are using if you think you won’t find a perfect substitute elsewhere. This is what we call “customer lock-in.”

eToro understood this perfectly.

They didn’t just create an online brokerage platform; they created a community by integrating social features such as the ability to see other people’s portfolios, copy trading, and educational tools.

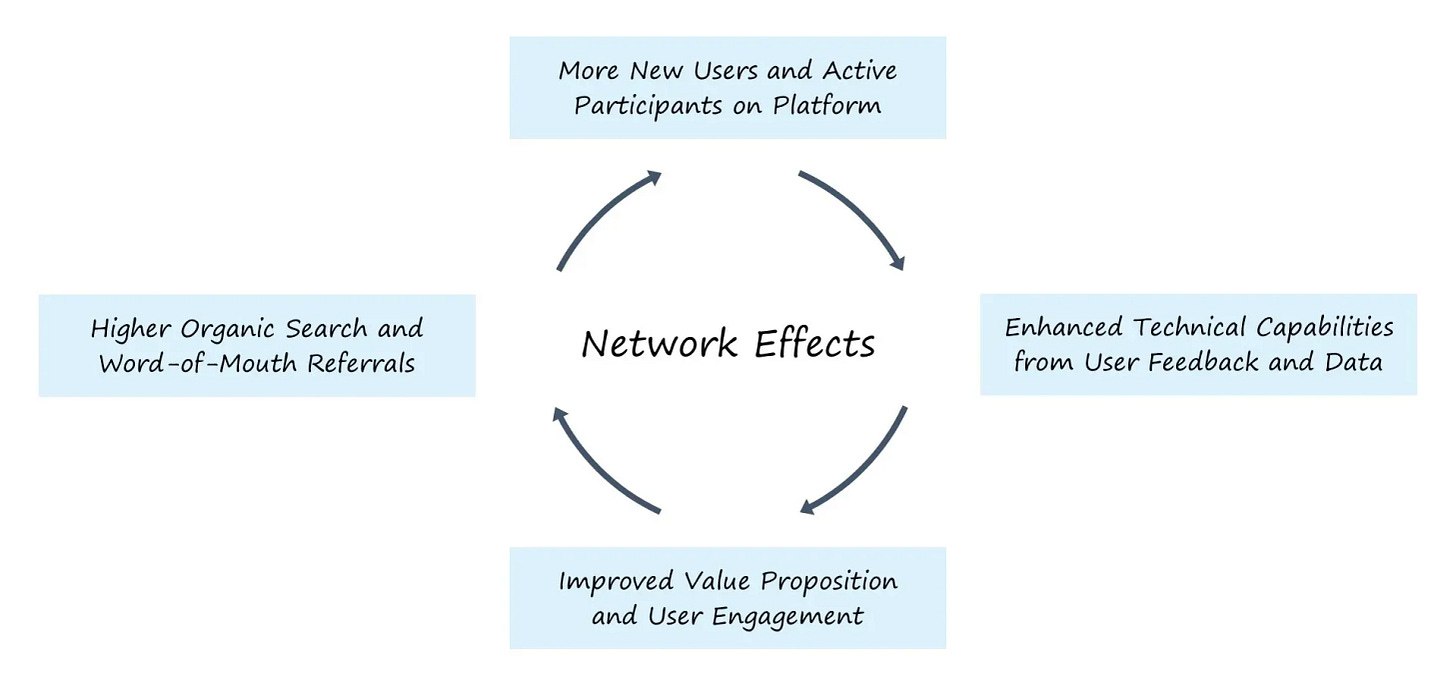

This turned what was a basic platform into a double-sided network.

Think about it, for each new user, the value proposition of the platform isn’t just brokerage, but also the ability to see other people’s portfolios, track them, and engage with them.

With every user sharing their portfolio on the platform, the perceived value of the platform increases for prospective users. The larger this network is, the more attractive the platform becomes.

Result?—A user acquisition flywheel that perpetuates itself.

We can see this in the data.

Though e-toro hasn’t recently disclosed its customer acquisition cost, it disclosed it in 2021 as $35 per new customer. This is nearly 1/8 of the average customer acquisition cost for online brokers, according to Bain & Company’s online brokers research.

This doesn’t just provide it with a flywheel of growth, but also erects significant entry barriers.

Imagine a user of a traditional brokerage platform. There is nothing stopping him from switching to a lower-cost platform or to a provider with a slightly better UI/UX.

For eToro, it doesn’t work this way.

A highly engaged user utilizing social features of the platform, following other people’s portfolios, using copy trade function, benefiting from educational tools, etc, won’t want to lose all these functions by switching to a different platform.

Even if other platforms can easily copy e-Toro’s capabilities, it’ll be nearly impossible to create the same network.

These network effects create a level of uniqueness that is nearly impossible to match by just product differentiation.

This is eToro’s unique advantage.

It’s actually trying to replicate what made some industries like e-commerce prone to consolidation in finance, which has historically not been prone to it.

It is a genius strategy.

You can never know whether these models you parachute in from other industries will work in your industry, but in the specific case of e-toro, it seems like they are working.

It reports that there are already a significant number of users who have monetized their portfolios by allowing other users to copy and follow their portfolios. These people are strong sides of the network. Think of them like social media influencers.

If an influencer leaves one platform for a different one, most of his/her followers also switch to the other platform to not lose engagement with them. The same applies here. Users following others’ portfolios won’t likely switch as they don’t want to lose this ability.

Those who open their portfolios to the public are even less likely to switch, as they are making money on this feature.

Complete customer lock-in.

Overall, eToro’s business has unique edges that can well differentiate it from the competitors in the industry.

This is a very valuable proposition in what has historically been a commoditized market.

📝Investment Thesis

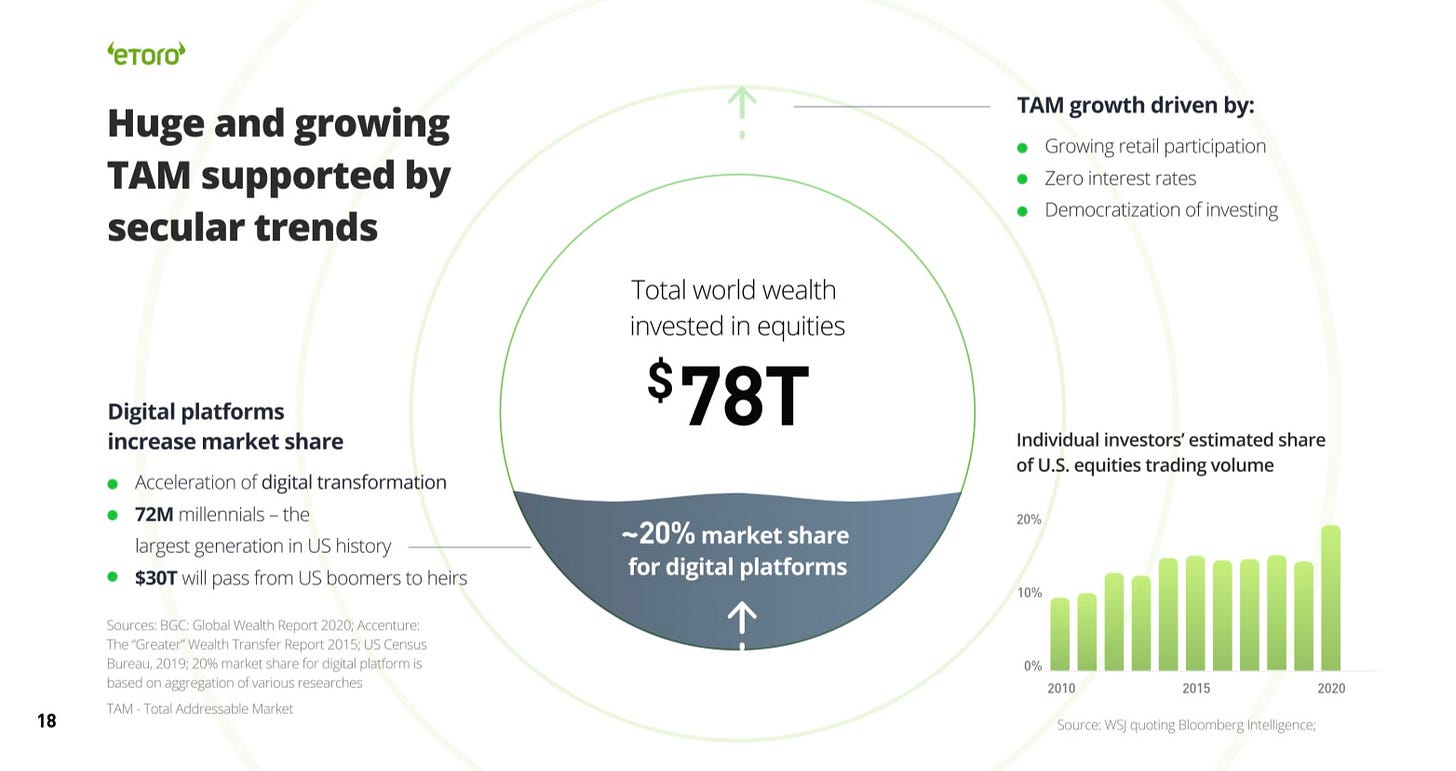

➡️ Retail investing is entering a secular growth era.

Currently, there are approximately 100 million brokerage accounts in the US and over $20 trillion in retail assets under management.

58% of all US adults have some sort of exposure to the stock market.

Even if this number grows just by 10% in the next 5 years, assuming stable GDP, $2 trillion will flow into the equity markets.

In Europe, the potential is even higher.

Only 7% of the European population has exposure to the stock market. Oliver Wyman expects that this will increase by nearly 75% in the next 5 years, and client assets under management will increase to $23 trillion from $13 trillion today.

In total, more than $12 trillion of money will flow into the equity markets in the next 5 or so years, and most of this will go through online brokerages as their adoption increases.

This is a huge opportunity for eToro.

Given its current market cap, it’ll have succeeded spectacularly even if it can capture a minuscule share of these assets.

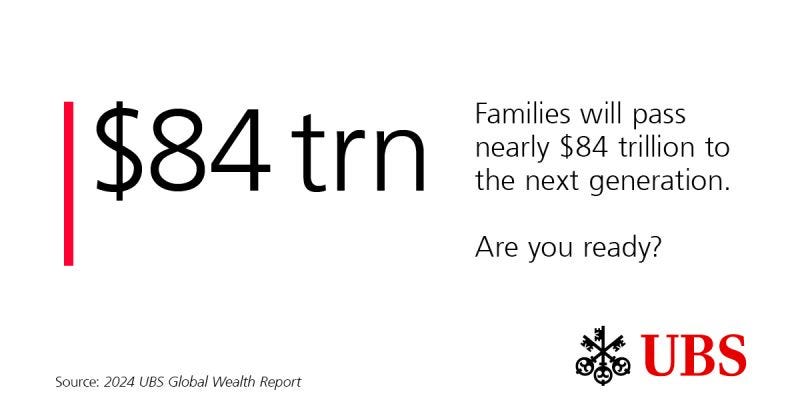

➡️ Massive wealth transfer is coming.

Boomers are probably the wealthiest generation in human history.

They have gone through several of the most transformational periods of human history—the industrial revolution, the computer revolution, the internet revolution…

Each of these technologies led to massive jumps in human welfare, and boomers accumulated an immense amount of wealth on the way.

UBS expects that $84 trillion of wealth will be transferred from boomers to the younger generations in the course of the next two decades.

And the younger generations who will manage this wealth don’t share the same consumer preferences as boomers.

They like remote rather than physical, they care about simplicity and user experience, they expect convenience at literally $0 price.

Thus, it’s very likely that these people will transfer their assets to the platforms they connect better with from the traditional financial institutions that were built around the concepts of trust, confidentiality, and prestige, thus are monolithic and clunky.

This is creating a secular tailwind for eToro.

➡️ eToro may have a higher activity rate than competitors.

eToro’s business model encourages engagement and social investing.

As people use features like ‘copy trade’ more widely, activity rates across the platform will naturally increase.

This will drive trading revenue per user up. This is a very high-margin source of revenue that contributes directly to the bottom line.

It’s very likely that e-toro’s trading revenue per user in maturity will far exceed peer platforms.

Overall, I believe there are several secular tailwinds that create an almost ideal economic environment for eToro to grow very fast in the next 5 to 10 years. The rest depends on how eToro will execute to take advantage of these.

📊Fundamental Analysis

➡️ Business Performance

Though there is not much data available as to its past performance since it’s a newly public company, what we know about e-toro is promising.

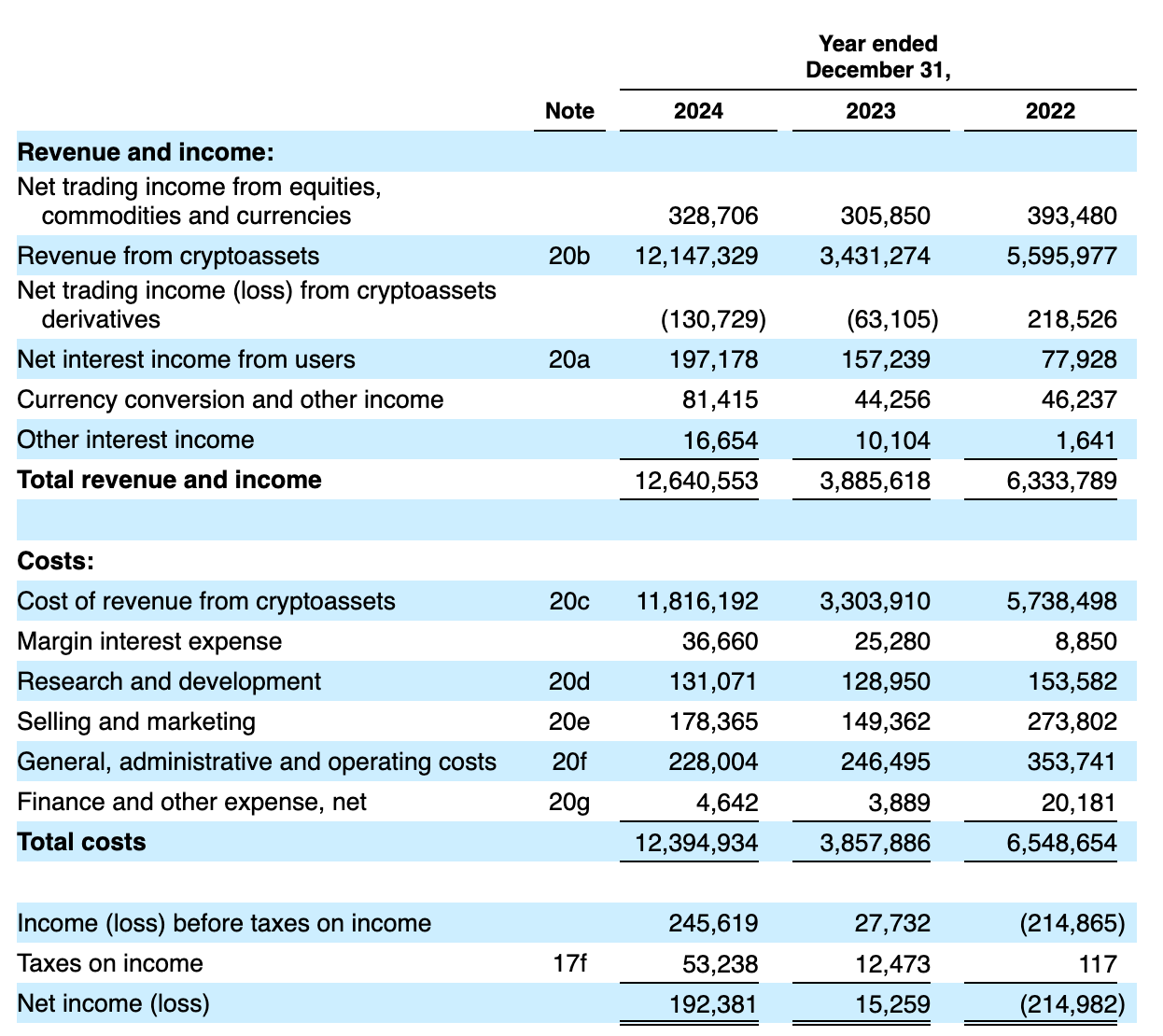

eToro primarily measures its business performance by a metric called “net contribution,” which reflects total revenue less the cost of revenue from cryptoassets and margin interest expense.

It makes sense since it focuses on the revenue generated from the user activity on the platform. Thus, I’ll use that metric to measure its performance, together with net income.

eToro’s net contribution grew 42% in the last two years, from $557 million in 2023 to $787 million in 2024. Net income also grew from $15 million to $192 million, a whopping 1,160% growth!

In Q1 2025, its net contribution was $217 million. If we annualize this number, we get a net contribution of $868 million, representing 10% growth. If we assume next quarters will see a higher growth rate, we can expect to see around 20% growth this year.

Though there is not much that we can talk about its performance due to a lack of data, we can at least say that it’s a growing business, and the mere fact that it’s profitable is a big positive.

It’s satisfactory, but a longer track record of successful execution of growth strategies is required to build a big conviction.

➡️ Financial Position

Here, we can talk more confidently—its financial position is rock solid.

Take a look at this; it has what I call a “golden descending line.”

When you put numbers for total common equity, earnings before tax, and total debt, it creates a perfect descending line.

This means that the pre-tax earnings can pay all the debt under a year, and the equity pool creates a large cushion of safety for hard times.

Indeed, its equity pool is 10 times the size of its debt.

Despite being a newly public company, its financials are rock solid, and it can weather any economic storm.

It passes from here.

➡️ Capital Allocation

Last year, eToro recorded a 24% Return on invested capital (ROIC).

Again, this is a metric that gains meaning only with a historical track record, and we lack it for eToro.

However, given that its projected growth for 2025 can be around 20%, we can infer that it’ll maintain a similar ROIC performance this year too.

This is indeed promising as it’s two times of the average ROIC of mature American companies.

Though eToro isn’t an American company, it’s still a valid benchmark as American companies have a higher average ROIC than their global peers.

Overall, we don’t have enough data to build conviction looking at its performance, but we can comfortably say it’s at least “promising.”

In most cases, this is the best you can get from a newly public company.

🏁Valuation

I said above that eToro has perhaps the most promising business model that I have seen in the online brokerage space for a while.

From the business model perspective, I am super impressed by the fact that they are trying to build long-envied moats of companies like Amazon and Meta in the fintech space.

Yet, this doesn’t mean that investment is automatically justified.

If something, a divergent business model brings more risks and discounts the value of the business in its early life. Thus, what I expect in such situations is that the valuation should be attractive on conservative assumptions.

If we need hyperbolic assumptions to justify the valuation, and then rely on the innovative business model to justify it, it’s not smart investing.

I would normally create a scenario based on the past performance of the business and trajectory, but given that this is a new public company that lacks a sufficient track record, I think it’s better to move from market assumptions and decide whether it can do better or not.

So, what is the market pricing today?

Given that the 10-year bond yield is around 4.3% and equity risk premiums for the US market are around 5.5%, investors expect at least a 9.8% return from equities to compensate for the systematic risk assumed in equity markets. Let’s say 10%.

The question is what eToro needs to achieve to return 10% annually until 2030?

Subtracting the cost of crypto assets from crypto revenue, it netted a total of $824 million in revenue last year.

Given that net income was $192 million, its net income margin was around 23%.

At the current setup, the market expects 15% annual revenue growth from eToro until 2030 with profit margin expanding to 25% and a 20 times final P/E multiple.

This will give us just around $1.9 billion netted revenue, $476 million in net income, and a $9.5 billion market cap, promising a near 10% annual return.

I believe this is too conservative for a small, fast-growing, and profitable company that has several secular tailwinds ahead.

In a slightly more optimistic scenario with 20% annual revenue growth and a net margin of 25%, keeping the exit multiple stable, we get a $12.3 billion company, which is more than double of today’s valuation but smaller than 3x.

Is it worth it? I am not so sure.

🏁Conclusion

When I dived deep into eToro’s business, I loved it. There is no question there.

But is risk-reward there? Actually, I couldn’t decide.

If we had a longer track record of execution, I could more easily say that its business characteristics will drive secular growth in the next decade.

But we don’t know this…

Though its recent numbers are promising, it has not been tested as a public company yet.

Plus, valuation is not that attractive for a small growth company.

Can it drive better growth than what the market expects? There is a potential, but we lack track record of execution to build a conviction for it.

If it were a 9% threshold, I would say it was easy, but 15% annual top-line growth for 6 years is a serious job. Even then what you get is simply the market return.

Is there a bull case? Yes.

However, the main shortcoming for me is that the bull case has at most 3-4x potential, making it look like not worth the risk.

In their bull cases, more proven companies like Nebius, Oscar, and Hims promise more than 3-4x returns. This brings up the question—Why take a risk by adding a new exposure?

All these considerations push me to stay out for now.

Although I like the business model and see potential for a sustainable competitive advantage, they aren’t enough to make up for the lack of track record and not-so-stellar reward promise.

Yet, there is a clear investment thesis, and I won’t hesitate to take a position if either valuation drops significantly or I see signs of accelerating growth.

Hope this helps!

What is the stock symbol ? Thanks

Not much said about the cryptoassets business. What is that? It's the major part of their business and in Q1 had a negative fross margin. Not good in my opinion.