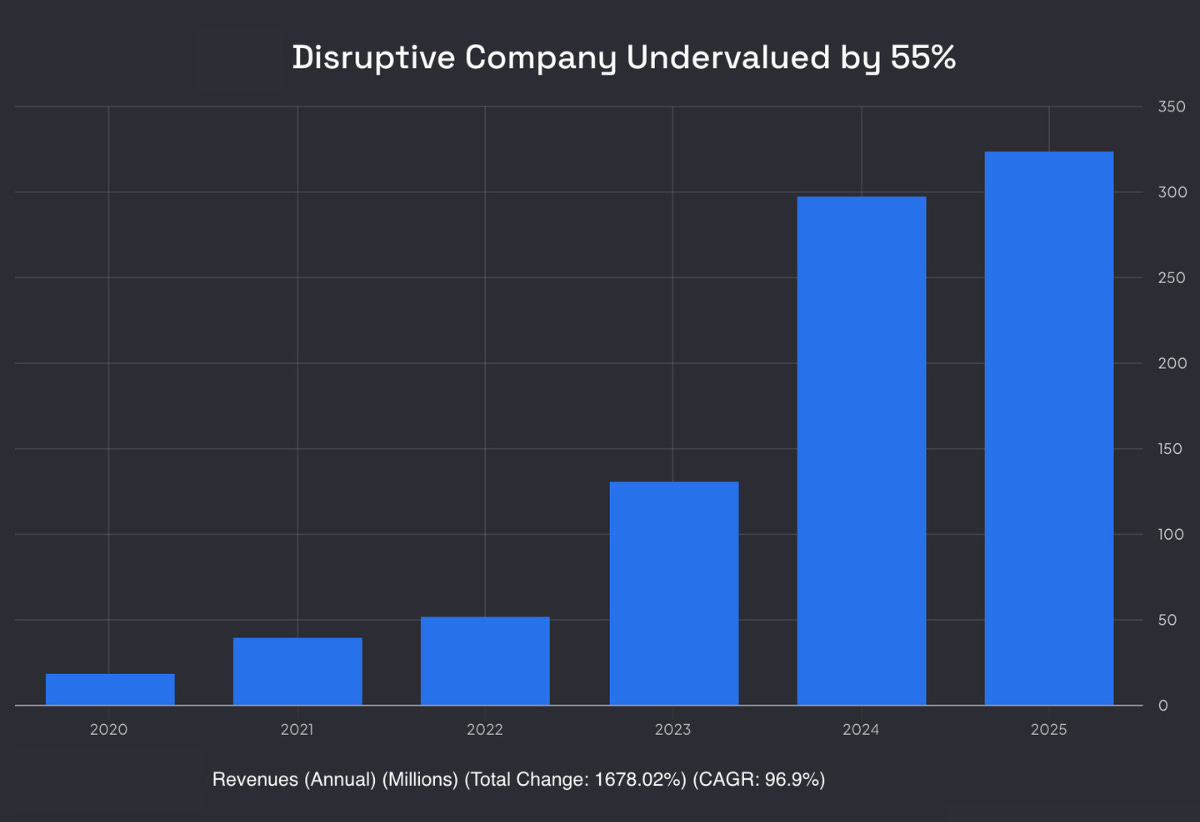

Disruptive Growth Company Trading At 55% Discount To Fair Value!

It's been growing revenues 97% annually in the last five years, closing in on adjusted EBITDA profitability yet the market still ignores it.

“Successful investors operate through frameworks.”

This is what I remember Bruce Greenwald saying in the 2021 Columbia Student Investment Management Association (CSIMA) Annual Conference.

It was a virtual event that year due to COVID, and I actually had nothing better to do at home, so I attended.

Among all the things said, this sentence stuck with me—successful investors operate through frameworks.

The idea was that successful investors tend to find patterns that they are good at locating, and they capitalize on them until that pond dries.

Then, those who are even better find and adopt new frameworks, and those who can’t are generally unable to maintain their success over the long periods of time.

Think about Benjamin Graham, the father of value investing.

He had a clear framework:

Buy a big basket of companies trading below net asset value.

If something goes up 50%, sell and replace the sold one with a new prospect.

Otherwise, hold for two years, sell regardless of the price at the end.

Repeat the process, put new prospects in the places of the sold ones.

This worked spectacularly for Benjamin Graham—not just for him, it worked for Warren Buffett, Irving Kahn, and Walter Schloss…

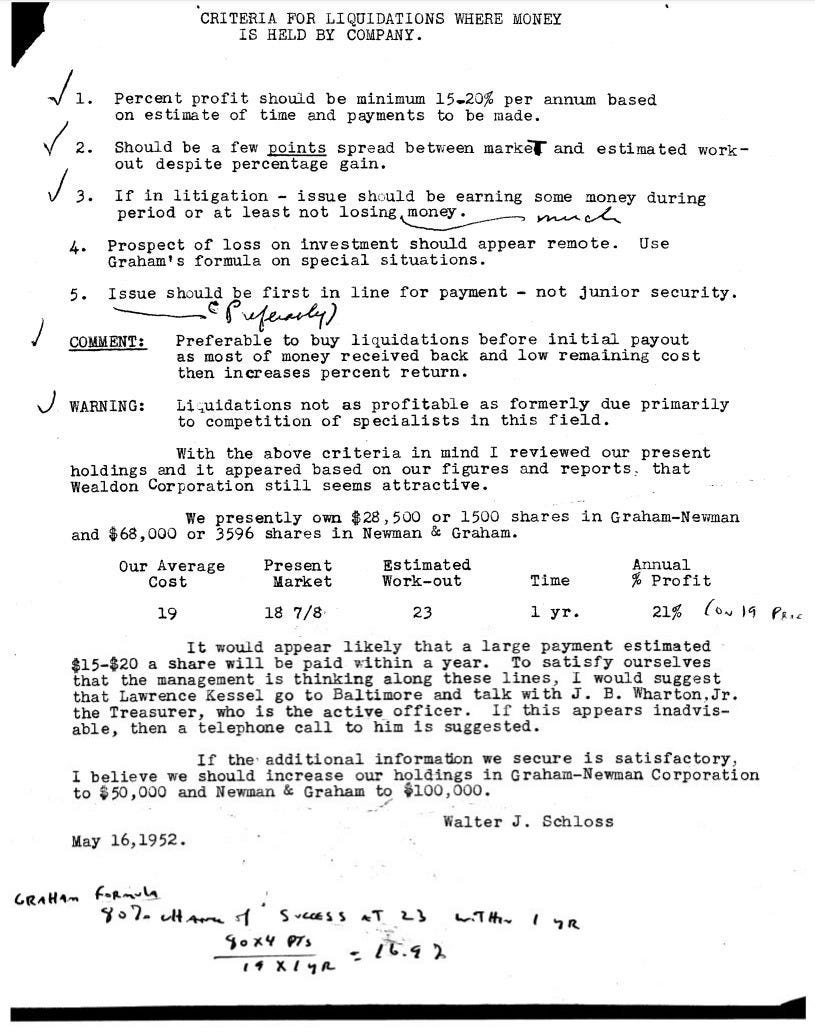

Walter Schloss even translated his liquidation framework into a checklist to be followed by his associates:

Take a look at his warning in the document, he says, “liquidations not as profitable as formerly due primarily to competition of specialists in this field.”

This is what happens.

Over time, as people replicate such known frameworks, these ponds dry up. This is why net-net investing isn’t as profitable as it used to be, as there is now just 1 prospect for every 10 at the time of Benjamin Graham.

This is why Warren Buffett is so great.

He started with the net-net framework, switched to completely different frameworks as his career improved, and conditions changed. But every time he capitalized successfully on those.

Here, we have frameworks too.

Our readers might have noticed that we occasionally own similar businesses in the portfolio. Those almost always tend to be growth positions.

The reason is simple. The biggest opportunity for growth stocks exists when two things come together:

Tech-enabled transformation of the market.

Legacy business models nobody actually likes.

This is a winning formula.

What happens is that tech enables new, superior business models. These superior models do two things at the same time:

Gain market share from legacy business models.

Expand the market by making access easier.

Result? Dual growth engine.

Think about marketplaces.

Amazon gained those who were living in towns and had easy access to a shopping mall because it was more convenient. Further, it also turned people who were going shopping once a month because they had to drive to a downtown mall into everyday shoppers because they didn’t need to go to the downtown anymore.

Same for fintech. Think about NuBank.

It didn’t just steal users from legacy banks because it was more convenient; it also expanded market access to those who were previously unbanked, as the bank was now on their mobile.

Again, dual growth engine.

The framework I often employ is trying to spot such transformations.

If you can do that, you can see many opportunities before others. The reason is simple:

If a transformation is happening in one market or a geography, it will jump to the in neighbouring markets or geographies too.

If you could spot the marketplace revolution with Amazon, you could more easily see that MercadoLibre and Alibaba. It’s a geographic jump.

If you could see it, you could also see Booking, Uber, DoorDash, etc They are basically marketplaces in different markets. Or it could even be different segments of the same market, such as Booking and Airbnb.

Again, another example is subscriptions.

If you spotted Netflix, you would have an easier time spotting Spotify, Duolingo, etc…

We have two similar companies in our portfolio.

They operate in the same market, but in different segments.

They both have worked exceptionally well, skyrocketing in the last two weeks.

They are transforming a monolithic industry through better business models enabled by tech. They are growing really fast.

Yet, if you remember, we also had the third one in the same industry. We had bought it in January and sold it in February after it doubled in a month!

This proves that there are still a lot of fish in this pond.

Now I have found the fourth one!

It’s in the same market but a different niche, growing very fast, and about to become profitable.

It grew revenues at a 97% CAGR in the last 5 years.

It’s already free cash flow positive.

Targeting profitability next year.

What’s better? It’s just trading at 2 times sales.

So, let’s cut this here and dive deep into this hidden gem!

🏭Understanding the Business

If the business is transforming an industry, it has a nice upside; if it’s transforming an industry that everybody hates, it has an immense upside.

This business is transforming an industry everybody hates.