Dave: Still A Great Opportunity Or Sell?

Dave stock doubled since we picked it last month. What should you do now?

Let me start straight with this: Dave stock doubled since I wrote an analysis in October.

That surely delights me because it was largely an overlooked stock despite the flawless execution, robust growth and positive free cash flow. It somehow didn’t appeal to Wall Street.

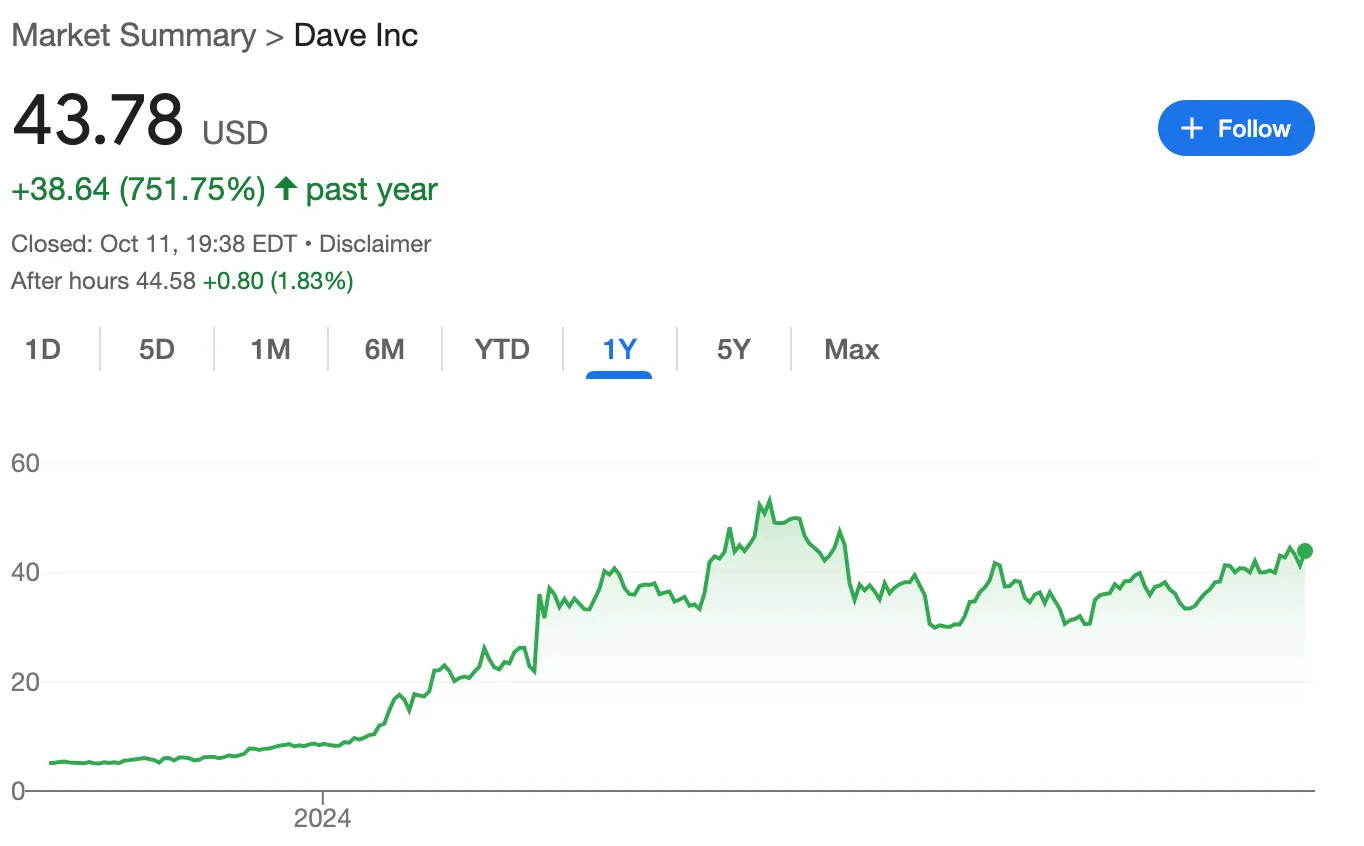

Most retail investors also ignored it and the reason was simple: It had already skyrocketed. Dave was already up 750% year-to-date when I wrote about it. I shared this screenshot in my write-up:

I knew this would scare most people off so I also said that the price you see on paper is largely a vanity metric. High appreciation doesn’t per se make any stock overvalued or huge decline doesn’t automatically mean the stock is now undervalued.

This is why I started the first issue of my email course by explaining the two most important things in investing:

Building confidence in the market.

Building confidence in yourself.

You have to be confident that, if you know the discipline and did a thorough analysis, your analysis has as much chance to become true as that of a good analyst in a hedge fund.

What makes you unique is the way you create the story about the company and how you value that story. In our write-up, we told a very specific story about Dave. If you haven’t read the first analysis, here it is 👇

Two weeks ago, Dave announced the Q3 2024 results and it has become apparent that our story is playing out.

Result? The stock doubled 👇

I am proud of this result as we create value for our members. However, as Howard Marks says, success carries seeds of failure in it. As the stock doubled, higher expectations are now priced in. This creates two set of questions:

If you are in, should you buy, hold or sell?

If you are out, should you get in or avoid it?

It all depends on whether the expectations got too high or the market still undervalues its potential.

To understand this I will:

Briefly discuss the investment story again.

Evaluate the Q3 results and the guidance.

Share my discounted cash flow analysis.

As you know, I rarely share DCF analysis as I believe most people just run the numbers ignoring the story, DCF tends to undervalue great companies because they tend to grow faster for longer in the first phase of perpetuity and it also tends to discount multinationals as they can keep growing faster than their core market.

In overcoming these challenges, I will tell the Dave story in a diagram, and incorporate the story in DCF analysis. I will also turn the latest value into an option value because Dave is still a pretty young company and we need to incorporate the chance of failure in our valuation.

Then based on this final option value, I will make my recommendation.

So, it’ll be a ton of value! Let’s get started!