Buying This Growth Stock With 3x Potential!

It's a simple and consistent business in a boring industry with a clear path to make 3x in the next 5 years even on conservative assumptions.

Never invest in the present, always invest in the future—says Stanley Druckenmiller.

This one sentence perhaps best summarizes the nature of investment returns.

Everybody likes profitable businesses that are still growing fast. Yet, when it’s obvious that this is the case, the price is generally in the sky already. Most future growth is priced in, and there is not much money left in it to be made.

Conversely, those who invest before it’s obvious make insane amounts of money.

For most companies, you have plenty of opportunity to invest before the inflection point. If you look right, you can see it coming and invest before the masses.

First, unit economics drastically improve; then operating cash flow shifts positive and GAAP profitability follows— when it happens, the stock price skyrockets.

Result? Those invested before GAAP profitability make so much money.

This is what happened in stocks like RobinHood, SoFi, and Hims & Hers in the last two years.

We invested in all of them before they hit the inflection point, but after there were clear signs that they were on this path.

This is one of those companies.

Here, take a look at this:

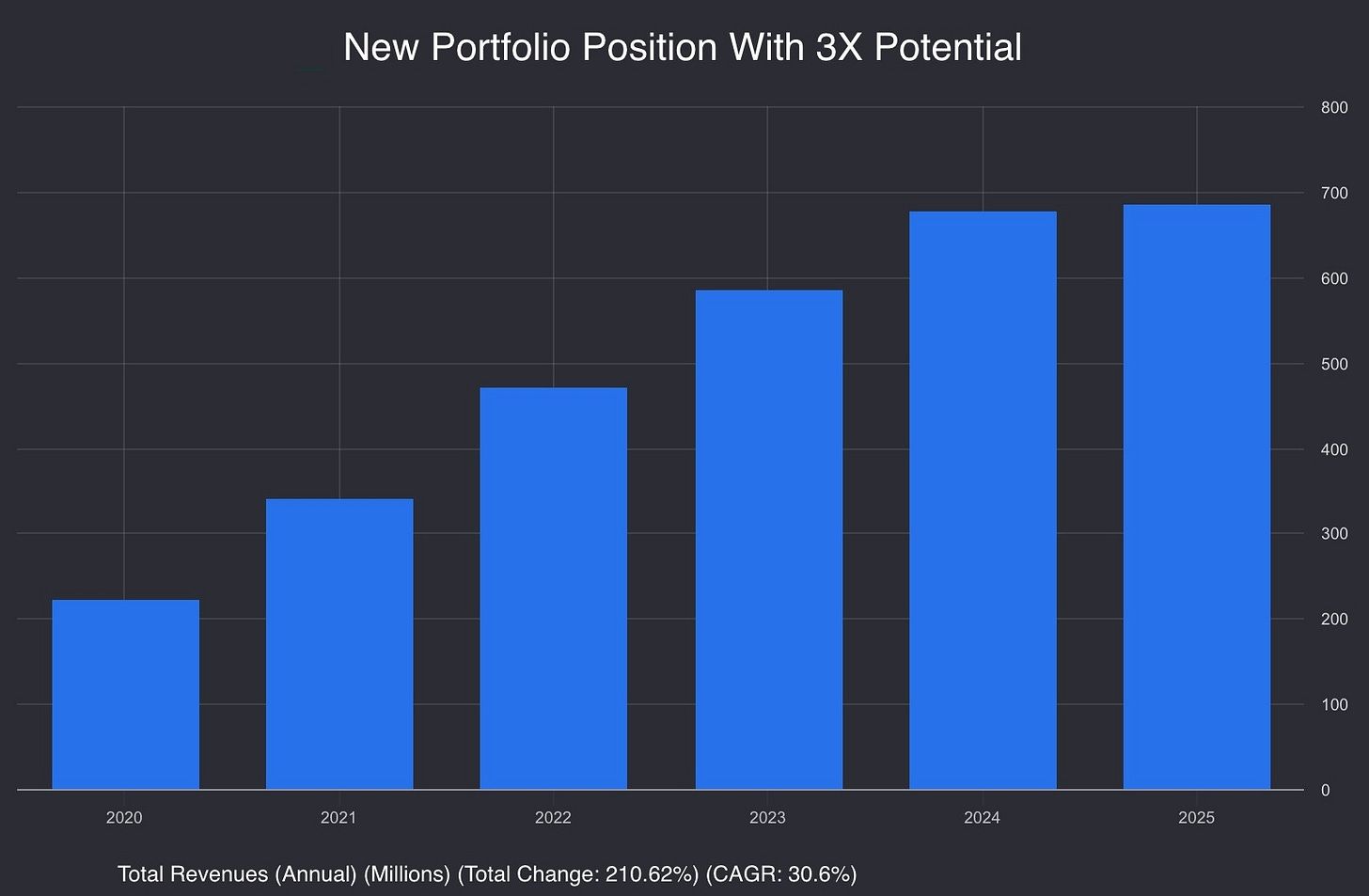

It grew revenues 30% annually in the last 5 years, yet the stock got hammered down 65% from its highs.

What changed? Literally nothing. The market shifted focus to hot sectors like AI.

This creates many opportunities in fast-growing businesses in boring, non-tech industries—this is one of them.

I have been following this company for almost four years now.

Management always executed as promised, the quality of their product is top notch, and it benefits from secular tailwinds.

I had been waiting for this opportunity for months, and now it has come.

As the market is at all-time highs and greed is pervasive, it gets harder and harder to find attractive opportunities with exponential upside potential.

This is one of the few remaining multi-bagger opportunities I can clearly see.

So, let me cut the introduction and dive deep into this asymmetric opportunity.

🏭 Understanding the Business

Peter Lynch describes his favorite stocks in three words—simple, boring, consistent.

These are the types of stocks that made the most money for me in the stock market.

This is one of them. It’s simple, boring, and consistent.

It has a predictable growth trajectory, and everybody can understand what it does, what the investment case is, and track the business performance.