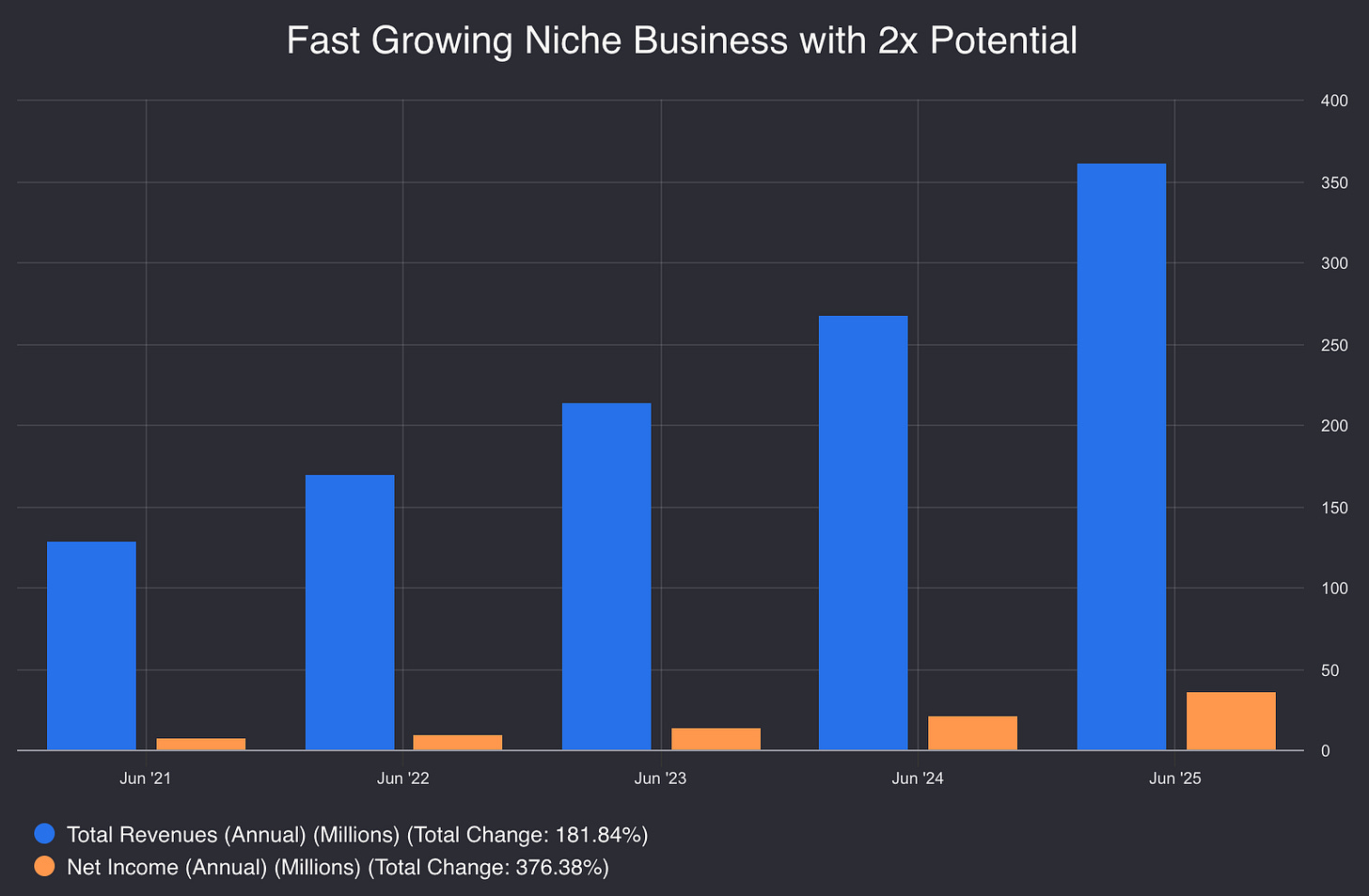

Buying This fast Growing Niche Company With 100% Upside

Revenues quadrupled and earnings quintupled in the last five years, management is guiding for 34% growth next year and it's trading at just 13x forward earnings.

It’s been an amazing start to the year for us.

We closed last year with a blockbuster 44% return, and our portfolio has appreciated further by 12% year-to-date, as a result of no significant drawbacks in any holding and major moves in some of our substantial holdings:

Inpost, up 36%

Oscar, up 22%

Pagaya, up 21%

Novo Nordisk, up 14%

The only unfortunate thing is that we had to close the InPost position as it became an acquisition target.

The offer was spearheaded by the founder & CEO, who knows that the stock is deeply undervalued. We saw this as his attempt to override minority holders at low cost, so we decided to lock up the gains and exit.

I wished to hold that company for a decade, and I’ll certainly buy more if the deal falls apart.

Luckily, we already have the stock where the proceeds from the InPost exit will go:

Market cap < $1 billion

30% annual revenue growth since 2021.

Two founders own over 60% of the company.

It’s dominating a niche industry with secular tailwinds, thanks to the sticky nature of the business and high switching costs.

It’s trading at just 13x forward earnings, and nobody is talking about it.

It can easily double over the next 12-18 months as the management delivers on the medium-term targets.

I’ll be putting proceeds from our InPost exit in this stock this week.

So, let’s cut the introduction here and dive deeper into this gem.

🚨 Important Note

We’ve beaten the market for four years by expanding margins. In the last quarter alone, picks like InPost and Fluence Energy generated strong alpha while the broader market stayed flat.

Following this performance, several institutional investors among our readers recently invited me to join their research teams. I thanked them. I value independence and am fully committed to building this publication into a full-fledged research firm with skin in the game. I’ll increase the output and publish 52+ deep dives this.

Given the increasing output, the price will also be raised to $200/year starting next week.

EXISTING MEMBERS WON’T BE AFFECTED.

Many readers recently reached out for a discount as they missed the last one since they weren’t paying attention during the holiday season.

To be fair to them, I am launching a final 25% discount before the price increases.

Valid until Monday and limited to 25 seats. You can claim it below👇

🏭 Understanding The Business

Some services are essential, and there is no way they are going to be provided by AI soon, not in the next 20-30 years.

This is especially true for critical industrial services like heavy machinery maintenance, water treatment, waste management, etc.