Buying This Exceptional Company Trading At Net Asset Value

Exceptional business, fast growth, long runway & fair value—a rare combination.

One of my early mentors was from private equity, and something he said has stuck with me—“when done right, it’s almost impossible to lose money in private equity.”

It’s because private equity has dual drivers of investment return:

Organic and inorganic growth

Multiple expansion

Think about it.

You buy a B2B service company, let’s say a cleaning company, which makes $10 million net profit a year. Then you buy another company that provides a complementary service, let’s say security, which also does $10 million a year.

You combine them together under the same corporate umbrella, cut the fat in back-office functions, cross-sell, and each company is now netting, let’s say, $14 million a year. This is the first driver of investment return.

When they were separate, they would get a lower exit multiple because they were smaller companies. Bigger companies make their owners richer; this is why they get a higher multiple.

So, when separate, each would get 4x exit multiple, and their combined value would be $112 million, even if we assume each would still grow its net profit to $14 million. But together, we are looking at a bigger company that gets a higher multiple, let’s say 7x. In this case, the combined entity is now worth $196 million.

The combined entity is worth 75% more than the total value of the separate companies. Effect of the multiple expansion due to size. The second driver of investment return.

The problem here is that private equity funds don’t generally have permanent capital, so they need to exit and pay their investors after 5-7 years and repeat the strategy.

Yet, this exposes the firm to the same risks—investment risk, and execution risk—all over again, jeopardizing the future gains. This is why I don’t own any private equity companies despite their unfair structural advantages.

Had they permanent capital, allowing them to buy and hold exceptional businesses forever, that would have benefited public shareholders much more. It would also be structurally similar to what Berkshire was to Warren Buffett, an investment vehicle to own exceptional companies.

This company does exactly that.

They own one of the most exceptional businesses in the world, which is growing rapidly in its industry, and the parent company is growing alongside it.

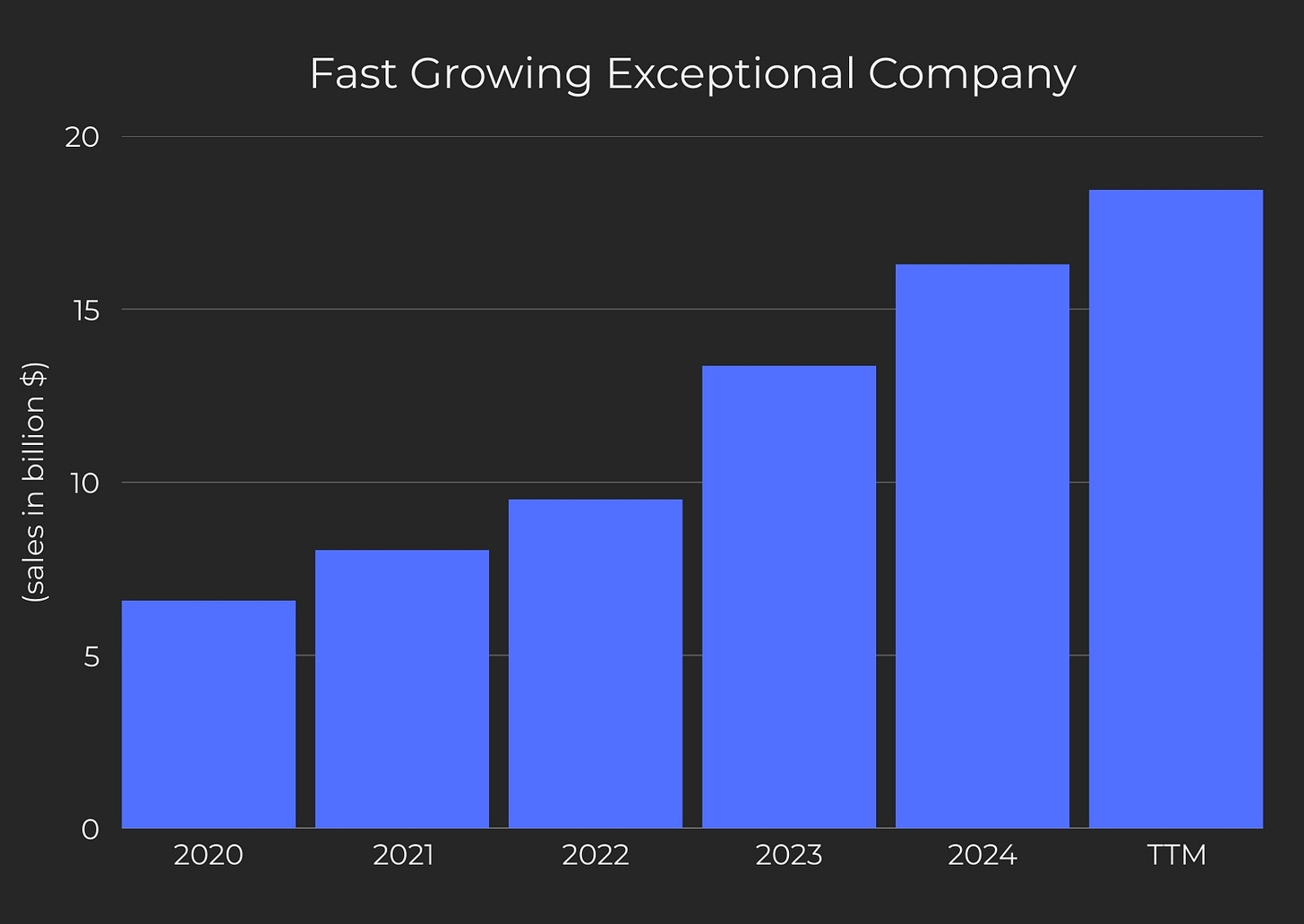

Take a look at this:

It grew revenues over 23% annually in the last five years, and the parent company grew alongside it at a similar rate.

I have been following the company for some time, but the stock consistently traded at a premium to its net asset value. Now that premium has eroded, the company is likely valued less than what’ll be its net asset value at the end of this quarter.

This is why I am pulling the trigger now and buying it. It’s hard to find an opportunity to buy such an exceptional business at net asset value in this broadly overvalued market.

So, let’s cut the introduction here and dive deeper into this gem.

🏭 Understanding The Business

Access to capital has always been a big problem for small businesses (SMEs).

They are seen as riskier by big lenders, so they are often pushed to predatory lenders that charge high interest rates with unfavorable conditions.