Buying This Disruptive Company With 30% Revenue CAGR and 95% Retention Rate!

This digital toll bridge with fast growth and decades of runway is finally fairly valued and I am buying.

I am going to give you a mind blowing fact— it blew mine.

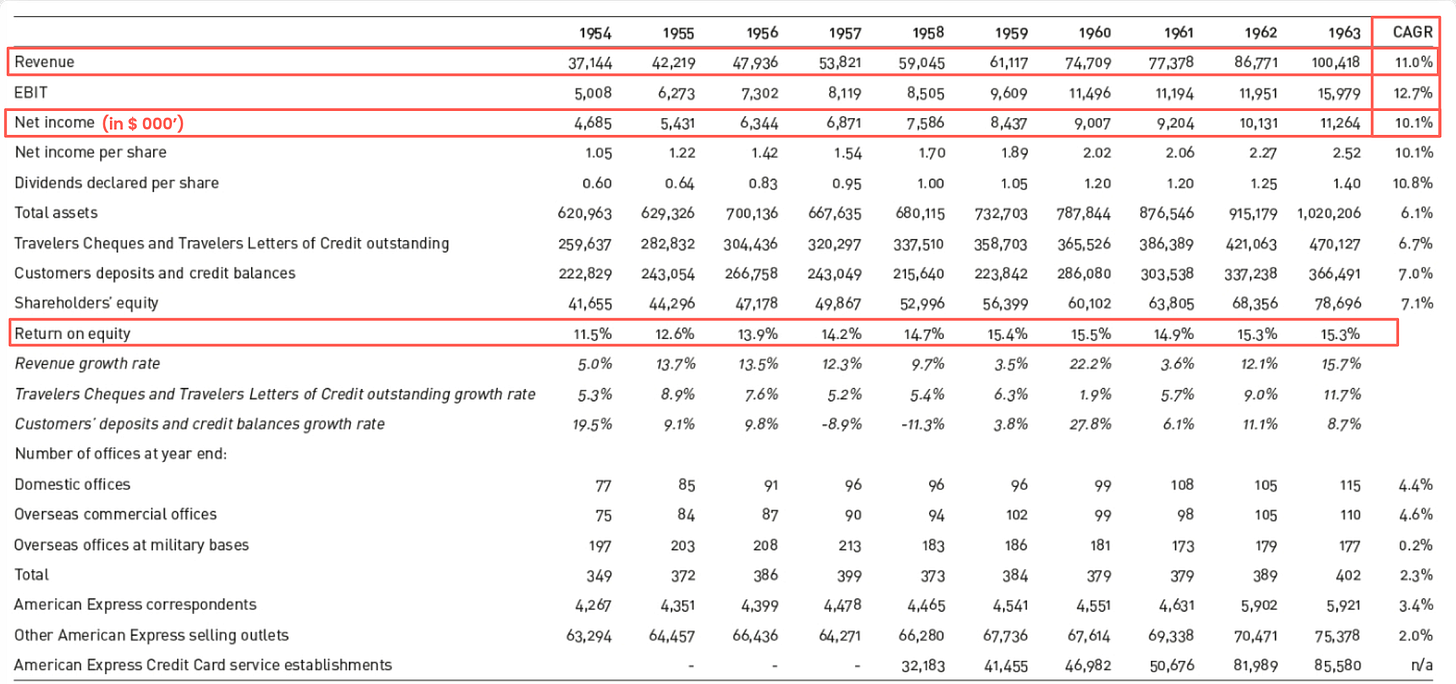

Warren Buffett bought American-Express when the company faced the risk of losing all its equity base following the Salad-Oil Scandal of 1963.

The stock plunged from $70 levels to $35 levels.

Here is what’s shocking:

When Buffett bought it, it had been growing its earnings at around 10% annually in the previous 10 years. Fast forward 60 years, American-Express is still expected to grow earnings between 10-15% annually in the next 5 years!

I am not making this up:

I thought a lot about this. How the hell could this be possible?

I have my answer.

It’s a toll bridge in an ever growing market—transaction volume.

Transaction volume can increase indefinitely because it’s driven by three infinite sources:

Inflation.

Population growth.

Productivity growth.

As these three only go up, the total transaction volume of the earth has to grow!

If they stop going up at some point, we probably have more serious problems than finances— humanity facing an extinction kind of problems.

For whatever reason transaction volume grows, American-Express takes its cut, and it makes more money.

Population grows, it brings in new customers. Productivity grows, its customers spend more. Inflation increases, basket sizes grow etc.

What’s even better?— Nobody blames American-Express.

When a business increases its prices, customers curse the business, not American-Express, nonetheless, Amex’s top-line grows.

Phenomenal business…

Since I noticed this, I developed a framework— I want to own high-quality, toll-ridge businesses in ever growing markets.

Advertising is one of such markets.

It’s an ever growing market because it flows from the total cost of goods sold. As the total cost of goods sold grows, advertising should grow proportionately.

This is why businesses like Meta and Google keep delivering above average earnings growth year after year.

But even they aren’t toll bridges. They own the medium themselves.

Is there a toll bridge like business in advertising?— Yes, there is.

I have been buying one of them recently with great conviction.

Here are some metrics for you:

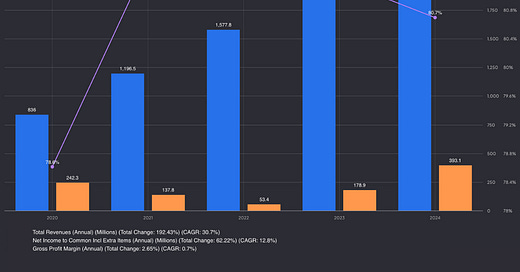

30% average annual revenue growth in the last 5 years.

No debt, over $1 billion net cash position.

80% gross profit margin.

This is why it was chronically overvalued. Until recently. My DCF model now shows that it’s 20% undervalued.

So, let me cut the BS and dive deep into this gem!

🚨Rest of he analysis is proprietary to our supporting members.🚨

I want to share a discount coupon to celebrate 13,000 readers!

Claim 25% discount and gain access to our outperforming portfolio!

Valid only until Monday 👇

Business Overview

The way we consume content has been rapidly changing for the last 30 years.