Buying This Disruptive Company With 5x Potential!

Best returns are generated through investing in companies that disrupt large, inefficient industries. We are looking at one of them here!

What is the most successful business?

Is it the one with the highest quality product?

The one that has the cheapest prices?

One with great customer service?

This may look like an easy question, but it’s actually not.

It’s not about cost, quality, or service… It’s about “value.”

A few weeks ago, Jensen Huang attended a panel in Stanford, and he was asked how increasing competition would affect Nvidia’s super high margins. I think his answer captures the point about value:

Our total cost of operation is so low that even when the competitor's chips are offered for free, it's still not cheap enough.

- Jensen Huang

That’s the essence of it. Nvidia is the greatest chip company on earth now because its products create so much more value for customers than competitors’ products.

But how do companies create value? It is simple: Invent new products that didn’t exist before.

This is true, but many successful companies don’t invent new products. How do they succeed then? How do they create value that customers want?

It’s by shortening the customer value chain.

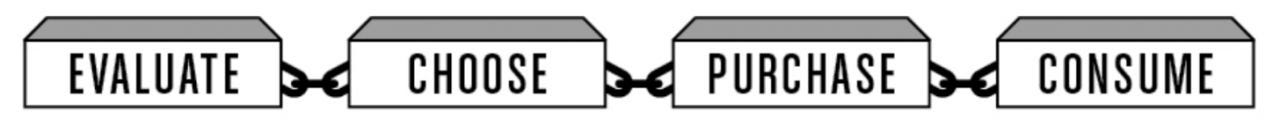

Simple customer value chain has four steps.

Consumers pay in time, money or both to go through each step. Thus, businesses that can eliminate one or few steps and still provide the same product to customers shorten the value chain. They can now capture some of the value unlocked by freeing up the resources customers spend on a step and pass some of this value to their customers, ultimately creating value for the customer.

This is called decoupling.

Take Amazon as an example:

Go to a bookstore.

Evaluate many options.

Purchase the books you liked.

Bring them back home to read.

Amazon eliminates all but one step: Purchasing the book. You don’t need to go to the bookstore, you can sneak-peek into books online, you don’t need to carry them back home as Amazon sends them to you. You only need to purchase.

On scale, this unlocks immense value and Amazon quickly gained millions of users by passing some of this value to its customers. It created amazing value.

This is why I am so optimistic with the business we are looking at today.

It’s disrupting a very old market and unlocking immense customer value.

Even if it captures a small part of the value that’ll be unlocked, it’ll easily make 5x. I think the numbers prove the point. It isn’t even active in all United States, yet:

It doubled the revenue last year.

It has a 16% free cash flow margin.

Hit an inflection point last quarter and become profitable.

Best? It’s trading at 10 times forward earnings.

I simply think it has one of the longest runways for growth and upside potential among all the companies in the market.

So, let me cut the BS and dive deep into it!