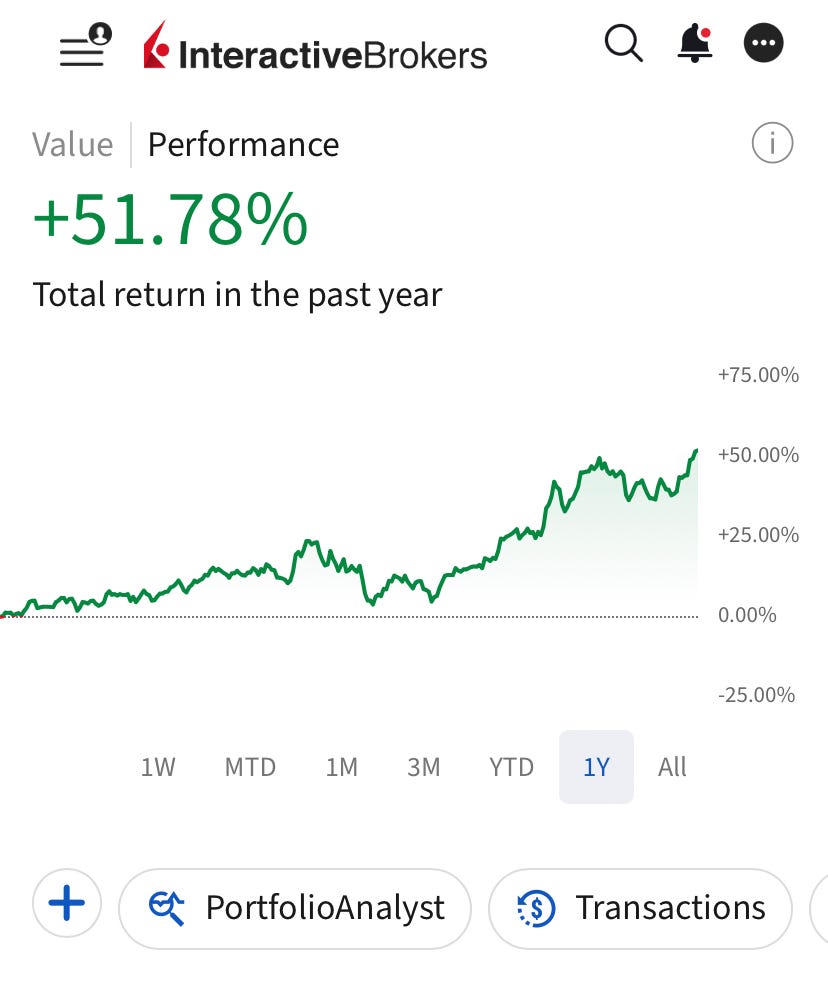

Beginning 2025: Our Portfolio Outperforms S&P 500 By 27%, Here Is What We Own!

Our portfolio is now up 51% in the last twelve months against 24% of S&P 500. Here is our updated portfolio!

💥Our portfolio is outperforming the market by 27%!

Portfolio is now up 51% in the last twelve months against 24% of S&P 500!

One of the first pieces I wrote when I started this newsletter was about why retail investors could outperform both the market and institutions.

As we are completing the first month of 2025, we got the data on 2024 hedge fund returns. Guess what? We outperformed 99% of them.

This is the list of top performing hedge funds, the others couldn’t even make into the list. We outperformed all but 1 of them!

It is even more remarkable considering the way we did it. I published research about all the companies I was gonna invest in before I invested in them and I invested in over 90% of the companies I have written about. Those I don’t own were written to create alternatives for the readers. It was all here.

We set the vision, delivered on it and delivered it publicly. I am very proud of this.

How did we achieve this? By simply having the right framework:

Fundamental knowledge.

Right strategy.

Discipline.

I have said this many times and I’ll say it here again: It is easy to obtain fundamental knowledge that you need to outperform the market. It only takes 6-7 months of hard work and reading a dozen books.

Most people don’t underperform because they don’t have the knowledge, they underperform because they focus on using that knowledge to find a jackpot rather than avoiding mistakes. Yet, most successful investors I know have made most of their money not on stocks that they thought would skyrocket, but on stocks that they thought they wouldn’t lose money.

This is basic inversion. If you want to make money, avoid losing it and the upside will take care of itself. This is how we've been operating here.

We buy:

Strong companies with wide moats at attractive prices.

Fast growing companies with strong balance sheets at fair prices.

Combining these two types of companies in a barbell portfolio allows us to easily adjust our position according to where we think we are at the market cycle. When things get too hot, we overweight strong defensive positions; when pessimism rises, we buy strong growth companies at discount.

We saw this play out last month.

I had previously explained that I think the US market is a bit overvalued though it is far from the bubble territory. In line with this view, we overweighted our defensive positions in the last two months. As a result, in the drawdown that started in mid-December and lasted until the second week of January, our portfolio actually went down less than the market and thus our margin of outperformance grew when things turned positive again as I expected in the December portfolio update.

This is what’s even more valuable to me than the outperformance itself.

I am going to give you the portfolio update in a minute but I want to talk about something else first.

There is a dangerous trend among investors: Assuming the inevitability of the future earnings. I see this both on Substack and X (Twitter).

People are increasingly buying no earnings companies and overpriced stocks and trying to justify it by the future growth opportunities.

They look at a chip company and just say:

It’s overpriced but this market will grow 28% annually in the next 10 years.

So the company can easily grow revenue 30% annually for the next decade.

If you then attach the industry median P/E of 32, you will see it’s worth buying.

You see what’s missing here? They don’t incorporate the chance of failure.

Let me tell you this, less than 1% of all public companies grow their revenue 30% annually at some period in their life.

What does this mean?

This means that there is a 99% chance that this scenario is going to fail, yet they don’t count that in their valuation. They are skipping the most important thing: Controlling risk.

We don’t operate that way here. Controlling risk is our priority.

We do this in three ways:

We demand very strong competitive advantage from our foundational positions.

We demand very strong financials from growth positions.

We incorporate risk of failure by remaining conservative at every step of valuation.

This allows us to assume less risk for outperformance than those blindly aggressive portfolios. We want to outperform not for the sake of outperformance, we want to outperform while assuming less risk.

And this is what we are doing!

Our portfolio is now up %51 against 25% of S&P 500!

Following transactions took place in our portfolio in January:

We didn’t sell anything.

We opened 1 new position.

Increased 2 of the existing positions.

In the last two updates, I provided my 2025 outlook for each company. In this update, I’ll also provide my general 2025 outlook for the market as I believe most people think wrong about the current valuation of the market.

So, let’s dive in!

🚨Our portfolio is proprietary to the members supporting the publication🚨

Members get portfolio updates every month!

Here is a 25% discount to celebrate 10,000 readers!

Valid only until Monday!

📊Here Is Our Full Portfolio!

As of today, we own 18 positions.