5 Stocks I'll Be Buying If The Market Pullback Continues

We are investors, we don't raise cash to sit on it and feel happy when the market is crashing. We raise cash to buy bargains when everybody sells into a crash. We play the infinite game.

Who wins the games?

This is the question I find myself explaining to people while watching the market erode literally every day in the last two weeks.

If you know me or have been following this publication for a while, you know that I don’t pay much attention to market movements, what’s happening in the economy, or where the interest rates will be in the next months.

The only thing that dictates my decisions as an investor is what I want to buy and the price I would pay.

If the stock is one that I want to buy and the price is attractive, I buy.

This has always been my modus operandi, and it’s never disappointed me so far. There has never been a period when I regretted operating this way two years later.

This is because the definition of an “investor” is very clear to me.

Investors are those who try to buy an economic stake in a business, which will be more valuable in the future.

When you see investing this way, it’s an easy job.

But if you fall into the common error of thinking that investing includes predicting the direction of stock prices, it becomes the hardest job. It’s a job impossible to do consistently.

We pay attention to market movements, credit spread, inflation rates, and other economic indicators only to determine our positioning. Nothing else.

When the markets overheat and prices become outrageous, we turn more defensive; when the economy falls into a pitfall and everything is going on sale, we turn more aggressive. That’s all we do.

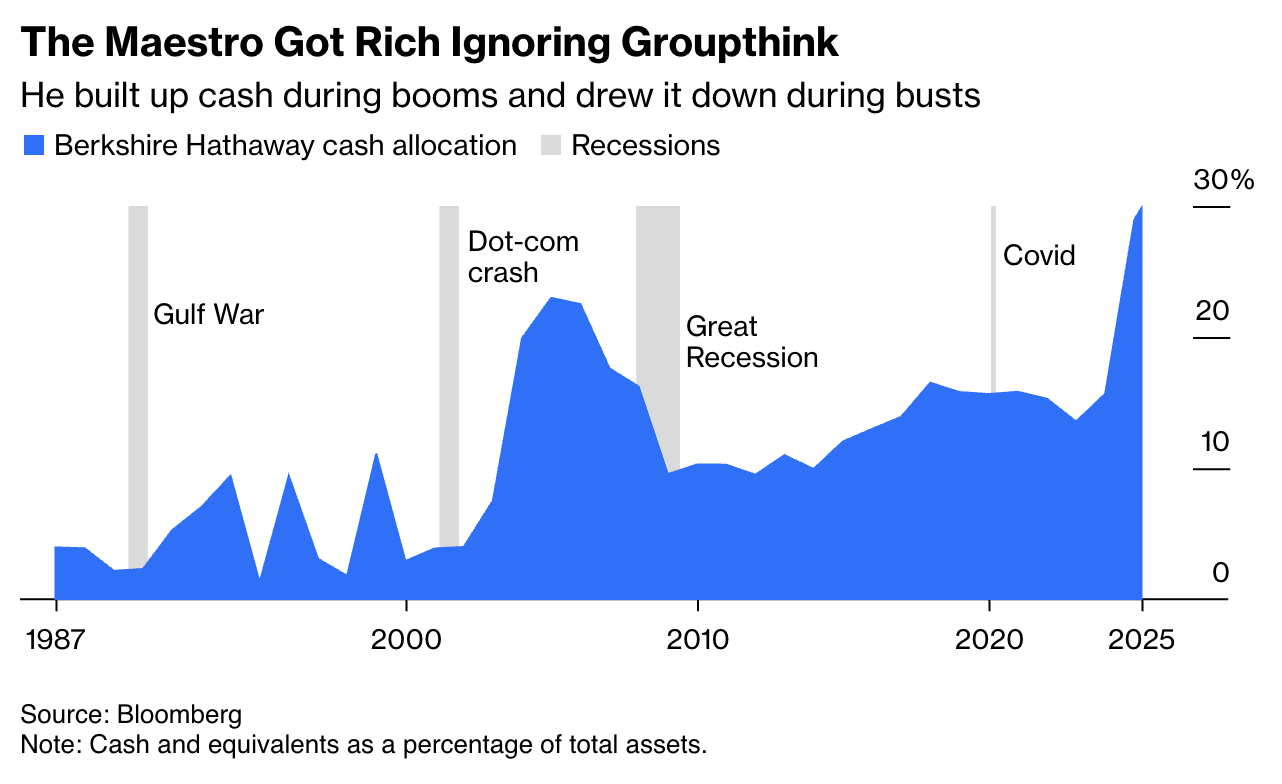

Look at Warren Buffett’s history of cash allocation and you’ll see this clearly:

Looking at the above chart, I think many people concentrate on the wrong thing.

What they immediately see is that Buffett has grown his cash position before major crashes, and shrunken it post-crashes, buying things on sale. This creates the illusion that he has perfect market timing.

What strikes me is the periods he built larger cash piles, but not followed by a major crash or a recession. Look at the period between 1987 and 2000. He grew his cash pile twice, but nothing substantial happened.

This is because he is not trying to time the market. He is just positioning according to valuations. Sometimes valuations deflate safely, but sometimes they turn into a bubble and pop. Because he is disciplined in his positioning, it looks like he timed the market.

He is acting the way he thinks is right, regardless of what comes next, and he is doing this over and over again, regardless of the outcome.

This is how you win the investing game.

Investing is not a game you can win by reaching a pre-defined goal; it’s a game that you win by managing to stay in the game longer.

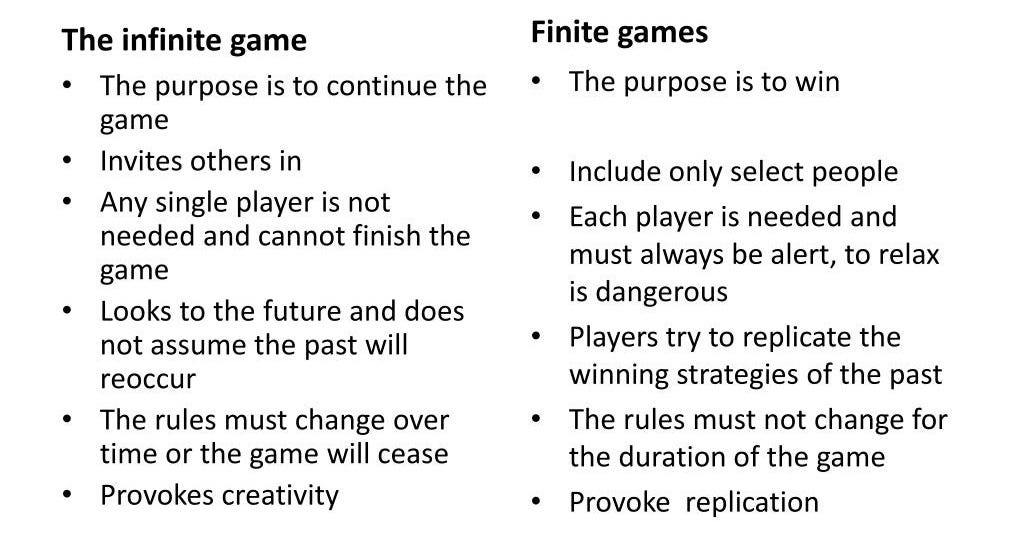

This is called ‘infinite game’ in game theory and mathematics.

For finite games, the goal is to win. There are clear-cut rules, and players try to replicate winning strategies to reach the end goal first. For one to win, others should lose; it’s a zero-sum game.

For finite games, the goal is to keep playing. Rules change over time, and it’s not a zero-sum game; many actors can win, and today’s losers may be tomorrow’s winners. It’s not a zero-sum game.

Investing is clearly an infinite game.

Our goal can’t be something like making 100x of our money in a year. It’s easy to comprehend. Assume you made 100x of your money in a year. What’ll you do next? You’ll keep it in the market so it can keep appreciating instead of eroding day by day.

It’s clearly an infinite game, so the goal is to play the game without dying.

This is also why Warren Buffett is a winner.

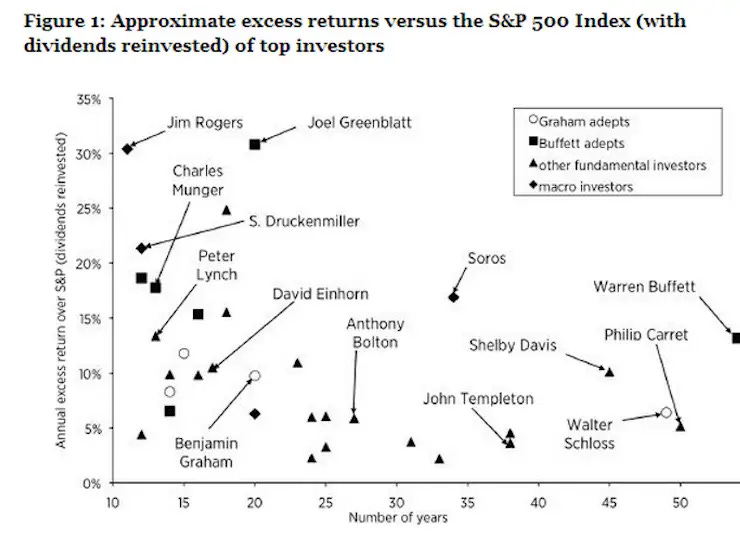

There are dozens of people who have made 200x of their money in a year in speculative assets like crypto, but no one remembers them. Warren Buffett never made 200x of his money in a year, but everybody knows and admires him.

Why? Because he’s been playing the game longer than others.

There have been others beating the market by larger margins, but no one has ever done it for over 50 years, except Buffett:

When you internalize this, your whole perspective changes.

You understand that what can save you today and make it look like you are winning may not actually be the winning strategy. The strategy to 200x your money in a year will never keep you in the game for decades. You’ll lose everything at some point.

The reason I explained all these is that I found myself explaining to many people in the last two weeks that the market is bubbly, but this doesn’t mean they should get out.

Investing is an infinite game, and winning means playing the game for the long term, positioning yourself to thrive over the next decades, not to make a homerun tomorrow.

This is why we do three things when the valuations get bubbly:

We stay in the market.

We position more defensively.

We buy when the market throws us deals.

That’s it.

We don’t cash out today to come in later. It’s a loser’s game.

We have been doing this for a while now.

If you have been following the trade updates, we have been increasing our cash position for months now. In the last two weeks, we exited a total of 6 positions and raised our cash position to over 15%. We also grew two of our promising positions that were gravely undervalued, and one of them has already gone up by 25% despite the broader market pullback.

Going forward, I believe this pullback will continue in the near term as valuations are still elevated. However, when the valuations come down, we’ll be buyers of great businesses at attractive prices; we won’t sit on our cash.

You too have to do this. I know it’ll be hard to press the buy button when the market is bleeding, but that’s the key to staying in the game and thriving.

Remember, we are playing the infinite game.

I have spotted 20 or so high-quality stocks that I want to own or increase my position in if this pullback continues, and 5 of them are already very close to buying prices I have identified.

I expect many of them to come to my target buying prices in case of just 5% more pullback in the market because the recent rally was largely driven by mega-caps and AI themes. The rest of the market wasn’t already very expensive, so they’ll come to no-brainer prices even in a 5% drawdown from the current levels.

So, let me cut the introduction here, and give you the 5 names, summary thesis, and my buy prices.

And note that I’ll be a buyer regardless of what the broader economy, interest rates, or politics do. It’s not our game. We are investors, not speculators.

5️⃣ Uber

5 Year Revenue CAGR: 34%

Return on Invested Capital: 23%

Forward P/E: 23

Buy Price: <$70

Uber is a business that has been on my list since the stock got hammered down last year due to concerns over disruption by the robo-taxi business. I couldn’t buy the stock back then because there were many other opportunities that I had to prioritize.

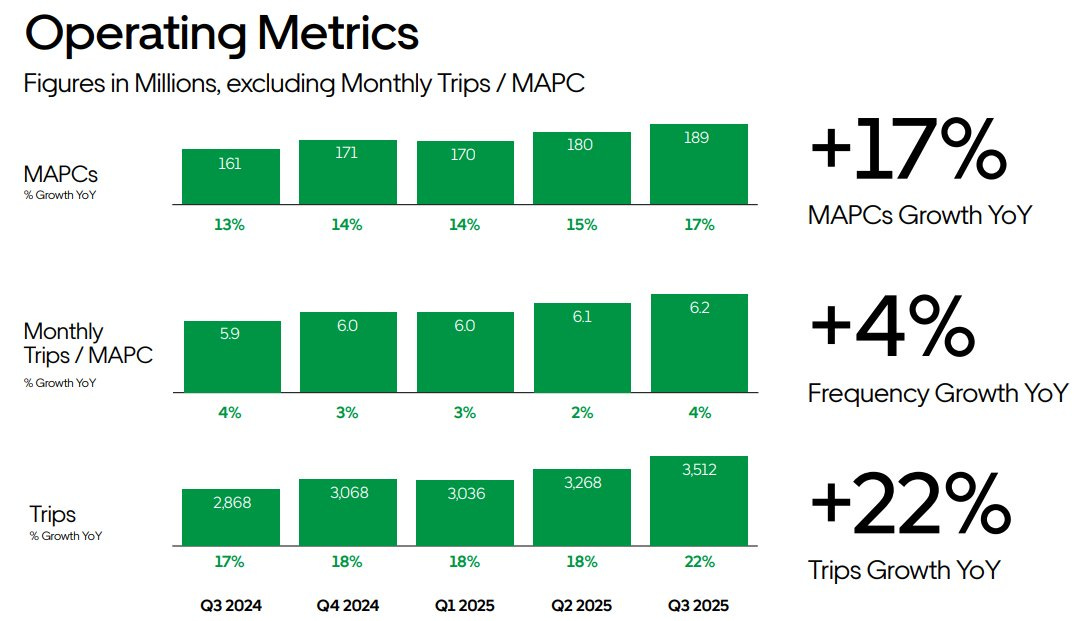

I was skeptical whether I would ever get another opportunity, as the business performed pretty strongly since then. Just look at this:

Revenues grew 20% last quarter YoY, which is stable from the same quarter the previous year. The sheer persistence of growth is already impressive, but what’s more impressive for me is that the dynamics underlying this growth strengthened even further.

Growth in trips accelerated from 17% last quarter to 22% this quarter. This is already impressive, but what impresses me more is that this growth wasn’t driven just by the growth in monthly active platform users (MAPC) but also by the growth in monthly trips per MAPC.

This is pretty unusual since most consumer-facing businesses like restaurants struggled over the last twelve months as consumers across the globe are coping with increasing living costs, thus cutting consumption. Despite the harsh economic conditions for consumers, Uber users took more trips per month. This shows us the demand for the service Uber provides is way less elastic than previously thought. It’s evolving to be more like a consumer staple in character, rather than discretionary.

This means that Uber is well-positioned to generate consistent growth and cash flows over the long term.

The biggest threat to this thesis was disruption by robo-taxi businesses. I have long dismissed those arguments for two reasons:

It will take decades for robo-taxis to scale globally.

Even when they scale, there’ll be many robo-taxi businesses.

This means that this business should necessarily commoditize to scale globally, and when it gets commoditized, the value again will shift to an aggregator platform rather than the provider itself. Instead of having dozens of robo-taxi apps, people will keep having just an Uber app, and Uber will send whatever robo-taxi is available.

In short, we have:

Rapidly growing business.

A product that is becoming more indispensable.

A business model that is resistant to disruption.

Recipe for a perfect investment.

The stock is currently trading at $83 per share, which is 17x 2027 earnings. I’ll be willing to buy at or below 15x 2027 earnings, which indicates a price below $70.

4️⃣ MercadoLibre

5 Year Revenue CAGR: 45%

Return on Invested Capital: 15%

Forward P/E: 29

Buy Price: <$2,000

Mercadolibre is one of my favorite businesses in the world. It’s been following the blueprint that Jeff Bezos built Amazon on:

Achieve scale economies.

Pass savings to customers.

Reinvest profits to reinforce scale economies.

This is what distinguishes Amazon and Mercadolibre from Chinese e-commerce companies like Pinduoduo.

Those companies like Pinduoduo derive their low prices primarily from the lower cost of sourcing. However, this advantage doesn’t scale as the geographic footprint of the business grows because most of the costs shift to logistics, and lower input costs are easy to match. Everybody can source from the lowest cost provider.

Thus, as geographic scope grows, a business that has a more closely knit supply chain in the region tends to have lower average variable costs. This is called local economies of scale. Walmart was the first firm to perfect this, and it dominated the retail industry. Amazon carried this idea to e-commerce by building giant distribution centers in many geographies.

Mercadolibre successfully followed this blueprint, and as a result, it now has a rock-solid grip on Latin American e-commerce. As LatAm economies grow faster than developed countries, e-commerce growth will also be faster, and so will Mercadolibre’s growth.

This is the obvious side of the Bezos blueprint.

There is also so obvious side of Bezos’ blueprint that Mercadolibre also followed perfectly. Bezos saw that Amazon’s e-commerce model guaranteed domination, but the margins would have to stay depressed all the time. Thus, he knew that he had to build a tech business by reinvesting the profits from e-commerce. Tech business would have higher margins, and this way overall margin profile and profitability of the business would improve. This is how AWS emerged.

MercadoLibre replicated this with their fintech business, MercadoPago.

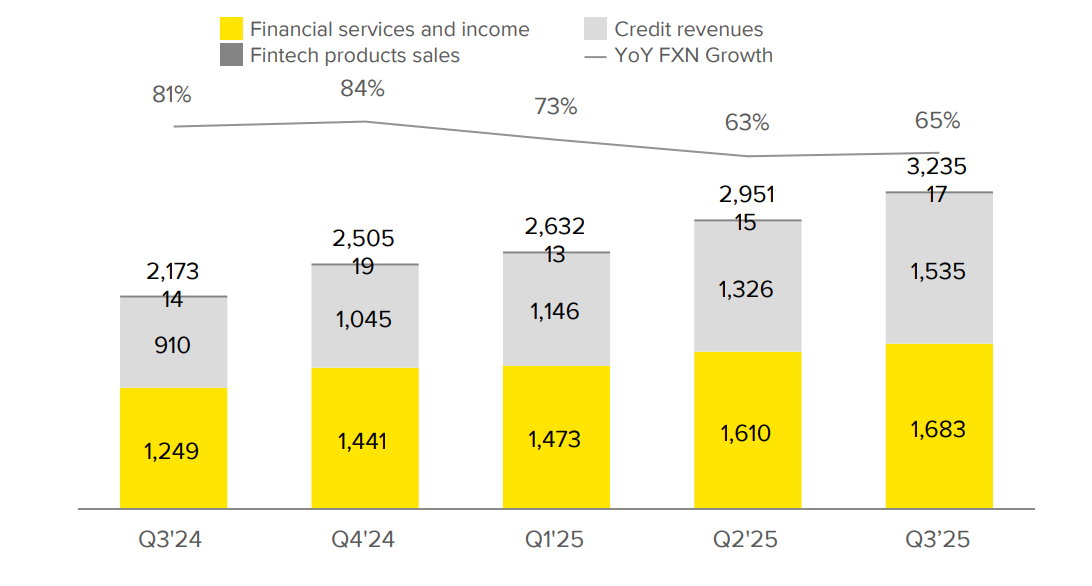

It’s now the second-largest fintech business in Latin America after NuBank, and it generated $3.2 billion in revenue last quarter:

Given that the company generated $7.4 billion in revenue last quarter, fintech revenues currently make up 43% of net revenue. It’s also growing faster than e-commerce, as it grew 65% YoY last quarter while e-commerce growth was at 38%.

This means that fintech will soon generate higher revenue than e-commerce. As a result, Mercadolibre’s overall margins will expand given that fintech is a higher-margin business than e-commerce. Thus, rather than having e-commerce net margins at high single digits, we’ll likely have them around mid-teens.

This is one of the best setups I currently see in the business world. We are looking at a business that is poised to grow over 30% annually while expanding margins at the same time.

This is something exceptional.

Even if we assume 30% annual growth for the next 5 years, we’ll get $96 billion in revenue in 2030.

Conservatively assuming a 10% net margin and a 20x earnings multiple, we’ll get a $193 billion company. The business is currently valued at just $98 billion, promising a near 100% return in 5 years.

I already have a position in this company, and I’ll be growing my position if it stays below $2,000 per share next week.

3️⃣ Inter & Company

5 Year Revenue CAGR: 43%

Return on Equity: 15%

Forward P/E: 10.5

Buy Price: <$7.5

Inter is the second-largest neo-bank in Brazil.

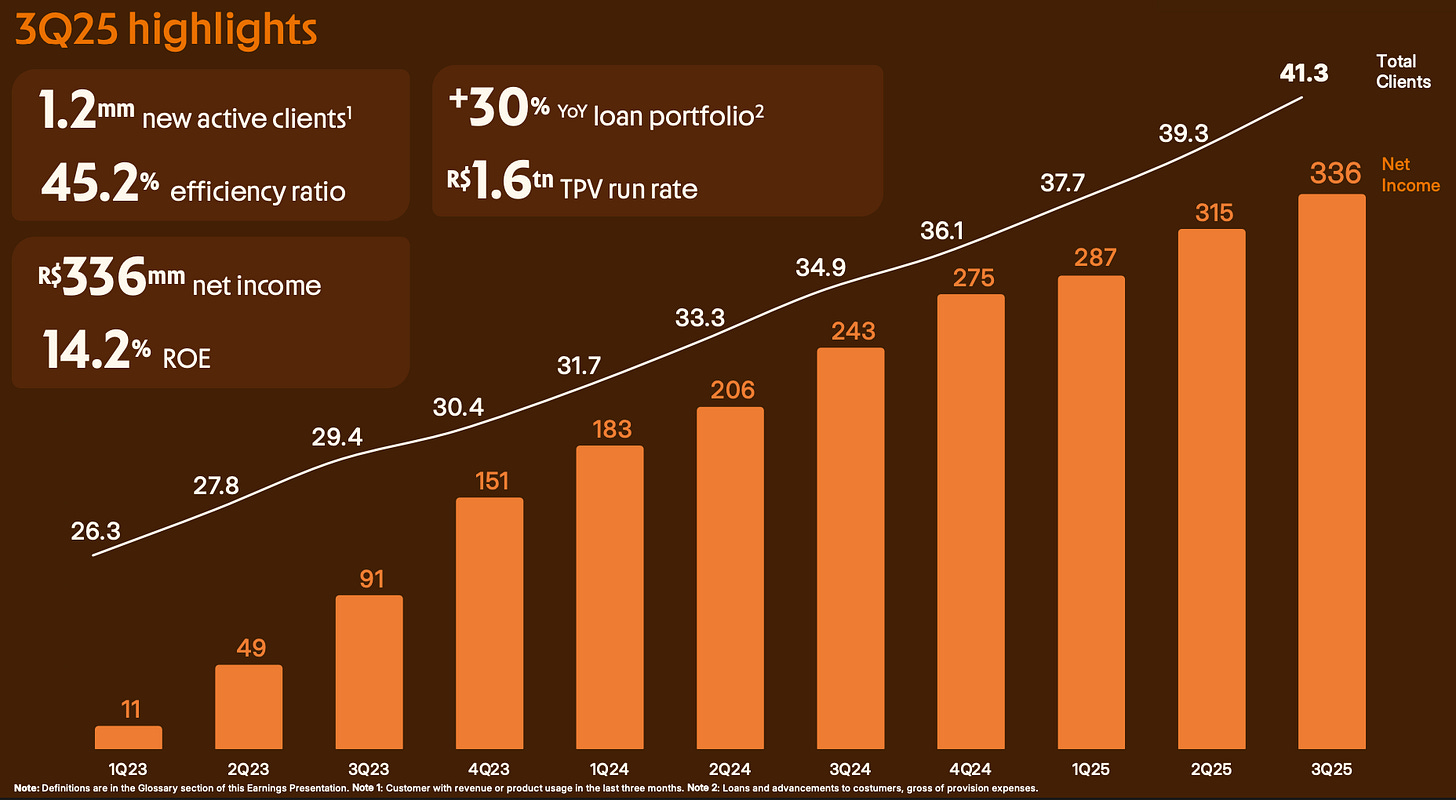

It's eclipsed by NuBank’s amazing performance; however, if we stop taking NuBank as a benchmark for a moment and look deeper at this business, we see that it’s also firing on all cylinders:

They added nearly 15 million users in the past two years and grew quarterly net income literally by 30x.

Despite this amazing performance, investors largely dismissed this company as it was focused largely on Brazil. The market wanted growth and expansion. They are doing this right now. They expanded to the US back in 2022, focusing on the Brazilian diaspora in the southern states. At the beginning of this year, they also expanded to Argentina, which I think is a great prospect for the firm, as NuBank isn’t active there

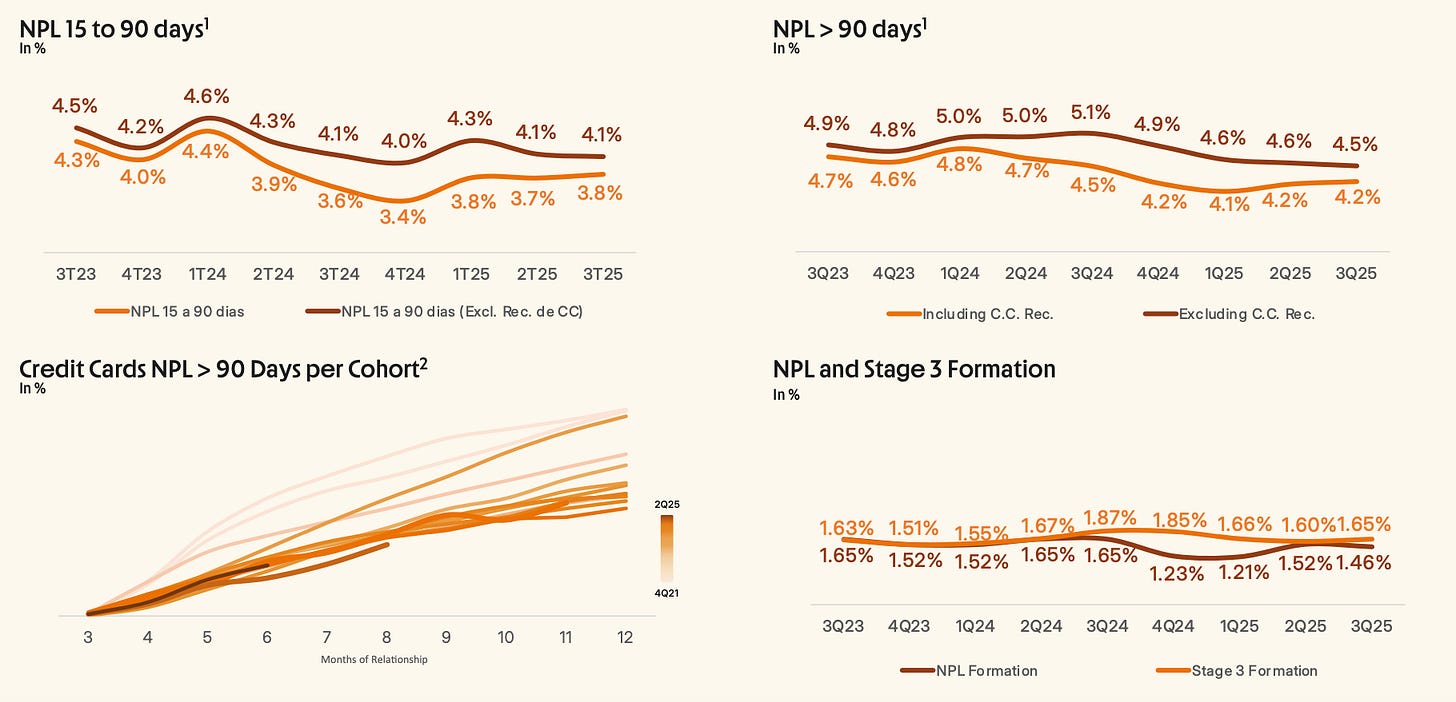

Despite this amazing performance in recent years and expansion into new markets, the valuation remained depressed as the Brazilian Central Bank raised interest rates to 15% due to increasing inflation. This scared investors, as over 33% of its loan portfolio is made up of unsecured loans.

I thought this wasn’t a big deal as its capital structure was strong and coverage ratio was around %140, meaning loan losses should have gone up by over 40% before starting to eat at its earnings. That never happened in its history as a public company.

Lately, they announced Q3 results, and we saw that the concerns were actually not grounded.

Growth continued as they delivered 26% revenue growth and 38% earnings growth while the non-performing loan ratios stayed stable:

The stock pulled back since earnings, mainly due to the drawdown in the market, which I was waiting for, as I couldn’t build my full position in this stock since it quickly appreciated by 20% after I bought it for the first time earlier this year.

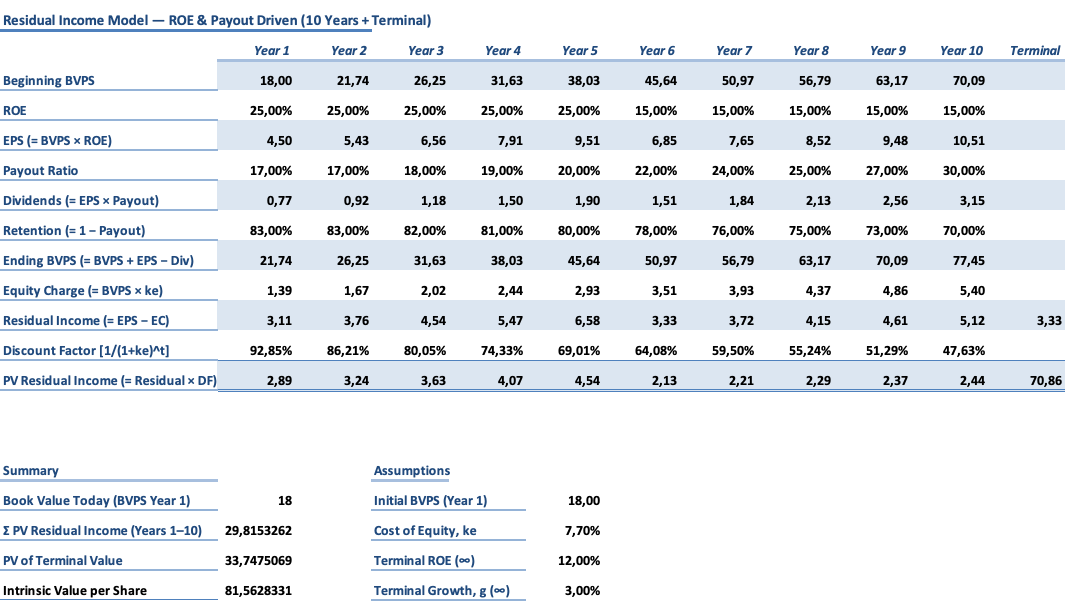

The management has a 30% ROE target starting from 2027. My residual income model, assuming 25% ROE, gives R$81 or $15 fair value:

However, given that it’s a financial institution in an emerging market that tends to be unstable, I recommend a big margin of safety of around 50%, which implies $7.5 as a safe purchase price.

We are currently just 10% away from this point, and I think we can easily get there if the market pulls back slightly lower. I’ll be a buyer if it happens.

2️⃣ Meta

5 Year Revenue CAGR: 17%

Return on Invested Capital: 22%

Forward P/E: 20

Buy Price: <$570

It gets no introduction.

Meta is one of the strongest businesses in the world, plain and simple, and they delivered only blockbuster earnings in the last two years.

So, what happened and why did the stock drop 25% from its highs?

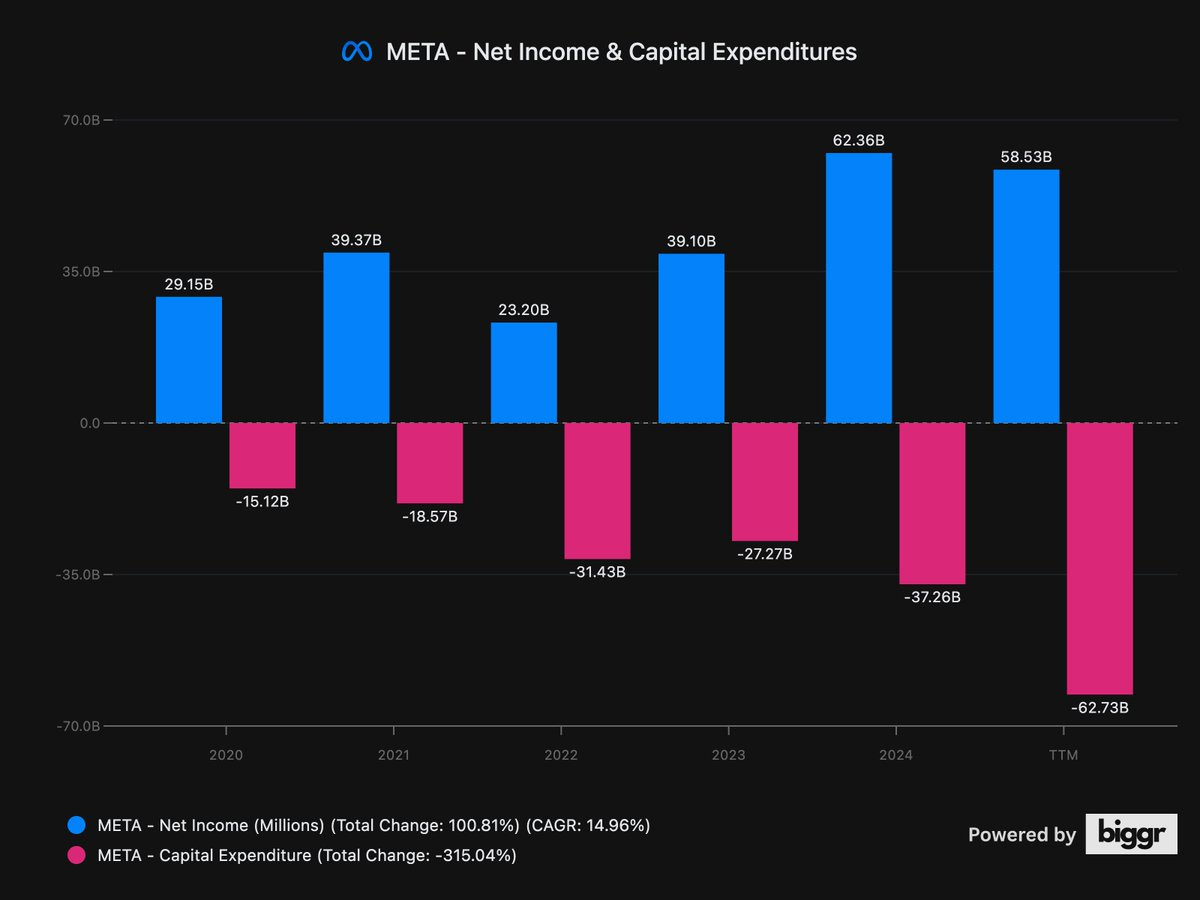

Here is the problem in a single chart:

Meta’s capital expenditures recently exceeded net income. The last time this happened was in 2022, and the stock dropped 75% from its highs.

Its history of burning money on unprofitable ventures like Metaverse is creating pressure on the stock, and I think it’s for good reasons.

It’s heavily investing in AI and giving away lavish contracts to AI researchers. The problem is that Meta doesn’t have a cloud business where it can monetize the capacity it owns. This is currently where other hyperscalers like Amazon, Google, and Microsoft are seeing initial returns on their infrastructure investments.

Given that Meta doesn’t have such a business, it has two options to generate returns on its investments:

Boosting internal efficiency and core growth.

Foundational models & application layer products.

They are currently not very competitive in the foundational model game, and the application layer is categorically far away from being profitable. Even if profitable applications can be created, I can’t think of anything that can reach a scale to generate ROI on Meta’s massive investments.

When it comes to boosting operations and core growth, there are some positive signals. They said in the last earnings call that AI is driving 3-4% better conversions in ads. This is a substantial reason for advertisers to boost spending; however, I don’t think it can alone generate high enough ROI to justify +$60 billion capex.

If they keep spending at this pace, and they say they’ll, D&A will start eating away at their bottom line, and earnings will stall without substantial top-line acceleration.

Where that acceleration will come from is the question.

Yet, the 2022 experience taught us that the fundamentals of this company are so strong that it can quickly return its bottom line to growth by cutting expenses and investments. Thus, I’ll still be a buyer if it drops below my purchase price.

It’s currently trading near 20x forward earnings; if it decisively drops below this, I’ll add to my position, meaning I am looking to buy below $570.

1️⃣ Legacy Education

5 Year Revenue CAGR: 34%

Return on Equity: 20%

Forward P/E: 14

Buy Price: <$9

This is one of the businesses we caught, but the market still sleeps on.

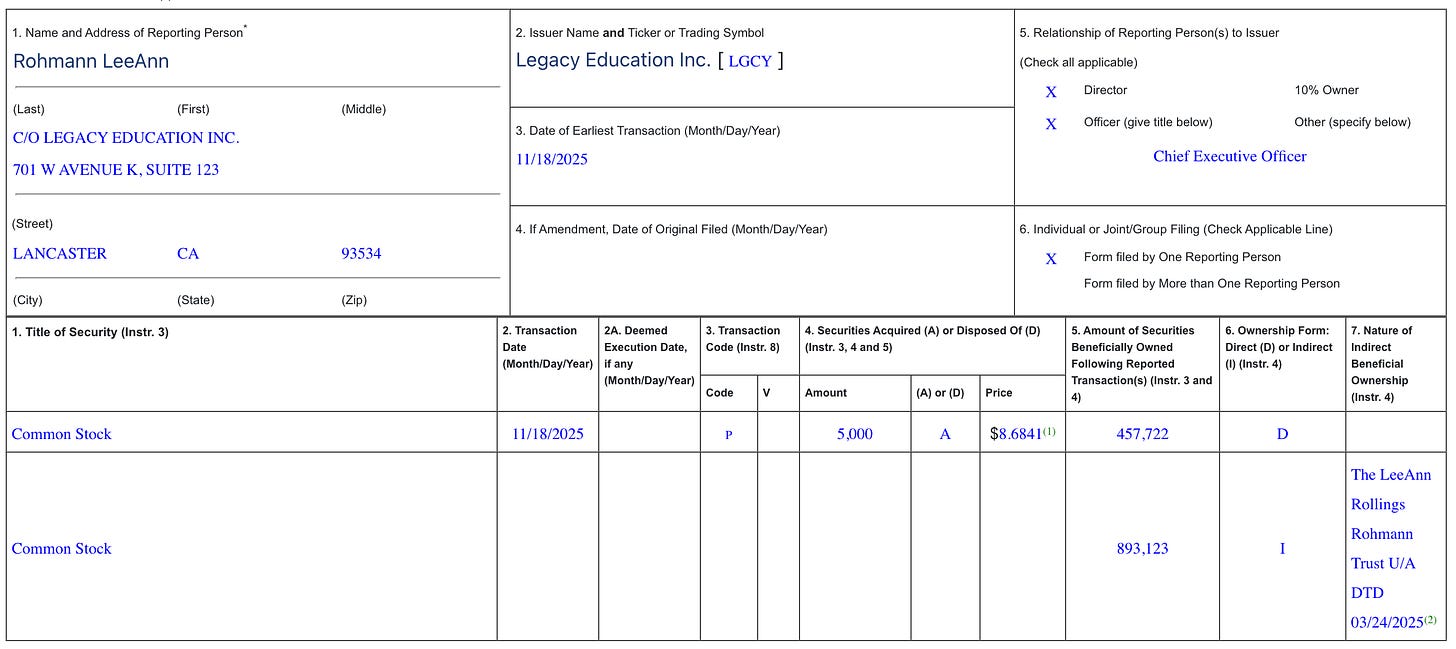

It operates for-profit colleges to train allied health professionals in California. It has been growing pretty fast with acquisitions, it’s profitable, and insiders own 25% of the company. The founder and CEO, LeAnn Rohmann, hasn’t sold a single share since the IPO.

They announced their Q3 results two weeks ago and delivered blockbuster numbers:

Revenue grew by $5.4 million, or 38.5% to $19.4 million.

EBITDA margin expanded 270 bps from 11.8% to 14.5%.

Diluted EPS hit $0.16; without dilution, it would have been $0.22, 5% YoY growth.

Their cash position reached $20 million, which is extraordinarily high for a company with just over $100 million market cap. This large cash pile signals that they are preparing for another, and potentially a big acquisition, as they had paid just $8 million for their latest acquisition.

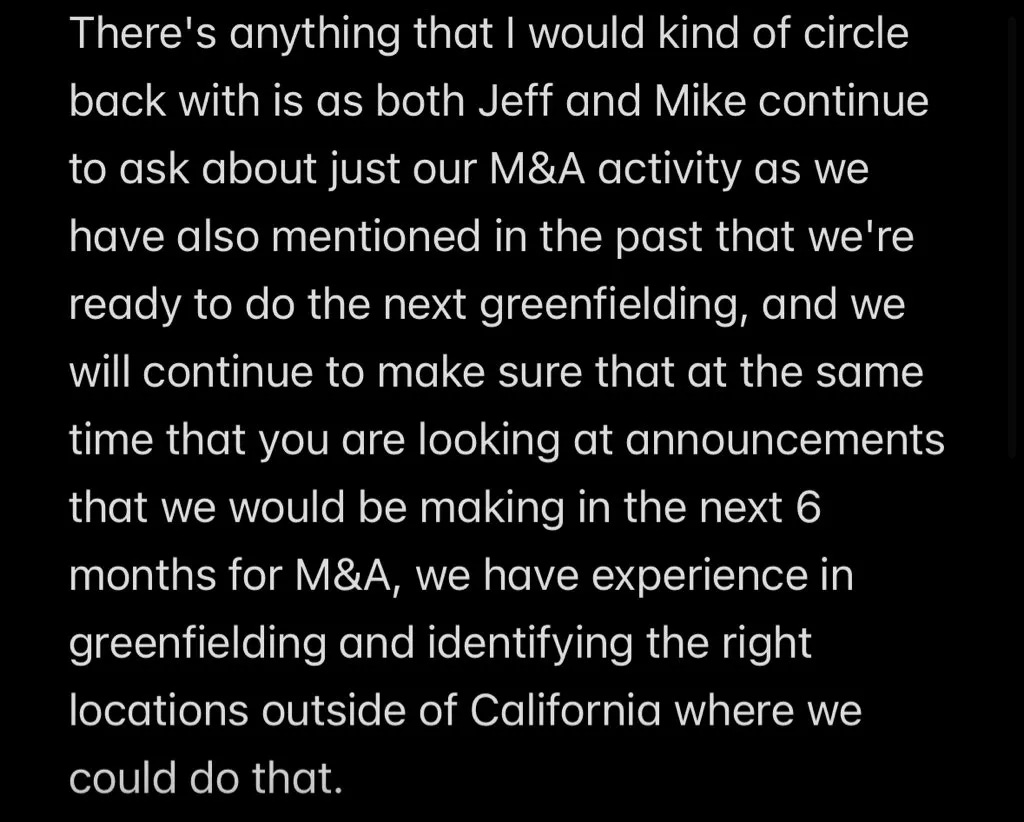

The management also openly signaled this in the earnings call:

This means that we can expect at least one acquisition this year, so the growth won’t slow down anytime soon.

After the management signaled another acquisition, the stock quickly went up by 25% from $8.60 to over $10. Luckily, we had significantly added to our position in the past two weeks, nearly tripling it in size.

CEO LeAnn Rohmann also bought 5,000 shares in the open market below $9 just before earnings:

In a normal market, I wouldn’t think that it can easily come down below $9 again, as the CEO bought below $9 and signaled an upcoming M&A just two days later in the earnings call.

However, given that the market is in extreme fear territory right now, everything can happen, especially in small-caps and micro-caps, where the float is largely held by retail rather than institutions.

If it ever comes down below $9, I’ll again add to my position.

🏁 Final Words

Investing is an infinite game.

In infinite games, you win by playing the game, not by reaching a pre-defined objective.

You have to keep in mind that we are positioning defensively only to be able to buy more of the high-quality businesses in a potential correction or a crash, not to sit on our cash.

This is why I always have a strange sense of bullishness at the time of corrections and crashes. If you see the game as a finite one, you won’t understand this, but if you see it as an infinite one, you get it.

I have already made my list, waiting for the businesses I like to drop below my target prices. These are just 5 of the businesses in the list that are close to or at the purchase prices I have in mind for them. There are many others, but it’ll take a larger pullback for them to get on the radar.

If they come below my purchase prices, I’ll play the game, without regard to economics and politics. In an infinite game, you win by playing, not hiding.

I hope this helps.

That’s a very good list and I share the same interest for 3 out of those 5 businesses

MELI profit margin has been declining, 10% > 7% > 5.7%. Assuming 10% is too optimistic.